Yves here. BuzzFeed got its first investor funding in 2006, the same year Naked Capitalism launched. Despite raising $700 million from investors, mainly in equity, BuzzFeed has only three quarters to go at current burn rates, per Wolf Richter’s estimates. Remember that external funding was not BuzzFeed’s only source of cash: it sold ads and entered into various sponsorship deals.

Nevertheless, as Lambert said, where did the money go? If we’d had only a meager $7 million over this time frame on top of our other funding sources, your humble blogger is pretty confident we would have caused more trouble than we have, which includes getting three government officials to leave office.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

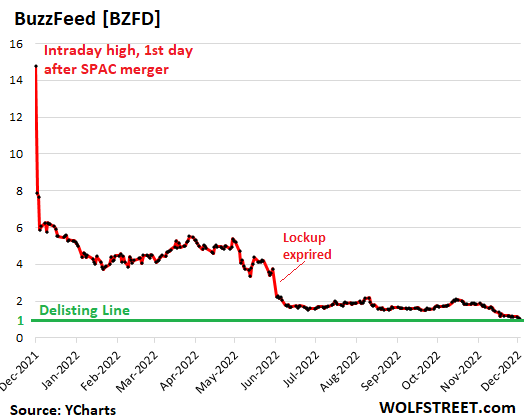

On the first day of trading after its merger with a SPAC, on December 6, 2021, shares of BuzzFeed [BZFD] jumped from the pre-merger price of $10 to $14.77 intraday, and then collapsed. On June 6, the lockup period expired, when certain insiders could sell, and the already beaten-down shares plunged another 40% in one day. Today the stock was trading as low as $1.02 and closed at $1.04, a new low, down 93% from the peak. If the stock drops further, the company may have to try to do a reverse stock split, maybe 1 to 25, such as Hippo, or whatever, to keep its shares from getting delisted.

Charts like this give me the willies about the free-money era, deeply infested with consensual hallucination, as I call it, that was already coming to an end when the SPAC merger was pushed out the window. But there is more to it, as we’ll see in a moment:

Revenues grew by 14% in the quarter, to $104 million, but that gain was driven by the $300-million acquisition of Complex Networks that closed in December last year. The net loss jumped to $27 million, while cash on hand dwindled to $57 million at the end of September.

How did a company that had raised nearly $700 million in funding since its founding in 2006, including from SoftBank, fall so far? Turns out, BuzzFeed is one of the lucky “free” online publishers. Many of the not so richly funded “free” online-only publishers are already gone.

The big promise in the early years of the internet was “free.” Publishers would put their stories, videos, and images online for free and would make money from eyeballs, as it was called during those crude days – from ads that these readers were looking at. As the ad technologies and metrics became more sophisticated, and as giants came into being whose tentacles started controlling all aspects of internet advertising, including the infrastructure to deliver the ads, and as “ad tech” was born to siphon out more and more of the funds that flow from advertisers in direction of the publishers, well, publishers got less and less of the revenue stream. But they have all the expenses of producing the content.

Many of the online-only publishers, including some well-known names, no longer made enough in revenues to pay for salaries and other expenses, ran out of cash, and shut down. Others were acquired by big companies. Most of the big publishers and many not so big ones began hiding some or all of their online content behind paywalls. But there are still some of us out there believing in “free,” and BuzzFeed is one of them, and it’s having one heck of a time.

BuzzFeed has raised nearly $700 million in total funding: $500 million in seven rounds of venture funding, including from Hearst Ventures, Softbank, Lerer Ventures, New Enterprise Associates, RRE Ventures, Andreessen Horowitz, and others. The biggest chunk came from NBCUniversal. Then, in 2020, it borrowed $50 million.

In December 2021, BuzzFeed went public via merger with a SPAC, and got, well, only $16 million in equity funding, of the $277 million that the SPAC itself raised during its IPO, as 94% of the SPAC shareholders chose to redeem their shares and get their money back, rather than watch BuzzFeed burn through their money (I discussed yesterday how the SPAC scheme works and who makes money when). As part of the SPAC merger, it also raised $150 million in a convertible debt offering.

At the time of SPAC merger, BuzzFeed’s implied valuation was a ridiculous $1.5 billion. Today, the market capitalization is down to $146 million.

BuzzFeed tried to grow via some big acquisitions, including the money-losing HuffPost from Verizon in 2020, in what was described as a stock deal; and Complex Networks, a youth-oriented media and entertainment company, from Hearst and Verizon, just after the SPAC merger closed, for $200 million in cash and $100 million in equity.

The layoffs started in 2017, with 100 people being shown out the door. In 2019, 200 people were laid off. In 2020, BuzzFeed announced a pay cut, always very helpful for morale. In the spring of 2021, the HuffPost laid off about 70 people, a month after the acquisition closed. In the spring of 2022, BuzzFeed News trimmed its staff via voluntary buyouts, following an announcement by CEO Jonah Peretti to analysts that the company would shed between 25 and 50 employees via voluntary buyouts. As part of it, two editors announced their departure on Twitter.

And yesterday, BuzzFeed announced another round of layoffs, this time 12% of its remaining staff, which would amount to about 180 people.

In a message to employees, Peretti wrote that to “weather an economic downturn,” the company had to “readjust” its “cost structure.” He said that revenues were getting hit. He blamed two factors: “worsening macroeconomic conditions” and “the ongoing audience shift to vertical video, which is still developing from a monetization standpoint” or whatever.

In the SEC filing, the company added a third factor to blame, in addition to the other two: the “integration” of Complex Networks including “eliminating redundancies.”

But cost cutting is expensive: The company estimates that it will cost $8 million to $12 million, such as severance pay, to cut these costs, and that it will book those costs in Q4, which will add to its losses in Q4.

When it reported its earnings on November 14, the company said that it was “focused on preserving cash,” of which it didn’t have a lot anymore. At the end of September, it had $59 million. How long will that last?

Its restructuring costs will amount to about $8 to $12 million, mostly related to the layoffs. So that’s cash out the door.

In Q3, it had a net loss of $27 million (and for the nine months, $95 million). But about $15 million were non-cash expenses (depreciation, amortization, impairment, and stock-based compensation). The remaining loss in Q3 of $12 million amounted to cash outflow.

So about $10 million in cash outflow due to restructuring charges and additionally about $12 million per quarter? At this rate of cash-burn, the company has about three quarters left – through Q2 2023 – before it has to start selling off the computers, chairs, tables, and coffee cups left behind by its laid-off employees to stay afloat.

Unlike many of my other Imploded Stocks, such as Carvana, that are in an industry where they should make money but don’t due to their idiotic Silicon Valley business model (the bigger the losses, the better), BuzzFeed is in an industry that is getting gutted by Silicon Valley’s ad tech.

BuzzFeed is facing what many “free” online publishers face: Revenues from advertising, organizing events, affiliate relationships with Amazon, etc. are not enough to cover the salaries and other costs involved in producing the content – even in Good Times. The “free” internet was fun while it lasted, but ad tech made sure it won’t last.

There are now some massive lawsuits by some of the biggest publishers in the world and related regulatory actions to deal with this, but it’s unlikely anything real will come of it.

Back in the mid 90s in the early days of the commercial internet I recall my (unfortunately now deceased) Cornell professor lauding the free service model.

He was very perceptive though in how he described it. His basic argument was that early on you needed to give away your service, build a large user base, drive down marginal cost and then create stickiness so that you could earn revenue from the users or advertisers. Effectively, the idea was to create a natural monopoly for your service, although he did not quite use those words. That part was critical though.

It does seem that internet services that have created some form of monopoly power make the real money; either purely internet based or in connection with form of physical infrastructure (in the case of Amazon). Not that the result is always bad: Amazon do have a genuine cost advantage (whatever else people may think of them) but there are other cases where rent extraction does seem to be the true profit source.

Online publishing does seem a tricky (although not impossible) area to do this in, given the challenges of being truly differentiated for a big enough audience (except for NC of course, but no doubt appealing to a well informed niche base not a mass one!) and the vast competition to create content, as well as so many people being prepared to do it for free.

> Not that the result is always bad: Amazon do have a genuine cost advantage (whatever else people may think of them)

Grotesque government subsidies hides a lot. Raping third party sellers to subsidize “Prime” whip cracking sadist to the tune of almost a grand per year, hides a lot.

Amazon’s Toll Road

Then there is the 150% annual churnover of slaves tied to their whipping post. Even if the work pace were halved it would still not be a long term survivable jawb. There is even an internal report that in some areas they are running out able bodied help, so many have been ruined. That hides a lot.

They have about 400 eclownomists toiling for them, and none had the guts to tell Bezos , slow the fuck down, so they overshot the planning and building of brightly lit satanic mills by five or six dozen and for good measure nearly a half dozen office towers.

https://www.ibtimes.com/amazon-warehouse-closings-2022-nearly-70-locations-closed-canceled-delayed-3613269

Bezos famed flywheel analogy is nonsense. It is not possible to have an ever faster spinning flywheel. The analogy should be an engine stuck at wide open throttle, the flywheel is along for the ride until disintegration, at which point the safest spot is far beyond the scattershield.

What are their expenses? I’m too lazy to look it up. Considering the quantity and quality of the articles on buzzfeed, by which I mean that they are publishing loads of trash, they must be burning money on staff, right? What else?

Fact of the matter is that places like this are dead weight. TikTok is eating the lunch of everyone. It’s strange and maybe even amusing to see Chinese intelligence beat out our own intel agencies, after such a long period of information dominance. Am I saying that buzzfeed is US intel? I’m saying that everything is US intel now.

Part of this feels like Mel Brooks’ “The Producers”….management know that they have a turd, but they keep producing Powerpoint presentations and generous metrics that legally-con new investors and bring in the money to keep operations afloat.

Buzzfeed is a case study on how to be a successful grifter!

16 years, wow. Helped in part by zero (real) interest rate policy. Thank you Fed!

“Information wants to be free” was the buzzy catchphrase taped on every Silicon Valley cubicle in the early days when “eyeballs” were the undisputed value measurement of the commercial internet. After Moore’s law succeeded in bringing computing to the masses, enterprising entrepreneurs had to find a way to profit from the abundance of information made possible by the plummeting cost of computing power, and advertisers wanting to reach the wave of new consumers going online for the first time was the answer. Giving information away for free became received gospel and a tailwind driving hypergrowth. Things have moved along since then, and the sophistication of ad serving and ad targeting tech has seen DAUs (daily active users) replace mere eyeballs as the value measurement standard, and the companies that moved down the stack to become platforms are siphoning away a lot of the financial value generated online for themselves. Early internet survivors that stayed on the application layer and didn’t find a way to migrate down the stack to inoculate themselves against the platform companies eating their margins are in a death spiral. For companies like Buzzfeed, this means their CACs (Customer Acquisition Costs) likely continue to outpace the Customer Lifetime Value, and the market sentiment has swung in the direction of tanking investor patience with non-resilient business models that prioritize growth over profits.

Made me look. Buzzfeed employs 1,700 people. Naked Capitalism is put out by four [4] people (I only know of three but have long suspected a fourth shadowy figure lurking in the background but admittedly it might just be a cat). Throw in every guest contributor ever and that number rises to the very low double digits.

Capitalism doesn’t explain this because if it did, wouldn’t one of those venture capital folks have thrown some money NC’s way by now?

Don’t forget the moderators! Those of us who have managed websites can’t over-emphasize the volume of spam that floods even the most

unpopular websites.

That central bank, easy money collaborator is the biggest missing link with many companies’ “productivity” and “innovation.”

No such thing as ‘just’ a cat….

I think coffeezilla, which has produced absolutely the best coverage of ftx, is a two man team.

They should have a company chef and masseuse as well.

People working here need to be pampered, dammit.

Information may want to be free, but the people who create it have bills to pay. So, [family blog] you, pay me!

I’m directing this rant toward all of those, ahem, online platforms that have expected me to photograph, write, and design for free in exchange for exposure.

Well, I am here to tell ya that exposure doesn’t pay the bills.

Isn’t Buzzfeed the outlet that more or less released the “news” Steele Dossier to the world? Karma is a real b**ch sometimes, isn’t she?

I really don’t see any company involved with both Softbank and a SPAC coming to a good end – those are just indications that your venture is a fraud.

1. Buzzfeed-HuffPost, et al had garbage content. Unless one loves lists, one’s time was better spent reading the wire services.

2. the old adage of take an advertising budget, 1/2 of it is worthless, you just don’t know which half is even more true today—despite all the advances in analytics.

I’d bet the percentage is even higher, 85%, at sites like Buzzfeed.

So you had cash burn on both ends..investors throwing money into a pit, and advertisers buy adverts on a site where readers aren’t interested in your products.

“the old adage of take an advertising budget, 1/2 of it is worthless, you just don’t know which half is even more true today—despite all the advances in analytics.”

The exact opposite is true. digital ads solved the 1/2 worthless problem, because you can target at the individual level, and tailor at the individual psychological level. https://www.sciencedirect.com/science/article/pii/S2352250X19301332?via%3Dihub

I have of course heard about BuzzFeed over the years but never got around to going to their site. Just did so earlier and it looks just like a dumpster fire of trash stories. So how exactly does a garbage publication like this get $700 million to set on fire and through up into the air? When it goes it probably not be missed but if I was an investor that lost their money, I would be asking some very hard questions. Still, that CEO of theirs – Jonah Peretti – is only 48 years old so I would not be surprised to see his name pop up again in another online publication.

If Buzzfeed has a competent legal team, management already has a generous bankruptcy-proof executive retirement plan set up.

Even if Buzzfeed goes to $0.00, Jonah can spend the rest of his life on the beach if he can’t find a future on the TedX circuit.

Don’t cry for me, Argentina!

So if the early “everybody’s a publisher” days of the web turned out to be smoke and mirrors financially couldn’t the same be said about the Google/Facebook/Twitter era with the only difference being they have the resources to produce more smoke, mirrors? Will Musk ever get his money back or Facebook last out another decade? What about the NYT or WaPo who seem to be having their own financial headwinds? Perhaps the pursuit of ink stained scribbling was never all that profitable in itself but more about the indirect benefits of “influencing” or simply the gratification of having something to say and being able to say it. When at The Nation Alex Cockburn used to joke that Navasky paid him “in the high two figures” and Pauline Kael would do college lecture tours to supplement her less than generous pay at the New Yorker. There are media figures who make lots of money of course but they tend to work at natural monopolies like cable TV channels or, back in the day, print publishers with big city monopolies. These big cheeses trying to protect their privileged positions could account for the shrillness of our current culture.

At any rate we are grateful for those like NC still in the trenches.

I recall reading Buzzfeed when it first started. And “free” internet? I almost died laughing at that one! There never was a “free” internet, unless one knew how to do super in-depth cyber research. Back to Buzzfeed; its quality deteriorated, and I moved on to other sites. I am not surprised by this read. I’m sure the CEO will survive and do just fine.

As an aside, I started a stupid little blog in 2007, and installed Google™ Adsense™, and got a payout of around $100 every 6 months or so.

It started to slow down around 2010, and I have not gotten a payment since 2015.

Same number of reader(s), but revenue collapsed, at least in part because Google takes much more vig.

Thank Dog (Or maybe Cat?) for NC….