Yves here. This story confirms the old cliche that real estate is always local. In quite a few major retros, suddenly there’s almost a surfeit of homes for sale, while in others conditions are even tighter than last year.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

“Inventory” in housing means homes listed for sale. Then there’s the shadow inventory – vacant homes that owners want to sell eventually because they have already moved into a new place but want to ride up the surge in home prices all the way, and then at the tippy-top, they’ll sell it to maximize their profits.

We have seen this during the past 18 months when home prices spiked: people bought a home and moved in, and they moved out their other home, but didn’t sell it, expecting a 10% or 20% or 30% gain in price on a leveraged bet with a much bigger gain on equity. The math makes sense, though it doesn’t always work out, and now it’s starting to be time to put those vacant homes on the market, and here they come, just as home sales are dropping because layers and layers of buyers have been removed from the market by the rising mortgage rates and sky-high prices.

Active listings jumped. In May, inventory of homes actively listed for sale jumped by 26% from April and are suddenly up by 8% from a year ago, the first year-over-year increase since June 2019, according to the National Association of Realtors today. There were about 38,000 more homes listed for sale in May than a year ago (data via realtor.com):

The strategy of not putting the old home on the market after moving out has had the effect of creating record low inventories for sale, and inventories remain low, but that is now changing, and very suddenly so.

Active Listings Jumped for Two Reasons:

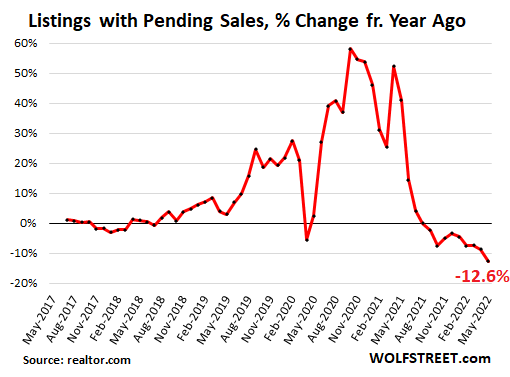

One, falling sales, as potential buyers left the market due to sky-high home prices and holy-moly mortgage rates. The NAR’s metric of “pending listings” for May, which tracks listings that are in various stages of the sales process, but before the deal closes, dropped by 12.6% year-over-year in May, after the 8.7% drop in April, the ninth month in a row of year-over-year declines:

Reported later in the month, closed sales have also dropped for the ninth month in a row, and the closed sales data for May should be another doozie.

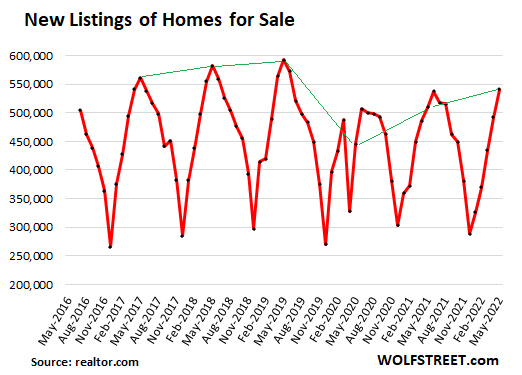

And two, the suddenly surging number of new listings in May. New listings jumped by 10% in May from April, and are now up 6.3% from May last year, the second month in a row of year-over-year increases, after April at 1.3% year-over-year. The 541,000 homes newly listed for sale in May was the largest number of new listings since June 2019.

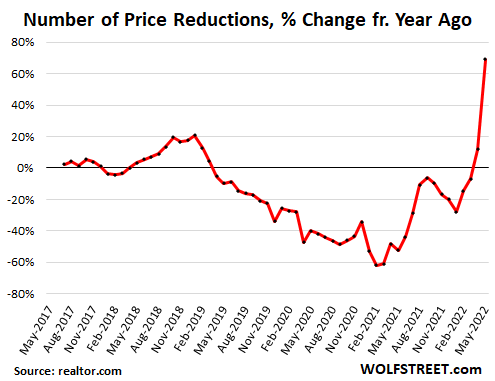

Price reductions jumped by 74% in May from April, and by 69% from May last year, in a sudden and massive U-turn from the very low levels last year and earlier this year:

Huge Differences Among the 50 largest Metros

Among the largest 48 metros (data for Oklahoma City and Hartford were excluded due to “data inconsistencies,” the NAR said), the number of active listings in May jumped the most on a year-over-year basis in Austin (+85.8% from May last year); and fell the most in Miami (-32.1% from May last year).

Among the 48 metros, active listings fell in only six of them as homeowners there apparently haven’t got the memo yet.

Among the 48 metros, active listings surged by the double digits year-over-year in half of them (24).

The table is sorted by the year-over-year % change of active listings:

| Metro, listings in May 2022 |

Active Listings, % Change YoY | New Listings, % Change YoY |

| Austin-Round Rock, Texas | 85.8% | 19.1% |

| Phoenix-Mesa-Scottsdale, Ariz. | 67.1% | 13.7% |

| Sacramento–Roseville–Arden-Arcade, Calif. | 54.6% | 5.6% |

| Riverside-San Bernardino-Ontario, Calif. | 51.6% | 6.3% |

| Denver-Aurora-Lakewood, Colo. | 49.6% | 16.5% |

| San Antonio-New Braunfels, Texas | 44.1% | 9.5% |

| Raleigh, N.C. | 41.6% | 27.9% |

| Seattle-Tacoma-Bellevue, Wash. | 38.8% | 17.9% |

| Nashville-Davidson–Murfreesboro–Franklin, Tenn. | 38.1% | 22.8% |

| Tampa-St. Petersburg-Clearwater, Fla. | 35.5% | 11.2% |

| Dallas-Fort Worth-Arlington, Texas | 34.4% | 18.0% |

| San Francisco-Oakland-Hayward, Calif. | 32.5% | 2.5% |

| Kansas City, Mo.-Kan. | 24.4% | -2.5% |

| San Jose-Sunnyvale-Santa Clara, Calif. | 22.9% | 3.2% |

| Jacksonville, Fla. | 22.5% | 8.4% |

| Memphis, Tenn.-Miss.-Ark. | 21.4% | 5.0% |

| Charlotte-Concord-Gastonia, N.C.-S.C. | 21.1% | 17.0% |

| Detroit-Warren-Dearborn, Mich. | 19.8% | 2.1% |

| Portland-Vancouver-Hillsboro, Ore.-Wash. | 19.2% | 3.0% |

| Louisville/Jefferson County, Ky.-Ind. | 19.1% | -1.3% |

| Las Vegas-Henderson-Paradise, Nev. | 18.6% | 20.7% |

| Indianapolis-Carmel-Anderson, Ind. | 14.2% | 11.2% |

| Birmingham-Hoover, Ala. | 12.5% | 3.5% |

| Atlanta-Sandy Springs-Roswell, Ga. | 10.6% | 2.2% |

| San Diego-Carlsbad, Calif. | 9.8% | -6.9% |

| New Orleans-Metairie, La. | 8.6% | -2.6% |

| Columbus, Ohio | 7.2% | -4.5% |

| Buffalo-Cheektowaga-Niagara Falls, N.Y. | 6.6% | 1.0% |

| Orlando-Kissimmee-Sanford, Fla. | 6.6% | 10.3% |

| Los Angeles-Long Beach-Anaheim, Calif. | 5.1% | -3.4% |

| Pittsburgh, Pa. | 4.6% | -1.5% |

| St. Louis, Mo.-Ill. | 4.4% | -2.1% |

| Houston-The Woodlands-Sugar Land, Texas | 4.3% | 4.5% |

| Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md. | 4.1% | 4.9% |

| Cincinnati, Ohio-Ky.-Ind. | 2.7% | 5.0% |

| Minneapolis-St. Paul-Bloomington, Minn.-Wis. | 2.4% | -0.7% |

| Baltimore-Columbia-Towson, Md. | 2.3% | -7.3% |

| Providence-Warwick, R.I.-Mass. | 2.1% | -5.8% |

| Washington-Arlington-Alexandria, DC-Va.-Md.-W. Va. | 1.5% | -5.5% |

| Rochester, N.Y. | 0.9% | 5.6% |

| Milwaukee-Waukesha-West Allis, Wis. | 0.7% | -5.3% |

| New York-Newark-Jersey City, N.Y.-N.J.-Pa. | -0.8% | 0.8% |

| Cleveland-Elyria, Ohio | -1.2% | -9.3% |

| Boston-Cambridge-Newton, Mass.-N.H. | -6.9% | -2.2% |

| Chicago-Naperville-Elgin, Ill.-Ind.-Wis. | -14.8% | -10.0% |

| Richmond, Va. | -15.3% | -7.8% |

| Virginia Beach-Norfolk-Newport News, Va.-N.C. | -19.3% | -15.1% |

| Miami-Fort Lauderdale-West Palm Beach, Fla. | -32.1% | -0.4% |

brother says on occasion that he wants to get out of kingwood(“the Livable Forest!”) and out into the country, again.

usually after some weirdness with his neighbors(which are legion….and, while “upper middle class”(=PMC), are just as prone to weirdness, assholery and drunken rages as the dirt poor i’ve spent my life around.

i advised him a year ago, now, to sell that mcmansion, get an RV and live like me for a year or so, then buy 50 acres for cheap when the market crashes.

(i’m surprised the irrational exuberance has lasted this long)

of course, his wife would immediately run off to colombia with the kids,lol

i’m interested to see how low the Mountain(big hill out back) goes…been for sale for more than a year….$800K for 140 acres of mesquite and cactus, no water(even underground), no grass, etc)

I don’t think the market for usable land will crash. In fact I believe it will continue to go up in value. The old saying “he who hesitates is lost” applies in this case.

Searching for Boston on the chart with hope in my heart…

…but abandon hope all ye who enter here.

If you had the good fortune to have been born somewhere else, never bring this kind of misery on yourself by moving anywhere like this.

It’s brutal out there. The new homes built in my town in metro-west are selling for astronomical prices. We’re so in need of housing but we’re getting new units at a trickle.

It’s getting ridiculous.. I am looking to upgrade and I just can’t. How can an area that creates so much employment cannot handle its own housing? Or is this caused by the phenomenon of hundreds of thousands of students.

It is caused by the phenomenon of NIMBY restrictions on housing development, many of them openly segregationist in origin in the suburbs. But even in the City of Boston housing construction is weighed down with red tape.

The governor is trying to force suburbs to build more housing and getting a lot of pushback from them.

Yes that is definitely one issue. We have a referendum up that would allow for more multi family builds. I support it but I doubt it will pass.

Most of the homes purchased here in tiny town the past 5 years have been for short term vacation rentals, and pretty much the only houses available for purchase are the dregs which needed too much work to make them viable, or the price wouldn’t work in AirBnB’ing them.

Should a big enough recession come about and tourism goes down in a big way, 1/3rd of the 900 homes here would more or less all be put on the market at the same time, which would be interesting.

Flyer from realtor in mail yesterday… 1431 S Mary Ave, Sunnyvale 94087 sold for $3.175m, $526k above asking.

For a 1974 sq ft, 4/2 house.

Sunnyvale is the Google though.

So price drops where there aren’t high-pay jobs.

I live in the San Jose area. A house across the street from me just came on market a couple weeks ago, asking shy of $2M. It’s new construction and relatively big, but I haven’t seen much action. No open houses or pending sale sign that I’ve noticed.

I’m confident this would have been snapped up even 6 months ago, but the recent mortgage rates are going to severely hurt anyone who can’t pay all cash. Even more anecdotally I’ve heard that the foreign buyers who used to do a lot of the cash deals have pulled back as well.

I do still see sales but I think they have to be either more realistic prices, or prime locations.

I’m told by friend who lives in Phcoenix-Mesa-Scottsdale (Mesa) that there’s a huge building boom going on despite the future lack of water.

Consider it the opposite of The Marx Brothers’ The Coconuts. Instead of swamp property they’ll be getting desert dust bowl property. But hey it all worked out so well in the late 1920s.

Presumably we are included in the Charlotte NC-SC category–halfway down the list.

Have a hard time with the idea that a significant number of owner-occupied homes can be kept unrented after owner buys a replacement property in hopes of a later sale. We own a second property in Fl that’s unoccupied, but our basis in it is only $30k. I get a couple calls a day from people wanting to buy, but we aren’t holding it to speculate. It’s been up before and then back down in 08, now it’s back to 07 levels.

I watch real estate websites of homes in our heavily sought-after neighborhood and the past 2-3 weeks have shown a sudden drop in sales. Majority of homes with this zip code have now been on the market for over a month and have lowered the asking price.

Some years ago I was looking at a full edition of the LA Times from the day after RFK was shot in 1968, and traipsing through the real estate section, the most expensive home was in Brentwood, a large domicile on a large lot that they were attempting to get $250k for.

That wouldn’t buy you a glorified shack in Pacoima now…

No mention of the effect of low real estate taxes (looking at you, California). Higher taxes discourage land speculation–rampant in CA–because it’s more difficult to hold land off the market without costs. In present circumstances, speculators option outlying farmland for a few thousand an acre, then persuade (bribe, suborn) local government to grant entitlements to build. They can then sell the land to builders for 50 – 100 times what they paid for it (tax free if they exchange for income-producing real estate!).

In Germany, the developers have to sell the land to the local government at the ag land price, then repurchase it at the upzoned price. All the “unearned increment” (the obscene profit from speculation) inures to the benefit of the public. Germany now has college free of tuition, excellent apprenticeship programs, world-class infrastructure, etc. The arts budget for the City of Berlin exceeds the National Endowment for the Arts for the U.S. of A.

A British study (Rethinking the Economics of Land and Housing by Josh Ryan-Collins, Toby Lloyd and Laurie Macfarlane) says 80% of residential price appreciation stems from more costly land. Of course orthodox economics has folded land into capital as one of the economic inputs, completely ignoring its unique characteristics.

Jane Jacobs, a planning authority, calls modern land-use planning positively neurotic in its willingness to embrace what doesn’t work and ignore what does. It’s an advanced superstition, like 19th century medicine when doctors believed bleeding patients would cure them.

Incidentally, Nixon put a moratorium on federally-built affordable housing, then Reagan cut HUD’s affordable housing budget by 75% (as he was cutting taxes for the top brackets by 50%…and with his successor, raising payroll taxes eightfold). This “affordability crisis” is the inevitable result of treating housing as an investment rather than a necessity. What’s next? Investing in air? water?

Here’s a look at the crisis’ early beginnings.