Yves here. Since real estate is ever and always local, one has to assume some real estate markets are still smoking despite the overall softening trend. I’ve heard recent anecdotes about home owners getting cold calls from brokers trying to get them to sell properties not on the market with crazy prices in enclaves favored by the super rich. Needless to say, they don’t need to get a mortgage.

Another factor that might be contributing to falling mortgage and therefore home demand is more and more companies bringing workers back to the office. So far, responses are varying widely, with some pretty insistent that pretty much everyone come back to city centers, particularly if they want to continue to get big city pay, others being willing to allow some work at home, and yet another cohort, mainly tech companies, allowing remote work to continue (although bear in mind some of them are also explicit that pay cuts are in store if they’ve moved to low cost, distant locations and plan to stay there).

In addition, a colleague who sold very high end financial services to very large institutional investors, said the idea that business travel won’t eventually come back is bonkers. “Those who don’t get on the road will have their lunch eaten by those that do.” That reversion will also make being not very close to airports less attractive.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

The evidence has been piling up for months in bits and pieces: While investors still have the hots for this housing market, potential buyers that need a mortgage and those who want to live in the home they’re thinking of buying are getting second thoughts, as evidenced by sharply dropping sales of existing homes and new houses even as inventories for sale have now risen for the third months in a row and new listings are coming out of the woodwork.

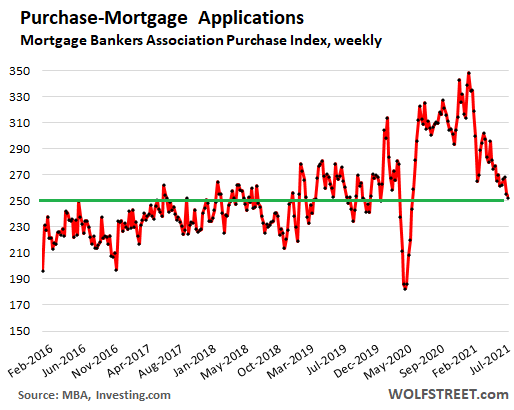

So here’s the latest piece of evidence: Demand from buyers who need a mortgage to fund the purchase of a home has been declining for months and in the week ended July 2 fell further and is now down 14% from the same week in 2020 and down 8% from the same week in 2019, according to the Mortgage Bankers Association this morning. Mortgage applications are now at the low end of the range in 2019. The entire Pandemic boom has now been worked off, plus some (data via Investing.com):

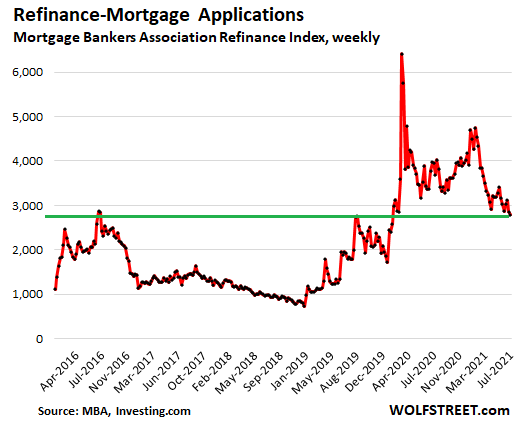

Mortgage applications to refinance mortgages in the week through July 2 fell to the lowest level since February 2020, having now also worked off the entire Pandemic spike, despite mortgage rates that are much lower than they were a year ago.

Refi mortgages go through boom-and-bust cycles based on mortgage interest rates, with lower-than-before mortgage rates triggering a refi boom, and with higher-than-before mortgage rates putting a damper on refis.

So refi applications in the week through July 2 remained 55% higher than the same week in 2019, when mortgage rates were a full percentage point higher than today; and refi applications were over twice the very low levels of 2018 when mortgage rates were grinding their way to 5%:

Can you imagine what this immensely overpriced housing market would look like with mortgage rates at 5% — meaning barely at the rate of CPI inflation? Me neither.

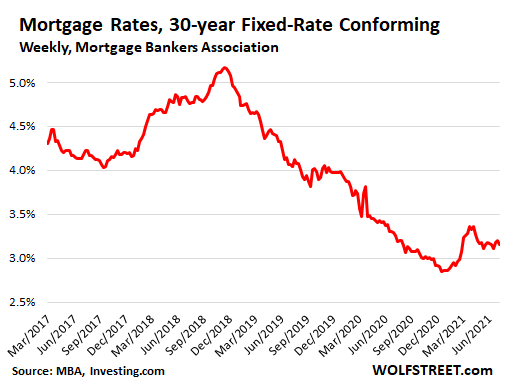

The average interest rate on 30-year fixed rate mortgages with conforming balances and a 20%-down-payment was 3.15% in the week ended July 2, according to the MBA today. The rate is down about 20 basis points since the recent high in late March and has remained in the same narrow range since late April:

It is interesting that mortgage rates have dropped 20 basis points from their recent high in late March, while the 10-year Treasury yield has dropped 40 basis points over the same period, widening the spread between them.

There is now consistent taper-talk coming from the Fed, including ideas about tapering its purchases of MBS sooner or faster than tapering its purchases of Treasury securities. Several Fed governors have now publicly expressed concern over the housing bubble, over investors’ involvement in the housing bubble, and over the Fed’s providing fuel for the housing bubble.

The first effects of this Fed talk concerning tapering purchases of MBS may already be showing up in the widening spread between the 10-year yield and mortgage rates – that’s maybe what we’re looking at here.

The crazier story is behind the CPI link. That purchasing power graph is terrifying.

Check out the total monetary reserves in our system if you want a scary graph. Its exploded since 2008 and doubled still further since the pandemic. So far the effect seems to have mostly been on asset appreciation rather then inflation (likely due to who those reserves are distributed to by the FED.. mostly rich people). It will be interesting to see if this inflation jump is a blip or more longterm trend

https://fred.stlouisfed.org/series/TOTRESNS

I’m not seeing a buyers strike – yet anyways – and IMO 8% is just too low to be considered a dip, unless it’s the opening of a trend.

What I am seeing is low inventory and crappy inventory (“fatal flaw” inventory), like homes on very busy streets or less than attractive exteriors. You can’t have sales with depressed inventory.

In my city of Brockton, Ma, there are 101 listing as of today on realtor.com. Six years ago when I started to look to sell my house in Quincy and move to Brockton, I recall about 250 listing in Brockton. 5 years ago – or 1 year later – when I actually bought – I recall about 200 or less listing. I recall asking the broker “when do you think listings will increase like they were last year?” When the buying frenzy started last 18 or so months ago from today, there were about 70 listings. Recently that has recovered to around 100 listings.

Of the 101 listed properties for sale in Brockton, 13 have open houses on July 10. If not everyone of of these homes do not go under agreement a few days after July 10, I might start to be open to a buyers strike. The pattern has been: the listing go on auto pilot or vanish about a week after open house or are listed as “contingent” as sellers decide which of the multiple over bids to choose to put under agreement. Having no “connections” to the RE market, I don’t see the sell price until months later under the “just sold” category in realor.com.

Based on the internets telling home value appreciation and what a property is worth today, the home I sold in Quincy, Ma (considered a more desirable city than Brockton and closer to Boston) has appreciated LESS than the home I purchased 5 years ago in Brockton. Sections of Brockton are indistinguishable from “nice” cities and have generously spaced suburban yards and family style layouts (split level ranch homes with multiple bedrooms and baths, garages). In contrast, Quincy is more compact when it comes to land and yards. But Quincy prices were already elevated 5 yrs ago due to proximity to Boston and IMO did not represent a value then, as did Brockton.

If you can ride the MBTA and not have to transfer to another mode of transit, Brockton is a great deal. Or it was a great deal, I haven’t kept tabs on what’s happening with the market there.

Funny you mentioned that, because being on the east side of Brockton I noticed on a map I am actually closer to the Braintree MBTA which goes directly into Boston, than is the the west side which staddles the main highway into Boston and for that reason so many assume it to be the better commute. It was a pleasant surprise to learn after I moved in I had it easier on the east to commute than I thought.

Hi Timbers, I’ve seen/read your comments for years here at Nakedcap, but never knew you lived in Brockton. I grew up next door in Avon. I also lived in Quincy for a stretch, too.

I’m in Metrowest now, and prices have gotten bizarrely, meteorically higher in the past year.

Regarding Brockton being good value, you’re correct. But, as always is the case in the US, it’s the perceived quality of public schools that underlie the house prices. If there’s pockets of poverty (as there are in Brockton) it means that average test scores get pulled down and families with more pricing power look elsewhere. Of course, there’s plenty of opportunity for bright kids to excel, my cousin went to Brockton public schools and has done quite well for himself.

I called for a top in Real Estate prices in June, back in April.

I’ll stand by that call, although it might be off by a Month or two.

Inventory is very low in my neck of the woods (W Sonoma County) and prices are at unsustainable levels, the Delta Variant and other Variants of Concern are the wild card, if this next wave is a bad one it’s going to have a powerful effect on the Real Estate Market here.

So could a fire that takes 5,000 or more homes this summer.

White swans.

So I just cancelled the purchase of a home. Long story short, the sellers realtor and my own acted in an unethical fashion, and as I said to the real estate attorney I retained, if I go through with the purchase, I will just sit there thinking about how I was defrauded, blood pressure rising, and give myself a stroke. I got my ernest money back, but the extra inspection, attorney fees, and non refundable loan fees still gave my bank account a big ouch.

So at some time in the future I may upgrade and move to a nicer house, but the house I have now is livable, the selection is sparse, and the prices are…irrational.

There’s a section in Freakonomics on the fallacy of buyer and seller agents acting with principles for their principals.

I have friends who are Realtors (brokers/agents). Some have college degrees, some don’t. Getting 1.5% of sales price for simply being the Listing agent is an incentive to focus on “closing” not on fiduciary principles.

Plus changing the closing price ±10% from list makes negligable difference to the commission, so the incentive is just to close the deal with minimum work and move on.

The Buyer’s realtor is really the seller’s realtor since the money comes out of the Buyer’s pocket. Asking a Buyer’s realtor to act on behalf of the buyer is like asking a Congress Critter who takes

bribesfrom big corporations to enact regulations in the people’s interest. BTW, most realtors have no ethics!Oh

July 8, 2021 at 2:43 pm

Charlie Munger says ‘show me the incentives and I’ll show you the outcome.’

I think the whole house selling process is full of dubious costs, but whatcha gonna do? It was funny, the real estate attorney said he would be debarred if he charged what realtors charged for what they do – and he wasn’t joking.

Some (most) of this was my fault. I get the realtor who had represented the seller of the house I now live in to “help” me look at houses, and this realtor was gonna sell my house after I brought another house. I had told the realtor that it was possible I would not find a house to my liking, and I would stick with my present house. (yeah – no money in that) So my realtor was looking at two commissions if she could just get me to buy a house. I might as well have put a steak in front of a Doberman and told the dog to wait an hour before eating the steak. A LOT of incentive to get the house sold…

I have bought houses before, and it worked out fine. So this was something I thought just didn’t happen. Considering, it worked out as best as it could.

The seller’s market in Boise is still HOT for smaller and mid-sized houses. Houses are still selling within a week of listing like mine did (actually three days after they fixed the listing errors on MLS). And I had a LOT of people looking at my house. But what I saw when I was selling my house was that there were VERY few families looking – it was mostly investors – and they don’t get mortgages – they pay cash.

Two friends listed their homes recently to harvest equity while they can. They foresee price declines along with softening in the seller’s market conditions. They face questions about where to move, and whether to rent for a while, if they can find available rentals that aren’t long(er) commutes.

Trading dollars by selling in one over-priced market and buying in another doesn’t seem like such a great deal. No wonder that RV sales have spiked in many areas around the country as a lot of people look for mobile solutions to ride out the current bubble.

Others bought those RVs to survive, as is apparent in many towns, under overpasses, along empty industrial park cul-de-sacs and adjoining tent cities. :/

“Trading dollars by selling in one over-priced market and buying in another doesn’t seem like such a great deal. ”

Very true! And rents have spiked so high that even waiting for the market to cool isn’t an option any more. I had to sell my house for health reasons – after a recent illness, it was made very clear to me that I needed to be closer to family, and fortunately they live in an area that isn’t a sellers market – yet!

I’d like to see more on what he mentions in the first line. Isn’t this the story of BlackRock et al. snapping everything up for cash?

The little duplex where I have been renting for the last several years appears to be of interest to an investment firm out of Brooklyn, NY. There has never been a sign outside to indicate this property was on the market, so I am guessing it was held as a hip-pocket listing that never went on the multiple. The real estate agent working with these investors indicated they had already purchased several similar rental units in this area. Although there are real estate signs all along upper Main Street, I don’t recall seeing many in our little neighborhood. New mortgage applications have dropped. I am not sure what that means for a real estate market with cash rich investment companies and possibly more than a few hip-pocket listings. After the dust settles I am afraid the U.S. housing market will have undergone a mass shift in who owns housing.

thanks for raising this, I also am trying to parse the relative impact of low/bad inventory and the asset managers like BlackRock and BlackStone buying up houses.

Agreed, Historian. And these investors make it near impossible for families to purchase a home before they are snapped up by investors. I have been looking for so long now that I am seeing these same houses come back on the market a few months later with a 30%-40% markup in the price and no change or improvement to the property at all. Hell, they dont even bother to change the listing or the photos. Shameful.

Still strong sellers market here in South OC beach cities with the few houses that hit the market selling in days for record prices. Too fast to put up For Sale signs or hold open houses. And brokers are cold calling. Very few houses being listed.

Employed by a large company that sells PMI and RE analytics. Absolutely no sign that the housing market madness is subsiding based on internal data.

Friend lives in North Wilmington, DE. Prices in his hood have gone up 30-50%.

Main Line outside of Philadelphia is up 10% YoY — probably less churn due to large property taxes and it’s an area people generally stay in because it’s a great place to live. Median house price is still around 700k or so.

The more upscale parts of Delco, e.g. Wallingford, Media, Swarthmore are up 10-15%, which sounds low based on the few anecdotes I’ve seen. My parents’ house has shot up 20% YoY to a little over 1 million. They picked it up for 135k back in the early 80s, which is depressing since wages have remained dog$hit for decades now. No way could I afford that at the present time.

I’m unmarried, which means no two wage household. I have zero desire to move to bumfsxk Iowa and work remotely or buy some sh!thole locally just to hop onto the Home Ownership Hopium Train.

Austin, TX still sucks due by virtue of being in TX — plus it’s rapidly becoming infested by neo-liberal technocrats.

SV is uber expensive and the culture is loathsome. CA is vile, corrupt state that makes Chicago look like Xanadu. CalPERS and the probate office are exemplars. Look at how Britney Spears had her life entirely stolen with zero effort by a horrid family.

I suppose it’s time to take my talents as a musician and prepare for a life of busking and making my bed under a bridge. I’ve transitioned from being jaded and cynical to numb and fatalistic, anesthetizing myself with booze or whatever else I can get my hands on.

“I have zero desire to move to bumfsxk Iowa”

that is a relief

Great timing for this post. See also recent retreats in lumber, steel prices, etc. May take months for those declines to be reflected in prices builders pay, but still–demand for construction materials not what it was. Mildly surprised (encouraged) to see that not everyone has forgotten the consequences of the previous housing bubble. Hope you have follow-ups planned.

Interesting. It makes me think that the real reason the home market is such a big deal is not the increasing “wealth” from an upward trajectory of prices, but the “cash out” that comes from the churn, and its effect on consumer spending.

In that sense, rising home prices are just an inducement. They lead more and more people to borrow more and more money from the future to finance someone else’s spending today. And, after all, it is spending today that drives profits.

Here in the Bay Area, the high stock option values that big tech employees get are going into housing… because engineers have to live somewhere.

A good modern 2br 2ba apartment rents for $3k+ in Sunnyvale. Better to ship some stock options while the stock market is high, get a mortgage with tax relief for something near work.

The bad news is HOA fees in the $500 range.

TimH’s three rules for buying your own house: 1. No HOA etc (so a SFH, no matter how old). 2. No nearby high density housing (parking overflow is a PITA). 3. Street isn’t a popular commute shortcut.

We can echo your point #3. For a while, for some gods forsaken reason, our avenue, (really a two lane inner suburban street,) was a “popular commute shortcut.” We got to the point where several of us stood out by the road at four o’clock in the evening waving at motorists to slow down. (We learned some very choice expletives that way.) Eventually, the traffic pattern reverted to it’s ‘norm.’

Here, in the Heart of Dixie, we have been getting a few ‘cold calls’ from realtors. Also a few, “Look what your neighbor’s house sold for!” postcards. No place is ‘safe’ from the Vulture Equity Brigade.

This immeseration and precarity expansion is the true meaning of the old “Trickle Down Economy” scam.

Trickle down economic is the only way pension funds can survive. Pensions basically put all pensioners on the side of the wealthy and that include the average granpa and granma with their 401k. The road to Hell is paved with good intentions in other words the paradise of a generation is the Hell of all the others that follow.

Market is rocketing along here in Medford OR (On I5 30 mile N of CA border). WE lost a lot of low cost housing in last year’s fire, but that can’t account of lots of appreciation in mid to hi range homes.

We bought our 1965 2000SF house about 8 years ago for $250K. Zillow now thinks it is worth $400K. WTF? A house down the street (Bigger, older, classier) just went for $650. Another one (really big, was used as an elder home for a while) just listed for $950.

It seems insane. our house here is almost at the same price level as our son’s in Fontana CA.

Be careful using local RE-generated price indices for expectations on sustainable appreciation in an unimproved dwelling. In many densely settled metro areas, homes are either being torn down or extensively remodeled by those don’t think they need to care what they pay. Local prices showing “20% gains” and up for the local housing stock often include properties that had been obsolete $500k dwellings (just to pick a #) before being replaced with upscale construction on a larger footprint. That gooses the average for the whole area. Not to mention the easy compares versus a year ago. Some composite aggregates correct for this (upgrading) but most local #s do not. Can show you plenty of properties in such regions that have yet to attain the prices from 2007. Caveat emptor.

Anecdote is not Evidence, but we sold our home back in April.

One of the buyers is a project manager at a GAFAM company, now encouraged to work from home. The buyers had a large cash down payment and private mortgage financing through a boutique San Francisco investment lender that probably doesn’t report to the Mortgage Bankers Association database.

If you’re in a market near a large GAFAM work-from-home presence, your mileage may vary.

I’m not sure how many people moved that far from population centers. There’s always the drive to move out of the city for schools/more space in the Boston area as people eye having a family. The pandemic certainly drove a few more people to think about where to go, but around here people are anchored to pharma/ed/med. Many of these industries don’t let people work remote and never did throughout the pandemic. My wife is a scientist at Brown and had about 6 weeks remote, while Brown figured out a plan for letting more people return.

Business travel will return, but I think it will take years before it all returns. I sold into pharma/biotech and hosting a sales team for a meeting was already considered a major pain. Conference rooms were at a premium in expensive Cambridge and SF, and getting everybody in the room at the right time was really hard. I’ve heard a few IT professionals say that there will be onsite meetings with vendors, but they’ll be much, much more selective. If you’re selling software (like I was) you’ll be at the bottom of the list for ability to come into any buildings. The other trend I’ve heard is that remote work spurred a lot of companies to realize that all the back office stuff can be remote and they can convert that additional space to lab space. So many of the people you might meet with will now rarely even be in the building.

Austin, TX is still climbing with a median price of $375,000. The house I bought in 2013 & then lost in a divorce in 2014 is now selling for double what we paid. It’s a great place, but wasn’t even worth what we paid back then. The party line is that lending standards are stricter, but we were qualified for a mortgage that was nearly five times our combined annual income. This is perceptibly not organic price discovery coupled to market fundamentals. Frankly, nothings been normal around here since ~ 2000.

How did real estate get so expensive?

They let banks lend into the real estate market.

Henry Simons was a founder member of the Chicago School of Economics and he had worked out what was wrong with his beliefs in free markets in the 1930s.

Banks can inflate asset prices with the money they create from bank loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Henry Simons and Irving Fisher supported the Chicago Plan to take away the bankers ability to create money.

“Simons envisioned banks that would have a choice of two types of holdings: long-term bonds and cash. Simultaneously, they would hold increased reserves, up to 100%. Simons saw this as beneficial in that its ultimate consequences would be the prevention of “bank-financed inflation of securities and real estate” through the leveraged creation of secondary forms of money.”

https://www.newworldencyclopedia.org/entry/Henry_Calvert_Simons

Margin lending had inflated the US stock market to ridiculous levels.

Richard Vague had noticed real estate lending balloon from 5 trillion to 10 trillion from 2001 – 2007 and went back to look at the data before 1929.

Real estate lending was actually the biggest problem lending category leading to 1929.

The IMF re-visited the Chicago plan after 2008.

https://www.imf.org/external/pubs/ft/wp/2012/wp12202.pdf

That’s not the only problem.

The UK eliminated corset controls on banking in 1979, the banks invaded the mortgage market and this is where the problem starts.

https://www.housepricecrash.co.uk/forum/uploads/monthly_2018_02/Screen-Shot-2017-04-21-at-13_53_09.png.e32e8fee4ffd68b566ed5235dc1266c2.png

The transfer of existing assets, like real estate, doesn’t add to GDP, so debt rises faster than GDP until you get a financial crisis.

The money creation of bank credit is being used to fund the transfer of existing assets and this pushes up the price.

The money creation of unproductive bank lending drives the economy.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

It’s a one way ticket to a financial crisis and Great Depression.

We had the financial crisis in 2008, and were now facing a Great Depression.

Japan discovered how to avoid a Great Depression and deliver Japanification instead.

https://www.youtube.com/watch?v=8YTyJzmiHGk

That’s handy Harry!

We can copy them.

That’s why we used to have Building Societies, isn’t it?

Yes, it kept the money creation of bank credit out of the housing market.