Yves here. We haven’t been too concerned about stock market frothiness because overvalued stock markets, in and of themselves, don’t do tons of damage when they fizzle…except when the purchases have been fueled by borrowing. That’s the key difference between the 1929 crash and the dot-bomb era.

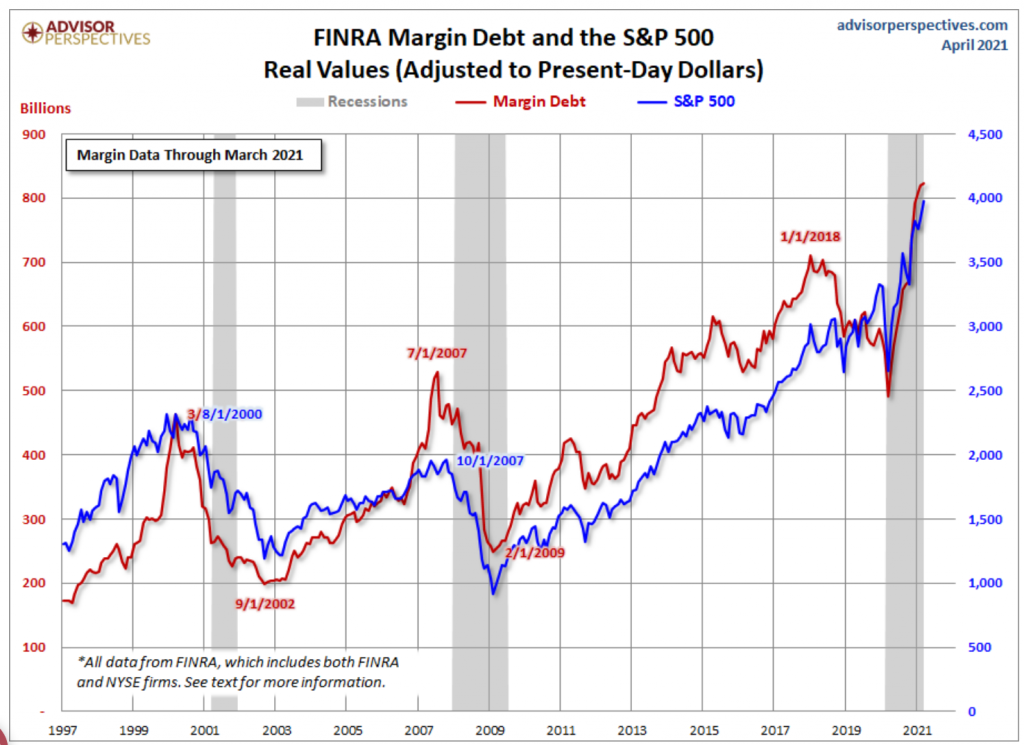

While we are not up to Roaring Twenties style leverage on leverage (trust me, it was widespread), the borrowing is getting into nervous-making territory. The chart below, from Advisor Perspectives, is through April and compares margin debt levels to the S&P 500 (not a perfect comparison, but a consistent proxy over time). The relationship isn’t quite as whacked as Wolf’s post suggests, but the recent trajectory is worrisome. It has a blowoff look about it.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

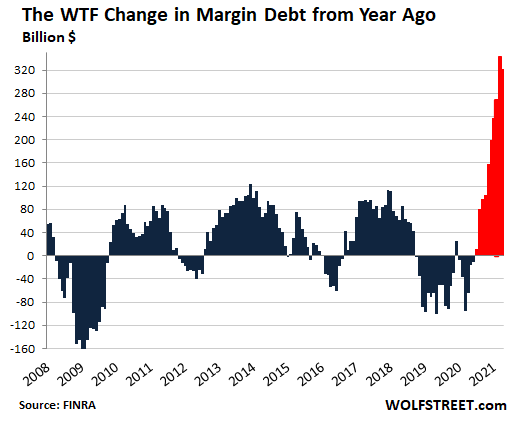

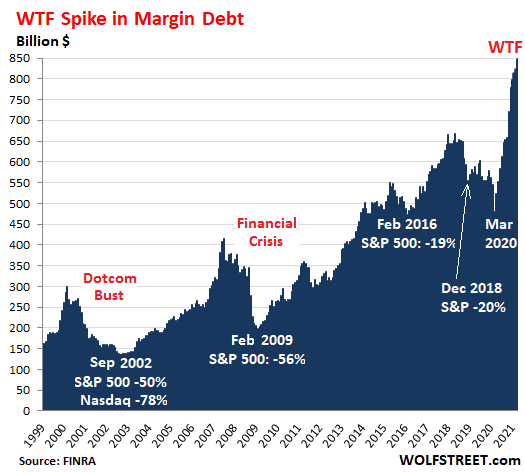

Stock market margin debt jumped by another $25 billion in April, to a historic high of $847 billion, according to FINRA data. It has exploded by $188 billion in six months, and by 61% year-over-year, and by 55% from February 2020:

Excess leverage is the precise and predictable result of the policies the Fed is promoting out of one side of its mouth with its interest rate repression and asset purchases.

Out of the other side of its mouth, the Fed – via its blissfully ignored Financial Stability Report – is warning about leverage, stock market leverage, and particularly the vast and unknown parts of leverage among hedge funds and insurance companies.

It named names: The family office Archegos, a private hedge fund that has to disclose very little, and that then blew up because none of the brokers providing it with leverage knew about the other brokers also providing leverage, and no one knew how much total leverage the outfit had. The amount of leverage didn’t come out until it blew up.

And this form of hidden leverage is not included in the known stock market margin debt reported monthly by FINRA, based on reports by its member brokerage firms.

This known stock market leverage is an indicator of the trend in leverage, the tip of the iceberg. History shows that a big surge in margin balances preceded and perhaps was a precondition for the biggest stock market declines.

In April, it exploded to a new WTF high of $847 billion, up by $188 billion in six months, having ascended to the zoo-has-gone-nuts level:

In this type of chart that covers two decades during which the purchasing power of the dollar has dropped, long-term increases in absolute dollar amounts are not the focal point; but the steep increases in margin debt before the selloffs are.

Leverage creates buying pressure and drives up prices. As prices rise, the collateral can be leveraged up further, and leverage builds with rising asset prices. And then when prices decline, the leveraged bets are sold to pay down the debt, and the selling triggers more price declines, and forced selling sets in. This is when Archegos blew up.

And so the Fed says in its Financial Stability Report that “measures of hedge fund leverage are somewhat above their historical averages, but the data available may not capture important risks from hedge funds or other leveraged funds.” And it recounts the Archegos fiasco, in terms of how this hidden leverage works:

“In a separate episode in late March, a few banks took large losses when a highly leveraged family office, Archegos Capital Management, was unable to meet margin calls related to total return swap agreements and other positions financed by prime brokers. Price declines in the concentrated stock positions held by Archegos triggered the margin calls, prompting sales of the stock positions, which led to further declines in the prices of affected stocks and, ultimately, substantial losses for some banks.”

“The episode highlights the potential for material distress at NBFIs [Nonbank Financial Institutions such as hedge funds] to affect the broader financial system,” the Fed’s report said.

It’s ironic that the Fed, out of the other side of its mouth, is warning about the results of its policies, including the ballooning leverage that isn’t known until it blows up.

Ha, and then says the Fed, still speaking out of the other side of its mouth, if that risk appetite declines “from elevated levels,” and outfits want to get out from this leverage, or are forced to get out from under this leverage, “a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.”

I really am puzzled at this point. Who wins, who loses, what is the motivation behind letting this happen again and again? Is there an “economy” that the Fed administers that protects and enables this activity?

Greed, I think. For instance, the uber rich have lots of influence over the frothing finance media. The media pumps up a stock and the wealthy play around that pumping, shorting or selling or what have you. Talking heads sell BS to suckers.

Capital begets capital and the cycle continues.

That’s all true. I don’t see how the banks (dark pools), hedge funds and the Fed fit into a legitimate scenario though if leveraging just escalates each time. If all this continuation is dependent on how the Fed reacts? Is the Fed the only thing that stands between the bad actors crapping out or “The House” fronting them more chips?

Pretty much my interpretation yeah! The Fed is just a college of banks, they are just there to have a structured, bureaucratic method for providing more liquidity when there’s a liquidity crisis. All that stuff about full employment is bull.

They were built to prevent the smoke filled meetings that JP Morgan and his buddies held during the 1907 crash, where they put a gun to Teddy Roosevelt’s head and told him to approve mergers or else.

But in reality, the Fed is just a more structured smoke filled room. It’s still a group of elites getting together to make decisions on liquidity. Their job is also to smooth out the frequent crashes of the 19th century, but honestly, since I turned working age, it’s been one crash after another, so clearly they are failing.

So reallly what they are doing now has become a way of doing business. And Powell is their PR man.

Yeah, to me, it’s just a federally sanctioned smoke filled room that has a veneer of academic economics at play in decision making.

I’m not a hotshot economics major or economic reporter, just a dude, but that’s what I see. Anyone reading these comments can feel free to correct me.

https://admiralcod.blogspot.com/2016/05/my-favorite-day.html

I found my new profile picture!

Jerome Powell is an extremely wealthy investment banker with a net worth (via internet search) of between 20 and 55 million dollars. Whose side do you think he is on?

BA from Princeton and Law degree from Georgetown. That is why people try so hard to get their kids into the Ivy League. Schumer……Harvard 1970 I think. On and on. It is a special club and you are not in it which george carlin pointed out.

Jonathan Levy in his new book “The Ages of Capitalism,” maintains that what you are talking about is what he call the The Great Repetition.

He characterizes the Fed as an administrative agency outside democratic control, by design and that it is now the most powerful economic policy making institution in the country. He believes that we are now trapped in a recurring economic pattern dependent upon converting leveraged asset price inflation into fresh incomes built out of the credit cycle.

Liquidity is now a product of state power lodged inside the U.S. central bank. However this repetitive stabilizer may have now become a great destabilizer, in the sense of creating an ever accelerating economic inequality through its policies of offering never-ending liquidity for speculative assets.

Freaking love it, I will get this book. Thanks!

Thank you for that

“Ages of American Capitalism” was written by Jonathan Levy, not the title stated.

What are you looking at these charts for?

Hey, look over there…shiny coin!

Ta-da…like a magic trick.

“Who wins?” Well, most of these arch-egos playing the financial game ALWAYS believe it will be them. Whether by some cunning short-play or leveraged long-play. In the end, the losers are EVERYONE because of the disruption in the economic system. But if you live close to the bone with little financial cushion, then the blade will feel the sharpest.

Yes, you are right about the impact. The resources to prepare and recover have really suffered also for those close to the bone.

Who wins? Not you

Who loses? Not them

Motivation behind letting this happen? Byproduct of averting complete collapse. 21T of QE BEFORE the covid helicopters were released.

FED has been in self preservation mode since 2008. FED = Financial System = Economy. It’s all the same thing. Don’t mistake it for the term you look up in the dictionary.

Who can tie their money up in cash and readily get financing so they can snap up assets on the cheap when the dumping starts? There’s your answer.

If you are rich enough to eat the temporary losses, in one lifetime you and others like you can achieve a remarkable degree of asset accumulation. In the end, even if you lose some real wealth in the crash, you’ll be a whole lot richer than everyone else.

I started looking at market capitalization data yesterday after reading Wolf’s post. The Finra data is easy, just have to find a free source for historical market cap. Intuitively, a level use of margin would cause the dollar value to rise with the dollar value of the market, but if margin grows faster it could be a warning. Unless I’m misreading this chart, it suggests they’re tracking.

Exactly. Adjusted for market cap its not quite as scary although cos market cap is ebbing a little now maybe it would look like its starting to get concerning.

> Unless I’m misreading this chart, it suggests they’re tracking.

Yes. What is different this time is that it is tracking it with no delay since the March 2020 FED hail marys thrown to prevent Mr Market’s melt down. He hasen’t sobered up since. When the hangover starts, it’s going to be a doozy.

Also, note how in previous eras margin debt grew at a rate faster than the price Mr Market was selling for, at least some of the time.

When I heard about it, I didn’t think Archegos was some kind outlier that had discovered something no one else had thought of.

It wasn’t an outlier at all…it was a clue.

Don’t worry, there’s only one cockroach ?

? and only one rat

It does look like a blow off top. doesn’t it?

And the Real estate Market sure looks like it’s at a top.

I see one heck of a lot of leverage and lots of fraud in all of the markets ( Paper gold is reliable that way) and quite a few threads unraveliing, Greensill and Archegos among them.

There’s nothing rational about these markets, it’s straight up fear and greed and the suckers are ripe for the plucking.

I will stick by my call of June for the top, with the numbers starting to show up in July.

“The markets can stay irrational longer than [most of us] can stay solvent”

The leverage is trying to reconcile the big gap between the 10 year paying sub 1.75% and the actuarial expectation of 6-7% annual returns of pretty much any big player out there – insurance companies, pension funds etc.

Between the dollar depreciating and the interest rates repression by the Fed, there isn’t much left. Except real estate but that carries its own – very substantial- risks.

As my specialization was investment compliance at one of the larger fund shops (Blackrock level), swaps and CFD exposure is reflected at its mark-to-market exposure in a NAV and can be effectively considered as off-balance sheet exposure. The fund accounting treatment between leverage via derivatives vs loans also lends itself to masking derivatives’ leverage issues. In Europe, regulators require semi-annual risk reporting categorizing derivative notional values but the Archegos issue also involves exchange/country-level aspects. For instance, legal teams would go through each country’s rules and regulations to see whether there was a case to be made that derivatives exposures did not need to be included such that capacity limits can be worked around. All the regulators need to do is to explicitly state stock exposure via derivatives must be included in regulatory reporting requirements/foreign ownership limits.

You’re forgetting the flip side:

You use “funny QE Money” to boost share prices is necessarily correlated with using “funny QE Money” to prop up sales, gross margins, and ebitda, and ….earnings!

Who is auditing all the leaders of the S&P 500 with foreign operations? WHo will monitor if loans are taken, say overseas, and disguised as “sales”, or “ebitda” flowing eventually to earnings?

Come on sheeple: you can’t wilfully inflate share prices WITHOUT wilfully inflating sales and earnings to match!

We’re living through forced price inflation. But yet, total revenues are UP? NO make sense! But some co’s are reporting “foreign sales” hugely up that nicely coincide with the shortages and price jack-ups domestically!

No, not correct at all.

First, you are confusing QE, which is an asset swap, with net spending. So this is what Lambert would call a category error.

Second, we most assuredly had inflation and crap earnings. Go look at the 1970s stagflation. Corporate profits were lousy (and not even clear if they meant what they appeared to mean due to the lack of good inflation accounting) and stock prices were in the toilet.

First, you are confusing QE, which is an asset swap, with net spending. Yves

What about the profit (or less loss) the asset “swap” may make for the asset seller? Granted a rich asset owner has less propensity to spend but cash for trash enables them to buy other assets like apartments and houses to grind the poor for rents.

Anyway, fiat creation for other than the general welfare is gross violation of equal protection under the law. Not to mention there are ethical means to increase liquidity such as equal fiat distributions to citizens.

Stage one – The markets are rising.

Look at all that wealth we are creating.

Stage two – It’s a bubble.

That wealth is going to disappear.

Stage three – Oh cor blimey! I remember now, this is what happened last time

At the end of the 1920s, the US was a ponzi scheme of inflated asset prices.

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth.

1929 – Wakey, wakey time

The use of neoclassical economics, and the belief in free markets, made them think that inflated asset prices represented real wealth, but it didn’t.

It didn’t then, and it doesn’t now.

The greed vs fear dynamics bring to mind a mascot for this discussion:

https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcR1BF-5Vf7-24CZVnoDbM9m8ZiOhAN95OyN-A&s

There’s a good reason it’s wearing a top hat.

All: I have been getting 8-10% price increase’s from my suppliers the last few days. There is some serious inflation going on.