It was really hard to get the most important stunningly bad findings from the latest FTX bankruptcy filing in a headline. So read on for more thrills and chills!

John J. Ray III, the newly appointed CEO of bankrupt crypto player FTX’s sprawling empire who played the same role in the then-biggest-evah Enron bankruptcy and other big corporate implosions, filed his formal initial assessment with the Delaware bankruptcy court in the form of declaration, embedded below.

The document makes clear that FTX was an unprecedented steaming mess of lack of controls and plenty of what looks like fraud, although Ray pointedly just sets forth bad facts and lets knowledgeable readers draw inferences. The record-keeping failure is so extensive that it sounds as if Ray is going to have to build a significant new company, from the ground up, to try to figure out what is what. Yet it’s also clear that much will wind up missing, particularly money. Ray said right at the top that a “substantial portion” of FTX assets may be stolen or missing.

At the stage of this filing, Ray could only make an approximate description of the business, putting operations into four “silos” and describing the major legal entities and activities in each.

Let us look at the things FTX did not have:

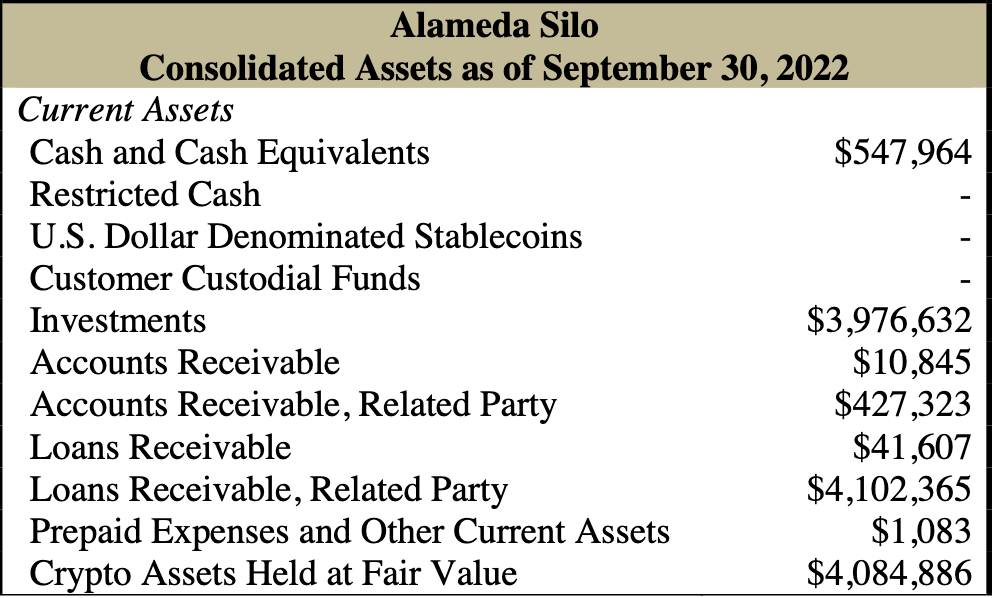

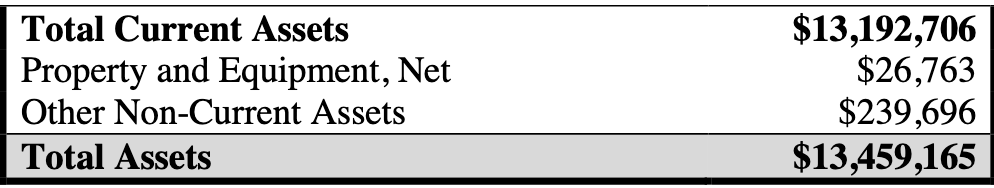

Balance sheets that showed crypto customer funds as liabilities1. The only customer holding on the consolidated balance sheets are fiat currencies!

Digital asset controls: “The FTX Group did not keep appropriate books and records, or security controls, with respect to its digital assets.”

An accounting department

Audited financials for all businesses. Only one “silo” used a recognized audit firm. The biggest customer-facing silo had its books prepared by a no-name flake (office in the Metaverse, you cannot make this up), two had no audited statements2

Record of bank accounts and signers on those accounts

Centralized cash management

Record of employees and their employment terms

Meaningful disbursement controls

Board meetings and/or “audited by flaky auditor” financials for many FTX entities

Records of most decisions

So far, Ray has found only $564 million of cash and has moved $760 million of crypto to cold wallets.

However, four entities appear to be solvent! And guess what, three were regulated ones: LedgerX LLC, d/b/a FTX US Derivatives, regulated by the CFTC; FTX

Capital Markets LLC, an SEC-registered broker-dealer; Embed Financial Technologies Inc., and its wholly-owned non-Debtor subsidiary Embed Clearing LLC, which are also SEC-registered broker-dealers. The fourth was “FTX Value Trust Company, a South Dakota Trust Company, which provides custodial services.” It appears that this custodian handled only fiat assets.

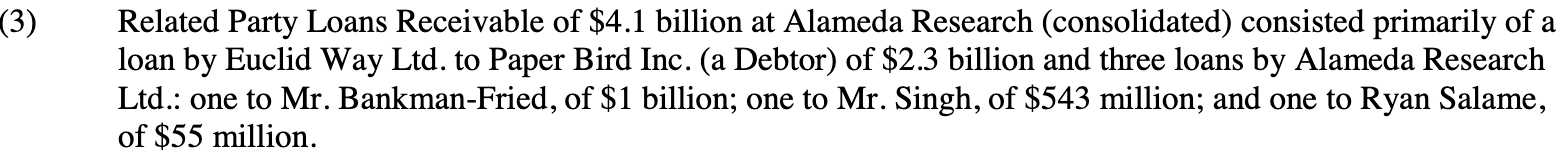

Oh, and as to that $1 billion loan to Bankman-Fried personally, it’s in a footnote, along with a $2.3 billion loan to a Bankman-Fried solely-owned entity:

Paper Bird is 100% owned by Bankman-Fried. From The Information:

New filings in crypto exchange FTX’s bankruptcy case revealed that Alameda Research loaned co-founder Sam Bankman-Fried $3.3 billion. The $3.3 billion included a $1 billion loan to Bankman-Fried and $2.3 billion to Paper Bird Inc., a Delaware-based company owned entirely by Bankman-Fried, according to a Miami-Dade County resolution approving the naming rights to FTX Arena.

I’m waiting for someone to press Bankman-Fried about that, given his sanctimonious handwaves about raising new money to help pay off all the people owed by FTX. What about paying your $3.3 billion back first????

That’s not the only not-kosher activity in this filing. Consider:

Unacceptable management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds, the secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol, and the absence of independent governance as between Alameda (owned 90% by Mr. Bankman-Fried and 10% by Mr. Wang) and the Dotcom Silo (in which third parties had invested).

And:

For example, employees of the FTX Group submitted payment requests through an on-line ‘chat’ platform where a disparate group ofsupervisors approved disbursements by responding with personalized emojis.

On top of that:

In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas.

Tax fraud! I assume many of the FTX employees were American citizens. When is the IRS going to have a good look?

Oh, and post-BK filing stealing, which in the trade is called “fraudulent conveyance”:

(a) at least $372 million of unauthorized transfers initiated on the Petition [bankruptcy filing] Date..(b) the dilutive ‘minting’ of approximately $300 million in FTT tokens by an unauthorized source after the Petition Date and (c) the failure of the co-founders and potentially others to identify additional wallets believed to contain Debtor assets

If you still think that this train wreck was merely the result of a bunch of young super entitled kids who could barely run a lemonade stand playing at high finance, the plans of Bankman-Fried and his sometimes girlfriend Ellison to flee to Abu Dhabi, where the US has no extradition treaty, should give you pause, as should software designed to hide misappropriation of customer funds and making private keys public, as in easy to steal. And we also have:

Mr. Bankman-Fried often communicated by using applications that were set to auto-delete after a short period of time, and encouraged employees to do the same.

There is also a lot of confused commentary on Twitter. The Bahamas regulator is fighting with the US petitioners over who is top dog in this process; the Bahamas regulator filed a so-called Chapter 15 filing. From the Wall Street Journal on November 16:

Securities regulators in the Bahamas are seeking to control FTX bankruptcy proceedings through the crypto exchange’s locally based subsidiary, challenging the company’s chapter 11 filing in Delaware and setting the stage for a possible venue dispute with its new U.S. management.

FTX Digital Markets Ltd., the crypto company’s subsidiary based in the Bahamas, filed for chapter 15 in New York bankruptcy court on Tuesday to seek U.S. recognition of Bahamian liquidation proceedings. The action, if successful, could move at least a portion of the legal proceedings over the collapse of FTX from the U.S. bankruptcy courts to local courts in the Bahamas….

Mr. Simms [the provisional Bahaman regulator] said Tuesday in a sworn declaration that the Supreme Court of the Commonwealth of the Bahamas has sole jurisdiction over FTX Digital and other entities operated from its “substantial office complex” in Nassau, Bahamas. He said he rejects the validity of any attempt to place FTX affiliates under U.S. bankruptcy protection, saying such an action required authorization from FTX Digital’s officers.

Both FTX’s exchange and Mr. Bankman-Fried relocated to Nassau in September 2021, according to court documents. Although FTX comprises a “seemingly complex structure,” the entire FTX brand ultimately operated from the Bahamas, Mr. Simms said.

Maybe experts can tell me otherwise, but the most important customer activities were not carried out through FTX Digital. If you look at fiat balances as a rough proxy for activity, FTX Digital represented less than 1/10th of the total. Thus it’s likely to be quite a stretch for the Bahamas to assert control over much more than the bankruptcy of the Bahama subsidiary.

However, some Twitter commentators are misrepresenting a press release from the Bahamas regulator saying it had assumed control of the assets of FTX Digital as meaning it had taken control of all assets. The Bahama regulator also oddly stated on Thursday that it had ordered all FTX Digital assets to be transferred to cold wallets as of last Saturday. As CoinDesk noted:

It’s unclear why the commission made the announcement five days after placing the order. It’s also unclear whether and when exactly these transfers may have occurred.

And the row is getting ugly. From the Wall Street Journal’s latest story:

FTX lawyers alleged that Mr. Bankman-Fried and the government of the Bahamas have worked to siphon and transfer FTX assets into accounts outside the control of management, even after the company filed for bankruptcy in Delaware last week. Filing for bankruptcy usually ensures that a company’s assets are ringfenced and can’t be touched without court authorization.

“The Bahamian government is responsible for directing unauthorized access to the debtors’ systems for the purpose of obtaining digital assets of the debtors,” FTX’s lawyers said Thursday. The Securities Commission of the Bahamas didn’t immediately reply to a request for comment.

In the meantime, Bankman-Fried seems to be pathologically unconcerned and free of guilt. I suppose having at least $3.3 billion and continued access to controlled substances might explain that. As Kelsey Piper of Vox, who interviewed Bankman-Fried via messaging, wrote:

As we messaged, I was trying to make sense of what, behind the PR and the charitable donations and the lobbying, Bankman-Fried actually believes about what’s right and what’s wrong — and especially the ethics of what he did and the industry he worked in. Looming over our whole conversation was the fact that people who trusted him have lost their savings, and that he’s done incalculable damage to everything he proclaimed only a few weeks ago to care about. The grief and pain he has caused is immense, and I came away from our conversation appalled by much of what he said. But if these mistakes haunted him, he largely didn’t show it.

Perhaps Bankman-Fried feels no need to feign being sorry because none of his fellow travelers have either. From the Heisenberger Report:

Keep in mind, these are the entities into which some of the smartest and best known venture capital firms on the planet threw billions of dollars. These are the entities around which countless journalists fawningly editorialized, spilling untold gallons of digital ink in the service of lionizing a would-be messiah. These are the entities that were glorified on a weekly basis by the most widely-followed mainstream financial media outlets on Earth.

The suggestion that this was so elaborate a ruse that no one — neither the most seasoned VCs nor the investigative arms of media conglomerates run by billionaires — could’ve known it might end in tears, beggars belief. The fact is, nobody looked, because nobody wanted to see.

And while officials pick over what they can find of the FTX corpse, other shoes are falling in crypto-land. Lender BlockFi has halted withdrawals and is expected to file for bankruptcy. The Winklevoss twin’s exchange/custodian Gemini had a spike of withdrawals and paused them on Wednesday. This fresh tweet says things are not looking much better now:

Crypto Is Flowing Out of Exchanges: Severe Outflows From Gemini, OKX and Cryptocom, Says JP Morgan https://t.co/vfQ6M3LQYE pic.twitter.com/4HiaxYiWW7

— BitcoinAgile (@bitcoinagile) November 18, 2022

I don’t see how Bankman-Fried does not wind up in jail. The US is very loath to prosecute white collar criminals, but this story has become way too visible, too many small fry lost money, and the conduct was too egregious for this not to be punished. Given the utter chaos of the financials, it may take a prosecutor who can argue jurisdiction and venue some time to master enough details to gin up a filing and get Bankman-Fried. If nothing else, there’s always mail and wire fraud to get discovery started. If no one else gets there first, expect a group of attorneys general from red states to saddle up.

____

1 The mini-balance sheets in the filing are constructed from unaudited balance sheets as of September 30. However, it appears FTX never recorded customer crpto holdings on its balance sheets: “Such liabilities are not reflected in the financial statements prepared by these companies while they were under the control of Mr. Bankman-Fried.”

2 From the filing:

00 FTX John Ray III declarationI have substantial concerns as to the information presented in these audited financial statements, especially with respect to the Dotcom Silo. As a practical matter, I do not believe it appropriate for stakeholders or the Court to rely on the audited financial statements as a reliable indication of the financial circumstances of these Silos.

“I don’t see how Bankman-Fried does not wind up in jail.”

They will stretch it out until everybody has lost interest in the story. Then he might get 6 months house arrest in a luxury mansion.

And he’ll be pardoned by Biden.

You can’t be pardoned until you are convicted. Won’t happen that fast. Look how long it took for Elizabeth Holmes to be convicted.

The last big financial fraudster to be pardoned was Marc Rich, and that was 18 years after his indictment.

This is demonstrably false: See Ford pardon of Nixon who was never convicted.

Nixon admitted he was guilty by resigning from the Presidency. There is no comparable step an ordinary person charged with a crime can take. Normal people can only halt a prosecution by ‘copping a plea to a lesser charge…if the prosecutor will accept that. They often don’t once the’ve gotten into court and never do if things are going their way, as they were with the Watergate investigation.

Nixon is the exception that proves the rule.

Nixon was pardoned to stop a politically divisive process from continuing. He is not even remotely in the category of a ordinary felon. The Nixon case is not generalizable. Ford was also hugely criticized for the pardon.

Enough evidence had been developed in the impeachment hearings and presented by Nixon to assure a conviction on obstruction of justice charges, so it’s not as if Nixon’s guilt was in doubt. From Wikipedia:

https://en.wikipedia.org/wiki/Impeachment_process_against_Richard_Nixon

More on the special circumstances:

https://constitutioncenter.org/blog/the-nixon-pardon-in-retrospect

What would be the sober national justification for pardoning a 30 year old meth addict who can’t keep decent records, destroys the few he does generate, builds back doors to facilitate stealing, and conveniently doesn’t member that he borrowed at least $3.3 billion?

Very large donations to the Ds.

And the Eucronazi’s.

Yves I think this argument is a bit of a stretch, sort of trying to transmogrify custom into a rule. I covered the Iran-contra trials. Cap Weinberger was a private citizen recently indicted, having made no amends or public admission of guilt or shame analogous to Nixon’s resignation, when Bush pardoned him.

The pardon power is sweeping and to my knowledge, never successfully challenged. If the argument is that Biden won’t pardon him because it looks really bad to do so prior to conviction, there’s a strong case to be made, albeit not an airtight one (no one ever went broke underestimating the willingness of American elites to stretch the boundaries of law or custom in service to corruption).

If the argument is that biden or a successor is somehow constitutionally constrained from doing so, I haven’t seen either statutory or judicial evidence of that.

OK I concede I overstated with saying convicted as opposed to indicted. Weinberger was and Nixon effectively was. But both the exceptions were prominent political figures. To mix metaphors, digging around could stir up a lot of hornets’ nests.

SBF is no Weinberger. Weinberger had served in many public positions, notably Secretary of Defense, and didn’t profit personally by stealing billions of dollars from millions of people.

And the risk to Biden and the Dems is that they can pardon only Federal crimes. SBF was operating under state law schemes, IIRC state money transfer licenses. There are also state securities laws and Federal laws operate in parallel, they do not supercede them. So this won’t stop prosecutions, just Federal prosecutions.

And FTX is being accused of being a Democratic party money laundry and some campaigns are even giving money back. Biden pardoning SBF would become a bloody flag for Team R. No risk of that for the Weinberger pardon.

Also see Jimmy Carter’s pardon of draft resisters who had fled to Canada.

Sorry? Those men didn’t want to give their lives to a political and unjust war. They didn’t have anything financial to gain. No comparison whatsoever. Jimmy Carter was a great and just president. Biden is a corporate shill – again, no comparison.

The point is draft resisters weren’t convicted or indicted before they were pardoned.

Holmes faces the music today in Cali. 20 years top end.

No crimes under state law?

Ken Lay and Jeff Skilling were vastly better connected. They went down. A lot of people believe that Ken Lay did not die of natural causes. He was certain to be convicted, as Skilling was.

And there will not be a loss of interest in the story. The people who lost money and Republican prosecutors won’t let go of this bone. Michael Lewis is doing a book, which if it wind up being too sympathetic (Lewis HAS to have heroes), he might get ripped, which would be fun.

Enron was under the Bush administration, which (for all its many flaws) was actually serious about prosecuting corporate fraud on occasion (see also Worldcom et. al.)

That said, what’s described here is really a cartoon clown show compared to Enron. Enron may have been a massive fraud, but it was quite a sophisticated one, perpetrated by people who knew what they were doing. FTX on the other hand was barely even bothering to pretend. Your Nigerian scam comparison is apt – that really was the level of sophistication here, and it was conducted in the full glare of the media spotlight. If the US doesn’t prosecute this it would amount to a public declaration that even brazen fraud by the rich and well connected is A-OK with them.

Michael Hiltzik has an article up that links to a Sequoia profile of SBF from less than two months ago – currently linking to a Wayback machine archive as it’s presumably been deleted (I can’t imagine why). It’s long, fawning and as awful as you might expect. Why anybody would trust Sequoia with their money after this is very much a question.

CP: Thanks for this great summary. It puts it all in perspective for me.

Must admit that I had a speed-bump moment when I read that it was going through a Delaware bankruptcy court. Now why does that sound significant? /sarc

Please stop feeding CT. Delaware is the big corporate law venue in the US. Most companies elect to be governed by Delaware law. It also has the most sophisticated BK judges. It was the bankrupt estate, not Bankman-Fried, that chose to file there.

Actually I was thinking more along the lines that Delaware is where Joe Biden was the Senator from for nearly forty years and it has been learned that the Democrats and FTX had some pretty dodgy connections that may be coming to light.

Yes, that is PRECISELY what I mean and that is CT.

Delaware is THE venue for big BK cases.

Holding it in any other jurisdiction would smack of venue-shopping.

Please excuse my parochialism but – BK? CT?

BK= bankruptcy

CT = conspiracy theory

I am up way past my bedtime :-(

Also small, I assume. I could incorporate an LLC for the stray cats down the the street online, in 5 minutes, for $99 and have my choice of vendors. Law firms for such filings are like wedding chapels in Vegas, except more plentiful.

Yes! Me too!

More likely, he will have a sudden health problem and “die”.

Yes, I think reality will start to set in when he is extradited. He’s still in super plush digs in the Bahamas, Nothing much has changed for him except Ellison maybe some other members of his love nest are gone and he has more time for video games.

It could take a while for that to happen. First someone has to gin up a criminal case. Second, it will be fought tooth and nail. Over my pay grade as to what possible time tables might be.

Why all the talk about fleeing to Abu Dhabi? Why not to Israel? I thought it was almost impossible for a Jew to be extradited from Israel.

I’m not in the business of making Ellison’s travel plans. Why don’t you ask her, since no one here is a mind reader?

But the US has no extradition treaty with Abu Dhabi, so it would never happen. And contrary to your assumption, Jews have been extradited to the US, mainly for financial crimes. This article even whines about it: https://www.jdsupra.com/legalnews/extradition-and-prosecution-of-israelis-7986281/

As a resident of Montgomery County, Maryland, I was thinking in particular of Samuel Sheinbein, whom it proved impossible to extradite for murder(!). But, looking on line, I see that Israel has made it somewhat easier to extradite since then.

Various states AGs not filing = the dog that didn’t bark. Which is what I expect.

I also predict that none of ‘the kids’ will do any time.

You have utterly unrealistic expectations of how the process work. Cases take time to develop. Even getting an urgent but dumb as dirt teeny filing for a tiny business takes well over 2 weeks, usually > a month given other law firm commitments.

New York State has a large staff by state AG standards, with all of 12 attorneys + the AG. Sometimes they leverage private sector attorneys who do a lot of outsourced work in return for a cut of the recoveries. Not sure there will be much of a pot for that given the bankruptcy process unless FTX had some decent D&O insurance, That could easily be a >$50 million pot.

So given very thin AG staffing, they need to wait for facts from the bankruptcy filings they can then use in connection with criminal legal theories. That will likely come when Ray starts putting in filings with exhibits that contain documents and what pass for records at FTX. They might even need to wait for depositions.

Statute of limitations for most frauds is five years or more. Wire fraud is ten years. As long as SBF is under what amounts to house arrest in Bermuda, the wheels of justice can do their usual thing of grinding slowly but exceedingly fine.

This. I’m confused why state AG filings would be expected so soon–the new CEO doesn’t understand the business so how can government prove anything beyond a reasonable doubt? The specific facts for criminal charges are still unclear and these facts, not a general situation of likely unlawful behavior, are the only way to justify bringing charges.

At this juncture, AGs would be beginning an investigation at best…

On Twitter, people are saying that some of SBF’s own tweets are effectively an admission that he stole customers’ assets. The idea is that this is pretty open and shut: his terms of service supposedly did not allow him to touch most of the deposits, and he admits having touched them.

Sorry, they misread the Terms of Service. And a pet peeve is the press keeps talking up “customer assets”. I may have slipped into that too but I try to avoid it. “Customer assets” is a concept from regulated financial institutions land. It does not apply here. All you have is the very crappy Terms of Service, which no one with an operating brain cell would have accepted had they read it.

The only promise re safe keeping types of behavior were with respect to fiat, not crypto. As we wrote:

And SBF can say he misspoke on Twitter. He has no legal obligation to be truthful there.

That is amazing. One mystery: supposedly SBF was requiring that startups he “invested” in park all their cash and crypto with FTX. Could they have gotten better terms since I imagine lawyers were involved? (Which would make them secured creditors, right?)

That is a nasty line of thought and plausible.

I believe that they’d have to be secured creditors, which means filing with the UCC, to be secured creditors, . Adam Levitin is proud of getting Coinbase to add UCC language to its Terms of Service.

And I am not up enough on bankruptcy to know what if any hierarchy there is among unsecured creditors

Plus if things ever get that far, it will be interesting to see if SBF execs try arguing “There was no/not much fraud, our Terms of Service were very easy to read and the customers weren’t promised much.”

That, and rich, connected parents just might add up to a get out of jail free card.

Different laws, so soon, for aristocrats.

I won’t be surprised.

I think there’s no way to predict how this prosecution goes, given that the nation’s institutions are -at present- in slow-motion collapse and public trust in them is in fairly rapid decline. For example, when the Enron scandal broke many commentators said things like, “This is an aberration, not indicative of how our system works.” That argument would receive widespread ridicule today. SBF could just as easily become the scapegoat as skate free.

Perhaps a swim at the beach like Nikolai Mushegian?

https://nypost.com/2022/11/09/drowning-death-of-crypto-visionary-fuels-conspiracy-theories/

I find this whole story wildly confusing, largely because I never paid attention to crypto currencies, because Yves Smith and Lambert Strether sniffed out the fraud quite a while back.

Yet I’m so old that I recall when the words “thrift” and “probity” weren’t archaic and were still in use.

Given that as a middle-class person more or less self-employed, I have ended up with two accountants and a financial planner, I find these entries in the list rather, errr, disconcerting:

Missing:

“An accounting department

Audited financials for all businesses. Only one “silo” used a recognized audit firm. The biggest customer-facing silo had its books prepared by a no-name flake (office in the Metaverse, you cannot make this up), two had no audited statements2”

Surely, the corruption is so thorough in the U.S. economy that none of these were an accident.

And as for hypocrisy: The Republicans have been dismantling the I.R.S. and other enforcement agencies for years and the Democrats oh-so-conveniently exploited the tottering government. Quelle surprise!

I thought there was control fraud, but there just wasn’t any control, period.

Obvious Republican and libertarian solution is to deregulate harder, and cut more taxes.

It’s much easier to subvert accounting controls if you never hire an accounting department in the first place.

My thoughts exactly. This was all on purpose. My first job out of college was working for a small privately held engineering firm. They had $6M in annual revenue and their books were a mess because of personnel turnover with the only constant being a book keeper who was great at the small stuff and horrible at the big stuff.

Even with all the problems, the payroll records, bank statements, cash all tied out. They had disbursement controls etc.

We spent a couple of years getting everything ship shape, but never had audited books. When we had an audit done 10 years later as part of being acquired they found only a couple of minor things they disagreed with. We had simple straight forward books on purpose.

The lack of real accounting practices was absolutely on purpose.

Enron had Arthur Andersen literally working full time in their offices. They pointed to them whenever anyone questioned their numbers.

The entire venture is a train-wreck of basic governance, and it’s going to take a while to figure out just where the money should be, let alone where it might have gone. Remember that it was fairly clear early on just how far from reality Madoff’s customer statements and balances were, but it took years to sort out just where it had gone and claw it back.

It’s not going to be helped by the fact that the ‘funds’ and ‘money’ here in many cases are in tokens that have only a tenuous link to an established notional value. The filing is telling in that it only outlines the approximate locations of globally acknowledged real tender, and doesn’t attempt to count the magic beans.

I think vast sums of the actual money are gone, vanished like a fart in the wind so to speak. Liars are ever present but this is a special case of assholery when it comes to the lying and to the self dealing.

Seems like we, the general we that is, need these cautionary tales every 10 to 15 years as the cycles of investing will often churn to bring in a new generation of savers and retirement planning. And combine it with old heads who don’t ask tough questions, or in particular examples questions at all.

In short, hey look a free lunch and also a new shiny object. Happened with Madoff, happened with Holmes and Theranos, and the WeWork fiasco.

John Kenneth Galbraith’s. “The Bezzle”.

If Theranos would have come about in the late ‘90s dot.bomb era or Covid era Holmes could have launched the IPO and gotten away with it.

Perhaps some of the tech people being made redundant in Silicon Valley could retrain as financial regulators, assuming there is sufficient will in Congress to fund those bodies adequately (which I concede is a big assumption).

After reading the statement from SBF setting his communications to auto delete, I am wondering how much nefarious activity happens over Slack in the US.

Also, he really must believe that he is untouchable if he is still being so effusive with the general public. I was shocked to see all these interviews right now

Now that I recall, Enron’s Jeff Skilling, who was also a narcissist, but not as extreme as SBF, talked more than a defense attorney might like when Enron failed, although I am pretty sure that was in the period before the lawsuits started flying. Wasn’t Elizabeth Holmes a bit too communicative after Theranos collapsed too? I think she had a period of trying to defend what she did that continued even into the trial, that the technology actually worked, or at least shoulda-coulda.

My impression is that SBF has an extreme personality disorder. He’s very disconnected. Amazing that supposedly sophisticated professionals found that compelling. Steve Jobs may have had a reality distortion sphere, but he was a gifted designer who also obsessively drove that into Apple’s industrial engineering. There’s no “talent” with SBF save his shysterdom.

“Amazing that supposedly sophisticated professionals found that compelling.”

Here’s what I posted on Social.coop the other day, by way of explaining what I think is going on with those “sophisticated” professionals:

diptherio

3. If you make something expensive, stupid people will think it’s valuable.

https://www.bloomberg.com/news/articles/2022-11-16/uk-house-prices-secret-agent-selling-properties-in-notting-hill

“I think your pricing strategy is wrong,” my client complains over the phone as I walk through an already dark Belgravia at 4:45 pm, en route to showing an Eaton Terrace house. I’m depressed enough without having to fend off a disgruntled seller.

“Oh really,” I offer tentatively. I’m running through the comps in my head, how we came to the £15 million price tag and thinking he’s going to chastise me for being overly optimistic in what looks to be a rapidly sinking market. Maybe he’s right.

“We should be asking £30 million,” he says flatly.

I splutter, thinking I’ve misheard.

“You’re attracting mid-range buyers who don’t appreciate the uniqueness of the property, we should be aiming for the top,” he continues. With so many ways to respond, my first thought is that I’ve never heard anyone spending teens of millions described as “mid-range.”

But what do I know? I’m a humble estate agent and my client is a business maverick. Perhaps he’s channeling his inner Elon, defying conventional paths to success. It’s certainly something to mull over as I turn on the lights and prepare for my viewing at a more modest £6 million house — with a client who hasn’t (yet) suggested doubling the price in the face of exactly zero offers.

Was listening to a podcast with Brad DeLong and Noah Smith discussing FTX and Brad quoted someone from Silicon Valley who told him that so many people there had become rich on stupid ideas that now they believe that to become rich you need to be stupid.

There’s definitely something up with his general affect and presentation. I’m faintly surprised that the law firm representing him doesn’t seem to have yet designated a baby-sitter / handler for him to vet and filter all his public comments.

I’ve spent most of my 30+ yr professional career around the entire range of finance types, CEOs, CFO, traders and bankers through ordinary back office and administrative staff, in US and international firms. While some of them can be pretty disjointed, rambling, and dissembling, none have been as incoherent and incapable of answering a question as SBF has in all the interviews and transcripts that I’ve seen.

For his investors (and everybody, really), this should have been the first and largest, brightest flaming red flag: he cannot accurately describe what he does and how his business works, at a macro or micro level of detail, either in specialized technical language or in more simplified general terms. To me, this indicates that he is both ignorant and incompetent (even before we get to potential charges of unethical / fraudulent / criminal behavior).

One problem with a handler is that the person to be handled needs to be cooperative. I’m guessing Mr. Bank-Friedman doesn’t fall into the cooperative category so the law firm has opted for damage control instead of proactive handling–some people won’t stop talking well after they’ve walked themselves off the wall of the Grand Canyon.

His whole schtick is a fraud. He claims he turned $10k into $1 billion in about a year or ao by arbitrage b/w US and Japanese Bitcoin prices. Obviously that’s not possible.

He and a lot of other crypto bros have been doing the standard pump and dump scams of tokens, trading on nonpublic insider info, “selling” tokens while simultaneously funding the sale through 100% loans, and other very basic financial frauds that cannot be done in modern markets with even a modicum of regulations.

SBF and others have been sued for these schemes for a few years but the cases have gone nowhere and the media/ VCs continue to go along with the obviously bogus us/japanese arbitrage story while pretending not to notice anything else.

So when some non-billionaire guy does a crime, the news tries to interview his parents. I would really like to hear what SBF’s parents have to say, especially since they being in regulatory law were part of the sales pitch. Also, what’s uncle Gary Gensler and his former colleague Professor Ellison comments? Or what does Stanford and MIT does have to say about some of their most infamous graduates being degenerate frauds?

Since Yiddish-isms are audially descriptive and frequently appropriate, Bankman-Fried always came across to me as part Nebbish (loser), part Putz (stupid jerk, to be polite) and all Goniff (crook). He also projects a kind of boyish “vulnerability ” that has clearly served him well and gotten him a lot of passes over the years (though not likely now). That characteristic seems to be at work with his post-bankruptcy tweets, as if we’ll just rumple the hair of a bright but mischevious boy who was caught blowing up frogs in the nearby woods…

Thought for a moment you were talking about Boris Johnson.

Hmm, it does, doesn’t it?

Thank you Yves. Maybe it’s the extreme narcissistic personality that allows these people to not think of consequences for them. And yes Holmes was a media darling until she wasn’t.. but this level of incompetence/greed/whatever the reason SBF has done all of these things is not easy to ignore.

Probably a decent bit of questionable or unlawful activity passes through Slack. But the tool is just serving as a instant messaging version of the secure phone call so I can’t really hold this reality against it. (Phone calls are better because if not recorded, recollection is more open to challenge than a screenshot of writing.)

I’ll admit it doesn’t look good for SB-F @ this juncture on his adventures with other peoples money, but as long as his prison cell has fast internet and a doctor on hand to prescribe methy drugs, it doesn’t matter where you play video games.

I hope SBF, is that the name?, still takes part in that NYTimes conference. The speakers should be a wall of shame.

There will be no investigation. The FBI, HSO, and IRS only investigate small fraud cases to create an illusion of doing their job, but are afraid to investigate large cases with any connection to either political party of the duopoly, because they will lose their job when the party involved comes to power.

I know this because I have been trying to prosecute proven political racketeers in Florida, all active in the Repub party, and the FBI, HSO, and IRS refused to investigate for years, even when reams of evidence was sent multiple times to all of their local, state, headquarters, and OIG offices multiple times during both Repub and Dem administrations. I am now suing the agencies themselves for the coverup.

They will not investigate this, because they know politicians are involved.

Did you manage to miss Jeffrey Epstein who actually had dirt on VERY big names? Marc Rich, who had to flee the country? Madoff, who was a pretty big political donor and a very big philanthropic donor? Ed Buck (https://www.npr.org/2021/07/28/1021704847/democratic-donor-ed-buck-convicted-drugs-for-sex-california)? Former McKinsey managing partner and Clinton pal/fundraiser Rajat Gupta? Elizabeth Holmes hosted fundraisers for Hillary. I could go on.

Sorry, your dog does not hunt. Sending evidence does not get prosecutors to saddle up. Press and victims do. They can’t not pursue a super high profile case.

As for the IRS, the reason it does not pursue big corporate cases is they generally involve complex and debatable issues like valuation. The big companies hired very fancy accountants and tax lawyers before they filed their returns, so hard to argue a crime even if they lose. Just “oopsie, too aggressive, pay the tax, interest, and maybe a penalty”.

Giving employees real estate and taking loans, not repaying them, and not declaring the income is about as easy a tax case as you will every find. Having no accounting department and no or “what rock did this guy crawl out from under” auditors vitiates the usual defense, “I was the CEO just relying on good professional advice.”

The odds are decent that the House Republicans will have hearings, if nothing else to beat up Gary Gensler at the SEC (when only a teeny sub was SEC regulated and it is solvent) and bang on about probable use of purloined funds for Dem campaigns and possible laundry of foreign donations. The problem is the Republicans aren’t good at complex cases and this is super complex, so they could turn this into another Benghazi.

They will almost without a doubt. Having juicy facts to shine a light on important policy issues never stopped Republicans from making stuff up.

In the House I would expect only a cursory look at the structural issues, a brief parade of victims, then a relentless focus on campaign finance and fauxrage about FTX’s role in disappearing money destined for Ukraine.

The latter allows the GOP to posture for the small but significant portion of its America First base, beat the crap out of Team Blue in the media, while positioning themselves as the true saviors of Ukrainian democracy. It will be odd to see the Republicans adopting the John Kerry strategy on Iraq, but before 9/11, green-eye-shade oversight of money spent on a war that everyone agrees is righteous was a proud, hypocritical tradition. Caro’s Master of the Senate shows Johnson as a maestro of serial procurement scandals.

I think Uncle Joe and the Ds have little choice but to go after him: it’s too big of a story and the House Repugs are certain to go apes#×+ with it in the lead-up to 2024. Even “Kenny Boy” Lay of Enron was prosecuted by the W admin…

On the other hand, if he does get away with it, then we really are beyond the beyonds.

Yves, you give a good description of how the regulatory system works now that regulations are nearly all deregulated.

These agencies do occasionally go after a sensational case with some political connection. I suspect that the targets pursued have political enemies, or no political defenders, or no one wants to be associated with them due to the nature of their crimes,

Some of the cases are unavoidable because there is already enough evidence to prosecute a civil case, or state AGs are ready to prosecute.

As to Press and victims getting them to saddle up, especially for a super high profile case, I am sure that those factors help.

My case is described in my response below to Fraibert. The fact that they get 70 public corruption conviction annually in Florida for decades, of less than one percent the size of my case, makes the involvement of many Repub state officials the most likely cause that they refuse to investigate my case.

If you would like to give my case some Press, I’ll be glad to send it to you.

I suspect that Spitzer was only a step into the rabbit hole of financial institution horrors before he was neutered. Who owned Kroll at the time?…

But he was governor during those unfortunate events. Or by neutering do you mean him being made governor?

No he means being taken out as Governor. Yes his stupidity made him vulnerable, but considering the scope of the crimes that have been uncovered and examined, he was beyond small fry and personal rather than ones that actually have deep consequences for large numbers of people. Think of the protections afforded Joe and Hunter Biden and their crimes versus Spitzer’s financial shenanigans to pay for the prostitutes. He was targeted and taken out and every investigation he instituted buried or destroyed.

The existence of what you consider evidence doesn’t mean that evidence is sufficient for a conviction. Depending on the nature of the evidence, it might not even be sufficient for probable cause. I’d be curious to see this lawsuit you mention.

Furthermore, contrary to your claim is that the DOJ has fully prosecuted two sitting Senators in recent memory (Senators Stevens and Menendez). The government was so aggressive in Senator Stevens’ case that it intentionally violated its duty to disclose exculpatory evidence under _Brady v. Maryland_ and it lost the Menendez case (but is starting a new investigation of more corruption!).

The case involves several ranching families in Florida active in state politics, who gave each other about $120 million in state and county conservation funds, mostly for “easements” to prevent development which is not foreseeable in their location, with values from two to five times the full value of their land, and no effect on their ranching at all. The evidence is voluminous and proves that the state itself knew that their land had no conservation value at all for endangered species or water supply, and that the ranchers were directly involved in approving the payments. All of the officials whose political party is known are Repubs.

For decades the same agencies have convicted about 70 local politicians annually in Florida alone, for amounts less than one percent of the amount in this case, so at least here they do not go after the big fish, at least not the Repubs.

Whenever this type of thing happens it is always so obvious after the event that the whole entity was a disaster. But all sorts of people who allegedly should have known better are always investors and supporters. There is definitely something about human psychology associated with social proof and being part of the crowd; linked with Keynes’s “animal spirits”.

I guess that a positive feature of US justice in this type of scenario is that there so many lawyers in different decentralised government bodies with career incentives to prosecute. Not to mention private litigation opportunities. Suspect that these guys will be brought to justice somehow. I guess it may run for years but they will end up in court.

Having recently reached curmudgeon status (hey you kids!… get off of my cloud~) I wonder how closely tied in the addiction to video games are to the whole cryptocurrency saga?

They are both fantasy worlds, not beholden to rules & social mores as happens in real life.

The concept for crypto came from video games – https://www.ft.com/content/78431430-1afb-4712-bb75-424788c60583

One way to look at it is that the whole fraudulent enterprise was made possible by people too lazy to actually play the video games being willing to pay to jump ahead of the other gamers. Not sure how many of the seven deadlies they covered with all that, but it’s got to be at least a few.

Disturbing thought: crypto currency is based how money works in Dungeon and Dragons.

The funny thing is how actual video game currency often gets implanted. There are sources and sinks where money is created and destroyed, similar to MMT.

Ongoing and thorough discussion of FTX on twitter spaces. It’s mostly a pro-crypto crowd so one expects the partisanship but the group assembled includes top professionals, including BK lawyers and regulators and digs deep into the legalities. Worth a listen, imho. Warning – these twitter spaces moderated by someone named Mario Nawfal have been lasting 7 hours each day: https://mobile.twitter.com/MarioNawfal/status/1593294639469150211?cxt=HHwWhoC-gY7CwpwsAAAA

I luncheon with a group of tech-biz Democrats in San Francisco regularly. Yesterday I remarked that FTX doesn’t have quite the footprint in the mainstream media one might expect, but none of them cared. “It doesn’t matter, because nobody important lost money, and the ones that did won’t admit it.” I tried to suggest that it was important news, that it had implications for society, that we need to strengthen our regulatory agencies to detect this kind of thing. Fell on deaf ears. Next subject. So maybe there isn’t a cover-up going on. Maybe the news media just doesn’t think it’s important. And thus fraud in society is further normalized.

Interesting intel, thanks. But…

This has been the lead story in the business press for days. So to me this comes off as whistling past the graveyard.

I remember in the early days of Elizabeth Holmes’ downfall, the WSJ comments section was full of true believers arguing that this was all an orchestrated campaign by journalist haters trying to destroy an “innovative” business. Your contacts aren’t even denying there was a serious fraud, just somehow trying to pretend it is no biggie.

The reason these tech-biz guys want to downplay it is it makes their most celebrated VC firm Sequoia and and other investors look like morons, and raises fundamental questions about crypto, which has been a big money maker in tech land.

Matthew Stoller is tweeting that Marc Andreesson (a god among gods in that world) is “the ultimate pump-and-dump crypto schemer.”

When have SF Democrats ever cared about ordinary people?

Phil Burton and his brother John in their early days, KO Hallinan at times, there have been a few.

I shouldn’t be giving these meth-odd actors any tips, but Djibouti is where you want to be when the shift hits the fan as they don’t have an extradition treaty with the USA.

Set up shop there with your next crypto venture being Digitalbooty, yeah that’s the ticket.

I’m in!

The FTX gang:

Sure they are a bunch of crooks who made their hustle appear to be a legitimate business. I am not condoning what they did. They are crooks.

But really, isn’t what they did not significantly different in kind from what a large part of so called investment is today? Fake or grossly overstated assets. Stock and debt based on such questionable assets. Pump and dump meme stocks. Even more dishonest.

Prices generally are artificially so elevated as to lack any semblance of rationality. I do not view that as honest either.

Hyped up business models that do not produce profit and just burn cash year after year and are hyped as growth stocks. Quarterly earnings/losses calculated using questionable accounting methods. Wall street treats this as honest. Its not.

Really bad stock deals promoted by ethically challenged wall street and its analysts to enable insiders to get their money out.

The FTX scam could have lasted for years except that someone panicked depositors/suckers who unsuccessfully tried to withdraw money that was not there.

I just can’t see Sam attired in tasseled loafers all the way up to a coifed do, as seen in the Hamptons. He almost looks homeless.

But yes, the 3-Letter-Montes on Wall*Street aren’t all that different from FTX, just a lot more sophisticated and unlike cryptocurrency, pretty much the entire investing population is all-in on their game.

This is Sam’s best outfit.

https://twitter.com/ZacBissonnette/status/1592608589369446400?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1592608589369446400%7Ctwgr%5E07d703b882149c0b497764ff6e85c2200cc17630%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.nakedcapitalism.com%2F2022%2F11%2Flinks-11-17-2022.html

I have read that what panicked the investors was something that appeared on Twitter. Is that true? If it is, this may all be a result of Elon Musk taking over.

What panicked investors was the announcement from the Binance CFO (CZ) that they were redeeming all their FTT tokens for dollars (FTT were the tokens that FTX issued), which was equivalent to all a bank’s depositors simultaneously asking for their savings account balances. The announcement was made on Twitter, but most crypto announcements have always happened on Twitter, so I think Musk’s involvement is unrelated.

Yes, that tweet put Fried on his back, with Zhao’s sword at his throat. Later, when Zhao backed out of the acquisition of FTX, and to the delight of the Coliseum crowd, he plunged it in…

I wonder what will happen to those highly paid execs at VC firms who performed “Due Diligence” on SBF and FTX?

I men, really, what’s suspicious about promising high returns with no risk…?

That “WeWork” scam was my previous favorite, you’d have to have at least sixth grade math skills and a Month’s experience with commercial real estate to figure that one out.

And don’t worry about the future of crypto, this is merely a winnowing process where the various coins are reverting to their fundamental value.

The Ontario Teachers’ Pension Plan in Canada wrote down its entire investment in FTX. Another example of quality due diligence–but one where management is supposed to be a fiduciary. Somehow, I bet that $95 million “mistake” won’t result in any consequence, even though a lack of due diligence in an investment is an obvious breach of fiduciary duty.

I’m not gonna lie. I’m at least as entertained by Yves post as I am by her smackdown responses in the comments. Go get ’em, Yves!

true dat. A very sharp in the shed, metaphorically speaking.

The true meaning of Effective Altruism:

Making license plates at 15 cents/hour

Being old school when it comes to the terms price, cost and value, I could never connect these to Bitcoin or crypto. In my view there was no there there. I associate those terms with a world of productive assets created by sentient beings. It seemed to me to be a financial system that had no foundation based on what could be considered productive output. Nonetheless I proceeded to try to understand crypto, blockchain, proof of work, proof of stake, DeFi, Web3 etc, etc, etc.

In my search for understanding I came across one Sal Bayat who explained the origin of Bitcoin and its creator Satoshi Nakamoto. Through all of his discussions he eventually came to the conclusion that Bitcoin was a fraud. But it was a new kind of fraud. It was a long con that combined elements of both a Ponzi Scheme and a Pyramid Scheme and given a new name which he called the Nakamoto Scheme. From there he proceeded to try to determine whether it was created as a fraud or if the fraud was emergent. It was all very enlightening.

Read for yourself

https://salbayat.org

Saagar on Breaking Points about FTX and Sam Bankman-Fried:

NYT, Elite Media CAUGHT Covering For SBF After Funding | Breaking Points

https://www.youtube.com/watch?v=UqDJ6Ph8r9o

I remain unconvinced that many major American corporations are significantly better “managed”. The just know the rules and are much better at “compliance”.

To people that complain about Federal government mismanagement, don’t stop complaining (it is “your” government), but try to understand that corporate governance is a complete joke compared to even the lamest of lame Federal management.

Give a guy like Trump credit for telling the truth. It’s a rigged game, he knows because he’s done it too.

Don’t be ridiculous.

Major companies can balance their books. They don’t have napkin doodle spreadsheets. They don’t have jokes masquerading as external auditors.

Have you looked at a bank account? A credit card statement? It’s fucking miracle. They handle that huge volume of transactions and they are accurate.

You may not like how they behave or their priorities, but they are competent. An operationally incompetent bank or trading firm very quickly blows up.

All these books did balance. That’s not the case with the $8 billion hole at FTX. They had to put in a spreadsheet plug. The normally super jaded Bloomberg columnist Matt Levine had his version of a meltdown over that.

Fraud is not the same as having the books not balance. The fraud is included in either the P&L or the balance sheet as the need occurs. Unless there is diversion of funds (as in embezzlement) the profits from the bad conduct will be reflected in the financial returns. That was the POINT at profit-growth-obsessed Wells Fargo and failing Lehman.

With Wells Fargo, the bank had institutionalized programs to put customers in accounts or products they had not authorized and then charge them fees. An accountant would not look at the marketing/authorization side to find out if the customers had been asked. In fact, if Wells had been more clever, it could simply have updated customer accounts in the usual microtype, had “opt out” requirements, and raped just about everyone.

With Lehman, as we wrote, it was visible before the collapse that Lehman was greatly exaggerating the value of assets, even ones where you could tell where they were fibbing, which meant they were likely lying everywhere.

But that wasn’t E&Ys sin. They participated in the Repo 105 ruse, which allowed Lehman to disappear some debt at the end of every quarter. Lehman opinion-shopped and got a London law firm to provide an opinion letter blessing it. Even though pretty much everyone agrees that the opinion was unsound, normally that would be enough for public accounting purposes (as in E&Y could rely on the bad opinion). I’m actually surprised that E&Y agreed to the fine, but perhaps they had some e-mails or memos that acknowledged they thought the UK law firm was all wet but weren’t about to upset the apple cart by making a fuss.

And to those that think crypto is a side show, the last time I checked, crypto was using the energy equivalent of Argentina.

By now everybody understands that energy is food, heat for your house, electricity for heavy industry, and power for your transportation. We are now, as a globe, resource constrainted, energy into crypto means somebody somewhere is impacted in a very bad way.

Are you sure that there is even a blockchain, or computers using a terrific amount of energy, or a cold wallet, or a warm wallet? Maybe they are all fictitious.

Bitcoin miners revived a dying coal plant – then CO2 emissions soared

https://www.theguardian.com/technology/2022/feb/18/bitcoin-miners-revive-fossil-fuel-plant-co2-emissions-soared

Why Does Bitcoin Use So Much Energy?

https://www.forbes.com/advisor/investing/cryptocurrency/bitcoins-energy-usage-explained/

Have you every tried bitcoin mining? It’ll thrash your PC, and burn it up if you don’t have adequate cooling:

Can I damage my computer by mining bitcoin?

https://bitcoin.stackexchange.com/questions/1612/can-i-damage-my-computer-by-mining-bitcoin

I was recently informed on the process of mining for a coin. Something like science fiction and some dystopian financial nightmare on the crypto market scene overall.

Rip Mr. Campbell.

https://www.senecaeffect.com/2022/11/colin-campbell-1931-2022-father-of.html

This post was worth having to read all the comments. It is providing me with joyous reading, many new ideas, and hours of sorting everything out.

Now, back to reality.

One could argue that FTX paid sufficient tribute to the Rs.

“Bankman-Fried has personally given more than $13 million to politicians and their campaigns on both sides of the aisle during this year’s election cycle. Ryan Salame, Bankman-Fried’s co-CEO, contributed almost $24 million to Republican campaigns.”

Blockworks

He was likely pursuing the Democratic party strategy of supporting the most extreme/problematic Rs in primaries in the hope like Dr. Oz, that they’d lose in the general.

These two appear to have been shoveling money at anyone adjacent to financial regulation. Plus he he had a super pac called Protect our Future championing pandemic preparedness. I imagine that perhaps he has some business venture there as well. The Daily Beast story below has some fun color. This quote is remarkable. “Rep. Maxine Waters (D-CA), the chair of the House Financial Services Committee, said last week that the FTX collapse is another reason why legislation is needed to regulate crypto. But on Monday, Waters said she doesn’t think lawmakers taking FTX money puts them in an awkward position during the company’s fallout, because members of both parties were recipients.”

I guess it’s ok if everyone’s doing it.

Shady Crypto Cash

Waters regularly says very stupid stuff. SBF was promoting regulation, but a bill that would have favored FTX and not the huge number of decentralized player (remember, he was running an unregulated investment fund and not a bunch of individual accounts).

I see that Yves gets lots of mentions about this post in the latest Moon of Alabama post. Lots of other interesting details such as when SBF said-

‘A huge thanks to @MaxineWaters , @PatrickMcHenry , and the whole House Financial Services Committee for having us today to talk about the future of digital assets.’

All together and having a good laugh-

https://www.moonofalabama.org/2022/11/behind-the-crypto-scam-complete-absence-of-trustworthy-financial-information-.html

Beginning to suspect that if investigations are carried out far enough, that this was the potential to be another Watergate. No, not like the endless ‘something-gates that we have been hearing about the past few decades but I mean the ‘sense of the original Watergate. There are far too many connections being revealed with too many groups from the Democratic party to the World Economic Forum.

Thanks for the link to Moon, Rev Kev, some great comments below the line. Some suggestions FTX crash was all orchestrated to absorb ‘ toxic liquidity’ and then self destruct, in order to destroy all public trust in crypto. This arguing is based on the names of the players involved. I’d love to read feedback from our fellow pundits on that. But I wanted to copy and paste this comment from the article:

Nine years ago, when crypto-fraudster @SBF_FTX was 19, his mother, a Stanford professor, wrote a very long article making the case that free will is a myth and that we should not blame people for committing crimes.

https://www.bostonreview.net/forum/barbara-fried-beyond-blame-moral-responsibility-philosophy-law/

Posted by: SeanAU