The infamous HAMP program, which the Administration revised so many times on the fly as to give incompetent and mendacious mortgage servicers air cover for failing to modify mortgages, at least had a stealth purpose. As Treasury Secretary Timothy Geithner said to the SIGTARP’s Neil Barofsky, it was to foam the runway for banks by spreading out foreclosures over time. But that still doesn’t excuse servicers for their favorite gimmick for not bothering with HAMP applications, which was to pretend they’d never received them.

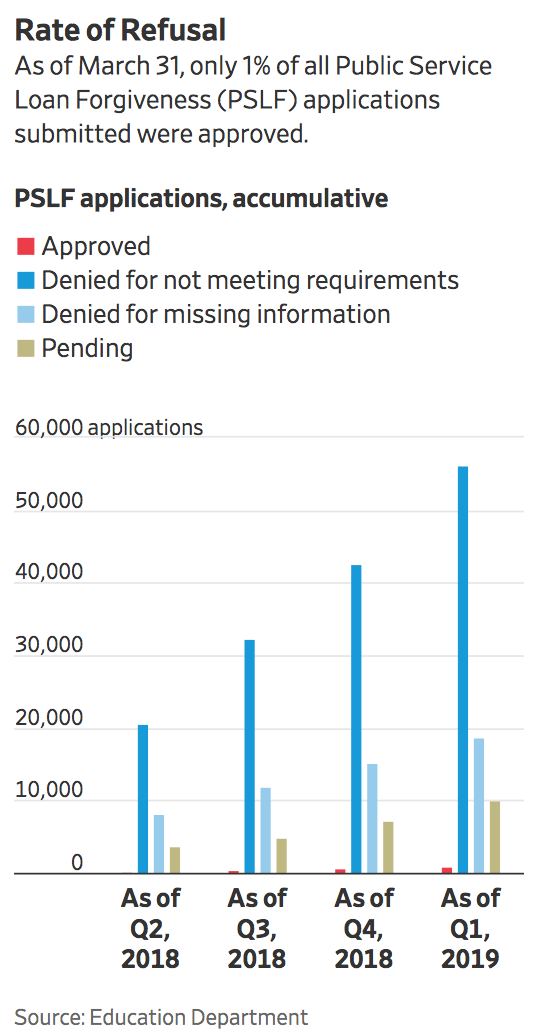

But it’s not clear what the thinking was behind the 2007 Student Loan Forgiveness Program, except to create better eyewash.  The ostensible goal was to give student debt relief for borrowers who went into socially useful but not>well remunerated lines of work. But not only were the eligible employers (note employers, not job types) poorly specified as “public service” which includes some highly paid employees at not-for-profits, other elements of the program were also drafted badly. Throw in lousy servicers, revisions to an already confusing program, and conservative sabotage into the mix, and you’ve created conditions where many make what they think are the qualifying 120 payments, only to have their application for forgiveness nixed. Only 1% of 73,000 applicants have gotten relief.

The ostensible goal was to give student debt relief for borrowers who went into socially useful but not>well remunerated lines of work. But not only were the eligible employers (note employers, not job types) poorly specified as “public service” which includes some highly paid employees at not-for-profits, other elements of the program were also drafted badly. Throw in lousy servicers, revisions to an already confusing program, and conservative sabotage into the mix, and you’ve created conditions where many make what they think are the qualifying 120 payments, only to have their application for forgiveness nixed. Only 1% of 73,000 applicants have gotten relief.

Admittedly, 25% of the rejections were due to “missing information,” which means some might eventually be approved. But as of June 30 last year, 29,000 applications had been reviewed and only 1% were approved, with 28% needing more information. You’d think by now that if a meaningful percentage of the then 28% with gaps had had them filled, the proportion being approved would be rising over time.

The broad outlines of the abject failure of this scheme aren’t new but the Wall Street Journal provides a useful overview and update. The program, launched in 2007, created a series of conditions for eligibility. Per the Journal:

To qualify for forgiveness, borrowers must work for a government entity or nonprofit, hold a certain type of loan, enroll in one of several specific repayment plans and make 120 full and on-time monthly payments, or 10 years’ worth. Falling short on almost any of these requirements can mean disqualification.

The article describes a litany of problems. First, only students who had Federal student loans qualified, not ones with private Federally guaranteed loans. Servicers too often enrolled borrowers into forgiveness programs for which they did not qualify or gave incorrect payment amounts.

And even though the Trump Administration has made its antipathy for the program evident by eliminating it in its budget announced in March, it’s not as if the Obama Administration did all that much to make it work. Again from the Journal:

At that point, with the first borrowers not eligible for forgiveness for seven years, the Obama administration put off specific steps that would have helped the program run smoothly. Officials didn’t advertise the program or establish a platform to guide borrowers through its requirements. They didn’t draw up clear guidance on which employers should qualify as public-service organizations—now a subject of litigation. A government investigation last year found that officials didn’t even produce a guidebook for the servicing company they hired, Fed Loan, to implement the program.

And measures designed to make borrowers whole for program screw-ups that did them harm have wound up being close to moribund:

[Public librarian] Ms. [Bonnie] Svitavsky hit her first snag in 2013, when she submitted a form to ensure her employer qualified her for loan forgiveness. It did, but that step revealed another problem: For the prior 23 months, her servicer, like with so many other borrowers, had her on a plan known as extended repayment, which charges standard monthly payments over 25 years. Those payments were now all ineligible toward her payment count.

The improper payment plan issue raised particular concern in Washington, where members of Congress, led by Sen. Elizabeth Warren (D., Mass.), in 2018 created a temporary fund of $700 million to reimburse borrowers who had mistakenly enrolled in ineligible repayment plans but otherwise qualified. The program has so far granted loan relief to 442 additional people.

If you generously assume an average borrower put $10,000 into the extended repayment scheme, only $4 million of the $700 million set aside has been deployed.

Mind you, this isn’t even the complete litany of things that can or have gone wrong with this program. Readers have described how they were encourage to consolidate loans to help qualify for the program…..only to find the new loan wasn’t eligible and had higher interest charges.

It is distressing to see the intensity of the hostility in the Wall Street Journal comments section to the idea giving a break to borrowers. There’s no acknowledgment that students could have had their employment prospects up ended by the crisis or been misled by their university about how realistic it would be for them to earn enough to repay their loans. A few readers did point out the escalating cost of higher education was the real problem, but the “how could you be so stupid as to get advanced degrees and then become a librarian?” viewpoint drown it out (never mind that a Harvard College colleague said the degree she got later in library science was the most useful education she’d ever gotten; she parlayed that into a research job at Bain and later a position as head of white label research at one of the major international equity firms).

I hope large scale debt forgiveness doesn’t wind up falling into the Maine category of “You can’t get there from here.” But the experience to date is not encouraging. The fact that so many hurdles were set up to make sure that only very deserving candidates could qualify illustrates how few better off individual are willing to consider that stagnant real incomes, rising housing, medical and education costs, and high job instability means that most people go from paycheck to paycheck and can’t build up a savings buffer. They are one mishap away from needing to borrow to get by. If they aren’t lucky enough to be able to get the funds from family or friends, the bank supplied sources range from pricey (credit cards) to punitive (payday loans). And if you miss a payment due to a second mishap, it’s well nigh impossible to get off the treadmill of penalty rates.

But as long as the well-off can convince themselves that overburdened borrowers were irresponsible, as opposed to unlucky, nothing much will change until pitchfork sales go way up.

Excellent. A new, rather poignant example of the “we are the 99%”.

Perhaps the WSJ commentariat are not big library users, but people are often surprised to learn that you need an advanced degree in library science to even be interviewed for many librarian jobs (unfortunately this can put career ceilings on those who have worked in libraries forever but don’t have the degree). I enjoyed my MLS program, flawed though it might have been, and was often in classes with people working at large multinationals and learned lots of useful and interesting things. I’m sure the same people who say this lap up PR from companies touting “big data” or AI without having the slightest idea what they mean or how they work. However, they almost certainly make more money than I do, which in America means they’re better than me.

Big data is the answer, Nobody knows the question.

The question is, “How do we make more money off the marks and make them think they’re getting a service instead of getting serviced?”

You think its bad now, wait another 10 to 15 years when the debt forgiveness portions of the income based repayment student loan programs come into play. PAYE and REPAYE also grant foregiveness, though not without a tax hit. This is the program I am dealing with, and if the rules change there, I’m in big trouble.

This problem is easy to solve. Make student loans able to be discharge in bankruptcy. Someone needs to take a real financial loss. Once banks begin to sucking wind on student loan losses they will be more diligent in making loans. Though Federal Govt will also be taking losses – I.E. all of us. The real problem is all the excess money sloshing around the economy is also being used to help bloat up college/university budgets. But until someone starts losing real money nothing will change. Of course debt forgiveness sounds great on the campaign trail, but you will hear howls by people (my wife and I included) that ate grass so my kids could get through their Bachelors program without any debt. And yes – picking a reasonably priced school was part of our requirements.

Re debt forgiveness: because you sacrificed- and possibly suffered- from the student loan program, it now requires sacrifice and suffering from those who could benefit from debt forgiveness now and in the future. And your comment about the Fed. Govt. taking losses is -in my view- reminiscent of the Stockholm Syndrome. Finally, there are ways to compensate those who paid high tuition fees and interest for an education.

> you will hear howls by people (my wife and I included)

Yeah, that was one of the most personally disgusting things I saw during the financial crisis — the idea that anyone would get a “free house” was widely viewed as an atrocity on the level of Auschwitz. Oh, the ranting. Oh the raving. Morally superior peasants castigated each other on message boards like crabs in a bucket. Meanwhile, back in the real world, foreclosures meant the entire neighborhood, city, and economy suffered unnecessarily, while banksters walked away with billions in their pockets. Laughing the whole time. The same is true of student loans. Nobody profits but the 1%.

You made the best decision you could at the time. So what?

If being frugal is such an admirable moral virtue, maybe you should view it as its own reward.

Demanding everyone suffer the same amount you did is equivalent to people who were born before vaccinations denying them to everyone else because everyone else ought to suffer too. Student loan forgiveness will create a better economy for your kids and you. Millions of young people might struggle through life slightly less, how unfair!

Nicely said.

Yes. This.

This program is flawed on so many levels:

First, it discourages the Borrower from paying off loans early when it might make fiscal sense to do so.

Second, if the Borrower has a loan with a 10-year term, at the end then what is left to forgive? Surely they don’t refund the payments you have made.

Third, Borrowers who are able to make 120 on-time payments arguably are capable of continuing to service their debt, and don’t need forgiveness.

Fourth, Borrowers who get behind are the most in need of forgiveness. Perhaps the requirement should be that the loan is in good standing at the time of the application.

Fifth, Borrowers risk being in worse position (perhaps much worse position) by making the 120 on-time payments than they would be if they weren’t striving for forgiveness. Anecdotally, I spoke with a person recently who has over $100,000 in student loan debt, and her payments, based upon her income, are something like $38 per month—in other words her debt is growing rather than shrinking. She hopes that her loans will be forgiven, but if they are not, then she will face financial ruin because new payment amounts will eventually have to be recalculated, and the payments will be crushing. I guess she will be paying for the rest of her life, which will likely be cut short due to the increased stress in her life. #Sad.

What about respecting the terms of a contract? The program set out requirements and offered a benefit, then reneged with mid-stream rule changes. Lots of people made plans based on the offer (myself included) and are now saddled with 10 additional years of payments.

I guess if I were a Wall Street crook, I could insist on the deal, but I’m just a lowly citizen.

Yes, “sanctity of contract” was the reason given for the welfare-queen bankers receiving their bonuses from taxpayer funds in 2008-2010.

One can condemn criminal bankers and still feel that students and home-owners have SOME responsibility to pay back SOME portion of the debts they took on.

There were lots of 100K kitchens and Spring Breaks that I do not want to pay for in forgiven debt.

Maybe half gets forgiven? Maybe I just have some memories of the scorn received from some smug home-owners when I tried to explain that we were in a housing bubble in 2004-2007, so don’t attack me too hard.

Reading this, I started to think that the main difference between the Democratic and Republican flavors of neoliberalism was that the Republicans are out in the open about not offering people any relief whereas liberals ostensibly offer help, but create such a maze of bureaucracy and disqualifications in the fine print that in practice people get nothing from them either. It was in Obamacare. It’s in their obsession with making everything “means tested.” It’s why everyone cringes when you hear the Dems start talking about shittier versions of what Sanders was doing, because instinctively we all know that’s what will happen. The false advertising headline of a solution and a thin gruel if anything at all in the fine print. It’s their MO.

On another subject, the decline in humanities education is a particularly sore subject to me. I find it fascinating that they aren’t able to connect the dots between the lack of funding and why American culture is so vulgar and stupid. Trump is the logical result of this system, what you get when you put no priority on teaching people culture and “let the market decide.” This is always where it was headed.

I can find nothing in this comment to disagree with — even partially.

The loss of humanities and civics as well as the arts causes me to hyper-ventilate when I consider the implications. And I agree that Trump is the logical result — not an aberration and not a symptom. I don’t see this as another subject, but as one of the root causes of everything described in your first paragraph.

We have been conditioned, as a society, to compromise and expect mediocrity as the best we can do. All in the name of “fairness”, of course. We have been conditioned to resent it if another receives a benefit that we did not — rather than see it as improvement to our society.

I now believe that this result is not inadvertent, but deliberate.

Emigrate.

Canada is close.

Australia is warmer.

Canada and Australia won’t take my wife and I. We are retired and don’t have the enormous amount of money required to emigrate if one is not a “contributing” member of society. And, AZ is hotter than Australia.

Spain has lots of expats speaking English, and Spanish is not hard to learn (especially if you are in AZ). And the income requirements are not terrible. That’s where my wife and I plan to go.

Our current list: 1. Portugal 2. Spain 3. South Africa 4. Greece or possibly Croatia.

Do not consider South Africa. Ask Thuto for information.

Mutare in Zimbabwe is better, or Swaziland.

I have friends who were committed to ZA, who have just returned to London.

Spanish is actually a pretty difficult language to learn, unless you don’t mind sounding like an 8 yo. No idea why people think it is so easy.

People think I am fluent but I’m not even close. Just have the right accent, but I know my limitations.

Seguro que hablas muy bien español!

I agree. Spanish pronunciation is difficult for English speakers and vice versa.

Canada has its own student debt crisis and credit reporting is more or less shared between the two countries.

The fascination with Canada among some Americans with never cease to amaze me.

I’m guessing the story is the same with Australia but I’m sure someone else could fill us in.

Yep. Neoliberalism is everywhere, and even if one finds a country better in some respects, the whole point of it is we want a better society everywhere. Here in the US, most of us are best equipped to make the small difference we can. We know the territory.

Not knocking it if someone wants to go elsewhere and can manage it, but there is no mythical land of Canada or somewhere else where we can go and things will be better.

Now in certain circumstances – such as Elizabeth Rowley, the founder of T1 International who is an American with Type I diabetes who finds it much more advantageous to live in England with her condition – it can make sense to be somewhere else, but as a general rule . . .

And she’s doing activism worldwide because of her experience . . .https://www.t1international.com/ourteam/ https://www.thediabetescouncil.com/interview-with-elizabeth-rowley-from-t1-international/

Here is a nice video of her talking about diabetes in UK vs US on Bernie Sanders’ channel (Sanders is so concerned about drug costs and has been since at least early 2000’s, maybe longer):

https://youtu.be/ujh9UPoEW5M

But England is horrible in other respects and worse than here, so it’s no paradise and the search for a mythical country to move to can exasperate me (and though more of the world is open to us than to some, there are bunches of places you really can’t possibly move to). And moving is a huge adjustment and expense. For most people – live and fight the battles where you are.

I’ve lived in a number of countries, both as a legal temporary or permanent resident, and also just legally as a long-term tourist with income from the US. I agree with you 100%.

People who suggest that Americans can just up sticks and move to another society and integrate there the same way people can do in the US (at huge personal sacrifice) are in for a rude awakening. I think that may be possible in Australia, but the widespread anti-Americanism in Canada makes it a tough place to live for the Americans I’ve talked to who’ve done it. As for other countries, you will be a permanent outsider at best, and you’ll find you haven’t escaped the reach of the US, just whatever ability you have to change it from the inside.

Political forecasting with math from a mathphobe, please bear with me and correct my mistakes.

https://studentloanhero.com/student-loan-debt-statistics/

” Americans owe over $1.56 trillion in student loan debt, spread out among about 45 million borrowers. That’s about $521 billion more than the total U.S. credit card debt.”

https://www.cnbc.com/2018/08/13/twenty-two-percent-of-student-loan-borrowers-fall-into-default.html

Assume 22% of 45 million = 9.9 million. These are the people who, were they to learn of Biden’s coopting by MBNA and the banking cartel infesting his home state, would vote against him for student loan doom alone.

If you’re student loan has been forgiven, and you are in a forgiving mood, then you should vote for Biden. (N)

1% of 9.9 million is 99,000 times (N the forgiveness factor). That’s a pretty small number of voters who would vote for Biden in the general election. Figure half these are Republicans, therefore cut the number in half.

In other words, this student loan forgiveness program is probably going to net Joke Biden at least say 25,000 votes nationwide if half those whose debts were forgiven vote Democrat straight party line.

Problem is the 9.9 Million (Minus one percent forgiven)….They are going to vote for Trump if Joe Biden is the Joke the Democrats nominate instead of Bernie Sanders.

Try navigating and maintaining compliance with the Dept. of Education’s program for forgiveness on the basis of permanent disability. This engineer and scientist couldn’t.

I have some issues with any blanket forgiveness of student loans. But the WSJ readers who object are mostly unaware, and like to stay unaware, that shittygroup, rather, citigroup, received 2.5 TRILLION in secret revolving loans from taxpayers. That is in addition to another half billion or so from tarp etc.

Blanket forgiveness for the Elite criminals Vs a permanent burden left on the backs of the young.

Well if you get confused by silly things like facts, you just might have to change your mind.

same model of ‘faux-forgiveness’ as used in the mortgages.. and it goes all the way back to the revolutionary war veterans ‘bait and switch’ pensions through the veterans the MacArthur and Patton murdered in DC

Yet another indictment of means-testing in government programs by one of the best financial journalists working today (meaning Yves for illuminating this and putting it into context, not the WSJ reporter in this case who I am not familiar with). Thank you, Yves.

I went to Kohls on Saturday. The sales clerk, a thirtyish woman, was helpful and competent but seemed tired and mechanical. A little conversation brought out that she works there part-time in addition to her full-time job. I said, “student loans?” And she said wryfully, “yes and I guess I’ll be doing this for the rest of my life”. So many people who could be helped but may never be, instead headed for early deaths from dispair.

I once took dance lessons in NYC from an NYC school teacher who had made the fatal mistake of getting a master’s degree from Columbia University Teacher’s College (most of their graduates are from wealthy families, or go into something other than teaching, or, more often, both).

Student Loan Forgiveness Program Offers False Hope, Rejects 99% of Applications.

wHAT else is new? ####the peasants til they hurt!!

Reading this post makes my blood boil. I’m disgusted with the “they have to have skin in the game” neoliberal shtick, excusing the charging of rents for higher education. I attended the University of California in the 1970’s and it was tuition-free to all; no means-testing. I paid a few hundred dollars a quarter for “activities/facilities” fees, plus room, board, and books.

This was all funded via the Cold War residue of the Manhattan Project, via the Lawrence Livermore and UC Los Alamos Labs. There is no reason that we couldn’t switch half-a-trillion from the annual National Security State budget to a Climate Change Manhattan Project and return to tuition-free higher education — except that public labs and public universities are harder for elites to extract rents from.

As for librarians, an acquaintance of mine was Employee 14 at Yahoo, because they needed to think about indexing and search. She did quite handsomely by her Library Sciences degree, let me assure you!

Agree about boiling blood. I’m fairly detached and enjoy the intellectual game of watching the crapification of our society, but: we are crippling our young people. I had a small student loan in the 1980s (less than $100/mo, paid off over 10-12 years), but I was still able to quit jobs, move to different parts of the country, travel in Europe, and still make a monthly payment. All of those experiences were essential to my progression toward mature adulthood. I am speechless when I hear stories about people with crushing student loans. There are so many disheartening, terrible things going on, including unnecessary wars. But it’s the student loan crisis that makes my heart hurt the most.

“I have a wife, two kids, and thirteen fiance companies to support.” Gorge Jettson.

Exactly how many trillions of dollars went to bail out the Masters of the Universe, how much junk debt did the US take off the hands of banks at 100% of face value? I have seen reports as high as $14 trillion, but it seems nobody really knows or wants to have any discussion about that.

The US government profits billions a year off the student loan program. It’s a revenue stream, one Obama fought to preserve. In a moral government setting a student loan program would be run as a not for profit program, or a subsidy program like agriculture, mining and the oil industry receive.

The government of the United States serves the rich, first and foremost, as evidenced in so many things, especially in higher education. In our society a college degree has long been promoted as a pathway to success and to building a stronger economy and nation. A half century ago states and the federal government invested in higher education confident of the return it would produce based on all evidence in our post-war society.

The United States no longer invests in its people, unless they are rich.

Some are waking up to what should have been obvious to anybody with a brain 2 decades ago: crushing student debt is robbing our economy of the spending that used to flow from college graduates into the economy. That same debt will continue to crush and economically stunt millions of these students throughout their lives, and as they watch the lives of their children, and then their grandchildren suffer the same fate.

The values of America for at least a generation, as evidenced by our government’s actions, are this: adding to the national debt to give trillions to the richest few is more important than the benefits of promoting the general welfare of our nation. This has been the case whether the President be Republican or Democrat.

Thanks Yves for your thoughtful post.

My hunch is that programs like these do not get screwed up because of any broad policies by the Obama or Trump administrations. Instead they get mangled by the Department of Education and the awful loan servicers.

I was personally put off by the “public service” aura of this particular program…..I mean that public employees (especially but not only federal employees) have high pay, good health insurance, more time off, and wildly superior pension plans over private sector workers. The notion of public employees “slaving away” and needing special debt forgiveness was rather offensive to me.

However, I favor debt reduction and targeted forgiveness for everyone, not just public employees. I favor easier discharge in bankruptcy, and that is just for openers. I favor forgiving all interest and penalties. I favor cancelling all loans for persons now over age 65…and so on.

This particular case of the librarian hit home for me. I received a master’s in library science in 1972 at the University of Minnesota. My cost was $398 per quarter, no loans of course.

My first job paid $8,000 a year and that was a good wage. The woman in this story deserves loan forgiveness, but I think she is quite overpaid at $72,000 a year. Being a librarian has no heavy lifting, short hours and time to read on the job, etc.

(I live in MN, so the salaries of everyone on the coasts are baffling to me.)

Finally, thanks Yves for coming to Mpls last week, I enjoyed the meet up and Bill Black.

Hmmmm:

17 % of the people holding student loans are 50 and older. Another 18% are between the ages of 40 and 49. This is from a simple Demos pie chart using 2014 data. I am confident those percentages have changed and increased, The 50+ group will go into retirement having SS garnished, retirement, and quite possibly many of those who are 40 – 49 years old will also.

The time line of putting the screws to students started much earlier the Pres Obama. Up until 1976, student loans could be discharged n bankruptcy. In a 1973 report by a Congressional Commission, it was recommended that bankruptcy could only be made after 5 years. Three years later in 1976, it was determined 18% of the student loans were in delinquency and only 1% were ever discharged in bankruptcy. Miniscule . . . In spite of the small numbers being discharged in bankruptcy, the Education Amendment was passed limiting discharge till after 5 years had passed.

In 1978 and even though some in Congress wanted to reverse the earlier law, the Senate version of the Bankruptcy Reform Act was passed which said ” the five year limit applied to loans backed … in whole or in part by a governmental unit or a nonprofit institution of higher education.”The House wanted to reverse the earlier bill from 1976.

In 1984, the Bankruptcy Amendments and Federal Judgeship Act of 1984 further tightened the rules on bankruptcy discharge by dropping “of higher education” from the wording of the legislation. This broadened the restrictions on discharge to include private loans backed by non-profit institutions as well as government loans.

The Crime Control Act of 1990 extended the period before which bankruptcy proceedings could commence to seven years after repayment began.

In 1991, the six-year statute of limitations on collection of defaulted loans, which had been established in 1985, was completely eliminated by the Higher Education Technical Amendments.

By 1998, the seven-year period after which student loan debt could potentially be eliminated through bankruptcy proceedings was also eliminated with the passage of another set of Higher Education Amendments.

Seven years later, in 2005, all qualified education loans, including most private loans, were excepted from discharge with the passage of the Bankruptcy Abuse Prevention and Consumer Protection Act. Private student loans no longer needed to be associated with a nonprofit institution to be excepted from bankruptcy discharge.

If you can crawl into a student loan office, you are assured of getting a student loan. Just sign your name and better yet get your parents to co-sign.

A Delaware lawmaker has played a consistent role in the financial industry’s four-decade campaign to make it harder for students to shield themselves and their families from creditors, according to an International Business Times review of bankruptcy legislation going back to the 1970s. Beholden to the former MBNA credit card company and Delaware incorporated banks, Joe Biden has been a real ass in assisting people stuck with oppressive student loans.

“Give me a break” Joe Biden trashes Millennials with these words; “The younger generation now tells me how tough things are. Give me a break. No, no, I have no empathy for it. Give me a break. Because here’s the deal guys, we decided we were gonna change the world. And we did. We did. We finished the civil rights movement in the first stage. The women’s movement came to be.

So my message is, get involved. There’s no place to hide.” as he sucks in all the advantages of being the go-to guy for banks.

It was not just Joe who help pass (he sponsored) the latest 2005 bankruptcy act. It was Senators such as Debbie Stabenow who I managed to corner in Michigan after she noticed a gray haired guy raise his hand to ask a question. And I did. I pointed out she helped to sponsor this bill and what was she going to do to fill this burden on young people since 30% were in default or delinquency. I cornered her again in front of Slotkin and also Peters. The answer back was “I support relief.” Support is not enough.

In my recent letter to her I asked what specifically was she doing. I await her answer.

Look, talk about Neoliberalism is easy to do and cheap. Activism requires much more than talk. I support Alan Collinge and the Student Loan Justice Org. in his efforts. It is a real problem and needs s much help as you can give it,

Sorry Yves . .

Thanks to run75441 for a revealing summary of bankruptcy legislation.

I study this issue a lot, and I have never seen an estimate of how many borrowers would file bankruptcy over student loans if the process was streamlined.

Let’s say that the number is 100,000 borrowers a year cancelling their debts. If the average cancelled debt is $50,000, then the total impact is just $5 billion. Really kind of pocket change in the federal budget, and yet a great source of anguish would be relieved.

I think we also need a statute of limitations on student debt, such as age 65. Now that would cost a lot more than $5 billion, but still worth doing.

These solutions and more are discussed in articles like the one here…

https://www.nakedcapitalism.com/2018/10/ending-evil-student-loans.html

I have updated this piece, and you can reach me at

bob.hertz@frontiernet.net