By Jerri-Lynn Scofield, who has worked as a securities lawyer and a derivatives trader. She is currently writing a book about textile artisans.

Those of us who often write about various doomsday scenarios – e.g., plastics, climate change – are well familiar with a standard magical thinking response: a miraculous change in the mindset of millennials will change the world, and save us all from impending disaster.

Alas, Deloitte published a report last week, debunking this scenario: The consumer is changing, but perhaps not how you think. Millennials, it seems, behave just like you and me: economic factors drive their behavior.

But I’m getting ahead of myself. Let’s discuss the Deloitte report, which begins with a statement of the conventional wisdom:

The consumer is changing. They are more capricious and less loyal. They have less time but are more conscientious. They shy away from stores and prefer experiences over products. Today’s consumer is an entirely different animal—and unrecognizable from their peer from the good old days. This brand of conventional wisdoms has been proliferating in the marketplace for a few years now. It appears as if there has been a seismic shift in the consumer’s mindset—and choices—a shift that has left the market asking: “Who is this brand-new consumer?”

There are even more clichés surrounding the millennial consumer. They are often branded as being more narcissistic, more idealistic, more socially-conscious, and more experience-oriented than any of their preceding generations. They have even been blamed for ruining everything from movies to marriage!1 They seem to have broken the mold of their similar-aged cohorts of past eras.

The bottom line: “Contrary to conventional wisdom, there’s been no fundamental rewiring of the consumer. The modern consumer is a construct of growing economic pressure and increasing competitive options.”

To expand:

Our findings debunked many conventional wisdoms about the new-age consumer. What we learned is that the consumer hasn’t fundamentally changed, but to the extent they are changing is because the environment around them is evolving, characterized by economic constraints and new competitive options. They’re changing because of the financial constraints they find themselves in. This, in turn, has been triggered by a rise in nondiscretionary expenses such as health care and education and the growing bifurcation between income groups. They’re also changing in reaction to the abundance of competitive options available to them, made possible by technology.

It’s this swirl of financial and marketplace dynamics that is heavily influencing the behavior of today’s consumer as opposed to a fundamental rewiring.

The Deloitte report emphasizes:

In any discourse on the consumer, it would be remiss not to mention their changing economic situation. As we first highlighted in The great retail bifurcation there is a deepening economic bifurcation between the top 20 percent income earners and the rest of the population—a divide that has a huge impact on consumer behavior.

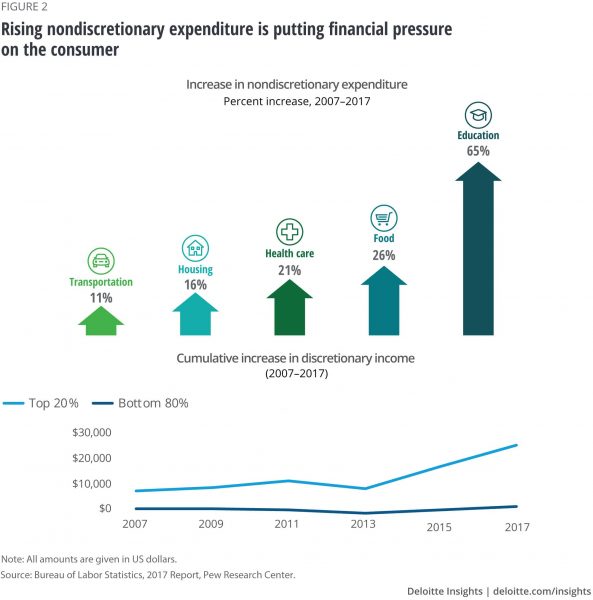

Between 2007 and 2017, income growth for the high-income cohort (>US$100,000 in mean household income) rose 1,305 percent more than the lower-income group (<US$50,000 in mean household income) in the United States. This divide has been even more conspicuous because of the rise in nondiscretionary expenses across groups (figure 2). The bottom 40 percent of earners had less discretionary income in 2017 than they did 10 years ago, and the next 40 percent saw only a minor increase. Only 20 percent of consumers were meaningfully better off in 2017 than they were in 2007, with precious little income left to spend on discretionary retail [Jerri-Lynn here: citations omitted.[

The Deloitte report makes clear that millennials are subject to the same economic pressures that burden everyone, including the shrinking middle class. To the extent the millennial cohort is unique, it is only so in that younger people are encumbered with high levels of student debt – look at that high level of education spending in the graphic.This is a problem, I should mention, that millennials have been bequeathed by Uncle Joe Biden. And I also draw your attention to growing health care expenditures, up more than 20% over the last decade. That problem is not unique to millennials, and encumbers all Americans.

The Bottom Line

But back to the burdens faced by millennials, who are financially worse off than older Americans. As Deloitte reports:

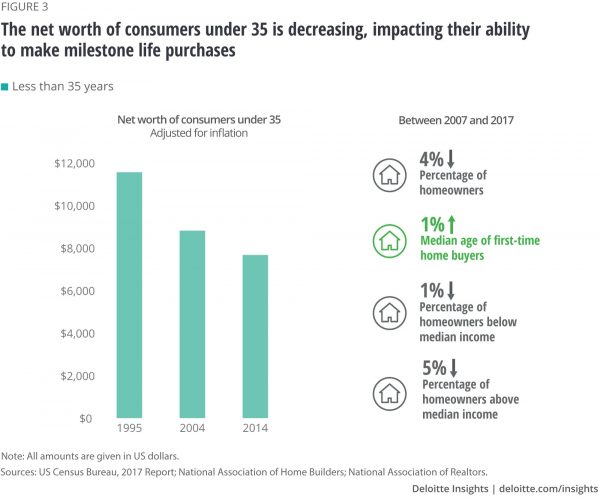

Moreover, there’s a good reason why millennials are reaching these milestones later in life: they are significantly financially worse off than previous similar-aged cohorts. Since 1996, the net worth of consumers under the age of 35 has fallen by 34 percent.24 Homeownership for the cohort declined by more than 4 percent between 2007 and 2017 (figure 3). And the rise in the education level of millennials hasn’t come cheap: Between 2004 and 2017, student debt has increased for consumers under 30 by 160 percent. Typecasting the millennial as simply being “different” overlooks a much bigger factor—that of their economic constraints.

Companies often say they need to “win with the millennial.” But the data about the economic well-being of this cohort shows that the millennial may well be losing economically. [Jerri-Lynn here: my emphasis.]

It’s not just the millennial cohort that’s losing – but everyone who’s not a member of the 1% (or perhaps, the 10%).

As Deloitte concludes:

In many ways the consumer of today is like the consumer of yesterday, they are a creature of the pressures they are under, coupled with the choices they have available to them.

And, to expand on the current status quo – thus addressing the issue raised in the headline to this post:

It’s important to note that the consumer can’t be viewed in isolation from the changing competitive market, driven by the explosion and access to choices. The consumer is changing in reaction to the proliferation of competitive options in the market. This change has been made possible by technology, coupled with reduced barriers to entry, and the emergence of smaller players who are creating niche markets with more targeted offerings.

That is one of the curious things about the chattering class talking about the economy being 70% consumer driven, at the same time TPTB have been putting downward pressure on wages for forty years. I suppose since most of our elite don’t actually make anything anymore, just moving money around, this consumption issue is too abstract to bother.

Another curious thing in the back of my mind, when I am arguing that most of the gains of the last 40 years have been hogged by the 1% and mostly the 0.1% – what happens if you succeed in reversing the trend and most “consumers” have more discretionary income to spend, do they just hasten the destruction of the biosphere?

Good question. Also, would a redistribution of wealth lead to an undesirable rate of inflation? People at the bottom of the scale who need to spend would suddenly start spending more — though perhaps only after paying down debt.

>though perhaps only after paying down debt.

Thus funneling the money back upwards again…

Wages have not even come close to keeping up with actual – not Fed massaged – inflation. Which apparently is a desirable inflation rate, but inflation caused by people making more money is akin to apocalypse?

Methinks a debt jubilee is well overdue. But then I guess we already did that for the banks with QE, and otherwise it is called helicopter money if it is done for the poor.

Still, debt jubilee might just make people feel more flush, consequently buying more consumer crap quickly turning into garbage.

Such are the perils of turning citizens into “consumers”, calling them “consumers” ten thousand times a day, as if our prime responsibility on this earth, to God and Country, is buying stuff.

Of course, there is exactly zero correlation after a certain point, of increased stuff leading to increased happiness. Probably there is a direct correlation, after a certain point, more stuff actually leading to unhappiness.

Here’s something I haven’t understood for a long time.

On the one hand, we have low inflation. On the other hand, non-discretionary spending — the stuff that’s really wringing younger consumers — has been rocketing through the stratosphere. So why is it that inflation measures don’t appear to take this into account? Is it because inflation gauges include wages as well as prices?

If that’s the case, maybe we need a different measure, since low inflation sounds like a good thing when, in the present, the cost squeeze on households is getting to be unbearable.

Do we really have low inflation? That statement is difficult to reconcile with the undeniable reality of Figure 2.

Our CPI metrics overemphasize the mostly discretionary items where we’ve actually seen price decreases (like clothing and consumer electronics), while de-emphasizing the non-discretionary stuff where prices have been rising. I suspect this is done for political reasons, as it make the Federal Reserve look like they’re doing to better job of managing the money supply than they really are, and it makes deficit spending by the government (and the implicit money-printing that goes with it) look less harmful than it really is.

Back in 2013, Barack Obama proposed moving Social Security cost-of-living adjustments to the “chained CPI”, which yields an even lower inflation value than the metric we use today. The backlash was tremendous, and the proposal was rightly dropped because it made the cost-of-living adjustments that were already inadequate even worse. Alas, Donald Trump is proposing the same thing today.

[And as a side note, this article doesn’t describe the massive price inflation we’ve seen in the stock market. If you wish to buy some shares of stock in order to have some dividend income when you retire, your dollars will buy fewer shares than ever before. If course, if you’re rich and already have a lot of stock… Now you’re even richer! Millenials aren’t the only ones getting screwed here. All of this accelerates income and wealth inequality in general.]

“Back in 2013, Barack Obama proposed moving Social Security cost-of-living adjustments to the “chained CPI”, which yields an even lower inflation value than the metric we use today. The backlash was tremendous, and the proposal was rightly dropped because it made the cost-of-living adjustments that were already inadequate even worse. Alas, Donald Trump is proposing the same thing today.”

Really? So Trump is really an Obama Democrat. Who knew?

No, Obama was a tool of the Elites. Trump is a member of the elites.

it’s the way “they” figure “inflation”.

hamburger=steak, 50 year old criteria, based on 80 year old assumptions, that never really reflected lived reality.

model=map, and all.

it’s been 15 years since i paid off my one and only mortgage…and almost 30 since i had a car loan to service. I have no credit card.we paid for this house incrementally, as we built it, with cash.(and, incidentally, since we did a composting toilet, we needed no permits, at all…so i had to personally inform the property tax people that it was there,lol., or it could have been years before they even knew about it)

the things we spend $$$ on aren’t counted by the bean counters.

deloitte seems to have discovered, to their great surprise, that the Demand Side matters. that this epiphany has finally penetrated their lofty tower is, I suppose, a good thing(like the IMF’s recent discovery that “neoliberalism” sucks for most folks)

better late than never…but all they needed to do was ask.

I’ve known that the official numbers were self serving bunk for 20+ years.

They don’t call it ‘chained‘ for nothing.

Here is the definition of core inflation pulled from the web:

“Core inflation is the change in costs of goods and services, but does not include those from the food and energy sectors. This measure of inflation excludes these items because their prices are much more volatile. It is most often calculated using the consumer price index (CPI).”

Given that there are ways to smooth volatile data, such as multi-year moving averages, and it is rather difficult for a consumer to get by without purchasing food and energy, this definition of inflation seems designed to mislead.

An increase in CPI might be welcome by many if it resulted from an increase in nominal wages of those low wage workers providing services.

This could allow easier servicing of consumer debt.

But holding wages down helps keep the headline inflation number lower.

But food and energy are a really small part of my spending. As the article above shows it’s medical, education, childcare, housing, retirement that are huge factors and keep growing faster than “inflation”. Medical is especially bad in that it is so random and hard to plan – very little spending then huge cost due to, e.g., cancer – and then you have no idea how much your insurance might pick up. Why isn’t retirement, housing, education (college), childcare mentioned besides food and energy also mentioned? Those are the things I worry about.

What we “want” has been getting cheaper and cheaper. Fancy cell phones, TVs, movies, online games, head phones, special foods, etc.

What we “need” has been getting more and more expensive. Education, healthcare, housing, transportation, maintenance, healthy food, clean water, etc. They are all far more expensive these days in the past. There are no Black Friday sales for real estate or tuition :/

The expectations for the average consumer have to be getting worse because they’re seeing how much things cost when they replace a fridge or a furnace and it doesn’t last as long as they remember the old one lasting. Or when they see their kid’s bills for tuition and rent. Or when they get sick and they realize a lifetime of savings doesn’t prepare you for the millions of dollars a cancer diagnosis costs. But they can buy a million cheap pieces of crap made overseas for a hundred dollars and have them shipped to their door so I guess that’s progress?

Meanwhile, the elite continue to ratchet up expectations of the good life and authentic cultural experiences far out of the realm of the average consumer.

Want to see Hamilton? Expect to pay a lot for tickets. If you can find them. How about Harry Potter and the cursed child? That’s shown in 4 acts, so you need two expensive tickets. Four tickets if you’re taking a date.

How about a nice trip to the movies? If you can get the reserved seats for the latest blockbuster, and you spring for popcorn, candy, and a drink, you’ll be spending $50 or more for the privilege of enjoying the film in IMAX 3D.

But, perhaps travel is where you would prefer to spend your free time and hard earned money? Well, now that our glorious leaders have turned most of Mexico, Central America, and a South America into awful places riven with crime and suffering from climate change, you’d best stick to the lower 48 in the US! Maybe you can see what’s left of the National Parks we’re not funding anymore? And watch out for the beaches contaminated with fecal matter and trash. By the way, don’t drive through the bad parts to get there or else you’re liable to have an authentically violent experience with the have nots.

Travel to Europe, the UK, and Asia, is well out of the means of most people. Disney is outrageously expensive and becoming more so… we tell people that what they can have is dirty, and not authentic, and we show them just enough of the good stuff to make them want it. And these people who have been shut out and told they’re worthless have a lot of guns. This isn’t going to end well.

The deplorables are going to respond sooner or later. God save our modern day Bourbons when they do. Because no one else will :(

“If you can get the reserved seats for the latest blockbuster, and you spring for popcorn, candy, and a drink, you’ll be spending $50 or more for the privilege of enjoying the film in IMAX 3D”. That’s for 2 people. A regular “Tough chick with a gun, doing anything that a stupid guy with a gun could do”, piece of Hollywood shit, will set you back $30 if you include the junk food. Of course with gas, parking and all that, it’s more like $40.

Two nights like that will pay for the material to paint a superb huge screen on a wall in your house or garage.

https://www.projectorcentral.com/paint_perfect_screen_$100.htm

A used video projector, old computer and $500 off the shelf sound system and you’ve got your own surround sound wide screen theater. 4K projectors are getting cheaper.

Youtube has free movies, warner, criterion, Netflix and Prime are cheap, especially when you have a BYOB night at your house. Screw Hollywood.

I’ve wondered too.

If a producer lowers costs by using lower quality components and/or reduced services without lowering product/service price, isn’t that a form of inflation?

And when prices are increased for an otherwise identical product/service, that’s plain ol’ classical inflation, right? How are the yearly and significant year over year price increases for things like health insurance and medications not registering on inflation measures?

And when both happen at the same time… ??

It used to be when you bought a PC with microsoft windows you generally got microsoft office included (word, excel, ect). Does that come included now or is it a monthly subscription? What inflation?

I’ve seen so many examples of this–it’s the reverse of the hedonic inflation adjustments–but I don’t think the governments statistics are capturing the crapification of everything. Ignorance by design. And even if you are willing to pay more for something that’s durable and/or well made, you’re hard pressed to find it. More chips in the gadget or appliance doesn’t mean it will last longer. Au contraire.

Yes, durability is vanishing. Chips in products like cars also restrict repair opportunities.

And oddly, the chips themselves are often very robust, but chassis/containers are increasingly cheapened. And then there’s the software, which is we see in the 737 MAX, and iOS/Windows, and Google Search, can be crappified during a products physical lifetime.

Measuring the economic inflation might inhibit not just profit-taking, but continual profit increase, one of the goals of the groaf philosophy.

Long, long ago in a galaxy far, far away (so mid-1990’s in Washington, DC) I worked for the Department of Labor, Bureau of Labor Statistics (DoL BLS.) My job related to adjusting the core Consumer Price Index (core CPI) in such a manner as to render it “current” and applicable to the year under analysis.

The CPI was devised in the late 1960’s and early 1970’s as a method to analyze the economics of the day so costs and incomes could be compared across long-ish periods of time. For reasons that were defensible at the time, the CPI did not include “energy” or food. (I put “energy” in quotes because it meant something slightly different back then, when gasoline cost pennies per gallon and your car maybe got 10 mpg. So if the price of a gallon of gas went from 20 cent to 25 cents, then that was one heck of a jump in price. Recall that in 1973 we had the oil embargo and the price of gasolene in particular and the price of energy in general went through the roof.) Food had not yet been commodified (they were working on that) so those prices were also considered too volatile. Health care costs could be ignored for equally good reasons. Yadda, yadda. In short, the CPI was based on the price of washing machines and TVs which have effectively fallen over the decades thanks to globalization. Thus was created what was called a standard basket of consumer goods and the price of that basket of goods was to be tracked over time. This was to be rendered into the CPI.

Then the economy changed in ways that could not have been predicted in the 1960’s and 70’s. These massive changes made the standard basket of consumer goods all but irrelevant. Consider a TV in 1970 and a TV today – exactly how are these comparable?

So why hasn’t the CPI been updated to reflect our present day? There are several reasons. For one, it would be a political nightmare. The fight over what to include in the new CPI would never be resolved. For another, it would destroy the very purpose of the CPI – that costs should be comparable over time. How to compare your 1970 phone to your modern phone? As an exercise, think back to what used to be required to make a long distance phone call, much less an international call, circa 1970 and then consider what is required today.

So how does the DoL BLS make such a decrepit method of tracking costs work in the present day? Do they have worker-bees checking prices of goods and services? Of course not. It’s all done with models. Costs are modeled and statistically adjusted and large meetings are held between “stake holders” and you may rest assured that members of the political class are consulted. The CPI has become an entirely political figure. You are not supposed to understand the CPI. It is unfathomable to the rational mind or to anyone not steeped in rather sophisticated statistics with good reason to buy into the elaborate fiction. Lies, damn lies, and statistics. Nothing to see here. Go about your business and don’t ask questions.

NB – This is a not half bad, if deliberately brief and incomplete, Wiki article on the US CPI -https://en.wikipedia.org/wiki/United_States_Consumer_Price_Index

Thank you for that. I tell many of my students in my economics classes is much the same story. But I like this as an actual referent I will probably use it in my classes.

I think there are more factors than listed above that impact the changing consumers. I can just look at my children to see clear examples.

1. Many of the jobs are in cities now. so half my kids live in big cities, don’t own cars, and live in rented apartments. So all of the expenses related to owning a car and a house are missing. That money goes into apartment rent, paying off student loans, and “experiences” such as travel and entertainment, including eating out. They don’t have the room to put anything in anyway, so the last thing they want is lots of doodads.

2. Marriage and having kids is being deferred until later, if at all. So the consumer purchases associated with those items are reduced. That goes along with living in apartments in cities without cars.

3. My kids are realizing (based partly on my cattle prodding) that retirement savings are important. So all of them are at least putting some money away in 401ks and Roth IRAs. That money is not being circulated in the economy as consumer spending.

4. None of them like carrying debt, so they are not racking up much debt for car purchases or credit cards. The ones that have student debt have been paying it down aggressively, so it is going away ahead of schedule. They all have jobs and I didn’t let them rack up large student debts in the first place, so they can do this. However, debt repayment means they are not buying consumer thingies.

I think the under 40 generation would have a very different consumer profile if they and their parents had not bought into the chimera that $100k+ in student loan debt is an “investment” in yourself. Even the $25k loan range (which I think is a reasonable amount of debt for a real 4-year degree with job prospects) will suppress consumer spending. Much higher than that is suffocating, unless you have a starting salary in the $75k/yr range or more.

I am wondering when the companies catering to retail customers understand that the out of control education and healthcare costs along with local ordinances limiting high-density housing development are suffocating their industry. The existence of lavish consumers is not an entitlement. It must be earned.

“Consumer” vs “Customer”

One invokes a goose with a funnel jammed down it’s throat consuming everything that is poured in.

The other refers to the voluntary choice, or custom, of shopping in a business you like, or seeking such a product.

Want my money? Hire English speaking people, some of whom are my age cohort, pay them decently, give them benefits and sell quality products. I will be loyal, will refer others to your store and will spend my cash there, instead of a credit card, which is saved for corporate stores.

Don’t expect me to go to your website, or do the work of the store, as in self checkout, which is just so darn confusing that many things fail to get scanned.

I hope you were being satirical. That world you desire is gone and frankly it is not coming back except maybe in niche locales. You will end up crabby and lonely if you dwell in the past. I find people who are working but are not totally fluent in English get to fluency rather quickly and also want to be fluent. Try assisting them instead of being annoyed. Imagine yourself in that position…..

I certainly agree wholeheartedly regarding pay and benefits.

Web shopping is not going away. It’s too convenient for us busy people though I make a point to try and deal with the actual stores or individuals rather than the Amazon monster or big boxes. I use Etsy a lot. Welcome to the 21st…

That world is not going away. It is sleeping. It is submerged. Good post, Cal2.

Yup, we live in a niche. It’s called “California”. Our generation has the money that companies want. We don’t eat at McDonald’s or shop at Target.

The fluency aspect is not to be understood, but rather to expect companies to hire Americans, and pay them decently, rather than cheap foreigners who can make themselves understood, but who don’t get nuances or fine details and often won’t or can’t follow instructions from managers or customers, though no fault of their own.

Enjoy your strip mall in Arizona.

There is more money in the world today than at any other time human history. Yet there doesn’t seem to be enough to go around. Hmmmm.

The price of education is completely divorced from its value and has become a commodity with similar dynamics to the wild price volatility that “consumers” face in health care. I went to college in 2007 and recall it being absurdly expensive even with a decent scholarship. I just went to grad school and lemme tell u, those days are a bargain. How could any standard econ models explain supply/demand of goods for which the average consumer pays different prices for the same good to the tune of 10s of thousands of dollars? And these are “nonprofit” institutions? Its like “deadweight loss” is the incentive vs profit…

There is no competitive, or otherwise, marketplace for a degree.

Maybe we should call it the Greed Index. On a related note, there is a *world* of difference between somebody on the bottom wanting more, and somebody on the top wanting more.