The financial press has gone into a round of hand-wringing over CalPERS’ efforts to chase higher returns in a systematically low-return market, now by planning to borrow at the CalPERS level on top of the leverage employed in many of its investment strategies, in particular private equity and real estate.

These normally deferential publications are correct to be worried. Not only is this sort of leverage on leverage dangerous because it can generate meltdowns and fire sales, amplifying damage and potentially creating systemic stresses, but the debt picture at CalPERS is even worse than these accounts they depicted. They failed to factor in yet another layer of borrowing at private equity funds and some real estate funds called subscription line financing, which we’ll describe shortly.

As we’ve often pointed out, garden variety borrowing, even on a widespread basis, can produce a world of hurt in the form of bankruptcies and nasty recessions. But the cause of financial crises, particularly in the modern era, is leverage on leverage that then impairs the banking system or other systemically important players. Recall that in the Great Crash, not only was margin lending on stocks at much higher levels than allowed now, but there was leverage on leverage on leverage in the form of trusts that bought stock, sold shares in those trusts, which were then bought by other trusts.

And even if an implosion at CalPERS and other public pension funds that follow CalPERS (and you can be sure there will be; CalPERS’ stepping out is a legitimator), that is not terribly consoling. California taxpayers that backstop the giant fund will wind up holding the bag. Any imitators in jurisdictions that don’t have strong government guarantees will instead impoverish their beneficiaries.

Mind you, borrowing at the investment fund level is not always a bad idea. We even advocated it for CalPERS as an alternative to investing in private equity. German institutional investors are allergic to private equity, and to achieve higher levels of risk, they invest in public securities and borrow across the entire portfolio. That approach is defensible because the German investors can determine what level of borrowing and other risks exist in their securities portfolio, and thus can also estimate how much leverage-related risk they are taking overall.

However, this is not what CalPERS is up to. As Institutional Investor summed up the new scheme:

At its mid-November meetings, the California Public Employees’ Retirement System revealed its plan to manage these changing market dynamics. The fund intends to change its strategic asset class allocation, funneling more money into private equity and adding a small amount of leverage to the portfolio….

CalPERS will be increasing its private equity portfolio from 8 percent to 13 percent of its total assets, or roughly $25 billion. CalPERS is selling some Treasuries and stocks to push further into privates….

The pension fund plans to add up to 5 percent of leverage, borrowed money, to its portfolio. CalPERS argued in the recent presentation that leverage would improve diversification and reduce risk.

For those of you who have even an itty bit of finance literacy, CalPERS’ assertion that borrowing would increase diversification and lower risk is so flagrantly false as to disqualify the institution from managing anything higher stakes than a church raffle.

CalPERS tells other less obvious fibs, such as trying to depict private equity as so critical to success that it need to put more money on that number on the roulette wheel. Remember, the name of the game in investment-land isn’t absolute performance but risk adjusted performance. Not only has private equity not generated the additional returns to compensate for its extra risk at least as long as we’ve been kicking those tires (since 2012), academic experts such as Ludovic Phalippou, Richard Ennis and Eileen Appelbaum have concluded private equity has not even beaten stocks since the financial crisis.

Let us stress that unlike German investors, who have a pretty good handle on all the leverage bets in their investment portfolios and thus can make a solid estimate of how much risk they are adding via borrowing across all their investments, CalPERS is flying blind with respect to private equity. It does not have access to the balance sheets of the portfolio companies in its various private equity funds.

And while having balance sheet would be a considerable improvement over what is has now, it doesn’t give the whole picture. CalPERS would also need to factor in operating leverage. When I was a kid at Goldman, whenever we analyzed leverage (as in all the time), we had to dig into the footnotes of financial statements, find out the amount of operating lease payments, and capitalize them, as in gross up the annual lease payments to an equivalent amount of borrowing so we could look at different companies on a more comparable basis.

Operating leases are a widely-used method for stripping cash out of a private equity investment. Many retail businesses owned their stores because retail is notoriously cyclical. Not having to pay rent reduced fixed costs and helped them ride out bad times.

Unlike owner-operators, private equity firms make money whether their investments do well or not, and so are not very sensitive to bankruptcy risk. As Eileen Appelbaum and Rosemary Batt described at length in their classic, Private Equity at Work, the private equity firm will sell the real estate of an investee company to a third party. The value of the real estate spun out depends on how high the rent payments are. That gives the private equity managers an incentive to saddle the company with expensive leases, since if it can claw out a lot of the value of the enterprise via real estate sale, it doesn’t much matter if the company later goes bust.

Another source of hidden leverage is subscription lines of credit. Instead of the customary practice of loading debt onto portfolio companies, here the private equity fund managers instead borrow at the fund level. And what backs this debt? Not the assets of the portfolio companies, but the chump investors. These credit lines are secured by the uncalled commitments of the limited partners.

Again investors like CalPERS are flying blind. Even though it is their commitment that is securing this borrowing, they have no idea how much is being used. But they were warned that they could be on the hook for this sort of thing. This is typical language from a recent limited partners agreement:

No Borrowings shall be incurred under a Fund Credit Facility that would cause the total aggregate principal amount of such Borrowings to exceed 50% of total Investor Commitments.

As one expert said regarding their deployment:

In terms of how heavily the managers draw on it, that varies quite a bit. Sometimes you see them almost maxing out the lines; other times it’s used so sparingly that it seems almost pointless for the fund to have taken on the fixed expense (e.g., origination fee) of having the line.

Note that virtually all funds now use subscription lines to boost returns. Our source also says they are being taken up by real estate funds too.

There are additional reasons to finger-wag at CalPERS. Of all players, it ought to recognize the risk of loading up too much on risk because it was caught out in the financial crisis and had to dump stocks at distressed prices to meet private equity capital calls.

Bloomberg’s article, Leverage on Leverage Is Big Danger for Investors and Their Lenders, was alarmed even without recognizing the additional dangers of hidden leverage. And it made CalPERS the poster child, starting with its subhead:

The decision by Calpers to use borrowed cash to boost returns shows how everyone is taking more risk to make a buck.

Key sections:

Calpers, the $495 billion California public-employee pension fund, is planning to put more money into chasing returns by taking on debt worth up to 5% of its fund value — or roughly $25 billion — to plow into financial assets. It is doing this because it can’t see another way of hitting its long-term return target of 6.8% to meet its promised payouts.

This seems remarkable to me: A very big pension plan, which invests in lots of different funds, including many that use leverage to boost returns, is now going to start using its own leverage on top to try to boost its returns. It highlights how investors of all kinds are having to take more risk to make any money.

Calpers’s strategy may ultimately be self-defeating: The more money you throw at any asset class, the lower its yield goes and the harder it becomes for anyone to earn a good return…

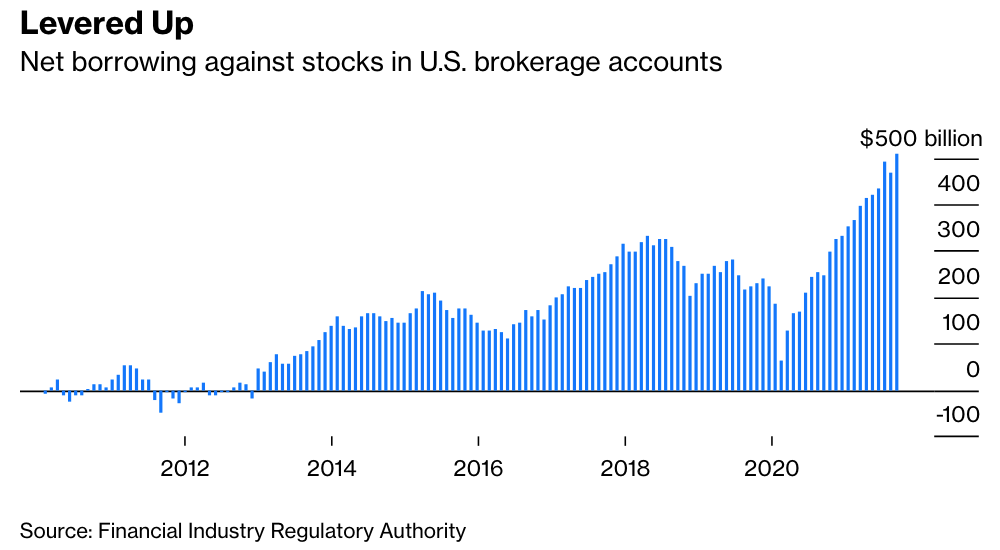

The other issue is that leverage in financial markets is high – and rising – and that makes things riskier and potentially unstable….

Guess what: Buyout deal valuation and leverage multiples have also jumped. The price tag on more than two-thirds of U.S. buyouts last year was more than 11 times earnings before interest, tax, depreciation and amortization (Ebitda), according to consultants at Bain & Co. At the peak of the last buyout boom in 2007, only about one-quarter of U.S. buyouts were at such high multiples.

Meanwhile, total debt is more than seven times Ebitda on nearly 60% of deals, according to Bain & Co.; in 2015, it was less than 20% of deals.

And yet private-equity firms are adding more debt to these businesses in order to take out dividends at a record rate this year.

The Institutional Investor account also gave cause for pause. For instance:

Ludovic Phalippou, a French financial economist and researcher whose work has been highly critical of private equity, cautions about the use of leverage in a portfolio. “Most people think that adding leverage increases returns, and that is a mistake,” he said via e-mail. “Put as simply as possible: If you invest in AAA bonds, let’s say you receive 2 percent for sure. If you lever up an equity portfolio, [you may, let’s say,] have a 50 percent chance of receiving 20 percent and a 50 percent chance of losing 10 percent. The expected return is higher in this example, but you don’t receive the expected return, [and] this is where the mistake is: You either win a lot more or lose a lot more. If you are a pension fund and increase leverage, you are doing the latter — i.e. basically betting the house. You are taking the risk of losing a lot of money because you want to have a chance to become solvent.”

As is usual for CalPERS, the board wasn’t properly briefed on the risks. To the extent its board members found out, it was after they’d approved the strategy, via press stories like these. As CalPERS board member Margaret Brown said:

This leverage on leverage risk was never raised or discussed with the board by staff, Meketa or Wilshire.

The old saw has it that God protects children, fools, and drunks. Perhaps CalPERS is wagering on divine intervention by being such an obvious dupe. But given how many naive investors get their heads handed to them, the good Lord apparently treats investing as graven image terrain and outside his protection.

This is likely a sign for the top of the market – the moment CalPERS loads on whatever, leveraged to its ears, you can bet that the short/medium term trajectory for those assets will be down.

At this stage, I think that CalPERS is willing to bet the house because they know that California, with its $3 trillion economy, will always pick up the pieces and pay the inevitable tab. And who is to doubt them? They do that for Pacific Gas and Electric Company (PG & E) again and again no matter how many times they cause death and destruction along with rolling blackouts which play havoc with the Californian economy. Why wouldn’t they assume that Sacramento will not do the same for them?

So I set myself the task of coming up with a CalPERS-style scheme based on their latest Jenga style tower of leverage that they came up with. So CalPERS has a headquarters building at 400 Q Street in Sacramento. How about CalPERS sets up a nominally separate corporation and then sells their HQ building to that corporation. They then lease this building at a cheap rate over say, a twenty year period. They can then take the money that they got from the sale and invest it in a PE corporation like BlackRock and use the interest earned to make the payment on this lease.

They no longer have the headache of running an actual building, can show the earned capital as a profit on their financial statements, and the interest payments earned which pay the lease make it a “free” building for CalPERS. And thy don’t even have to move. And if you believe that this is a good scheme, I can get you a good price on the Sydney Harbour Bridge. But CalPERS does have a lovely building-

https://www.calpers.ca.gov/page/newsroom/media-resources/image-library

Excellent piece. It is all the other state pension funds I am concerned about. They need to see CalPERS rightly ridiculed for leveraging the state pension fund. “Dear Trustees Everywhere, Don’t do this. It’s stupid.”

In order to make this economy go around and come around maybe it is time to invest lotsa BBB money in an infrastructure that benefits from demand from an aging population. The very idea is a significant improvement on the shell game going on in pension fund “investments.” Fer example: invest pension fund money in quasi-government enterprises that make products which will be in demand for all of us old farts. Transportation, food, home care services, etc. Expand assisted living facilities. College degrees for health care workers. But no no no. That is way too logical. We have to invest our money in companies that invest in other companies, that in turn borrow money to invest in other companies that have large diversified operations that never make a profit except by tax dodges. And that profit is immediately gobbled down by outrageous fees for maintaining this economic structure of financialization of even the most idiotic things. And so the pension funds are getting screwed both by losing money over precious time and having expenses go through the roof due to cost of living rising for goods and services which are becoming scarce and of poorer quality.

This is a very good piece. At least I think it is since I only understand 10% of it. What I do get is that there’s a good chance CALPERS will blow up and then CA taxpayers are on the hook to pay pensions. I would like to know what happens next?

I suppose state and local tax hikes, big school budget cuts, layoffs at state and local levels. CA becomes a bigger disaster.

What else? What kind of systemic melt downs?

What else? How about a Detroit-style bankruptcy and restructuring of benefits leaving all those retired firefighters, social workers, DMV clerks, and trash collectors holding the bag of (say) a 75 percent benefit cut? Just like the Private Equity vampire business model CalPERS says they want to emulate “in-house!”

At least these retirees already know the locations of all the decent bridges to live under.

Follow the money…

Ms. Smith-

You missed the point. CalPERS is going for the Nobel Peace Prize in Economics. They are proving that leverage doesn’t increase risk. It actually reduces it. Most people think buying on margin is risky but they are wrong.

CAPM is dead. Long live CAPM

So, just trying to understand private equity here, people buy into private equity as a partner with others. Not fully knowing who those partners are? They give the private equity people money to invest in companies in money only, no control over the company nor have access to the company books? The object is to extract as much out of the company before it goes under? Leaving many empty shells behind, workers included just turn there backs and move onto the next victims.

Have I got this right?

So how is this good union practice CalPERS?

Or do I have this private equity thing wrong?

Classic American media bias on display here: Professor Ludovic Phallipou, who holds the position of Academic Area Head of the Finance, Accounting & Economics group at the Oxford University Saïd Business School gets dismissed by I.I.’s Alicia McElhaney as a “French financial economist and researcher…”

Since when is Oxford in France?

I think the point is that Ludo is a French national. He holds a professorship at Oxford University (specifically at the Saïd B-School). I don’t think Alicia McE is asserting that Oxford is in France…