You can try to blame the business press non- and mis-reporting of sickly Black Friday and underwhelming Cyber Monday sales on Omicron eating the news, but that won’t get your very far. The sort of gumshoe reporters that once covered the retail sector would not be pressed into pandemic coverage.

In fact, the slow retrenchment of American consumers has gone largely unmentioned. We are supposed to believe that they really did shop early as they were encouraged to do to get in front of supply chain failures. But as we’ll see below, spending on goods had fallen in the third quarter and retail inventories grew this quarter, which is the opposite of what you would observe if consumers were making purchases as retailers were having trouble keeping items in stock.

Indeed, the press has underplayed the recessionary warnings. From a post in late October:

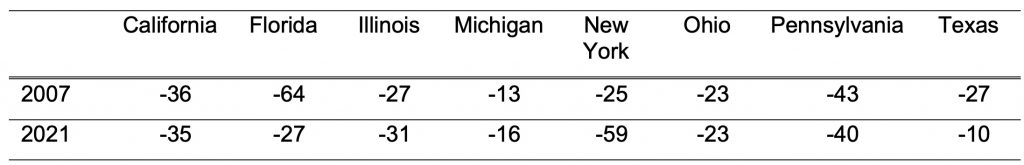

Two series – from The Conference Board on business conditions, employment and income six months hence, and from the University of Michigan on the financial situation in a year and business conditions a year and five years hence – tell the same story: sentiment peaked in spring or early summer. And it has been falling precipitously since (Blanchflower and Bryson 2021a). This is true for the US as a whole and for the eight largest states for which The Conference Board collect data.

Why does this matter? Well, the rate of decline in these sentiment indices is of the same magnitude we saw back in 2007, before the Great Recession (Blanchflower and Bryson 2021b,c). We call it the 10-point rule. When the indices drop by at least 10 points, this is an early warning signal for a recession.

We test this proposition for the US over the period 1978 to September 2021 and show that consumer expectations about future economic trends are highly predictive of economic downturns 6-18 months ahead, thus providing an early-warning system for the economy (Blanchflower and Bryson 2021a).

Table 1 The Conference Board expectations data in the eight biggest US states, 2007 and 2021

It is not hard to infer that consumer confidence was propped up by government intervention and spending, and their withdrawal while Covid is still very much out and about has produced a great deal more caution.

And from CNBC a few days later, at the end of October:

Spending for goods tumbled 9.2%, spurred by a 26.2% plunge in expenditures on longer-lasting goods like appliances and autos, while services spending increased 7.9%, a reduction from the 11.5% pace in Q2.

The downshift came amid a 0.7% decline in disposable personal income, which fell 25.7% in Q2 amid the end of government stimulus payments. The personal saving rate declined to 8.9% from 10.5%.

Neither Lambert nor I recall seeing any reports on changes in same-store sales across major retail outlets, which was once a staple of business reporting. Neither of us recall this year seeing any major media reports of how dismal this Black Friday was either. Even worse, the mentions of the shopping day talked up how much store traffic rose…..when that turned out to be very much disconnected from revenues.

Kevin W sent this Tweetstorm:

Store traffic is up from last year but not even close to 2019. And online retail sales did not increase from the prior year. So people are just broke.

— The Hessian Courier (@LeftistMoniker) November 30, 2021

Omg, sales are such garbage we have actually shrunk the trade deficit by almost 20 billion dollars YTD. So unless any of you bought a rare foil 20 billion dollar Pokémon card…

— The Hessian Courier (@LeftistMoniker) November 30, 2021

If the trade deficit is shrinking, that means consumer demand is shrinking and consumer discretionary budgets have nothing in them. Because I assume you didn’t suddenly start buying American, because what do we make

— The Hessian Courier (@LeftistMoniker) November 30, 2021

Consumer sentiment, expectations, and conditions. As you can see, we have the exact same sentiment this year as last year. It went up and fell back down to “pandemic normal.” pic.twitter.com/YX61mkueds

— The Hessian Courier (@LeftistMoniker) November 30, 2021

TJ Max, Macy’s, Target, Burlington coat factory, Nordstrom, Victoria Secrets, all in some degree of trouble.

— The Hessian Courier (@LeftistMoniker) November 30, 2021

I don’t know anything about corporate retail upper level management, I have no idea if garbage Black Friday numbers will cause seasonal layoffs early. But if it happens, watch out

— The Hessian Courier (@LeftistMoniker) November 30, 2021

I don’t know about crash, but the Fed planning to tighten as consumers are retrenching is misguided. Remember the Fed mistakenly thinks it can stimulate growth when all it can stimulate is speculation in assets, but it can choke activity. It had all these years since the Taper Tantrum to try to take some air very slowly out of financial markets…and acts as if it has finally gotten the nerve. We’ll see how long its resolve holds.

For further confirmation and more detail on the sorry state of retail, van Metre below presents data. For instance, he shows at 8:58 that inventory levels rose even though the media reported them as falling.

And don’t assume Cyber Monday came to the rescue. Those sales were marginally down this year versus last year, which given inflation, means a larger decline in real terms.

So the reporting on the state of retails conforms with (crap) Covid reporting: facts are being omitted or fudged to do everything possible to preserve year end spending. We’ll see how much can be shoved under the rug before the great unwashed public notices that it is not just lumpy but also moving.

I’m curious as to how the Inflationistas are going to spin/ignore/distract from this data in order to keep momentum behind their incessant demands for rate hikes?

Zero interest rate-negative real rate policy is bad for everyone and the planet as it distorts the economy, discourages savings and encourages consumption of everything from $300 sneakers to $80,000 SUVs to $1,000,000 second houses.

Fighting inequality/pro-equity can’t be done via monetary policy (despite what the Fed Twitter account might say), it has to be fiscal (defund the Pentagon-CIA) and tax policy (at the minimum tax the top 0.5%).

today’s discourse about tax and spending is non-existent because the media likes talking about culture wars instead as focusing on the culture wars delivers the biggest audience, and has the by-product of aligning with the interests of the top 0.5%. And there are many useful idiots in pundit-land who are more than happy to play their part in dumbing down the public discourse.

IMO, YMMV.

Um, the “natural” rate of interest for a fiat currency is zero — anything higher than that has to be “defended” by central bank operations.

But I agree that fiscal policy is most important of all and would be delighted to see monetary policy slide into well-deserved obscurity.

“The “natural” rate of interest for a fiat currency is zero“? Really? Why?

If the interest rate of a fiat current is less than the inflation rate of assets, it’s practically begging for debt-driven speculation in assets. We’ve witnessed this quite thoroughly since 2009.

I would argue that the “natural” interest rate equals the inflation rate, so that people with savings don’t lose money when they choose not to spend it immediately, and so that people cannot profitably speculate with borrowed money. Anything lower hurts savers and drives income inequality higher.

I share your concerns about inequality, but the interest income channel is, as Warren Mosler puts it, “welfare for rich people.”

The “natural” rate of interest for a fiat currency is zero because it’s a sovereign monopoly (by definition the monopolist is a price setter) with infinite supply. The central bank sets (and defends) its rate as a policy lever, but the sovereign doesn’t have to “borrow” to spend in the currency over which it exercises a jealous monopoly of issue.

>Um, the “natural” rate of interest for a fiat currency is zero— anything higher than that has to be “defended” by central bank operations.

LF specifically notes negative real rates, not 0 rates. I agree — 0 percent real rates would be an improvement

Who or what is LF?

The idea that low interest rates promote growth is grounded in theory only.

There seems to be no empirical evidence to confirm it, at least according to this economist.

https://ideas.repec.org/a/eee/ecolec/v146y2018icp26-34.html

I’ve been wondering lately about whether Covid has significantly changed peoples buying patterns. Not just in the obvious way of more purchasing going online, but in where and how they shop. There are no figures out yet, but here in Dublin quite a few people have noted that footfall in the city centre seems way down, while suburban malls seem to be doing quite well. One very large and very well located retail development in the city centre is conspicuously lacking any tentants. A major Irish fast fashion retailer (well known for its very careful and rigorous approach to property) has announced a move into the US market, but they’ve stated that they are avoiding very large floorplates and instead focusing on mid-sized and well located units.

If I was to make a guess I’d say that people are increasingly nervous about crowds and are being more selective about where and when they shop. They may also be getting more sceptical about sales and prefer to pay ‘normal’ prices knowing that so many sale prices are a scam anyway. So it could be that a flop in sales might not be a recession signal, it could be a sign instead that major retailers are just reading the market wrong. Only time will tell.

This year my brother and I made a pact: no more buying crap for each other for Christmas. We will exchange small gifts (my brother really likes the hot sauce I make from my garden) and that will be it.

We’re hoping to expand this beyond just us. The idea will be that only individuals in the family that will get gifts are the little kids. If adults need to give, let them give it to the kid’s savings account or something.

We’ve run into issues with others in the family. There’s a lot of people who seem to think that the only way to show affection is to buy shit off Amazon.

After an overwrought & overbought 3 hour session of opening xmas presents 15 years ago, my wife & I informed our family that we were done with giving or receiving gifts, with the exception of kids.

The effect was just too much for my 3 sisters who previously tried to outgift one another by giving multiple gifts (see, I care more!) to everybody in upping the ante, and one of them actually started crying, for it was as if we had jointly plunged a rusty shiv into Santa’s belly repeatedly, just to make sure he was dead with little chance of resurrection.

Fast forward to now and the whole family is on board-no gifts necessary in order to enjoy time together.

SATAN is an anagram for SANTA.

Coincidence?

And they both fancy red

And they have never appeared in the same room together

I have been surprised by that visceral reaction you describe. Very visual, Wuk!

You’d think people would be over the moon to be able to save some money AND the underappreciated stress of trying to buy something for people who can get two day delivery on almost anything in the world.

Another soft landing on this is to request donations for charities you like. If they don’t like the charities you like, tell them to give in your name to a charity of their choosing.

I’m curious to know the reasoning for giving gifts to children, but not adults. Massive gift giving (and receiving) is learned behavior. In my view reducing gift giving starts with the children. Give them fewer gifts and find other ways to enjoy the holidays and impart new values. Consumerism should die one gift not given at a time.

Go Team!!! It’s so fun to limit gifts to those you make. We have 9 kids in our family so that was a way mom and dad got us really thinking. My favorite for years was candles. Easy as pie to make with the aid of some vino and Jazz. We’d go to St. Vincent de Paul or EMAUS and find cups, glasses with fun logos or labels and turn them into a candle. Some pretty funny stuff. Nice move Wuk.

Gift giving is a tradition that goes back millennia, so it’s hard to turn that faucet off even though it has been arguably ruined by consumerism. There’s a spot in the Iliad where two opposing warriors realize that one of their grandfathers had stayed at the house of the other grandfather one time, and they immediately decide not to fight each other and trade their armor on the spot. Gift giving is an integral part of the practice of xenia, or “guest friendship.”

Thats very sensible. I must admit that I’ve been enjoying not having to buy so many presents this year as I know there will be no big family gatherings.

That helps! We are not seeing one branch of the family but I intend to send some jam or other things from the garden down to them.

I will try to inculcate that sensibility at risk of alienating myself from my family even more than usual.

For the last 20 years of her life, my mother would decree ahead of time to our family (about 15 of us including grandkids) what the mode of gift-giving would be at a given year’s Christmas. For instance, white elephant, grab-bag, and so forth. No money spent on gifts. The one exception was that she would pass around a Heifer Project catalog and have all the children pick out what animals they wanted her to give in their name. We always had a blast. Retailers would be horrified if they had known.

Buy experiences for loved ones, food, from epicurean to basic, makes the ideal gift. It is totally useful, leaves little waste and may not be subject to sales tax. Cook a meal, visit an elder, skip the Chinacrap.

This is the most subversive website around this topic we’ve ever seen, now into it’s third decade:

http://www.verdant.net

A speaker at an office/industrial real estate conference where we are (Washington DC) said last week that office occupancy in the suburbs was up to 60% now but downtown still about 20%. Could be partly because the Federal Government has not returned to work in large numbers but the disparity looks bigger.

White collar folks are not going to ride the Metro until covid is eradicated.

I was thinking the exact same thing.

Liberalism is working hard to destroy Boston’s metro like with so many other public goods enjoyed by the poors. No mask enforcement, vagrancy (I would prefer spending a little $ and opening drop in shelters in the bigger stations), unbelievable bad behavior like bicycle riding on platforms, smoking, snorting drugs…without the normies to balance it out, it is something to behold.

This reduction in percieved safety and polite “middle class” norms on all forms of mass transportation is evident everywhere from the “We are playing you music and passing the hat” on Paris subways to the unwashed “I want to tell you about Jesus” folks on the Austin, TX airport bus. Plus there are fairly obvious differences in behavioral norms between classed and (dare I say it?) ethnic groups. Some behaviour is threatening; others are just inconvenient.

But the end result is the same: less middle class use of public facilities from parks to buses; more “privatizatization (Uber to Disney World). We are all looking forward to the convenience that automated, small vehicles might bring in urban areas. But if that means sitting next to random “Let me tell you about Jesus” folks, people will still prefer private ownership reguardless of the overall socital costs.

Back of the bus hoodlums, plus Covid have pretty much destroyed 90% of ridership on BART intracity in Bay Area, and MUNI Railway, buses, streetcars, cable cars in San Francisco, same thing. Downtown is dying, if not dead. People who can drive to the safe suburbs to shop and recreate.

Truly 90%? Needs a link.

Looks like BART now accommodates about 25% of pre-COVID ridership during the week and a little less than half on weekends (I’m not in the Bay Area but this was easy to find).

https://www.bart.gov/sites/default/files/docs/202110%20Monthly%20Ridership%20Report.pdf

We’ve fallen way past “middle class” norms like talking softly or forming neat queues (this is the northeast, after all, that was never gonna happen) down below the very basics of public safety and health, like not spitting on the floor or smoking in what is basically a train tunnel.

If poor people are taking public transportation in spite of this, it’s because they have no better alternative, not because they approve.

And the buskers in Boston were overwhelmingly awesome. I miss them.

Glad that I’m not the only person who noticed this. I’ve witnessed each and every one complaint that you’ve mentioned. I’m convinced that the reason they don’t want to enforce any of the rules is political. The organization wants to stay out of the public eye and thinks (likely correctly) that any attempt to enforce the rules will result in negative news articles.

Meanwhile, no one could get the T’s new $1 billion fare machines to work when loading our monthly passes two days ago.

A group of individuals calling themselves the MBTA Riders Union actually advocated against enforcing the mask mandate on the T. I had never heard of this group before this article and certainly never voted in any “union” elections in all the years I rode the T.

Mind you, I’ve ridden the T a total of like 10 times since the pandemic started, and that has been enough to witness everything I described, and a whole lot of the unmasked.

i think i know where this comes from: the powers that be are frightened by the drop in ridership and the work from home narrative. any barrier to the return to the old normal (which likely won’t happen) threatens the momentum they had built for anti-congestion purposes by getting drivers to pay for the mbta even more than they do now. you see the drive to make the mbta free: raise ridership numbers, which currently sit at 50% of pre-covid like much of the country, at any price.

i first heard of the anti-mask narrative from the former DOT secretary most in charge of cheerleading for the mbta, i’m sure you know who that is.

monumentally silly public policy.

don’t be surprised if public transport is outsourced to Uber/Lyft by some “genius” Clintonian, urban, Democrat mayor—piece by piece. it’ll start innocently enough.

Yes, like the WEF and their (quote) “you will own nothing and be happy about it”. It’s been happening in computer software and apps for quite a while. It’s being accelerated by the massive buy up of housing as well. The near final nail in the coffin is the normalization of mandates. Their hope is that soon there will be no public transport for thee, only transport for me – the person with the proper QR code and no church affiliation or attendance verified by the tracking device in your purse/pocket. Don’t want those “Have you been saved” conversations on the light rail.

It should have been obvious that there are still enough people who appreciate the threat of COVID to keep them out of the traditional Black Friday mob scene.

COVID accelerating an at-home trend in retail just like with cinema, only less dramatic.

Since last year, I have developed a major aversion to ANY sort of mob scene.

It’s not just the fear of COVID. After almost two years of no crowds, just the thought of being in a group of more than 15 is both agoraphobic and exhausting.

People have gotten nasty and toxic over the past 2 years. Who wants to be around them?

But traffic was markedly up since last year, on the order of 30%, contradicting your theory.

Buying was down.

Store Shopper Traffic Down 28% on Black Friday in 2021 Compared to 2019.

If you can draw a bigger crowd in Year 2 of the plague than Year 1, that isn’t hard. It’s Wolf Street’s “nothing goes to h*** in a straight line.”

True, lower disposable incomes from rising inequality is a big factor in declining sales, bigger than fear of infection, and yet ecommerce sales merely stayed flat while in-person fell a lot. So the fear factor has to be important in accelerating the collapse of brick and mortar that began in the 2000s.

I think about staying home and a lack of activities especially for kids during the course of the last 18 months. I could see the demand for black Friday purchasing was pulled forward or non existing. Then with smaller gatherings, there is less demand for gifts. Kids grow. If you aren’t taking them anywhere nice, why get nice clothes? And so forth.

Seen this exact thing in my own home. We spend very little money on clothes. Nothing but casual athletic wear because we dont go anywhere nice and work from home. Kids prefer wearing that stuff too. I ask family for new clothes for their birthdays and Xmas when they outgrow the old stuff. For the adults i buy books and wine. Older kids and young adults need $ so i give them that.

Costco reported increased sales y-o-y for November, but at a decreasing rate than previous months. This seems to confirm some of the decline. (Prices are certainly much higher than last year).

Anecdote re: increased inventories. Walmart is opening their brand-new distribution warehouse north of Charleston 6 weeks early – because they need somewhere to store all the 2021 Halloween products that never made it to the stores – so they can sell it next year…

Regarding excess inventory, I really wonder if a large retailer can or would store that for next season. Perhaps so if it’s not perishable, or gigantic bags of candy bars.

Distribution centers opening in SC, nearer to my neck of the woods. Location is incredibly convenient to I-85 corridor. Granted this center was just announced, it’ll be open in 2024.

https://www.wyff4.com/article/walmart-distribution-center-spartanburg-county/38000824

Im increasingly of the opinion that Costco is a scam. I know Americans dont agree with me, but I suspect things will change. Same goes for Apple.

I remember the press last week screeching that “Retail was back, Baby.” and “This will be the best Black Friday Evah!!!!!

So, I went shopping on Black Friday at the local retail complex. Granted, I did not go until after lunch. (I am too old for the dawn patrol.) No one greeted us at the door with sales flyers. There were no “deals”. And only one store I entered all afternoon had more than one register open. There were no lines. There were no crowds. I spent less than $50 for a few items I had planned to buy whether it was Black Friday or not, and didn’t have to wait for more than two minutes to be rung up anywhere.

When I went home the evening news was declaring that the pandemic hadn’t hurt a thing, that pent-up consumer demand had ruled the day it was going to be a great Christmas.

Not from my casual observation.

I went to some chain stores on the following day when the sales were mostly still on. No crowds to speak of (but a little more than a typical pandemic Friday), either, and no store-wide sales, just discounts on specific items.

I was in Williams-Sonoma last Wednesday to pick up a couple of things for thanksgiving. This was at a very upscale mall (Neiman’s, Nordstrom’s, Prada, Gucci, LV, fancy restaurants, etc).

I was expecting a mob scene but it was pretty quiet.

The manager of the store said there aren’t many Black Friday deals from what she could see. I don’t bother with Black Friday so I couldn’t confirm.

from Bloomberg, a report and an excuse. Scroll down to read:

“For the first time ever, Black Friday saw a reversal of the growth trend of past years,” Vivek Pandya, lead analyst at Adobe Digital Insights, said in a report on U.S. e-commerce trends. Online spending last year on Black Friday totaled $9 billion.

This year, sales on Thanksgiving Day were flat at $5.1 billion, and the sluggish two-day performance was a “sign that consumers started to shift their spending to earlier in the season, responding to promotions and deals from retailers that started in October,” Adobe said.

Shoppers’ Store Visits Rose 48% From 2020: Black Friday Update

I believe the problem with Black Friday sales is the expansion of the time sales happened. Well ahead of time some big retailers started offering advanced sales campaigns. It only took a few days until most retailers were promoting multiple days sales events. People bought early. Also many consumers finally realized most of these Black Friday deals weren’t that great. They didn’t fall for all of the super bargain hype being promoted. It probably resulted in fewer sales. Black Friday has out lived its usefulness as a marketing tool. I suspect next year we may see a different approach to what used to be Black Friday. Kind of like the new and improved concept of marketing.

Fed and 30 years of Clinton-W Bush economics has painted DC into a corner.

The economy needs to get away from zero rates, but everyone is addicted to it….rich and middle class. Effective fiscal policy is a joke, as in the midst of a boom for the top 5%, DC removing the state/local tax deductions cap (unless I am mistaken) and subsidizing new Teslas, among other things that will NOT help the bottom 51%.

For all the screeching in Twitter-sphere, pundit TV about “the issue of the day” , no one talks about capital gains taxes, estate taxes, defense-intelligence-homeland security spending, etc.

Rates will not rise. The housing market will tank. A $450,000 mortgage @ 3% is about $1,900 per month plus escrow (taxes, etc.).

That same mortgage @ 8% is about $3,330 per month.

Math is an absolute btich.

Housing markets tank first where people don’t want to live, in houses that have issues.

In the nice areas, prices more settle than drop.

My family all wants new phones so we went to the Verizon store on Black Friday. I had my teeth gritted, ready to wait in a long line and then pay for 4 new phones.

Granted it was the afternoon, but there were more salespeople than customers in the store. Then we learned that they hadn’t gotten stocked with many phones and they were already sold out.

Other big ticket items (X box, PS5) are also hard to find this year. I wonder if companies had chips to satisfy customer demand if the numbers would be a little different.

>>they hadn’t gotten stocked with many phones and they were already sold out.

I wonder if this isn’t a classic bait and switch. The same thing happened to me with a Black Friday tire sale. The discounted models only had one tire each for sale.

Luckily you only need one front tire for a car. https://www.youtube.com/watch?v=QQh56geU0X8

At least in technology areas, lack of supply is a huge damper. I have several friends that are clamoring to find a PS5 for Christmas gifts and are likely out of luck. Sony couldn’t get chips and supply up to demand. I hear the same in the computer gaming arena with GPUs nearly impossible to get. This has to be a major damper on sales.

I hear that auto-sales are down, but the automakers are having their most profitable lives every selling less cars. Wolfstreet covers the beat well, showing shocking growth in average vehicle prices:

https://wolfstreet.com/2021/12/02/crushed-sales-volume-no-problem-november-was-most-profitable-month-ever-for-dealers-new-vehicle-sales-as-americans-paid-whatever/

So lots of problems coming together to take the air out of the confidence sentiment. Consumers wage growth has stagnated or they can’t get back to work, supplies of desirable goods are down (people don’t replace a PS5 with a Switch), and perhaps many Americans are just shopped out.

Just spent three days in Denver (southern suburb) visiting friends. On Wednesday, one insisted that we go to Costco (she was very upset when we arrived and I was wearing the same clothes I had worn during their summer visit with us.)

The store was jammed with shoppers; the shelved, bins, aisles, were stuffed with goods (same at the two chain grocery stores I went to.) We browsed the clothing section, which was piled high with jackets, sweats, pajamas, winter boots, all for incredibly low prices. What were these supply chain, and inflation, problems we had been hearing about all summer?

Note that we don’t shop at home in Chautauqua County, NY; or, only at Tractor Supply, where eight-foot high welded wire, deer-proof fence, has been unavailable for over a year.

Oh, and then we went for lunch and sat on the patio in 73 degree sunshine. On December 1!

The spending by mainly the upscale isn’t enough to create the record breaking numbers they like to report during the holidays.

And you could be pointing out something else…the goods are flowing to where the money is because wealth disparity means prices have to rise. And when you say “extremely low” prices, as compared to what in what year?

Mikel, I checked out the clothing section only. I seldom buy clothing and when I do, usually go secondhand. Or buy fairly expensive but functional and long-lived hiking shoes and well-made pants at REI. But I did pick up a hooded sweatshirt for $9.99. (Mostly to keep friend happy.) Fur-lined women’s winter boots were $30. Puffy jackets were $20. I kept thinking of Jerri Lynn’s reports on how fast fashion adds to pollution and ecological degradation, plus exploitation of workers.

I’m a little puzzled about the poor Black Friday/Cyber Monday sales. I’m more inclined to believe it’s declining consumer confidence and possible COVID- or supply chain-related retrenchment than consumers being broke.

For example every month since July, the IRS has been sending $300+ to about 35M families who have children for the Advanced Child Tax Credit–it’s about $15B each month in total. A big chunk of these families are somewhat poor and should have a big “multiplier” on their purchases. It seems like a good set up for a nice Black Friday, but it didn’t happen.

Also as related by a commenter above, some of the hottest items are very hard to find. If there were a decent number of XBox Series X consoles out there, that would be a lot of $500 purchases occurring that simply aren’t due to chip shortages and likely supply chain issues. Believe me, every kid (especially boys) wants either this or a PS5 to update their old consoles. Anecdote: The only way I could get a XBox Series X for a Christmas gift was to open a line of credit with “Citizens Bank” and pay 24 months of payments even though I’m (fortunately) well off. The regularly priced XBoxes are impossible to find. But that’s American for you… predatory banks working with corporations to rip off customers in a topsy turvy consumer market.

I am honestly more worried about demand post-Christmas. In January, the Advance Child Tax Credit payments stop, and that money line dries up.

There was a story about lines at my local best buy a month or so ago. I was in there not long after, and the doors were olastered with signs saying they had no xboxes.

The supply problem with Series X and PS5 is exacerbated by ‘bots’ running scripts that snap up stock of the consoles as they become available from online retsilers, which are then scalped at a higher price to desperate punters. Some

lawmakers recently proposed a bill intended to target this behaviour.

Supply down here in Australia is quite low and has been all year, but maybe not as bad as in the US, though it seems to vary between retailers. Finding them online is a bit of a crapshoot (unless you go to facebook marketplace or whatever, where you can see the scalping at play, with people selling the consoles at around 150% RRP). That said, I pre-ordered a Series X at a nearby store two weeks ago after they gave the impression it wouldn’t be much of a wait and sure enough, it arrived this week. The market here’s not as big as the US for sure but then I doubt we get as many consoles either.

Many comments about buying Xbox and games. Do people realize the time, the game played, and other information on Xbox is tracked, recorded and likely sold to others? Imagine a youngster trying to find affordable insurance as an adult and being told “From ages 6 – 27 you put in a daily average of 6 hours per day on your game console. In addition, you ordered chips, dip and beer an average of 6 days a week from the age of 14 on. Therefore, we will offer you the Bronze insurance packages for $2,000. per month due to your high level of obesity”. Thank you for shopping Excellon for your insurance needs. Link: https://www.howtogeek.com/269121/how-to-stop-windows-10-from-telling-your-xbox-friends-what-games-youre-playing/

Wealth disparity is a driver of inflation.

There are only so many goods and services that top earners want or need. They’ve had money for a while and already have alot.

The only way to keep up numbers like quarterly sales growth in an economy with growing economic disparity is to raise prices.

Economic disparity is a major factor of supply and demand.

And now people have taken out loans for a lot of things they can’t afford. There is worry about interest rates that are already extortionary for all but the privileged.

Cutting interest rates won’t solve the oroblen being decribed in the article.

In the middle of the comment, I changed “wealth disparity” to “economic disparity”.

Don’t know why. Maybe I shouldn’t use the terms interchangeably.

One more thing; when the economic narrative is dire enough maybe the Fed will continue that welfare for the wealthy program they’ve got going.

Channeling my inner “Billy Ray Valentine” reminiscent of the “Trading Places” scene where protagonist Valentine explains why pork belly prices are going down … ;-)

“See this year, grandma and grandma learned about the supply chain! Yeaaaah, they read that Time article NC posted about Jani the giraffe! Then they got scared, real scared – see now, little grandson Billy ain’t gonna get the John Cena GI Joe with the kung-fu-grip. Then their son-in-law ain’t gonna wanna bring the kids over for Christmas if all grandma and grandpa got for presents is socks! So they shopped really early, got ahead of the game … now the BFCM numbers suck … so I’d wait to shop till after Boxing Day, when all the suckers have cleared out.”

LOL

Probably the best economics film of all time!

a great comedy and it cuts through the homo economicus facade of academia-economics.

And it’s a Christmas film too!

As I get older, I realize that film radicalized me as much as a steady diet of punk and golden age rap.

#SameSame … ;-)

Indeed! As I have said to many: low key one of the best dissertations on class, race and socioeconomics.

Also, just saw another post on social media proclaiming “Die Hard” as the best Christmas film. Hahahahaha! Ik denk zo niet … <3 "Trading Places"!

Cheers.

Mass media are corporate owned, with few exceptions. Is it possible they don’t report matters that might not influence readers in a way favored by corporate designs?

I’m going to quote from a recent Bloomberg Businessweek article (Nov 22 issue):

“Consumers are flush with cash, and they’re not spending as much on travel and dining out – they’re spending on goods.” Brian Yarbrough, a retail analyst at Edward Jones. Yarbrough goes on to say “Retailers are probably in the best position coming into this holiday season than they’ve been in many years”.

So what is this talk of retail bankruptcies?

Nov 22 was before Black Friday.

They didn’t go out and spend.

i work as a RV product specialist. Usually our sales are decent until cold weather starts(around October and November). This year they declined in August.

What would happen to retail sales profits without the Christmas season? Summer is pretty good, and back to school. But the story goes that all profits are made in the Christmas season from Thanksgiving to Christmas. So… that’s not good for retailers who are already in the red. Malls have been going under for a good 15 years – slowly at first and then all of a sudden, apparently. This is a real-time demo on just how it all works or it doesn’t work at all. All or nothing. It’s more than Covid. It’s probably more than CO2/pollution consciousness. It isn’t demographics alone – an older, smaller population would still be buying – maybe more selectively. It is a factor of joblessness, hardship, crappy-expensive-hard-to-access healthcare, even hunger and cold and sleeping rough. Society has broken apart in so many ways. And the worst part is that it is gradually going to get worse, not better. Until government steps up. Our dear leaders.

Kind of interesting that our infrastructure for the last 40 years has been big retail stores; roads to and from; parking lots, cars, and the credit card industry. That’s the infrastructure needed to maintain a nation that lives on consumerism. But there is no other production and employment to keep it running. No big industries. No seed corn. It’s like capitalism, even industrial capitalism, has a shelf life. And to build an infrastructure to maintain it all when there is no employment is nutty. It’s a bridge to nowhere. To build new high-tech industries is a good idea, but those jobs require educated and trained employees. When you offshore your high-tech industries and much of the other nuts and bolts you once made to keep the entire system running – and you start importing all your merchandise… I can’t believe it has held together this long. What bunch of smart guys thought this mess up? Besides Clinton, Rubin, Summers, et.al.

well said. we cannot recover till nafta billy clintons disastrous policies have been reversed, if they can that is.

the chickens are coming home now, the nafta democrats still cannot figure out that demand for goods and services is wage driven.

they created a economy that no longer can generate meaningful, gainful employment.

the nafta democrats said we would just get another job, or learn how to code. totally oblivious to reality.

in my home its a made in the u.s.a. as possible christmas. virgils or virgil zero 6 packs of soda “POP”

zevia sugar free 8 packs of soda “POP”.

maglight flashlights with packs of rayovak batteries.

bulk boxes of pearsons salted nutrolls. i drive right past the factory on my way to the mpls/st.paul “INTERNATIONAL” airport.

wigwam and fox river socks. both really well made. plus some other made in the u.s.a. finds.

Well, I see a pattern here. MSM is sayin’ shop ’till you drop, buy now and save, etc. MSM is also saying let ‘er (or it) rip. They also are pounding how safe the vaccines are. In addition they spout vaccines uber alles, any and all other treatments are to be stigmatized. MSM continually says how strong Biden is pushing for build back America and he really wants (but the repubs keep blocking) Medicare for all, taxing the rich, a revised immigration policy, etc. Someone seems to be trying to hoodwink the populace. Who’s pulling these puppet strings?

Retail sales over the years: https://www.census.gov/econ/currentdata/dbsearch?program=MARTS&startYear=1992&endYear=2021&categories%5B%5D=44X72&dataType=SM&geoLevel=US&adjusted=1¬Adjusted=1&submit=GET+DATA&releaseScheduleId=

It’s possible when the data gets updated, we’ll be seeing a dip.

So I suspect my smallish city is a bit of an anomaly but a lot of the “shopping” I’m seeing is in local thrift and antique stores. I also have a friend (braver then me) who frequents estate sales and he tells me business is booming. Our local holiday craft and framers markets are also busy.

I’ve been buying the old, recycling, and unique as gifts for years and competition this year is stiff which I think is a good trend.

Also noticing that our local thrift stores have had a huge boom in donations as everyone cleans out their closets and cupboards while stuck at home.

I’m pretty sure no one really tracks these “markets”.

How on earth does this capitalism thing actually work?

God only knows.

The Chinese were trying to increase internal consumption, but they were using neoclassical economics.

Davos 2019 – The Chinese have now realised high housing costs eat into consumer spending and they wanted to increase internal consumption.

https://www.youtube.com/watch?v=MNBcIFu-_V0

They let real estate rip and have now realised why that wasn’t a good idea.

The equation makes it so easy.

Disposable income = wages – (taxes + the cost of living)

The cost of living term goes up with increased housing costs.

The disposable income term goes down.

They didn’t have the equation, they used neoclassical economics.

The Chinese had to learn the hard way and it took years, but they got there in the end.

They have let the cost of living rise, and they want to increase internal consumption.

Disposable income = wages – (taxes + the cost of living)

It’s a double whammy on wages.

China isn’t as competitive as it used to be.

China has become more expensive and developed Eastern economies are off-shoring to places like Vietnam, Bangladesh and the Philippines.

The dynamics of the capitalist system are more complex than today’s policymakers and business leaders realise.

I have come up with this equation, which really helps.

Disposable income = wages – (taxes + the cost of living)

What does the equation do?

The equation puts the rentiers back into the picture, who had been removed by the early neoclassical economists.

Employees want more disposable income

Employers want to maximise profit by keeping wages as low as possible

The rentiers gains push up the cost of living.

Governments push up taxes to gain more revenue

If only the Chinese had known about the equation a few years ago.

We want consumers to keep on spending, but take away their purchasing power with ever rising housing costs.

How on earth does this capitalism thing actually work?

God only knows.

National economic coverage has gotten to be more and more dominated by the flat-out boosterism that always characterized the bulk of local press.

Always the best time to buy a house. Or a new car. All businesses doing swimmingly, except those that collapse so thoroughly that it has to be acknowledged.

it might be worth noting that spending on durable goods fell at a 26.2% rate after rising at a 50.0% rate in the first quarter and an 89.3% rate in the 3rd quarter of 2020, and that about 70% of the 3rd quarter 2021 drop was due to constrained sales of autos…