Lambert here: The rich are different. They hide their wealth. Sadly, does not name names!

By Neil Cummins, Associate Professor of Economic History, London School of Economics. Originally published at VoxEU.

Sharp declines in the concentration of declared wealth occurred across Europe and the US during the 20th century. But the rich may have been hiding much of their wealth. This column introduces a new method to measure this hidden wealth, in any form. It finds that between 1920 and 1992, English elites concealed 20-32% of their wealth. Accounting for hidden wealth eliminates one-third of the observed decline of top 10% wealth share over the past century.

The 20th century’s ‘Great Equalisation’ of wealth in Europe and the US was the result of the decline of top wealth shares. In England, the wealth share of the top 1% transformed from over 75% in 1900 to less than 20% by 1970. Economists believe that new wealth created by the post-war ‘Golden Age’ of economic growth grew faster than old wealth, accumulating at the net-of-taxes rate of return (Piketty 2014).

This stylised fact is based primarily upon declared wealth. But the incentive to hide wealth exploded over the 20th century. In 1950s Great Britain, the top marginal rate of estate tax was almost 80%.

Is the ‘Great Equalisation’ of wealth illusory? A simple misreading of the true wealth distribution, a result of an increased tendency of elites to hide their riches?

Declared wealth-at-death data are the primary source for our understanding of the 20th century wealth distribution in England (Atkinson and Harrison 1978, Atkinson et al. 1989, Atkinson 2018, Alvaredo et al. 2018). Since 1858, the individual details of wealth at death have been centrally recorded in the Principal Probate Registry calendars. This source records all decedents in England and Wales with wealth above the threshold (currently £5,000). Name, address, date of death, the name of the executor and an estimate of estate value were consistently recorded. I digitised the original printed volumes and algorithmically parsed and formed them into a database suitable for economic analysis, in a process which I describe in Cummins (2019a).

Using this 100% sample over the period 1892-1992, my new analysis (Cummins 2019b) presents a method to estimate hidden wealth. I define ‘hidden’ wealth as wealth missing from the perspective of the probate calendars, and therefore of the tax authorities. A portion of this will be legal portfolio re-arrangement to tax-exempt trusts, inter-vivos bequests, charitable donations, gifts to non-family members, and a portion will potentially be illegal tax evasion.

The method is a simple accounting exercise that exploits the nominal, individual-level data. The key identifying assumption is that wealth declared before 1920 was a more accurate measure of the ‘true’ wealth of a dynasty than wealth declared after 1920. The incentives suggest that this is reasonable – taxes on wealth before 1920 were a tiny fraction of taxes after 1920.

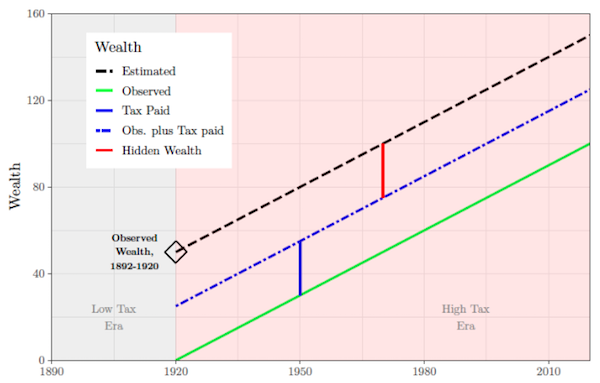

Figure 1 The Concept

During the low-tax era of 1892-1920, I sum declared wealth at death, by dynasty. I then calculate an expected flow of inherited wealth that should show up in those same dynasties after 1920. For most, wealth after 1920 is in excess of that predicted by the inheritance flow from 1892-1920. This is newly created wealth. However, for certain dynasties, declared wealth is systematically below expected wealth from inheritance. This is hidden wealth.

For the analysis, I select only rare surnames of English origin which have fewer than 100 people observed in the 1881 census, and track these rare surname dynasties in the probate calendars from 1892 to 1992. Within this group, I define a ‘Victorian elite’ as the top 1,500 richest wealth-holding surnames from 1892 to 1920.

Formally, I compare estimated wealth calculated using the net-of-taxes rate of return on capital on observed dynastic capital during the low-tax pre-war years with that actually observed in the later high-tax post-war era. I incorporate wartime destruction and all death taxes paid into this estimate of ‘true’ inherited-wealth. Figure 1 illustrates the concept for calculating hidden inherited wealth.

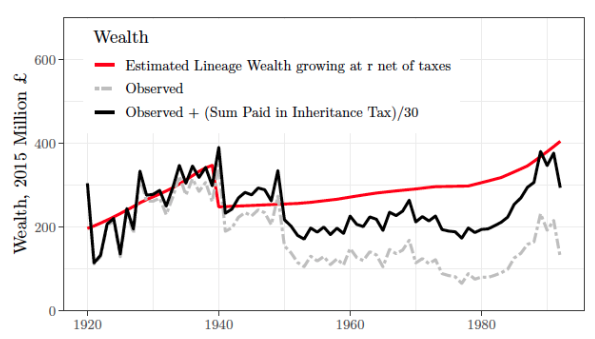

At the aggregate, this estimate is lower than observed wealth as new wealth is being created by non-inheriting surname dynasties. However, for the richest English dynasties, the Victorian elite of 1892-1920, it is clear that at least 20-32% of all elite wealth is hidden by their descendants in the period 1950-1992. This is shown in Figure 2.

Figure 2 The Missing Wealth of Victorian Elite Lineages

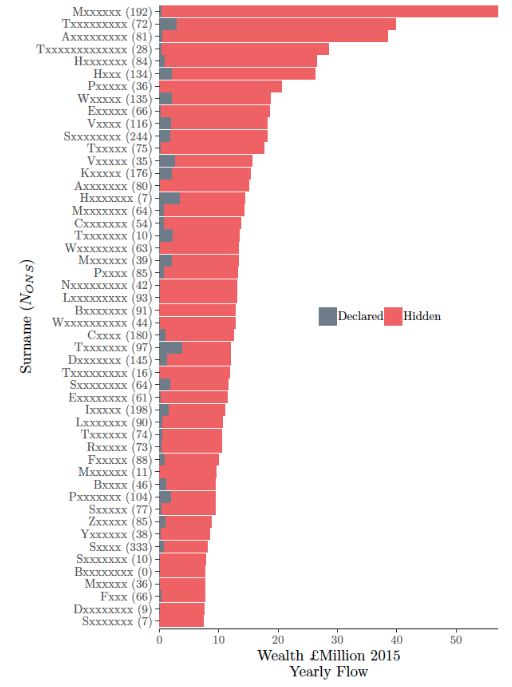

At the individual surname level, this hidden wealth estimate, and the proportion of hidden wealth, strongly predict the appearance of a surname in the recent Offshore Leaks Database (International Consortium of Investigative Journalists 2019). This suggest that a proportion of inheritance taxation is potentially being evaded. Further, the richer the dynasty, the greater the proportion of hidden wealth.

Using the locations of 31 million UK voters from the electoral roll of 1999, and data on the complete price paid for house sales in 2017-8, I show that hidden wealth is associated with more expensive postcodes. Hidden wealth boosts contemporary consumption and the living standards of hiding dynasties. Further, I show that the children of those with hidden wealth are more likely to attend the elite universities of Oxford and Cambridge, over the period 1990-2016.

Figure 3 The Top 50 Hiding Dynasties, Hidden and Declared wealth

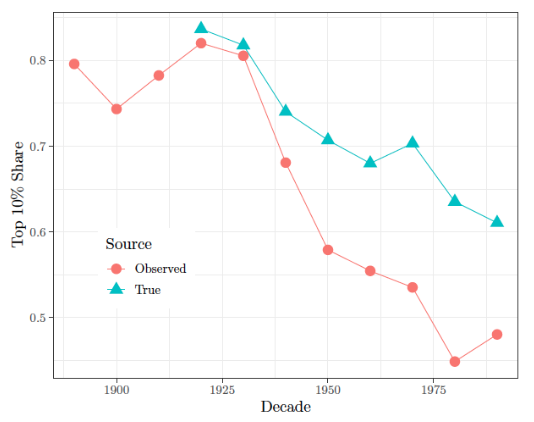

Incorporating this elite hidden wealth into a recalculation of the top decile wealth share shows that the decline of the ‘true’ wealth share is significantly more muted than that for observed wealth. The richest decile holds an extra 10% of the ‘true’ wealth distribution, equivalent to a 33% reversal of the observed decline.

Figure 4 Top 10% shares, Observed and ‘True’

In Cummins (2019b), I present a simple method, combining historical and contemporary data, to estimate hidden wealth at the surname level. This method produces a set of surnames that are potentially hiding a large amount of wealth. Tax authorities could use this information to investigate potential evasion.

Internationally, the pattern of a low-tax pre-war era followed by a high-tax post-war period is almost universal. Applying the method presented in this column to other historical wealth data from other countries could lead to the uncovering of vast sums of hidden wealth.

The implications of incorporating hidden wealth into the top wealth shares are of profound importance. Changes in wealth inequality were the largest equalising force in the 20th century. My paper shows that the true top-wealth share did indeed decline, but not by as much as that observed in the reported data. This finding is important for our empirical understanding of the true evolution of inequality over the last century and is crucial for attempts to understand the causal forces behind the ‘Great Equalisation’. It also highlights the need for further research on hidden wealth, both contemporary and historical, in the UK and elsewhere.

This data would be an interesting case to use a Benford’s Law analysis. https://duckduckgo.com/html?q=benford's%20law

By just glancing at the distribution of the declared wealth, one can reasonably say something smells.

Speaking of hidden wealth in the UK:

Rahm said never let a crisis go to waste.

The Royals have an Andrew crisis. Help them out in exchange for the Queen’s influence on Lords, Ladies and assorted MPs to tighten up applicable English laws. She has a unique ability to summon their assistance whilst defending the Realm.

Are not the Royal’s incomes still untaxed from Churchill’s 1950’s?

Not entirely. After the Windsor Castle fire fiasco – fire inspections were not allowed to check the castle for fire hazards etc before, for reasons of royal protocol or similar, the Queen simply assumed/expected tax payers to pony up for the repair work, I don’t think royals need both with insurance policies etc. either. There was something of a mini revolt about this, and she agreed to pay some form of tax, as in throwing a bone to tax payers. Basically, when it comes to royal assets, it’s theirs when it comes to having exclusive use of, but ours when it comes to paying for them, so no inheritance tax either. I think heir Charles ‘donates’ some revenues from his various inherited estates around the country in lieu of taxes. So in answer to your question, royal incomes are no longer not taxed, but taxed in a very modest way favourable to the family.

It seems to me that there are some simple things that, if set in law and strictly enforced, will end all of this wealth hiding. Like –

– no anonymous directors or shareholders for companies in any jurisdiction

– no contract is legal with a corporation with anonymous directors or shareholders from any jurisdiction

– no bank secrecy regarding tax matters

– if any jurisdiction has bank secrecy, it is excluded from international banking (now there is a nice case for economic sanctions!)

This can be done by a willing legislative and executive of the US caliber. With 800 military bases around the world, do you think anyone will be able to hide their wealth?

Essentially jurisdictions where wealth is hidden are pirate jurisdictions. End pirate jurisdictions!

What/Who do you think those bases are protecting? The starkest evidence is protecting the Syrian oil to be used for the Syrian population (if it were a Syrian private oligarch, who knows…)

This is fascinating but hardly news and therefore potentially damaging to the cause of wealth taxes if oversold.

My biggest objection is that the “legal portfolio rearrangement” effect will be massive. The rich fled offshore throughout the postwar period, perfectly legally. Barriers were erected slowly. Structures predating new rules remain effective (I forget the exact date but trusts created before 1967(?) successfully avoid many restrictions since imposed). Even onshore tax planning still works, such that many of the wealthy own nothing and the analysis would have to follow their trustees.

My other objection is that there is no one rate of return. Landed families saw great destruction of wealth in agricultural recessions and in the imposition of protected tenancies. Holders of fixed income securities suffered likewise both sides of WW2, from wartime inflation and financial repression. In contrast unregistered portable wealth appreciated greatly (art!), partly as a way to avoid currency controls etc. The postcode analysis does not say if it controls for date of purchase, given that central London property was also a losing proposition until the 70’s and afterwards a rentier’s dream.

As a result, the inferred wealth changes may be very wrong for individual names depending on their portfolio composition, even if broadly accurate for the group. Any analyses that depend on the inferred wealth of names may be misleading (Panama papers frequency of appearance gives me hope though!). There is no mention whether family trees are constructed to cope with marriage, too. This would be a good use of genealogy websites….

It would be interesting to use the postcode correlation as an independent check on the inferred wealth of the names: Are the names buying property in central London in the last twenty in the same rank order as declared or inferred wealth?

Well, just look at the list of billionaires who, I am sure, have lots of hidden wealth as well as the declared stuff:

I will admit that I really do not understand everything to do with finance, but one thing about this article bothers me: What does he mean by “Great Equalization of wealth” in the US and Europe? I don’t recall seeing any “Great Equalization of wealth” in the 20th Century in my history travels.

What, no billionaires? When did the first billionaire emerge, 1980s?

Harrimans. 1950’s.

Owned most of the shares of stock bought by the USSR of the outside of Katowice coal and steel works.

I have always assumed that Guernsey, Bermuda, Bahamas, and British Virgin Islands were always structured to facilitate hiding wealth of the British (and others) 1%.

I look forward to the Colonel’s musings on this one…

So I was reading in Nicholas Shaxson’s book “Treasure Islands: Tax Havens and the Men Who Stole the World” about a guy – one of two brothers actually – who could personify this development. Here is the Wikipedia entry-

https://en.wikipedia.org/wiki/William_Vestey,_1st_Baron_Vestey

The point is that after starting off running a meat canning factory, he eventually became a Baron and then a Lord while conducting his affairs from France which meant he paid no taxes in the UK where he lived and they couldn’t touch him. He only lived for business and apparently nothing else.

I’m not sure how much of this wealth is hidden and how much of it is just there and nobody knows about, I have never had to admit to anyone what my net worth is and what it is made up of, and I can gift what I want to my kids and nobody would know about that either, while not trying to hide anything the fact is nobody would know, also at the same time when I die I would be pretty likely to have already passed a lot of it on with nobody again knowing anything about it. It would seem if the only data point that the researcher has is data from wills which is cross referenced to property purchases, which is a very small part of what is going to tell the whole story, and all of that is without even thinking about trusts or offshore games …

I too have been reading ‘Treasure Islands.’ I think that the tax havens are a positive for developed economies, but a drag on developing economies. They allow the elites of the developing economies to provide capital to American and European banks, but suck these assets aware from the Third World Poor.

I think they also facilitate a sort of con on the developed world taxpayer, who thinks that wealthy people are being taxed at a high marginal rate, when, with all the offshore hiding that goes on, their effective tax rates are much lower. If the effective tax rates were closer to the marginal rates, capital would flee for the hills, and it would be a disaster for the developed world. Leftists can’t seem to wrap their heads around that.

Are you sure it’s Treasure Islands you’re reading, not Atlas Shrugged?