Yves here. This piece provides a solid, high-level discussions of what to do about the long-festering banking mess in Europe (see Nick Corbishley last week on Italian banks, for instance). Not surprisingly, the authors deem the approaches best able to remedy the problems as least likely to get done.

By Arnoud Boot, Professor of Corporate Finance and Financial Markets, University of Amsterdam; Elena Carletti, Professor of Finance, Bocconi University; Hans‐Helmut Kotz, Resident Fellow, Center for European Studies and Visiting Professor of Economics, Harvard University; Jan Pieter Krahnen, Professor of Finance, Goethe University Frankfurt; Loriana Pelizzon, Professor of Law and Finance, Goethe University Frankfurt and Senior Researcher, SAFE; Marti Subrahmanyam, Charles E. Merrill Professor of Finance, Economics and International Business, Stern School of Business, New York University. Originally published at VoxEU

Covid-19 has placed renewed pressure on the European banking sector as firms and households struggle to meet the costs imposed by the pandemic. This column provides a comparative assessment of the various policy responses to strengthen banks in light of the crisis. While the authors do not make a specific final recommendation, they review the different options suggested within current research and provide a criteria-based framework for policymakers to guide them in their decision making.

The Covid-19 pandemic will leave deep scars across the globe, particularly in the euro area. Given that the health of banking systems is inextricably tied to the performance of the underlying economies, the non-performing loans (NPLs) of banks are an important issue. What are the policy options to safeguard the integrity and functionality of the banking system? And what are the criteria defining the desired response? This column will address these questions in the context of the EU.

What makes the identification of a suitable policy response particularly difficult is the strong reliance on banks and the apparent ‘overbanking’ in Europe (Pagano et al. 2014). At the national level, banking markets are highly concentrated, and many institutions are considered too-big-to-fail. The structurally low profitability of European banking makes this even more of a concern.

Policy responses should take these structural issues into consideration. In particular, the policy actions should neither reinforce the substantial reliance on banks, nor perpetuate a ‘legacy banking’ architecture that is nation-centric and prone to a ‘doom-loop’ between the fiscal state of national governments and the state of the banking system. The extent to which financial markets could play a more prominent role should also be considered.

In this column, we discuss and evaluate a variety of policy options that are considered in the current debate on how to deal with potential problems of the European banking sector, amplified by the Covid-19 crisis.2 The evaluation is based on a set of criteria that, in our view, capture the effectiveness and credibility of a proper policy response.

Evaluating Policy Options

We carefully distill the requirements that a desirable policy response should meet in light of two objectives of the policy intervention: (i) the stability of the banking system and (ii) the ability of the banking system to fulfill its important role in society. Subsequently, we apply the criteria to the policy options.

Assessment criteria

We define the following five criteria:

1. Effectiveness: Can the overall objectives be achieved? Does the option deal effectively with the problem at hand? Does the implemented model make a difference?

2. Feasibility: Is the option feasible in a broad sense? We consider various dimensions regarding feasibility:

a. Is the option feasible (e.g. not rejected outright by the legislative process or by the treasuries involved)?

b. Is a political mandate for the option possible?

c. Are policymakers and regulators able to execute the policy?

d. Is the option viable in a narrow sense (i.e. not too complex)?

3. Credibility of the policy: If put in place, can it be carried through over time?

a. Is the problem of ‘regulatory capture’ addressed?

b. Is the option resilient to the ‘too-many-to-fail-problem’ of policymaking?

c. Is the policy time consistent, in the sense that incentives to re-adjust are kept at bay so that ex post credibility can be ensured?

4. Alignment with incentives of private players: Does the (public) intervention leave ex ante the right incentives and initiative for banks and firms? This question includes the following aspects:

a. Does the option prevent ‘zombification’ of firms and/or banks?

b. Can regulatory arbitrage be contained?

c. Does the option allow for private initiatives to deal with problems at hand (e.g. no weakening restructuring incentives)?

d. Is the flow of credit to firms, in particular SMEs, sustained?

5. Structural impact at the bank level: This criterion assesses the impact of the policy on the longer-term challenges of the banking industry. The following questions are considered:

a. Does the option respond to the overbanking issue?

b. Does the option limit the market power of established institutions?

c. Is this fostering positive renewal in the financial system?

d. Does it strengthen the role of capital markets in Europe?

Evaluation

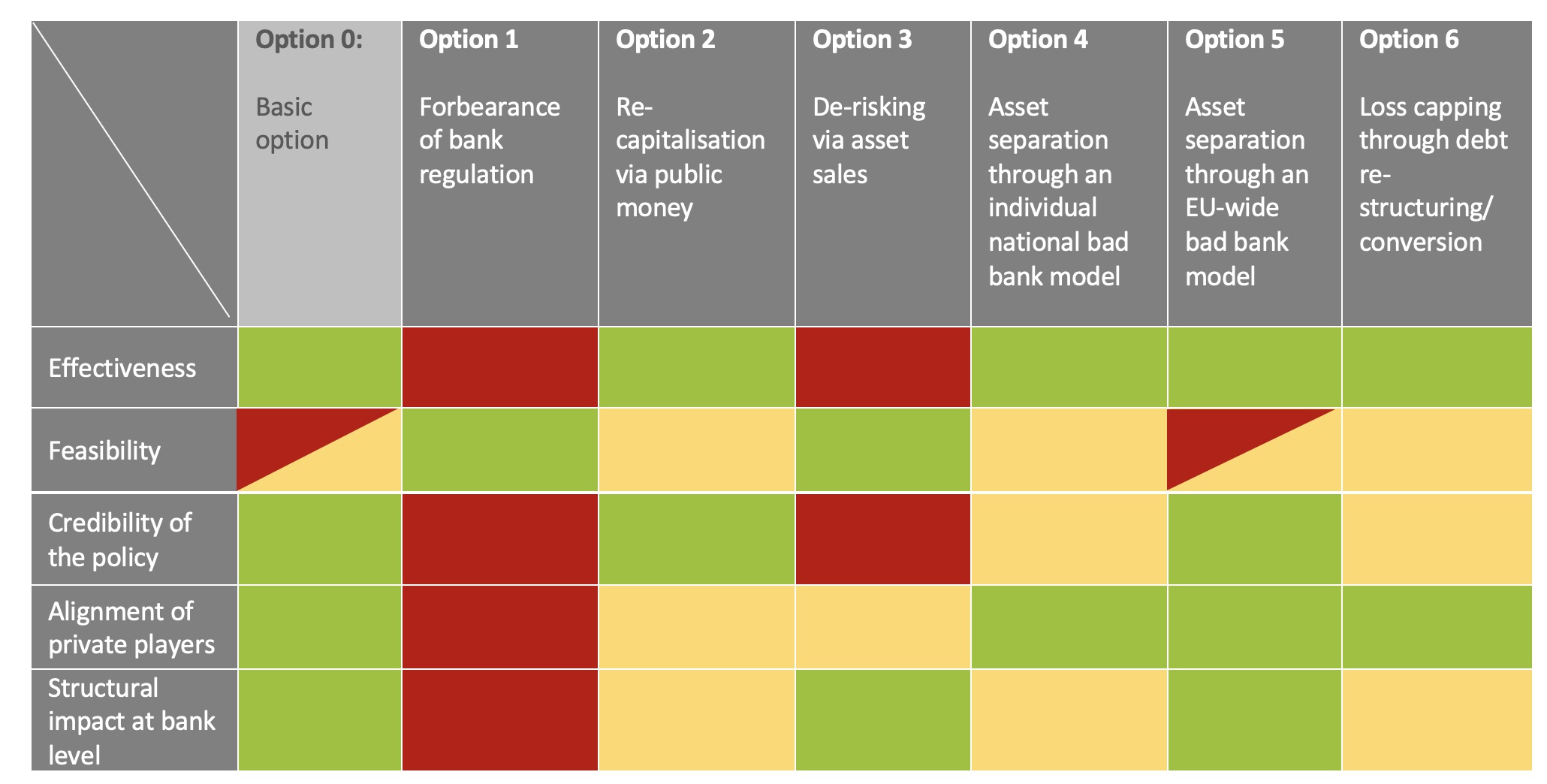

We evaluate the various options along the criteria defined above, giving an assessment based on a three point-scale: yes (green), medium (yellow), and no (red). Table 1 summarises the results of the evaluation. For more details see Boot et al. (2021).

Option zero: Private recapitalisation

The basic option to improve the resilience of a single bank is to have it strengthen its capital base. This would allow the bank to deal with the problems at hand on its own (e.g. raise equity and manage non-performing loan). Such private sector initiatives seem preferable, if circumstances permit. A privately recapitalised bank would take full control over its own destiny and have the right incentives for making appropriate business decisions. As Table 1 indicates, this option is effective: it provides the right incentives to private players and would have the right structural impact at the bank level. Feasibility might be an issue, but it is a useful benchmark.

Option 1: Forbearance

The forbearance we focus on aims at giving banks some leeway in meeting regulatory requirements. Banking supervisors have stressed their willingness to accept temporary breaches of regulatory capital requirements if the shortfall is due to pandemic-related provisioning. The actions taken include deactivating surcharges for systemically important banks, lowering risk weights, excluding assets when calculating the leverage ratio, and temporarily suspending newly introduced accounting rules (IFRS 9). We evaluate option 1 under the assumption that it is the only measure taken by authorities and interpreted broadly (including, for example, relaxing accounting rules). As highlighted in Table 1, this option is feasible, but it would be largely ineffective because it does not contribute to the overall stability of the financial system in the medium term. Forbearance may beg for more forbearance, as often happens. Financial institutions will learn the lesson that tough regulatory rules will be bent whenever the risk outlook is gloomy enough. This option might provide perverse incentives to private players as a sole measure. In particular, it could entail substantial elements of the banking union to be suspended. It may lead to the zombification of banks and encourage continued lending to sclerotic firms. Moreover, this option would not have a favourable impact on the banking sector.

Option 2: Recapitalisation via public money

Recapitalization by governments refers to precautionary and mandatory recapitalisations, as suggested by Schularick et al. (2020). For European banks, the authors estimate a capital shortfall between €60 billion and €600 billion, depending on the pandemic scenario. The acceptance of such publicly financed equity infusion would be compulsory, conditional on not passing a stress test. Hence, this alternative could build on the previously discussed basic option if recapitalising via private money cannot be accomplished. As reported in Table 1, this option is effective and credible, but it would be difficult to implement because it encounters resistance as it involves public money. Moreover, this option could perpetuate overbanking. To contain this risk, it is key to attach strong conditions to the public infusion of capital.

Option 3: De-risking via asset sales

In case a bank is unwilling or unable to raise new equity, it may seek to improve its capitalisation ratio by selling assets, or more generally, by ‘de-risking’. This can lead to fire sales, producing systemic risk. As shown in Table 1, this option is feasible and would have a structural impact to the banking system, but it is not effective because the option might imply fire sales and threaten wider financial stability. Moreover, banks would have a strong incentive to substantially cut back on lending. This option is not credible because it may contribute to systemic risk in the economy, which, in turn, may make subsequent bailouts more, rather than less, likely. In terms of alignment with private incentives, this option would limit zombification and contain moral hazard.

Option 4: Asset separation through an individual bad bank model at the national level

‘Bad banks’ – also called asset management companies – have been used in the past to resolve calamities in banking. Sweden in the early 1990s is an interesting case in point. A bad bank typically needs substantial support by the government because losses will be realised. Creating a bad bank tends to invite challenges that relate to the nature of the assets transferred. What is a fair price of a particular loan? How can policymakers ensure that the private information owned by the bank is shared with the management of the bad bank? How can the bad bank optimally manage the assets and maximise recovery? In our assessment we assume that there are clear incentives to maximise the value of recovery. As reported in Table 1, this option would be effective and would provide the right incentives if the bad bank is managed and incentivised in the right way. The risk of moral hazard is limited, but there are still risks concerning national champions. However, in terms of feasibility this option is complex. The structural impact on the banking sector is constrained if national banking champions are preserved or created.

Option 5: Asset separation through an EU-wide bad bank model

A variation on option 4 is to set up an EU-wide bad bank – the irrevocable transfer of non-performing loans by banks to a supranational asset management company. Collecting these loans from across the single market, as reported in Table 1, is effective and might be managed more efficiently and objectively than national vehicles. However, complexity substantial undermines feasibility. Moreover, the supranational solution may trigger ‘mutualisation’ concerns. That being said, it might also incentivize the creation of a market for distressed assets, and ultimately help the development of the Capital Markets Union (Beck 2017). In doing so, it could have a favourable structural impact on the banking system in Europe.

Option 6: Loss capping through debt restructuring/conversion

A different approach to tackling NPLs is a partial transfer of the default risk on each bank loan from a bank to (typically) a public authority. One avenue is via a targeted insurance scheme that offers coverage for realised losses exceeding a threshold level. Another avenue is a scheme where a public body refinances existing bank loans (where these new loans have limited recourse on the bank involved). It should be noted that this is effectively a capital infusion by the government since the bank receives more than the distressed value of the loan. As highlighted in Table 1, this option would be effective and, compared to the bad bank option, it leaves incentives more aligned, preserves the informational advantage of bank relationships, yet might have weaker collection incentives. The feasibility largely depends on the presence of an effective state-owned ‘development bank’, or a similarly established institution. Credibility relies not just on the effectiveness of the development bank, but also on the political strength to deal with the too-big-to-fail problem and moral hazard (see option four). The restructuring consequences of the scheme are partial, as individual loans are the focus; the risk of preserving national champions still exists.

Table 1 Overview: Criteria-based assessment of selected options

Conclusion

In this column, we have highlighted and assessed several policy options that aim at improving the resilience of European banks. The policy options range from forbearance, public recapitalisation, asset sales/de-risking to asset separation (bad bank at national or EU level), and loan conversion by state banks. We have evaluated each along a list of five criteria that should define the desired response: effectiveness, feasibility, credibility of policy, alignment with private incentives (mitigating moral hazard), and structural impact on the banking industry. Clearly, none of them are a panacea and there are positive and negative aspects to all of them.

Our assessment indicates that asset separation and loan conversion might be crucial for the viability of the European banking system, as these options dominate the other three (forbearance, public re-capitalisation, and de-risking). Among the preferred options, we point to the benefits that an EU-wide bad bank might bring (option 5). Such EU-wide system, collecting NPLs from across the Single Market, could potentially operate more efficiently and could be less prone to capture than national vehicles. On the downside, informational advantages embedded in the long-term bank-firm relationships might be lost. This loss of information would be avoided in a debt conversion scheme (option 6), and possibly also with a national bad bank (option 4).

When it comes to feasibility, the national bad bank and/or debt conversion options might have a benefit but have a disadvantage when it comes to the credibility of the policy. National authorities might still find themselves ‘captured’ by domestic banks.

In this assessment, we have taken no stance on whether an infusion of public money is easier to accomplish at the national or at the European level. We also have not attached a value to the risk transfer to the European level with the pan-European bad bank. It could improve risk diversification but, for sure, raise mutualisation concerns. Although we do not make a specific recommendation, we provide a framework for policymakers to guide them in their decision making.

Author’ note: An extended version of this column is available as SAFE White Paper No. 79.

See original post for references

Its interesting and revealing that the option of taking failed banks into public ownership, even temporarily, is not considered.

Much of this is beyond my pay grade, but the experience of the Irish bad bank in the early 2010’s was generally positive. It rescued the overall banking system from its own greed and ineptness, and it allowed a reasonably careful management of most of the bad assets – primarily property. The banking system more or less healed, and along with far better regulation is now in a surprisingly good condition considering the absolute mess it was in just a few years ago.

However, it is very clear that there was a huge lost opportunity to take the banks into public ownership in order to allow for a more comprehensive restructuring. Allowing the banks to walk away without their bad assets provided some very bad incentives for repeating behaviour, which took aggressive regulation to head off. Ireland desperately needs a banking system run more closely to the Rhine model of close alignment with local industry, rather than the Anglo model of quick profits made through mortgages and consumer debt.

Whether or not publicly owned banks are a good thing or not in the long term, it does seem clear that its in everyones interest that failed banks are now allowed to sail on with their existing management and structures and consolidation doesn’t help matters. Only public ownership for the period of stabilisation can give any guarantee of weeding out the rot.

Funnily enough, when Sweden took action in the early 90s they did use public ownership too, though wasn’t mentioned under option 4. IMHO that was the most effective handling of excessive banking bad debts in my professional life and I’m surprised it hasn’t been used more often as a model. I guess the aversion to public ownership is probably a big reason why not.

I imagine that for most of those running the show, going public would be for them the equivalent of their ” Precious ” being thrown into the pit of Mordor.

Conclusion:Give the banks whatever they want, always. If not, they will use extortion to cripple the economy.

See Greek crisis, 2008 America, Russia 1999, Asian ‘tigers’ 1997, Hoover 1931-32, JP Morgan 1906(I think), 1892 Depression,etc. etc..all the way to Andrew Jackson v Bidell 1831 ish, who was Pres of Bank of US. Bidell essentially said, give me what I want or I will tank the economy. Jackson didn’t, Bidell followed through-1830’s depression.

There are many, many more examples, see Arthur Schlesinger’s books.

There’s a reason that on his deathbed, Jackson said his greatest accomplishment was breaking the bank. Honestly, that is no small feat. I can’t think of many examples where the banks have pulled that sort of stunt and lost anyway.

Of course an MMT trained economist is not part of this paper. Just more neoliberal claptrap that got everyone into this mess to begin with. In other words, “useless.”

Of course I am not an economist, but…

Two options have 4 greens, so supposedly effective

Option 0 is basically “free market” capitalism and that is an obvious benchmark that won’t happen, as the authors point out but for different reasons, thus feasibility is an issue as there’s no free money involved

Option 5 gets 4 greens also, and the banks get to unload their npl’s on the bad bank. I wonder how much this resembles the QE practice of purchasing worthless securities at face value? And creates a “healthy” banking system by purchasing the bank mistakes, which are then harmlessly rolled over (harmless if the goal is inflated asset values not allowed to adjust downwards) free market socialism.

But like I said, I am not an economist so just window shopping

I believe it’s much more interesting that there is no option to direct government funding to individuals & small business. Under such an option, rent & mortgages could be paid. The banks would end up with these funds through such a scheme.

If the issue is with large corporations, then bankruptcy should be undertaken. Then & only then should banks receive the government funding option or the bad bank option.

I’m not an economist either. I’m trying to follow how the bank reserves are to be increased or the requirement for such reduced in all options. The bad bank options are a bit different but at what point does this become rearranging deck chairs? The national governments of the euro zone would seem to be in a tight spot if there just aren’t enough reserve euros in their countries.

Even the sober assessment of how to fix banking seems to assume a can opener. The reason Schaeuble said “We are over-banked” (referring to both the EU and the US) was because the banks and their debtors were so over-stretched in search of profit that they could not succeed. So the first step (clearly missing in the options above) to making banking viable would be to assess the real profit environment and do it in unforgiving detail. Banks’ business plans should analyze reality. Their charter should demand it. Our modern economy is still based on an optimism way beyond its sell date. I don’t intend to sound too absurd here, but we could solve the profit problem for a long time if we could figure out how to make the debt we owe to society and the environment become the generator of profits. It’s all digits – except for the limited resources. And not the “profits” we formerly accrued from exploitation of the environment (in every way) – but the profits we will gain from repairing the planet. What is clean water worth? Why the environment is not considered an “asset” is beyond me. I think it’s because looking at that kind of balance sheet is very complex. It will require economists and scientists working side by side. And we are all too lazy. I don’t think any of the fixes we are offered above should be banked on.

” Why the environment is not considered an “asset” is beyond me.”

Oh but it IS an asset! Because it can be exploited, it can be a truly huge asset! The problem is that being an ‘asset’ involves destroying the environment in order to squeeze money out of it. They externalize all the losses and only benefit.

Its not that bankers don’t understand. They do. They just don’t care. They know they won’t be the ones paying the price 20 years from now, so the can gets kicked down the road perpetually. And don’t get your hopes up about economists working with scientists: many economists are essentially hagiographers. NC had an article like a week ago about how the main function economists serve is to better justify corporate power. Well, not all of them, obviously, perhaps not even the majority, but that’s what the most powerful economists do.

Neoclassical economics and financial crises go together like strawberries and cream.

Financial stability arrived in the Keynesian era and was locked into the regulations of the time.

https://www.brettonwoodsproject.org/wp-content/uploads/2009/10/banking-crises.png

“This Time is Different” by Reinhart and Rogoff has a graph showing the same thing (Figure 13.1 – The proportion of countries with banking crises, 1900-2008).

Neoclassical economics came back and so did the financial crises.

Neoclassical economics produces ponzi schemes of inflated prices.

When they collapse it feeds back into the financial system.

Neoclassical economics still has its 1920’s problems.

What’s wrong with neoclassical economics?

1) It makes you think you are creating wealth by inflating asset prices

2) Bank credit flows into inflating asset prices, debt rises faster than GDP and you eventually get a financial crisis.

3) No one notices the private debt building up in the economy as neoclassical economics doesn’t consider debt.

What is the fundamental flaw in the free market theory of neoclassical economics?

The University of Chicago worked that out in the 1930s after last time.

Banks can inflate asset prices with the money they create from bank loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Henry Simons and Irving Fisher supported the Chicago Plan to take away the bankers ability to create money.

“Simons envisioned banks that would have a choice of two types of holdings: long-term bonds and cash. Simultaneously, they would hold increased reserves, up to 100%. Simons saw this as beneficial in that its ultimate consequences would be the prevention of “bank-financed inflation of securities and real estate” through the leveraged creation of secondary forms of money.”

https://www.newworldencyclopedia.org/entry/Henry_Calvert_Simons

The IMF re-visited the Chicago plan after 2008.

https://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf

It looks like they did have some idea what the problem was.

At the end of the 1920s, the US was a ponzi scheme of inflated asset prices.

The use of neoclassical economics and the belief in free markets, made them think that inflated asset prices represented real wealth accumulation.

1929 – Wakey, wakey time

Why did it cause the US financial system to collapse in 1929?

Bankers get to create money out of nothing, through bank loans, and get to charge interest on it.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

What could possibly go wrong?

Bankers do need to ensure the vast majority of that money gets paid back, and this is where they get into serious trouble.

Banking requires prudent lending.

If someone can’t repay a loan, they need to repossess that asset and sell it to recoup that money. If they use bank loans to inflate asset prices they get into a world of trouble when those asset prices collapse.

As the real estate and stock market collapsed the banks became insolvent as their assets didn’t cover their liabilities.

They could no longer repossess and sell those assets to cover the outstanding loans and they do need to get most of the money they lend out back again to balance their books.

The banks become insolvent and collapsed, along with the US economy.

When banks have been lending to inflate asset prices the financial system is in a precarious state and can easily collapse.

What was the ponzi scheme of inflated asset prices that collapsed in Japan in 1991?

Japanese real estate.

They avoided a Great Depression by saving the banks.

They killed growth for the next 30 years by leaving the debt in place.

https://www.youtube.com/watch?v=8YTyJzmiHGk

Debt repayments to banks destroy money, this is the problem.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

What was the ponzi scheme of inflated asset prices that collapsed in 2008?

“It’s nearly $14 trillion pyramid of super leveraged toxic assets was built on the back of $1.4 trillion of US sub-prime loans, and dispersed throughout the world” All the Presidents Bankers, Nomi Prins.

They avoided a Great Depression by saving the banks.

They left Western economies struggling by leaving the debt in place, just like Japan.

It’s not as bad as Japan as we didn’t let asset prices crash in the West, but it is this problem has made our economies so sluggish since 2008.

This is the big problem.