Yves here. We’ve sometimes addressed why negative interest rates are a bad idea. A corroborating data point: Sweden ditched its negative interest rate experiment in 2019, and said in mumbled economese that it didn’t do what it was supposed to do.

One of the many times we debunked the official rationale for negative interest rates was in a 2016 post, Economists Mystified that Negative Interest Rates Aren’t Leading Consumers to Run Out and Spend. We’ll hoist at length:

It been remarkable to witness the casual way in which central banks have plunged into negative interest rate terrain, based on questionable models. Now that this experiment isn’t working out so well, the response comes troubling close to, “Well, they work in theory, so we just need to do more or wait longer to see them succeed.”

The particularly distressing part, as a new Wall Street Journal article makes clear, is that the purveyors of this snake oil talked themselves into the insane belief that negative interest rates would induce consumers to run out and spend. From the story:

Two years ago, the European Central Bank cut interest rates below zero to encourage people such as Heike Hofmann, who sells fruits and vegetables in this small city, to spend more.

Policy makers in Europe and Japan have turned to negative rates for the same reason—to stimulate their lackluster economies. Yet the results have left some economists scratching their heads. Instead of opening their wallets, many consumers and businesses are squirreling away more money.

When Ms. Hofmann heard the ECB was knocking rates below zero in June 2014, she considered it “madness” and promptly cut her spending, set aside more money and bought gold. “I now need to save more than before to have enough to retire,” says Ms. Hofmann, 54 years old.

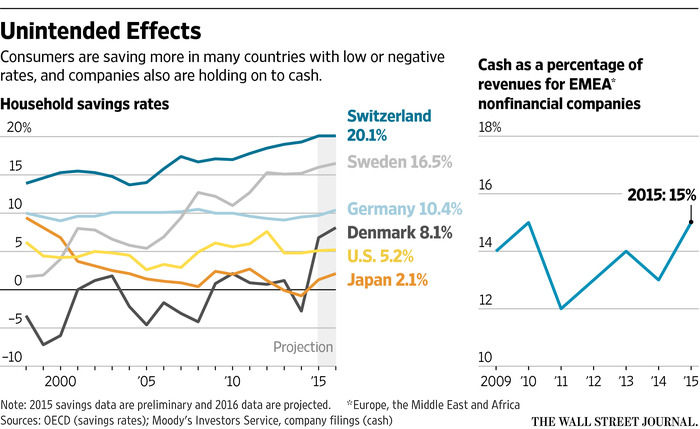

Recent economic data show consumers are saving more in Germany and Japan, and in Denmark, Switzerland and Sweden, three non-eurozone countries with negative rates, savings are at their highest since 1995, the year the Organization for Economic Cooperation and Development started collecting data on those countries. Companies in Europe, the Middle East, Africa and Japan also are holding on to more cash.

The article then discusses that these consumers all went on a saving binge..because demographics! because central banks did a bad job of PR! Only then does it turn to the idea that the higher savings rates were caused by negative interest rates.

How could they have believed otherwise? Do these economists all have such fat pensions that they have no idea what savings are for, or alternatively, they have their wives handle money?

People save for emergencies and retirement. Economists, who are great proponents of using central bank interest rate manipulation to create a wealth effect, fail to understand that super low rates diminish the wealth of ordinary savers. Few will react the way speculators do and go into risky assets to chase yield. They will stay put, lower their spending to try to compensate for their reduced interest income. Those who are still working will also try to increase their savings balances, since they know their assets will generate very little in the way of income in a zero/negative interest rate environment.

It is apparently difficult for most economists to grasp that negative interest rates reduce the value of those savings to savers by lowering the income on them. Savers are loss averse and thus are very reluctant to spend principal to compensate for reduced income. Given that central banks have driven policy interest rates into negative real interest rate terrain, this isn’t an illogical reading of their situation. Ed Kane has estimated that low interest rates were a $300 billion per year subsidy taken from consumers and given to financial firms in the form of reduces interest income. Since interest rates on the long end of the yield curve have fallen even further, Kane’s estimate is now probably too low.

Back to the current post. Aside from the effect on savings (that economists expected negative interest rates to induce savers to dip into their capital to preserve their lifestyles and make up for lost interest income), a second reason negative interest rates hurt, or at least don’t help spending is by sending a deflationary signal. If things might be cheaper in a year, why buy now?

The one wee bit of good news is the Fed doesn’t think negative interest rates are a sound idea. In fact, since 2014 (the year of the taper tantrum), and probably a bit earlier, the central bank realized that it had driven interest rates too low and it was keen to get out of the corner it had painted itself in. But it has yet to work out how to do that without breaking a lot of china.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

As The Guardian and many other newspapers reported yesterday, the Bank of England yesterday announced that it was preparing the ground for negative official interest rates within six months.

As the Bank has suggested, this does not mean that there will be negative rates. But unless they allow for the possibility if that now they will, as they admit, restrict their policy options. In that case this announcement has to be seen as creating the possibility of negative nominal interest rates.

There are a number of things to say.

The first is that this announcement is hardly surprising. There has been a strong, downward, trend in interest rates for 500 years now, which has in the last decade seen them head to around zero. Given the trend, negative rates are the next place to go. Other countries, such as Denmark, already have.

Second, this is no shock to financial markets. Government bonds are already being issued at real negative interest rates i.e., after many years of tying up their money the investor will get back less than they put in. All they are doing is paying the price for security that the government provides.

Third, consumers are also already familiar with negative interest rates. Anyone holding cash now is seeing its value fall in real terms. But again they are buying the security that only a government guarantee on their deposit can provide.

Fourth, the policy is hardly surprising. That’s because savings are sky-rocketing. For those who think this is because of Covid that is, at best, only part of the story. The real one is that if the government runs a deficit (and it is), and injects new money into the economy as a result (and it is) then someone has to hold that new money on the other side of the double entry equation. And since every borrower (and the government is technically that, albeit in a very special way) requires a lender. In this case means that as cash is being injected someone must hold it, in the form of savings. And in that case the government wants to cut the price paid on cash.

Fifth, there is good economic reason for trying to force cash out of the unproductive economy where it is sitting right now. As I have said time and again on this blog, saving is a pretty economically useless activity at the macroeconomic level. It may be personally important (which I will not dispute) but at a macro level it just withdraws money from the economy and reduces the scale of economic activity. The latter is especially true since the link between savings and investment is now very largely broken. Banks, we now know, do not lend out depositors’ money. And money in the stock market is not used to fund new share issues, and so has no relationship with investment. In that case, of course the government wants negative rates: it wants to encourage this money out of saving and into use.

Sixth, it is an unfortunate fact that this will not work. As I have already noted, in practice we already have real negative interest rates. There is nothing new then about this policy. And since existing negative rates have not stopped people saving, making such rates official will have little macro impact. After a crisis people are cautious. They are willing to pay the price of a government guarantee. And if that is a negative interest rate, so be it. I suggest that will continue to be true for several years based on past trends.

My suggestion is, then, that the Bank can try this policy but it will be a vain attempt to stimulate the economy that will not succeed. Much more radical thinking is required to achieve that. I will address that in another post, soon. I will link it when it is up.

Umm. You fund a national job guarantee program that results in full employment, and real investment via government fiat. Let us make some real capital, not the fictitious capital that runs asset prices up the pole. Also, how do we diminish private debt? Raise incomes? And lower interest on credit card, mortgage and college loans? I’ll be very interested in your ideas to address this conundrum. And yes, break some china. If we want to pay 2% interest on Treasuries, the Fed can do this anytime it wants. So do it!

In the US, the last chance for your solution died when Bernie lost the primaries. There is no realistic political path to get there – remember 70+ million people voted for Donald Trump in November of last year. Biden – who is an austerity minded individual – is in charge.

For years I’ve been complaining that instead of voting Obama for Term 2 I should have gone McCain/Palin based on the theory that “if the barn is rotten and falling down, are you really doing the right thing to prop it up rather than pushing it over?”.

Trump seemed like a bulldozer (and was in certain ways) but boy, oh boy am I excited that Joe is in the driver’s seat! ‘Course… this is in the “let’s push the barn over so we can finally rebuild the damned thing”-line of thinking, so YMMV.

In a slightly more serious tone, while austerity is a bad idea at this point in time I’m of the opinion that we need to kill this line of thinking with fire and it looks like Joe is positioning himself for a perfectly terrible job. The 2020’s are going to suck; here’s hoping the 2030’s represent an economic springtime for America.

How do we diminish private debt? How about the longtime proven method of debt restructuring?

The more we delay it, the more zombified our economy will become. And maybe allow markets to set rates and have some real price discovery.

Yep. Very low or Negative rates drive the population at large to save. This counteracts any hoped-for bounce in economic activity. Consumer spending stagnates. Growth stalls. Meanwhile the sovereign fiscal authority expands its balance sheet (they have to keep buying the bonds to repress the interest rate from rising). And so we pass the magic point where they can let the interest rates rise.

The only – orderly – way out of this is to devalue the currency.

I think we may all be turning Japanese …

It’s amazing that the same economists that think negative interest rates should make people spend money also are the first ones to say raising taxes causes people to reduce their spending. Do they really think people care who is taking their money before tightening their belt? It’s a logical fallacy, both cannot be true without violating another (questionable) economic assumption of rational consumers/savers.

I am not an economist, so I have never had any conviction in the veracity of the notion of “rational actor”. I suspect that it is simply a useful simplification that enables modeling. Unfortunately any simplification at the onset (assume rational actors) creates its own problems – What is “rational”?

The one thing I know empirically – as a man of certain age – is that since I cannot rely on 4% interest rates, I have to assure that there is enough principal in savings on which to draw when I am no longer physically or mentally able to work. So I save more at the expense of discretionary spending.

I do not consider myself irrational but apparently plenty of economic models do :)

The only people dumber than economists are those they use to make their models. Interest rates have zero influence on average consumers’ decisions. Of course if the government injects money directly into financial assets, it will pile up. If that cash were injected where it would immediately go into circulation, things would be different.

I feel like the really insane about all of this is inflicting a penalty doesn’t make me want to buy things I already don’t want anymore. Or in the sense of a car or something a negative interest rate might be 1% but If buy something I want I lose 20% of the value or maybe 100% because I don’t actually want the thing.

Who knew that the Vapors would turn out to be so prophetic?

https://www.youtube.com/watch?v=IWWwM2wwMww

? You really think so?

> There has been a strong, downward, trend in interest rates for 500 years now, which has in the last decade seen them head to around zero.

Rubbish. Interest rates in my lifetime have gone up and down. How quickly Volker’s “crush the peasants” with sky high FED funds rates in the eighties is forgotten. The operating pricipal is when a peasant get’s a raise of ten cents an hour, it’s a disaster of biblical proportions and a massive threat to the system but when a billionaire steals his or her next billion it’s pure justice.

> . . . Do these economists all have such fat pensions that they have no idea what savings are for . . .

Bingo.

Me? I am on strike and operate on the principle that the buck I don’t have to spend is way moar valuable than the one I do. A new $50,000 car? No effing way. The absurd payments, the absurd insurance, the absurdity of trashing it when a $50 sensor buried deep within gets fried, just after the warranty expires.

Negative interest rates are a sign the system is beyond repair. The sensors are broken, just like with the newish car heading to the scrap heap.

Operative word in the quote you have highlighted is “trend”. On a long scale, the Volker spike is simply noise. So, the quoted statement is valid.

Another interpretation is that the system is getting less stable.

Heart rates tend to go erratic just before death, after all, despite their relationship to the long-term trend.

Negative interest rates combined with Cash for Clunkers…sounds like a winning combo. Bus and bike…a sure thing.

An economist walks into a bike shop and says “Why would anyone use these things when it’s much easier to take an uber?” One persons rational is another persons crazy pants….

I’ll see whatever your lifetime of interest rate experience happens to be and raise you this Bank of England paper that tracks the secular decline over a period of more than 700 years …

https://www.bankofengland.co.uk/working-paper/2020/eight-centuries-of-global-real-interest-rates-r-g-and-the-suprasecular-decline-1311-2018

I think the paper is a hit jawb on Piketty. Emphasis mine.

Lots of cherry picking of ancient German data to fit a narrative that discredits Piketty, by the usual supects.

The gist of it is that negative rates are inevitable, like the sun rising tomorrow or water runs down hill.

In light of the title of the post, that negative interest rates will never work, what is a stupid person that makes stuff to believe?

stupid person that makes stuff = factory worker, a type of sub human being that economists imagine are too stupid to realize they are stupid.

I hate to tell you but Piketty’s r>g is obviously ridiculous. Trees do not grow to the sky. You can never never never never never have a subsector of the economy that forever grows faster than the economy as a whole. You always have at least mean reversion. Otherwise the subsector of the economy become the entire economy.

Piketty deserves to be criticized every time that claim is repeated.

My (precious) landlord bought my home, of the last 20 years, in 1970 for $900 nzd. Today the house is worth maybe $800,000 nzd (?), But it is 50 years older and, ratbag tenents had stolen chattels or destroyed (painted old fireplace surrounds etc) during the preceding 30 years, before I moved in (in 2001).

I was trying to explain to my house owning son, that if mortgage rates were to rise from the current 2.5% to 5.0%, the value of his house would drop by 50% and he would be underwater.

If interest rates are at 00.00%, then the costs to service a $1,000,000,000,000 (a trillion dollars) debt is exactly the same as for a $1,000 debt; $00.00 pa.

But, if interest rate go 1% negative, then a $1,000 debt will earn the “debtor” $10 per annum.

Wonderfully, if interest rates were to go 1% negative, then a $1,000,000,000,000 (short scale, one trillion dollars) debt will earn the “debtor” $10,000,000,000 ($10 billion) pa.

Clearly, I am NOT an economist, but rather, a “Forest Gardener”.

I suspect people are more likely to spend more, and save less, when the following conditions are present:

– they feel secure

> secure economically, they have excess income and great job prospects

> secure politically and socially, they have no worries about instability that may cause them to move (or other expenses)

– they have something they want (or need) to spend on

If people are not feeling secure and motivated negative interest rates might just push people to move money out of banks and into diamonds, gold, cash, etc.

What policy would work (stimulate spending)? Higher wages? Education? Better job prospects? Fairness Truth and Accuracy in journalism?

> Secure in the knowledge that a trip to the ER won’t send them into bankruptcy.

We got no reasonable gun control after Sandy Hook.

We got no public healthcare during a pandemic.

Out system is so broken the security you speak of is unlikely to come until after a massive spike of insecurity (if you catch my drift). That thought alone further undermines the “thinking” behind negative rates.

Just because the two things that would remove much of the despair and rage; national healthcare for everyone, free at the point of use, and two thousand dollars a month for everyone for at least the time of the pandemic, quarantines, and depression levels of unemployment are not even being considered; having a Patriot Act II and giving more money and weapons to the police state is being considered.

On one of my earlier rants, I mentioned that most of the people here illegally are here because they don’t think they have any other choice as the United States has spent over a century destroying their countries’ economy. It benefited the corporations. We have the same situation here. Destroy the American economy for the benefit of the wealthy and the corporations.

I have some money put away for a rainy day but each time interest comes due, it gets smaller and smaller. Before too long it may even go to zero which is made worse by the fact that inflation is eating away at it constantly. But negative interest rates?

Do they think that if they do this, that I will pull that money out and put it in the stock market to chase earnings? Seriously? The chances of this happening are about the same as me being able to swap my wife for a hot 22 year-old supermodel. Yeah, not going to happen. So if they do this I will double down on my saving too.

There is also the spectre of “alternative savings vehicles.” ASVs such as the traditional ‘precious metals,’ and utilitarian tools. Comes a collapse, money will be very ‘fluid’ in value, perhaps without value. Growing your own food will become ‘king’ again.

As my brother and a mutual friend are fond of observing, the fundamental unit of account is the calorie …

Perhaps you could incorporate as a bank and have the central bank pay you to borrow from it. The question would be, though — where to store the accrued interest earnings?

Real estate seems to be the hot new thing. The stock market is passe

retail silver coins selling at a 20% premium to the exchange price and the price not being arbitraged away should be enough evidence that something is wrong.

Silver has always been manipulated.

A better measure of worth will be how many calories of food energy an ounce of silver can buy for you.

Feudal Japan measured ‘value’ in ‘koku’ of rice. (A ‘koku’ was the amount of rice to feed a person for a year. [A very practical definition.])

Read: https://en.wikipedia.org/wiki/Koku#:~:text=The%20koku%20(%E7%9F%B3)%20is%20a,100%20sh%C5%8D%20and%201000%20g%C5%8D.

Give it a couple weeks at least. It takes awhile to mint new coins or “rounds”. The exorbitant premium is due to the same trend/delusions that GME was

The argument I have read against this possibility in the USofA is the banks can’t make money in a negative interest rate environment, the banks own the Fed, thus it never happens.

As to whether that is a valid argument, I can not say. It sounds right, but that doesn’t mean it is. Any insight to to this line of reasoning?

Low rates depress income for trust banks that make money on a spread on balances in two ways: the lower rates directly, and indirectly because low rates lead to tighter management of cash balances. You’ll see this noted in earnings reports and guidance from the BNY Mellons and State Streets. Likely different story for investment banks and banks that focus on mortgage lending, like Wells Fargo.

Low rates hurt insurers, too, who earn less from their large float. I believe that was the reason given for a recent flurry of layoffs in the sector.

Are banks making money now, with interest rates at .25%? I doubt banks’ income is generated from savings and checking accounts nowadays.

I don’t think retail banks make much on most deposits, deposit taking likely is more a cross-sell opportunity for more lucrative products (and they get fees from overdrafts). Banks that have other financial institutions as their clients did get meaningful revenue from deposits at one time.

Credit card and personal loan interest are above 10%, for many way above 10%, not to mention the scam charges and fees that so mysteriously appear on the statements of so many people, so somebody is making money off the mopes these days, particularly the ones that do not have any savings or property. Which is what, maybe 30-40% of the Empire’s population?

This actually is an important point. Banks used to make serious money from float of all sorts when interest rates were >2%.

Quite! The European ones are bust. The British ones are next. The American ones are welfare queens

We likely won’t see negative rates as a result of policy here in the US. As Yves points out, the Fed is on the record as being against them. They also back that sentiment with an array of “market” tools they can deploy. In this case their main technical tools for controlling the Fed funds rate: Interest in Excess Reserves and Reverse Repo operations, act as sufficient rudders for control of market rates. That’s not to say that negative rates don’t presently occur as discrete occurrences in American rate markets and that the future won’t see “trades” at negative levels. But trades are the weather and policy is the climate.

What is interesting is the pressure towards negative rates in “vassal” markets. Particularly the UK, Australia and Canada. Richard Murphy correctly bemoans the futility of negative rates with regard to the predicament the UK finds itself in. But the UK is part of a larger system. And within the context of that system negative rates in the UK provide a benefit. At least as understood by the minders of that system.

Within the American, for lack of a better word, Imperial system that the UK occupies. They aren’t a true sovereign. Nowhere is this seen more clearly than in monetary activity. I think over the years I’ve seen passing reference to the “carry trade” here on this blog. Whereas I referred to trades as the weather before; the carry trade is unique, it is the climate, it may even be the air all around.

A small refresher. The Fed has flooded markets with cash via the creation of reserves. The deployment of these reserves are governed by a number of seemingly mystical regulations that all seem very reasonable if you’re a parishioner in the church of modern “economics”. For our purposes let’s ignore SLR, LCR, and all other sorts of bullsh*t acronyms and just assume that the behavior of this Fed created cash is governed by rules.

As a bank that holds these reserves you can liberally take this cash and invest it in government securities; if you run out of government securities you can deposit it at the fed at the IOER level. A hedge fund or dealer trading desk or money manager can also do this, with the understanding that the demand above that ioer level provides a “put” for their rate instrument. They then repo out that US government security and get back US dollars. Why? Well then you engage the FX forwards market and swap those dollars for a vassal currency, let’s say CAD. You take that CAD and invest in a Canadian government security. Here you realize a positive spread. Take that yield difference in your favor and swap back to dollar. Take that dollar and buy a house in Miami.

There are so many Fed created dollars that the global markets are drowning in them. They generate very low implied borrow rates via forward which have the effect of dragging down yields in vassal markets. Unlike the US, vassal systems don’t have the “paper” required to satisfy this demand and so their rates keep getting dragged to, and perhaps beyond zero. Their central banks don’t have the ability to control this market drift and so just prep themselves for keeping up with the charade by saying it’s policy. They are between the proverbial rock and hard place. The only way to stop this would by by asserting their sovereignty and stop supporting the US dollar via Fx arbs that leave all the externalities in their own yards. Of course in the long run, all of us, including central bankers, are all dead. So good luck waiting on professional economist to exercise rational behavior.

If the system ever truly worked, you would expect zero rates to occur once all of society’s problems were solved. Negative rates? Jesus must of come back. I see neither of those things.

The inevitable path of the American system and its vassals was set after the Iraq war and the GFC, which laid bear the rot in the twin pillars of American power, the military and economic. The pandemic was simply the event which pushed us to the edge of that artificial reality, from which we could see the world outside our cognitive bubble. China ascendant economically, Russia superior militarily; “poor” Cubans sending doctors across the world to save lives. No central banker can change that.

Although the American revolution divorced the USA from the UK politically, their respective banking sectors have been joined at the hip since the 1700s.

Good post, but I think panic over the declining American hegemony could result in experiments like NIRP.

IT in many banks have been programming to handle negative interest rates just so they aren’t caught off-guard should the US banking system goes down that road.

In non-banks too, like asset managers, working through all the possible unintended consequences in downstream processes.

Totally agree Yves conclusion, but I know some of the guys on the MPC are not idiots. Some are (in fact I know that one particularly dumb ex-MPC member is also unpleasant to share an elevator with, but Jan Vlieghe and Ben Broadbent are both very sharp. So what if they know exactly what we know, but they still want to do it? What is it that they know that we dont?

I would posit that this is about distributional effects and excess indebtedness. Negative rates can speed the erosion of debt burdens, while maintaining property prices. I think that’s why its the preferred solution of the BoE. Even thought it will do terrible things to domestic demand, all the other solutions might damage property prices. And that would never do.

This is kind of related to another IMHO good point I never see it discussed. At least in the US there are so many debtors that I think negative interest rates could induce more spending, if those negative rates resulted in a reduced debt load. I wouldn’t be surprised if this outweighed the effect of reduced savings.

But that never happens. Interest rates are near zero, and people have triple digit APR payday loans and credit card debt probably over 15%. Without reducing debt burdens, what’s the mechanism by which negative interest rates are supposed to increase spending? The cash constrained are still cash constrained so AFAICT it’s just hurting savers.

Yes, it doesn’t matter for things like credit card debt because these rates don’t depend much on policy rates. The only place where it matters is mortgages, but that advantage is quickly erased by resulting price rises so people get saddled with even more debt and much more risk of losses should interest rates ever rise (and house prices plummet). People get exactly the same house but are saddled with much more debt they can never hope to repay, causing even more dis-inflation/ deflation eventually.

I think lower interest rates can work temporarily during a recession when they are only held low for a year or so. But keeping them low for a decade is just deflationary imo, because people and markets simply adapt to them.

The BIS wrote a nice report some years ago. By comparing many episodes in many countries over a few hundred years, it turns out that there is no historical evidence that routine consumer price deflation hurts the economy. However, what DOES cause a lot of harm is asset bubbles and the inevitable collapse that follows. This is what happened during the Great Depression and the GFC. The take away is that the central bank policies should be aimed at preventing asset bubbles forming.

And current Fed policy has created the current asset bubble in stocks and real estate.

I’m trying to think through your point. The erosion of existing debt burden would happen how, by speeding inflation?

A negative rate means theoretically, you pay to own the debt, not the debtor.

This is about the only semi-rational explanation I have seen. Of course, it has a super-problem, which is that RE price growth that is faster (and not just on average, average can be driven by extremes) than real-income growth is super-bad. But it’s super-bad in a long term, and right now, pretty much all of the anglo-saxon world and growign chunks of the rest believes that growig RE prices are good only.

One fascinating wake-up call will be with the changing demographics (not only age distribution, but also geographical distribution), and related to that, immigration.

“there is good economic reason for trying to force cash out of the unproductive economy where it is sitting right now.”

Yes real estate and the stock market would be good examples of an “unproductive” part of the economy. “supply side” low interest rates do not create “top line” growth. Wealth creation primarily from speculation of money already earned is a zero sum and not growth. We’ve seemed to have confused wealth inequality with growth.

Encouraging (or forcing) more money from savings into (maybe) return-generating assets only means more demand on the same finite supply of assets. Savings will not turn into final consumption today just because it is decried to be worth less tomorrow. If the desired outcome is achieved, all CBs will have done is to guarantee the asset bubbles to overexpand and pop (probably in a very short period of time as wealth-protecting refugees flee from one collapsing bubble into another causing the cascade failure of all bubbles).

When the end consumer is already under a crushing debt burden, they don’t have any more disposable income to spend on new services and products. The frenzy to get consumers to buy is a lot of excess effort that does not build towards an economy’s future. (See desperate ad dollars chasing shorter attention spans…. automated bidding to show an ad on youtube? To be at the top of a search page over other advertisers? )

The harder trick would be to figure out economists believe consumers need to consume more over time? How many TVs can one watch at the same time? After a certain age, one realizes that one buys less from the market, but worries about an indefinite remaining lifetime of paying for future needs. How can that need be mitigated from turning into with an obsession with savings? Not with negative interest rates.

Also, how does negative interest rates and consumer price inflation interact in the mind of a consumer? My money is worth less tomorrow and prices are also higher? A double whammy? That does not increase propensity to consume in that mind.

Looking at the economy as a full circle of money like the energy cycle in nature, it seems almost illogical to read RM saying “… every borrower (the gov. here) requires a lender (public money here) which means that as money is injected someone must hold it in the form of savings”. (I’m assuming that unless someone holds the money there will be no money to lend out the next time, so spending it makes the equation of borrowing and lending sorta pointless?) He lost me there. It does make perfectly good financial sense, for financiers only, that not having to pay interest on money is good for business – but that demolishes the balance needed to keep the system going. I get that part. Except the financiers don’t have any business left and that’s their own fault. In nature energy is held briefly at no charge and, following the laws of entropy, is then passed on to the next user down the energy chain. It is a perpetual thing because you can’t charge interest for sunlight. We can’t make money a perpetual thing if everyone in finance is middle-manning the Fed and the Treasury. And about that bygone link between saving and investing? – that was demolished 50 years ago and the system is now having to acknowledge it because the virtuous circle of old-fashioned money is broken beyond repair. It might be more accurate to now say that idea has long since lost its usefulness. And if we want things to function, for people to spend, demand and consume (sustainably) we need to do non-interest-rate money. We should replace the idea of “interest” with the idea of “sustainability”. Stimulate the entire economy with the money necessary to achieve sustainable well being, and just call it good.

Negative interest rates will work perfectly fine for inflating property prices, killing consumer spending even more – and in general bubble up the price of any asset where leverage is deployed. The latter being the actual design goals of all stupid central banks policies.

Once CB’s have committed to crossing the event horizon of the “negative interest” black hole, they can’t get back out of it without also causing a crash in the price of the leveraged assets that they have sworn to protect at all costs (to everyone else). Interests rates will therefore be stuck on negative “forever”. Liquid assets like stocks will assume the role of money as the preferred store of value.

PS:

Economists and Politicians encourage us to spend, but, based on decades of experience I shall save more just to spite them and benefit me, because I know they will not be there for me if I suddenly need money.

Could buying and stockpiling non-perishable survival supplies for years to come be considered a form of “saving”? Would stockpiling such things also be a way to spite them?

We now know that the previously inconceivable (negative interest rates) is now possible. When an ancient taboo is broken, and there is no immediate retribution, then the perpetrator may be tempted to descend into the previously, unimaginable ………….depravity?

So, what is to stop negative 100% interest rates? Money that progressively diminishes, day by day, and disappears completely at the end of a year? Sort of the “inverse of a payday loan that starts at $1,000 and grows to infinity”?

I am not saying, but asking?

That concept or very similar has been invented as a concept.

https://rationalwiki.org/wiki/Demurrage_currency

How would people react if it were imposed? Maybe rebellion. But short of that?

Maybe do the least possible work in the hamster wheel moneyconomy and do everything they can for trade or barter or subsistence. Maybe demand that their employER pay their rent and car loan and expenses directly to the recipient of these payments rather to them. Maybe demand to be paid as much as feasible in gas/ electric/ car-fuel/ motor oil/ food/ etc. and rather less in “money”.

But mainly earning as little self-destructing money as possible and earn as much direct barter goods and skills as possible, and also as much personal subsistence as possible.

It appears to me that Real Estate “Values” rise when interest rates fall.

Four pf the houses I have owned, which were at modes prices when I owned them, are now valued on Zillow at over $1 Million

If I were a fully paid up member of the Billionaire Class, I’d like this.

I’m definitely one of those people that have reduced their spending as a result of negative (real) rates. Why is it so hard to understand for economists that when less money comes in, you’ll have to save more to reach your savings goals?!

I can also tell you that even if interest rates were ever going to rise again, my spending will not be fully reversed. Because of the lower (zero) interest income, I have had to replace certain items with cheaper alternatives that now turn out to be just as good! So I won’t go back to the more expensive stuff. I have also entered into a routine behaviour of looking for the cheapest supplier for everything. I really didn’t bother a decade ago, but a decade of low (zero) interest rates has ingrained this behaviour in me now.

So in my case, low interest rates have made me contribute to a dis-inflationary spiral and this will stick.

This has been my and my friends’ reaction as retirees. In early retirement I spent interest income. In the last decade, it hasn’t been there, so I feel the need to preserve principle. Social Security and pension increases do not keep up with inflation.

Anybody notice what’s going on with tbills lately

4 week 2 bp

3 month 5 bp

1 year 9 bp all at new lows

while 10 yr notes and 30 yr bonds are rising.

Yes that makes perfect sense. Short maturities stay low because the Fed is determined to keep rates low for long. Long maturities rise because that means high inflation ahead.

I expect the long end to go up a lot in the coming years, because everybody expects the Fed to be behind the curve when CPI inflation picks up and the long maturities will price that in.. If the long end rises too much because of increasing inflation expectations, the Fed will be forced to raise rates to bring the long end of the curve back down.

Yes, lots of cash and not enough t-nills

It seems to me that part of the problem is that people in charge think in terms of models and become slaves of their own models and economic dogma, without stepping back to look at the purpose of the economy in the big picture. Economy is here to serve the needs of the people, not vice versa.

Case in point, the Fed seems obsessed with boosting the inflation so their economic models are validated, yet no one seem to question that inflation means basically taxation and impoverishment of people.

Same with spending, we all seem to agree that we are exhausting the resources of the planet in which case some thriftiness and savings would seem the appropriate prescription, yet spending is being promoted as cure for all. Trying to coerce people into doing things hardly works, especially when they dont make sense to the common man.

“Economy is here to serve the needs of the people, not vice versa.”

is this assumption accurate?

And Political Economy is here to explain why this may not actually be so.

Really appreciate Richard Murphy’s article and his website. However, I do find myself increasingly discounting an assumption that the primary policy objective of governments and central banks is to increase economic growth, and that this is a tax on savings in an effort to force spending to meet this objective. IMO the past thirteen years have shown this assumption is at best incomplete and perhaps even a red herring. I have gradually come to believe the policy elite is perfectly fine with long-term economic and social stagnation punctuated by periods of depression that cause economic distress among large segments of the population and that enable the One Percent to acquire financial assets and real estate very cheaply with the tremendous wealth they have accumulated after 40 years of lawless markets, no enforcement of antitrust law, Neoliberal policies, and privatization. The GFC of 2008 and its aftermath revealed the template.

Besides enabling further private sector accumulation of debt to induce damaging behavior like corporate stock buybacks, I expect Negative nominal interest rates will cause those who have not experienced deep speculative losses to buy equities and junk bonds. This will further boost already stratospheric Stock and Junk Bond Prices for the global 14 percent who hold the vast majority of both asset classes; further enrich CEOs, board members and senior corporate management under their stock option and stock price-based compensation programs; enable Wall Street to peddle IPOs and SPACs; save many Zombie companies from dissolution whose operating cash flows are insufficient, even under the current negative real interest rates regime, to enable them to pay the interest expense on their debts; and besides stripping savers of their assets, further disempower the middle class politically under our Citizens United political framework, while increasing support of “conservative” policies among the electorate by aligning their financial interests with those of the One Percent.

Although I expect others can add further insights to this list, I don’t think it’s inconsequential that there’s also a “Mt. Everest” aspect to gaining policy implementation of negative nominal interest rates policy among a small group of legacy “senior” economists who believe this policy to be the final remaining capstone of their illustrious careers in service to the “right people”.

To me, however, this represents one of the last gasps of financial capitalism, a starkly different system from the regulated industrial capitalism with social safety nets that I supported in the distant past.

The article says “at a macro level it just withdraws money from the economy and reduces the scale of economic activity.” That is how taxes work. I conclude that negative interest rates are a wealth tax that dares not speak its name. If we are going to create more money than anyone can spend, and won’t allow straightforward taxation, then this is what we get.

Nicely done. Whether that was the intent of the Larry Summers types or how it has worked out in practice, it seems to be almost locked in for good. Until the next great financial crisis. Which has been overdue now for …take your pick…eight years, ten years, twelve years…the longest stretch without a recession in financial history says the Economist mag. Yet it didn’t alter the trajectory which a Sept. Rand study revealed to be the biggest financial wealth transfer in history: $50 trillion upwards to the 1% or thereabouts, money which would have stayed amidst the 60% bottom layers if the original New Deal arrangements for finance and regulation had not been undone by Neoliberal changes.

Gee, a world awash in savings even with negative returns…but which says it cannot afford a Green New Deal which had plenty of proposals for constructive spending…the horror!

By the way, I couldn’t find a single reference to that Rand study on the greatest transfer of wealth in human history – the Presidential campaign…could you?

This seems like more central bank economic policy designed by the rich, for the rich.

There is no shortage of money via MMT, but it is all going to the Wall St banks and the billionaires. These are people that created the current economic nightmare, and they are now using Fed money and the pandemic to accelerate the economic destruction of the middle class.

Negative interest rates? Are we back to TARP now with its zero interest rates? Our unquestionably solvent and profitable banks need this? I am not reassured. /heh

Have always maintained that in a healthy economy, that savers are rewarded while speculators are punished. What we have now is the opposite where savers are being punished and speculators are being rewarded. How important can saving be? One of the major reasons that modern China got where it is is that the Chinese people are furious savers of money. This meant that China was able to borrow against these savings to develop the country without being forced to go to international money markets which would lead them to being vulnerable to ‘hot money’. Back some twenty years go I would read accounts of the problem of Chinese savings being so huge. That would be a nice problem to have.

I think the key observation in the posting is that the link between saving and investment has been broken. And how. Let me observe and state a few things that have been missed. I never see descriptions or graphs comparing the target overnight rate the Fed and Treasury strive for in the REPO market, very low, 2% or lower range for more than a decade now, which means the cost of borrowing to speculate, or, heaven forbid, to lend money to aspiring businesses and start ups…that’s the cost of borrowing to large institutions…is very l ow; so what is the loan rate charged to start-ups by a range of institutional lenders…nothing nearly that low…but the gap is what isn’t getting the attention. As Mark Blyth has recently stated, there are “pipes” (for the flows so dear to MMT folks) which lead from the Fed programs to the large financial players, now of all stripes, but no pipes from these players which lead to the neediest on Main Street, and start-ups of all stripes. The emergency COVID measures helped a bit…but are complex and uncertain in duration, much less scope this time around.

Public banks, anyone, willing to narrow that lending gap to the small businesses, and for causes that even the local Savings and Loans won’t take up? Of course the existing locals will protest they are being undercut…exactly! by a publicly subsidized rival. Here’s a real chance for Biden and Yellen to design a program for red state rural America to step in where even the local private community banks won’t take risks.

No guarantees on that, that it will succeed. From what I’ve seen for six years now with a front row seat in Trump country in the Western MD mountains, the other problem, in addition to start up capital, is buying power. Food Co-ops which might have been a big hit in say, very affluent Montgomery County, just don’t seem to have the buying power base, demographics and income, to easily survive.

Are you suggesting Biden and Yellen should do something like this?

How many of the banker’s debt products can an economy take?

Let’s find out.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

Economies fill up with the banker’s debt products until you get a financial crisis.

1929 – US

1991 – Japan

2008 – US, UK and Euro-zone

The PBoC saw the Chinese Minsky Moment coming and you can too by looking at the chart above.

Lower interest rates and you can squeeze a few more of the banker’s debt products into your economy.

The bankers have reached market saturation globally.

No one can take any more of their debt products.

“Go negative” the bankers

That’s why we need negative rates so we can squeeze more of the banker’s debt products into our economies.

The Western central banks have been using monetary policy to try and cure a private debt problem with more private debt.

They didn’t see the problems developing in private debt.

They didn’t know the problems were caused by private debt.

They tried to cure the problem with more private debt.

“We cannot solve our problems with the same thinking we used when we created them.” Albert Einstein.

He’s right, but we tried to do just that.

The Western central banks have been busy painting themselves into a corner.

The only way our economies can hold all that private debt is for interest rates to stay close to zero.

Negative rates must be considered when all else fails.

They are trying to cure a private debt problem with more private debt.

The economics of globalisation has always had an Achilles’ heel.

The 1920s roared with debt based consumption and speculation until it all tipped over into the debt deflation of the Great Depression. No one realised the problems that were building up in the economy as they used an economics that doesn’t look at debt, neoclassical economics.

Not considering private debt is the Achilles’ heel of neoclassical economics.

That explains it.

When will they wake up?

Let’s see how global policymakers are getting on.

Not considering private debt is the Achilles’ heel of neoclassical economics.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

No one realises the problems that are building up in the economy as they use an economics that doesn’t look at debt, neoclassical economics.

They are all asleep at the wheel.

This leads to a financial crisis.

1929 – US

1991 – Japan

2008 – US, UK and Euro-zone

The PBoC saw the Chinese Minsky Moment coming and you can too by looking at the chart above.

The Chinese were lucky; it was very late in the day.

The Chinese woke up before the financial crisis.

They looked at private debt to see the financial crisis coming.

The Japanese woke up after the financial crisis.

They knew they had a private debt problem and de-leveraged,

The West hasn’t woken up.

Western central banks have been using monetary policy to cure a private debt problem with more private debt.

They don’t know what they are doing.