By Nathan Tankus, Research Director of @thepublicmoney, Research Scholar at Global Institute for Sustainable Prosperity, and has often published in Naked Capitalism. Originally published at his blog, Notes on the Crisis.

On April 1st I used the Small Business Administration’s Payroll Protection Program as an example of a program from the CARES act congress most egregiously designed from a budgetary point of view:

“The size of the forgivable loans in the Small Business Administration program certainly wasn’t picked based on the enormous need small businesses have to make payroll and rent. What exactly is the purpose of capping the program at a specific dollar amount? When they run out of funds, is the need for small businesses to make payroll any less? Are those who get in their applications after the funds appropriated run out any less deserving of the funding to make payroll payments than the small businesses who got funds?

The reality, of course, is this program is likely to be extended. But when? And by how much money? Will the small businesses who need it now be able to wait for the extended negotiations over extending it?”

As I predicted, the program ran out of funds last week. Congress did indeed drag its feet for a week in negotiations over extending it, finally approving a paltry 310 billion dollars yesterday. In addition to the predictions I made, there were problems I didn’t discuss (though have been concerned about). The structure of the compensation (as well as the incentives banks face in general) meant they prioritized larger and wealthier clients in access to the funds. This was worsened by the structure of the fees, which should have been lump sum amounts (or even provided greater compensation for processing smaller dollar loans) but instead provided compensation based on percentages of loan size. This created the obvious incentive to focus energy on processing large loans for big clients rather than small clients. As if all this wasn’t enough, Small Business Administration rules meant that the 500 employee limit applied per establishment and not per business as a whole so a number of medium sized businesses were able to get access. In addition, franchises of larger businesses also qualify since they aren’t technically considered under the control of their large multinational corporation franchisors. Medium sized enterprises have been returning funds amid the public backlash.

In other words, the Payroll Protection Program has been a mess. Its cap has created a political battle that has reinforced for the public that there isn’t enough to go around so we must fight each other over what little we can eek out. It has created administrative hurdles that have delayed the process of getting money out the door and threatened the capacity for the program to preserve payroll. Its time limited nature has meant that this is only a stop-gap, even for those who get funds. This adds to longstanding problems with the Small Business Administration. It has always had a race problem both in being unwilling to take on additional credit uncertainty (which cuts out Black borrowers with little equity), including not being willing to provide start-up financing. An SBA ruling in 1966 stated:

“While new businesses qualify [for loans to the disadvantaged business community]…we do not intend to provide start-up financing for a small grocery, beauty parlor, carry-out food shop, …[they should not be made] unless there is a clear indication that such a business will fill an economic void in the community.”

Additionally, its slowness in approving loans had greater effects on more precarious Black businesses. However, at least in this period the Small Business Administration was explicitly tasked with (and pursued) providing loans in Black communities. This specific focus on the Black community has been abandoned. In more recent times, the Small Business Administration’s “Minority Lending Program” has adopted a more ‘race neutral’ approach which has left Black small business people behind. They’ve focused on lending to concentrations of already existing small businesses in specific neighborhoods, which disadvantages both existing Black businesses and aspiring entrepreneurs. Their definition of “minority” is also … expansive. As sociologist Tamara K. Nopper says in her excellent article on the subject:

“That is, as long as a certain total of loans are made, the total may be comprised of any combination of minorities, which includes white women […] by moving toward a more flexible conceptualization of ‘minority’, the SBA publicly promotes the idea that black economic progress has sufficiently been made. […]. Overt discrimination against black economic development is institutionally treated as a dimension of the past and therefore government ‘intervention’ that occurred during and in response to the civil rights/black power movements is no longer deemed necessary. Ultimately, the SBA’s approach flattens important distinctions among people of color in terms of historical treatment, current experiences with racism, and financial need.”

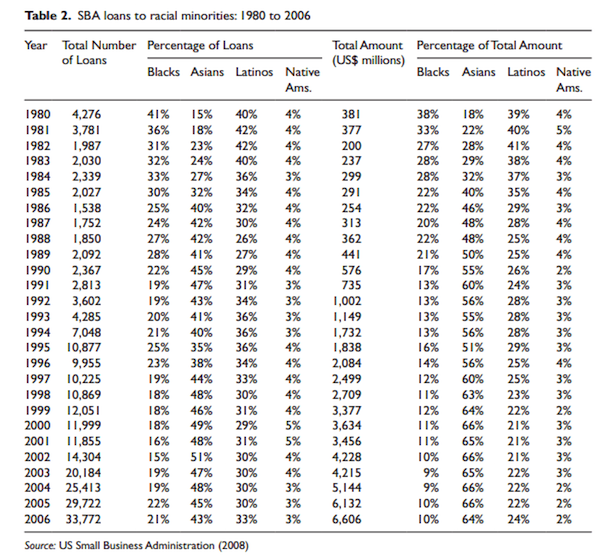

Nopper’s work also highlights why the structure they’ve chosen for the PPP, guaranteeing loans that banks originate, is such a bad one and exacerbates racial inequalities. This structure was adopted in the early 1980s by the Small Business Administration, replacing direct lending programs. There are systematic patterns of discrimination among “mainstream” financial institutions and a lot of reasons to think that those patterns reproduce themselves in reviewing SBA loan applications. As a descriptive fact, Nopper shows that since this switch, lending to Black small businesses has collapsed while falling considerably for Latinx small businesses and growing markedly for Asian small businesses. The numbers have fallen even further since her article in 2011.

The current reporting on access to the PPP shows these patterns have reproduced themselves in this SBA program. As of April 7th, 1/3rd of Community banks (which Black businesses disproportionately rely on) still didn’t have access to the program. Majority Black neighborhoods have disproportionately experienced large bank branch closures over the past decade. Meanwhile, banks focus on servicing existing and larger customers first have boxed out isolated Black small businesses the most. At a fundamental level, the racialized failures of the Small Business Administration in general and the PPP in particular reflect the fact that banks are bad credit intermediaries. They are good at processing payments but not good at evaluating borrowers on behalf of actors whose goals aren’t profit and reinforcing the status quo. Because of their role as credit creators, they are used to being in the driver’s seat.

This brings me to the title of this post- why are we bothering with this complicated structure in the first place? Why rely on banks which are used to providing credit screening when the purpose of our desired oversight isn’t repayment and we want to save as many businesses and jobs as possible? Tax and state regulatory authorities are more equipped at providing the kind of oversight we want- confirming employees of businesses and auditing costs- and are just as capable of initiating payments that the banking system processes. They also already have payroll and banking information of businesses, eliminating problems we’ve had in making direct payments to individuals. We don’t need the stricture of loans at all. We can provide conditionality-lite basic incomes and simply fine businesses who fire employees. We can even impose non-monetary costs such as worker representation on boards of directors.

If we’re worried about payouts, we can do what I’ve already recommended- suspend them. Most importantly this process will be much simpler and involve a minimum of initial regulatory effort. It’s easier to clean up problems after the fact then rush money out the door and do oversight at the same time. We can base this basic income on a formula that includes the number of employees, but also include other demographic factors that struggling Black businesses are likely to have. Even if we didn’t, money directly into your bank account is much more likely to help than a complex bank-administered process that you feel is inevitably stacked against you. Most importantly, by providing it to every business, no one is left behind. Banks are not the right administrative actors for our goal of replacing lost revenue and income and it is far past time we realized that.

Whatever happened to “we the People” not trying to be facetious but we want to help small business and that’s important and we seem to be helping large corporations which isn’t so alright. In the meantime the people including first responders are relying on charity.

It goes back a long way. There is a fundamental concept in the US that there are deserving and undeserving people. So every program must be complex with lots of rules that deny assistance to the undeserving. Once you get lots of rules, then there is the opportunity to get loopholes through lobbying. Even without the loopholes, the wealthier people and organizations can hire the lawyers and accountants to figure out how to navigate and take advantage of the rules because it becomes difficult for applicants to apply and qualify. The complexity also means you needs organizations that can distribute the money – with the PPP, the obvious solution was the big banks.

In the PPP, that meant that large businesses with local subsidiaries with less than 500 employees could go to work and access the money quickly by throwing expertise at the problem immediately. Their relationships with the big banks helped enormously. Some actual small business somewhere doesn’t stand a a chance in that system.

The “socialist” countries have far less complex systems. They view everybody as needing a helping hand at some point, so their administrative systems are more simple and comprehensive in practice. If they want to deliver money to the population, its pretty simple. It is one of the reasons their healthcare systems are inexpensive compared to the US – there is just far less administration and intermediaries between the patient and the payer that each add delay, and cost.

Florida deliberately set up their unemployment system to make it difficult for applicants to succeed in getting benefits. Florida has succeeded beyond their wildest dreams – less than 20% of applicants have succeeded over the past month: https://abcnews.go.com/Health/wireStory/florida-slowest-state-us-process-unemployment-claims-70249821

This is likely to ripple throughout the Florida economy because those people don’t have income and won’t be paying bills.

NYS has a more applicant friendly system and 70% of applicants are already getting benefits (my son was furloughed a month ago and has already received NYS benefits for two weeks including one week with the Fed $600 – the first week was before the federal money was available)

What happened to helping the truck drivers out there too.. remember we moving the freight to get to everyone..especially owner operators

The responses of our elites to this situation have all been about preserving their wealth and power. The PPP boondoggle was cooked up well in advance and pushed early on by the usual suspects like Andrew Ross Sorkin on CNBC. When I first heard about it, my response was, “Well, I hope you small business people have been in a regular foursome with your banker. Otherwise, you’ll be left out in the cold.”

I would have to say that the very idea of funneling money to workers through their (essentially former) employees is part of this effort to make sure that everyone still has a boss. Give the money to human beings, not businesses that won’t be able to operate for the foreseeable future, nor should aid be given to corporations that will only use it to enrich their stockholders and management.

I’d say the responses havE actually been about augmenting and nailing down the elite’s wealth and power. Big question is “what can be done about it?”

One item might be for people who can still make campaign contributions to send money to Shahid Buttar, who is challenging Pelosi in her Mama Bear lair out there in San Fran. Here’s a link to the campaign web site: https://shahidforchange.us/

The MSM is of course burying Buttar in a giant cone of silence. I wonder how may “progressives” in the Bay Area are sick of Nancy Antoinette and her chocolate ice cream? Enough to get rid of her in the primary? And is Bernie doing anything to help him” Silly question, I guess.

I’ve been making $27 contributions to Buttar as I can afford to.

Thank you. I have too.

He has an uphill battle ahead of him. He needs to get help and I don’t know if he will. I don’t suppose he will get help from AOC or Bernie. Not a peep from them about him as far as I know. Very clarifying, as Lambert likes to say.

I may be the only one having flashbacks to HAMP, but I am.

Banks, who will be taking a fee, administer a program supposed to help Mom and Pop, but those getting help are largely Mom and Pop’s competitors. So we have a program “foaming the runways for more Donor class (larger banks with fees and payroll support that doesn’t have to be repaid for those more likely to survive this). Political class gets props for doing something, and can point to the small percentage of non publicly owned businesses that beat the lottery. Meanwhile a multitude of truly small and probably struggling businesses get no help for a situation they have little to no say in.

And those lucky ones that do get a program so stingy and unrealistic even it was likely to fail in any situation where the business must remain closed.

Instead of being the backstop they should have been. Even if Democrats hadn’t been posing for decades this might not have been a debacle.The ridiculous definition of small business has evidently designed not to be about truly small business for decades. The least a majority could have done was explicitly excluded publicly owned and/or fully owned subsidiaries from the category. But once again this is all lip service.

The banks take a fee to provide loans that are guaranteed by the government. So where exactly is the incentive for the banks to do any due diligence when handing out money? They get paid no matter what.

This is just another backdoor bailout for the banking industry dressed up as helping the little guy.

HAMP was designed to help the banks. Without that backdoor bank bailout this latest debacle wouldn’t give me that sense of Deja Vu.

I would be interested to know what the editors and contributors to NC think about “The 4th Industrial Revolution.”

Surely, there has been some coverage of those heightened rumblings of this next generation social engineering.

How seriously should those theories or plans be taken?

How would the disdain that these particular “futurists” (many well-connected) have for what they call “legacy industries” be reconciled with ideas like the one above?

How much do you think the current crisis is going to used to speed along the destruction that would have to occur to lead to this fantasy or realitly of the alleged “4th Industrial Revolution?”

I read a few references trying to figure out what the 4th Industrial Revolution is supposed to be and I came away with a crazy word soup better left in a closet at the World Economic Forum or populating the wet dreams of Silicon Valley John Galt wannabees. You are clearly new around here. The bones of the 4th Industrial Revolution have been thoroughly picked clean in previous posts, links, and comment threads. And the 4th Industrial Revolution has nothing to do with the topic of this post — IoT, self-driving cars, the AI singularity … robotics, nanotech, quantum computing, biotech … ? The immediate worries for the future will be getting food and keeping a roof over our heads.

I’m sorry but doesn’t it seem obvious that the problems with the PPP are features and not bugs? The reason we’ll never get a UBI for small businesses is that our congresscritters are wholly owned by the corporations, and they are acting to protect their employers…er, I mean campaign contributors. Why would they care if the bones they throw to the rest of us are insufficient and convoluted? To the extent that small businesses go under during the crisis, that’s just more assets for the big boys to snatch up on the cheap in the aftermath and more space in the economy for their monopolies to fill. Massive failures of small business is, I think, a big part of what the policies are actually aiming for. The PTB don’t want to save the Mom & Pop’s, they want retrenchment and consolidation, just like we had after 2008. Just like HAMP was about foaming the runway for the banks, not helping homeowners, the PPP is about looking like they’re doing something for the little guy while shoveling more goodies to their cronies.

If you start out with the assumption that our national leaders are actually trying to do the right thing for the average person, you’re going to have a real hard time understanding what’s going on, imho.

I know that this is a constant complaint of my, but I’m starting to think that this is mass death wish by elite lemmings. It is understandable and common position to either selflessly work for the welfare of others or to selfishly work for your welfare; what the PTB seem to be doing is stealing the rent money and going on a booze and cocaine binge while burning the house ’cause they are cold. Having wealth is great if you have an economy in which to spend. Otherwise it is just a pile of toilet paper, which there is a shortage of.

My dad has a small Pool Tile/Coping business in Louisiana. He applied to the first round of small business loans/grants, and lo and behold they had run out of money!

Heres to hoping he not only gets approved but that they have $$$ to give to ACTUAL SMALL BUSINESSES AND NOT FN HUGE ASS CORPORATIONS!

Hey Becnel…hope you’re doing well.

Or well enough.

Odd. Me and your dad are in the same boat, different paddles but same boat. I don’t expect any help from the government. ..

Restaurant owner around the corner from my shop got both- PPP and $10,000 disaster grant. Doesn’t think he’ll take the PPP…it’s got too many complicated conditions (I see you, Lambert!) and he’s worried it’ll just become a huge debt in 2 years.

Guess we’ll all just do what we always do…

Take it and smile.

And keep on keeping on.

Isn’t it nice that the Elite can rely on us mopes to, as you say, “keep on keeping on?” So we will once again bust our butts creating another pile of real wealth that these froth-suckers can once again financialize and leverage off of?

And yet the mopes, who must see what’s being done to them, continue to either support and defend the status quo, or just drop their heads between their shoulders and keep on keeping on…

Some of us don’t drop our heads.

May not have the luxury of retirement or regular income, but we do what we have to to keep on keeping on.

And we sure as shit don’t forget.

Did he apply thru one of the big bank branches – BoA, Citi, Wells, regional behemoth?

Or did he apply thru a smaller community local bank?

That seems to be a big part of the story in many locales, but it’s not being reported much.

‘Why are we bothering with this complicated structure in the first place?’ Because the alternative is logic.

Is the incompetence deliberate or just a result of trained incapacity? It’s a mix. One part calculated misdirection (4.25 billion leveraged 10x, minimal oversight), one part meritocratic idealization, one part methodological ignorance, steeped in pecuniary emulation. It’s class war masquerading as quantified quality. The end goal? Make rent extraction invisible meanwhile ‘allowing’ market ‘forces’ to justify increasing the public’s debt obligations through public infrastructure privatization. Just waiting for the austerity hucksters to become fashionable again.

https://www.nakedcapitalism.com/2016/10/the-return-of-the-repressed-critique-of-rentiers-veblen-in-the-21st-century.html

The austerity hucksters are already starting their “but the DEFICIT!” howling.

Rick Scott, (R, Medicaid Fraud) appears to have presidential aspirations. He bought the governor’s spot in FL with money stolen from the public, bought a wine over a simpering fake Dem in the senatorial contest, and is on his way up. He sent this recent letter around to me and the rest of his mailing list:

Dear Mr. McPher (sic),

Thank you for contacting me regarding the federal response to the Coronavirus global pandemic. I appreciate the opportunity to respond.

Congress recently passed, and the President signed into law, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which helps those workers who have lost their jobs, had their hours cut or are getting lower tips, and small businesses that have been forced to close or have lost significant revenue. There are many good things in this bill, including funding for our health care workers, personal protective equipment and expanded testing, and support for small businesses.

We have to remember that $2 trillion in new spending means a $2 trillion tax increase somewhere down the road – even in a crisis, we need to be smart about how we spend taxpayer dollars. When this crisis is over, Congress MUST propose a plan that cuts federal spending over 10 years by AT LEAST the total amount this bill spends.

Again, thank you for contacting me with your concerns regarding the Coronavirus. Please reach out to my office with any specific questions on the resources available in the CARES Act. I am proud to represent all Floridians and am working diligently to help get the necessary resources to Floridians to combat this public health crisis.

Sincerely,

Rick Scott

United States Senator

This, from a guy who is slippery enough to have avoided prosecution for running a $4 billion Medicare and Medicaid fraud operation when he was CEO of HCA. Even Politifact, that great whitewashing operation, rated claims about Scott’s fraud as “mostly true.”

I am on his mailing list, so I will be getting monthly or more frequent blasts as he ramps up to a likely run for the Brass Ring.

‘We have to remember that $2 trillion in new spending means a $2 trillion tax increase somewhere down the road..” Would love to put a shirtless Mr. Scott in the town square stocks and brand him on the chest with Warren Mosler’s Deadly Innocent Fraud #1:

The federal government must raise funds through taxation or borrowing in order to spend. In other words, government spending is limited by its ability to tax or borrow.

Fact:

Federal government spending is in no case operationally constrained by revenues, meaning that there is no “solvency risk.” In other words, the federal government can always make any and all payments in its own currency, no matter how large the deficit is, or how few taxes it collects.

Mosler’s book is always free online for any newbies –

https://www.moslereconomics.com/wp-content/powerpoints/7DIF.pdf

Great opening. Thank you NT. “…money directly to your bank account.” I’d just like to rave on this. Because I’m so old and jaded and weary I just get sick at the thought of letting Congress make their rotten sausage over and over again. So I’m thinking we otta just slam the IRS into reverse and go full-tilt direct money as credit to everyone – no exclusions – rich and poor, adult and child. Do this until a perceivable level of cooperation and well being is established. (This condition is sometimes referred to as “consumption.”) We might realize that we want to keep such a system going because it will also be an inexpensive way to clean the air and water and preserve habitat and reduce plastic garbage and on and on. Consumption would limit itself if manufacturing pushed by the profit motive were tamed. Given a respite from all the exploitation both society and the environment can do a lot of self restoration.

And we’ll need a moratorium for businesses so they can adjust their expenses to their reduced income.

Taking care of both sides of our catastrophe – consumption and manufacturing – is really pretty logical. Of course this will require nationalizations (as if we didn’t already have nationalizations based on profit) of oil and other sources of energy and manufacturing; agriculture… all the essentials. The big question now is: If we could “go back” how should we do it? What is our goal? It will seem very brazil to hand out money even to the money-handlers – like pink-slipping the entire finance combine – but really all we will do is turn them into a utility. Which is what they really are. We will simply turn credit into what it really is, a direct form of human energy.

You can’t just give money to every business, when many are going to fail because they cannot adjust to life in a pandemic environment. I read the other day that this is pretty much it for most department stores. Lord & Taylor already has given up the ghost and Macy’s is on life support. How many restaurants can survive when tables and ordering lines (fast food) have to be distanced and intensive and intrusive sanitary protocols put in place? And do you really want to give coal, oil and gas companies money?

I won’t miss Macy’s [except the big store in Manhattan where Kris Kringle worked] or Lord & Taylor but I do miss the Macy’s and Lord & Taylor of forty years ago and I would very much miss the little hardware store up the street. I would miss the little used bookstore on the corner of Mainstreet, the glaziers who fixed my car window when it was broken, and the small theater where I saw a live production of Perfumerie at Christmas. I would miss the meat distributor in the next county, and the little shops along the street in the town over the hill. But there wasn’t much left to miss before Corona. I do not look forward to a main street of empty buildings.

“And do you really want to give coal, oil and gas companies money?” — Do you mean Exxon and BP or are you thinking of the little company up the road that delivers heating oil? [Actually I think Exxon and BP already got theirs — weren’t they covered in another part of the CARES Act?]

The world after Corona will be a changed world — consolidated into great Cartels, far fewer jobs, more homeless and less of life’s essentials for the greater part of us all.

If this program goes on long enough, we are each going to start a few dozen small businesses that provide B2B services to one another — except they are all closed down for epidemic, you see — so we can collect all the money to keep our dog on the payroll.

At some point in the future — maybe not in this country, or this reality — someone will eventually realize that if you want to help the people, you should just pay them directly. Until then. My dog, CEO and chairman of three dozen pet services businesses, or someone else’s dog, will be in line ahead of you.

This reminds me that I need to get a dog before the next round of closures…

why are we bothering with this complicated structure in the first place?

The more complicated, the more restrictive the fewer people who can apply. I can tell you from personal experience that those business with connections; banking friends, accountants, etc. got their applications in first and were approved first. Regardless of the amount they were asking for.

The same for state unemployment. Here in Illinois, if you didn’t dot your i’s and cross your t’s, your application didn’t go thru. And if you did everything correctly and were approved, the complicated rules of looking for work daily and reporting your search weekly, set many up to be disqualified for beneifts. Imagine; you have been approved by mail, you are waiting for your checks, by mail, then you get a notice, by mail, that you have messed up on your weekly reporting. No checks.

It’s not accidental, it’s on purpose.

Yes. Let that sink in.

Then think about this: when is the legal system so unjust that it no longer merits obedience? Isn’t this the question that tips the balance?

You mean, “how long ago…”.. or depending on your skin color…. has it ever been”just”?…

Because so many businesses should be scaled back

Because financial predators should be eliminated

Because global warming

Because consumer addiction dulls human values

Because millions should be working on infrastructure and education

Because MMT says UBI is avaiable

Because parenting should be a paid position

Because I agree with John. And I am sure that I am not the only one.

+1

If ours is a truly consumption based economy, one would think it would be more effective to provide a monthy amount to each one of us directly (politicians excluded) until the situation improves. No intermediaries such as the SBA, Banks and others needed. The amount needs to be at least $3000 and unemployment benefits need to be suspended during the time these payments

The inclusion of the SBA (a roadblock and drain clog) and the Banks (skimmers) shows that the whole idea was to help the bigger businesses(a payback for bribery).

Liberty Bank in Bellevue and Poulsbo Washington, at just about 100M in assetts worked all weekend and the following Easter weekend to successfully process more than 130 PPP loans to small businesses. From $10,000 to over 2 million in loan size 100% of these local businesses received approval. With a customer base of just over 250, every client was notified of the PPP availability. About a quarter of the SBA loans went to new customers, often after they failed to get help from their existing banks, many of which were among the biggest in the country.

About a quarter of the SBA loans went to new customers, often after they failed to get help from their existing banks, many of which were among the biggest in the country.

Small, local, community banks rock!

If businesses want income during times like this they can bloody well take a suitable insurance. If they don,’t, they can file for bankruptcy. The Fed and Govt are turning capitalism on its head and leave the tax-payers holding the bag. Scoundrels one and all.

Or they can (family blog) themselves for all I care. It’s not the taxpayers problem.

Most importantly, by providing it to every business, no one is left behind. Banks are not the right administrative actors for our goal of replacing lost revenue and income and it is far past time we realized that.

Yes. Great post. Thanks.

Why don’t we just not use a virus to force an artificial business cycle, to avoid the reality of failing actuarial carry.

When this is all done, the experts are going to be outed for the fools they are.

Dominate, administer and exploit.

Keep them quiet, stupid and dim-witted.

Reduce their biological potentialities.

Confiscation without compensation.

Surprise, to eliminate their sense of security.

Sound familiar?