Investors reacted to the Fed’s unprecedented Sunday moves, of dropping the Fed Funds rate to 0%, launching a new $700 billon Treasury and mortgage bond buying program, increasing the size of dollar swap lines, and other measures, with revulsion. S&P futures and the Dow mini went to limit down in 15 minutes.

The central banks signaled desperation and lost credibility as well as firepower. And the timing, coming right after Trump said he had the authority to remove the Fed chairman, had the look, whether true or not, of the central bank capitulating to the President’s demands.

What is the point of cutting interest rates when they are so low as to not have a significant impact on funding decisions? Mr. Market has worked out that central bankers are pushing on a string and what the world needs is more demand to replace the massive deflationary shock of many people and businesses suddenly having or facing the high odds of a hit to their incomes. That means massive spending programs. Even Mark Zandi, whose role as a talking head is to put a happy face on distressing data, is in Defcon 1 mode. From the Wall Street Journal:

“The onus is now squarely on the Trump administration and Congress—there’s no other way out,” said Mark Zandi of Moody’s Analytics. The measures so far will help, he said. “But this is a tsunami. They need something that’s three or four times as large.”

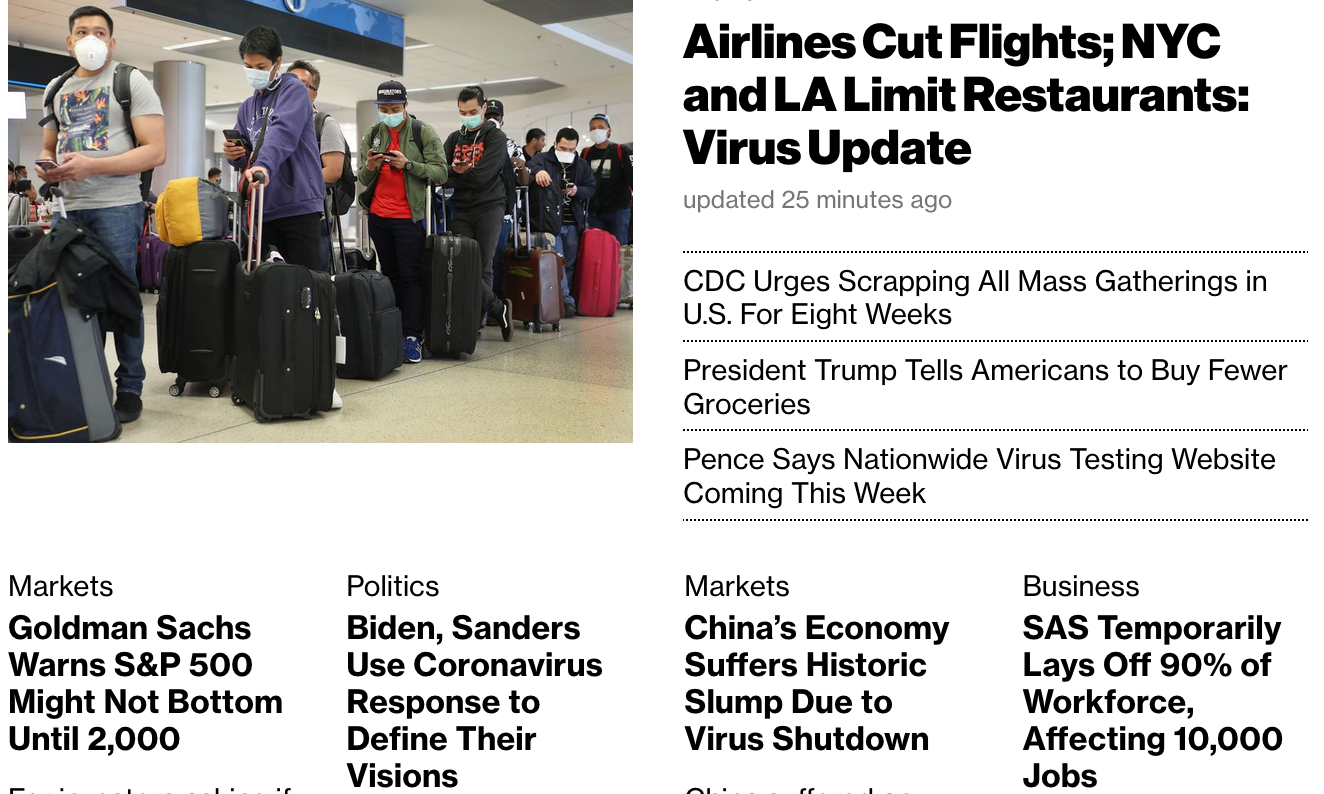

Just look at the headlines at Bloomberg:

Another big bit of bad news came out of China. Even though they claim to have gotten their new coronavirus case rate down to effectively zero, the economic cost so far is much higher than analysts had cheerily predicted. From CNN:

Separately, fresh data coming out of China showed the economy has been hit harder than expected by the coronavirus outbreak.

Retail sales plunged 20.5% in the January-to-February period from a year earlier, much worse than the forecast 0.8% rise by analysts polled by Reuters, according to the National Bureau of Statistics on Monday.

Industrial output also fell 13.5% during the same period, while fixed asset investment plunged 24.5%, both widely missing estimates.

And as many experts have pointed out, it isn’t as if business in China will get back to normal all that quickly. For instance, there have been reports of workers being slow to come back to their jobs. Reader Petter in comments yesterday gave a vignette that suggests how long the recovery might take:

A data point from Norway: my brother in law has a business – supplier to the fish and meat industry, selling everything from gloves to machines – everything. A significant portion of what he sells comes from China. Normally when he reorders the delivery time is three months, now it’s year. A year.

He’s in contact with colleagues and associates in the food business and it’s the same for them. So what happens when the butchers, slaughterhouses, fish farms go empty for gloves, masks, aprons, etc? Which is definitely going to happen. They’ll have to shut down. According to my brother in law, the factories that supply him from China, when they open again, and they may already be in the process of reopening, their first priority is to resupply China, and that may take a year. Europe is going to have to wait.

One last point – my brother in law is already getting calls from want to be customers who are out of supplies, and he’s turning them down. He has to.

ewmayer opined that most food processors could make do with what they have…except for latex gloves, which sound like a must-have.

The magnitude of the fall in China gives the rest of the world a forecast of what it faces when other economies shut down to stop coronavirus spread. Big corporations see the financial squeeze coming and are trying to get ahead of it.Banks have better capacity to lend than in 2008, but in the US, for a very long time, banks loans have been a diminishing source of funding. They rely more on financial markets: bond issuances, securitizations, commercial paper. Credit lines are a backstop and making serious use of them is a sign of widespread stress. From the Financial Times:

Today, it is not Wall Street financial institutions, but companies in a variety of industries that are stressed, as a simultaneous supply and demand shock means they need to tap credit lines to pay their bills. With flights halted, supply chains disrupted and the consumer economy gutted, companies are trying to stockpile cash, whether they need it immediately or not.

It’s one thing for the aircraft manufacturer Boeing to draw down its entire $13.8bn credit line. It’s another for multiple big corporations to draw theirs at the same time. Still, as a recent Credit Suisse report pointed out, “we now have a global banking system where all major banks have to pre-fund 30-day outflows” with high-quality liquid asset portfolios. This is one important reason why these corporate funding stresses haven’t caused a real time banking crisis in the way that the 2008 subprime crisis did.

Consider just the airlines. Delta, the strongest large US carrier, is already making barely-coded requests for a bailout. As our Clive observed by e-mail:

I can’t see any international travel on any sort of scale for the next six months — possibly a year — save for repatriation flights laid on by governments. The entire passenger aviation industry will have to be nationalised and put into a state of suspended animation. Bilateral arrangements may start to creep back in on a very limited basis where there’s large and largely unstoppable flows of people by other modalities (US to Canada and Mexico, U.K. to France and the RoI — that sort of thing).

Yet any rescues may not come soon enough to limit the loss of income to employees of not just the airlines but all the related activities: the catering companies, the airport stores, the terminal staff. A data point from David:

Air France has temporarily laid off 80% of its staff, and two of the three terminals at CDG are being closed,

And vlade added:

SAS laid off 90% of staff, AirNZ also laid off high proportion of staff… In regards air travel, this will have way more impact than 9/11, as I don’t think the govts can support all the airlines.

Interestingly enough, in the CZ, the intra-country public transport (trains and buses) was strengthened to reduce crowds.

And confirming the recognition that central banks are out of ammo, other equity markets fell and safe haven assets rose despite other central banks taking emergency measures. Again from CNN:

The People’s Bank of China on Monday pumped 100 billion yuan ($14.3 billion) into the financial system by offering one-year medium-term lending facility (MLF) loans to banks. On Friday, the central bank announced it would cut the amount of cash banks need to hold as reserves by 50 basis points, injecting around 550 billion yuan ($78.6 billion) into the economy. The RRR cut took effect on Monday.

The PBOC also said it would take other measures to lower borrowing costs to protect the economy that has been damaged by the coronavirus outbreak.

Elsewhere, the Bank of Japan announced Monday it would hold a one-day policy meeting later in the day, to replace the scheduled meeting on Tuesday and Wednesday. The Reserve Bank of Australia also said Monday it stands ready to purchase Australian government bonds to support the market. It said further policy measure will come out on Thursday.

Yet that didn’t do much for Asian markets. From Ipek Ozkardeskaya, Senior Analyst at Swissquote Bank, by e-mail:

Asian stocks were smashed, with Australia’s ASX (-9.79%) taking the biggest hit..

The fact that lower Chinese production will have a severe implication on most international companies’ operations is now leading to another round of downside valuation in market prices…

Gold tanked to $1504 an ounce during the Friday’s stock rally and jumped to $1575 in the overnight trading session. Though such violent swings are disturbing for a safe haven asset, chaotic market conditions give little alternative of rescue to investors.

WTI crude (-3.18%) shortly fell below $30 a barrel. The mounting selling pressure is partly countered by expectations that the global production would curb naturally if a barrel is exchanged below $30. Most producers would bleed money near these levels.

However, a critically important and perhaps missing player is the ECB. Stunningly, last week, Lagarde repudiated abandoned Draghi’s “do whatever it takes” stand when that central bank could make a real difference by keeping a lid on the spreads of Italy’s and Greece’s bonds relative to those of Germany. Italian bond yields made a record single-day spike. Lagarde quickly went into reverse. From the Financial Times:

Ms Lagarde backpedalled quickly after her press conference by stating in a televised interview that she was “fully committed to avoid any fragmentation in a difficult moment for the euro area”.

The ECB’s chief economist, Philip Lane, also sought to reassure investors that the central bank was not leaving Italy to fend for itself, after the country went into lockdown to halt the rapid spread of the virus. In a blog post he said the central bank was “ready to do more” to contain any sovereign debt stress…

The ECB last week announced plans for €120bn of extra asset purchases — on top of its €20bn-a-month existing programme. Mr Lane said this showed it would have “a more robust presence in the bond market during phases of heightened volatility”.

The new monetary policy package — including more cheap loans and lower capital requirements for banks — was agreed unanimously by the ECB governing council. But some members indicated they would have preferred a bigger “envelope” of extra bond purchases.

However, the pink paper pointed out that Lagarde’s original stance got applause in some quarters, particularly Germany. And some of its reader think Lagarde meant what she originally said. For instance:

Phillip J. Fry

Considering she’s a veteran politician and former IMF director, she must have calculated the effect on markets in advance. It was a deliberate point she made. No moral hazard under her watch.

Backpedaling now just looks like she is out of her depth. Understandable given the unprecedented nature of the crisis, but not what we want from someone tasked with guarding our currency.

WMD

Of much greater importance is the letter to the FAZ from prominent Germans. This is what Germany thinks. And what they think matters. Their view is that most of what is wrong with the EU can be laid at the door of the feckless and profligate Southern Europeans. Clearly their bonds should not be trading anywhere near those of Germany. In fact, these profligate so-and-sos need a bit of punishment, so that they might return to a proper sense of their duty.

And, as Germany ultimately controls the purse strings, Italy can go whistle for real support.

So, so long the Euro and the EU, it was nice while it lasted (not).

So part of the global swoon may not be only that the epicenter of the pandemic may soon be the US, whose fiscal and disease containment responses are sorely lacking, but also that the Europeans are failing to contain a potential financial system meltdown.

European stocks tumbled on Monday, as sweeping central bank intervention failed to staunch the wave of volatility that has shaken global markets.

The FTSE 100 fell 4.7 per cent at the open, taking losses so far this year for the London blue-chip index to more than 30 per cent. The sell-off was widespread across Europe: Germany’s Dax and France’s Cac 40 were 4.6 per cent lower.

The Federal Reserve cut US interest rates before markets opened on Sunday and joined forces with other central banks in a bid to prevent a more severe economic downturn and market dislocation caused by the coronavirus pandemic….

“The Fed has thrown everything at this. If we are now facing the end of central bank action, it means we are on our own,” said Seema Shah, chief strategist at Principal Global Investors. “There is a fear settling in the market, investors are terrified that this was all that was left.”

More and more countries are announcing lockdowns. The Czech Republic just joined the list. As you can see from Bloomberg, more and more US cities are restricting or closing a wide range of venues. The CDC has recommended against gathering of more than 50 people.

Mr. Market has already worked out that the stimulus bill working its way through Washington is inadequate and is lobbying for more. Even the normal Democrat-loyal New York Times took the unusual step of shellacking Pelosi’s bill for not living up to its promise of delivering paid sick leave when in fact it covers only 20% of all workers.

A cornoavirus lockdown has an economic impact a lot like that of a disaster, like a hurricane, but playing out over a longer time frame. FEMA has found that 40% of businesses shutter in the wake of a disaster. And of the business that reopen, only 29% survive the next two years.

The US economy is 70% services. Travel, tourism, theme parks, casinos, cruises, restaurants, hotels, and restaurants are already in meltdown mode. Due to the market perturbations, people are likely to cut back on all sorts of discretionary spending, from home redos (and purchases), to donations to charities to plastic surgery and shrink visits. Anyone who can stand to wait won’t have surgery. And who would go to a nail salon, or get a massage, or go to a doctor’s or dentist’s office unless they though it couldn’t wait?

And remember, 40% of Americans don’t have enough money or slack on their credit card to handle a $400 emergency. Many workers will be hit with hours cutbacks or job losses. They need assistance pronto or the economic damage will cascade: defaults on rent or mortgages, delinquencies on credit cards, defaults on car payments. And you have societal consequences like hunger, homelessness and suicides.

In light of that, mainstream thinking is way way way behind the curve. From the Wall Street Journal:

Some economists are advocating for tax rebates or direct subsidies to households, like the 2008 bill to boost the economy that saw more than 100 million households receive rebate checks.

Economists say such efforts will temporarily help staunch the bleeding for workers, businesses and investors as vast swaths of U.S. commerce shut down, bringing economic activity to a standstill.

But they say Congress will have to provide a much bigger package—perhaps on the order of $400 billion—to prevent the world’s largest economy from spiraling into a much bigger crisis. One big fear is that the widespread shutdown of businesses across the U.S. for potentially weeks, if not months, could lead to the collapse of many companies and then a vicious cycle of rising unemployment, falling consumer spending and more industry strain.

Unless that $400 billion comes soon and a lot goes directly to individuals suffering financially as a result of the coronavirus, even that much money will be too little, too late.

And before you think concern about the economy is misplaced when people are dying, even more lives are at risk from fiscal malpractice. Hoisted from Links yesterday:

Health and the economy are closely linked. The correlation between per-capita GDP and health (life expectancy) is essentially perfect. If the covid-19 pandemic leads to a global economy collapse, many more lives will be lost than covid-19 would ever be able to claim. (12/12) pic.twitter.com/ZXcj2s8PAA

— Francois Balloux (@BallouxFrancois) March 14, 2020

The slow, too small, and too narrow sought-after responses don’t merely reflect being in a fog of information gaps. The speed and aggressivenesses of the lockdowns, and their drastic impact make the broad outlines all too clear. Our supposed leaders are in a fog of denial. They cannot fathom that so much of what they had come to accept as the normal and proper operation of our system will crumble if radical action isn’t taken soon, yet that very radical action will also result in changes they deem inconceivable, or worse, aesthetically unacceptable.

As we found out in the financial crisis, in tightly coupled systems, events can propagate across the various elements too quickly for anyone to intervene and limit the damage. The relentless drive for highly efficient systems, from just-in-time manufacturing to radically limiting inpatient time so as to reduce the number of hospital beds per capita, have created fragile systems that are now being tested to destruction. And we are learning, to our collective detriment, how many are wanting.

I’m assuming the Fed move was in reaction to monetary velocity data, which given all the various lockdown procedures and self isolation in the past week was down steeply.

I’m an IT guy though so this is just guessing.

Lowering interest rates and buying bonds will not improve monetary velocity. QE is just an asset swap. Per Investopedia:

https://www.investopedia.com/terms/v/velocity.asp

Investors who sell bonds to the Fed in QE will not go out and buy goods and services. They might sit on the cash (or more likely, lend it out in reverse repo) but sooner or later they will make another investment. All this secondary market trading does virtually nothing for the real economy. In fact, various studies have found higher levels of secondary market trading activity generally (both the trades as well as the size of the asset management business) are bad for growth.

One notable change this time around compared to the GFC is that, certainly here in retail, the TBTFs (speaking for the U.K. anyway; hopefully people familiar with US market may step in to fill the gap in my first-hand knowledge) who know that ultimately the government is the one who will keep them propped up are taking preemptive — and I’d even call it a little firehosey — steps to stave off a consumer credit crunch.

My TBTF is offering on-request payment holidays for credit cards and loans, no fees (guess the U.K. government is wise to the banks’ propensities to lard up junk fees if they can get away with it) and extending lines of credit where there’s some fair assessment that the borrower isn’t fundamentally holed below the waterline before all this even began.

This approach — and the significant benefits it brings — is key to tiding over retail borrowers for six months to a year without putting them under pressure to default. It is of course the opposite of the “liquidate everything” of JP Morgan fame (or infamy) from the 1920’s. So we have learned that. And also the central bank (certainly the BoE) being willing to buy any commercial paper from a regulated consumer lender is very useful because, if anything, it’s actually easier for us to place our ABS in the OTC market because, if you’ve some modest risk appetite remaining, you can get a positive yield (try finding that anywhere today) with only the most trivial assumed downside that, if push come to shove, the government wouldn’t buy this ABS off of you via QE.

So, for the laity (I’ll resist the urge to add “that’s no laity, that’s Yves Smith”) the transmission mechanism between central bank support and us peons scrambling around in the mire is somewhat improved since the dark days of the GFC and the positivity medieval thinking of the Depression era.

Ultimately though, the difference between what we have at the moment (which I’d describe as inefficient and suboptimal muddle through) and neutral to even possibly slightly beneficial outcomes of all this is the willingness, or otherwise, of government to implement fiscal responses and employer-of-last-resort policy measures.

But the problem with banks giving credit to the 10% who don’t need it, is that it will help convince them that the 90% don’t need government help. Though I guess maybe it will keep au pairs out of the unemployment line.

It’s not I don’t think really more credit per se that will fix this. Not pulling the fingernails out of existing borrowers to make payments they can’t make (banks doing loan mods, in other words) is an important criteria.

But the other step will be government works programmes to pick up the holes in the labour market left by hospitality, lodging, travel and so on.

>is offering on-request payment holidays for credit cards and loans

The one thing we – aka our supposed gumment – needs to “go medieval” on is interest rates. And I mean slam a manhole-cover sized lid on them.

Credit Cards – 1%. Mortgages – 1%. Personal Loans. Whatever. Let people at least borrow – since giving it to them is apparently so hard – from the banks at rates very close to what the banks get the money for.

An oxygen mask for the rapidly fading middle class, at least.

It came to me in the last day or so why my banks could give a flying… squirrel less that I threaten to move my not insignificant savings out of their banks; Why pay me a percent or 2 when they can get it from the Fed for cheaper?

We have destroyed the saver as well as the desire to even court savers to deposit in the banks thanks to all this QE-this and QE-that. The system is rotten all the way down to the bedrock, let alone the foundation.

Slamming down usury rates would at least be a step in the right direction, though many more steps would be required.

“Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves.” – Norm Franz

(laity – good one) Is it me or is the US Congress as dumb as a bag of rocks? Just a rhetorical question. From your blurb here I’m even more convinced that Nancy is so concerned about maintaining a budget, a proper budget – whatever that is – that we are being led by some group memory of a lost tradition. Lost for decades. If Nancy and her caucus had realized that it really doesn’t matter at this point in time whether we subsidize the corporations to provide unemployment benefits, etc or whether they mail everyone hit and miss checks for various amounts it would probably be recognized by most people as a very good decision. Maybe do both. Because if they don’t do something for industry too then it will be years before the economy starts to function again. Nancy thinks we need to discipline corporations in a time of Corona? She’s so useless.

She’s somehow worth over $100,000,000 working as a humble public servant all these years so not quite useless.

Its her husband’s money. He is a successful developer, I believe, in the SF area.

He recycles post offices, too.

In my read, Pelosi is more concerned with working for her real masters while making noises that seem believable to the unwashed masses. Major corps exempted because they “should” be providing the sick leave? How about adding that to the law, Nancy?

We The People have no leaders and no “public” institutions that work for us any more.

Do we still have a domestic supplier for piano wire? Else we’ll really be up a creek once those unwashed masses finally awake from their slumber to find they have no job and no home and can march on Washington again.

This is getting terrifying now, was going to say scary but I believe scary is in the rearview mirror. Desperate people do desperate things. Our very complex society is at risk of crumbling and the pain that will cause the to those on the lower economic tiers is almost incalculable (monetarily and psychologically).

We live in a time of extreme political discord, distrust in media, distrust in government, distrust between political ideologies/parties and political polarization. And this was ALL BEFORE the virus caused upheaval.

We are living in a historical moment right now, I hope we measure up.

When was the last time the mankind did? (measure up)

I like the idea of an interest moratorium on all bank loans. The Fed’s actions seemed to assume that borrowers want more credit. Maybe some do, but more want cash flow.

I think in addition to an interest moratorium, a payment moratorium as well. All mortgage payments (and interest) should be suspended until we all can return to work. Additionally, make it illegal for any landlord to collect rent. People can concentrate on purchasing the necessities of life (food, other consumables) – and can start paying for their housing when this completes (and they return to work). This is going to have long term effects on our economy – might as well accept that and ensure that no-one is rendered homeless.That would be government for the people…

Minor quibble: It was Andrew Mellon, not J.P. Morgan who made the infamous demand to “liquidate everything.” Morgan was bad, but Mellon was totally depraved and even richer. I think it’s important we remember his evil.

Thanks! I relied on memory because I was too lazy an arse to look it up. And got it wrong. So there’s a morality play in miniature for you, right there.

The Fed has a regularly scheduled meeting March 17-18. It was a blunder to do this interest rate drop this weekend because it states that the financial and economic situation is so bad that they couldn’t wait 3 days to do it as part of a normal meeting. They could have announced a 1% drop Wednesday afternoon and it would have showed serious intent, not panic and capitulation to Trump.

There’s a liquidity problem of some kind in the background among the trading houses and “primary dealers.” The Fed has been providing “liquidity loans” to the repo market since last September. I think they stopped around the end of January, but then had to start up again a couple of weeks ago. I presume Powell and the rest of the directors know something we do not know.

The underlying provision of funds to the repo market (the squeezes last fall) has been widely misconstrued. As Warren Mosler said,

It was mainly the result of:

1. Big banks being required to hold large liquidity buffers. So the normal suppliers of liquidity to the repo markets (in addition to fund managers) are constrained. Nothing wrong with their health, as way too many asserted. No evidence of credit-driven reluctance.

2. Many of the said banks who nevertheless had ample buffers were lending to the FX swaps market because more money to be made there

3. Fed tightening making the above acute

4. Fed initially not getting that its policy of relying on reserves to manage liquidity (which works fine when there was tons of liquidity, but not otherwise) was no longer effective. Had they gone back to their pre 2008 procedure of using repo as the primary tool for managing liquidity, I doubt things would have gotten as stupid as they did.

This needs financial stimulus, and apparently, IMF was already saying so a week back – https://ftalphaville.ft.com/2020/03/06/1583518706000/The-economic-response-to-coronavirus–why-it-s-mostly-fiscal/

Which is why Germany is going to break the Europe, being the idiots they are (apologies to any German readers, but my experience is that austerity is not just German elite’s preoccupation – in fact, I’ve seen German elite showing they understand it’s bad, but not being willing to sell it to German public, particularly West German public).

the gist i derive from only half-heartedly observing Europe over the last many years(esp. since the Greek Crisis) is that Germany is the Euro version of Pete Peterson.

what’s it going to take for the Austerians to finally be ignored, if not laughed out of the room?

In the US, it’s been perfectly obvious for decades that Cheney was right when he rasped that “deficits don’t matter”…just look at the pentagon…or wall street…or the tax free megacorps(as in, if they really cared about “fiscal responsibility”, they’d be invading the Caymans in order to repatriate all that jack and tax it)

A Great(er) Depression. Thats what will be required to kill this thinking. Its what was required last time.

I often think that the way to think about financial markets is in terms of claims on future consumption. Well there is no a crisis regarding the scale if future consumption, cos future production looks impaired. Its not entirely surprising we are reevaluating the value of those claims

they’d be invading the Caymans in order to repatriate all that jack and tax it) Amfort

No need to invade if the assets are US dollars since they are all (except for paper FRN’s and coins) at the Federal Reserve in accounts where negative interest can readily* be levied on them.

*Except the banks might try to pass that negative interest down to small depositors which is why all US citizens should have debit/checking accounts at the Federal Reserve ITSELF where they can be shielded from negative interest up to a reasonable account limit.

‘Should’ is doing a lot of work in your statement, not that I don’t agree .. but there is no way us plebs will be allowed THAT particular Elite ‘Banking’ Pleasure !

Nothing central banks do “stimulate” anything. They only existed for bubble control and asset swaps. The former they have struggled post-regulation era.

It’s time to get rid of the Fed. All they do is help the rich get richer.

BOJ joins peers to fight coronavirus effects, ramps up risky asset buying

…and more mayhem follows (see article).

Finally, the rich have a justification for owning the government!

It’s official now, money is backed by nothing.

It’s a motivational system.

Buy gold!

A motivational system? In part, it would seem – see Bezos telling his employees to eat cake (from Whole Foods?) and share their wealth with their fellow desperates.

Seems to me that what backs money is that “full faith and credit” thing, which is based on the total economic activity of the political economy. And we got how many trillions in “nominal value” derivatives and other foam floating over the top of it all, plus all the other vulnerabilities that “traders” have insinuated. The stone soup being all the little people who ‘make money” the old-fashioned way — by doing useful services for people who get paid for making stuff (so much of which is deadly crap like plastics and pesticides and fertilizers and Instant Fashion.)

Buy gold? Can you eat gold?

I held gold for a while, except that all I had was a piece of paper saying that I had ownership of an undifferentiated piece of gold in a vault somewhere. Which had probably also been sold to half a dozen punters on the basis that we wouldn’t all want our bit at the same time. Or that even if we did all we’d do is swap our bits of paper and no-one would be the wiser as the actually lump of gold never actually put in an appearance. Can I actually get my hands on that lump of gold to break bits off to exchange for bread or meat? If push comes to shove those bits of paper would only have the value of an equivalent piece of toilet paper.

Buying gold only works in normal situations. We’re not in a normal situation.

And we’re not in a Great Depression scenario. Then there weren’t enough jobs for the people. What we face is a situation where there might not be enough people on their feet and willing to risk infection to fill the jobs – perhaps the really necessary ones like baking our bread or turning cows into steaks, or truckers to truck the bread and meat to the shops, or folk willing to woman the check-outs in the shops.

It’s backed by force — that’s the “sovereign” bit, eh?

that is quite right. So gold isn’t enough, it has to be gold+guns – though a shotgun and/or a glock INDIVIDUALLY is a peashooter or smaller against the military and para-military. I have no answers. But I’ll still have some of both.

You do know what a sovereign is, don’t you?

https://en.wikipedia.org/wiki/Sovereign_(British_coin)

Wuk, not really. You can just as easily say money is backed by everything.

When i’d go to Europe on biz back in the day, i’d pick up a fresh brand new bundle of 100 of the latest currency that had fallen apart to take with me, and the higher the denomination-the better. Typically a bundle cost around $10, and I could have dozens to choose from, currencies used to go bk all the time due to hyperinflation.

Now, why would I need something like that?

I’m a bit of a prankster, and leaving a Polish 10,000 Złoty banknote on the ground in a busy train station and then watching what happens was great fun, or putting a banknote on the rail of an escalator, or making little paper airplanes out of debauched banknotes, or what have you.

How are your investments doing today?

A lot of people who were living charmed lives seem suddenly to be reaching with their toes, head barely above water, feeling for a bottom…

I have been skeptical of those who are skeptical, that NIRP won’t come to the U.S.

POTUS wants NIRP. Mr Market wants NIRP. The Fed has no other options to pull out of it’s tool box (it’s tool box consisting of only it’s sell identified tools chosen to benefit Mr Market and only Mr Market) at this point except more and more QE

I think there is a very good change the Fed will do NIRP. They look so desperate, you’d think they all owned huge stock portfolios.

Mr. Market doesn’t want NIRP, as the European (and Japanese) experiment are showing it does nothing much, and actually hurts the banks.

Mr. Market wants a financial splurge.

Fed (and any CB) is a has-been in terms of crisis resolution, and the market knows it.

+1 (€)

(see, now look what happens, I bet that’ll have that Schäuble character on at me for causing inflation… people creating paper assets and all that…)

I know. But the banks are….just the banks, only a part of Mr Market.

The Fed will have to come up with a way to keep giving banks their welfare check.

I still think Mr Market wants NIRP. Could be wrong though.

Then there’s the other option – The Fed cutting to the chase and buying stock outright. I’m sure any needed change in law to allow that can be attached to a law that might be quickly passed and signed.

Or they might be bold and to do it on it’s own. It’s not as if they need to hide, what do they have to be afraid of? It’s a big part of what Trump boasts about, making the stocks to up and up.

The could even call it COVID19 Stimulus and Recovery Package For The Working People Who Own 401Ks.

what if the plunge protection team is buying and it’s not working. I don’t see this as a parallel to 2008, it’s what 2008 has led to, the result of a sort of control fraud done under the auspices of gov action that lavished wealth on one segment of the population due to some sense that they were saving the superior citizens and the rest of us can bootstrap our way along. How many years ago was it suggested that raising interest rates would make the next crisis easier to deal with? Well here it is. I think vlade knows of what he speaks and is likely correct, no nirp. I can’t even guess what the response will be considering the vapid nature of the entire leadership structure.

Mr. Market does not want NIRP Go read the comments section at the FT and WSJ, which is retail and low end institutional investors. Loathed. You’d have to look very very hard to find an institutional investor who likes it either, and tons of very vocal ones who don’t.

Mr. Market is real people making real investment decisions. NIPR has come about only due to central bank action, and it’s been a proven bust (see Sweden abandoning it). But the EU has some of the dumbest worst economists who also have a hearing in policy circles…

The Fed has finally worked out that merely super low rates are somewhere between counterproductive and destructive, and negative ones are worse.

Well I predict some sort of stealth NIRP. Probably letting inflation loose. Now the powers that be don’t like inflation because it is “A tax on everyone.” And it is a tax that despite all their bought and paid for loopholes can’t avoid paying. But in the face of a crisis of this possible magnitude (think unemployment north of 20%, the stock market down more than 50%, and bankruptcies left and right) the only way to make people spend the limited money that they have would be to make it worth less if they don’t spend it.

They have claimed to be trying to increase inflation at least since 2010. They got the CPI-U up a little over 2% a couple of times, but their “preferred measure,” the CPE, has only touched 2% briefly a couple of times and mostly has stayed well below. Of course that was partly because everybody knew they weren’t serious about reaching 2%, but they really don’t seem to be able to start inflation going. The current problem is a lack of supplies, due to lockdowns, and also a lack of Aggregate Demand because of the refusal to raise wages. I don’t know what they’re going to end up doing, but it’s going to have to be systemic, and as revolutionary as the New Deal was in its day.

I think more likely than NIRP – after all, even under the threat of devaluing their savings you can’t force people to go out and buy! buy! buy! when they are concerned where their next paycheck is coming from – is the Fed following Bank of Japan and ECP and loosening the current “USTs as collateral for repos” rule, and perhaps embarking on outright asset purchases to put a floor under the market.

(Now that my post is up, I see timbers already had the same thought, above.)

But the US Census is hiring! $21/hr offered at my local library!

$13-50/hr based on your area’s cost of living. Plus benefits incl health coverage.

In 2010, over 600,000 people were hired.

Perhaps we need a 10x increase to keep workers safe.

They support a wide variety of small businesses each day.

In the end though, more people will just need a check.

I’m not sure if that would do anything though. Even if you hired a bunch more people they would have to have something and somewhere to spend those wages and large sections of retail are closing down with the potential for all “non-essentials” being closed. For example; B&H in NYC announced its closing its physical location. So even if you wanted to spend there you can’t unless its via the web. I have to wonder how many warehouse locations may close now as well.

But you could make rent or the mortgage or buy food, which is good.

But you could make rent or the mortgage or buy food, which is good

It is. I’m just trying to think of something to alleviate the effects of a massive drop in consumer spending in order to keep things moving; debt holiday? Fed Govt purchasing? I honestly dont know.

Jubilee would help. Especially those people who do the boot-strapping which is what I think pulled the global sh!tbox of a globalized economy out of the toilet. Just ordinary people re-learning how to barter and trade and form cooperatives and grow their own little Victory Gardens and to the extent possible, fix their own stuff when it breaks. I’m guessing that aside from the effects of all those overseasings of manufacturing jobs and the impacts from that, rednecks who can work a lathe and drill press and twist wrenches and apply Duct Tape ™ and grow food and already know how to live at a lower level are the ones who will survive. Once they get past the great personal depression and sense of despair that losing what was not sustainable. Just guessing, of course— but look at amfortas and how he’s adapted.

You need fiscal stimulus injected at the bottom since the whole system is a massive “trickle up” operation. Fiscal stimulus at the top just gets uselessly accumulated like adipose tissue in a body with metabolic syndrome.

The US Federal government needs to start cutting big checks to households — a “reverse tax” if you will, with an emphasis in particular on the bottom 2/5 of the income distribution.

That’s the solution. Not going to happen, because ideology, eh?

That Ideology is just more supply-side BS. You are right. Demand-side means bottom-up. At their very best, the overlords can only bring themselves to yoyo between top-down and bottom-up; faux Keynesianism. Two weeks of this, a week of means-tested that.

It’s pretty difficult for me to imagine what kind of demand you can create with people confined to their houses that would even begin to compensate for the enormous decline in consumption that has already taken place. What are people going to spend the money on, besides black market toilet paper and hand sanitizers? Fiscal stimulus is going to fall flat for the next few months until demand starts picking up again on its own (there will be a lot of pent-up demand when this is over, but the damage will be deep and long and consumption patterns may change somewhat permanently — the Depression generation was notoriously penny-pinching).

When I say this I understand that it is a good thing to keep vulnerable people paying their rents and other bills and keeping even more unnecessary demand-destruction from happening. It just seems to me like the CNBC types are still dreaming that there’s some fiscal stimulus magic unicorn that is going to save us all now that the Fed’s quiver is empty. There isn’t.

This is spot on the money. I would expect streaming services, ebooks, games, (&c) to see an uptick; but it’s hard to see someone who had spent $100 a week going out spending $100 a week on at-home entertainent.

Really a big fiscal stimulus is required simply to keep the services sector in a state of suspended animation until the pandemic is over.

Without it, there will inevitably be another shock as people are allowed to resume social lives, but all of the gyms, restaurants, clubs (&c) are out of business; and the massive labor supply (laid off service workers) means massively downward pressure on wages.

And by not telegraphing that “life will be able to go back to what it was before,” the government greatly increases the risk of (as you say) consumption patterns changing permanently.

Consumption patterns should change permanently.

I’m concerned for my local, family owned and run Philly Cheesesteak place. My wife and I would go most weeks and spend $25 each trip for a lunch we loved. We’ve not done that for nearly a month now and won’t again for 3-4 months at least. Roughly the same goes for the Mexican Taqueria, the Teriyaki place and the Mongolian BBQ.

A link from a week or so ago here(?) made mention of those with physical assets should take the brunt of this slowdown; namely that commercial real estate should take the hit for no rent during this time (or at least share in the downturn in business by percentage).

CRE will still have an asset at the end, while these mom-n-pop’s won’t if they fail. Further, CRE will have a hard time getting anyone else into these spots once these businesses fail.

there will be a lot of pent-up demand when this is over, but the damage will be deep and long and consumption patterns may change somewhat permanently — the Depression generation was notoriously penny-pinching

The propaganda wasn’t nonstop back then. Even in the midst of this pandemic, people are still addicted to their devices, which churn out endless advertising. It will take a calamity of monstrous proportions to break Americans, and increasingly most of the rest of the world, out of their stupor. I don’t think coronavirus, as bad as it is, is nearly us up to the task.

(cough infrastructure cough)

There are plenty of plans – yeah most of them idiotic, bad for the environment, but some filtering can be done – that can put people to work. We’ve talked about “shovel ready” projects for long enough that it would seem there should actually be some.

If the consumer is going to pull his horns in, which will be a good thing for the planet and everybody’s mental health, then it’s the perfect time to put people to work for the good of everybody.

Where were the butchers gloves made before China? Cleveland, Erie, Peoria?

Agree, I do not quite understand this – how is government financial support supposed to help under conditions of lock-down if those are the ones causing in large part the economic stress? So, I get sick leave or some form of support and can in effect take that vacation and the airline gets a bailout but I am not allowed to travel… It is likewise unclear how fiscal support can achieve much when lock-down is still widely applied.

Nevertheless, though sad, it is interesting how flattening the curve reduces the death rate due to Covid-19 but at the same time increases the duration of societal stress bringing with it increased death rates of a different type. Likewise, it seems that a sharp, short blow to the economy is exchanged for more severe and lasting damage.

On what timescales, then, and in what manner should these support measures be implemented? And how – against the backdrop of failing supply lines and failing of upward of 40% of businesses *nationwide*, thus causing a compression of the output gap that would constrain MMT-based printing?

It seems pretty clear that the outbreak needs to be resolved or brought under control before any other measures can be expected to be of more than band-aid benefit.

If there is no demand for services, then perhaps the main effect of financial support for the bottom 2/5 will simply be to minimize the loss of rents and debt payments going to the top 10%. A very direct “trickle-up.”

quarantine

The Census Bureau was offering $25/hr in Boston for regular census-taker, with higher amounts for supervisors. However, this was marked over with $27.50/hr. because they couldn’t find enough people. The Boston Globe ran an article on this, and I have heard from people applying for the job, that the hiring process is taking forever, which sounds like a standard hiring process.

I got my Census form the other day. They have done their best to make it as “efficient” as possible — getting people to go online to fill it out. If you don’t, they’ll follow up with another letter, and if that fails, target you for a personal visit. No way they’re hiring 600k people in 2020, even before you factor in that the Administration would PREFER a sampling error on the low side.

An excellent precis, much appreciated.

Jar jar binks running the ecb is not helpful, though Germany may not notice it is about to have its own 1588 moment… Happens to the best of them.

Demographix finally catches up to the older dogs of Europe…. Indonesia, Brazil, Turkey, The Philippines, and Bangladesh replace Germany, France, Italy, Russia and Spain. Kartoonklowns running the ships into the ground. Yosemite Sam in Moscow, mini the poo(p)bear in Beijing, sir DroopyDog at the Fed, Elmer Fudd at # 10, Barbie Fife in Paris, Biff in the Whitehouse and Lucy still pulling back the Football in Berlin…a truly sad and pathetic moment in time…

The world turns a page and thankfully the butterflies and bees don’t know it’s a Monday…

The ‘Pelosis’ and the ‘Lagardes’ of the world have been shown to be the kind of “technocratic leadership” that have no idea on how to handle a real crisis. I am borrowing here ideas from a comment by David. I have in my list of usual suspects Mrs. Von der Leyen. The German ordoliberals, are indeed representatives of German thinking or are they dinosaurs about to extinct?

Reading along with lambert et al during last night’s debate, with the stretched truthfulness (for lack of a better word) while knowing basically for weeks now,thanks to NC/Yves/Lambert/Jeri Lynn,that the economy, the global economy, is on the brink of catastrophe, was surreal and I came away from it disheartened. The weight of misinfo/disinfo/dysinfo/ and the shallow thinking into which it is all being dumped creates a morass of muddy bs. How to debate someone who simply lies, and lies in a way that the more powerful portion of the population wants to hear and so are uncritical about it.

Our supposed leaders are in a fog of denial. They cannot fathom that so much of what they had come to accept as the normal and proper operation of our system will crumble if radical action isn’t taken soon, yet that very radical action will also result in changes they deem inconceivable, or worse, aesthetically unacceptable.

Thank you yves for your consistently clear thinking.

Much clearer than mine which is that the chickens are staying the course to the roost which is stuck between a rock and a hard place.

QE may not work this time.

“It’s easier to imagine the end of the world than the end of capitalism.”

Captialist Realism: Is There No Alternative?

–The late Mark Fisher

On the bright side, this brings a well deserved end to globalization. And if my little sea-side town is never again graced with another bad perfume tour bus or the bay with a “Norwegian Princess” it will indeed be a blessing.

Corporations big and small will be begging for bailouts, “Oh, the poor workers!” Every prop-up should come with two demands: the removal of existing management and the replacement with a worker co-op.

Now pass the pop-corn…no butter please.

If the Fed isn’t telling people to Run for their Life, I don’t know what is

I think we need to begin a program of direct government grants to individuals, starting immediately at a rate of $250 per person per week, until the dust settles. This would help people afford their bills and keep the general economy at least minimally lubricated. Naturally this money would flow upwards but it would help ordinary people along the way.

Actually, Tulsi Gabbard, who I think gets it, and can somewhat step outside the neoliberal groupthink, has introduced a resolution (HR Res 897) that will actually help ordinary citizens and at the same time provide an answer to the problem of getting help particularly to hourly workers, those without sick pay, and those who otherwise ‘must’ go to work each day. No–one else has come up with a solution that has any prayer of being effective, IMHO.

The gist: “… expressing the sense of the House of Representatives that there should be a direct emergency economic stimulus for individual Americans in response to COVID–19, urges the Federal Government to provide an emergency non-taxable Universal Basic Payment of $1,000 per month to all adult Americans until COVID-19 no longer presents a public health emergency. The Universal Basic Payment will be a temporary economic stimulus package to empower Americans directly and immediately.”

Yes please. Straight from the U.S. Treasury. America needs a sovereign currency again, not this commercial bank-issued rubbish and the entire Rube Goldberg machine that supports it.

Nature still offers her bounty and human efforts have multiplied it. Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.

True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.

The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit. – FDR inaugural address

Yes, this as well as a mortgage/rent freeze, debt/credit write downs, emergency food cards.

I know, not gonna happen… maybe tho if things get so dire. MMT really exposes the neoliberal fiscal ideology here.

New York manufacturing activity posts record drop in March [Reuters]

It’s not too soon to be using the D word.

With all this going on, what will happen to Social Security as payroll shrinks and the Trust suffers? I am old and depend on SS to live and Medicare for care. Worried as most of us are not just for the Virus but also about what future we have left.

My opinion: SS payments will stay ok because the govt needs regular people to keep spending, keep buying groceries and things. SS and unemployment insurance are 2 ways to keep pumping money into the customers hands, which is almost all spent into the real economy. The pols who want to cut SS and unemployment insurance for ideological reasons should look at how important those payments directly to individuals were in 2008-9 to keep spending happening on Main Street; how important those payments were in keeping the GFC from being even worse.

Thank you, Yves, for a terrific overview. Obviously, fiscal stimulus is critical. It has to be BIG. But it also sounds as if we need an import substitution program for simple products like gloves for the fishing industry RIGHT NOW. But it can’t be done right now, even if we tried. It would take years to rebuild the long gone infrastructure needed, train staff, etc. By which time, China is exporting the stuff again. Meanwhile, on a personal note, I’m pushing 70 and everyone I have had personal contact with in the last 2 weeks outside of my chiropractor’s office is older than I am by a lot. No symptoms so far, so I can’t get tested. I could be an asymptomatic Typhoid Mary and not even know. Unpleasant thoughts abound.

All true.

But note your “‘years to rebuild” still means people are employed, doing the rebuilding. It’s something. But it does need protection from China and the whole “‘they’ll make things for us while we… we… provide financial services for them! Yeah, that’s it!”

Idiots

If America repealed or cancelled MFN Status for China and if America resigned from the WTO and if America resigned from New NAFTA and if America abrogated or cancelled as many other trade agreements and treaties as necessary . . . . going all the way back to GATT Round 1 if necessary . . . . to reclaim the International Legal Authority to forbid the import of anything and everything from China ( and anyone else-of-choice); then we could afford to spend the time and money to restore our own butcher gloves industry back into existence. Because whomever actually spent the time and money rebuilding a domestic butcher gloves industry would KNOW that butcher glove imports from every anywhere outside America would be forbidden forever.

Of course we can’t do that under the current Global Regime of Free Trade Slavery. In fact, we can’t do ANYTHING about ANYTHING under the current regime of Free Trade Slavery. If I am wrong about that, then “something will be done” and you can all laugh at me about how something DID get done within the current Free Trade Slavery context.

“ No economic activity was more irrepressible [in the 14th century] than the investment and lending at interest of money; it was the basis for the rise of the Western capitalist economy and the building of private fortunes-and it was based on the sin of usury.

Barbara Tuchman”

Lots of interesting if occasionally incomplete rumination in “The March of Folly.”

Hey, all you people who hate on Floridians, looks like it’s going to be an active hurricane season this year. Maybe we’ll suffer an “Andrew marries Katrina” event, and you can smile that the folks who have come to live here just got what they deserve for not (before the votes are counted) bringing in Bernie to fix the probably unfixable.

It’s a fair bet that the extreme weather events, already cued up this year in places like Memphis, are only going to put the toxic icing on the cake that “running government like a business” has baked.

WWFDRD? (What would FDR do?)

Speaking of Andrew and Katrina, at the moment, coronavirus is fighting global warming. Hot weather supposedly kills the virus, but the virus has counterattacked by reducing production and transportation, thereby reducing greenhouse gases. Mighty forces in dangerous contention! Hurricanes…. I wonder if there are also restless tectonic plates, or errant asteroids nearby.

On a less cosmic scale, what about the Imperium? Isn’t it time to stop blowing money on useless wars and weapons, and call the troops home? There’s going to be a lot of trouble right here for them to supervise….

Hot weather absolutely does not kill the family of SARS virus and C-19 in particular.

The greenhouse gases which have been put up are persistent in place for several-to-many years.

The various nitrogen oxides break all the way back down to nitrogen at some point, I guess. The methane oxidizes down to . . . carbon dioxide. Which adds to the other carbon dioxide which stays up there till some of it enters the ocean or plants suck some of it down.

What a several years long mega-deep depression . . . if we get one . . . . will do is to slow and reduce the up-put of sun-reflecting and/or sun-blocking rays and wavelengths. The less of them which get reflected and/or blocked, the more of them reach all the way down to the ground, to eventually degrade into heat ( except the ones which power net-net photosynthesis).

And that means that in the event of a global depression, such as New Corona could bring us, that global heatering would heat up even faster and hotter because of the fresh un-dimming of the incoming light.

Financial idiot here (the reason I come to NC) but instead of putting a $1TR in the repo market, why not just give every adult in the US $5k? Same trillion just put to use in the real economy. But I’m sure I know why…

Because your oligarchs do not want to take their collective boot off the collective neck of their peasantry.

Never let the average joe know what’s truly possible. They’ll inevitably ask for it again in the future.

I said last night the Primary is over with that debate, but in an outside chance primaries are delayed and socialistic policies save the day before they re-convene, perhaps Bernie still has a chance.

1 in a million, but he still has a chance. We’ll maybe 2 in a million if Joe get’s coronavirus and doesn’t make it.

Just thinking into the future, about the workers. I can imagine that people will take antibody tests to prove that they’ve recovered from the virus. They’ll show that to employers who will then advertise it to customers. “This business is certified FluFree(TM)” or “We only employ SARSStars(TM)”

“ewmayer opined that most food processors could make do with what they have…except for latex gloves, which sound like a must-have.”

I’m in the food industry, have done consumer shows with sampling in various parts of the US and Canada. In Canada they (at least in the city of Toronto) take a different approach to gloves. They much prefer handwashing to gloves. The logic I think makes sense. Gloves can be an illusory protection if you touch anything unsanitary, your hands are infected if you have gloves on or not. Better to insist people wash hands and have hand washing stations readily available. Most importantly insist food handlers are trained in basic food safety principles.

So, my two cents is gloves won’t turn out to be a must have. At least in the food industry.

yup your view has cred since you have experience and theory of the specific issue at hand. At hand :-)

Incidentally, while running the CV gauntlet from Málaga to Oslo to Gatwick to MIA l saw hundreds of latex gloves passing CV from passport to passport, and I never once saw an agent washing his gloved hand or changing gloves.

In the specific example of the fish-processing industry Petter and I mentioned, alas, some kind of waterproof liner underneath the knit fabric gloves is indispensible for 2 reasons:

1. Working in the cold and wet, being able to keep the skin dry is crucial to keeping your hands from freezing;

2. Sharp knives and the many nasty bacteria in fish slime are a really nasty combo – I recall one time in my time in Alaska I accidentally poked a sharp knife tip through both the thick cloth outer gloves and the inner latex one. A tiny nick, and I promptly stripped the gloves and washed and disinfected my hands. The cut still got infected within the next few days.

That of course is not a representative use case for such disposables as latex gloves – but in the by-far-biggest-user, the healthcare industry, re-use is similarly not an option.

I thought a few of the arguments to justify charging interest on loans were 1} future value of money is less than present value due to inflation 2) some loans are investments in ventures — the interest is a share of the returns to those ventures 3) interest payments offset the risk of principal loss. What did I miss? Do any of these justifications for charging interest apply — with possible exception of #3 — with the economy shutdown by the Corona flu? The payments to principal and interest and lumped fees for taxes, insurance, and finance charges should all be halted as much of the economy has been halted — by fiat. Not doing so will result in a most destructive restructuring of the economy. Small and medium businesses will fail. Home owners could lose their homes. Renters will be evicted. Landlords will lose their properties. Even large businesses could fail as their income streams stop flowing after years of leveraging those income streams to support stock buybacks and special dividends.

The Fed move will make free money available to those who can obtain loans:

“Now supposedly, interest rates right now are exceptionally low, so it would seem that it would be easy to get money for profitable ventures. But it’s not, because the institutions that can offer capital are looking for either totally safe assets like government bonds or crazy high returns that can only come from grabbing market power or looting.”

“In other words, monopolies and private equity can borrow money, but people who do useful things that get 6-10% returns have a much harder time doing so. This is largely because small banks have collapsed, and small banks are the networks through which productive enterprises borrow money. According to the Institute for Local Self-Reliance, “In 2018, community-based financial institutions made 52 percent of all small business loans, even though they controlled only 16 percent of banking assets.” “The Coronavirus Crash”, Matt Stoller [https://mattstoller.substack.com/]

I believe the Fed move will help finance mergers. It will do nothing positive for most small and medium ventures, and nothing positive for the real economy.

You missed a doozy: Forgone consumption by the lender. For a longer analytic and historical account of “justifications” for usury see Ch 4 of “The Morality of Money”, Walsh & Lynch, Palgrave (2008,2014).

Ultimately this is real economy vs. finance economy. The central banks can move the needle for big banks and for finance because of the interest rates. But their ability to make people get on a plane, go somewhere else, and eat a fancy meal is zero. What China is seeing and the rest of the world is seeing is that fiddling the knobs on interest is all well and good if there is a base of supply and demand going on.

People have rightly asked if this is a “Chernobyl Moment” for the PRC. I suspect it may also be so for the myth of the central banks. And for the lure of distended supply chains.

Thank you Yves. This was a great synopsis of our reality. We are spiraling into “a vicious cycle of rising unemployment, a fall in consumer spending, and more industry strain.” And “there’s no such thing as managing the pandemic versus protecting the economy”. And what is Congress doing? – waddling around in a fog of legislated denial. I have the indelible image of Mitch’s face when he attempted to go into a 10-day recess. He looked terrified.

The Congress is probably trying to figure out how to help themselves and their financial, insurance and medical industry friends under the guise of helping the economy. These decisions take time.

Viruses have been killing humans for thousands of years, its regrettable “x” amount will perish, but it is the nature of the beast, what they are doing now is making sure that “x” amount is far in excess of what it needs to be. You do not shut down your economy to a virus, that is reality.

“WASHINGTON, March 16 (Reuters) – A group representing major U.S. airlines said the industry needs $50 billion in grants and loans to survive the dramatic falloff in travel demand from the coronavirus outbreak.

In a letter made public on Monday, Airlines for America said members need $25 billion in grants and $25 billion in loans, while cargo carriers need $4 billion in grants and $4 billion in loans.”

So, what’s the point of providing ZIRP, trillions in repo funding and QE for “liquidity” if the money doesn’t go to the economy or businesses that need it?

Because maybe it’s not meant to go to the economy and those who need it?

I’m hoping some of the airlines (United, Delta, American) go bankrupt. They don’t care about their customers and will just raise ticket prices, squeeze legroom, seat width, add more cancellation fees and provide crappier service if bailed out.

Companies that bought their own stock back should not get free taxpayer money.

It’s their fault that they shot their cash reserves.

Damn straight!

Bank run anyone?

In my mind, at some level this coronavirus impact on the global economy provides a taste of what will be necessary in order to combat global warming (global heating if you prefer) and ecocide. That is, the world will need to substantially reduce both its production and consumption of material goods across the board. This of course will end “forever growth” and all of the business paradigms that require forever growth. The resulting economic upheaval will be enormous. Rather than lowering interest rates, dropping helicopter money from the sky, and all the other actions of central banks to juice consumption and growth, we ought to be devising ways to completely retool society and make a brave new world where everything is smaller and actually sustainable. Lets not waste this golden opportunity!

Humanity will survive this virus. It won’t survive global warming imo.

If the airlines go bankrupt so be it. Same with Boeing. They’re profit making enterprises who have been paying lavish compensation to their top executives and using their profits and borrowing capacity to buy back their stock hand over fist. If they didn’t plan for a rainy day let their shareholders and management pay the price. The can operate out of Chapter 11 like any poor schnook who isn’t politically connected. Why should the taxpayers bail them out. If the Government is going to bail out anyone, it should be the average person struggling to make ends meet who gets laid off because of the corona virus.

If things are getting you down. Just pause and look up Ubers share price :-)

The measures necessary to tackle the coronavirus shut down most economic activity.

You can’t actually stimulate an economy that has deliberately been put into a coma.

We need to find a way to keep things ticking over until normal economic activity can be resumed.

If you leave the stock markets open, then they have to reflect the lack of economic activity in the economy. This, and many other markets, need to be put in suspended animation until normal service is resumed.

Here’s an idea.

The global focus seems stuck on what to do about COVID-19. This focus results in recommendations to shut down social interaction of every sort in the belief that this will prevent continued infection. Of course, there is also a focus on cure, but that is yet to come.

There is another “virus” that is being ignored. It is the “economic fear virus” that is raging everywhere. Why not shut down ALL THE MARKETS: stocks, bonds, commodities, financials, debt, etc., for thirty days to prevent the spread of fear from infecting everyone further.

Clearly, the idea of a “free market” simply means unregulated fear and panic spreading everywhere which prevents any economic action from being effective. So, shut down “the socalled free market” for a while.

We should also look at breaking up monopolies. These are just concentrations of wealth in the same way that basketball crowds concentrate people.

The closing of small businesses and schools means closing valuable facilities that educate our children and produce salaries. The various financial markets produce nothing but wealth for those who can afford to be involved. They need not be kept open given that they produce nothing of value except more wealth.

As many are aware, markets today are almost completely automated. The people milling about on the floor of the NYSE are stage props. By and large, the actual trading is being done by computer programs. So, let’s send all the financial geniuses, traders, C-office (CEOs, CFOs, etc.), Ps (Presidents, Vice Presidents), economic advisors, ideologues, etc. home. They are clearly doing little to nothing to control the “economic fear virus.”

To slow the economic crisis, let’s follow the same path recommended to slow the COVID-19 virus.