Yves here. Hubert points out that foreign governments are more willing to take a steely-eyed look at the poor prospects for airline operators that American pols are. That may be due to government operated airlines being a fresh memory.

By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). While he has worked extensively in the industry, Horan currently has no financial links with any airlines or other industry participants

Third Quarter Produces More Ugly Financial Results

The third quarter US airline financial results released in the past week further confirmed what this series first argued five months ago—the industry cannot prevent ruinous cash drains because, in the absence of bankruptcy filings, there is no way to shrink their cost structures enough to match the catastrophic coronavirus -driven revenue collapse. [1]

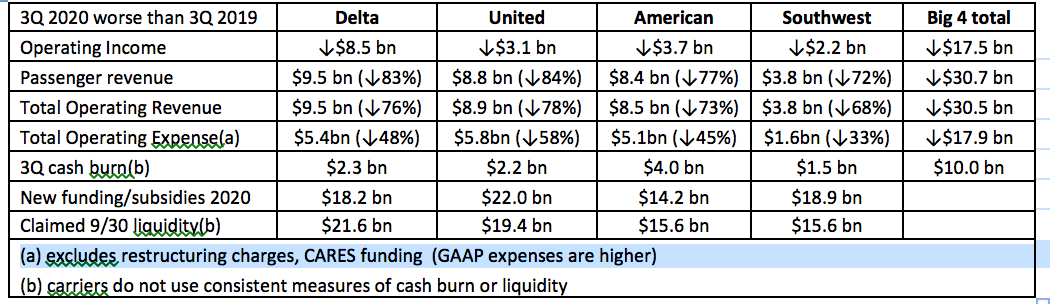

In the third quarter (historically the industry’s most profitable quarter), the Big 4 US airlines reported a GAAP net loss of $10.8 billion (versus $10.6 bn in the second quarter) and a GAAP operating loss of $12.3 bn (versus $10.5 bn in the second quarter.) As the table below shows, these carriers are still $17.5 billion below operating breakeven and $10 billion below cash breakeven.

After second quarter results were released, Southwest CEO Gary Kelly said that revenues would need to double in order for Southwest (the financially strongest carrier in the industry) to reach cash breakeven. Kelly illustrated the industry’s lack of improvement in the third quarter by saying Southwest still needed revenue to double in order to reach cash breakeven. [2]

Although basic operating economics did not improve at all, these carriers did manage to reduce their cash burn from an atrocious $15 billion in the second quarter, to a somewhat less atrocious $10 billion in the third quarter, mostly due to one-off agreements with unions and suppliers to delay or discount current contractual obligations.

Carrier cash drain measures should be taken with a sizeable grain of salt, since each carrier uses different components in their cash drain calculations, with some excluding debt repayments. One Wall Street analyst who constructed a more appropriate “apples-to-apples” measure found that United had understated cash drain by 56% ($1.2 bn in the 3Q) and Delta had an understatement of 144% ($3.4 bn in the 3Q). [3]

Between taxpayer subsidies (out of the $50 billion CARES Act funding) and new debt instruments, these four carriers have raised $73 billion since the beginning of the crisis, accounting for all (or nearly all) of their claimed September 30thliquidity. Thus current operations would not be possible without this magnitude of new funding.

The Cash Drain Will Continue Since The Huge Revenue/Cost Mismatch Isn’t Being Addressed

There is no evidence of anything that could drive $10-20 billion dollar revenue increases or cost savings anytime soon, and no one in the industry has even attempted to lay out a concrete program for achieving breakeven.

In their third quarter earnings announcements, the Big 4 carriers suggested that the fourth quarter cash drain would be 20-25% less than the third quarter drain, but did not explain how this would be accomplished, and previous predictions of cash breakeven by the end of the year will obviously not be met.

Even though the risks of contracting the virus aboard a flight are extremely low [4] people simply don’t want to get on airplanes because the risks at other points during a trip (including quarantine and the overall hassle) remain high, many of the business/entertainment justifications for travel remain closed, and many travel alternatives (e.g. Zoom) make more sense. The major increase in Covid cases means that international borders will remain closed for the foreseeable future.

After eight months, airlines have obviously explored every possible way to reduce costs outside of bankruptcy. As the results in the table clearly indicate, these fleet order deferrals, capital spending freezes and voluntary staff furloughs and paycuts don’t come anywhere close to reducing costs enough to match the revenue collapse. Many of these cuts are temporary—most staff savings expire in 3 to 12 months, and fleet obligations have been delayed but not reduced. Some simply shift the financial pain to even more vulnerable parts of the aviation ecosystem (including regional feeder carriers, airports, manufacturing and maintenance suppliers). Involuntary layoffs will likely increase, but outside of bankruptcy these are difficult and inefficient; Delta took a $5 billion “restructuring charge” for its voluntary furlough program in the 3Q without making a sizeable dent in its cost structure.

The Industry’s Phase One Narrative Claims Have Collapsed

Throughout the crisis the singular objective of the Big 4 US carriers is ensuring that their current owners maintain total control, so that they can reap all the gains from the equity appreciation that would likely follow a full demand recovery, and are not in any way penalized for anything they did that contributed to the collapse.

This objective creates insurmountable conflicts with traditional capitalist market mechanisms. Owners of companies whose business models collapse to the point where they hemorrhage cash for extended periods and cannot meet ongoing financial obligations do not get to keep exclusive control. The law establishes rules for how the initial burdens of restructuring should be shared, with previous equity holders having the lowest priority. The law also is designed to ensure that the distribution of future upside gains from restructuring should be based on the tangible contributions made to a recovery plan that had been approved by all of the major parties that had suffered from the collapse.

When major industries do not want to deal with the law or economic reality the number one priority becomes the construction of PR narratives that the media and politicians will uncritically accept. These airlines constructed narratives that portray actions directly benefitting current owners and managers as primarily serving broader public interests. The narratives are also designed to divert attention from the economic and financial data contradicting their claims, and from the self-inflicted problems that predated the virus, including major reductions in competition and $50 billion in extractive stock buybacks that badly hurt the industry’s ability to cope with the demand collapse.

The Phase One airline narrative, that emerged after coronavirus shutdowns first hit in March, emphasized that the $50 billion taxpayer subsidies they demanded were a one-time, short-term fix. They were primarily benefitting airline employees, and were only needed as a stop-gap measure to prevent the collapse of industry infrastructure that created huge external benefits across the economy. Since the impacts of the virus would not affect industry fundamentals and that a rapid, “V-shaped” demand rebound would be fully underway by the fall, it would be foolish not to leave current owners and managers fully in control.

As discussed earlier in this series, [5] evidence completely discrediting the “subsidies are just a one-time temporary stopgap and industry fundamentals are fine” claims was available by April. However the industry’s narrative promulgation successfully blocked any public discussion of whether the massive subsidies had actually benefited anyone other than these four private companies.

Seven months later, the bleak third quarter results have triggered a few media stories suggesting a “Prolonged Coronavirus Travel Drought” and that “Airlines have given up on 2020. Now next year is looking bleak too.” [6] But no one in the media or Wall Street has openly admitted financial results clearly show that that all of the claims underlying the industry’s narrative had been totally wrong.

The ability of manufactured narratives to block recognition of economic reality has always been weaker outside the US. The same demand/cost problem exists worldwide, but public debate in other countries has actively considered of restructuring alternatives (bankruptcy, public investments with strict conditions, temporary nationalization) that have been completely off the table in America. Carriers (Aeromexico, Latam, Avianca, South African, Thai, Kenya) have been forced to file bankruptcy where US-type subsidies have not been available, and carriers (Lufthansa, Air France, Cathay Pacific) who asked for bailout money on a one-time basis are now admitting that the problem is much bigger. [7] Foreign airline executives have been much more frank about the magnitude of the crisis than their US counterparts. Air Canada CEO Calin Rovinescu called it “hundreds of times worse than 9/11, SARS, or the global financial crisis – quite frankly combined”. Lufthansa Chairman/CEO Carsten Spohr admitted that “We do not expect demand to return to pre-crisis levels before 2024.’ [8]

US Airline Bailouts Were Always for Major Investors Not Workers, and Cannot Be Justified By Benefits For The Overall Economy

The airlines’ “this is all serving the greater public interest” narrative claims were just as illegitimate as the “this is just a short-term problem” claims. The sole purpose of airline payroll support was to help prop up airline stock prices, by creating expectations that these airlines were “Too Big To Fail.” Capital markets could safely ignore actual financial results and could lend money to (or invest in) the major carriers without worrying about bankruptcy risks. Every time rumors about a second tranche of “payroll support” subsidies emerged in the press, airline stocks jumped.

Support for airline bailouts in Washington came from politicians who wanted to boost stock prices but needed to create the appearance that they just wanted to help beleaguered workers. Job losses are unfortunate in any situation, but none of these politicians have ever explained why United pilots are more deserving of taxpayer largess than the tens of millions who have lost much lower paying jobs.

US airline bailouts had almost none of the major conditions (such as shareholdings and veto power over future mergers and other major decisions) imposed elsewhere. This was so that current equity holders could capture all of the gains from any financial recovery facilitated by the bailout funding.

US airlines have also adamantly opposed restrictions on their ability to funnel the company’s limited cash to shareholders and executives in the middle of the crisis. Delta and Southwest turned down Federal loans because they would have imposed temporary caps on executive pay and prohibitions on share buybacks and dividends. [9] This has increased discord at Southwest where management turned down taxpayer funds in order to avoid pay and buyback limitations, but then turned around and demanded all employees accept a “voluntary” 10% pay cut.

Coronavirus never threatened the critical aviation infrastructure that (in better times) much of the economy had relied on. Airline are one component of the global trade and tourism industry, which does create huge employment and other external economic benefits. But airlines don’t create any of these external benefits by themselves, and the subsidies airlines have received have done nothing to revive trade and tourism.

Society would obviously be harmed if the assets (aircraft, hubs) and management skills (ability to maintain aircraft and manage complex networks) employed by the major airlines were destroyed and had to be totally rebuilt from scratch. A major objective of the industry’s PR narrative is to falsely conflate the preservation of those capabilities with the preservation of the current ownership structure of these specific publicly listed companies including “current debt holders, current equity owners, and current programs to programmatically offer cash and non-cash compensation to senior executives” and most media coverage has explicitly endorsed the industry’s desired framing. [10]

The only voices in Washington dissenting from the “airline subsidies create huge economic benefits” consensus were a few conservative Republicans. “For the past six months, the American taxpayers have spent $25 billion covering the payroll obligations of passenger airlines. No other Fortune 500 companies—including restaurant groups, transportation firms, hotel chains, or entertainment businesses—have received taxpayer-funded grants…The excess capacity of the airline sector will not be resolved in the near future and continuing to force the entire payroll obligation onto the taxpayers is not sustainable.” [11]

The Battle To Protect Current Airline Owners Enters a New Phase

The airlines’ narrative challenge has gotten more difficult. They still need to keep bankruptcy options completely off the table, and need to further solidify the conflation of “survival of airlines” with “survival of current ownership/financial arrangements.” They still want to make sure they capture 100% of any eventual industry recovery, but don’t want to have to contribute any additional cash, and want to make sure the taxpayers, workers and suppliers who are contributing get none of that upside.

But they now need to convince politicians and the media to replace emergency, one-time subsidies with totally open-ended subsidies, even though first $50 billion didn’t solve the industry crisis, and other, worse-hit industries still aren’t getting anything. They need to ensure that ongoing subsidies don’t even have the mild restrictions of the March subsidies (such as prohibiting layoffs, service cuts, stock repurchases and mergers). And they need to divert attention from the growing evidence showing that past subsidies were just a direct wealth transfer from taxpayers to a tiny set of politically influential investors, and that those investors have no idea how to solve their structural problems (including the demand/cost mismatch and the permanent destruction of corporate and international business).

The industry began rolling out a second phase narrative with the release of its third quarter results. It redefines the problem in order to claim that the industry crisis is already over. The airlines have raised more than enough liquidity to sustain operations until coronavirus has been beaten. If the airlines can raise cash, and now have plenty, there’s no need for anyone to keep monitoring actual cash drains. If the “problem” has been solved, annoying questions about financial results can be ignored (more importantly) no one can suggest that the structural problems can’t be fixed without restructuring efforts that could wipe out equity holders.

United CEO Scott Kirby said cash burn had seemed like an important metric at the start of the pandemic. “But that’s not at issue anymore. We have enough liquidity to get through the crisis” and we are now refocused on “winning the recovery.” Delta CEO Ed Bastian said the money it had raised gave it a “good line of sight to positive cashflow by the spring.” [12] Needless to say, the airlines did not provide any evidence to support the new “crisis is over because we have all the cash we’d ever need” narrative, and the reporters following the story happily publicized the narrative without examining whether it was based on anything more than the same wishful thinking that was behind the previous “rapid V-shaped recovery” narrative.

But “is today’s liquidity sufficient?” not only isn’t the right question but is impossible to answer. It depends on numerous factors that the airlines cannot influence and no one can predict with any confidence (e.g. widespread vaccine availability, herd immunity rates, future demand for corporate and international travel.) When Scott Kirby says “we have enough liquidity to get through the crisis” he’s really just saying there’s enough cash on hand so we can’t be forced into bankruptcy involuntarily in the next few months, while we hope for billions in new open-ended taxpayer subsidies and a miraculous decline in the virus.

The much more important questions are “How can airlines quickly get costs (and financial obligations) back in line with their reduced near-term revenue potential?” and “When the coronavirus crisis finally begins to subside, what will it take to achieve ongoing improvements in industry efficiency given major changes in capacity and demand?” This series has argued that closing the cost/revenue gap and reestablishing an efficient industry is impossible outside of a bankruptcy-type process.

How Far Will Airline Owners Go In Order To Maintain Total Control?

As has been discussed throughout this series, the public has a huge interest in an airline industry that is strongly competitive and offers the most service that can be economically offered at the lowest economic process. The airline owners’ determination to maintain total, exclusive control of how the industry deals with the coronavirus crisis so that they can capture the full value of any future equity appreciation is fundamentally incompatible with the public interest.

The airlines’ refusal to address their major structural issues has left significant wasteful overcapacity in place. The desperate efforts to increase liquidity without risking control, including the “burn the furniture to heat the house” moves described in Part Two of this series [13] have led them to surrender control of frequent flyer programs and other core components of the business. The loss of those programs, and the cash they have wastefully been burning squanders resources that should have been contributing to an eventual business recovery.

Current owners have every incentive to take any risk that might protect their control. The outcome for current equity holders is the same whether they file for chapter 11 protection next week or whether they wait until evehttps://www.nakedcapitalism.com/wp-admin/edit.phpry last asset has been mortgaged and all the cash has been burned. They have no incentive to allow their financial position to be wiped out, even if it would significantly improve the future viability of the airline.

As the fundamental cost/revenue mismatch remains unaddressed, and as cash drains continue, it is highly likely that these owners will further threaten the public interest by demanding further reductions in competition in order to provide short-term boosts to their stock price. Since they will refuse to consider any bankruptcy-type restructuring efforts they will insist the more mergers and more price collusion is the only way to “save the industry.” “Every big crisis in the industry so far has led to further consolidation. After pure crisis management is behind us, somewhere in the middle of next year, there is going to be a stage when consolidation and further collaboration in the industry will take place.” [14]

____________

[1] Hubert Horan: What Will it Take to Save the Airlines? Naked Capitalism June 3, 2020. Second quarter financial results were discussed in The Airline Industry Collapse Part 3 – Recovery Expectations Were Always Dreadfully Wrong, Naked Capitalism August 4, 2020

[2] Kyle Arnold, “Southwest Airlines needs ‘business to double in order to break even,’ CEO says” Dallas Morning News, August 28, 2020; press release, Southwest Reports Third Quarter 2020 Results, October 22, 2020

[3] Analysis of Hunter Keay of Wolfe Research cited by Holly Hegeman, Plane Business Banter, October 23, 2020

[4] Bryan Corliss, Covid in cabins: Low risk, no silver bullet, Leeham News, October 14, 2020; Bjorn Fehrm, Do I get COVID in airline cabins? Part 13. DOD tests confirm OEM results, Leeham News, October 15, 2020

[5] see Part 3, August 4, 2020

[6] Alison Sider, Airlines Plan for Prolonged Coronavirus Travel Drought, Wall Street Journal, October 16, 2020; Kyle Arnold, Airlines have given up on 2020. Now next year is looking bleak too, The Dallas Morning News, October 16, 2020

[7] Jens Flottau, Lufthansa CEO Says Deeper Cuts Are Needed As Recovery Falters, Aviation Week, September 16, 2020; Centre for Aviation, Canada’s airlines remain in a dangerous state of limbo, 17 Sept 2020; Benjamin Katz, British Airways CEO Departs as Parent IAG Seeks Revamp, Wall Street Journal, October 12, 2020; Jude Webber, Latin America’s airlines stare out along a future of empty runways, Financial Times, October 18, 2020

[8] Centre for Aviation, Airline Leader, issue 53, 2020, p. 6-7.

[9] Alison Sider, American Secures Larger Government Loan After Rivals Reject Cash, Wall Street Journal, Sept. 25, 2020

[10] Rusty Guinn, Hook, Line and Sinker, Epsilon Theory, October 1, 2020 cites multiple examples of media stories that had swallowed the industry narrative conflating “survival of the airline” with “survival of current executives and ownership positions” hook, line and sinker.

[11] Oct 8 statement of Senators Mike Lee (R-UT) and Pat Toomey (R-PA) Ben Goldstein, U.S. Senate Republicans Object To Proposed Airline Relief, Aviation Week, October 08, 2020. It is not clear whether the Senators objecting to blatant corporate welfare are willing to fund broad-based relief programs for the individuals and localities most at risk due to coronavirus impacts.

[12] David Slotnick, United’s CEO argued it’s not a problem that airlines will keep burning tens of millions of cash per day for months, Business Insider, Oct 15, 2020; Justin Bachman, United Airlines sinks as loss undermines vow to ‘lead the rebound’, Bloomberg October 15, 2020

[13] Can Collateralizing Frequent Flyer Programs Help Save the US Airlines?, Naked Capitalism July 6th2020

[14] KLM CEO Pieter Elbers quoted in Helen Massy-Beresford, Airlines Likely To Need More Government Support, IATA CEO Says, Aviation Week, September 24, 2020

This, of course, is the key point of course. Its amazing how many people don’t see that there is no good reason to spend public money to protect the existing companies – what is important is to protect the underlying assets, whether thats aircraft or the skilled people who work with them. CEO’s and shareholders will spend a fortune persuading us otherwise.

I suspect that they will fail in the end, mostly because other capitalists will be licking their lips at the prospect of mopping up the remains of the industry for a song, and creating new networks of cheap airlines. This is of course very bad news for the aircraft manufacturers as well as it may prove far cheaper for the next decade or so to buy up surplus existing aircraft than order new ones, especially if kerosene price stay low.

The priority of course should be to protect the existing jobs and the terms and conditions of workers. The CEO’s and shareholders should be able to look after themselves.

> The priority of course should be to protect the existing jobs and the terms and conditions of workers.

Why? No one ever gave a rat’s ass before. Millions of peasants were told to FO when they complained that their jawbs were being sent to China. Now we can’t even get the basics straight because, ta da, know how was lost. Besides, aren’t the empty planes flown to China for cheapo service anyhow?

Although as far as good done per pound of carbon emitted, it’s not clear to me that society overall would be harmed if we lost a lot of airline capacity, assuming that we DIDN’T build it back from scratch.

The future of the airline industry is in its past — nationalization.

The airlines will get bailed out for the same reason that the government subsidizes AMTRAK. The PMC class use the services, hence they are essential.

+1

Mass transportation should be a public utility.

Exactly. This is a very good article but I don’t understand why HH states, “the public has a huge interest in an airline industry that is strongly competitive.”

Why? The reason we have Amtrak is that the railroad companies couldn’t make a profit competing with each other for passenger service. I live near Medford (MFR) and there is very little competition. One airline controls the route from MFR to Portland. Another from MFR to San Francisco and Denver. Another from MFR to Salt Lake. Only on the MFR-LAX route is there a choice of airlines.

As LA Bob says, air travel should be treated as a public utitity. Efficiency, not competition, is what matters.

Aren’t the Washington State Ferries a public utility?

They are a part of the Department of Transportation (WashDOT) and a public service. But good luck. They seem to be uniquely hated. Sailings have been reduced over the years to save money, and the eastern Washington crowd want freeways (and there’s a tunnel that cost mega dollars that bypasses downtown). Always more freeways. When you’re ferry dependent, life can get very challenging. The price keeps rising, and there are now many private foot ferries.

And there’s a history there. From the Washington state Ferry Wikipedia entry:

Toward the end of the 1940s the Black Ball Line wanted to increase its fares, to compensate for increased wage demands from the ferry workers’ unions, but the state refused to allow this, and so the Black Ball Line shut down. In 1951, the state bought nearly all of Black Ball’s ferry assets for $5 million (Black Ball retained five vessels of its fleet).[4] The state intended to run ferry service only until cross-sound bridges could be built, but these were never approved, and the Washington State Department of Transportation runs the system to this day.

Indeed. And in that vein, we should be seriously transitioning to bullet trains to get around this country. But nooo. Nothing will earnestly be considered that might actually benefit the general public. However, there will a bullet train built. Where? Unbelievably, from Southern CA to Las Vegas. (For fat cats, with fat cat money, as I understand.) Wonder if there are tax abatements and evictions to give the professional managerial class easements and eminent domain to pull this off? Makes perfect sense to me!

But I digress. It’s my opinion that the pollution caused by the airline industry should be made as distasteful as tobacco.

We can’t do bullet trains. Look at what happened with the effort to build high speed rail from SF to LA.

We have too much existing infrastructure in the way.

And another big reason it’s not gotten anywhere is that the terminal in LA is out in the boonies….but even if not, pray tell, where do you locate the terminal that makes sense? High speed rail works in Europe and Japan because the terminals are well integrated into city public transportation. Outside NYC and sort of in Chicago and Boston and DC, we don’t do public transportation in America.

Mass transit requires high density housing and offices.

California does not have this in its extensive “suburbs.”

“High speed rail works in Europe and Japan because the terminals are well integrated into city public transportation” Yes and no. Some recent or planned TGV stations are in the boonies, too.

The thing that has surprised me most about the Airline bailouts is how unique their condition has been. As Hubert highlights, no other single industry has received this level of nearly unconditional support. I think it will be quite hard for Americans to swallow any additional support for the Airlines while Congress and the president have dithered on economic support for the vast swathes of Americans suffering. It seems a true reckoning must occur quite soon.

I’m not sure the public knows how much support the airline industry got (compared to others).

The last 40+ years have shown the attention span and memory of the american voter is extremely short. I doubt most voters even remember the $50b bailout, it was forever ago.

Maybe what this story is really about is the Professional Managerial Class trying to protect their preferred mode of travel. Think of what they have had to give up this year. The conferences, the conventions, Las Vegas, overseas holidays, business class travel, etc. – most of it on somebody else’s dime. They want it all back one day which is why there is so much effort to protect not so much the airlines but this deferred way of life of theirs.

I see two diametrically opposed forces at work:

1. PMC wants their travel perks back, including expensed trips to Vegas strip clubs;

2. Finance/CFOs look at 2020 savings from “deep sixing” those perks and say, hmm, let’s cut those back permanently.

Who gets the CEO’s and board of directors ear? Not sure, pass the popcorn please.

My money is on the Finance/CFO team. Because in business, nothing hollers like the dollars.

Not so at the airports at each end though. And passengers to not enjoy the TSA experience, further pushing the don’t-fly thinking.

TSA is very tolerable now that airports are deserted.

“When major industries do not want to deal with the law or economic reality the number one priority becomes the construction of PR narratives that the media and politicians will uncritically accept.”

Hmmm – rather interesting to read this article just after reading the earlier article about Hannah Arendt & “Truth”…

Here under the Euro-flyway the skies remain (mostly) a fine pleasing azure blue. The occasional contrail marks the heavens, but the ever bustling international class appear to be remaining earthbound. Now if these same touroids would just get in their cars and go home I could walk in the streets again; the preferable mode of travel here for the locals. What’s wrong with sea travel anyway? However, there has not been a cruise ship in sight, and the demise of this “industry” is a true blessing for civilized human beings everywhere.

“The major increase in Covid cases means that international borders will remain closed for the foreseeable future.” This is the most depressing, though true, statement. Thanks for posting these important articles.

Thanks for this post. Not a good look for the owners. In related news:

The airline lobby will meet with @OMBPress

at 3pm today about a @USDOT

rule they’re pushing. Their proposal makes it harder to hold them accountable for withholding refunds and mistreating their passengers. This rule is harmful and should not be finalized. https://reginfo.gov/public/do/view

https://twitter.com/chopraftc/status/1320747501096472577