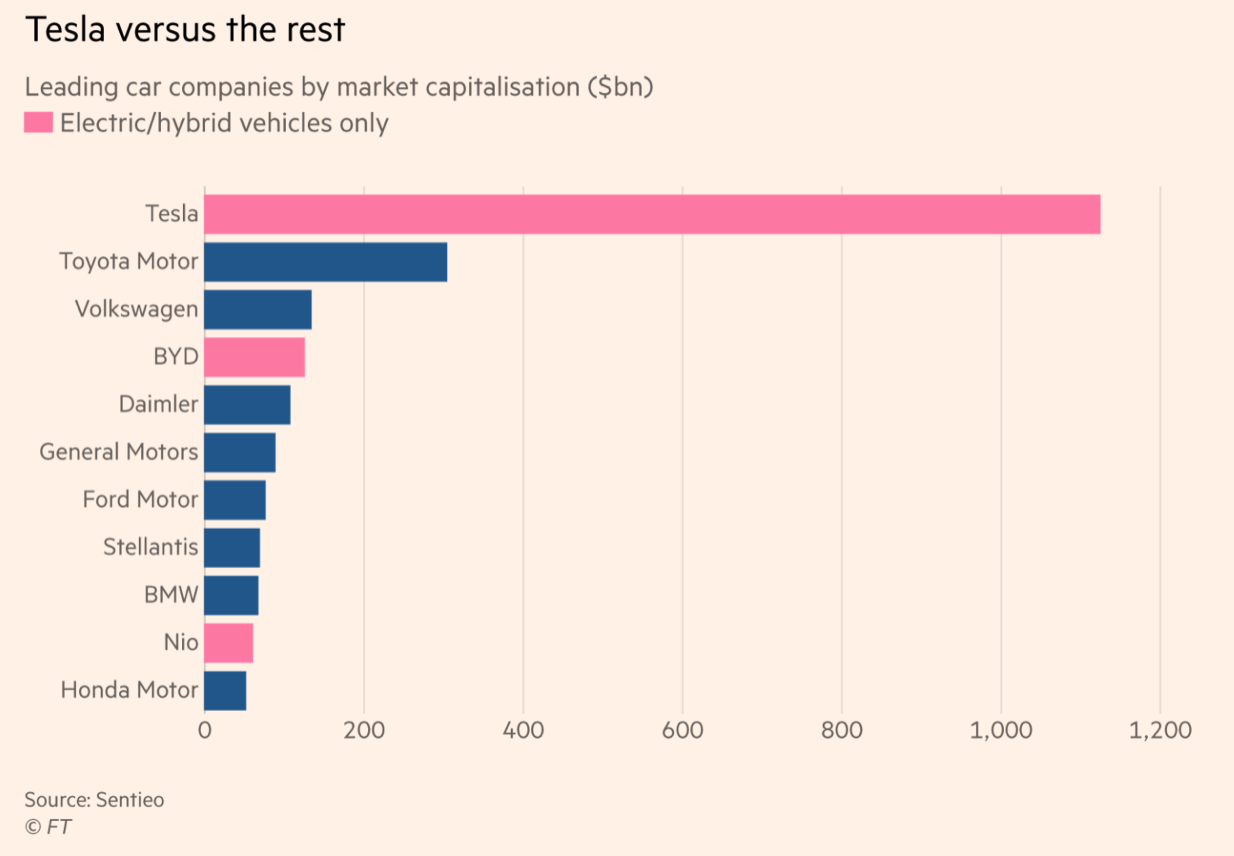

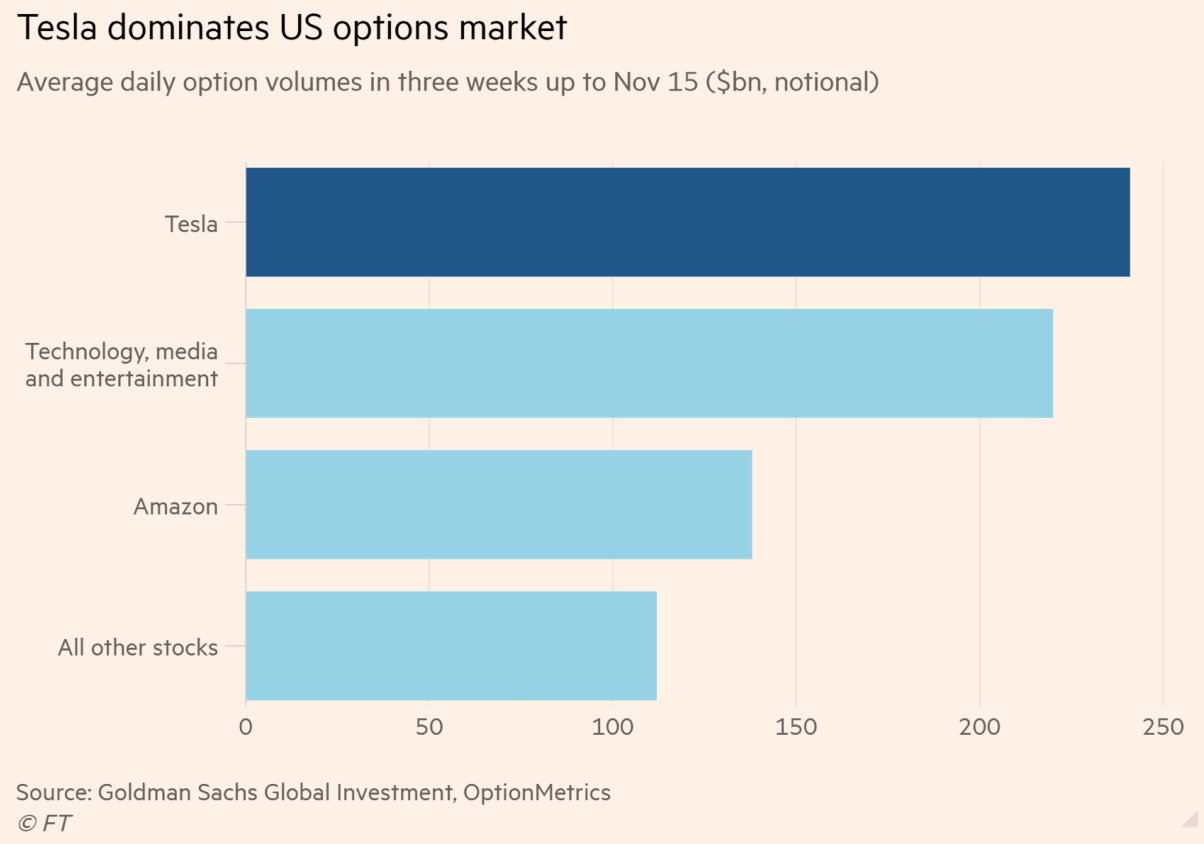

Robin Wigglesworth of the Financial Times does an impressive job of documenting a major factor, if not the factor, in Tesla’s stratospheric valuation: ginormous derivatives trading in Tesla shares. Even in this meaty piece, Wigglesworth only gets to the biggest part of the picture, which is a mind-boggling $241 billion in net notional value in option trades a day. The charts below explain much:

Reader HighlySuspect explained how the options trading gooses the stock price:

Market makers gladly sell call options to retail and make a huge profit doing so – it’s complicated but essentially the busy options market means call options are intrinsically overvalued and expensive, so market makers will sell these expensive options, hedge their position by actually buying Tesla stock, pocket the options premium, then sell the Tesla stock when the options position is closed. The market makers hedging by buying Tesla stock is actually one of the biggest factors behind the fast and enormous Tesla rallies – it’s an enormous source of buying.

Pink paper readers disputed a claim in the article, “Ordinary retail investors have been the primary power behind the Tesla options boom.” There is a whale in Tesla, billionaire Leo KoGuan who claimed he had bought nearly 7.2 million shares by early November, mainly though exercising call options. That makes him the third largest Tesla investor after Elon Musk and Larry Ellison. But no one would consider him to be an “ordinary retail investor, even though he is egging on individual investors on Reddit forums. Reader Dave Hedgehog argued that retail buyers could not be the driving force:

The typical premium on ATM tesla options is currently about 7% of the nominal value. I have absolutely no idea what the distribution of strikes traded is but if we assume ATM is the average then that is $17bn of premium being traded every single day.

That’s every single US investment account trading $42,000 a year on this single stock’s options.

But there is no doubt a lot of retail action, which the pros love. Per reader klog:

Thanks for this article…. So it sounds like the street is real lay short gamma… explains the wild price swings. Retail investors buying options makes me laugh as an ex vol trader…. We know they will not be hedging any gamma and just bleeding theta (but they don’t know what any of those terms even mean).

And exchange traded options aren’t the only part of the Tesla stock frenzy:

Tesla’s fame and the volatility of its stock have also started to make it a component in some structured investment products, such as “auto-callables”, further enmeshing its shares into the fate of the broader financial ecosystem.

Auto-callables are complex savings vehicles — particularly popular with Asian investors — where bankers construct an attractive, bond-like fixed return by selling stock options. Historically they have been mostly options on broad stock market indices such as the S&P 500, Hang Seng or Nikkei, but because of falling market volatility some bankers have started to structure them with options on choppier individual stocks. Tesla has emerged as a popular choice.

“Tesla is perceived as safe because it is big and at the technological vanguard, but it’s incredibly lucrative [for investors] to put into structured products because it is so volatile,” says Simplify’s Green.

Back in my childhood, when investment products with embedded options were first being developed, the option would be sold OTC by a professional dealer to, say, a mutual fund. The dealer’s exposure would then be hedged various ways, which could include using exchange-traded options.

The Financial Times points out that money managers are feeling compelled to load up on Tesla, since the underperformance of the average equity fund was in part due to not loading up enough on the car maker:

For US mutual fund managers as a whole, Tesla alone crimped their relative performance by 0.46 of a percentage point in October, according to Wells Fargo analysts, helping turn what was heading towards being a decent year into yet another mediocre one for stockpickers.

So many storied short sellers have been burned betting against Tesla that short interest is low.

Tesla is also the poster child in a trend towards options trading dominating equity trading:

One has to wonder what that chart would look like ex Tesla. Nevertheless, leverage is what creates systemic risk in financial markets. The Financial Times points out that that Tesla’s stock fell by nearly 18% in November, and nothing came unglued, but that decline merely gave up gains in October.

Equity derivatives are traded on exchanges, or if OTC, ought to be subject to central counterparty clearing. The dirty secret of derivatives exchanges and clearers is that the margin they are required to post isn’t sufficient to cover default risk (a large enough deposit would make most derivatives unattractive). Recall that in 2018, a single defaulting Norwegian counterparty of Nasdaq Clearing AB blew through his own collateral, the central counterparty’s capital, and then a fund of contributions from non-defaulting members, plus a general fund for all of Nasdaq clearing. Experts have worried that central counterparties can fail and are therefore effectively “too big to fail” entities. I’d like to know about where the Tesla options and other derivatives are cleared and more important, how significant Tesla activity is to those hubs.

It goes without saying that Tesla is overvalued, but a stock being overvalued is no barrier to it becoming even more overvalued. EV wannabe Rivian is valued at $110 billion, mainly by riding on Tesla’s coattails. Even though Tesla has been a technology pioneer, JD Powers and Consumer Reports surveys show the cars are not well made, and they cost a lot too! It’s not clear why the big automakers haven’t gained more ground (perhaps reluctance to cannibalize their conventional cars) but the Koreans are catching up, and the Chinese have targeted this sector too. At some point the gig will be up and Tesla will be valued like a car company. But don’t ask me to make book as to when.

Other automakers haven’t caught up to Tesla because they are still attached to making profit. Tesla uses green credits and interesting accounting to claim profits. The real costs of BEVs for the US market put them far out of the reach of the average consumer and additionally require expensive modifications to set up home charging.

As an anecdote on the retail realities of BEVs, my friend bought a model S and then had to change apartments to get a garage and spent $2k having it wired to charge up his car. He can easily afford that, but that’s a small subset of all car buyers.

as a counter-anecdote, it cost me $200 to have a 14-50 outlet installed in my garage to charge my Tesla MY….and I charge it overnight when electricity rates are lowest.

My friends install expense was partially due to him not owning the facility and requiring more extensive work than many detached single family homes.

Moreover, how many apartment dwellers can even do that? EV adoption will suffer without extensive charging abilities.

I would guess that a modern (capacity capable) circuit box was on the interior wall of that garage. Easy task for a no permit needed alteration. Very different price for a permit required, capability altering, external installation.

The Tesla owners in my town have been taking advantage of the “free” charging points (12kW) on my college campus that were intended for instructors. They’ve since been converted to ChargePoint hook-ups. No more Tesla’s. Expensive cars, cheap owners.

Same here, but I also have solar panels in California. I’m on the NEM 2.0 plan (net energy metering) which means my meter runs backwards on sunny days. We’re having sunny weather this month so even at the end of November, I’m generating more energy than I’m using.

Since the month of October, I’ve been feeding more into the grid than I’ve been consuming. The summer months are what really clobber me. Darn that AC!

OTOH, if I had more solar panels than the six that are already on the rooftop, I would probably be a net contributor to the grid throughout the year. I’ll have to check with the installation company on that one.

re retail traders not knowing about gamma or theta – sure, they don’t, but their reason to buy is not the same as a professional option trader. I.e. for many of them it’s a bet with a known downside – same as buying a lottery ticket, but with a much higher probability of paying out (for many, it seems almost a certainty).

Not that it changes the whole dynamics, because while there’s undoubtedly a lot of retail money in Tesla options, it’s still likely less than institutional.

TBH, this is one of the (many) practical problems with the current derivative pricing and trading, because they assume you can buy/sell as much as needed of the hedge instruments (which is usually the underlying, here specifically the stock itself) w/o moving its price. Which is patently untrue, and not just in-extremis. Many of the hedging algos are really self-reinforcing loops.

Quite true. And nice to point out the flawed logic presented presented with an air of superiority extra technical jargon thrown in.

Market makers are like bookies with people betting on which horse will win. Except in the case of finance if everybody thinks one horse will win then that horse can continue to win against the ‘real world odds’ for quite a long time. (Which is pretty repeating you point just in a different manner.)

A new use of leverage (well not really, but certainly now popularized). We are now in the Rampant Speculation “I can’t lose phase”. Sigh. The story eventually ends with the “and it’s gone phase”.

I (and many others) get to play by proxy with my S&P 500 index fund. It’s fun right now.

The Tesla story is fascinating to me for reasons I don’t fully understand. Maybe it’s because I’ve always been a little bit of a car guy and I still remember seeing an electric car on Mr. Rodgers Neighborhood ages ago and thinking that was the coolest thing. I still think EVs are a good idea, I just wish it was anyone but this company leading the way.

I guess the other side of it is, as much as I hate con-men, it’s interesting to watch the con in action. Musk isn’t just a rich jerk, he’s a con-man and Tesla is the con. I’ve mentioned this before, but I would highly recommend the three part TrueAnon podcast series on Elon Musk to help connect a lot of the dots. A lot of the financial stuff is above my head (I’ll re-read this post a few times, and I thank you Yves for making it) but that podcast breaks it down a bit easier for me.

He’s the modern day PT Barnum. His ability to sell the Boring Company as doing anything useful at all is astounding. Hyperloop? Nah, just a shitty tunnel with LED light, but look, we’ve made traffic three dimensional!

I believe something in the neighbourhood of 50% of all EVs are manufactured and sold in China. Musk is big in the USA but probably a bit player in a good bit of the rest of the world.

The city of Shenzen, alone has 16,000 electric buses And 22,000 electric taxis. I have no idea how many personal EVs.

Probably no Chinese manufacturer can match a Tesla 3 but how many people in the USA can afford one? Reportedly mid and upper range Chinese EVs have been showing real strides in quality control. Really low end (~US$5,000 or so) EVsstill are probably a bit dicey in quality.

Elon Musk is not “Just” a con man any more than Steph Curry is just a basketball player.

I was listening to a conversation recently with a few ‘regular guys’ talking about Tesla and stock investments. The conversation went to Tesla shares and one pointed out that Tesla valuations were vastly out of synch with its earnings, and the other person not unreasonably pointed out that so was Amazon 10 years ago. So they seemed to agree between the two of them that it was well worth buying a few for the long term. Of course, one could also point out the many other companies that were overvalued and turned out to be…. overvalued. Most are long forgotten except to the people who lost their shirt.

Its hardly surprising that there is financial chicanery going on with Tesla, but I guess the core question for anyone interested is whether Tesla is Amazon or Theranos. There is no question but Tesla make good cars. Its actually highly impressive that they are making pretty good cars that beat out far more experienced manufacturers in such a short time, and are ahead of the game in some key areas, such as the electric drivetrain (which is significantly more efficient than its competitors, using less rare earths). Even the Japanese and Koreans took a couple of decades of very intensive investment to be able to match the then market leaders. The Chinese have been investing massively since the 1990’s and still haven’t (quite) caught up.

But to justify its price you have to assume that Tesla will be at least the equal of GM or Toyota or VW within a decade or so. Its very hard to see how Tesla can move from being a niche high end manufacture to having an entire range, plus the capacity to make several million units a year. And doing all this, while becoming profitable. And this in the face of an enormous investment by some of the main new companies, most obviously VW and Hyundai/Kia/Genesis (they cooperate on EV’s). And the Japanese are very advanced in battery technology, so if they make a breakthrough in solid state batteries soon (which seems very possible if rumours are correct), they’ll leapfrog everyone. And it won’t be in any of those companies interest to help out an upstart like Musk. So at the very least, there will soon be a highly competitive market in EV’s which will prevent anyone making excess profits – i.e. there isn’t a potential monopoly situation as with FB or Google or Amazon.

Anyway, this is just a meandering way of saying that nobody should come to me for stock investment advice.

The thing about Amazon is that you could see where their potential profits were being spent: lowering prices on products and shipping costs to increase market share, infrastructure buildout (for both physical goods and cloud computing), etc. If they cut back on any of these, their profits would rise as their existing businesses would keep going. Add in the fact that they are good at pursuing monopolistic market power, and you have a real case for future profits w/o any major breakthroughs.

Tesla has no such obvious initiatives it could cut in the near future to boost profits, nor any credible path to market dominance (as you noted).

I am also not aware of Amazon consistently failing to deliver on promises, unlike Tesla.

So yeah, don’t trust my analysis of stocks, but I do think the Amazon analogy is seriously flawed, and one should seriously distrust financial advice from anyone throwing it around casually!

Hi PK,

Tesla is ahead on the central control software – Musk is a softy, but otherwise not so much.

The drive train is not special and the overall system is relatively primitive. Hyundai is already ahead in this respect heat pumps and integrated thermal systems etc..

Perhaps Tesla is Theramazonos. A pyramid of various kinds of trickery and exquisitely legal fraud balancing on its point of actual and possibly good product.

Does anyone want to bet against Nancy Pelosi and the holders of the purse strings these days?

Meeee!

I’m thinking that, in the 2022 election, Shahid Buttar will win his primary against Pelosi.

Aren’t most of Pelosi’s constituents the classical limousine liberals? If so, they they and Nancy are exactly eachothers’ type, and they will all be true to eachother.

If the outcome seems in doubt, the Pink Pussy Hat brigades and the Goldman-Sachs feminists will all come out to warn that a vote for Shahid Buttar is a vote for the Patriarchy and for Misogyny and against Womens’ Rights.

Plutonium Kun is right; Tesla is either Amazon or Theranos.

Two years ago I was at an open-but-off-the-record conference which included some very senior professionals in the national security/intel world. At a coffee break one was asked “What do you (meaning his organization) think of Musk?” He paused for a few seconds then said “We haven’t quite figured out what his genius-charlatan ratio is”.

So, dear commentators, if Ford plus the Korean and Japanese companies begin to produce a large numbers of EVs with dedicated battery production facilities and retail dealer systems to back up repairs, and Tesla begins to decline, what are the financial system consequences of all those Tesla options with weak counter-parties? Is this 2008 and AIG all over again?

To Yves and the gang; enjoy a safe and un-moderated Thanksgiving.

Comparison to Theranos????? Tesla’s cars work, their solar energy systems work, their space vehicles work, their utility & utility management systems work.

There’s really only one direction to go from the top. Staying number one is a fool’s game guaranteed to wind up deep in number two.

Tesla’s end game will be its quality deficit. It is a luxury good due only to its niche as a positional good. No one will buy a Rolex when everybody has one. And no one would buy a Rolex if the numbers on the face were crooked or the links in the band didn’t match. Quality counts and luxury buyers can’t support too many makers of high end EVs. The Asian car makers understand this; the rest, do not. Tesla will join Packard and the Chrysler Imperial in the museum.

I don’t think it’s so black and white? There is plenty of space in between those. Tesla could quite likely become something like BMW – a medium sized car manufacturer with strong margins due to a fancy brand. They are not too far away from that, at the moment.

Ironically, Tesla could hypothetically become the largest, most profitable car manufacturer the world has ever seen, and still be a stock market disappointment compared to its current valuation, or compared to Amazon.

If Tesla turned into another BMW, with the same market cap as BMW, it would represent a 95% drop from the current market cap according to the article. Whatever Tesla is promising the market right now, becoming another BMW isn’t it.

Yes, it’s unlike Theranos in that this vast edifice of wishful thinking and promises is built on top of an actual viable business, albeit one that’s clearly far too small to take the weight of all those expectations (perhaps Enron would be a better comparison). But I still think the odds of them delivering on it are vanishingly small, and I see no indication that the market has priced this in.

Rather than Amazon, I guess that Tesla aspires to become the Apple of EVs.

Like Apple phones, Tesla EVs are prestige objects. Tesla EVs signal that their owners are “rich but green”. So far, none of their competitors can match this prestige. This allows Tesla to sell their EVs with a significant premium.

The question is if Tesla can make a profitable business out of this, as Apple did with their phones.

But that goes back to the comment elsewhere on the thread, that that is tantamount to BMW market share and not at all consistent with its current valuation.

There has always been a “musk”…ford, Hughes, onassis, zeckendorf, trump, McCarthy, LaGuardia, Franco, Fidel, Buffett, bluhdorn, Gulbenkian, Watson, kreuger, ET AL…the media needs a bigger than life driver to the story to keep the bread and circus game going…farcebrook alien “dork markerburg” didn’t invent chasing eyeballs…nifty fifty anyone ???

Regarding whether Tesla makes good cars or not: for the 2022 models, Consumer Reports (CU) only recommends the Tesla Model 3 (cost about $50,000 US). It does not recommend the very average Model S (poor reliability despite a $100,000 price tag), nor the very poorly rated Models X and Y (both at $100,000). Nonetheless owners of all models do like their Teslas very much according to CU.

By way of comparison CU gives a higher rating to the Mazda CX-5 (the car I bought last year) that has a price tag of about $30,000.

Tesla makes an astonishing car. Everyone I know who owns one (dozens of people, by now) loves it and thinks they’ll never buy a gas car again.

In a way, it’s such a fundamentally new category of transportation it hardly belongs in the same category as regular automobiles. So Consumer Reports, which originally classed the Model S as “the best car we’ve ever tested” is really being unfair when they then apply the same standards of reliability to the Tesla as they do to old-fashioned gas-powered cars. They have no ability to discern between radical new tech and old tech, so they just put it into the whole old category and rate it’s relative reliability; in other words, they structurally penalize innovation.

But, as they themselves admit, Tesla owners have among the highest satisfaction index of any manufacturer…which should tell you that CU’s criteria in this case is woefully inadequate.

Ironic to me (not) that the one billionaire who is legitimately disrupting not one but three legacy industries — automotive, energy (solar) and rockets (the purview of military industrial contractors like Lockheed-Martin) should be the one billionaire most vociferously attacked and smeared by the mainstream press (which, among other conflicts of interest, earns hundreds of millions in automobile advertising every year from every manufacturer but Tesla). Musk is the one billionaire who has actually put his money where his mouth is to evolve the world from fossil fuels, and executed brilliantly so far. If every other car manufacturer buries Tesla by putting out excellent electric vehicles he will have accomplished his primary goal, which is to speed up the world’s transition to renewable energy.

Please don’t tout the myth that Tesla’s cars are high quality.

Tesla is operating on quality brand fumes, likely on its S line, which as you know is its high priced model and apparently does out perform luxury brands.

JD Power rated Tesla next to the bottom last year in product quality.

https://www.greencarreports.com/news/1128625_tesla-ranks-last-in-initial-quality-build-issues

Consumer Reports rates Tesla 27 out of 28 on reliability, and deems its Model 3 to be average in quality, its other cars sub par:

https://insideevs.com/news/549130/consumerreports-tesla-reliability-poor-2021/

https://www.reuters.com/markets/asia/tesla-electric-suvs-get-poor-scores-consumer-reports-2021-11-18/

Another report this year on widespread products, basic stuff like parts not fitting well together:

https://www.autoevolution.com/news/detailer-makes-demolishing-analysis-of-tesla-s-build-quality-171486.html

a big roadworthy riff on the good ol’ electric golf cart?

Actually, I heard the same line from people who bought other electric car models. It’s not the brand it’s the fact that they are electric. Driving an electric car can be quite fun. The more other car manufacturers bring out electric models, that are cheaper/ better performing the less interesting a Tesla will be.

I have a feeling that Elon is cashing in now by selling a huge amount of his stock holdings. Pair that with the sunsetting of the tax credits for Tesla cars.

Musk’s companies have always relied on some form of support from the govt. His space X company relies on public infrastructure. The Hyperloop outfit requires state and local govt support via federal funds. When these dry up, Tesla will shrink.

There have always been cars (well, all sorts of things) that were popular despite being poor values in real terms. A good many were eventually brought down to earth by their investors/creditors. A good many others were brought down by their competition. So far, neither actors are slowing Tesla down.

RE comparisons, I’d say Tesla is more like a Ponzi scheme than anything else.