A newly released study by the Economic Policy Institute reaches a devastating but not surprising conclusion: globalization has screwed American workers. However, putting numbers on how much sustained trade deficits with China translate into lost American jobs, and those numbers turning out to be large, gives free trade cheerleaders a lot less wriggle room.

EPI estimates that American sacrificed 3.7 million jobs as a result of US-China trade deficits since China joined the WTO in 2001, with 3/4 of the losses taking place in manufacturing positions. They also point out that job losses to China have increased since Trump took office.

The EPI estimates are consistent with earlier studies. From a 2017 Wall Street Journal article, How the China Shock, Deep and Swift, Spurred the Rise of Trump:

What happened with Chinese imports is an example of how much of the conventional wisdom about economics that held sway in the late 1990s, including the role of trade, technology and central banking, has since slowly unraveled….

Both presidential candidates aimed much of their criticism at 1994’s North American Free Trade Agreement, which boosted imports from Mexico. Even then, though, the real culprit was China, economists now say.

Many U.S. factories that moved to Mexico did so to match prices from China. Some of the new Mexican factories helped support U.S. jobs. For example, fabrics made in the U.S. are turned into clothing in Mexico for sale globally by U.S. companies….

A group of economists that includes Messrs. Hanson and Autor estimates that Chinese competition was responsible for 2.4 million jobs lost in the U.S. between 1999 and 2011. Total U.S. employment rose 2.1 million to 132.9 million in the same period.

Recall that the much-touted NAFTA was supposed to deliver one million American jobs, but instead resulted in job destruction, with studies estimating anywhere from nearly 800,000 jobs to over a million.

Now to the executive summary of the EPI report:

U.S. jobs lost are spread throughout the country but are concentrated in manufacturing, including in industries in which the United States has traditionally held a competitive advantage.

- The growth of the U.S. trade deficit with China between 2001 and 2018 was responsible for the loss of 3.7 million U.S. jobs, including 1.7 million jobs lost since 2008 (the first full year of the Great Recession, which technically began at the end of 2007). Three-fourths (75.4%) of the jobs lost between 2001 and 2018 were in manufacturing (2.8 million manufacturing jobs lost due to the growth in the trade deficit with China).

- Trade deficits with China and resulting jobs losses continued to grow during the first two years of the Trump administration—despite the administration’s heated rhetoric and imposition of tariffs. The U.S. trade deficit with China rose from $347 billion in 2016 to $420 billion in 2018, an increase of 21.0%. U.S. jobs displaced by China trade deficits increased from nearly 3.0 million in 2016 to 3.7 million in 2018,—a total of more than 700,000 jobs lost or displaced in the first two years of the Trump administration.

- The growing trade deficit with China has cost jobs in all 50 states and in every congressional district in the United States. The 10 hardest-hit states, when looking at job loss as a share of total state employment, were New Hampshire, Oregon, California, North Carolina, Minnesota, Massachusetts, Wisconsin, Vermont, and Indiana, and Idaho. Job losses in these states ranged from 2.82% (in Idaho) to 3.66% (in New Hampshire) of total state employment. The five hardest-hit states based on total jobs lost were California (654,100 jobs lost), Texas (334,800), New York (185,100), Illinois (162,400), and Florida (150,700).

- The trade deficit in the computer and electronic parts industry grew the most, and that is reflected in job losses: 1,340,600 jobs were lost in that industry, accounting for 36.2% of the 2001–2018 total jobs lost. Not surprisingly, the hardest-hit congressional districts (those ranking in the top 20 districts in terms of jobs lost as a share of all jobs in the district) included districts in California, Massachusetts, Minnesota, Oregon, and Texas, where jobs in that industry are concentrated. One district in Georgia and two others in North Carolina were also especially hard hit by trade-related job displacement in a variety of manufacturing industries, including computer and electronic parts, textiles and apparel, and furniture.

- Surging imports of steel, aluminum, and other capital-intensive products threaten hundreds of thousands of jobs in key industries such as primary metals, machinery, and fabricated metal products as well. These three sectors, alone, have already lost 372,700 jobs due to growing trade deficits with China between 2001 and 2018.

- Global trade in advanced technology products—often discussed as a source of comparative advantage for the United States—is instead dominated by China.This broad category of high-end technology products includes the more advanced elements of the computer and electronic parts industry as well as other sectors such as biotechnology, life sciences, aerospace, and nuclear technology. In 2018, the United States had a $134.6 billion trade deficit in advanced technology products with China, and this deficit was responsible for 32.1% of the total U.S.–China goods trade deficit that year. In contrast, the United States had a $6.5 billion trade surplus in advanced technology products with the rest of the world in 2018. The U.S. balance of trade in advanced technology products declined by $132.7 billion between 2001 and 2018.

- China is exporting goods to the U.S. through other countries. Although the bilateral trade deficit with China has declined in 2019 (through November), the overall U.S. trade deficit in non-oil goods, which is dominated by trade in manufactured and farm products, has continued to increase, as has China’s overall balance of trade with the rest of the world, suggesting that trade diversion (Chinese goods, and parts and materials being used in products, that the U.S. imports from other countries) has grown in importance. This is an important topic for future research.

Growing trade deficits are also associated with wage losses not just for manufacturing workers but for all workers economywide who don’t have a college degree.

- Between 2001 and 2011 alone, growing trade deficits with China reduced the incomes of directly impacted workers by $37 billion per year, and in 2011 alone, growing competition with imports from China and other low wage-countries reduced the wages of all U.S. non–college graduates by a total of $180 billion. Most of that income was redistributed to corporations in the form of higher profits and to workers with college degrees at the very top of the income distribution through higher wages.

Mind you, this outcome should have been and was likely expected. From a 2018 post; forgive the length of this section, but it’s important to understand that economists knew full well that blue-collar workers would be likely to take a hit from globalization:

And in an Institute of New Economic Thinking panel last October, Berkeley economics professor Brad DeLong explained how the Ricardian fairy tale that is drummed into those who have some contact with economics is unrealistic and a more accurate view of liberalized trade shows it favors the rich:

In that case, we cannot escape the conclusion that comparative advantage is the ideology of a market system that works for the interest of the wealthy. For comparative advantage is the market economy on the international scale, and the market economy is, via the Negishi weights that it assigns to the social welfare function that it actually maximizes, is a collective human device for satisfying the wants of the well off, and the well off are those who control the scarce resources that are useful for producing things for which the rich of the world have a serious jones.

Pia Malaney is Co-Founder and Director of The Center for Innovation, Growth and Society (CIGS) and Senior Economist at the Institute for New Economic Thinking, pointed out that Serious Economists understood the costs of more open trade even though they pretended not to:

Specifically, as most of you probably know, the Samuelson-Stopler theorem would give you good reason to expect that less educated workers in the US would take a hit with more open trade. As Harvard economics professor Dani Rodrik wrote in 2008:

The Stolper-Samuelson theorem is a remarkable theorem: it says that in a world with two goods and two factors of production, where specialization remains incomplete (plus a few more technical assumptions), one of the two factors–the one that is “scarce”–must end up worse off as a result of opening up to international trade. Not in relative terms, but in absolute terms. But the theorem is also quite limited in its applicability. It applies only to a case with two goods and two factors, and so its real world relevance is always in question.

But there is a version of the theorem that is remarkably general and powerful. It says that regardless of the number of goods and factors, at least one factor of production must experience a decline in real income from trade as long as trade induces the relative price of some domestically produced good(s) to fall (and as long as the productivity benefits from trade are restricted to the traditional, inter-sectoral allocative efficiency improvements, about which more later). All that this result requires is a very mild assumption, namely that goods be produced with varying factor intensities (i.e., use different combination of factors). The stark implication is that someone will lose, even if the nation as a whole becomes richer…

The theorem does not identify who exactly will lose out. The loser in question could be the wealthiest group in the land. But if the good in question is highly intensive in unskilled labor, there is a strong presumption that it is unskilled workers who will be worse off. And before you curse economic theory, note that this is really accounting–not economics at all.

Rodrik goes on to argue that this might not be as absolute as it seems, since if manufacturers could increase total factor productivity in response to import competition, they could afford to preserve or even increase worker wages even if the prices for their products fell. But Rodrik pointed out that analysis of firm-level efficiency was pretty dodgy, and you could see the same results by the virtue of the least efficient firms going out of business, which would still hurt overall employment. Moreover, as we pointed out back then, companies were crimping on worker pay even before the crisis. The early 2000s recovery saw labor get a markedly lower share of total income growth than in any post-WWII expansion. And the proportion going to profits versus compensation got even worse after the crisis.

So the bigger point is economists had very good reason to anticipate that more open trade would hurt the US working classes, but they either pointed chose to ignore that or rationalized it in various ways. At worst, they’d take a short-term hit and would get a new job and might have to acquire some skills….as if that were all that easy if you are supporting a family, and/or older, and employers won’t give you credit for training in later life.

Back to the current post. In other words, the remedy to less-skilled workers getting shafted has been various “Let them eat training” handwaves, of which the latest flavor has been, “Why don’t they learn to code?”

But there is a bona fide problem. Even though globalization was a losing proposition for American labor, those eggs were broken quite a while ago. It’s not clear how we unscramble that omelet, particularly since the US pretends to be allergic to industrial policy. In reality, we have it in spades via certain sectors getting lots of subsidies, tax breaks, and/or Federal spending, such as defense, real estate, Big Pharma and health care, and higher education.

With the natives becoming more restless, as epitomized by Sanders’ rise in the polls, the officialdom might finally be cluing in to the need to make more concessions to workers, particularly as the coronavirus is throwing sand in the gears of Chinese supply chains. We’ve pointed out for years that outsourcing and offshoring often don’t improve profits but instead represent a transfer from factory-level labor to middle managers and top executives…and on top of that, increases the fragility of the business. If some critical products like drugs come to be scarce, the US may finally have its long-overdue big think on the dangers of depending on the kindness of foreigners.

Yeah, but how many were gained. Nor was WTO revelant. They were already gone by 1997. You also need to count that 4 million jobs in hundreds of millions jobs created, is not much. Your barking up the wrong tree.

You mention the WTO was “gone” by 1997. Would you expand on your comment, thx.

I think that Bert meant that jobs “were already gone by 1997” maybe do to NAFTA. I saw the same in furniture manufacturing. NAFTA sent a lot of jobs south to Mexico. Then to China and then to Vietnam or Thailand.

Try and buy a dining room table. Look where it’s made. I had to buy a table in 2012 – made in Vietnam – and all I do is watch as my cats ruin the finish as they tread across the top. I’ll grant you my lack of “discipline” but, when I was producing tables in the ’80’s and early ’90’s, a dining table had to live up to an unwritten understanding of specs, or specifications.

Management inevitably cheats on the specs when they have to produce more tables with cheaper labor. Labor gets screwed but so do the consumers.

Where did you get the hundreds of millions of jobs created? You can’t consider part time minimum wages jobs to lost good paying manufacturing jobs. The reality is we are in a race to the bottom and the destruction of the middle class.

Precisely. A job lost from a plant manufacturing heavy appliances or major electronics is replaced by two jobs, one at the convenience store down the street as a part-time stocker and the other as a self-employed “landscaper,” at roughly 40% of the pay at the manufacturing position. Without pension, health insurance (sic), vacation, sick days, family medical leave, parental leave (dreaming here, but even the slowest among us gets the point)…

And it is a net loss for the nation in having fewer, highly-skilled workers capable of doing such work.

There is long and well-documented history of business simply not giving a damn. “Their sole object is gain” like Napoleon said.

“Hundreds of millions of jobs created” in a country with a population of 340 million would strongly infer that that we have an unemployment rate of around a negative 400% or so and that Labor is King.

I don’t see it.

Who are you going to believe, me or your lying eyes?

https://www.statista.com/statistics/191734/us-civilian-labor-force-participation-rate-since-1990/

You also need to count that 4 million jobs in hundreds of millions jobs created, is not much.

Yes, the number appears low….very low.

Good piece. I think that I posted these articles here before but there is also evidence that American trade policy helped to fuel the deadly opioid epidemic.

Free-trade policies contributed to the opioid epidemic

https://www.statnews.com/2019/10/08/free-trade-policies-opioid-epidemic/

Opioid overdose deaths were 85% higher in areas of the United States that suffered auto plant closures.

https://www.cnbc.com/2019/12/30/study-finds-auto-plant-closures-lead-to-rise-in-opioid-overdoses-death.html

I think the evidence of the devastation caused by American trade policy and globalization is now overwhelming yet I am constantly told that free trade has been a big success and that it is the fault of workers for not keeping up with the times. Of course, as Dean Baker points out, the professional-class people who often provide the backbone of support for globalization have mostly been protected from globalization’s most damaging aspects.

https://www.pbs.org/newshour/economy/column-free-trade-proponents-upset-protectionist-barriers-u-s-doctors

Positive interest and yields on inherently risk-free sovereign debt (including bank reserves), besides being welfare proportional to account balance (and thus a moral abomination), also encourage a trade deficit by providing welfare to foreigners too.

Another unjust encouragement is the allowance of foreign ownership of real assets such as land.

And then domestically there’s government privileges for private credit creation, i.e. for “the banks”, by which jobs are automated and outsourced away with what is, in essence, the PUBLIC’S credit but for private gain.

Thanks, B. Clinton.

https://www.cnn.com/2000/ALLPOLITICS/stories/10/10/clinton.pntr/index.html

Exactly. It required Democratic complicity to do that much damage to America. Then there was that saintly fraud, Carter, who got the deregulation ball rolling.

An unforeseen consequence of ending the cold war? If the cold war had not ended, would these jobs have simply gone to other countries?

To be expected, the King of the North (currently russia and her allies which include China) and the King of the South (currently the Anglo-American world power and her allies) will be in a battle against each other, ever more so in the last days. The King of the North does not have the military might to be an empire but the King of the South was foretold to prevail in this period while the King of the North drains the wealth of the King of the South…. What say you, sure looks like said Biblical prophesy has come true in spades. Just look at the King of the Norths asset sitting in the King of the Souths White House.

But, but, but,

Obama came here to Oregon and litterally stood just a few hundred yards from where a bunch of those jobs in high tech manufacturing were sent to China and lectured us about how this was in our best interests while at the same time our local Representative prattled on about local farmers exporting potatoes as if the two are economically equivalent.

I remember a Trade Droid in St Ronnie’s admin stating “Who cares if you make computer chips or potato chips.”

Neatly encapsulating the stupidity in one line.

It’s not just manufacturing jobs going overseas now. A lot of design jobs and R&D jobs are shifting to China and elsewhere. As a STEM worker I have seen employers getting more and more picky about who they hire in this country (US) simply because they can. Not as many opportunities available. Most STEM workers are not in software like idiots like Joe Biden seem to think. But software jobs are being targeted for offshoring also.

I can tell you from experience that this is very true. What would have gotten you a job with an appropriate degree and a phone interview in the 1990’s is taking specialized knowledge and multiple interviews, often including panels and senior management for a mid level engineering job.

You know, I’ve been on slashdot since 1996, and in all that time there have been those who urge STEM workers to unionize.

FWIW I’m one of those manufacturing workers (maintenance and machinery repair/rebuilding) who “re-trained” in computers. I’m typing this on my FreeBSD box. And after all that training, the jobs were in India, and my student loan is with Navient.

‘Nuff said.

So they finally noticed China, but haven’t yet noticed India? They (the elite) just aren’t that into to you (laborers)….

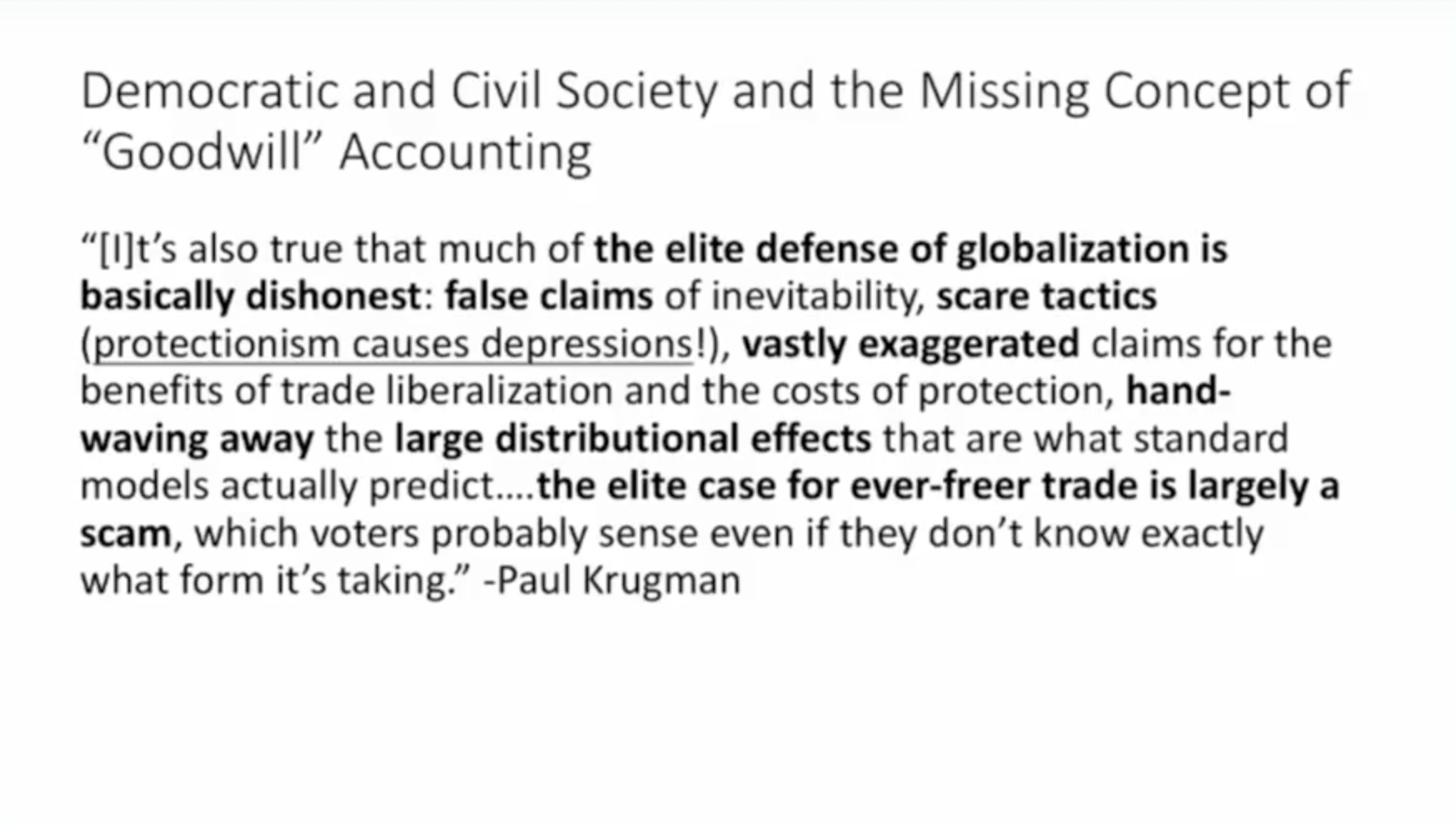

Excellent post but I think you are being too nice to Delong and Krugman, both of whom made careers in the 90s by dunking on all of us who were making this exact point (re: global mfg competition and lost jobs) back then. The fact that they have walked some of it back is nice but it hasn’t changed either’s view that they know better wrt all things economic than the rest of us.

I also think there is a bigger point on trade that virtually all economists believe but won’t say out loud to the rest of us. Which is that, if a company can make something cheaper elsewhere, they should; and so, if people lose their jobs because their work can be done cheaper elsewhere, THAT IS A GOOD THING. Even in the post above, there is the admission that it was known that jobs here would be lost when China came in to WTO (though, again, I recall both Krugman and Delong downplaying how many) but no admission that losing those jobs was a bad thing.

And a further level of disingenuousness: back in the day, all the crap about comparative advantage at least was prefaced by the assumption of free labor markets. We can (and I do) argue about how free US labor markets are (given power disparities between workers and employers and institutional conditions like the uneven-ness of health care provision) but not even the most neoliberal economist can argue that China has free labor markets. Even so, still “free trade good, protectionism bad.”

Who replaced the central processing cores in DeLong and KrugThon? They’ve been advocating unregulated FT (TM) and “Let them Eat Training” for 30 years now.

Is it getting harder to sell that cr*p down in Ivory Tower Land?

Reminds one of how China donated to the DNC (and to Bill Clinton), who subsequently admitted China to the WTO and shared proprietary satellite technology.

https://www.nytimes.com/1998/05/18/us/clinton-says-chinese-money-did-not-influence-us-policy.html

“The growing trade deficit with China since China entered the WTO affects different regions in different ways. Some regions are devastated by layoffs and factory closings while others are surviving but not growing the way they could be if new factories were opening and existing plants were hiring more workers. This slowdown in manufacturing job generation is also contributing to stagnating wages of typical workers and widening inequality.

Following are the key highlights of this report:

U.S. jobs lost are spread throughout the country but are concentrated in manufacturing, including in industries in which the United States has traditionally held a competitive advantage.

The growth of the U.S. trade deficit with China between 2001 and 2017 was responsible for the loss of 3.4 million U.S. jobs, including 1.3 million jobs lost since 2008 ”

https://www.epi.org/publication/the-china-toll-deepens-growth-in-the-bilateral-trade-deficit-between-2001-and-2017-cost-3-4-million-u-s-jobs-with-losses-in-every-state-and-congressional-district/

Neoeconomics was a bust. And, it was politically driven. Trump offered the US the only alternative to the status quo which sold the middle and lower class out. It’s really no wonder why he won the election.

The USA doesn’t just need to think of industrial policy, it needs to think why such ruthlessness in the economic sphere is a key part of its culture. It needs to think of newer economic paradigms.

Apart form its currency, the trajectory of the US is to become irrelevant, and the Silk Road Countries the most relevant.

How that meshes with Global Warming is no sot clear, except to note the Silk Road route is impervious to sea levels, but is affected by desertification and fresh water.

The US has been losing jobs to Asian countries since the 1960s. However, now there is the additional use of automation, even more than before.

https://www.nytimes.com/2018/12/13/opinion/robots-trump-country-jobs.html

The Robots Have Descended on Trump Country

They are leaving many ‘casualties of history’ in their wake.

The war on labor started even before Carter’s time.

https://www.marxists.org/history/etol/newspape/workersvanguard/1976/0137_10_12_1976.pdf

Carter Will Continue Anti-Labor Policies of NixonlFord

Shareholder value is more responsible for current job loss and low wage workers.

Corporations are also being misled;and financialization is only one of the reasons!

https://fabiusmaximus.com/2019/11/23/american-businesses-failures/

America’s giant corporations are decaying

Midwest companies also lost jobs through takeovers.

https://washingtonmonthly.com/magazine/novdec-2015/bloom-and-bust/

Bloom and Bust

Regional inequality is out of control. Here’s how to reverse it.

Also NE and Midwest also lost jobs to low wage south. South gained jobs and still votes GOP.

And about those millions of new better paid jobs see:

https://www.forbes.com/sites/timworstall/2016/10/19/the-us-lost-7-million-manufacturing-jobs-and-added-33-million-higher-paying-service-jobs/#182d67c14a20

The U.S. Lost 7 Million Manufacturing Jobs–And Added 33 Million Higher-Paying Service Jobs

Now that they’re generating results that fits one’s beliefs, will the economists’ models escape criticism from folks that routinely bash economists elsewhere?

The US runs a significant trade surplus in services against the rest of the world. Does that, by the same token, mean that the US has taken away millions upon millions of service jobs from other countries? So other countries should be putting up barriers to US services exports?