Yves here. As the old saying goes, “The yield curve predicted nine of the last five recessions.”

By Inês Gonçalves Raposo, an Affiliate Fellow at Bruegel who previously worked for the Financial Stability Department of the Bank of Portugal. Originally published at Bruegel

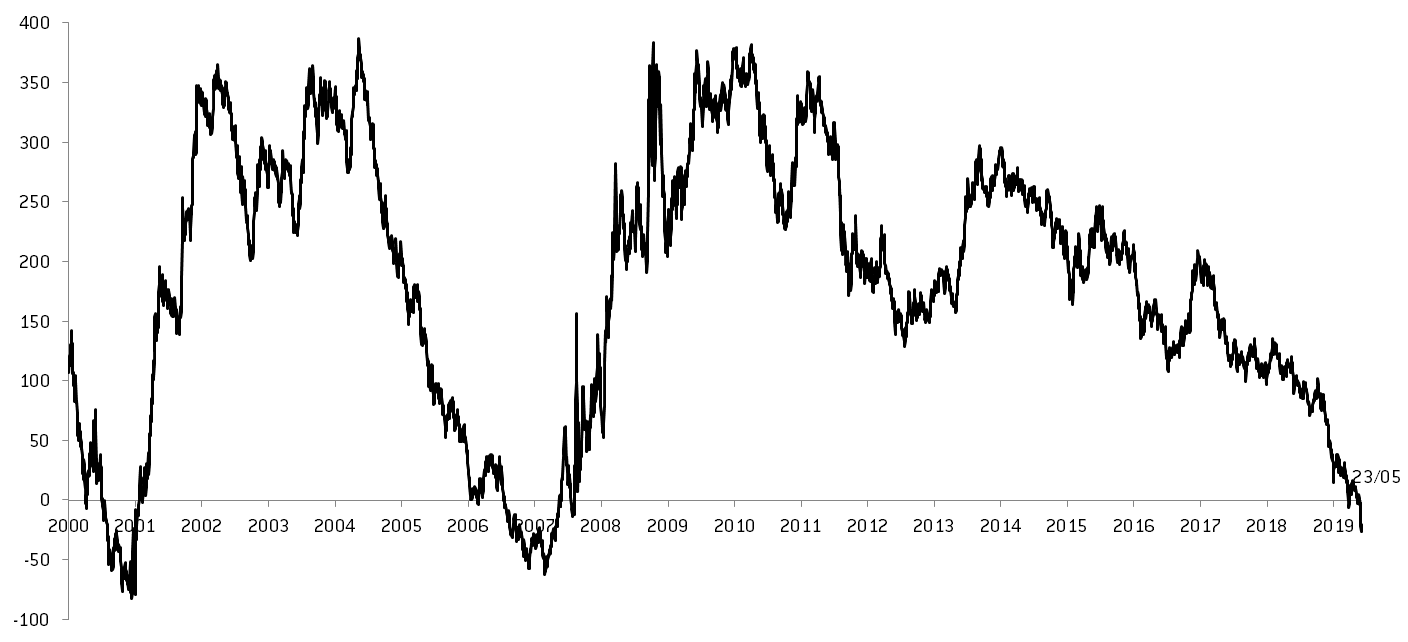

Longer-term yields falling below shorter-term yields have historically preceded recessions. Last week, the US 10-year yield was 21 basis points below the 3-month yield, a feat last seen during the summer of 2007. Is the current yield curve a trustworthy barometer for future growth?

The yield curve plots the yields of government bonds for different maturities. Market analysts often use it to understand future growth expectations and predict recessions. A regular yield curve will be upward-sloping, as the yield on longer-maturity bonds will be higher to compensate for the risk. This is no longer the case for the United States, where the yield for the 10-year Treasury Notes first became lower than the 3-month T-Bill yield this March, staying so since the end of May (Figure 1). Is the yield inversion a red flag for future growth? We review the latest economists’ views.

Figure 1. Spread between 10-year US T-Note and 3-month T-Bill, basis points

Source: Bloomberg

Matt Phillips and Stephen Grocer document the fall in long-term yields of government bonds in Australia, Britain, Germany, Japan and the United States since January. Indeed, for Frances Coppola, the global inversion of yield curves deserves some consideration. She draws attention not only to the United States, but also to Canada, the euro area, Switzerland and the UK, , where the curve inverted for shorter maturities; Hong Kong’s is “inverted along almost its full length”; Japan and South Korea’s seem to be close to inverting.

Coppola recalls that historically, “an inverted yield curve has preceded every U.S. recession since WWII”, though “not all U.S. yield curve inversions have preceded recessions”. While an inversion can sometimes merely signal a slowdown, Coppola warns against dismissals of the latest developments, as they signal that “the market is pricing in significantly lower interest rates to come”, which foreshadows falling inflation and poor economic outlook.

There are two episodes, in 2000 and 2005, when the Fed ignored inverted yield curves. In 2005, longer-term rates did not rise despite “a 150 bps increase in the Fed Funds Rate”. Instead, the yield curve flattened. The interpretation was that bond markets were irrational, and it remained so until December 2006, when the yield curve inverted. During that time, the Fed had been raising rates and only started cutting them six months after the inversion. The same flattening took place after the Fed raised rates in 2018, but this time things seem to be different: the Fed has “paused interest rates and says it is rethinking monetary policy. Nonetheless, the siren voices saying ignore the yield curve are getting louder”.

In the past, one of these voices was precisely the Fed’s chair, Jerome Powell. The reasoning? Changes in interest-rate markets have distorted the information that we can take from the yield curve. To put it simply, we cannot extract as much information on the growth outlook from the yield curve as in the past. This view was shared by Ben Bernanke, who named last summer “regulatory changes and quantitative easing in other jurisdictions” as distortions affecting the curve’s signalling power.

Nicolas Spiro argues the US yields are being anchored by the low yields in Japan and the euro area. Spiro explains the inversion of the US yield curve with latest survey data on Germany’s manufacturing sector, which has fuelled “concerns about the euro zone’s largest economy and the broader slowdown across the bloc”. In his view, the yield curve is not accurately portraying economic sentiment, in contrast to data on US manufacturing activity, for example. The signalling power of the bond market, for Spiro, “says more about the actions of global central banks than it does about the direction of America’s economy”. In a similar fashion, Mohamed A. El-Erianwrote for Bloomberg in March that the American job market and consumption sentiment are strong and that inflation expectations are low because of “a structural weakening of inflation drivers”.

Some economists have empirically tested the claim that yield curves have lost predictive power over time. According to Carlo Favero, Sebastian Vismara and Iryna Kaminska, warnings about yields should not be dismissed. Favero et al. focus on the United States and United Kingdom and see how the yield curve has “performed as a predictor of GDP growth over time in the US and UK”. The authors find that the yield curve slopes’ predictive power over the level of economic growth was gradually lost in both countries during the early to mid-2000s. Recently, however, there has been an increase in predictive power. This increase, according to the authors, is driven by policy-rate expectations, which correlate “positively and significantly” with future GDP growth. Terrence Mills, Forrest Capie and Charles Goodhart focus just on the UK and find favourable evidence towards “the hypothesis that the inverted yield curve is (…) a predictor of UK recessions for horizons up to 18 months for both the pre-WWI and post-WWII periods”.

James Hamilton from Econbrowser also takes the pulse of the US yield curve through different measures. The spread between the 10-year/3-month interest rates is narrowing; the term premium on 10-year bonds has become negative, meaning a higher expected annual return from a T-Bill rather than a T-Note. Hamilton also estimates a regression predicting next-year average real growth as a function of the current interest-rate spread and quarterly GDP growth rates. He concludes: “The fall in the spread of about 200 basis points since the end of 2015 would lead us to expect about 1% slower GDP growth over the next year.” Another measure is the difference between the term premium and the spread, which is currently negative, a common feature with the past six recessions. However, there is still “another 80 basis points to go before we get there this time around”. His takeaway is that it would be “imprudent” to ignore the developments in the 10-year/3-month spread, yet the current slope of the yield curve “is not as clear and not as dire a signal as some analysts might have you believe”.

Simon Moore shares this view and says that, though the signs are not particularly encouraging, the current inversion of the yield curve is not as deep as in other points in history. According to Moore, for the probability of a recession within one year to be higher than 50%, the spread would have to reach four times its current value. An alternative way to look at it is that two rate cuts by the Fed would “get the yield curve back to its traditional upward slope”, ceteris paribus.

For Michael Mackenzie, global trade flows and business investment are motivating buyers’ behaviour, which will hold “even in the event of an unexpected trade truce before the G20 meeting in late June”. Mackenzie writes for the Financial Times’ ‘The Long View’ that the current developments on global sovereign bond markets and the risk of a global economic slowdown running into the second half of the year may increase pressure on the Fed to cut rates. However, the lack of indicators such as lower inflation and falling consumption or business investment make this move unlikely to happen anytime soon. Mackenzie warns that markets will still expect a “pre-emptive rate cut” by this summer, “which in turn means low Treasury yields and the prospect of a sustained curve inversion”.

The Economist sees Europe being in a “tighter spot” than the United States. The latest flag for concern, they report, are Germany’s negative 10-year yields. Falling global trade, muted growth, and inflation mean the bloc risks falling into stagnation. Yields were already negative for shorter maturities, Eshe Nelson recalls, but the long-term bund is “the benchmark for all European debt”. B. De Backer, M. Deroose and Ch. Van Nieuwenhuyze write for the NBB Economic Review that the yield curve is a useful, though imperfect, predictor of recessions in the euro area: “the yield curve did not invert before the sovereign debt crisis”. Similar to the US, in Europe each yield-curve flattening not only preceded a recession, but also “was accompanied by significant increases in the short-term yield, whereas the change in long-term yields was smaller” which, as the authors point out, stresses the role of monetary policy. Yet, unlike the American yield curve, the euro-area yield curve still has a “significantly positive” slope, signalling a low probability of recession for now.

The negative spread between long- and short-term bonds, similar to 2007 levels, rekindled the attention over the inverted yield curve. So did the fact that the decrease in yields is now global. As a result, some blogs attempted to estimate empirically the claim that the yield curve is losing predictive power. These estimates mostly focus on the United States but matter for Europe: as Luis de Guindos says, while monetary policy can “shield the euro area economy from spill-overs from US monetary policy”, the United States still play a key role in driving global financial cycles.

Speaking of the inverted yield curve as an indicator or recession this podcast episode with ft shows that the fed is or has already moved on to its newest and according to them more accurate indicator of recession – https://www.ft.com/content/92dea877-1c35-4a98-b24f-9fb8b4d122ec