The WTO issued a ruling in its biggest trade dispute ever: the tit for tat between Boeing and Airbus over government subsidies. Boeing started its action against Airbus in 2004; Airbus lodged its case against Boeing in 2005. Boeing won a ruling in its favor in 2019, permitting the US to impose tariffs on $7.5 billion of European goods; as we’ll see, the US has already started levying charges. The EU win allows Europe to impose tariffs on $3.99 billion of specified US goods, including Boeing airplanes, although the EU needs to take an additional formal step to get rolling.

The extraordinarily attenuated process shows why WTO adjudications aren’t a great way to stop trade abuses. And this timeline doesn’t include appeals, which currently are a non-starter due to the Trump Administration refusing to appoint new WTO appellate judges.

The disparity between the amount of trade the US can subject to tariffs, $7.5 billion, versus the EU’s $3.99 billion, means the US is being reported as having an advantage in settlement talks (“talks” also assumes a Biden win).

But the Wall Street Journal reports, in a pretty big detail that other accounts appear to have missed, that the EU can levy more in tariffs based on earlier decisions in its favor:

European officials say they can levy an additional $4 billion in tariffs based on a previous finding of other U.S. violations, which would be on top of the $3.99 billion awarded on Tuesday.

Ooops. Even though this $4 billion is outside the aircraft tit-for-tat cases, if the US doesn’t have other WTO judgments against Europe in its favor (and I don’t see any indication of that in the stories I’ve seen), it looks like a slight edge for the EU on a raw numbers basis.

And the US position is weakened a bit further by the 737-Max diminished state of Boeing, which means that aircraft tariffs would hurt Boeing more than similar tariffs applied to Airbus. The EU could impose 15% tariffs on the 737 Max right when Boeing hopes to deliver planes to buyers like Ryanair in 2021.

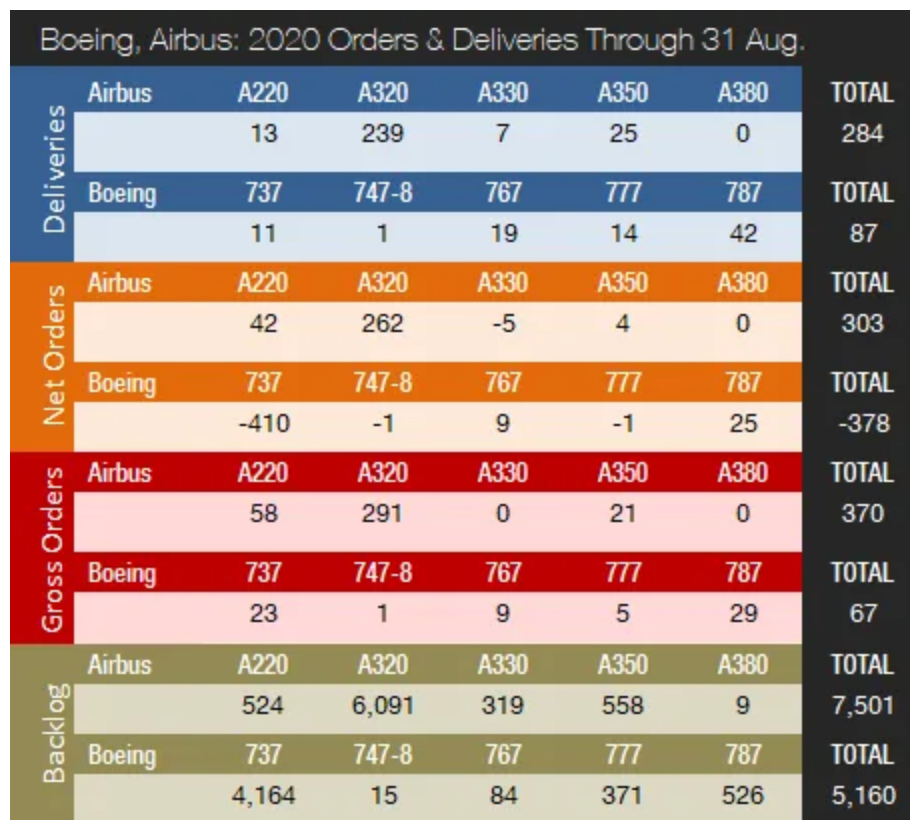

It would be nice to see a version of this chart that showed the nominal sales value of these orders and deliveries, but this gives an idea of the relative positions of the two manufacturers. From Defense Security Monitor on September 14:

And from the body of the story:

At the end of August, Airbus reported a backlog of 7,501 jets, of which 6,615, or 88 percent, were A220 and A320ceo/neo family narrowbodies. This is 224 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of August 2020, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,160 aircraft, of which 4,164, or 81 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.7 years of shipments at the 2019 production level. In comparison, Boeing’s backlog would “only” last 6.4 years at the 2018 level, which we use as a proxy for 2019 due to the severe drop in 737 MAX deliveries. This year to date, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, is negative due to cancellations exceeding gross orders. Airbus’ book-to-bill ratio is 1.07, thanks mainly to very strong order bookings in January. In 2019, Boeing’s book-to-bill ratio was negative, while Airbus reported a book-to-bill of 0.89.

Lambert linked yesterday to Leeham News’ take on Boeing’s 20-year Current Market Outlook: Boeing’s latest forecast raises more doubt than hope. Even Boeing isn’t trying to pretend that conditions will improve soon.

Even the mainstream press concedes that Boeing has more to lose. From the New York Times:

The tariffs, when American companies are reeling from the coronavirus pandemic, would be especially painful for Boeing, which is already struggling from a pair of devastating crises. Boeing, like Airbus, announced plans this summer to cut more than 10 percent of its global work force amid a steep decline in travel, which has forced airlines to delay and scale back plans to buy planes. Both Boeing and Airbus plan to cut more than 30,000 jobs in all.

To state the obvious, this isn’t a great time for Boeing and Airbus to be kicking each other in the teeth via tariffs. And even though the WTO rulings allow each party to levy charges on goods other than airplanes, they are listed first and presumably represent the biggest economic target. And the US has already hit US Airbus buyers with tariffs, which makes it well nigh impossible for the EU not to respond in kind, even if the intent is to bring the US to the table.

BOEING: The EU will immediately re-engage with the U.S. in a positive and constructive manner to decide on next steps. Our strong preference is for a negotiated settlement. Otherwise, we will be forced to defend our interests & respond in a proportionate way. #EUTrade @wto https://t.co/oQPjPmYm37

— Valdis Dombrovskis (@VDombrovskis) October 13, 2020

The Seattle Times and New York Times reports give the most background on the disputes. From the Seattle Times:

The WTO authorized the action against the U.S. in response to illegal government subsidies for Boeing. The parallel ruling allowed the U.S. to impose $7.5 billion in tariffs on EU goods for illegal subsidies to Airbus.

In October 2019, 15 years into the case, the U.S. finally slapped tariffs of 25% on a series of non-aerospace goods including European wine, whiskey and cheese and a 10% tariff on European-built Airbus jets. In March, the U.S. increased the tariff on imports of Airbus planes — though not those assembled in Mobile, Alabama — to 15%.

Note that the WTO doesn’t regard subsidies per se as illegal; governments can subsidize production targeting domestic customers to their heart’s content. The no-no is subsidies that confer a advantage in foreign trade.

The US objected to Airbus having gotten bargain-rate loans that allowed the European champion to move up from its below 25% market share in 1990 to being a competitive equal. The EU targeted the State of Washington’s business and state occupation tax relief for Boeing. Even though the US has tried depicting the WTO ruling as invalid because Washington eliminated those WTO-offending gimmies in March, the WTO ruling against Boeing is based on the harm of those subsides from 2013 to 2015.

It isn’t clear if the two sides can come to terms. If Trump unexpectedly wins in November, it’s hard to see the Administration backing down, particularly with US Trade Representative Robert Lighthizer sounding as pugnacious and as unconcerned about accuracy as his boss. From the Journal:

U.S. Trade Representative Robert Lighthizer, the top U.S. trade negotiator, said the EU has “no lawful basis to impose tariffs” because the subsidies for Boeing have already been repealed. He suggested the U.S. would consider retaliating if Brussels moved forward with tariffs. “Any imposition of tariffs based on a measure that has been eliminated is plainly contrary to WTO principles and will force a U.S. response,” he said.

But the Journal also reports that the two sides have been trying to de-escalate:

Both the U.S. and the EU have taken steps in recent months to defuse their dispute, which spawned a series of claims, WTO rulings, concessions and appeals that have colored broader trade relations between them and led to tariffs on goods ranging from cheese to industrial parts.

Boeing earlier this year stepped away from tax breaks provided by Washington state for 787 production. The company recently said it planned to end assembly of the plane in the state and move it to South Carolina. Airbus announced a deal in July with Spain and France to change some financial-support agreements.

Both sides now maintain they are in full compliance with WTO guidelines.

If Biden wins, even though his team would presumably prefer to come to an understanding with Europe, most observers expect his Administration to move slowly so as not to look soft on trade.

The New York Times, interestingly, depicts the current state of play as more contentious than the Journal does:

It remains to be seen whether the new tariffs will ultimately persuade the United States and Europe to come to a negotiated settlement that would lift the levies, or merely inflame relations and result in higher costs on businesses and consumers on both sides of the Atlantic. The European Union has repeatedly appealed to the United States to remove its tariffs, but American officials say Europe has not taken the necessary actions to stop its Airbus subsidies.

The tariffs will not go into effect immediately. The European Union needs to request authorization from the W.T.O. to impose the levies, which it can do at an Oct. 26 meeting at the earliest. The European Commission last year issued a preliminary list of American products that it could choose to tax, including aircraft, chemicals, citrus fruit, frozen fish and ketchup.

Regardless, aside from the EU possibly seeking WTO authorization sooner rather than later, no one expects anything to happen on this front until after the election. And optimists hope that going through a period of higher trade barriers will eventually lead to a reset and improved trade relations. But to quote a cynical colleague, “If you want a happy ending, watch a Disney movie.”

It might well be the case that both the US and the EU turn more and more protectionist as the consequences of the pandemic linger and causes prolonged pain at both sides of the Atlantic. You might find examples in other industries suggesting that confidence has been eroding for long. For instance, ALCOA is about to close factories in Spain in a long process which is not leaving good taste in the mouths.

While Airbus is suffering along with the rest of the industry, its hard not to see them coming out as the ultimate winner in a few years time. While Boeings troubles get the spotlight, all the other potential competitors – Mitsubishi, Comac, Embraer, Sukhoi – all are in deep trouble in one way or another. Nobody seems to have an aircraft capable of competing with anything in Airbus’s range. It may have been more through luck than good strategic thinking, but Airbus’s purchase of Bombardiers C-range seems to have been a masterstroke, essentially allowing them to control a spectrum from smaller regional aircraft up to the long range broad bodies. Its a very significant risk now for any airline to buy anything but Airbus.

I think the question is whether Airbus wants to be in the spotlight as a near-monopolist. The duopoly suited Airbus and Boeing as it allowed the appearance of competition in the market. It may be that the Europeans would not be unhappy in seeing the US do what needs to be done to keep Boeing viable. Maybe its better to be the dominant one of a pair in a duopoly than be in the firing line as a highly visible monopolist. Especially as China and Japan will be very frustrated at their inability either to break into the market or to be able to get a good deal in partnering up (as Mitsubishi did with Boeing).

I agree in terms of technical and organisational superiority. It’s Airbus all the way. The snag is, Boeing is both a ward of state for the US government generally and a TBTF for the US military specifically. Plus it can be kept aloft (no pun intended) by the bottomless pork barrel that is US military spending.

As Ignacio said above, I can’t see any outcome other than increasing protectionism and economic nationalism. No, it’s not capitalism and it’s definitely not “the free market”, whatever that might mean. Whereas I once hoped that Big Finance would prove to be an example of the perils of the current geopolitical strategies in play (if I may elevate them with that description) and a salutatory lesson in what not to do, it seems like it is being taken as a template.

I shudder as the prospect of another 10 or 20 years and what it will all look like at the end of this process. It’ll be like my TBTF (which is a value destruction machine, predatory dinosaur and general all round menace to society all in one) but everything everywhere will work (or not work) like it does. That said, it keeps me off the street and tens of thousands of others like me. So a teeny bit of me wonders, maybe that’s just how it is and is it really so bad? Apart from the waste of human effort and soul-sappingness of it all, that is.

As Yves has pointed out before, the snag for Boeing is that its military arm is so small it simply can’t produce enough overpriced weapons to make up for its losses on the civilian side. And of course its also having very severe problems with its aerospace arm. So I don’t see how the US government can support Boeing without blowing existing trade rules out of the water. They may want to do that, but plenty of other powerful sectors won’t want to be sacrificed for the sake of Seattle.

I’m not suggesting that Boeing will be entirely abandoned – it is obviously TBTF. But its rescue may come in the form of maintaining its name and some iconic aircraft, while the company itself is just a hollow shell, maybe sold off to someone like Lockheed.

As a commercial manufacturer, Boeing is in deep trouble. The decision to push all 787 construction to SC has finally put the nail in to coffin that they are an engineering-focused company. This was one of the things they had going for them, and that crapped it all away, just like HP did. My guess is that we’ll see a long drawn-out decline in that side of things, since WA state has finally woken up to the fact that the relationship they had with Boeing was abusive. People are going to be wary about flying on SC-built aircraft, and that will make airlines more chary of buying them in bulk.

The situation with building in SC vs WA is similar to the US Post-war rocket-building program: it wasn’t enough to get the Nazi designers over here: the culture of excellence was in the DNA of the engineering/build teams, and it was only when the Germans were overseeing actually construction that the rockets stopped asploding on the launch pad, or just after.

i have heard that airlines are very …cautious accepting SC 787s…as in they are spending more time on those than the WA built ones.

seems like they dont like some of the quality issues….that while they might not crash the plane…soon….they will eventually become a problem

I believe Qatar refused to accept SC 787s, the quality was too poor. Not sure what they will do now, maybe stop buying Boeing altogether.

> Especially as China and Japan will be very frustrated

It’s not all that easy to manufacture aircraft or aircraft engines. I believe that Boeing, after its MBAs outsourced everything they possibly could, kept wing manufacture in-house. Too lazy to find the link, though. (One of my vices is watching aircraft take-offs and landings on YouTube, which is more poignant than it used to be, and the easiest way to spot an Airbus vs. a Boeing is to look at the shape of the wing where it joins the body.) Incidentally, China’s bet on trains is looking very, very good in every way: Geopolitically and environmentally.

The problem for China and Japan is that they hitched themselves to the losers of the battle. Comac used the Bombardier C-series as the basis of its designs, but found themselves cut out when Airbus took over that aircraft. Airbus and China have a very interesting, quite fraught relationship, with Airbus doing just enough to stay favoured by Beijing without losing all its manufacturing secrets. Mitsubishi tied itself to Boeing as a subcontractor and now seems to be in the double loser position of being tied to Boeing as it goes down, while its own aircraft, the Spacejet, seems to be quietly being put to sleep – it just can’t compete with the A220. That pretty much kills off Japans civil airliner industry for another couple of decades.

Russia is probably the only country capable of producing the full package of a viable modern airliner without getting hitched to other partners. But the new Sukhoi is a disaster – it looks like political pressure meant it was pressed into production a couple of years too early. Nobody will touch it now as its already has a crash record that makes the MAX look good.

Both China and Japan have tried hard to make modern engines, but don’t seem to have succeeded in breaking into the tight monopoly between Europe and the US. China in particular has struggled, even with widespread licensing of Russian military engines (there is quite a lot of synchonicity between military and civilian engines, especially in Europe and Russia). Its very, very difficult to be self sufficient in aviation technology if you want to be able to produce aircraft without being politically vulnerable. I think the Chinese and Japanese seem to have decided its simply not worth the effort.

China and high speed rail is a whole other big ball game. They made a smart decision to go for high speed rail over other options (although to be fair, they invested massively in road and airports too), although I’m not entirely sure it’ll pay off as much as they want. Not least because they over invested in high speed while leaving themselves underinvested in conventional rail – one reason China imports so much Canadian and Australian coal is because it simply doesn’t have the rail capacity to bring coal from its inland mines to the coastal power stations. Its also very questionable as to whether most of the network is coming even close to paying its way. And it may also be harbouring some long term bad news – I can’t find the link now, but a few years ago I read quite a detailed report in an engineering journal saying that substandard concrete used would mean that the lines would have a much shorter lifespan than anticipated.

Also, as the Chinese pretty much ripped off Japanese tech, they are finding it hard to sell their rolling stock abroad. Initially, they wanted to base their network on either Siemens Maglev (as in the Shanghai line) or French conventional HSR technology – but both didn’t fall through as the conditions were too rigid (i.e. they would have to basically accept piracy of their designs). The Japanese were content to do so as they are moving on to new generation designs. So Chinese rail tech is really only of interest to other countries when it comes with Chinese money – it can’t compete in cost, quality or design with Japanese, French, Korean or Spanish technology. And the evidence suggests that the Chinese are reconsidering whether they should be dishing out cheap loans and partnership deals in the way they’ve been doing the past decade and a half.

I think China is going to continue to sink massive resources into this and after decades of R&D, they will eventually succeed.

Why? China is a much larger nation population-wise than Japan. The other reason is fears that they might be cut-off in a way not dissimilar to how Trump has cut semiconductor exports to Huawei.

Most of China’s HSR lines are losing money.

https://www.inkstonenews.com/business/most-high-speed-railway-lines-china-are-losing-millions-every-year/article/3036425

Keep in mind that not all mass transit lines are for profit – some are made for political reasons or the hopes that they will lead to positive externalities.

In the long run, China is likely to build its own domestic R&D base in this field and then their innovations will likely be truly indigenous.

The composite wings (and center box) for 787 are largely Japanese products, by Mitsubishi and Subaru (the old Fuji). And carbon from Toray but everyone buys from Toray.

For the 777x, they have moved assembly of the wing back to the US, but the production of the composite parts stays in Japan. I think that technologically, that leaves the crucial parts in Japan. But the Japanese had hoped/planned to get more work on the 777x, not less. The plan was to become an almost-equal partner, and they’re not at that stage

I don’t know how much of the structural design is done in Japan and how much at Boeing. The heavy work might still be at Boeing, to a fairly deep level of detail.

I once read an interview where the CEO of Subaru made a joke that “next time” Boeing could no longer build a plane without them. The implication would be that today, Boeing still does enough of the design that they could have picked another manufacturer.

I have also read that the Japanese consortium lost money on the 787. They were buying the work by offering a low price in order to develop themselves, they were not (yet?) demanding the work based on superior capabilities.

It is hard to develop aircraft and engines that are reliable and perform well. The large Rolls Royce, Pratt & Whitney and GE engines can stay on wing for up to 30,000 flight hours and get removed for degraded performance. The medium size engines often get to the mid 20k flight hours. Do any other jet engine manufacturers make engines that reliable?

For the aircraft manufacturers wings are a big deal. They need to flex correctly for a good ride and have the correct shape for efficiency and performance. Mating the wing and center body is another tricky part to get right, and some manufacturers won’t allow outsiders to observe some assembly steps.

Also, considering the Airbus vs Boeing and Embraer vs Bombardier WTO fights would COMAC ever be able to sell outside China?

Finally, I admit I still like watching 747s take off and land, and I can do that from my office window. Luckily they will keep flying until they wear out or get parked for an Airworthiness Directive.

I’m curious how the EU could slap tariffs on Boeing sales to RyanAir as I thought that was a UK based airline.

Once Britain leaves the EU for good, won’t all tariffs that are EU-based no longer apply?

I realize I could be oversimplifying things, there could be retroactive tariffs if the planes were ordered years ago before the break-up, or there could be some complicated jurisdictional issues with RyanAir as it has operations in the EU and is still subject to the tariffs.

Ryanair is more Irish, but check this:

https://investor.ryanair.com/Brexit/

Tldr, Ryanair has an EU license and needs majority EU shareholders. They have enough UK shareholders that this might become a problem. In that case non-EU shareholders will lose voting rights until enough shares have been sold to EU citizens.

A couple of years ago, after the Brexit vote, Michael O’Leary said in an interview that Ryanairs policy was to buy back sufficient shares from UK institutional shareholders to ensure it had an EU majority. I don’t know if that was followed up or if Covid interfered with this. But the company is certainly registered and licensed in Ireland.

Ryanair is Irish not British.

Well that explains it, thanks. I guess Irish as in Republic of Ireland, not Northern Ireland?

What a tangled web.

Ryanair was created as an offshoot of a major leasing company (aircraft leasing is a major business in Ireland) back in the 1980’s and started off mainly on Irish routes. Although essentially a European wide airline now it is still headquartered and run from Dublin.