Yves here. Richard Murphy makes some critically important points about the current low interest rate conundrum, which is how central banks have effectively painted themselves in a corner. They can’t do much to increase interest rates without hurting housing prices, which has a strong effect on consumer spending, both via dampening housing-related activity and chilling sentiment, aka the wealth effect, which operates most strongly through housing.

MMT advocates argue that the way out of this mess is to run the economy by setting a price for labor via a Jobs Guarantee, rather than manipulating interest rates. For those who have not yet read it, we strongly encourage you to spend some time on a seminal 1944 essay by Michal Kalecki on the obstacles to achieving full employment. It is the best single explanation of how we got where we are.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

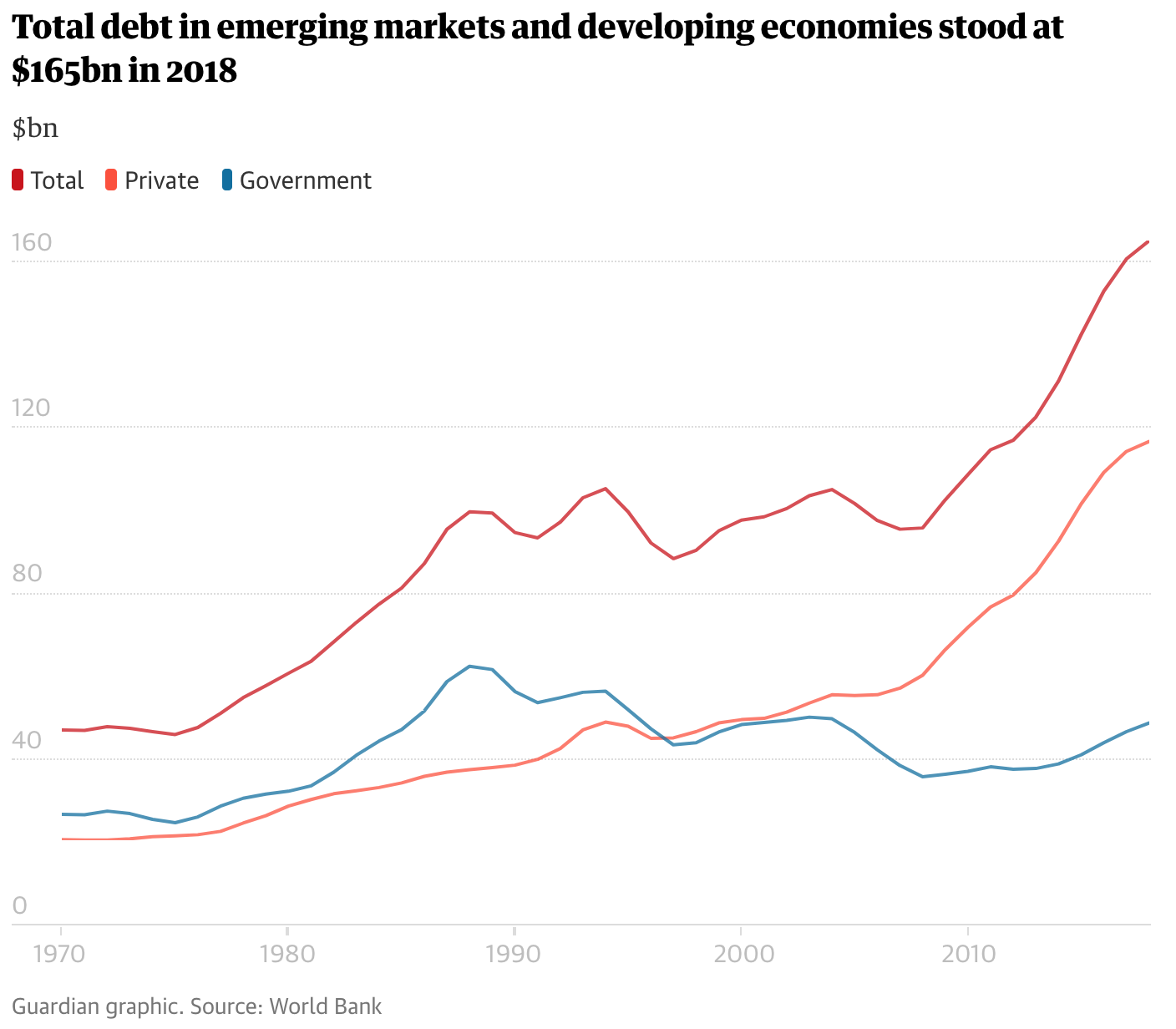

As Larry Elliott notes in the Guardian this morning, the World Bank is worried that debt is rising worldwide. This is their data:

Larry raises two concerns. One is the rise of personal debt. The other is that the data on national debt hides the fact that much of the growth is amongst developing countries.

Dealing with the latter first, the concern is very real. Debt is not a concern for a country like the UK, where we have our own central bank and currency and have issued almost all our national debt in sterling. We cannot go bust because by definition we can always pay our sterling debts. This, though, is not true of many developing countries where loans are often in a foreign currency, and usually the US dollar. There the whim of Donald Trump holds sway and could cause real problems, as would any downturn in world trade, which climate change might involve. There are real issues here.

But so too are there in the growth in personal debt. This is a symptom of over-consumption and incomes that are too low. I am not suggesting that the same people are doing both: they are separate but related issues created by an economy that promotes excessive consumption of goods produced at minimum cost to deliberately fuel debt, which then keeps people enslaved to the economic process that has ensnared them. This is the real crisis of modern capitalism, and the real reason why it is so frightened of climate change movements.

The solutions are threefold, and all are noted in my book The Courageous State.

One is to break the consumption cycle. The first way to do this is to tackle the pernicious role of advertising, which is always intended to make people unhappy.

Second, there is an obvious need to lift real incomes, the flattening in which has fuelled this crisis.

And third, there has to be a commitment to continuing low interest rates as anything else would fuel disaster and the most massive collapse.

But I stress, to argue that low rates caused this problem is wrong. It was the drive for growth, in GDP and debt, that fuelled this and brought the world to its knees in so many ways. And it is low wages for most that exacerbated that. Low interest rates are a symptom and not a cause. So let’s tackle the real issues, and not the symptom.

“The first way to do this is to tackle the pernicious role of advertising, which is always intended to make people unhappy.”

‘Always’ here is doing too much work. There are effectively 2 kinds of advertising, produce/service advertising, ie making your produce/service more widely known to people looking for such a produce or service, and image or brand building advertising. I agree in many cases the latter is pernicious in that they are selling a ‘life style’ rather than the actual product or service. It is important to distinguish between the two.

I don’t mean to sound harsh, but do you watch much TV? I now have it playing in the background when I am attending my mother. I don’t see the tidy difference you do. Start with the pervasive drug company ads, which feature pretty smiling people. Sometimes they are shown briefly with an MD but that is rare. They are regularly bouncing around with family or cooking or tending their garden or playing sports. In fact, many of them are so bouncy and cheery you’d think the drug companies were selling uppers.

And how do you position the ASPCA ads with the woman with the chewy/annoying Upper Midwestern voice droning on about the suffering of the innocent animals as they show pictures of shivering and scrawny dogs? They don’t even show before and afters to demonstrate that giving money to the ASPCA did some good! I am a big sucker for animals and these ads are a complete turn off.

With all due respect, Yves, you are talking about brand building ads that I specifically agree are pernicious.

But no, I do not watch much TV. I am European but spent a couple of years living in the US, many years ago. Two things struck me about advertising.

1 On TV, there did not seem to be any break between a program and an ad. In Europe, there is a clear break – end of part 1, ads, then part 2 or whatever. In the US, ads were seamlessly segued into the program.

2. in cinemas. In Europe, you have to sit through several minutes of ads before the film starts. When I was in US, there were no cinema ads at all. I expressed surprise but apparently, this was not the done thing. Is this still the case?

Advertising for services like home repair and etc… have been relegated to the coffee shop bulletin board here in the US.. I’ve migrated almost exclusively to sports radio since they literally never mention politics. There I’ve learned that my aging dog (who is obviously my best friend) needs CBD’s to revitalize his aging body, while I need super beta prostate to be a better father and husband…I could then perform better than I did when I was 25! while at the same time no longer be letting everyone down :-(

In Cinema, advertising is accomplished through product placement directly in the film itself and once you realize studios are doing this, it becomes very obvious and distracting. They try to make it seamless but it is so ubiquitous now that it’s impossible to miss. I wanted to provide a link but there are too many, just google ‘product placement in film” for lots of examples.

Yes there are cinema ads now. One reason why I do not go to the cinema (or what we call the “movies” here) anymore at all. The ads range from national brands to local business advertisement.

TV shows in the U.S. used to have regular breaks as well. A half-hour show would usually have one commercial halfway through and hour-long shows would usually have 3 commercials at quarter-hour intervals. This was certainly the case in the 70’s, 80’s and well into the 90’s, as far as I remember.

I don’t know when they first tinkered with the formula, but it’s gotten progressively worse to the point where now it’s near impossible to watch television. The lack of any coherent structure is just an insult to the viewer. And it’s not good for the brain.

I agree with the frequency of ads being annoying but the notion that they are indistinguishable from the show is ludicrous.

I have DVDs of programmes from the 70s and 80s, half-hour sit-coms mostly, and the usual running time was around 25 minutes, with five minutes for ads. Late 80s and early 90s sit-coms saw running time around 22 to 23 minutes. Recent sit-coms – like BBT – oftimes run less than 20. That is WAY too much advertising, and explains why I junked cable over seven years ago and now exclusively watch DVDs and Netflix.

I have no idea what you are saying about “not a clean break”. No one would mistake the ads for the programming. Please tell me how, say, the drug ads I mentioned would every be confused with the content of West Wing or a news show.

I agree, I agree, I agree.

Our daughter has suffered with Crohn’s disease for over 15 years. Putting aside how insane and pernicious our system of healthcare finance is, it is ridiculous how much advertising there is for the biologics to treat Crohn’s. The ads almost read like a battle between Coke and Pepsi. Of course, the truth is that these are complex drugs that require regular monitoring and adjusting by a trained gastroenterologist — who if they aren’t familiar with the options shouldn’t be practicing medicine. Most are administered in a hospital setting as they are either via IV or need to be watched for allergic reactions. No layman is qualified to choose between them. Yet, you seemingly can’t avoid ads for them.

Also agree about the ASPCA ads. When they come on we race to change the channel. They are offensive and we are total dog lovers.

A neighbor makes tv commercials of the high end variety, and his next shoot is in Hawaii for some drug company, and I inquired if it would feature all the usual suspects, i.e. happy-fit 66 year olds riding bikes or looking purposeful, he smiled and said, but of course.

I asked him why it was ok for insurance tv commercials to be funny and irreverent considering the product they are pushing is really serious, while beer commercials which used to be funny, now push new can technology, rather than dwell on the sudsy swill inside said container.

I think I threw him for a loop, as he’d never contemplated it all that much heretofore.

Thank Gaia for no TV, at least in this household ! Going on 20 years now, without any more un-needed consumption-inducing distraction .. with all the commercial advertizing hearing loss that goes right along with it !

Truth in advertising if it existed could help. The truth, the whole truth and nothing but the truth. It’s an amusing thought. Opportunity of a lifetime for comedians.

Breaking the consumption cycle and advertising? Now that is going to be a tough row to hoe. Our economies are built around “shopping” even though a survey found that over 90% of purchased goods are no longer in that household after six months. As an example of how deep it goes, remember what happened after three thousand people died on 9/11? George Bush told people that the best thing that they could do was to go out and go shopping! In any case, if you cut down shopping, surely that would be good for the balance of payments as most stuff is made overseas and imported into the country.

I do agree with raising wages as that would mean that people could retire debts and have the freedom to purchase more necessities. But I do disagree with keeping interest rates artificially low. Increasing interest rates without hurting housing prices sounds tough but with higher wages, people would be able to afford any rise in house prices. But to be realistic, which part of the American economy has the money to purchase houses these days? The Australian economy and financial laws have been warped around the idea of letting people purchase houses here in spite of the fact that house prices only see reality in the rear vision mirror. Less and less people can afford houses so it is usually the wealthier segments that can do so. Must be the same in America.

But solid interest rates do have advantages. It means that you no longer punish savers and reward speculators. And I seem to recall that one reason that China became such a powerhouse was that their people were fierce savers and all that money then became available to loan to new businesses instead of China having to chase “hot money” on the world market which would have kept them on a very short leash. People used to be encouraged to be responsible and to save money. Now they want people to have no savings whatsoever but to spend every available dollar on consumption “for the good of the economy.” And of course if the economy tanks again, that is their problem then.

I agree with you. Low interest rates are pushing wage earners into the casino known as the stock market. Our pensions are now being rounded up like hogs for a big slaughter when this market bubble finally pops.

Also, the comment in the article “where Trump holds sway” is really a worrying trend I see more in CNN and didn’t expect here. As mature adults we must stop using that @$$ as a scapegoat for all that is wrong, an excuse to do nothing or a Boogie man who is the source of our victimhood. He’s more of a puppet than a puppeteer.

But it’s a losing game because no matter how much money is sucked out of pensions and “invested” in the current capitalist market in equities (nobody ever questions how secure equities are – because they are not – they are dependent on demand, irony of ironies, because they are killing it and sucking it dry as we speak) it will diminish over time. Nothing is being done, nor acknowledged as necessary, to strengthen societies. That’s the only thing that matters. Hard to convince a CEO of that.

I’ll put something controversial here.

If we raise real wages, a mix of two things mentioned in the article happen:

– repay debt

– consume more.

Now, let’s start with he second. If we, as a society (country, mankind etc.) consume more, we produce more CO2. There’s almost no consumption that involves exchanging money that does not in some way consume energy, which most of the time now still means more CO2.

So “consume more” on aggregate is going to make a bad situation worse. Unless, of course, we’re all in an end-of-days/apres moi le deluge mode, it’d matter. We should not increase (aggregate) consumption if we can hep it. Maybe we’d talk about evening out consumption, rather than increasing then, if we want to help the poor. But that implies sacrifices by most of us (because, on aggregate, the 1% is not responsible for 90% of the CO2 emissions), which is a hard sell.

– repay debt. Now, here’s an interesting thing. The debt is not a real stuff. It’s a shared halucination (as is money). We could get the same by simply cancellign some of the debt. In theory, that would hurt some pensioners whose investments are in the said debt, but they don’t really care about the debt, they care about their lifestyle. Moreover, what happens to both the repaid debt (i.e. is it used for consumption somewhere, if so, see above), and what does the debtor do with the extra money now (spend in consumption? see above).

Talking about rising real wages in the light of the climate catastrohpe we’re facing is like talking how the drinks in Titanic bar are expensive and given they will be shortly going down, why not drop the price?

That is, unless we look at it from an entirely different perspective – of how can we most equitably share the resources we have, not just for us, but our kids and their kids. But that’s not about rising real wages, that’s about real use of real resources.

TLDR;:

– any solution to the social problems that increases CO2 levels (which right now increasing aggregate consumption does) is ultimately a dead end.

– we need to look at aggregate consumption redistribution, not aggregate consumption increase.

– that requires major sacrifices not just for top 1% (of the world population, not just a country), whether we like it or not.

There is a dream out there that consumption can decouple from emissions. I think it is possible but the switch isn’t happening fast enough to save us.

You probably know that there is a much more general theory for this stuff in thermodynamics which basically says you can’t do _anything_ without creating waste or disorder somewhere nearby. With that in mind it really looks like radical de-growth is needed to stop wrecking the world unless we find a way to get our entropy somewhere harmless. That’s the long term problem of all being on one planet.

I think renewable energy buys us some time on the emissions side before we have to tackle the more general problem of all the other damage we are doing killing everything else off to fuel our growth.

The big problem is that the prisoner’s dilemma prevents any move to de-growth if it means the ones still focused on growth will overwhelm those opting for de-growth.

I think that’s why a lot of people are looking at the world and waiting for the painful but apparently necessary collapse to jolt us into needed change, maybe ignoring how violent such a collapse would be.

This is the nub of the problem, Vlade. Aggregate consumption redistribution with aggregate consumption reduction.

Is it possible? It’s an individual decision (reduce, reuse, repair, recycle), share, give away … it’s also economic, political, monetary etc etc

A quick three minute refresher …

youtube.com/watch?v=WfGMYdalClU

we’re all going to need the best of luck to get through our future.

Why is a job guarantee better than a UBI for putting a floor on wages? The question is specific to this issue — I see that a job guarantee has other advantages, such as integrating people into the community and giving them access to the “means of production”, aka capital, as part of a running organization.

Why is a job guarantee better than a UBI for putting a floor on wages? @pe

If voluntary work is the ideal to aim for, then why even be concerned about a floor on wages? Are wages the only possible source of income? What about a Citizen’s Dividend to replace all fiat creation beyond that created by deficit spending for the general welfare? Too fair?

But to answer your question, similar to milk dumping in the 1930’s, a JG would consume a worker’s time and energy to make it unavailable to the private sector AND to her/himself. So, instead of, for example, babysitting your own kids, a JG would boost wages for strangers to do so instead. Brilliant, huh? /sarc

Besides which, higher wages encourage more automation which, under the present system, is unethically financed and thus the gains from it are not justly shared.

So a JG is a rather stupid, short-sighted patch to an unjust system. And that proposal comes from people who have shown no interest in abolishing government privileges for banks, a major source of our problems to begin with.

Should we have generous spending by government to accomplish legitimate domestic goals? Yes, but let’s not pay people to waste their time.

Besides which, higher wages encourage more automation

…promises promises…

This may be a valid point, and the OP asks a good question.

If a land guarantee is no good because the top would just take the choice land for “them and their’n” and isolate the disadvantaged and vulnerable on poor land…

If a UBI is no good because the top would just raise their prices and the UBI would become the new benchmark for zero…

Then how would any other mechanism designed to put capital in the hands of the many have any other effect except to enable the top to continue their swindle for a little longer.

The root cause of our socioeconomic dysfunction does not seem to be that the many have little to no capital. I mentioned on a different thread recently that i think inflation has nowt to do with money printing. The printing would precede inflation if that were so, and yet it appears to works the opposite. Prices rise, and the currency is inflated to maintain liquidity. Inflation would be a proxy for arrogance in that case.

Price discovery has become divorced from markets. The prices we pay have little to do with the value of the product or the cost to produce it. Insulin is 19th century technology, it isn’t costing folks $400 a month because they’re paying back R&D. It’s not price discovery anymore, it’s power discovery.

We do need to put capital in the hands of the many, and yet I think it’s a valid caution that doing so only works if the arrogance of the price-setters is broken, and the many are free to utilize their new capital effectively.

What do you think about high interest rates? It seems an effective means of reminding the markets how to function. The ancient Jubilee also seems tailored to short-circuit an arrogance/inflation cycle. I’d value your thoughts on this.

You are right of course, wages go to increased rents and so on as well obviously (maybe less than UBI as not *everyone* will get a raise especially if it’s only the minimum wage being raised for instance, but enough might that rents will just eat it).

There is of course the answer of directly giving the people the things they need! Not UBI, not through increased wages, but just fricken give people their basic needs like free housing and healthcare and so on already. Provide people their basic needs and that would be a floor on wages.

What do you think about high interest rates? Sol

Since usury is ANY positive interest rate and since usury is forbidden from one’s fellow countrymen in Deuteronomy 23:19-20, then low interest rates are obviously less evil.

That said, HOW low interest rates are produced is critically important; i.e. welfare for the banks and the rich is NOT the proper way to lower interest rates and has all sorts of evil consequences that may easily overwhelm any short-term perceived benefit.

So let’s have low interest rates but let’s have them be produced ETHICALLY.

The ancient Jubilee also seems tailored to short-circuit an arrogance/inflation cycle. I’d value your thoughts on this. Sol

Since government-privileges for private credit creation cheat both borrowers AND savers, Steve Keen’s “A Modern Jubilee” is greatly to be preferred over old-fashioned debt forgiveness.

If a land guarantee is no good because the top would just take the choice land for “them and their’n” and isolate the disadvantaged and vulnerable on poor land… Sol

Huh? Land reform could be done in a number of ways but the chief requirement should be that no citizen need pay rent to have some land to live on.

So a land guarantee is not only good but essential to economic justice.

A UBI is just another form of corporate welfare where the state puts spending power in the hands of the consumer for no effort on either part. It means the corporates avoid paying a factor of production (wages) for the crap they produce in order for households to gain purchasing power. Why do you think the elites are trumpeting a UBI as being the new nirvarna? It’s another free ride for these parasites!

The social ills of being jobless are desecrating the mental health of millions of people globally, so paying people to be jobless is a death spiral for society and community.

Consequently, to say a JG is stupid carries a wiff of ignorance beyond constructive thinking. You need to get out more.

1. Corporations avoid paying wages.

Higher and even higher min. wages can address that (so as to detach wages from UBI given to the people). For example, you can get free $500 and your boss can pay lower (due to higher and even higher min. wages)

2. Crap (corporations) produce matching purchasing power.

People can be trusted (or maybe not) to use that money to purchase non-crap. Maybe they will use the extra money for textbooks or just books. Buy better quality foods (organic and fresh). Afford to pay baby sitters or get help for their elderly parents, when they can’t now. Buy trees to plant, or more indoor plants.

3. Consumers (getting UBI and spending power) for no effort either part.

That’s the issue with the military getting MMT money for no effort on their part. We don’t throw out MMT. We make sure we guard against waste. The same here, I believe. We keep UBI, but watch out for mis-uses.

Wage slavery as the norm is a relatively recent phenomena and is largely* the result of an unjust finance system.

A JG would perpetuate wage slavery and is:

1) Unjust.

2) Short-sighted in view of ever increasing automation.

3) Stupid in that a focus on providing jobs rather than on accomplishing work is bound to be wasteful of human time, energy and morale.

The insights of MMT allow a MUCH better solution, btw.

*Land reform is also needed in that just as private entities should not be allowed to own rivers, the ocean, the atmosphere, the water supply, etc., neither should they be allowed to own land in excess of personal needs.

Are you seriously telling me that there is a shortage of worthwhile collective projects The US has decades of deferred maintenance on infrastructure, perilous little child care or elder care…I can name tons of productive work people would be proud to do.

Moreover, you miss a UBI will never never never never never be able to pay even close to a living wage. Massively inflationary.

Only a JG can assure a decent standard of living by adding to the productive capacity of the economy.

Moreover, you miss a UBI will never never never never never be able to pay even close to a living wage. Massively inflationary. Yves

I’m not in favor of a UBI but of de-privileging the banks, which would be massively DEFLATIONARY by itself* and thus allow, at least during the de-privileging period, a relatively large Citizen’s Dividend to compensate for the deflation.

Only a JG can assure a decent standard of living by adding to the productive capacity of the economy. Yves

Since very many people hate their jobs, I sincerely doubt wage slavery to government is the solution to wage slavery to the private sector.

*Since de-privileged banks would not be able to safely create enough deposits to match existing loans as they are repaid.

Simply, a Job Guarantee puts a floor under wages. People can work for less (on something they personally believe is important to do, for instance), but through their own choice. Nobody would be forced to work for less.

Another advantage to a JG is that it works countercyclically. Someone thrown by bad times onto relying solely on their Universal Basic Income would still be paying prices that have been set higher, economy-wide, by the UBI that everyone else is getting. Somebody thrown onto JG pay would be paying prices set in a non-UBI-augmented economy. I bet that those prices will be lower, and the JG paychecks will stretch farther. It ought to be government policy that those paychecks will provide decent subsistence.

UBI shares this drawback with Monetary Policy generally. It amounts to tinkering indirectly with the money supply, then sitting back to see how Mr. Market will work things out. Some things are too simple and too important to be sloughed off like this.

Simply, a Job Guarantee puts a floor under wages. Mel

Minimum wage laws can do that.

So a real purpose of a JG is to put a CEILING on wages by providing a buffer stock of pre-disciplined, pre-broken wage slaves for the private sector to draw upon.

Some justice that. But since when have elitists ever been concerned with justice? But that simply makes them senseless sinners according to:

He who despises his neighbor lacks sense … Proverbs 11:12

He who despises his neighbor sins … Proverbs 14:21

Huh? That makes no sense. Even with a JG, highly skilled trades like PE fund management could be payed as many million per year as they could get away with, just like now. No ceiling.

No. Minimum wages are a policy tool of Governments who are wrapped up in the neoliberal construct. Legislated fair wages are closer to what you are thinking, but a JG is better because it creates a demand for labor which develops a pool of skilled people available to the market at a price above the legislated job guarantee wage price.

For markets to work, there must be supply and demand according to ECO1 and the JG is a means to achieving that in the labour market.

Yeah LOL …

I always hear some banging on about this mythical labour market, then I ask for 24 Qtrs of data to support that view.

Never knew structural un-under employment could be associated with market anything. Yet if anyone were to suggest price controls on anything else … wheeeee~~~

So the short answer is that it’s more direct, and easier to compute what the floor is.

An (sufficient) UBI would indirectly set a floor that a full time job would have to at least be on the order of the UBI to be sensible — who would give up all that time if it didn’t significantly improve your standard of living — but it’s unclear what the floor would be: 50% of UBI or 150% of UBI.

The countercyclical effects would also be indirect and difficult to compute: depends on the tax structure and how much different classes depend on the UBI before it gets eaten up by taxes.

Wrong. See above. A UBI will never be able to pay a living wage.

See above where? The only answer I see is ‘Mel’s answer, which gives why a job guarantee works as a wage floor, but doesn’t show that UBI doesn’t work as a job guarantee or why it works poorly. Thus I tried to follow the implications forward — if they are wrong, a full explanation or a link to a follow explanation would be appreciated

In fact, I think my “short answer” applies to most systems that intend to set a wage floor other than a job guarantee — they all work indirectly and thus are difficult to compute across a variety of conditions.

A Nationwide bank report included this :

“Even in the North and Scotland, where property appears

most affordable, it would still take someone earning the

average wage and saving 15% of their take home pay each

month more than five years to save a 20% deposit. In Wales

and Northern Ireland, it would take prospective buyers nearly seven years, and almost eight years for people living in the West Midlands.

“Reflecting the trend in overall house prices, the deposit

challenge is most daunting in the South of England, where it would take an average earner almost a decade to amass a 20% deposit. Again, the pressures are most acute in the

capital, where someone earning an average income would

need around 15 years to save a 20% deposit on the typical

London property (this is even longer than was the case

before the financial crisis, when it would have taken around

ten and a half years).”

Good luck with that.

I’ll come in on the side of savers, a serious analyst in Germany compared the money saved via ultra-low interest rates to the income lost and lost income was substantially higher. Oh and look, over time companies will be healthier in total because bad models and bad management kept on life support only by ZIRP die off. So let’s raise rates and wages, alot, and get back to savings and sensible investment rather than debt-fueled consumption and fake signals about the allocation of labor and capital. Maybe the Fed would also have an easier time keeping funding markets open (this week’s repo was $250 billion, even more than the so-called “year-end needs”) if investors got paid for a change for time preference.

I’ll go further and say raise rates and wages a lot – and then raise taxes a lot as well to pay for local roads, hospitals, schools, etc. But I totally agree about killing off all these companies on artificial life-support and letting more efficient men and women come in, pick up the pieces, and run them as proper businesses once more. And that includes those unicorn companies as well such as Uber that cannot run on their own financial resources. Colour me old-fashioned.

I thought in MMT you don’t need taxes (not being facetious, honest question here). Maybe I read that wrong in a paper on that. Isn’t using taxes to fund expenditure deflationary in MMT and taxing really just a redistribution tool?

I think the political entities in biggest trouble are ones that have expenses but no currency of their own to inflate. This is why nations in the EU are in such trouble, because they are forced to behave like sub-units only receiving the disadvantage of a single currency without the power to print money (printing money being the prefect and uniform wealth tax).

You are absolutely correct about the EU – the disconnect between monetary policy and politics has not served them well.

MMT says taxes drive the demand for money. They make the money valuable. About what is taxed and how much, MMT declares not much else. Personally, I think all of the hidden subsidies for the wealthy need to come to light, then tax policy would be more sensible.

Great point. But those subsidies embody the economy almost. Think of DARPA and that revolving door.

On that tangent I think the current showdown in Iran has a lot to do with missiles, air superiority, S300/S400 vs. patriot systems. If the US no longer makes the best weapons because their procurement supply train siphons too much off, it is a HUGE turning point for US hegemony.

No, you absolutely have to pay taxes. Please do more homework. Taxes are what lead people to need to use the government’s money. Paying taxes is essential under MMT.

Taxes also serve to drain excess demand to control inflation, redistribute income, and provide incentives and disincentives.

And Taxes could drain off the power of Big Money. Taxes could reduce the power and influence of Big Money.

Sorry Rev, but you missed the MMT lecture on taxes.

Taxes don’t pay for services. Money is a fiat issued by the sovereign. Taxes destroy the issued fiat. They are not revenue, but a monetary tool of the fiat issuing sovereign.

Agree about the so called gig economy. Gig is apt as the term means a whirling short term effect without substance. The person who coined the term should be awarded one of those scholarly thingies they hand out to economists. :)

No, I was making the point on local taxes, not Federal taxes. From what I understand, under MMT the Federal government can print whatever money is required but I do not think that this applies to State or Local governments.

We should all be allowed to print however much we want. Then it would be easy to see who the greedy piggies are and who live within their means.

That is correct, but that great American socialist Richard Nixon had a clever idea: revenue sharing. The Feds hand out funds to state and local government, subject only to checks on fraud and corruption. The idea was the Feds were better at raising revenue but state and local governments were more on top of their needs plus could in theory administer small-scale programs more efficiently than the Feds.

Reagan killed revenue sharing.

Housing is priced by the ability to make payments, in most markets. Low interest rates means more can be borrowed, and drives prices up.

It is surprising an accountant ignores that connection, and should read Yves first paragraph introduction. In my book, there is a direct link between low interest rates and high debt levels.

The FED gladly painted itself into a corner. Who benefits the most from low interest rates? The one percent. Who benefits the least? The ninety nine percent.

In addition to Yves’ citation of TV, “the pernicious role of advertising” has also corrupted the commercialized internet, where it ultimately winds up as as propaganda for “the armaments industry”. See Kalecki, also reposted today by Yves.

Would you please come tell this to our city planning director?

He continues to advocate for zoning changes and variances that allow more houses to be crammed into tiny nonconforming lots, claiming this extra housing stock will create more inventory and reduce skyrocketing housing prices. The result has been that we have tiny little crapboxes going for a half million dollars in what used to be working class neighborhoods, pricing everybody who lives here out. All the zoning changes do is line the pockets of developers while housing prices continue to go up anyway.

But this seems like the right thing to do if you aren’t thinking it through, so the city continues to allow more development which has had exactly the opposite of its supposedly intended effect, and the developers keep coming to ask for more favors. Absolutely maddening.

The only way to drive prices down is to raise interest rates and IMO it’s a bitter pill we’re going to need to swallow if we want anyone other than the rich to be able to have their own home.

But why do you think increasing supply is increasing prices? I can see how, but it goes against good ol’ Econ 101 yet again! Could you explain it to the victims? Probably, as they are living it, but the rich people that make the decisions are firmly in the “you can’t get a man to understand something…”

Anyway my question is how would you change this anyway. Where they are tearing down $500k housed to build $1.2mil houses I can see it, but you call these “crapboxes” so it seems the price is driven entirely by location not the house quality itself. In this case not building any houses certainly doesn’t solve anything… you could build multi-family maybe but everybody hates “tenements” including the people that live in them and again you qualified the buildings as “tiny” so how would I build apartments in those small spaces?

You should not build anything in those small spaces.

The town I live in is already the most densely populated in the state and there are very few open lots left and the remaining ones are pretty much all nonconforming. Years ago they would have been someone’s yard. What’s happening is people with a yard will sell, developers will snatch up the property and then petition the city to split off the yard into a separate lot and ask for a zoning variance to cram a small house in. A generation ago there was a huge parcel of farmland that was sold for development but that was packed with single family homes rather than the apartment buildings that in hindsight would have been very nice to have right about now.

Now the rising prices may be due to demand to an extent, however the population of the town hasn’t grown much in 40+ years while the number of homes has grown by a lot – fewer people are living in each home these days. That, plus many are investment properties that sit empty most of the year. That happened in part because the town is being marketed as tourist destination, even though it is the least appealing in the area from a tourist standpoint.

So I agree with the article’s prescription of reducing advertising so that consumption (investment properties) will decrease but that alone won’t solve it.

I’m sure you’re aware of the next bit but humor me for a minute. Conventional wisdom is that low interest rates mean people can afford a more expensive house. Now people might assume that means a bigger house but the reality is it just means you get to pay more principle and less interest for the same size house. There are people who paid say $100K 30 years ago and want to sell now. If the going rate is $500K, how many of them are going to say $300K is enough and sell for less than the going rate? And even if they do, there’s always a real estate person there looking to buy on the cheap and flip just to make sure no altruism sneaks through that might dampen Mr. Market’s exuberance.

So the only way to really change this that I can see is to raise interest rates which would definitely put many recent home buyers underwater on a mortgage. Now if we had a functional government that wasn’t only serving the rich, the government could take measures to assist the homeowners who would be hurt. Since we don’t, I assume beatings will continue for the rest of us non-rich until we get our minds right.

This I just can’t see as being accurate:

IMO, the opposite is true. There will be a pull back and/or slower growth, but there does NOT have to be a disaster or massive collapse unless we insist on instantaneous normalization – which is not required.

Raising rates might pose more problems for foreign nations with USD based loans. However, this too is bad and should be fixed, as it is part of surrendering national sovereignty to the US. Therefore, the part and parcel of the debt solution is to get off the USD and each nation build it’s own credible sovereign banking system in it’s own currency beyond the reach of Trump/The Blob/Federal Reserve/The USD.

That leaves us with the rates themselves. They must be raised. Each second they are not, is a subsidy to the rich and malinvestment and a delay returning to a system that gives proper value to savings, capital, and labor.

The economy will not “crash” but real estate, asset prices, and consumption will fall or not rise as fast. Eventually I expect the economy to perform better, as capital will become scarce like it once was, and more likely go into actually productive channels and investments. Because now, capital is going into ways to screw us like segmenting hospitals into business units for the sole purpose of getting an un-earned buck by harming a lot of other people. IMO that is one consequence of low interest rates and QE and cheap, undervalued capital that is not scarce as it once was. The is soooooo much “capital” out their looking for anything to “invest” in that it finds things that cause harm not good.

I’m puzzled by the emphasis on personal/household debt. Central to my ongoing education here at NC has been the Minskyian principle that very low interest rates lead to increasingly wild corporate speculation as part of the “search for yield.” Why load on the irrational (though rational from a corporate standpoint) effects of advertising on personal consumption when the captains of industry are on a binge?

Personal/household debt has been established to be unproductive in macro terms. It’s a drag on the economy.

You are mis-staing Minsky. His argument has nothing to do with level of interest rates. It has to do with creditors becoming increasingly willing to lend to risky borrowers as memory of the last banking crisis fades.

165 Billion?????? Total (private?) debt???Worldwide?

USA alone has c.27 TRILLION in private debt and 20+ trillion public debt.

Is this his error or my error?

Citigroup alone “borrowed” about 4 Trillion from taxpayers during their most recent insolvency.

You need to read the original article. That legend should have said 165% of GDP, not $165 bn

Thank you. Only skimmed it after seeing legend.

Sigh here is my usual give-up-all-hope post:

>One is to break the consumption cycle. ….Second, there is an obvious need to lift real incomes,

Yeah, um so I pay somebody more money on the one side of the ledger to sell pants, and then I go visit another guy who might be thinking about buying some new pants and convince him that he should wear them for a bit longer and put his money in “savings”.

How the (family blog) does that even work?

Speaking of root causes, mass consumption is merely the “mess of pottage” a desperate population has been sold in exchange for their legally stolen birthrights – family farms, businesses and skills which have been automated and outsourced away with what is, in essence, a government privileged counterfeiting cartel for the benefit of the banks themselves and for the most so-called credit worthy, typically the rich.

I am a banker and my only real product is debt.

Who can I load up with my debt products?

Pre-2008 – The West

They can’t really take any more of my debt products, who else is there?

Post- 2008 – Emerging markets

The global economy is now full of the banker’s debt products (well nearly).

Keep lowing interest rates so I can squeeze a few more of my debt products into your economy.

When you hit zero, then just go negative.

This is how I earn a living, and I’ve got to shift these debt products

Fill her up mate.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

What Japan does in the 1980s; the US, the UK and Euro-zone do leading up to 2008 and China has done more recently.

Economies can only take so many of the bankers’ debt products before they hit the Minsky Moment.

Only China saw it coming.

The USP of neoclassical economics – It concentrates wealth.

Let’s use it for globalisation.

Mariner Eccles, FED chair 1934 – 48, observed what the capital accumulation of neoclassical economics did to the US economy in the 1920s.

“a giant suction pump had by 1929 to 1930 drawn into a few hands an increasing proportion of currently produced wealth. This served then as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied themselves the kind of effective demand for their products which would justify reinvestment of the capital accumulation in new plants. In consequence as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When the credit ran out, the game stopped”

The problem; wealth concentrates until the system collapses.

“The other fellows could stay in the game only by borrowing.” Mariner Eccles, FED chair 1934 – 48

Your wages aren’t high enough, have a Payday loan.

You need a house, have a sub-prime mortgage.

You need a car, have a sub-prime auto loan.

You need a good education, have a student loan.

Still not getting by?

Load up on credit cards.

“When the credit ran out, the game stopped” Mariner Eccles, FED chair 1934 – 48

This is what it’s supposed to be like.

We know because we have used this economics before.

Thanks for this comment quoting Eccles.

> “When the credit ran out, the game stopped” Mariner Eccles, FED chair 1934 – 48

The game goes into extended play mode now, extra points for repo madness. There is no way of knowing when it will blow, but blow it will, and they cannot stop playing, as then it would blow instantaneously.

I appreciate Richard Murphy’s concise summary of the root causes of high indebtedness and his suggested road out of the dilemma. Earlier this week I looked at exposures of the largest four derivatives issuance and trading banks that are minimally summarized in the tables at the end of the OCC Derivatives Report at September 30, 2019. Wondering about the extent to which Fed rate policy has also been directed at containing financial exposures of these large Primary Dealer banks to abrupt material changes in interest rates and equity market indexes. Too, as we saw in mid-September, the volume of the Treasury’s debt issuance in the wake of the current administration’s tax cuts that favored the wealthy and large corporations would likely have led to increasing rates absent the Fed’s renewed massive purchases of Treasury debt over the past few months. As the old Chinese curse goes, “May you live in interesting times.”

Want to get rid of advertising? Eliminate it as a cost of doing business for tax purposes. So, a firms advertising costs come right out of the bottom line. The implications are staggering beginning with the return to sanity. Think about all of the visual and mental pollution that would disappear. No more shopping channels, truck ads, billboards or junk mail to begin with. Monopolies and oligopolies would wobble. Everything would go local. And think of your poor neighbors. Wandering the streets with no purpose or direction. Sounds like my kind of dystopia!

Very astute! The implicit subsidy for advertising (or the cost of dismantling a factory to send it overseas) discloses how planning and public policy, not some mythical invisible hand, guides economic decisions. For another example, it’s not an accident that a calorie of high-fructose corn syrup is less expensive than a calorie of carrot. Ag subsidies!

The big question: will we wake up to this before we go over yet another cliff?

That only affects businesses who pay tax. This creates an opportunity to increase advertising if your corporation lives in a tax loophole or haven.

When we bought our first home in 1988 it was $66,000. We put down $30,000 for a mortgage of $36,000 @ 10.5% interest for 30 years. Affordable payments @$320.

That same house now bought by a young family would cost over $500,000. If the new owners could scrape up a 10% down payment they would have a mortgage of $450,000 at the tiny interest rate of 4% w/monthly payments over $2,200 at 7 times what we had to pay.

In what world have wages on average gone up 7 times in 32 years?

My vote is for high wages, high rates and high taxes minus The Blob.

Name another commonly held used consumer item that goes up in value aside from used homes?

After 1980-82, when interest rates for home mortgages began dropping from the 13-15% crazy high interest rates, it wasn’t so much the value of the home went up, it was the cost of the mortgage loan went down. So a house that cost, for example, $10,000 with a 15% interest rate could be sold for a higher price at a lower interest rate and cost the buyer the same monthly home mortgage payment as the same lower price house with higher interest rate. People started buying loans instead of houses. You could say that’s a difference that doesn’t make any difference, and on one level you’d be right. There was also a big rush of then 20-30 somethings, the baby-boom generation, entering the home buying market. That also increased prices in neighborhoods with good k-12 schools. Suddenly owning a house or buying a house was considered a sure-fire path to wealth… and a house bubble ensued. There was also the near mantra that you could take out too large a loan because your salary/income would always go up. Not anymore. Now the 20-30 year old generation is indebted and less able to afford a house or home at these insanely inflated prices in what were once middle class neighborhoods.

maybe end REITs, limit the number of personal income-generating properties to 1, and forbid foreign corporations and non-citizens (excepting work or study visa holders) from owning (but not leasing) residential property.

RE: “……1944 essay by Michal Kalecki on the obstacles to achieving full employment. It is the best single explanation of how we got where we are.”

I would suggest then that the study be printed post haste in toto as leaflets and distributed whole heartedly into the national homeless community to at least explain why they are cold, destitute, feeling betrayed, and hungry. Might make a difference. LOL!

(I really get tired of reading about how we got where we are in long, discombobulated wording!)

Incidentally, the comments in the link are far, far more coherent than the author.

I strongly agree. The Kalecki post is excellent as are the comments to it.

I am trying to understand the statement made at the end of this post: “… there has to be a commitment to continuing low interest rates as anything else would fuel disaster and the most massive collapse.” Who would collapse?

Other than the interest rate on house loans and possibly car loans how much does the interest rate on private debt really depend on the Fed interest rate? Banks have invested in laws that place private borrowers at their mercy … and they have no mercy. Banks charge interest rates, service charges, and penalties much as they please — at rates which appear to me related more to low wages, job insecurity, harsh debtor laws, and rapidly increasing costs than to Fed interest rates.

State debt is government debt but states do not maintain their own fiat currencies, and their economies could collapse like the economies of individuals. The rate they must pay to borrow money is related to the Fed interest rates — though with some separation in the sense I believe that states cannot borrow directly from the Fed at Fed rates.

The chart at the top of this post has curves for private debt and government debt. Where does Corporate and non-Corporate business debt fit — or is it separate from both private debt and government debt? If Corporate debt and general business debt is part of this post’s category ‘private debt’ wouldn’t an increase in the Fed rate diminish the ability of Corporate management to loot by borrowing against their firm’s ‘projected’ future earning capacity? An increase in Fed interest rates would also make bonds more attractive than shares leading to a drop in stock prices.

I think a lot of laws need to be restored, some current laws changed and it might be nice to enforce those laws before playing with Fed interest rates. Judging from how the government handled the previous collapse earlier in this century I image an increase in Fed interest rates followed by a collapse might effect another massive transfer of wealth to Finance, a further decline in small and medium businesses, and some transfers to some large Corporate entities.

Richard Murphy seems to think that there is a way to develop a “Goldilocks” solution to our economic dilemma. In my view he is wrong and terribly misguided. The reality is, with climate warming, mass extinction, etc…we need a global economic reset. This will require vast write downs of debt, and massive losses of “capital”. Billionaires will vanish from the scene. Consumption levels across the board will decline sharply. Lifestyles, especially in the “developed” world will change dramatically. Nothing less will save our planet, and by extension ourselves.

I’d be interested in seeing a chart of personal debt as a percentage of assets at nominal values. I suspect that asset price inflation would flatten that curve pretty significantly.