By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

You guessed it: For over half of it, taxpayers are on the hook. Time to take a look.

The mortgage for “2 Cooper Square,” a 15-story luxury apartment tower with 143 units in the NoHo neighborhood of Manhattan, is now over 30 days delinquent, according to the Commercial Observer. In 2010, when the building opened, three-bedroom apartments sported asking rents “as high as $20,000 per month,” gushed the Wall Street Journal at the time. In 2012, the developer, Atlantic Development Group, sold the long-term leasehold in the building to Wafra Capital Partners in Kuwait for $134 million. In 2019, Wafra unloaded the leasehold to David Werner Real Estate and Emerald Equity for about $85 million – a loss of nearly $50 million, or about 37%.

At the time of the deal, David Werner and Emerald obtained a mortgage from Goldman Sachs of $65 million. The mortgage was securitized by Goldman Sachs in September 2019, along with mortgages on other commercial properties, into the commercial mortgage backed security GSMS 2019-GC42, where it represents 6.1% of the collateral.

And 15 months later, the mortgage is 30 days delinquent.

Occupancy plunged from 96% last year when it was securitized to 82% in the third quarter of 2020, according to a note by Trepp, which tracks and analyzes CMBS. Trepp notes that the loan has not yet been moved to the servicer’s watch list or the special servicer.

The other day, we discussed two luxury apartment towers whose occupancy rates had plunged into the 70% range during the Pandemic – the “New York by Gehry” in Manhattan whose mortgage had been moved to the servicer watch list, and the NEMA in San Francisco. But the mortgages on those properties were still marked as “current.”

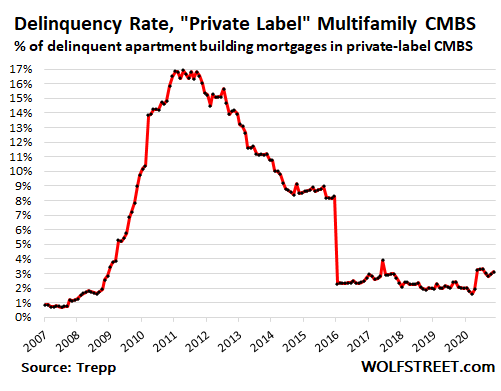

Overall, the delinquency rate for these multifamily “private label” CMBS loans – “private label” because they’re not backed by the government – has ticked up to 3.1% in November but is still relatively low compared to the blow-up during the 2009-2012 mortgage crisis when the delinquency rate reached 17% and stayed there for a year, and compared to current delinquency rates of hotel CMBS (19.7%) and mall CMBS (14.2%). More on that straight line south in a moment (delinquency data through November provided by Trepp):

That straight line south occurred in January 2016 when a delinquent $3-billion CMBS loan tied to Blackstone’s $5.3-billion purchase of Stuyvesant Town-Peter Cooper Village in Manhattan – a property with 110 apartment buildings on 80 acres with 11,250 apartments – was paid off.

So for now, landlords of apartment towers in the centers of large cities, afflicted by the renters’ exodus and plunging rents, and landlords anywhere afflicted by renters not making rent payments, protected by eviction bans, are still trying to make mortgage payments on their rental properties, hoping that the surge in vacancies and non-payment of rents are short-term phenomena and that people will come back and fill those apartments and that tenants will catch up with the rent.

But how much apartment building debt is there, and who holds it?

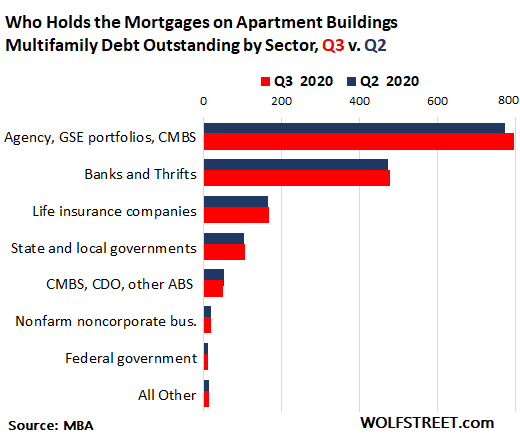

These “private label” CMBS and other private label securitizations only hold a small portion of the total commercial mortgages backed by apartment buildings.

The total amount of multifamily mortgages outstanding in Q3 was $1.65 trillion, up by $31 billion from Q2, according to the Q3 report this week by the Mortgage Bankers Association, based on data from the Fed’s Financial Accounts of the United States, the FDIC’s Quarterly Banking Profile, and Wells Fargo Securities.

The US government: $798 billion, or 48.4% of the $1.65 trillion in apartment building debt, is backed by the federal government through Government Sponsored Enterprises (GSEs), such as Fannie Mae and Freddie Mac, and government agencies such as Ginnie Mae, which securitized many of these loans into CMBS, and sold them to investors. The government is on the hook for losses. And the Fed has acquired $9.3 billion of these “Agency” CMBS.

Banks and thrifts: $478 billion or 29% of the multifamily debt is held by banks and thrifts. The Fed has pointed out in the past that some regional and smaller banks are heavily concentrated on commercial mortgages, and that for these specific banks, a downturn in commercial real estate would pose a significant risk.

Life insurance companies hold $168 billion or 10.2% of this multifamily mortgage debt.

State and local governments hold $108 billion or 6.5% of this debt in pension funds and the like. This ultimately also sits on the backs of taxpayers.

Private label CMBS, collateralized debt obligations (CDOs), and other asset-backed securities only hold $52 billion, or 3.1% of this $1.65 trillion in apartment building debt.

The chart shows holdings by sector, red for Q3 and blue for Q2 (data from the MBA):

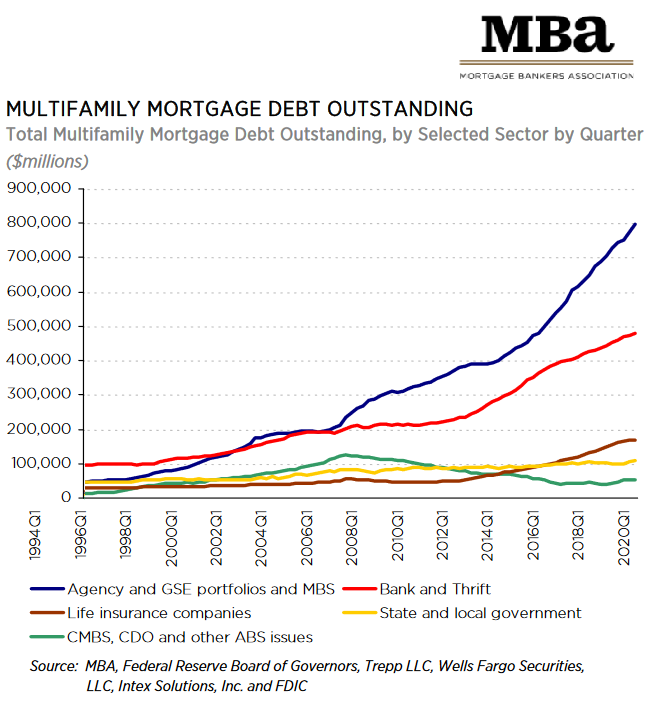

The US government started barreling into multifamily debt during the Financial Crisis. Until then, government-backed multifamily debt was about on par with the holdings of banks and thrifts. Since then, the government’s share (blue line in the chart below) has shot up to nearly 50%.

Banks and thrifts have remained active, and their total holdings grew over the years (red line), but their share declined, as the government’s share surged.

Private label multifamily CMBS (green line), which blew up royally during the Financial Crisis and since then had to compete with government-backed entities, are down by about half from their heyday before the Financial Crisis and dropped again in Q3 from Q2 (chart via the MBA, click to enlarge):

The federal government is guaranteeing nearly half of the multifamily debt outstanding. With state and local government holdings included, taxpayers are ultimately on the hook for $906 billion, or 55%, of it. So if this debt begins to topple in a serious way, it’s the GSEs and agencies that take a big part of the licking, even on CMBS that they sold to investors.

The good thing is that, in terms of commercial real estate, the GSEs and agencies are limited to multifamily commercial debt and they don’t work with mall loans and hotel loans, whose losses are now accruing to investors and institutions around the world.

Time for public housing Austria or Singapore style? Looks like we’re already halfway there in terms of owning the debt….

JFYI, Nixon started a moratorium on building federal affordable housing. Then, later, as Reagan was cutting the top marginal taxes, he also cut HUD’s spending on affordable housing by 75%.

Between Reagan and Bush 41, payroll taxes increased eight-fold, too.

Gosh, I wonder why we have such banana-republic income/wealth inequality and an affordable housing crisis…

You need to remember that the Faircloth ammendment, inserted by then Senator Duncan McLauchlin “Lauch” Faircloth in 1998 prohibits any expansion of public housing.

But then, that was recently repealed. https://www.commondreams.org/news/2020/07/02/fair-housing-advocates-celebrate-passage-aocs-repeal-faircloth-amendment

Ain’t nobody gonna stop us now.

Interesting thought. If “we” own the debt/mortgages/etc.; “we” might end up owning the housing. And “we” could, if “we” wanted, turn it into break-even low and moderate income/wealth housing.

A “paltry” $1.65 trillion?

Compared to the FED’s pandemic debt orgy, tis nothing.

Just another broken glass rev up the economy moment.

And … besdes … think of the millions who don’t have to make rent payments.

What could go wrong?

Let me fix one of your sentences:

“think of the millions who CAN’T make rent payments.”

That works.

Multi family units are on a tear. It’s the construction boom of the century. My question isn’t why are we now subsidizing housing or even why aren’t we admitting we are subsidizing it – it was inevitable – but why did we allow a glut of “luxury high rise condos” to be built over the last decade. Just to help absorb up all that frivolous cash? I know – let’s use the taxpayer!

It doesn’t help that we have homelessness in this country when like 8% of the existing housing units we have aren’t even being used. And that’s using data from last year. With the upcoming evictions crisis that statistic may get even worse.

See my comment above about Nixon and Reagan’s (non)commitment to affordable housing. This has been going on for some time now. Also see How Public Housing Was Destined to Fail (a previous link from NC, if memory serves)

An MMT reminder: taxes don’t provision federal programs. They can’t. Where would people get the dollars to pay taxes if government didn’t spend them out into the economy first? Alone in the economy, the federal government is only constrained by resource shortages, not shortages of dollars.

Which means homelessness and joblessness are explicit choices, not the product of dollar shortages. (San Francisco has five times the number of its homeless in vacant houses, for just one example…no resource shortage there!).

A “paltry” $1.65 trillion?

Still, that happens to be close to the total student debt in the U.S. last I looked.

Interesting. A lot of ‘if it can’t go on, it won’t go on’ processes in the U.S. coming to a head.

Sure, they created $28-29 trillion in the years after after the GFC to save the banks, but those among TPTB pushing for a ‘return to normal’ after vaccinations will have increasingly less runway to work with in 2021 onwards.

If things continue as they have we may need to revise the old saying: “A billion here, a billion there, pretty soon, you’re talking real money.”

Good grief, Is there ANYTHING that the Federal Government not on the hook for in some way in this economy?

I like how in Economics courses they essentially never mention the government, as if it doesn’t exist and the rest of the economy occurs naturally without any government involvement whatsoever.

I like how the Federal Government, occurs naturally, without any Economics involvement whatsoever.

Take a look at this Wikipedia article about government spending.

Note that, although federal spending is often criticized as at “drunken sailor” level, it’s really quite low. The source for the table at the bottom of the article is Heritage and the Wall Street Journal–so not exactly tree huggers, yet these sources report the U.S. has relatively modest spending as a percentage of GDP–between Argentina and Malta. If you remove roughly 10% of that spending to normalize military spending (still three times more than China), then the U.S. spends roughly what Cambodia does, as a percentage of GDP. (Note: clicking on the table headers sorts on that column). Gosh, I wonder why we have third world infrastructure!

You might also pay attention to the “Heterodox Economics disagrees” section of the narrative. It thoroughly debunks orthodox economist’s contention that federal spending “crowds out” private sector access to resources.

No. It’s the economy of thievery. Family housing – 20k/mo. Huh. There are people who can’t pay their rent, and there are evictions that are a little crazy, because I don’t know who’s got resources to rent their units.

I’m not an economist, as I’ve explained, and much of this goes over my head, but this one, not so much. Ultimately it appears the working stiffs bail out the class of the few that receive giant tax breaks (or corporate welfare) when things go to hell – or not. The government exists to be raided. Is this this mortgage model any different?

So yeah. Get people that need housing in these vacant monstrosities. (And convert dead retail malls…)

And here I’ve been worried about my ongoing, motel-to-motel difficulty geting a new place to rent with no recent rental history and low credit score! I forgot I ALREADY had a piece of tens of thousands of places to live! My bad.

Great article.

Good article so far, but it’s incomplete. I checked Wolf’s web site and there are several additional paragraphs including the chart referred to in the last sentence of the post.

This is the remainder of the text of the original post. The chart wouldn’t copy and paste and I don’t know anything about embedding.

Sorry! Fixed now. We had a problem last time by only partly deleting some ad code, which meant the ad didn’t show but for readers using Chrome, they couldn’t see anything after the remnant code. Now this. Apologies.

I had a crazy thought reading this post. I began to wonder whether the large lump exchanges detailed for “2 Cooper Square,” used as an exemplar represent the history of an investments or a history of payments and settlements between Big Money players with the US Government acting as ‘Bank’ and as one of the players. How do Big Money players exchange huge amounts of money without alarming the Populace to the bribes and payoffs?

I had another crazy paranoid thought. How much method lies in the otherwise mad actions of the Government? What is the ‘Plan’ and what is the place of the Populace in that Plan?

The last I looked, the various GSE organizations were responsible for a huge percentage of both residential and commercial backed mortgage securities, being historically, both the creators and buyers of such instruments.

Private big money players have, in turn, been successful in converting their privately created debt assets (through securitization) into tradable form (tranches) that can then be converted, if necessary, into state money on demand.

Public (GSE’s) and private capital organizations are both responsible for hoodwinking the public–with the national state becoming extremely comfortable with the process of converting private mortgage debt into state money.

Well, we do have a homeless problem.

That is a deliberate choice. It’s part of “labor discipline”–that is, sending the message to the population that they had better take whatever crappy job is on offer, or suffer the indignities of poverty, even homelessness and starvation…and if they’re extra ornery, we’ll put them in a cage. The U.S. is the current world champ in caging people–five times the world average per-capita figure, seven times the demographically identical Canadian incarceration rate. So…is Canadian crime much higher than U.S. crime. Nope. About the same. Incarceration doesn’t prevent crime. It’s for labor discipline and nothing else.

Adam Eran: It’s for labor discipline and nothing else.

No. It’s very much about the benjamins, too.

https://www.sentencingproject.org/publications/capitalizing-on-mass-incarceration-u-s-growth-in-private-prisons/

It’s a growth industry. In some rural areas, prison guard jobs are the only good jobs around. Is this a great country or is this a great country?

Adam,

You are right, the only constraint is inflation which definitely does not exist in our demand constrained economy. Capacity utilization is also below the level necessary to generate inflation. Employment is also, of course, too low. In fact, central banks worldwide have failed to even deliberately increase inflation to a target rate of 2% The Federal Reserve even announced that inflation, and unemployment is so low that the static target rate has been abandoned in favor of an average rate.

In this environment, trillions of dollars can easily be absorbed by the economy. Like in the great recession, Republicans are obstructing sufficient fiscal side relief necessary to contain economic contraction.

I elaborate on neoprogressiveargument.blogspot.com

A) Taxpayer liability for the soundness of mortgages owned by states and local governments is limited to the taxpayers of those states. Thus, some taxpayer populations are likely more encumbered than others.

B) I’m ranked a little above “clueless” when it comes to understanding the debt side of the U.S. financial sector, but I have a couple of questions …

1) Was the Fed’s action to buy agency MBS a short-term (“provide market liquidity”) or a long term (“indirectly monetize Treasury spending under TARP or TARP-like interventions”) measure?

2) What does it mean for the Fed to own an MBS? That is, nominally the MBS is a quasi-bond asset on the Fed’s “balance sheet” whose value can be marked to market for accounting purposes but whose cash flow is also guaranteed (in theory) by the Treasury Department. (But will the Fed later monetize the funds needed by Treasury to honor a crashed MBS’s cash flows due to the Fed being the MBS owner? Seems to be a meaningless transaction, thus my Question #3. ) For today’s Fed to be described as having a “balance sheet” does not comport with what I, probably quite imperfectly, learned about the Fed decades ago in B school.

3) For the agency MBS presently owned by the Fed, especially for those bought during the TARP period at “above-market prices,” will those instruments ever have a different owner? That is, what would lead any bank or institutional investor to want to own those instruments in the future? If those instruments can only decline in price in the future, then purchase by the Fed to “detoxify” that debt has also effectively “zombified” (as opposed to “retired”) that debt? That is, it is debt whose existence led to the Fed inflating U.S. currency by another 1+ trillion dollars. For Wall Street, that’s a good gig, but at some point the rest of the world will say “no mas.”

These questions came to me after reading two brief notices:

https://www.reit.com/news/blog/market-commentary/mortgage-reits-cmbs-markets-and-fed

https://www.investopedia.com/terms/a/agency-mbs-purchase.asp

One thing not mentioned here is the cost of building subsidized or affordable housing. In places of California, it is 30-100% greater than building a normal Single Family Residence (SFR) or a Multi-family unit. In the Central Valley area, the cost has been over $450,000 to renovate or build new one multi-family unit, whereas the normal market rate of an existing SFR has been $350,000. The cost is so high due to all the requirements imposed such as LEED certification, Prevailing Wage Labor (unions) and loaded lender/builder fees. Often times the land contributed has a value of almost $0 as the builders are required to have a % of the units be affordable (85% of market price and 65% of market price) with deed restrictions placed for future affordable pricing. Lastly, with the restrictions on where these properties can be built via Nimbyism or governmental regulations, causes less to be built. Example of governmental regulation, is forcing a builder go through a full General Plan Amendment which could take up to 5 years, with added EIR which adds another 1 year. So with this, if the builders/developers could build these units without all the imposed regulations, they could be produced faster and at a better cost. Thus, more affordable units in the market.

Watch the next big building craze. Homebuilders and others will be building SFR subdivisions, not selling houses, but instead holding as rentals. Basically apartments with personal land to use, not a balcony.