We’ve been pointing out for years that private equity has become a not-so-hot investment over the last decade, on average not beating benchmarks that require PE funds to beat the S&P 500 for the last decade. The reason is simple: too much money chasing too few deals. Private equity as a share of global equity has more than doubled since 2004.

The failure to meet benchmarks means that investing in private equity hasn’t been earning enough to justify its risks, particularly its illiquidity. And the usual rationalization, that investors will be fine if they invest in top quartile funds, is so obviously bogus that it’s sad to see professional investors fall back on it. First, investors accept that they can’t beat the market via manager selection in other types of financial investments; that’s why they rely heavily on index funds. And in private equity, top managers no longer stay top managers from fund to fund, meaning there’s no sound basis for trying to identify top managers in advance.

The other rationale for private equity, that it provides returns that aren’t highly correlated with that of the stock market, falls apart when mis-reporting is corrected. Most investors bizarrely report private equity results lagged by one quarter, so June 30 results for the rest of portfolio will be combined with private equity results from March 30. Once you correct for the lagging, the lower correlation disappears.

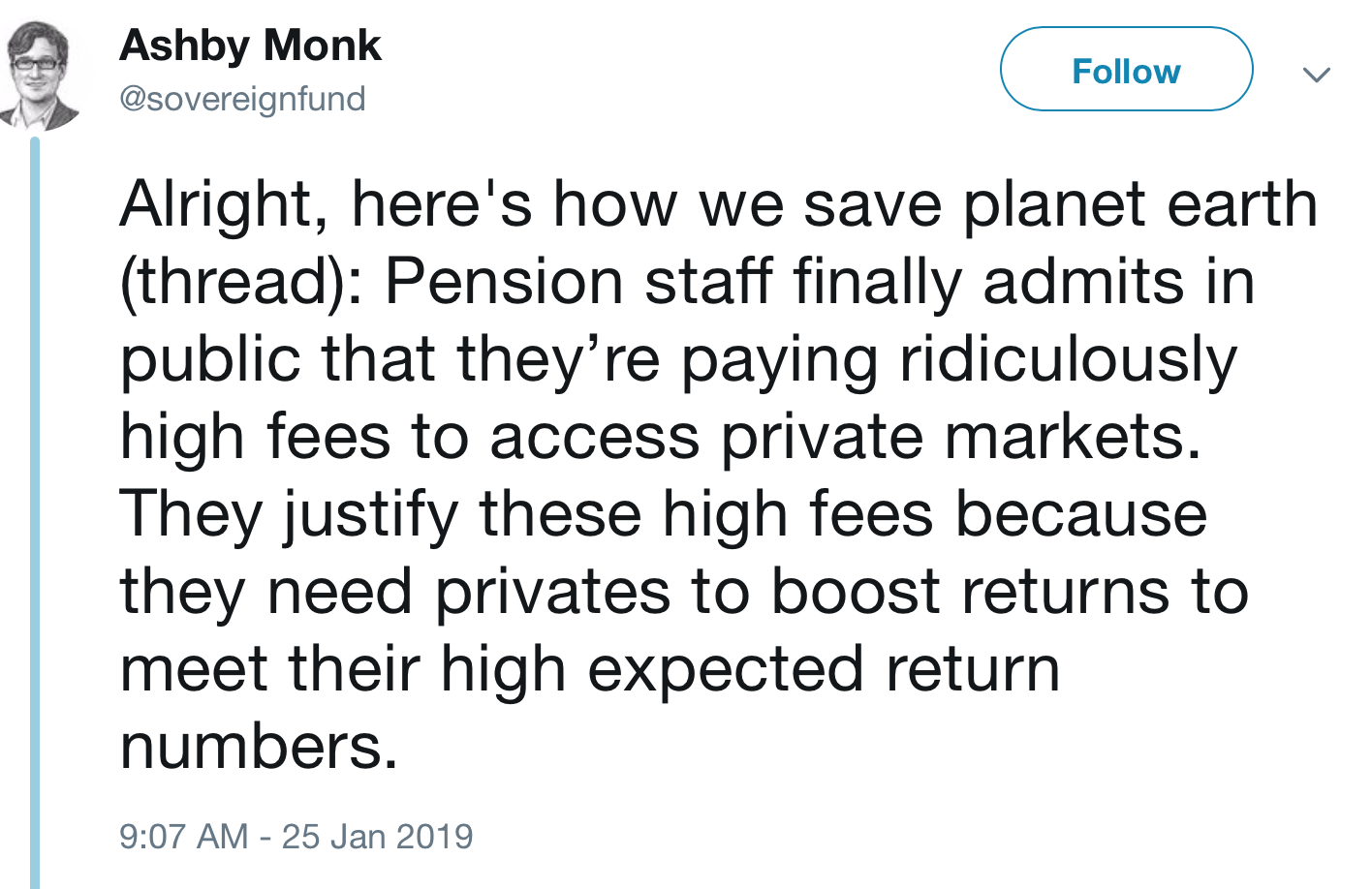

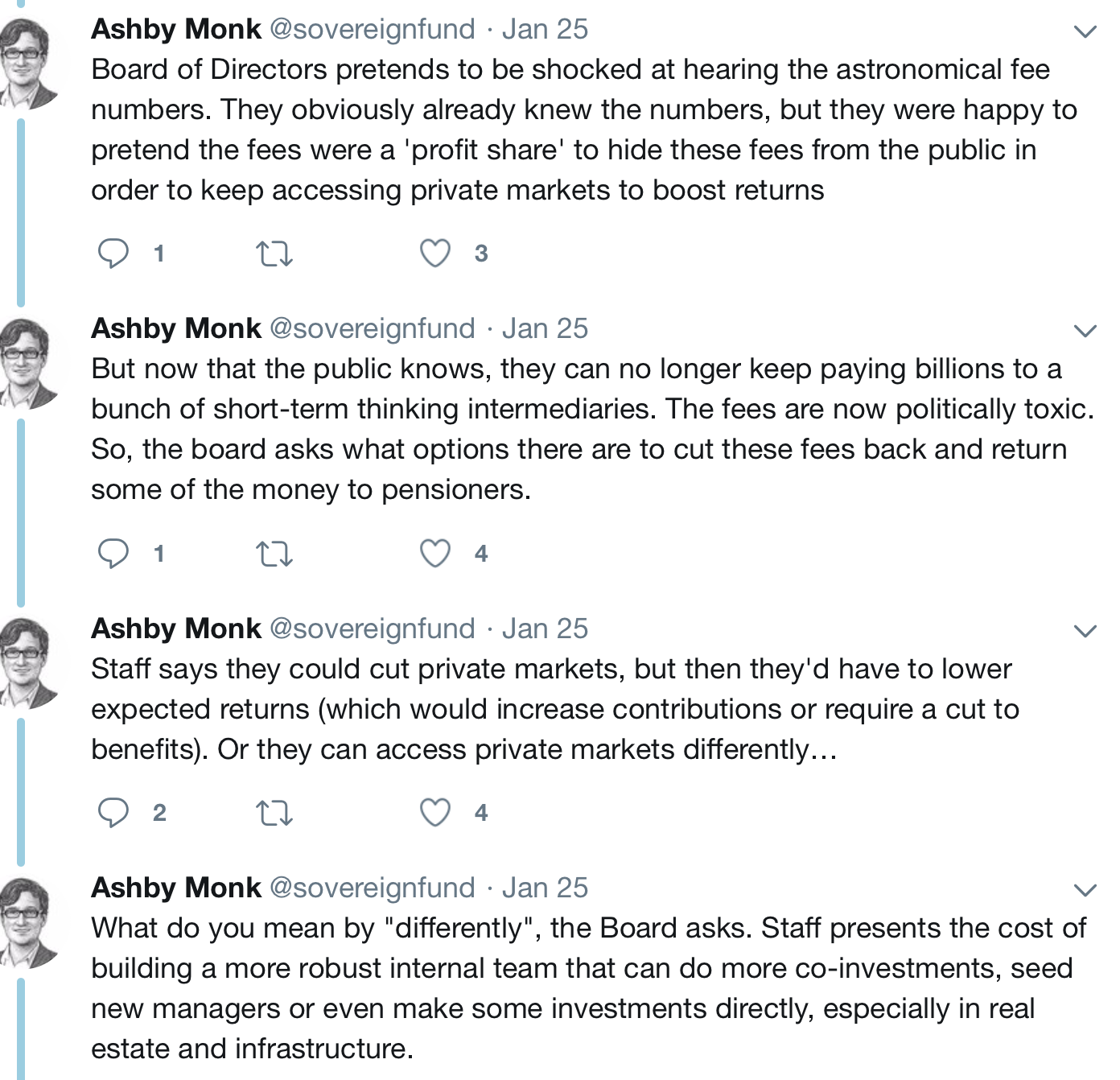

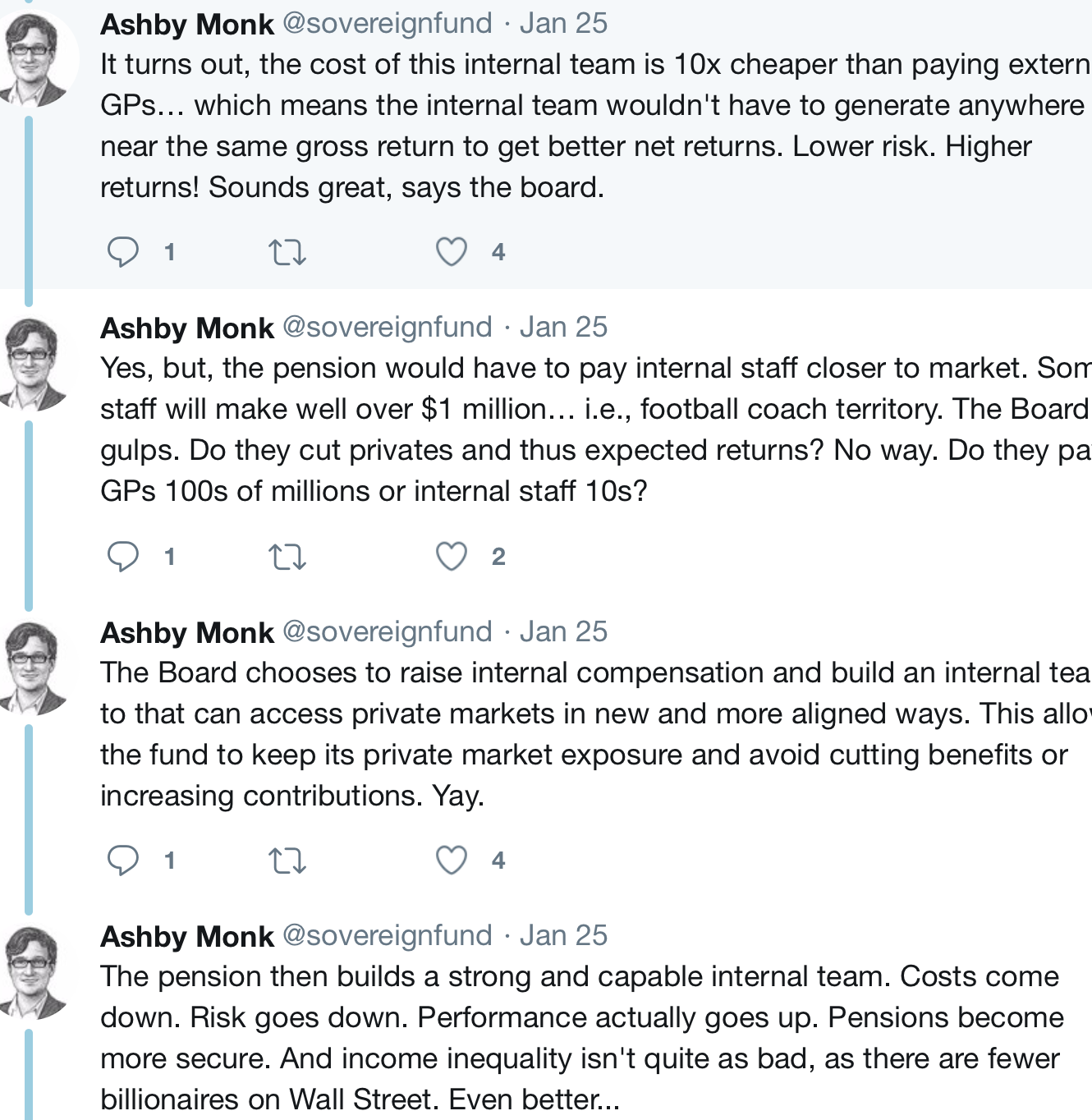

As we and other have pointed out, there is a way out for investors desperate for private equity like returns. Private equity firms pull in a massive 7% per annum on average in fees. The most obvious is to bring private equity in house and cut out the price-gouging middlemen, as Stanford’s Dr. Ashby Monk advocated long form in this tweetstorm. From the opening section:

One theme that Dr. Monk has stressed elsewhere is that private equity investors are often their own worst enemies by engaging in forms of herding and group-think that only helps strengthen the position of private equity fund managers.

The importance of bringing private equity in-house, or using other strategies to get private-equity-like returns, like public market replication of private equity, become even more acute as some funds are jacking up their fees.

Recall that private equity fund managers have been warning over the last few years that private equity returns are likely to be lower going forward, so raising fees will cut even further into net returns. Yet the fund managers are confident they can get away with a fee increase because desperate investors, particularly public pension funds, continue to throw money at private equity. Specifically, some fund managers are increasing so-called carry fees from 20% to an eye-popping 30%. From the Financial Times:

Institutional investors are in some cases paying 30 per cent in “carried interest” — the share of profits taken by the private equity groups — up from the traditional 20 per cent share of profits that the industry has charged for decades.

Funds charging this “super carry” have been launched recently by Carlyle Group, Vista Equity Partners and Bain Capital in the US and EQT, Eurazeo and Altor in Europe…

Investors worry that private equity groups can dictate terms when they are able to raise funds at their fastest pace since the crash. Buyout groups take on average 12 months to raise a fund compared to 20 months in 2010, according to Preqin.

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/36e778c4-4bfa-11e9-bbc9-6917dce3dc62“This shows a complete rebalancing of power in favour of buyout funds,” said the head of a multibillion-euro private equity group in Europe.

“[After the crash] the industry was shaking like rats in a cage because of fears that we were going to have to reduce our carried interest and, lower our management fees.”

The article describes one example, a Bain fund, where Bain is lowering the management fee to 1% but increasing the carry fee to 30% and eliminating the hurdle rate, which is the requirement that a fund meet a minimum return, usually 8%, before it can levy a carry fee. Note also that reducing the management fee isn’t as big a gimmie as it might seem. Those fees like transaction fees and “money for nothing” monitoring fees that private equity firms charge to portfolio companies are offset against the management fee. Lowering management fees means that private equity funds will be able to retain more of these hidden charges.

The article points out that the last time there was a wall of money flooding into private equity that allowed funds to raise fees, it was at a market peak:

A rise in carried interest hit the industry during the boom years leading up to the financial crash in 2008 but it went away when funds struggled to raise money in the lean years that followed the crisis.

The story sadly does not stress that the funds raised in the vintage years right before the crisis performed badly, and that calls into question the notion that investors should swallow the fee increases because performance warrants it.

One commentator also highlighted how clueless most private equity investors are, that they’ll be satisfied if private equity delivers net returns over those of public markets, when in fact private equity needs to do substantially better than that to compensate for its extra risks, that of illiquidity and leverage.

Michael Wolfram of Bfinance, a London-based financial services consultancy, said at the recent Berlin event that not every investor is accepting new terms but that “if private equity still delivers more than public equity then regardless of the fee level that’s fine”.

Virtually all of the investors in private equity go through the show of having professional advisers like Wilshire and making supposedly rational asset allocations, when they are flagrantly ignoring the bedrock principle that higher risk investment need to deliver a higher expected return to justify investing in them. We’ve seen CalPERS repeatedly throw sound finance practices out the window when it tries to justify the supposed necessity of investing in private equity by claiming it’s the only strategy that can beat its benchmark. First, that isn’t true, since CalPERS has refused to consider alternatives that can deliver similar returns. But even more important, CalPERS is dispensing finance snake oil when it engages in this argument. What matters isn’t absolute return but risk adjusted return. For the last decade, private equity has fallen short and top executives in the industry have warned that if anything, returns will fall in the future.

But it seems that there is no shortage of fools who are prepared to invest in private equity as currently constituted rather than build up internal capabilities. So expect recent vintage investments to end in tears.

I whole heartedly agree with Dr. Monk’s idea that cutting out the overly compensated PE firms would be very wise for pension funds. I frankly don’t understand why independent shops don’t open up that severely undercut the fees that are charged by the Bains and Blackrock’s of the world. However, I fail to see the connection between more efficiently investing pension money and saving the environment. What would stop an in house alternative investment unit from investing in weapons, petrochemicals, etc.?

I expect it’s the “nobody ever got fired for hiring McKinsey” bureaucratic arse-covering herd mentality, working in favor of a guild or cartel of established incumbents able to set prices. Add your revolving doors and old boys networks and there you go.

In contrast, hiring an ‘unproven’ cut rate newcomer exposes the fund managers to criticism, even prosecution, if it goes wrong.

Same ass covering dynamics apply in government contracting, accounting, consultancy, etc. God fights on the side of the big brand battalions. MWOB set asides offer one potential way to bust the cartel but those diversity contracts tend to be noncore functions.

This points to the difference between career and investment risk. It is worth noting that career risk is borne by the managers and investment risk is borne by beneficiaries.

If I’m a manager and can get the upside of investment risk while avoiding the downside of career risk I’m all in. Hey, it’s not my money. I’m not being held accountable.

“Everyone is doing it so it must be prudent.”

Would be good to see a story outlining in detail examples of the range of initiatives that asset owners have already undertaken to find new, more aligned private markets models. I think it’s rationale that most public pension fund boards are reluctant to be first movers but if they don’t have a clear idea of all the first-moving that is actually happening in the market then it’s hard to be a fast-follower. Most consultants are also not incentivised to show innovation to their Trustee clients. The asset owner community needs a few PhD students to create a library of new models.

We’ve pointed out that the Ontario pension funds do do private equity in house. There is a model.

In addition, many family offices have been doing deals in house for decades.

But wouldn’t paying a million-dollar annual salary to an in-house PE staff also be politically toxic?

I’m thinking of what happened at Harvard back in the 00s just before the GFC, when the $6.9 million dollar salary of its chief endowment manager became a lightening rod for activists who wanted the university to pay all staff, including outsourced staff, a living wage. Also, many of the endowment’s investments were subject to divestment campaigns so there was a lot of public and alumni anger focused on the endowment fund managers.

IIRC, eventually they agreed to pay a living wage and divest some of the most controversial investments, but in the meantime they let the fund manager twist in the breeze and eventually he resigned and became an outside consultant for much more money. And now the in-house fund managers are once again making multi-million-dollar salaries.