Yves here. The article cites a list by Robert Reich of how people become billionaires. Reich’s categories wind up missing private equity, since Reich assumes the only way people get rich in money management is via inside information. In fact, someone is twice as likely to become a billionaire by managing money as he is by going into tech. Asset management has strong scale economies based on the size of fund. Get a big enough fund and charge high enough fees (and in private equity, they are both rapacious and well disguised) and you get rich.

By Philip Kotler and Christian Sarkar Originally published at Fix Capitalism

The cover of the May 20, 2020 issue of Forbes magazine carries a picture of Larry Ellison, billionaire founder of Oracle Corporation. On page 114, there’s a Billionaires Index that runs six more pages in very small print. The following becomes clear:

- Almost every country has billionaires. Even Venezuela and Zimbabwe each has one billionaire.

- The U.S. has the largest number of billionaires, around 624.

- China has the second largest number of billionaires, 390. Not bad for a country professing communism. In fact, the number of Chinese billionaires is even higher, because Hong Kong is listed separately with 66 billionaires, and independent Taiwan adds additional 40 Chinese billionaires.

- Germany has 110 billionaires, Russia has 102 billionaires, followed by India with 94 billionaires.

- Each of the remaining countries has fewer than 100 billionaires, with many in Australia, Canada, France, Switzerland.

- I would guess that there are more billionaires who were not known by Forbes or not counted because their wealth couldn’t be estimated. This would include royals, dictators, and criminals. I would venture that the world has somewhere between 2,000 to 2,200 billionaires. The estimated total net wealth of the world’s billionaires is over $8 trillion.

Our thesis is that billionaires could become a force for good – especially if their resources were used for the Common Good. There are three way this can happen:

- The billionaires suddenly realize that the Common Good of the planet is an important goal for them, so they join forces to save humanity and Nature,

- Our governments make billionaires pay their “fair share” of taxes, or

- Society decides that billionaires shouldn’t exist, and our governments simply tax them out of existence.

Will the billionaires agree to higher taxes? In the recent US elections, we recall that Bernie Sanders suggested billionaires should be taxed out of existence, while Joe Biden warned us against demonizing the wealthy.

There’s a common myth that there will always be billionaires. And the media worships billionaires like Bill Gates and Warren Buffett who illustrate that some billionaires can work for causes that are beyond their own selfish interests.

Where do Billionaires Come From?

We should start by asking where do billionaires come from? Do they just spring out of the fertile digital soil of Silicon Valley? Can anyone – with enough hard work – become a billionaire?

So how do you become a billionaire? Robert Reich, former U.S. Secretary of Labor, explains four sources of wealth:

- Inherited Wealth: around 60 percent of wealth in the US is inherited. The best chance you have of becoming a billionaire is to marry or be born into intergenerational riches.

- Monopolies: Jeff Bezos’ Amazon accounts for nearly 50 percent of all e-commerce retail sales in America. Our patent and trademark systems, which have been extended in duration, create billionaire like George Lucas and Oprah Winfrey.

- Insider Information: Hedge fund billionaire Steven A. Cohen made “hundreds of millions of dollars of illegal profits” – through his expertise in insider trading. This is not an isolated incident.

- Politics: You can invest in politicians – or even bet on them, like racehorses – through your timely campaign contributions. Americans for Tax Fairness estimates that Charles Koch and David Koch and/or Koch Industries could save between $1 billion and $1.4 billion combined in income taxes each year from the Trump tax law―and that doesn’t include how much the Koch Industries save in taxes on offshore profits or how much their heirs will benefit from weakening the estate tax.

Good luck with these four strategies.

Without them, the average US worker would have to work for 25 thousand years to become a billionaire.

How has the number of billionaires grown over the past few decades? In 1996 there were 423 billionaires spotted in the wild. In 2019, that number rose to 2,153. Billionaires constitute just 0.00003 percent of the world population, but they currently own the equivalent of 12 percent of the GWP (gross world product) and a much larger percentage of the total wealth of the world.

Interestingly, even as COVID destroyed the economy, billionaires got richer – to the tune of $10.2 trillion.

The Billionaire’s Defense

Arguments used to defend billionaires are often based on the story that without billionaires, society would not progress – innovation and philanthropy would diminish – making life even worse. Facebook CEO Mark Zuckerberg, worth $70bn, explains this in an appearance on Fox News. Billionaires should not exist in a “cosmic sense,” but in reality most of them are simply “people who do really good things and kind of help a lot of other people. And you get well compensated for that.” He warned about the dangers of ceding too much control over their wealth to the government, allegedly bound to stifle innovation and competition and “deprive the market” of his fellow billionaires’ funding for philanthropy and scientific research.

“Some people think that, okay, well the issue or the way to deal with this sort of accumulation of wealth is, ‘Let’s just have the government take it all,” Zuckerberg said. “And now the government can basically decide, you know, all of the medical research that gets done.”

So who decides what research gets done? The drug companies? The billionaires themselves? There is a serious argument to be made that allowing billionaires to decide societal priorities is profoundly undemocratic. Should mega-rich donors like Bill Gates drive philanthropy, usurping the role of democratic governments to decide what social ills to tackle and how?

Even in terms of innovation, Zuckerberg is wrong. The Information Technology and Innovation Foundation (ITIF) reports that while in the 1970s almost all innovation winners came from corporations acting on their own, more recently over two-thirds of the winners have come from partnerships involving business and government, including federal labs and federally-funded university research. Moreover, in 2006, 77 of the 88 U.S. entities that produced award-winning innovations were beneficiaries of federal funding.

Facebook, for all Zuckerberg’s talk about innovation, makes the bulk of its profits from selling access to customer data via advertising. It’s certainly not a fountain of societal innovation.

Unfortunately, the record of billionaire activism is not always a stellar example upholding human values or even democracy, for that matter. The John Birch society, for example, was principally backed by Fred Koch, the father of the infamous Koch brothers. The society famously attacked Martin Luther King and the Civil Rights movement, as well as JFK – with a campaign to spread hate just two weeks before his assassination in Dallas. This thread of regressive billionaire activism continues to this day. The John Birch society’s tired slogan – “this is a republic, not a democracy” is now being amplified by the Trumpists.

These are billionaires who are not interested in the Common Good. In fact, it is their actions that have driven our society to a level of public insecurity and mistrust, not seen since the 60s, or the Civil War, as some have argued. Clearly, not all billionaires are interested in saving the world.

Will Billionaires Solve the World’s Biggest Problems?

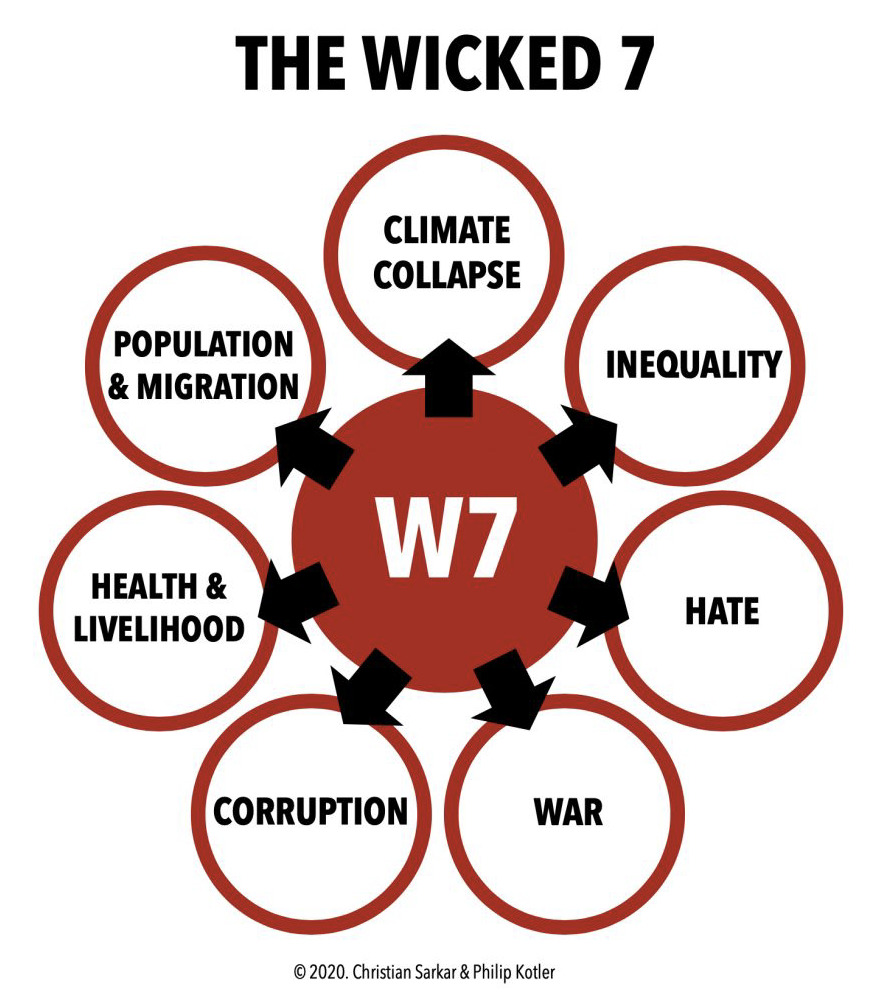

Our world is plagued with wicked problems. Recently, we started a project studying what we can do to mitigate the 7 most Wicked Problems in the world. COVID-19, for example,would be classified under “health and livelihood” and hopefully the new vaccines will get the coronavirus problem under control within a few years.

Note that one of the Wicked7 problems is inequality. As a problem, it also contributes to other problems such as war and health and livelihood. Inequality is an insidious and growing problem and it is intrinsically related to the growing number of billionaires in the world. As the number of billionaires increase, and average incomes remain the same, income inequality grows as a problem.

Given that these wicked problems are an existential threat to our future as a civilization, why is it that the smartest minds in the world are still busy working on algorithms to maximize advertising efficiency or building financial instruments for hedge-fund profits?

What would happen if the world drafted Bill Gates, Elon Musk, Tim Cook, Jamie Dimon, and Jeff Bezos – gave them a mission to find solutions to “save the planet in the interest of the common good” and then presented their “solutions” to the governments of the world – put them to a global vote? The Big 5 CEOs could afford to be paid nothing for this challenge. Well, isn’t that what they should be working on? Paul Polman, former CEO of Unilever, could also be drafted as the project manager of this Manhattan Project to save humanity. Let’s lock them in a “zoom-room” for the next six months and see what they come up with – we’re pretty sure their businesses will continue doing well without batting an eyelid.

Narrowing the Distance between the Rich and the Poor?

We also must ask: what would happen if our governments started working for the Common Good?

What would it mean to the world if we (1) got rid of monopolies, (2) stopped the use of insider information, (3) prevented billionaires from buying off politicians, and (4) made it harder for the billionaires and their corporations to avoid paying taxes?

You can’t – as the late Paul Polak used to say – “donate your way out of poverty.” Billionaires know that just giving money to the poor is not a lasting solution. The statement is often made “don’t give fish to the hungry, just teach them how to fish.” The task is how to create a better education and better skills in people so that they can create value for others and get paid for the value they create.

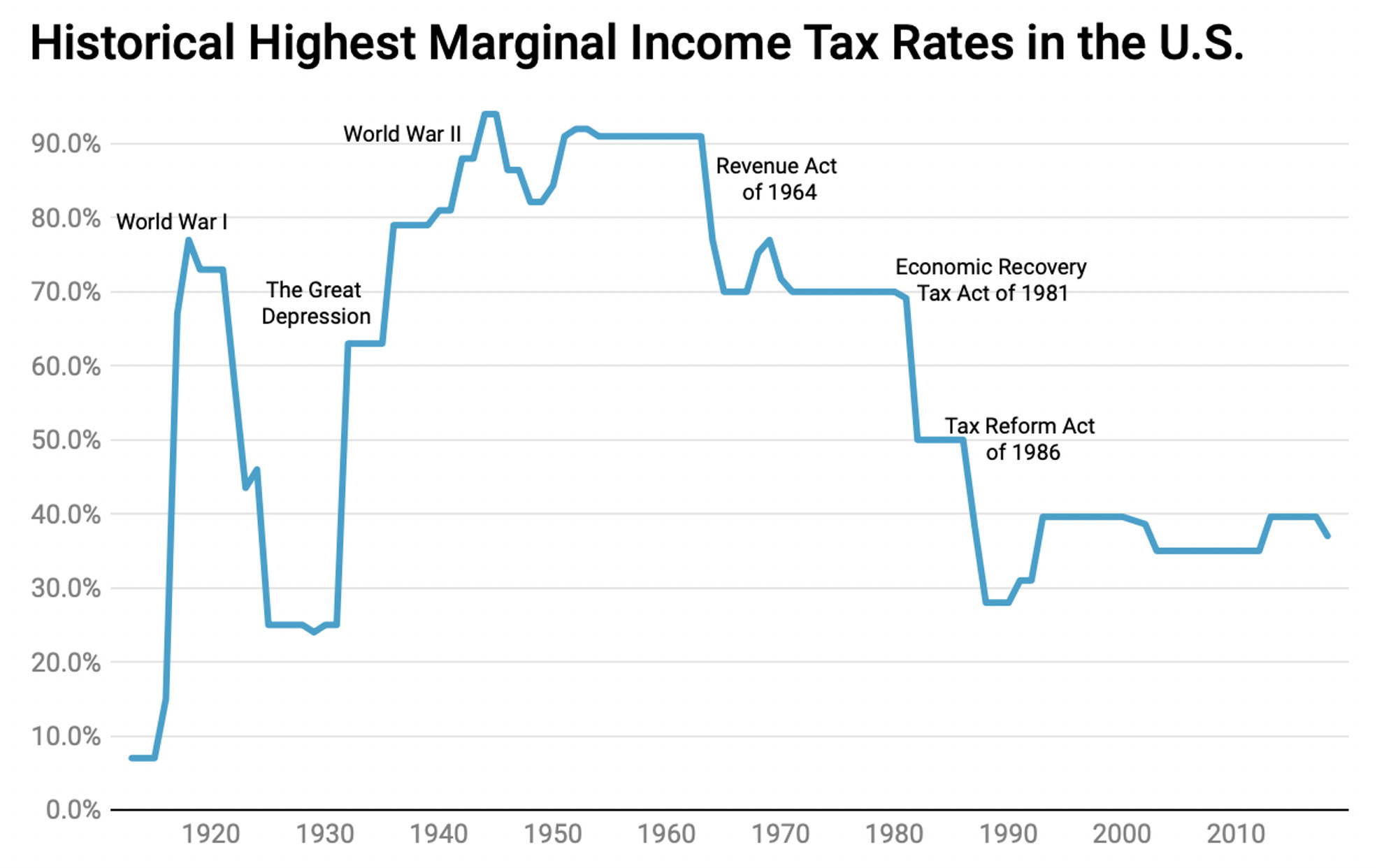

A quick review of the history of taxation in the US shows us what’s been going on: for too long, too many wealthy persons have paid taxes on their wealth at a lower rate than their secretaries! Today’s top U.S. marginal income tax rate is 37%. This is the rate paid on the last bracket of income, not on the whole income. The rich person pays substantially less that 37% on his or her total income. The 37% bracket only affects persons earning an annual income of $518,400 or more.

Look at how high the top bracket income tax has been historically. The rate was almost 80% in World War 1, over 90% in World War II, and pushed down over time by Republicans to a low of 37%.

This 37% top tax rate seems ridiculously lower compared to Scandinavian countries that pay a top income tax rate of 70%. What do Scandinavians get back for this very high marginal tax rate. They get back “freedom from insecurity.” Scandinavians don’t have to pay for medicines, surgeries, college education, maternity leave, longer vacations, and so on. The evidence is clear that many Americans might prefer to live in a country with higher taxes on the rich, than in today’s America where at least 15-20% of U.S. citizens can’t meet their basic needs without help. Yes, most of us have plenty to eat but the important things we need like health care and a college education are priced as luxury goods.

Isn’t it interesting that US citizens have to pay US taxes no matter where in the world they earn their money, but our US corporations don’t have to do the same. And we thought corporations were people too!

Americans for Tax Fairness points out the loopholes:

- Tax avoidance through offshore tax loopholes is a significant reason why corporations, which paid one-third of federal revenues 60 years ago, now pay one-tenth of federal revenues.

- U.S. corporations dodge $90 billion a year in income taxes by shifting profits to subsidiaries — often no more than a post office box — in tax havens.

- U.S. corporations hold $2.1 trillion in profits offshore — much in tax havens — that have not been taxed in the U.S.

- General Electric, which uses a loophole for offshore financial profits, earned $27.5 billion in profits from 2008 to 2012 but claimed tax refunds of $3.1 billion.

- Apple made $74 billion from 2009-2012 on worldwide sales (excluding the Americas) and paid almost nothing in taxes to any country.

- 26 profitable Fortune 500 firms paid no federal income taxes from 2008-2012. 111 large, profitable corporations paid zero federal income taxes in at least one of those five years.

The simplest solution is to end tax “deferral.” Corporations would pay taxes on offshore income the year it is earned, rather than indefinitely avoid paying U.S. income taxes. This would also remove incentives to shift U.S. profits to tax havens, and it would raise $600 billion over 10 years.

Why isn’t this happening? Ask your local Senator or Congressperson. Chances are they are too busy raising campaign funds for their re-election.

Passing a higher tax on the rich only slows down the growth of their wealth. Senators Elizabeth Warren and Bernie Sanders have called for a wealth tax. Elizabeth Warren proposed that households should pay an annual 2% tax on their net worth above $50 million, and a 3% tax on every dollar of net worth above $1 billion. She recently added possibly raising the billionaire wealth tax rate to 6 percent instead of 3 percent to help pay for “Medicare for All.” Note that the working poor and the middle class do not pay higher taxes. The wealth tax is only paid by very rich.

Another solution is to raise the estate tax. Wealthy persons need a plan describing how their wealth should be divided upon their death. They cannot be allowed to avoid paying estate taxes on their wealth. Married couples won’t pay any inheritance tax on the first $22.36 million in exemptions. The tax on the remaining wealth after exemption is 40 percent.

The estate tax could yield more if two changes occurred:

- lower the tax-exempt amount to a much lower number, and

- increase the tax rate on the remaining amount from 40% to a much higher number – say 70%.

The government should increase the estate tax rate in a further effort to reduce the growing concentration of wealth in the U.S. Yet Republicans argue that higher estate taxes will lead to more avoidance and also lead talented people to work less hard or threaten to leave the country. I would counter-argue that there are a great many civic-minded talented people waiting to move up the wealth ladder and take their place. The tough issue is what the government will do with the higher estate taxes? Will it be used by government to increase wages and jobs? Or will it go into more defense spending and more bureaucracies? Why don’t we ask citizens to decide?

Convincing Billionaires to Consider the Future of the Planet

Let’s return to how to encourage the super-rich to give back more of their wealth to society. Bill and Melinda Gates and Warren Buffett carried out an excellent approach to this problem, with their giving pledge. They recruited billionaires to make a commitment to distribute half of their wealth to philanthropic causes within the next 10 years. Today 211 billionaires have made this pledge. Furthermore, each billionaire describes the cause(s) that might get his or her “give-back.” There is an argument to be made that if the rich have to “give back” to society, they took too much from society to begin with.

The recruiting effort is continuing. Imagine how many low income persons would benefit if 2,000 billionaires, not just 211 would implement a giving pledge.

Billionaires face the problem of identifying which giving causes would do the most good. This problem faces all the billionaires, including the largest ones: Jeff Bezos ($200B), Bill Gates ($98B), Bernard Arnault and family ($76B), Warren Buffett ($67.5B), Larry Ellison ($59B), Amancio Ortega ($55.1B), Mark Zuckerberg ($54.7B), Jim Wolcott ($54.6B), Alice Wolcott ($54.4B), and S. Robson Walton ($54B).

Billionaires prefer giving away their money to their favorite causes rather than giving their money as taxes to the U.S. Treasury. They want to control who gets the money. They might not want to see the money go to make or buy more weapons of war.

This problem has been dubbed “gilded giving” by the Institute for Policy Studies. Here is their description of the problem:

The charitable sector is currently experiencing a transition from broad-based support across a wide range of donors to top-heavy philanthropy increasingly dominated by a small number of very wealthy individuals and foundations. This has significant implications for the practice of fundraising, the role of the independent nonprofit sector, and the health of our larger democratic civil society.

- Risks to charitable independent sector organizations include increased volatility and unpredictability in funding, making it more difficult to budget and forecast income into the future; an increased need to shift toward major donor cultivation; and an increased bias toward funding heavily major-donor-directed boutique organizations and projects. The increasing power of a small number of donors also greatly increases the potential for mission distortion.

This privatization of charity and the job of government does not bode well for democracy or the common good. Yet there are exceptions. When Andrew Carnegie, the richest man at the time, decided to start giving back money to good causes, he landed on a brilliant idea. He wanted to raise the educational level of average Americans. Instead of giving money to colleges, he decided to build public libraries, first in America and later around the world. With public libraries, persons would have access to books and be able to build their knowledge in whatever field of interest. Young students could sit quietly in a library, do their homework and chance on seeing a book that might change their life.

Lessons from the Gilded Age

The U.S. simply needs to look back at history, to our Gilded Age, to see what can be done to curb wealth growth.

President Theodore Roosevelt, elected in 1901, moved to break up the monopolies. John D Rockefeller’s Standard Oil was split into 34 separate companies, including the predecessors of Exxon, BP and Chevron.

What’s stopping us from doing this today?

We need to convince billionaires that contributing to an equitable and harmonious society is as pleasurable as earning a lot of money.

The Danger to Democracy

Finally, are billionaires a threat to democracy?

Both Trump and Biden raised a substantial part of their campaign contributions from billionaires. Apparently the total cost of the 2020 election was close to $14 billion, making it the most expensive election in history and twice as expensive as the previous presidential election cycle! The Institute for Political Innovation points out: although people tend to think of the American political system as a public institution based on high-minded principles, it’s not. Politics behaves according to the same kinds of incentives and forces that shape competition in any private industry. Katherine Gehl and Michael Porter sound the alarm, and make suggestions on what can be done to unrig our political system.

Rebecca Henderson points out that in the U.S. and the UK, only around 30% of the youngest voters feel that it is “essential” to live in a democracy, compared with upwards of three-quarters of voters born before WWII.

She explains:

If government is the counterweight to the free market, democracy is the force that ensures that governments do not devolve into tyranny, seizing control of the markets in the process. I believe that strengthening democracy is the only way to ensure the widespread survival of free-market capitalism, and with it the prosperity and opportunity that has changed the lives of billions of people. It’s also the only way to tackle the world’s biggest threats, from global warming to inequality. Business has the resources, political power, incentives, and responsibility to make significant progress in this endeavor. Indeed, it has widespread support. People today report trusting their employer more than the government or the media, and a recent global survey finds that 71% of respondents believe that “it is critically important for my CEO to respond to these challenging times.”

So, the final outcome of this debate is political. And that is not always, as history has taught us, a pleasant outcome.

Studies show that as income inequality grows, so does social unrest and populism. The threat of fascism increases exponentially.

It’s time to come to our senses as a society, and put a stop to this unbalanced economic system. Times of crises call out for public leadership in service of the Common Good. Absent that leadership, businesses have a responsibility to not be silent, and more importantly, to act.

In a Democracy, that means all of us, billionaires, businesses, and citizens, must act in a transparent way to:

- ensure the public is given access to the truth, and protected from misinformation and “alternative facts.”

- ensure elections will be fair and free (without the imposition of poll taxes, and other suppression techniques)

- promote policies for the Common Good, instead of tax-breaks that serve narrow, special interests.

In short, businesses should support Democracy, and protect society from corruption. Without this basic understanding, we will see a government, institutions, and markets that are no longer trusted by the consumer or the citizen. We will be unable to react to other, more difficult, challenges, and the government of the people, by the people, and for the people will perish from this Earth.

If you’re a billionaire, ask yourself: what kind of world do I want to leave to my children?

The rest of us should ask ourselves this question as well. Our time as humans on this planet is almost up. Who will lead us?

Ohhh, nifty topic. Thank you!

Sorry for the late comment, but I must take issue with the “Wicked 7” Chart. It’s been bugging me.

Population & Migration is in fact the rhizome from which the other 6 “wicked problems” emerge and infest our existence. None of the others would present existential risks — nor likely even exist — but for human over-population exceeding the carrying-capacity of Planet Earth. The human population has trebled since I was conceived in the mid-1950’s.

Neither capitalism nor democracy can solve over-population. In fact, they are the causes. Hoarding and greed are also the inevitable capitalistic and democratic response to over-population. Only a secular and humanistic socialism can place the appropriate value on lives in being that might slow-down growth and distribute — and redistribute — resources in such a way that most people may live the best material life attainable, and not just a few billionaires.

Good topic, yes, and mostly interestingly handled. But I have to sort of disagree with 2 things in particular:

First, even mbillionaires who think they have the world’s interest at heart tend to make notoriously bad choices about what to spend money on, and their money and power make any feedback systems weak and ineffective. That is, they don’t listen to others, except people like themselves, because they don’t have to. Their money, surrounding themselves with sycophants, and society’s values all turn all of us into sycophants.

Second, I have an alternate crisis model: Our problem is the 3 Cs:

Climate and the larger ecological crisis;

Corporations and inequality leading to fascism;

The failure of the US Constitution and the rule of law (caused by corporations and inequality).

Add Coronavirus and make it 4 if you want, although it’s only a crisis of its current proportions because of the corrosive effects inequality and corporations have had on our society.

All except the virus are caused by a complex psychological condition that can be summarized as Wetiko disease, aka malignant egophrenia (Paul Levy, author of Dispelling Wetiko). Call it an attachment disorder, malignant narcissism, trauma-triggered addiction… it’s all of those. I think of it as civilizational autism.

Seeing Wetiko: on Capitalism, Mind Viruses, and Antidotes for a World in Transition

https://www.filmsforaction.org/articles/seeing-wetiko-on-capitalism-mind-viruses-and-antidotes-for-a-world-in-transition/

WOW! Haven’t read much of it, but he really lays it out!

Past a few hundred million, money is something different. Basically it’s power. Below about 30,000 money is survival. You don’t have much slack at all. The next hundred million or so, money is spending money. You buy all these things you want. After about 100 million you have more money than you can spend so money is power. You can hire as many people as you want to do your bidding. If you have enough money your shadow last for a century like the Rockefeller foundation for example, what is the Ford foundation or the Carnegie foundation etc. And that kind of power can be used to simply notify everyone else’s power, Including the power of government.

So yes, billionaires destroy democracy.

There’s a book “Billionaires and Stealth Politics”. The author goes through a list of the richest people in America and figures out what they can about their politics. Most of them are rather secretive, and most of them who is politics can be known our flatly right wing.The famous liberal billionaires are about three: Soros, Buffet, and Gates. Few of them seem to have any serious social concerns at all.So I’m pessimistic about the premise of this piece recruiting billionaires to good causes etc.

That does seem to be Bono’s program though.

One could make the argument that they “earned” it so they should keep it. In any large organization however, most of the work is done by employees. The lines of who truly deserves x amount are rather blurred and so pay is determined through a lot of factors. The billionaires are the ones who control the money most though and so on down the ladder. Greed generally leaves everyone on the way down trying to hold on to as much as possible for themselves. People at the bottom are always left with the take it or leave it option, usually ensuring (especially in weak labor markets) that their employer is likely to extract significant value from them (depending on industry, but this is definitely the case in monopolies and relative monopolies, especially in capital intensive industries with high barriers to entry). At the very least, even if people are going to say “they earned it” then their children who did not earn it should not be inheriting the wealth. Increase the estate tax to 90% over $3 million I say. Make them spend their earnings or donate them before they die. If zuckerberg is so full of himself I expect him to erect a 500ft statue of himself in Idaho before he kicks the bucket.

What people brainwashed by neoliberal culture don’t understand is that great wealth (beyond what you create with your own hands) is made possible only by the functioning society of people in which you live. Hard work plus a good idea come to nothing without the infrastructure of society and the legal structure of the state. The society that enables wealth therefore has a claim on a significant portion of that wealth.

Thank you.

I’ll note that the rich are, by definition, the most so-called “credit worthy.”

Fine, that’s unavoidable but why should we subsidize them via government privileges for private credit creation?

Because those privileges allow us to steal too, from those less creditworthy than ourselves? With only the poorest being pure victims of the system?

So don’t complain about billionaires if you favor government privileges for the banks.

That said, unless the system is changed, I too will loot the poorer when it comes time to buy a home – I don’t support the system and I’m trying to abolish it but continual rent increases and the loss of freedom of apartment living has become intolerable.

Many good points in this piece, but the fact that great wealth and income inequality are corrosive to the common good and destructive of “democracy” should be (and is) reason enough to tax away obscene and even just excessive income.

It’s too bad that the authors don’t divulge that government spending precedes taxing and borrowing. Is it possible they don’t know that taxes are not needed to fund federal government programs?

And of course my interest in saving “free market capitalism” is nil. It’s always going to annihilate democracy and the common good one way or another.

I agree. This piece was well intended. But haven’t we always been? I’d just submit that we do not have a democracy (clearly this has become a difficult illusion to maintain) and we do not have the kind of capitalism that we remember and idealize. We have hit the wall on both ideals. Capitalism can’t make an easy profit anymore so it now financializes everything and externalizes the costs. As a result the planet has been completely trashed in an effort to service all the debt and feed the starving, and there isn’t anything left to grab. Without the profit motive nobody is gonna do all that work. Without a job or a really good deal on prices nobody is gonna buy all that crap. And without “consumers” and “consumerism” capitalism is a dead duck. And now we are globally so overpopulated that the planet is literally dying in all of our waste. Nobody wants to have a pogrom. Right? That leaves only discipline. And discipline leaves out profiteering. And this post is merely whistling past the graveyard.

As a public school teacher who directly experienced the corruption, incompetence and viciousness of so-called education reform, most of it coming from tax-exempt vehicles for billionaires, I’d strongly urge that any and all efforts be made to redistribute their often ill-gotten or parasitic wealth. Their self-styled philanthropy is almost always a means of expanding their fortunes and power, and comes nowhere near compensating for the harm they otherwise do, merely by existing.

If there’s ever to be a serious Left in this country, it can prove its mettle with a frontal assault against the non-profit/philanthropic complex. It’s another reason why the importance of unions, as self-financing working class institutions, cannot be overstated.

Something else Andrew Carnegie helped create: https://en.wikipedia.org/wiki/Teachers_Insurance_and_Annuity_Association_of_America

TIAA states it is for-profit.

“The task is how to create a better education and better skills in people so that they can create value for others and get paid for the value they create.”

Really? This is the task?

I’ve seen this movie before, and I know how it turns out.

Am I right in assuming this is a trick question?

I think it was a typo, “Did Billionaires Destroy Democracy and Capitalism?” seems correct at this point.

Zuckerberg is partly right – some billionaires are simply “people who do really good things and kind of help a lot of other people. And you get well compensated for that.” That statement advances the argument that billionaires “earn” their billions and improve life for the common person. Most billionaires probably do earn their first 100 million or so, but after that, their inner vulture emerges. Rep. Ocasio-Cortez reminds us that; “You do not make a billion dollars; you TAKE a billion dollars.” Most often, by lying, cheating, and stealling.

Some billionaires like George Soros actually do a lot of good things for strangers with their billions. However, the vast majority of philanthropy is merely an attempt at atonement by the few who dared to look at their Dorian Grey portraits in the attic. Nobody can spend a billion dollars – just swap it for more billions. We can all remember a time not so long ago when a millionaire was considered rich! Today, you only need a net worth of more than $10 million to be at the top of the 1%. An order of magnitude greater ($100M) is still far-far short of a measly billion. You need a second order of magnitude for that.

“100 million” is the cut off point?

Seriously?

I find this a little troubling as too much of the post focuses on taxes. One can think of taxes as a proxy for government policy oriented to the super rich, but I think so much more is going on. They use their wealth as power to change many other things.

That said, until someone starts selling a comprehensive program not much will change.

Many good points in this article, but one inaccuracy.

The Swedes do not get their economic-security state by taxing billionaires. Nor can America. The welfare state is built on taxing everyone from the middle class on up.

Even if we taxed American billionaires at 90% of income, we would collect less than $1 trillion of tax revenue. That would not pay for Medicare for all, or free college, or more generous unemployment benefits, unless supplemented by sales and income taxes on the middle class.

Bob,

A correction I’d like to make to your list re Medicare for all. The US pays about 6 to 7 percentage points of GDP more than any other developed country for healthcare (doctors, hospitals, drugs). The implementation of high quality universal public healthcare in the US would require a DECREASE in taxes not to cause a recession. No sales or income tax increases would be necessary. Of course the vast amounts of money saved could fund, at least in part, universal childcare, eldercare, education, etc., avoiding the need for a decrease in taxes.

This is a key issue. Advocates of Med4All often say that it will cost less overall, and they are probably right.

But the cost to the government has got to go up, it seems to me.

Right now, we collect about $300 billion a year for Medicare Part A, and we effectively collect about $900 billion in income taxes for Medicare Part B and Medicaid. Part of the Medicaid dollars come from states.

You seem to be saying that we can provide Med4All for less than $1.2 trillion per year, which would enable a tax cut.

$1.2 trillion for the whole country would be about $4,000 per person.

I do not think that is a realistic amount, when you factor in older persons. Medicare alone costs over $11,000 per enrollee, and Medicare pays pretty low rates to providers.

One can argue that higher taxes for Med4All is better than private insurance premiums. I can listen to that. But not a tax cut,

I mean, you also forgot that taxes do not directly fund spending. MMT is a thing.

This is a left-pocket, right pocket issue.

At the worst, if one insisted on recouping all M4A spending via taxes, most people would see an increase in their bank accounts due to any increase in taxes being more than offset by decreases in insurance payments and unreimbursed medical costs.

Taxes paid to government could be called “govertaxes”.

Taxes paid to private insurance companies could be called “privataxes”. Currently they are called “premiums”.

If one single CanadaCare for Americans program were legislated and then engineered into existence, and private health insurance companies were incinerated ( no more receptacles for “privataxes” (premiums) to go into, the amount of privataxes would go down by more than what govertaxes would go up by.

I think that Canada spends 5k per person, so I would agree that 4k is low, but it’s not out of the ballpark. US government spends 4.2k per person now(pre-COVID), so a slight tax cut is theoretically possible, but I agree unlikely. But since we spend 6k privately on top of that(not counting time and headaches) there is plenty of room for savings.

Whether replacing the current healthcare system with a more efficient public one would be recessionary rather depends on what people do what all that money they aren’t spending on healthcare. Even if you taxed people enough to offset the cost, if it really was more efficient then they would still have some discretionary income left over. The question would then become: what do they spend it on, and is it enough to counteract the loss of GDP from cutting the inefficiencies in healthcare that accounted for that extra spending? If they all stashed it under their pillows then yes, it would be a recessionary change – but if they spent it on starting small businesses, supporting the local economy and the like, it could well have the reverse effect.

I do agree that managing economic cycles rather than balancing the budget should be the primary consideration. The point of taxing billionaires more isn’t to fund social programs – it’s to reduce inequality.

Would most Americans be better off if we paid for health care through taxes, rather than through insurance premiums and out-of-pocket charges?

It depends on the size of new taxes. An income tax of 8% would provoke much opposition from households earning more than $200,000, and households with very cheap insurance through TriCare, or a generous employer, or a very strong union.

This comes to well over 15 million households. I am not sure we can pass Med4All with that much opposition.

If the amount now being spent on their insurance policies by their employers or for TriCare would put toward that MFA tax increase most of those 15 million households would not see any increase.

And yes that should be a requirement.

And as Yves points out once they do not have copays and deductibles a majority would see a savings.

How can one conceivably enforce that sort of requirement? Only strong unions can force employers to open their books and indeed transfer insurance premium money into wages. The government totally lacks the manpower to check up on every larger employer.

Taxes don’t “fund” federal spending. This has been known since the ‘40s (see Beardsley Ruml).

The purpose of taxation is to give the fiat currency value, to modify public behaviour, and in the case of the very rich, to prevent the danger that plutocracy poses to democracy.

Isn’t the World Economic Forum the club of billionaires trying to shape the world?

“Will the billionaires agree to higher taxes?”

Isn’t that a bit like wondering whether bank robbers or any thief or fraud will agree to being arrested, tried and found guilty of criminal activity? Of course they won’t agree. Their agreement or disagreement is beside the point. All that matters is the law.

Wealth strongly selects for sociopathy.

Agree, seems obvious from displayed behaviors.

T.

Andrew Ross Sorkin was hosting a panel from Vanity Fair (Graydon Carter, Michael Lewis, Bethany McLean to name a few) to discuss the crash of 2008-2009. (Sorkin’s book “Too Big to Fail” had just been published.) Toward the end of the event, they turned to the live audience for questions. To everyone’s surprise, John Mack, CEO and Chairman of the Board of Morgan Stanley at the time, stood up and said five words that I will never forget. He calmly said to the panel and to those in attendance, “You have to stop us.” Still gives me chills. They will forfeit absolutely nothing for the common good unless they are forced to do so.

Just yesterday discussing this very topic with friends. My thesis: billionaires are indeed a threat. We as a nation have been foolish to allow these mega fortunes to grow unchecked. Too much power to a few (un-elected) individuals – I was imagining a grumpy billionaire deciding to do something fiendish like corner the market – not on some commodity (Like the Hunt brothers tried with silver ) but antique violins or guitars then locking them all away – or even burning them. Nothing we could do about it. Nothing.

Tax em’ more? Jail em’ more (such as Steve Cohen – proud new owner of the Mets?

One idea: have some formula that when a company goes public the CEO/founder can only grab a certain % of the shares.

With most of the Supreme Court living with the heads up their Neo 18th century butts – I fear any proposal shot down. Not to mention our Senate/Congress.

It is disconcerting that Mark Zuckerberg – CEO of a glorified App – and a bunch of servers has accumulated $70 billion. Property rights? I assume our reps in DC will ultimately just prostate themselves again before the clever young tycoon.

Isn’t that so weird? A billionaire could track down every Stradivarius in existence, burn all of them in his living room fireplace, and not see even a single thing change in his life. A rounding, well not error, but a rounding error sized adjustment to his wealth.

Good grief.

Okay, I feel like I’m reading a David Brooks article. Hides more than the truth it tells. I’m seriously sick of the Republican / Democratic framing. If we the people can’t get past that then we’ll never take a serious look at the billionaires and what they are doing.

The article does not support the title. It doesn’t even support it’s stated thesis which is that billionaires could become a force for good? It just bounces from one topic to another. Some good data but a lot of platitudes. Seems to think spending is dependent on taxes and that the purpose of taxes is to fund something. I also call BS on the “good” v. “bad” billionaire labels since there’s no stated criteria other than apparently PR management used to judge / use said labels.

Since I’m not a billionaire, the question I’ll be asking myself is what can I do to protect my family and my community from policies wrought by the global elites of which the billionaires have the greatest number of votes as they pertain to the voting faction represented by western derived / created capitalism.

I haven’t dug into the details, but reports say that MacKenzie Scott (ex-Bezos) has given away over $4BN so far. Assuming it’s going to meaningful causes and is not just tax avoidance, this puts pretty much everyone else to shame…

“Mackenzie Scott … has given away over 4bn dollars…”

It’s not his money to disburse. If I mug you, take your wallet and then give some of the contents to a passing beggar would you be impressed by my generosity?

She’s a her, she got her money by being married to Bezos, which isn’t theft but is family money, like 60% of the wealth income in America. You can say that it isn’t hers to disperse, but it legally is, and she is trying to do some good with it. Society can theoretically claim ownership of everything and everyone, but as Margaret Thatcher said, there is no such thing as Society, it’s represented by the government, which is headed by Trump. I trust him far less than I do MacKenzie. I agree that we should work for a fairer and more just society, but inaccurately demonizing well meaning house(ex)wives isn’t useful in that, I don’t think.

Billionaires are the greediest in the room, not necessarily the smartest. We have ceded planning and government goal setting to them and their corporate commisars. They have no interest in what is best for the majority of the population. Following neoliberal principles, they see government as profit center and resource extraction for personal benefit. They should be taxed to reduce their power. Seeing those taxes as necessary for redistribution to the littles is false.

China allows billionaires but it appears that the Party will not cede power to them. They understand about the removal of the “mandate of heaven” when the people are not considered. The Party in China allows and harnesses the capitalist’s greed for the benefit of the whole. It will be interesting to see if the Party in China can avoid being bought the way our democracy has.

Most billionaires expect to exercise the power they think their money buys. That will work until it fails.

It will be interesting to see if the Party in China can avoid being bought the way our democracy has. John

Currently, the banks in the US hold our economy hostage via a single payment system that must work through them or not at all.

So no buying politicians is needed – just threaten the shutdown of the economy.

Though I note that China is (potentially) bypassing private banks by introducing Central Bank Digital Currency.

A lot of dancing around something Marx figured out in 1867. Yes billionaires destroy capitalism, but they are endemic to it, and capitalism destroys itself.

Democracy is already dead.

The 624 billionaires of the Capitalist class are completely in bed in with our national state structure and are able to protect themselves from excessive taxation because such capital, through access to highly paid and sophisticated lawyers, is continually able to use state power to protect its privileges.

For example, the metamorphosis of capital goes hand in hand with the legal privileging of certain assets (first land, and later financial assets and then intellectual property).

Equality before the law today means that a few (for example 624 billionaires) can continue to turn ordinary assets into capital simply through hiring the right lawyers.

By focusing solely on billionaires as being at the origins of inequality, corruption and war is to vastly simplify the apparatus of power that we face. And we haven’t even looked at our modern system of surveillance which intimately links the data of private monopoly power with the data of NSA bureaucrats.

Inedible. We’ve come to seize your berry, not to praise it.

I liked the idea of locking Gates, Musk, Bezos, Cook, and Dimon {what’s he doing in this class?] in a room for six months to come up with solutions.

Except he seems to be willing to let them out after the six months were up!

Capitalism precludes democracy–rule of/by/for the whole of the people, not just the 1% at the top. My understanding is that it is still the case that most people become very wealthy by inheriting it; it has naught to do with commercial legerdemain, shrewd stock picks, or anything else of the sort. Capitalism is as useful as was feudalism, which is resembles all too much in its abrupt divide of the cream from the manure that feeds the American Beauty Rose (cf. Rockefeller).

Nothing will change unless it is made illegal to give money to elected officials – ever! And that includes corporations.

Two thousand years ago a man named Jesus said; “No one can serve two masters. Either you will hate the one and love the other…….. .”

Or the allowable limit to elected officials being extremely low. Or money just put in an overall account for all candidates. That seems unlikely for the foreseeable future.

There was not even restrictions put on ratings agency’s from shopping around to rate bonds. There’s a situation that blew up by 2008 when junk bonds rated too high helped crash those mortgage securities. So what amends did the regulators make since then? As I understand it – the system is still the same – an honor system.

Like the honor system that all billionaires will be good.

The billionaire class have not formed a cabal bent on destroying humanity, but they’re not motivated to save our asses either, which I doubt that they could. We’ll have to do that ourselves.

I like the idea of closing the deferred income loophole. That however will require the cooperation of our politicians, who are not inclined to bite the hands feeding their campaigns for re-election. I’m not in favor of killing all the lawyers, but I could look the other way while hundreds of lobbyists were wiped from the face of the Earth.

Maybe add people trying to achieve that status! And many others who walk over the backs of others to get further up the ladder!

YES.

Get rid of them.

The globalists found just the economics they were looking for.

The USP of neoclassical economics – It concentrates wealth.

Let’s use it for globalisation.

Mariner Eccles, FED chair 1934 – 48, observed what the capital accumulation of neoclassical economics did to the US economy in the 1920s.

“a giant suction pump had by 1929 to 1930 drawn into a few hands an increasing proportion of currently produced wealth. This served then as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied themselves the kind of effective demand for their products which would justify reinvestment of the capital accumulation in new plants. In consequence as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When the credit ran out, the game stopped”

This is what it’s supposed to be like.

A few people have all the money and everyone else gets by on debt.

Einstein’s definition of madness “Doing the same thing again and again and expecting to get a different result”

See what you mean, Albert.

Is that why Keynes added some redistribution?

Yes, it stopped all the wealth concentrating at the top.

Not dodgy, old, 1920’s neoclassical economics!

The economics of globalisation has always had an Achilles’ heel.

The 1920s roared with debt based consumption and speculation until it all tipped over into the debt deflation of the Great Depression. No one realised the problems that were building up in the economy as they used an economics that doesn’t look at debt, neoclassical economics.

Not considering private debt is the Achilles’ heel of neoclassical economics.

What could possibly go wrong?

The inevitable.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

No one realises the problems that are building up in the economy as they use an economics that doesn’t look at debt, neoclassical economics.

1929 – US

1991 – Japan

2008 – US, UK and Euro-zone

The PBoC saw the Chinese Minsky Moment coming and you can too by looking at the chart above.

The Chinese were lucky; it was very late in the day.

Wait till the Americans realise they have been repeating the economic mistakes of the 1920s.

As a CEO, I can use the company’s money to do share buybacks, to boost the share price; get my bonus and top dollar for my shares.

What is there not to like?

Share buybacks were found to be a cause of the 1929 crash and made illegal in the 1930s.

What lifted US stocks to 1929 levels in 1929?

Margin lending and share buybacks.

What lifted US stocks to 1929 levels in 2019?

Margin lending and share buybacks.

A former US congressman has been looking at the data.

https://www.youtube.com/watch?v=7zu3SgXx3q4

“The Great Crash 1929” John Kenneth Galbraith

“By early 1929, loans from these non-banking sources were approximately equal to those from the banks. Later they became much greater. The Federal Reserve Authorities took it for granted that they had no influence over these funds”

He’s talking about “shadow banking”.

They couldn’t control the lending from shadow banks in the 1920s either.

They thought leverage was great before 1929; they saw what happened when it worked in reverse after 1929.

Leverage acts like a multiplier.

It multiplies profits on the way up.

It multiplies losses on the way down.

Today’s bankers seem to have learnt something from past mistakes.

They took the multiplied profits on the way up.

Taxpayers picked up the multiplied losses on the way down.

….. etc ……

“Are billionaires a threat to democracy?”

Yes.

Capitalism’s Achilles’ heel is it does not limit greed. The filthy rich accumulate wealth, turn it into power, which is used to preserve and expand their wealth. Through “political contributions” the wealthy ensure that their interests are served first and foremost. Fortunes are now being spent on school board elections because they are so cheap for the filthy rich to buy, a few million dollars and voila.

Joe Biden is president because the wealthy decided that Bernie Sanders was completely unacceptable and could not be the Dem’s candidate.

The wealthy are deciding what to do with our money. This is in several ways. The primary way is that they are charging too much for their services. By overcharging us, they accumulate vast sums. Then, instead of us deciding what to do with our own money (the surplus) they get to decide. (This used to be a conservative cry “We know what to do with our money better than the government!” but it apparently doesn’t apply to corporations.) And if you look at Bill Gates track record, I would rather decide what to do myself.

Those getting filthy rich make enough money to pay their overhead, pay their debt service (if any), and their investors (if any) and then take the rest. That they have no personal needs that amount to even a tiny fraction of their wealth they play games giving it away. Realize that to spend $1,000,000,000 you would have to spend $532,000 per hour of every working day for an entire year. Set yourself a goal to see if you could plan to spend that much money on things you could actually use or benefit from.

And Jeff Bezos has been allowed to accumulate $187,000,000,000. I say allowed because “we the people” in form of our government has establish rules, norms, and laws governing his business. We built the infrastructure that is used by his business. We are not paid back for his use of all of that. So, again, he is “using” our money to his own ends, which have no checks and balances. He does as he wills, like cutting off employee’s healthcare coverage during a pandemic.

Yves, a bit of a tax question. I did taxes for awhile & had a few situations of transfer of ownership of a business where a spouse died or other reason. These were small (under $1 million) businesses. But what happened was the spouse got a step up in basis upon the death. Which is what confuses me.

Take the Detroit Lions football team. William Ford bought the team in 1963 for $6 million. He died in 2014 & his wife became owner. The team is now valued >$1 billion. Did Mrs. Ford pay an inheritance tax of 40% on that $1 billion? Not that we know. In fact, his will allowed William’s children to inherit the team as well.

Tax questions (in the simplest form. The org structure could be so convoluted that there is no direct Ford ownership). Did Mrs. Ford receive a step up in basis upon her husband’s death? If she was an owner, yes. Any tax on that $1 billion in inherited value increase has been lost. So now her basis is not $6 million, but $1 billion. If she were to sell, she may not face any tax consequence. It is in her family’s best interests to keep passing the ownership onto more family so they can continue to get a basis step up, thus completely avoiding tax on the growth in value. What if William’s will gave shares to grandchildren? There is little incentive for billionaires to sell their teams, unless they start suffering cash flow issues. Usually ownership is held in some sort of entity that offspring hold shares in. Sale of shares is permitted, but restricted amongst family members. The team remains with “the Ford Family”. And then only one member manages the team. Actually, Mrs. Ford (firestone, she was a child of the firestone tire company married to a grandson of Henry Ford’s auto company….) is known as sole owner. Then recently she handed ownership to her daughter. At another time in the past, Mrs. Ford’s son ran the team for awhile. This was just passing mgmt amongst the family, not ownership. In fact, the daughter most likely is in the same situation. She is just the manager & potentially due to tax issues, won’t become owner until the mom dies (another basis step up?).

So at some point, tax is going to come due but when? We have already lost millions in tax by lowering the rate on this sort of transaction. And lets not forget lost taxes that were used on such fine buildings as the Pontiac Silverdome. Built by the city for the football team, then abandoned by the team for another building built 50% by the city of Detroit (both financially solvent cities!). After 15 years of the eyesore it was torn down by the city (at city cost).

Sports teams are pets to billionaires. They should be targets of higher taxes, not lower (owners are billionaires buying a product that is valued at over a billion dollars).

Sorry to ramble.