This is Naked Capitalism fundraising week. 1154 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our current goal, burnout prevention.

We warned you from the get-go that Bitcoin = prosecution futures. The IRS is in the process of making that even more so that it was. Speculators who have been treating cryptocurrency as a license not to pay taxes face a rude awakening.

We described in 2014 how the IRS had ruled that Bitcoin and other cryptocurrencies were tradeable property, meaning that gains and losses upon sale would be taxable events. As we wrote then:

More important, the fact that Bitcoin is property means it can be taxed at short or long term capital gains rates, or as ordinary income, depending on the holding period of the Bitcoins in question and the status of the holder (investor v. trader v. Bitcoin miner v. business accepting Bitcoin as payment). The record-keeping burden of having to track Bitcon prices against the dollar at the time of acquisition versus the time of use will be a substantial deterrent to their use in commerce.

And we also warned in 2018 that the IRS was cracking down, in Bitcoin as Prosecution Futures: Coinbase Agrees to Turn Customer Records Over to Department of Justice for Possible Tax Evasion:

Even in the US, which so far has been more lenient toward cryptocurrencies than China, the noose is tightening. Top Bitcoin exchange Coinbase has decided that trying to defy the law, in terms of not complying with a IRS summons requiring it to turn over information about customers who had engaged in more than $20,000 in Bitcoin transactions in a year, was not a viable position. Apparently Coinbase had had the Silicon Valley libertarian chutzpah to think the rules didn’t apply to them. The IRS does not regard “disruption” as a tax exemption.

Bizarrely, many people who use Bitcoin and other cryptocurrencies labor under the delusion that those transactions aren’t subject to tax reporting and tax compliance. As we reported at the time, in 2014, the IRS determined that Bitcoin was property, not a currency. That meant that gains on trading in Bitcoin are taxable the same way gains on trading in currency futures or selling a piece of land are.1 That means, and that means you, those transactions are reportable as income for US taxpayers.

The supposed virtue of cryptocurrencies like Bitcoin is their Achilles heel as far as hiding from the taxman is concerned. The famed blockchain contains the full ledger for each coin, meaning the history of all transactions, and that record cannot be altered. The blockchain contains the date and time and the amount of each transaction, as well as the unique identifier for the wallet associated with that transaction. Knowing the wallet does not get you to the holder of the wallet, but it gets you a fair bit of the way there. As Lee Sheppard pointed out in Tax Notes last year:

Moreover, many transactions are now settled off the blockchain and never recorded there. The exchange that processed the transactions would have the only records. From an investigatory standpoint, the blockchain’s limitations and the widespread practice of off-chain clearing combine to make the blockchain more like the Depository Trust Company, which holds publicly traded shares on behalf of brokers, who control information about beneficial owners. To find the owner, it is necessary to sue the intermediary in each case.

That isn’t as far-fetched as you might think.

The US Treasury’s Financial Crimes Enforcement Network had stated that cryptocurrency exchanges are money service businesses because they often convert the cryptocurrencies into money. That means in pretty much all cases they are obliged to register and to comply with anti-money laundering rules.

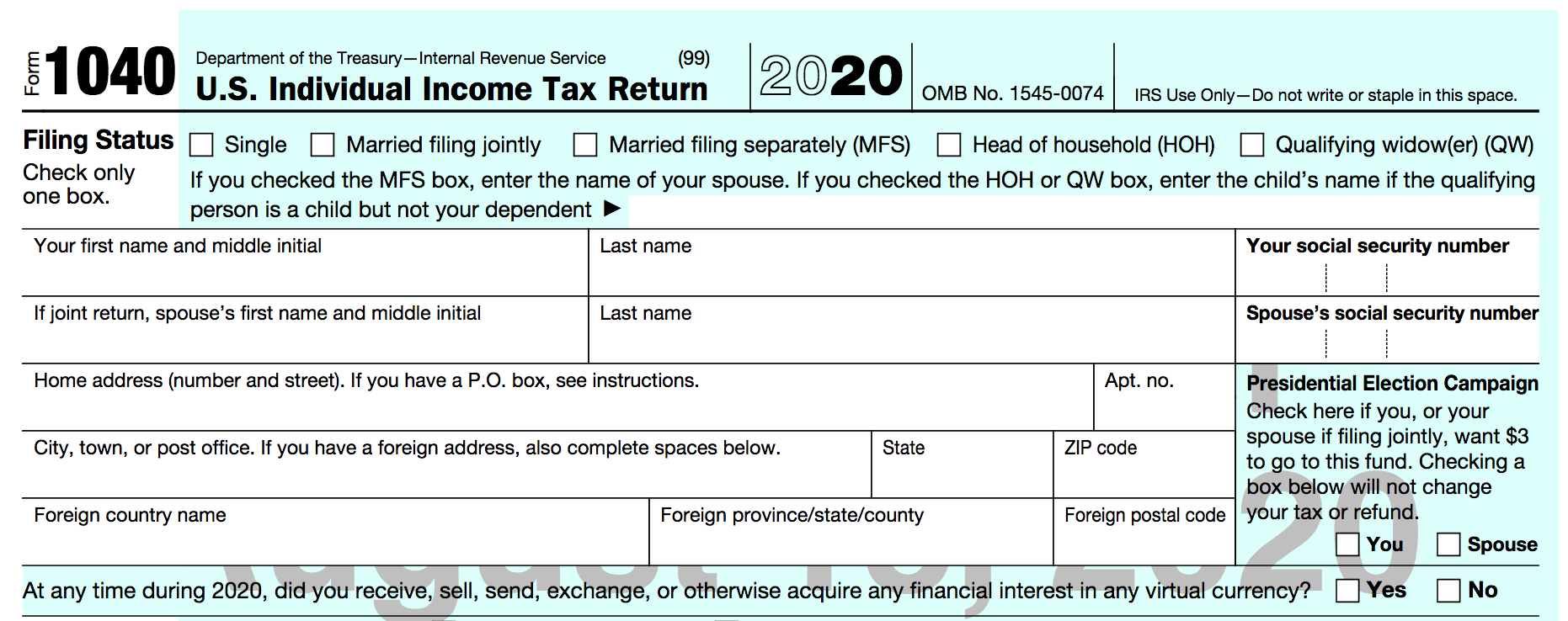

The IRS is turning the heat up even higher on cryptocurrency users. For 2020 individual tax returns, the agency has, as its most prominent question, whether filers had dabbled in cryptocurrencies, which it calls “virtual currencies”:

The Wall Street Journal, in a thorough piece, explains that this placement is designed to set up prosecutions:

The IRS’s move is a strong warning to millions of crypto holders who aren’t complying with the law that they must file required forms they may see as burdensome and pay taxes they may think are unfair. It has impressed tax specialists.

“This placement is unprecedented and will make it easier for the IRS to win cases against taxpayers who check ‘No’ when they should check ‘Yes,’” says Ed Zollars, a CPA with Kaplan Financial Education who updates tax professionals on legal developments.

Mr. Zollars notes that U.S. tax authorities have already succeeded with a similar strategy: A simple tax-return question about offshore financial accounts greatly aided their crackdown on Americans hiding money abroad. Since 2009, it has brought in more than $12 billion from individuals.

The story describes how cryptocurrencies have become popular, with Coinbase reporting 35 million accounts as of July and Chainalysis, a cryptocurrency investigations software firm, estimated US Bitcoin users alone from June 2019 to June 2020 at 3.1 million or more. It also describes how the IRS provided cryptocurrency assistance in prosecutions, such as of a Dutch child pornographer.

And that’s not all. Again from the Journal:

Meanwhile, the IRS is forging ahead with other crypto compliance measures. Earlier this month, it offered rewards up to $625,000 to code-breakers who can crack so-called privacy coins like Monero that attract illicit activity because they claim to be untraceable.

In late August, the agency released guidance affirming that taxpayers who receive crypto for completing “microtasks” must declare it as income. This applies to users of firms like StormX, which makes tiny payments in crypto to people who do small tasks such as playing games, answering surveys, or evaluating products.

Given how vocal cryptocurrency users seem to be (based on our experience in the comments section), it was instructive to see comments in the Wall Street Journal skew slightly in favor of the IRS. The main beef was about how it was difficult and therefore unfair to make cryptocurrency uses account for their transactions. One reader dealt with that nicely:

Bill Taylor

There are lots of transactions for which the tax accounting is complicated. The problem with crypto currency is the number of unsophisticated owners. People buy this stuff not understanding how it works and then complain. It’s like complaining about noise after buying a house next to the airport.

Frankly, the only thing surprising about this move it is took so long for the IRS to get around to it.

Why haven’t governments expressed any concern about capital flight risk? It’s baffling to me.

I can’t think thru that one. You mean if crypto users start using crypto without exchanging it for sovereign?

Exchanging sovereign for crypto, and leaving it in crypto.

Yes, I agree. That’s a big problem.

The BIS has stated that central bank digital currencies are coming. Sovereigns are currently tolerating the counterfeiting of their sovereign currencies through so called “stablecoins”(USDT etc), unclear how long they will continue to do so. From a computer sciences POV the only way these networks can achieve anything like the throughput required is via so-called Layer 2 chains (Lightning for Bitcoin, Raiden for Ethereum). But these entail classic Page 1 money laundering risk: Bob sends funds to Alice through Ted’s account without Ted’s knowledge.

I’m pretty sure these are not the droids you are looking for.

I’m not sure how that would be the case. I just don’t see people converting cash into bitcoin to just have it sit. Sure, it may happen but not to the degree of it being a source of capital flight.

Will a Neo-FDR seize all the cryptocurrencies?

FDR didn’t seize anybody’s all that glitters, but did make it illegal for Americans to own in a few forms, such as ingots or coins dated after 1933, so you could legally own anything dated before that, as a result 100% of the trade in the USA was in the latter until 1975 when everything goes.

$20 gold coins containing just under an ounce in content sold for around $45 in the 60’s, to give you an idea.

Now, how to get around that pesky post 1933 gig?

A number of countries struck gold coins of older designs with dates such as 1908, 1912, 1915, 1935, etc., so as to be able to export to the US market. Turkey had the most interesting restrikes, in that theirs were always dated 1923 with a little bar under the date and a number below. Let’s say it was 31, just add em’ up and the real year it was minted would be 1954.

I’d say with some certainty that most every Austrian & Swiss restrike in this fashion contains gold that somehow made it into the banking houses of the cantons during the war, despite no new mining in Switzerland.

Making the restrikes in Austria with Swiss gold was like double plus good covering your tracks, ha.

seignorage of a sort?

Humans come and go, but money abides.

When the UK was in the hostile takeover business way back when, they took Spanish pieces of 8 and counterstamped them with the head of King George III for use in Merry Olde, or in Australia where they made more money on the deal by cutting out a ring and creating 2 coins of the realm, worth about 20% more in the bargain in face value versus pre-Pommy money. There was a number of variants, all using 8 Reales coins as a host.

Ugh. Money *doesn’t* abide. Museums are filled with coins and bills from long dead governments that have no purchasing power anymore. They may have become collectible artifacts that you can sell for (actual) money, or you can render down their raw materials and make new, current money from them, but they are not money in and of themselves anymore.

Money does abide and merely changes form to the next issuing country’s specie, and no it isn’t all locked up in museums-only the cream of the cream, not unlike a museum that has Monets & Picassos, but no Kinkades or Red Skelton paint by the numbers art

What do you think happens to the lions share of it, does it just disappear into the ether?

So how about this: Money and Credit are two different things. And what actually abides is civilization. I certainly think money is a useful thing to have and to spend. But the most useful thing in all of history is credit. Civilization giving itself the necessary credit to advance. So everyone says, Oh no! that will “debase” money. Which is not really true. And the best way to end the whole argument is to have sufficient civil fiat for direct spending for society’s needs while at the same time having and maintaining money, currency, that could well be sanctioned separately as a secured value of some kind. But to mix the two creates a danger in both directions – fiat “debases” money, or money “counterfeits” fiat. The basic difference might be that fiat Credit has nothing to do with debt at all, whereas money is, in fact, a form of debt. And blahblabla.

Oh for the love of…your entire point (not just here but in basically every comment you post) is that ‘real’ money things have some inherent worth (and that evil fiat doesn’t). But then you acknowledge that new governments issue new specie. That isn’t money mystically changing form; that’s new currency backed by a functioning government.

Functioning government to manage the currency is what matters, not what the currency is made of.

I’ve been thinking the same – the seizure of all cryptocurrencies. BUT since the Fed is already studying how to create a digital currency, wouldn’t an FDR want to encourage the transfer of non-US dollar cryptocurrencies, like Bitcoin and others, into dollar-backed “digital currency”? Maybe by offering a $1-to -$1 worth of crypto for a certain time, then a $.95-to-$1 crypto by a later date?

Amazon has already patented its own blockchain structure.

Does that diminish the prosecution futures aspect? Not at all. Where do I remember this from? Somebody was giving advice to North Korea on the how-tos of crypto. He got back to the US and was promptly busted by the FBI.

So, the lesson would be, watch what you’re selling and buying.

So this looks like the IRS really doesn’t agree that anything can be money as long as two people agree to use it. Anything can clearly be property and can be bartered. In order for something to be property it only needs to be possessed by someone. Nobody questions that. So why does crypto need to go through an exchange-rate process with the dollar or other sovereign money? Crypto can not be accepted as money any more than a bushel of apples can – theoretically. The IRS is actually giving crypto recognition that it is more than barter. By allowing it to be used. And by allowing the gains to be calculated in dollars. The IRS is facilitating the laundering of crypto. The only way crypto is “more” than barter is if it is some form of (counterfeit) money – Oh I know, let’s call it “virtual money.” Then nobody will notice.

The next step for the IRS is to say that taxes can be paid in crypto.

No, the IRS is treating crypto exactly the same as dealing in foreign currencies. It’s a financial asset, as all of its backers tout, unlike personal property (buying jewelry or furniture and selling it later at a profit, which is pretty rare since you are buying retail and selling wholesale). The IRS seldom takes interest in personal property transactions, even though you can donate personal property to a charity and take a writeoff.

I agree then that the IRS is being vigilant. They are gonna have to modernize their forensics for this. I think it’s Taleb (?) who says that only people who do not understand crypto are against it. I admit I don’t even begin to understand it as a form of money. But somehow I think it shouldn’t be assumed that it is benign. So I’m usually freaking out because I think people (like the SEC) are inclined to be complacent.

I believe the dollar is supposed to be non convertible, no? So any bank cashing bitcoins into dollars is committing some type of felony. Is that money laundering? At any rate, non convertibility of the dollar underpins the monetary sovereignty of the United States federal government. Anyone involved in undermining our monetary sovereignty should be imprisoned for treason.

Non-convertible means the government won’t give you anything else (such as gold) in exchange for it. It doesn’t mean you can’t buy gold with it, or buy it with gold (or crypto). Your definition would preclude any kind of commerce using dollars.

I’m not here to defend cryptocurrency but this is an odd move after all of the talk lately of Trump’s (and by extension, other millionaires’/billionaires’) tax avoidance. The IRS would rather focus on cryptocurrency traders than the 1%? Extremely on-brand for a government almost wholly owned and operated by them.

Please reread this post. The IRS has been acting in a consistent manner since 2014 and has been ramping up its enforcement actions over time. It presumably has a normal timetable for releasing its draft returns for the next year.

And as the IRS says, Congress makes the rules. It doesn’t consider itself responsible for the design of loopholes and resulting loophole abuses.