Yves here. Subprime auto loans provide more evidence that this supposedly solid “recovery” has cracks in its foundations. This is the sort of “Ponzi finance” behavior that Minsky accurately depicted as leading to eventual ruin.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Auto loan and lease balances have surged to a new record of $1.33 trillion. Delinquencies of auto loans to borrowers with prime credit rates hover near historic lows. But subprime loans (borrowers with a credit score below 620) are exploding at a breath-taking rate, and they’re driving up the overall delinquency rates to Financial Crisis levels. Yet, these are the good times, and there is no employment crisis where millions of people have lost their jobs.

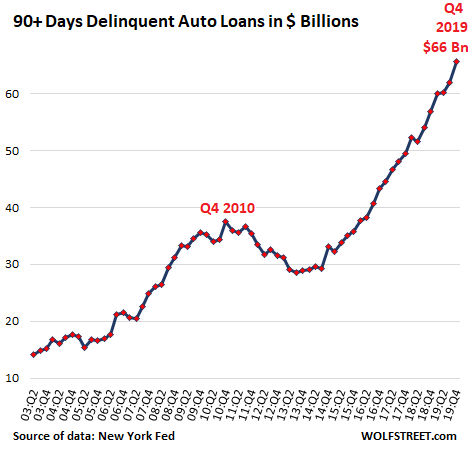

All combined, prime and subprime auto-loan delinquencies that are 90 days or more past due – “serious” delinquencies – in the fourth quarter 2019, surged by 15.5% from a year ago to a breath-taking historic high of $66 billion, according to data from the New York Fed released today:

Loan delinquencies are a flow. Fresh delinquencies that hit lenders go into the 30-day basket, then a month later into the 60-day basket, and then into the 90-day basket, and as they move from one stage to the next, more delinquencies come in behind them. When the delinquency cannot be cured, lenders hire a company to repossess the vehicle. Finding the vehicle is generally a breeze with modern technology. The vehicle is then sold at auction, a fluid and routine process.

These delinquent loans hit the lenders’ balance sheet and income statement in stages. In the end, the combined loss for the lender is the amount of the loan balance plus expenses minus the amount obtained at auction. On new vehicles that were financed with a loan-to-value ratio of 120% or perhaps higher, losses can easily reach 40% or more of the loan balance. On a 10-year old vehicle, losses are much smaller.

As these delinquent loans make their way through the system and are written off and disappear from the balance sheet, lenders are making new loans to risky customers, and a portion of those loans will become delinquent in the future. This creates that flow of delinquent loans. But that flow has turned into a torrent.

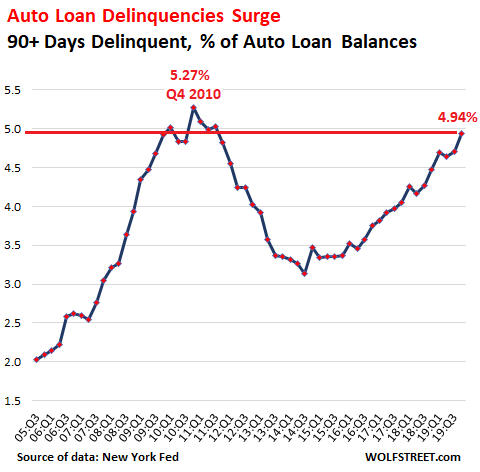

Seriously delinquent auto loans jumped to 4.94% of the $1.33 trillion in total loans and leases outstanding, above where the delinquency rate had been in Q3 2010 as the auto industry was collapsing, with GM and Chrysler already in bankruptcy, and with the worst unemployment crisis since the Great Depression approaching its peak. But this time, there is no unemployment crisis; these are the good times:

About 22% of the $1.33 trillion in auto loans outstanding are subprime, so about $293 billion are subprime. Of them, $68 billion are 90+ days delinquent. This means that about 23% of all subprime auto loans are seriously delinquent. Nearly a quarter!

Subprime auto loans are often packaged into asset-backed securities (ABS) and shuffled off to institutional investors, such as pension funds. These securities have tranches ranging from low-rated or not-rated tranches that take the first loss to double-A or triple-A rated tranches that are protected by the lower rated tranches and generally don’t take losses unless a major fiasco is happening. Yields vary: the riskiest tranches that take the first lost offer the highest yields and the highest risk; the highest-rated tranches offer the lowest yields.

These subprime auto-loan ABS are now experiencing record delinquency rates. Delinquency rates are highly seasonal, as the chart below shows. In January, the subprime 60+ day delinquency rate for the auto-loan ABS rated by Fitch rose to 5.83%, according to Fitch Ratings, the highest rate for any January ever, the third highest rate for any month, and far higher than any delinquency rate during the Financial Crisis:

But prime auto loans (blue line in the chart) are experiencing historically low delinquency rates.

Why Are Subprime Delinquencies Surging?

It’s not the economy. That will come later when the employment cycle turns and people lose their jobs. And those delinquencies due to job losses will be on top of what we’re seeing now.

It’s how aggressive the subprime lending industry has gotten, and how they’ve been able to securitize these loans and selling the ABS into heavy demand from investors who have gotten beaten up by negative-interest-rate and low-interest-rate policies of central banks. These investors have been madly chasing yield. And their demand for subprime-auto-loan ABS has fueled the subprime lending business.

Subprime is a very profitable business because interest rates range from high to usurious, and customers with this credit rating know that they have few options and don’t negotiate. Often, they might not do the math of what they can realistically afford to pay every month; and why should they if the dealer puts them in a vehicle, and all they have to do is sign the dotted line?

So profit margins for dealers, lenders, and Wall Street are lusciously and enticingly fat.

Subprime lending is a legitimate business. In the corporate world, the equivalent is high-yield bonds (junk bonds) and leveraged loans. Netflix and Tesla belong in that category. The captive lenders, such as Ford Motor Credit, GM Financial, Toyota Financial Services, etc., or credit unions, take some risks with subprime rated customers but generally don’t go overboard.

The most aggressive in this sector are lenders that specialize in subprime lending. These lenders include Santander Consumer USA, Credit Acceptance Corporation, and many smaller private-equity backed subprime lenders specializing in auto loans. Some sell vehicles, originate the loans, and either sell the loans to banks or securitize the loans into ABS.

And they eat some of the losses as they retain some of the lower-rated tranches of the ABS. Some banks are exposed to these smaller lenders via their credit lines. The remaining losses are spread around the world via securitizations. This isn’t going to take down the banking system though a few smaller specialized lenders have already collapsed.

But demand for subprime auto loan ABS remains high. And as long as there is demand from investors for the ABS, there will be supply, and losses will continue to get scattered around until a decline in investor demand imposes some discipline.

Subprime is a very profitable business because interest rates range from high to usurious, … Wolf Richter [bold added]

And here’s a root of the problem: the redefinition of usury from ANY positive interest rate to high interest rates that has taken place since John Calvin.

US = usury soaked and so we are.

I love it. That’s from the third paragraph. Since it is such a fluid and routine process, it has surely been correctly modelled? If so, what’s the problem, since it accounts for the backstop to the loan?

Or was his original quote sarcasm? On second reading I think that may have been the case, but economic reporting is such rubbish I think I should be given the benefit of the doubt.

It’s how aggressive the subprime lending industry has gotten, and how they’ve been able to securitize these loans and selling the ABS into heavy demand from investors who have gotten beaten up by negative-interest-rate and low-interest-rate policies of central banks. Wolf [bold added]

The MOST a risk-free asset should return is ZERO percent. Otherwise we have welfare proportional to account balance. Subtract overhead costs (and a zero maturity wait premium in the case of account balances at the Central Bank, aka “reserves” when the account holder is a bank) and we are in NEGATIVE interest territory.

So negative interest is perfectly normal* for risk-free assets.

The problem then is HOW negative interest is produced and currently that is via welfare for the banks and the rich at the expense, one way or another, of everyone else, including the poor in need of transportation.

*Nevertheless, individual citizens should be shielded from negative interest until they have saved enough fiat to invest properly. Hence the need for citizen accounts at the Central Bank itself.

I think I can add two more reasons:

2) As so well explained already on NC: the cost of new cars continue upward at a breakneck pace, including expensive new technologies, etc, without meaningful worker salary gains.

3) The cultural shift to massive pickup trucks and SUVs (I don’t know but I would guess these types are more expensive than your boring sedan).

expensive new technologies

That are not always in the buyer’s interest.

law of unintended consequences…..given the federal fuel economy requirements automakers have moved to very low displacement, high output turbocharged engines to hit MPG standards.

(in my opinion) these engines are not as reliable traditional non-turbocharged engines over the long haul without meticulous maintenance.

And so once a car starts aging out-of-warranty, car owners get hit with the triple whammy of continued payments, unexpected repair bills and having negative equity (“upside-down”) on the car.

exactly

This is more of a peak car issue than a subprime issue. The demand for cars and total miles driven in the US has flatlined if not slightly declined. In order to keep up sales the auto companies financing arms have been extending credit to riskier borrowers.

Those loans are now defaulting at a higher rate reflecting the credit worthiness of the borrowers. Banks and credit unions have maintained the same standards and as such aren’t having an increase in defaults.

Going forward auto companies will have to lower their production rate to more accurately reflect demand.

Doesn’t it feel as if there is a degree of keeping the punch bowl full? The car is a central piece of American identity, especially for a significant portion of the younger set. I can visualize an increase in civil unrest(or at least an increase in anger) were the car to become unavailable to those who need one, which is of course everyone due to our public transit situation.

As a millenial, I don’t know many people in my age range who view the car “as a central piece of identity”. More so just a nessecity to get from point A to point B. If there were other options most wouldn’t care.

A nice Keynesian model of finance: demand (for yield) determines available supply. credit quality is no longer relevant.

as stated *lots* of car buyers buy based solely on monthly payment (often at 84 month-terms).

This innumeracy + the new car hypnosis + income never verified allows them to be totally screwed over at the car dealer finance office. Then add that buyers are often underwater on their prior car…and this liability gets rolled into the new car’s payments.

Read some of the prospectuses for some of the asset-based securities sold by places like Carvana…it makes one shake your head.

Ironically given the rider subsidies and price distortions over at Uber-Lyft, for certain people (ie, living in metro areas) they’d be better off just using Uber-Lyft for much/all of their transport needs.

It’s been many years since I’ve financed a car purchase, so this statement in the article had me scratching my head: “On new vehicles that were financed with a loan-to-value ratio of 120% or perhaps higher…”

A LTV over 100% on a depreciating asset??? That’s insane (or at least insanely irresponsible).

Deterioration, or even elimination, of lending standards, asset backed securities, reach for yield… Where have I heard all this before?

If you are underwater on your existing loan and roll it over into your new loan Voila!

Good thing that Joe Biden is busy at the moment with running for President or else he might try to come up with a bill to make auto-loans inextinguishable in bankruptcy.

Another user brought up Uber and Lyft and I’m curious as to how much of a factor ride hailing is in this surge of delinquencies. Both companies have been active in encouraging potential drivers to get new vehicles, with Uber working closely with the company which bought out its in-house subprime loans division.

I mean, at some point, if working ride hailing gigs isn’t paying the car loan off, the borrowers are going to stop making payments.

Is this due to a culture of entitlement, or to lousy educational systems that don’t include courses in basic household financial management, or to the power of hucksters and corporate advertising, or all of the above?

Yes.

blame the victim in quite a few postings above.

how about this: due to flatlined wages and ever-increasing costs on basic necessities, the average american doesn’t have $400 to rub together in time of need.

old car craps out. they must have one otherwise they can’t work and their whole life will enter a downward spiral. they can’t raise the downpayment. plus, their credit is probably in the crapper from having to rob Peter to pay Paul a time or two before.

voila–you are stuck with this kind of crappy loan on a depreciating asset.

anyone who has never had to face this decision should not be judging. i have actually seen forums where this issue comes under discussion, and i kid you not–the out of touch upwardly mobile commenter says “why not pay cash and avoid financing? i always do. it is the only sensible way, yadayada”. due diligence means nothing if you have nothing to bargain with.

people down here are trapped into this idiocy. it’s not that they don’t know that it is idiocy (perhaps some don’t). it is that one doesn’t have much of a choice unless they want to really give up everything and go live under the nearest overpass.

Thanks for this ^

Isaiah 3:14-15

The incredible tragedy is that no one in the rich USA need suffer a reduction in their standard of living in order to have a just system. Indeed, a just system should enhance their standard of living by healing a bad conscience and what must be near insane levels of cognitive dissonance.

Jeremiah 34: 8-22

Amos 2: 6-8

Amos 3: 10-11

Amos 4: 1

Land tenure was shredding it’s customary social responsibility as usury spread throughout the near East. Debt arrears led to the dispossession of the small landowners and sometimes even the flight of considerable numbers of them from their communities by the widespread practice of bond slavery and by the appearance on the scene of large individual and privileged Estates. Creditors foreclosed on land and wealthy individuals bought it from poor holders. The new owners tended to discontinue their communal services and perhaps even to stop paying taxes, shifting this communal duty to people dependent upon them. Thus, what used to be a single group of people enjoying equal political rights, members of a territorial community, were now divided into a social estate of nobility, free from community obligations, And into an estate of working people who had to perform the community obligations for themselves and for their masters.

The new appropriators, or at least some of them, were immune from the redistribution of shares of land and from community control, and could do what they wanted with their holdings, irrespective of whether at that time they performed any duties as community members or not.

This weakened Central authority of the Middle Babylonian period was evidently ready to cede to persons of special status and to sanctuaries It’s right to collect taxes, to levy soldiers and workers and to use the services of its subjects. The ensuing privatization terminated the economic renewal and clean slate practices (debt forgiveness-amargi) that had been customary throughout the early and middle Bronze Age. Babylonia entered its so-called Dark Age.

-M. Hudson

…and forgive them their debts

This story is as old as the Bronze Age, when the rural usurer-oligarchs ensnared the smallholders to the detriment of the palace’s ability to maintain public works and man the army

Hence andurarum, deror and the jubilee …

I used to work in subprime “risk management” (2000-2005; there was no “risk” for us. My bank made successive record annual profits every year I was there).

Nothing much has materially changed.