Yves here. I must confess to enjoying takedowns of the New York Times. I used to go after Andrew Ross Sorkin regularly. Here, the object lesson is an attempt to depict those poor maligned billionaires as paying their fair share of taxes.

By Julie Hollar, the managing editor of FAIR’s magazine, Extra! Originally published at Common Dreams

According to a White House analysis (9/23/21), the country’s 400 wealthiest families have an effective tax rate of just over 8%. At the New York Times (9/23/21), reporter Jim Tankersley was quick to cast doubt on the figure.

The New York Times (9/23/21) criticizes the White House for taking into account the main way billionaires make money.

According to Tankersley’s framing, the analysis “seeks to show a gap between the tax rate that everyday Americans face and what the richest owe on their vast holdings,” and is “an attempt to bolster Mr. Biden’s claims that billionaires are not paying what they actually should owe in federal taxes, and that the tax code rewards wealth, not work” (emphasis added). In other words, it’s an analysis with a political agenda.

Dubious Data Point

This is in contrast to “most measures of tax rates,” which “do not use the White House method of counting asset gains as annual income.” The piece emphasizes how “unconventional” the White House analysis is, and that it’s “well below what other analyses have found.” (Note that these analyses don’t “seek to show,” but simply “find,” thus enhancing their social science credibility.)

Tankersley points to one data point here:

The independent Tax Policy Center in Washington estimated this year that in 2015, the highest-earning 1,400 households in the country paid an average effective tax rate of about 24%, compared with an average rate of about 14% for all taxpayers.

First, that “most” measures don’t count asset gains says more about how thoroughly the rich have rigged the tax code to exclude most of their income than it does about how one ought to measure income—or tax rates. The Tax Policy Center figure, for instance, only considers federal income tax, which ignores state and local income tax, as well as payroll, consumption and excise taxes.

Second, the “independent” Tax Policy Center should hardly be assumed to be agenda-free; according to its most recent annual report (2017) available online, the group’s “Leadership Committee” includes representatives of major financial firms like Goldman Sachs, Morgan Stanley and the Carlyle Group, entities that have a direct stake in keeping gains in financial assets from being counted as income.

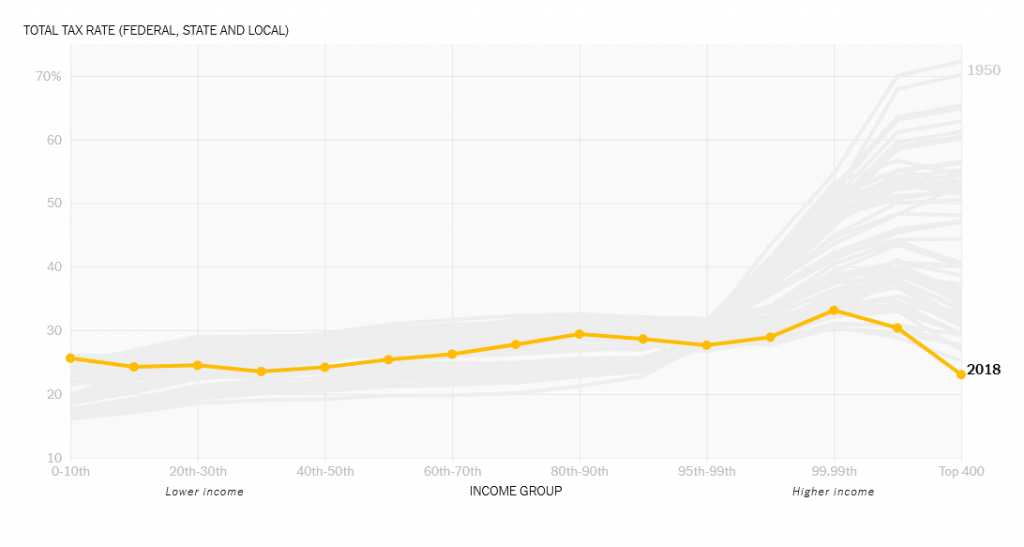

And third, it’s crucial that the data from the Tax Policy Center comes from 2015, since that was before the 2017 Trump tax cuts slashed taxes even further for the ultra-rich. As New York Times columnist David Leonhardt (10/6/19) pointed out in 2019, the tax cuts “helped push the tax rate on the 400 wealthiest households below the rates for almost everyone else” in 2018, to 23% for the wealthiest versus 28% for the average taxpayer.

Top tax rates have been pushed so far down over the last 70 years that the richest households now pay a lower percentage than any other income group (New York Times, 10/6/19).

Top tax rates have been pushed so far down over the last 70 years that the richest households now pay a lower percentage than any other income group (New York Times, 10/6/19).

Victory for the Richest

It’s a remarkable victory for the rich over the rest of us: The richest Americans had an effective tax rate of 70% in 1950 and 47% in 1980. Meanwhile, the average taxpayer has seen relatively little change in their effective tax rate over the same period.

That’s all according to University of California/Berkeley economists Emmanuel Saez and Gabriel Zucman (Triumph of Justice, 2019), who were not using the “unconventional” White House method of dividing taxes paid by total asset gains. They were, however, using the White House method of looking at the top 400 as measured by wealth, rather than the top 1,400 as measured by adjusted gross income. They were also considering all taxes, including payroll tax (Social Security and Medicare), state income tax, and consumption and excise taxes.

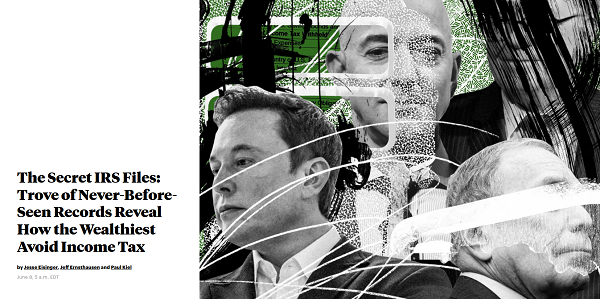

ProPublica (6/8/21) “compared how much in taxes the 25 richest Americans paid each year to how much Forbesestimated their wealth grew in that same time period”—an obvious precedent for the White House analysis that was overlooked by the New York Times.

ProPublica (6/8/21) “compared how much in taxes the 25 richest Americans paid each year to how much Forbesestimated their wealth grew in that same time period”—an obvious precedent for the White House analysis that was overlooked by the New York Times.

If you want to look at what the very richest Americans pay in taxes, then the way Saez/Zucman and the White House do it is more accurate than the way the Tax Policy Center does it, because those 400 billionaires—worth a combined $3.2 trillion last year, up $240 billion from the year prior, as calculated annually by Forbes—are very often not those with the highest taxable income.

For instance, Warren Buffett, a perennial Forbes 400 member who currently ranks No. 4, voluntarily released his tax returns in 2015. His reported income ($11.6 million) didn’t even put him in the top 14,000 earners. That year, Buffett paid about 16% of his reported income in taxes.

Buffett released his returns in response to Trump’s attempt to deflect attention from his own refusal to release his returns; Buffett had nothing to hide, since his methods of avoiding taxes were perfectly legal.

As ProPublica (6/8/21) found in its recent bombshell report on leaked tax returns of the ultra-rich—yet another analysis using similar methods to the White House that went unacknowledged by Tankersley—Buffett is particularly good at tax avoidance: From 2014–18, while his wealth grew by over $24 billion, he managed to pay less than $24 million in taxes. It’s an effective tax rate of 19% on reported income measured the “conventional” way, but a tax rate of just 0.1% on his actual gains. That’s the lowest of any of the country’s billionaires.

Mind-Boggling Methods

The ultra-rich have a myriad of mind-boggling ways of getting away with not paying taxes that the rest of us have to. Two that the Biden administration is pushing to eliminate relate to asset gains.

If someone sells a stock, any gains from the purchase price are taxed at a significantly lower rate than other income; the White House is seeking to end that preferential treatment for those earning above $1 million.

Further, if someone instead holds that stock until they die, and leaves it to an heir, those gains are not taxed. So billionaires like Buffett and Jeff Bezos can vastly increase their wealth, never pay taxes on most of it as long as they don’t sell it, pass those assets to their children upon their death and—poof!—those billions are never subject to income tax. This dodge is called the stepped-up basis, and it’s a major driver of the racial wealth gap.

Lawmakers Impacted

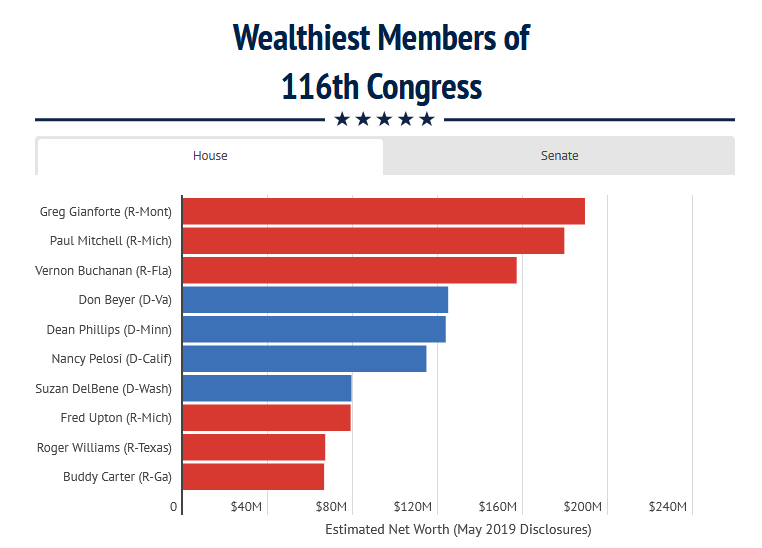

As Open Secrets (4/23/20) points out, many lawmakers have a direct interest in avoiding taxes on wealth.

Most people don’t think the wealthy—or corporations—pay their fair share of taxes (Pew, 4/30/21). But their representatives aren’t eager to fix the system. Tankersley mentioned at the end of his piece that congressional Democrats have “pushed back” on Biden’s efforts to change both capital gains taxes and the stepped-up basis. He didn’t mention how many Democrats would be directly negatively impacted by those fixes.

Given that the majority of members of the last Congress were millionaires (Open Secrets, 4/23/20), any children they have will greatly benefit from the stepped-up basis. And any member of Congress who holds stock and ever plans to sell any of it is impacted by increases in the capital gains tax. Not to mention all the wealthy donors funneling money into super PACs for most Congress members.

Fortunately for them, they’ve got the New York Times running interference.

call me shocked….particularly when the NYT has been controlled (in whole or de facto) by the same family for….how many decades?!

PBS had a very good two part show on William Randolph Hearst this week. One of Hearst’s late 19th cent competitors, the NYT, gets mentioned as catering to the business class. So twas ever thus.

Surely the problem is less the predilections of the Times but that these papers, that primarily represent the uppers, get tagged as “national papers” authoritative for everyone. In Hearst’s day there was much less groupthink in journalism. The poor did have Hearst and others (at least for awhile) as their champion.

That Hearst show was informative and fun!

The Times has a unique business opportunity now. They can expand ad revenues by catering to the new designer noose and pitchfork trend.

When the New York Times Colludes With the Billionaire Class

When don’t they? But if you read the NYT, you get what you deserve.

What happens with any business entity trying to assert independence (including governments) largely owned by Blackrock and Vanguard? ;)

This is a complete misunderstanding of how asset managers work. Both Blackrock and Vanguard consist almost entirely of index funds. They exist solely to achieve the tightest index replication at the lowest cost. They have disincentives to waste money and energy influencing management. No only does it conflict with their cost minimization imperative, but it would also lose them corporate 401(k) business, which is more profitable than just running plain vanilla indexes.

On top of that individual investors like my mother who trade through Vanguard have their shares registered in “street” name. They are reported as if Vanguard owns them when the investor actually votes the shares.

I had to laugh at the title of this post, when the NYT colludes with the Billionaires it’s Monday through Sunday and it has been that way since well before I was born 68 years ago.

The cigar smoke has thinned and the mirrors are cracked, that’s the only change.

The book by Zucman and Saez is actually call Triumph of Injustice.

;-)

Can it be called collusion when a company is in fact owned by billionaires like Carlos Slim?

Isn’t that just working for one’s boss?

Oh, so the NYT reporter’s name is Tankersley? Well, here in Tucson, there’s a very wealthy family with the same name. Wonder if there’s any connection.

He’s from McMinnville, OR and went to Stanford, so not an obvious connection if there is one. Worked for the Oregonian.

Forgive me if this is common knowledge, but it was certainly new to me.

An interesting bit from the ProPublica article – those with massive hoards of wealth, like Bezos and Buffet, can still reap the benefits of those hoards without technically cashing them out. Bezos, for example, can take out loans using the billions of Amazon stock he owns as collateral. As a loan isn’t income or an accession to wealth, it isn’t taxed. I’m certain the rates for these loans are way better than the ones an average person will find available to them, and this has the added benefit of letting the stock appreciate while still technically owned by Bezos. I’m also pretty sure he can write off the (probably negligible) interest on those loans as tax deductible, which is pretty insulting.

I’m not entirely sure how to fix that, but it seems like a way to have your cake and eat it too. It’s as bad as politicians putting considerable stock holdings in ‘blind trusts’ managed by close friends or family members, and then pretending like their hands have been washed clean.

The Independent Tax Center figure of a 14% average tax rate for all tax payers is absurd.

The combined Social Security/Medicare tax rate is 15.3%. Most places have sales tax in the 8% range. An income tax rate of 10% kicks in above the standard deduction of $12,400. Most states have income taxes that start quite low.

And every renter has the landlord’s property tax factored in to their monthly bill.

When does the When the New York Times Colludes With the Billionaire Class?

On any day ending with a “y”

I misread the headline as “Collides”. Oh, boy, a man-bites-dog story! Oh. Darn.

Billionaires not paying their fair share of taxes is of far less concern than that billionaires are allowed to exist. They are a dire threat to democracy and the state. When individuals have enough money to wholly own portions of Government there is no Government of, by, or for the people.

Democracy does not exist, except as a deluded and obscuring shibboleth, and as usually happens everywhere and every when, Great Wealth OWNS what you call the “state.”

Good luck changing that, short of the Jackpot… and if any humans come out the far side of that, anyone give odds on how the remnant political economy will be structured?

Modulo, possibly, whatever is happening in China, or is that just more pie in the sky thinking?

Back around the GFC during my last gasp reading of the NYT I saw an article penned by Andrew Ross Sorkin’s. I ignored it and went with my life. Then I thought, well maybe I should let Sorkin know what I thought of his byline.

So, I emailed him:

roast to Sorkin: “When I saw your byline on an article in today’s NYT I thought that I would do something productive. So, I picked the belly button lint out of my navel.”

Sorkin to roast:“I am happy to be of assistance in your grooming endeavors.”

The point at issue is whether unrealized capital gains should be taxed each year, that is whether to tax the gain in an asset’s value each year as if the asset was sold, even when it wasn’t. Current practice, as the post indicates, is to tax a gain in an asset’s value only when the asset was sold — the capital gains tax.

There can be no question that current practice allows asset values to increase tax-free (until sold). Equally, there can be question that, interacting with other parts of tax law, this facilitates large capital accumulations.

OK, so far. The problem is there are big problems with taxing unrealized gains. Here are three:

First, what to do about unrealized losses? Does the government have to pay refunds on each loss of value? Or do taxpayers pay taxes on gains, and eat losses?

Second, what about all the selling that would hit markets as taxpayers are forced to sell to pay tax on unrealized gains? This is akin to the problem that occurs when heirs need to sell a family business or farm to pay estate tax.

Third, it is easy to calculate unrealized capital gains on publicly traded securities. There is a publicly reported purchase sale price, the gain is the difference. But what about other assets? What about the aforementioned businesses and farms, what about summer camps and beach houses. Gains on these properties are taxed on sale; which again yields two real prices, purchase and sale. But for an annual tax on gains in asset values, where there was no sale, how would gains be calculated, and by whom? For those summer camps, would an annual appraisal be required, or could we just take the Zillow number?

Everything is as it is for a reason — or reasons. Sometimes those are nefarious. Sometimes not. In this case I think we have what we have because anything else raises insuperable practical difficulties and dire unintended consequences. The problem isn’t the way assets are taxed, it’s the policies that have concentrated assets so few hands.

Good reasons to focus on an asset tax. Say 2% a year on anything over $10 million total asset value and 5% above $100 million. Also do away with all non-profits, the shady tax dodging far outweighs the good done by legit outfits. I think most good works done would be done even without a deduction.

Many middle class people pay a similar tax on their main asset (their home). If the only asset is untradeable shares in a company then 2% of the shares become the Treasury’s which might help us get wind of dodgy corporate practices before they blow up.

Before knocking off non-profits how about eliminating shell companies? (Did we see this floated as the Biden administration arrived in a flush of optimism?).

Good point about property taxes. And asset inflation in general could be lightly touched with a capital gains adjustment that goes inversely with the borrowing rate. (for example) States with tax abatement like Ca.proposition 13 could take some back with a capital gains tax on sale proportional to the tax savings over course of ownership. .etc. .

Prop 13 reform is very needed. Corporations never die and they sell themselves, not the properties they were formed to own, causing the tax burden to fall more and more on residences. I like the idea of a Person being allowed an ownership or other beneficial interest in only 2 properties subject to the benefit of Prop 13. The same principle could be applied to things like political donations. Eliminating shell companies (or at least greatly restricting them) seems like a good idea in the same vein.

The inverse borrowing rate idea is clever but sounds complicated. I favor a radical reform of the banking system (Public Banks and MMT for the people not at the Fed window) which would make asset inflation less dependent on rates. Of course these days ideas that excite unemployed accountants have more traction than radical systemic change…

As for asset taxes (putting on my academic Capitalist destruction as the churn of creation hat); Any asset that does not on average return 2% a year (thus maintaining one’s wealth despite a 2% levy) is mis-allocated and needs to be transferred to somebody who will more productively utilize it. The sizes and trigger points of the levy could be adjusted as needed.

I still think we should be focusing on removing the wage cap on income subject to Social Security taxes. I know it won’t officially goto the general fund. But if it could at least cover social security & Medicare, then we wouldn’t have to dip into the general fund to cover those shortfalls.

Why all the focus on “income tax?” Such an easily gamed construct.

“We” the mopes should maybe be honest and direct about it. Demand (haha) that our representatives legitimize a “wealth tax” that includes destructive taxing of intergenerational wealth transfers?

I mean, while “we” mopes are spitballing, https://www.merriam-webster.com/words-at-play/were-just-spitballing-here, and wishing that bits of the current political economy could be tweaked to favor us and ours more than others currently atop the heap, let’s “go for the gold!” No?

Bear in mind you are at war with BlackStone and other “wealth protectors” in the white shoe trade: https://blackstonewealthprotectors.com/ fun to read their opening web page.

‘Rise like Lions after slumber

In un-vanquish-able number –

Shake your chains to earth like dew

Which in sleep had fallen on you –

Ye are many – they are few.’