By Narayana Kocherlakota, Lionel W. McKenzie Professor of Economics University of Rochester. Originally published at VoxEU.

The Federal Reserve has a mandate to maintain long-run employment and price stability. However, lags in monetary policy and unexpected shocks can lead to short-term deviations from these targets. This column argues that the Fed’s objective is asymmetric, with inflation overshoots being more costly than undershoots. Using data from the Summary of Economic Projections it shows that the Bernanke Fed was too hawkish, the Yellen Fed was too dovish, and the Fed under Jerome Powell has at times been too hawkish and too dovish. Modern macroeconomic models should integrate such asymmetries when analysing monetary policymaking.

The Fed’s monetary policy actions affect inflation and unemployment with a lag typically thought to be around two years in duration. Of course, given the possibility of shocks, it cannot ensure that either inflation or unemployment will be exactly at their long-run levels within that two-year time frame. Both academic and policy economists typically model the Fed as viewing downward inflation (or unemployment) misses as being just as costly as upward misses. In this column, I argue that the Fed’s objective is actually asymmetric, in that it derives material costs (benefits) from overshoots (undershoots).1 The resulting trade-off between downward tilts in inflation and unemployment has played a key role in monetary policymaking over the past 14 years.

In a classic 2006 paper, the Norwegian central bank governor Jan Qvigstad offered a simple way to evaluate the appropriateness of the monetary policy decisions in light of possibly competing central bank objectives. Qvigstad argued that monetary policy could only be said to be appropriate if the two-year-ahead forecasts for unemployment and inflation were either both too high or both too low (relative to their longer-run objectives).

What is the logic behind this criterion? Suppose the Fed expected inflation after two years to be too low and unemployment to be too high. Then its policy choices are too hawkish, as easing would facilitate a faster forecasted return of both unemployment and inflation to their long-run levels. Alternatively, if the Fed expected unemployment after two years to be too low and inflation to be too high, then its policy choices were too dovish. (Notice that this logic does not mention forecast errors! We shall see in what follows that this omission is an important one.)

Does the Fed follow Qvigstad’s criterion? To address that question, we can turn to the Summary of Economic Projections (SEP).2 The SEP is a survey of Federal Open Market Committee (FOMC) meeting participants (the governors of the Federal Reserve System and the 12 Reserve Bank presidents). It collects their forecasts of the evolution of inflation and unemployment over the next two to three years, and (beginning in April 2009) their long-run forecasts for inflation and unemployment. But these are not forecasts in the usual sense of the word, as they are not conditioned on the policymaker’s outlook for how the FOMC will choose monetary policy. Rather, each participant is asked to base their submission to the SEP on their own individual assessment of appropriate monetary policy. As a result, each participant’s projections for inflation and unemployment can be seen as describing the medium-run and long-run targets for those variables that they are aiming to achieve using the tools of monetary policy.

In a recent working paper (Kocherlakota 2023), I classify the (median) FOMC’s two-year-ahead projections from April 2009 through December 2022 into five color-coded categories.

Purple projection: The projected unemployment rate (UR) is too high and the projected inflation rate is too low. Policy is too hawkish according to Qvigstad’s criterion.

Blue projection: The projected unemployment rate is too high and the projected inflation rate is also too high. This policy stance satisfies Qvigstad’s criterion.

Green projection: Both variables are expected to return to target within two years. This policy stance satisfies Qvigstad’s criterion.

Orange projection: The projected unemployment rate is too low and the projected inflation rate is also too low. This policy stance satisfies Qvigstad’s criterion.

Red projection: The projected unemployment rate is too low and the projected inflation rate is too high. Policy is too dovish according to Qvigstad’s criterion.

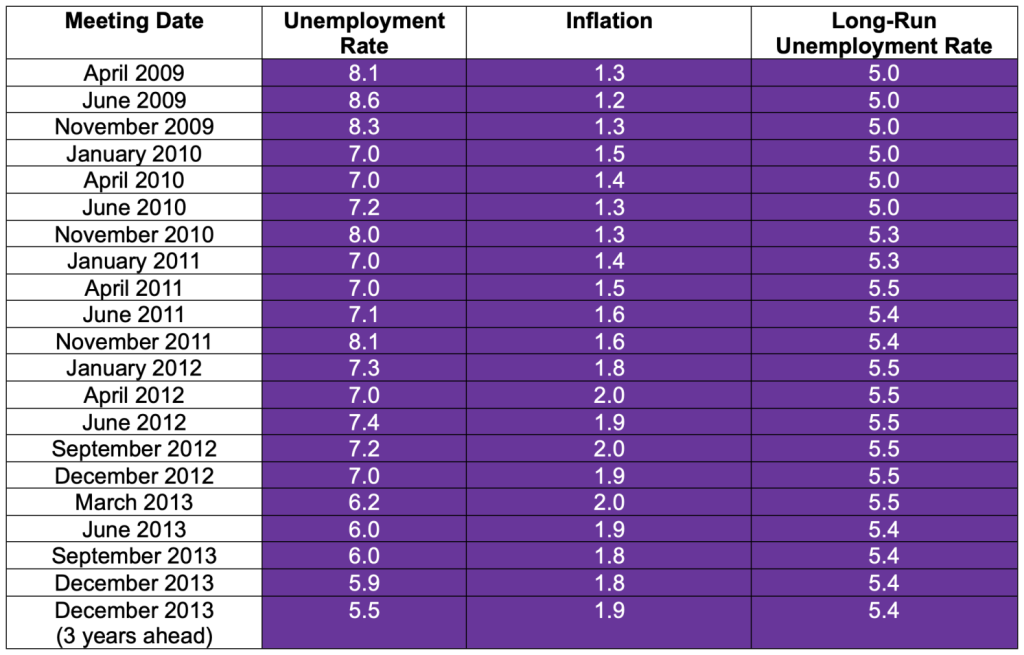

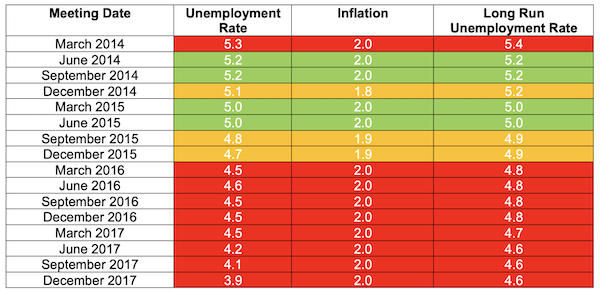

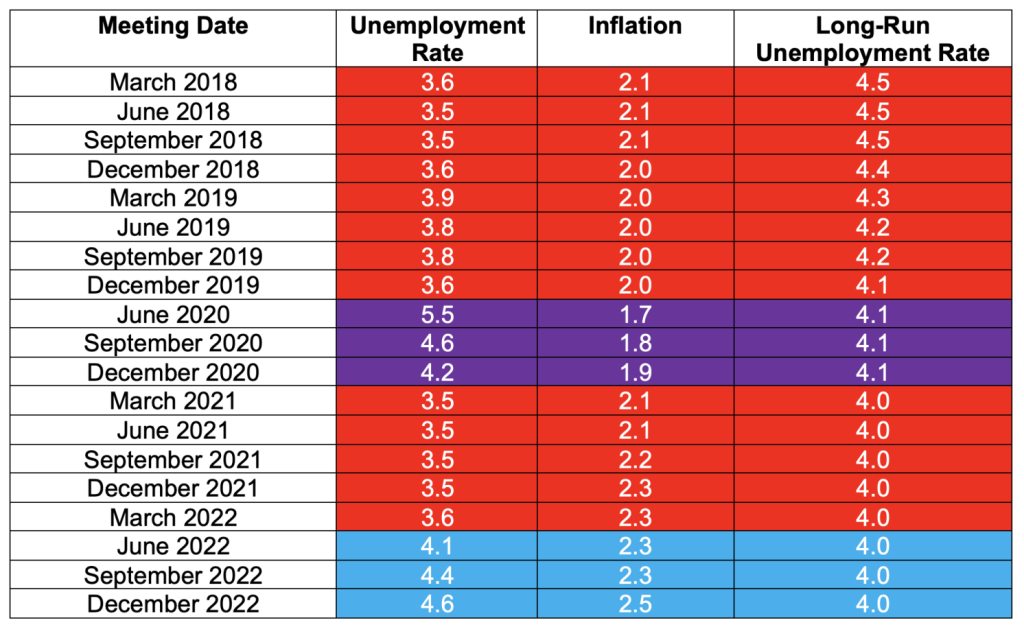

The results of these classifications are depicted in Tables 1-3, where the Tables are distinguished by the relevant chair of the Board of Governors. The Tables and Figure 1 are taken from Kocherlakota (2023). The Bernanke projections are all purple, meaning that they are too hawkish according to Qvigstad’s criterion.3 The Yellen projections are often red, meaning that they are too dovish relative to Qvigstad’s criterion. The Powell projections have at times been too dovish (pre-Covid and toward the end of the Covid pandemic) and too hawkish (during the beginning of the Covid pandemic).

Table 1 Median projections from the Bernanke Fed

Notes: These are median projection (from the Survey of Economic Projections) for the fourth quarter unemployment rate (UR) two years ahead, the fourth quarter-to-fourth quarter PCE core inflation rate (inflation) two years ahead, and the long-run unemployment rate (long-run UR). (The median projection for the long-run core PCE inflation rate is 2% at every meeting.) All entries are coded purple, as discussed in the text, meaning that they are more hawkish than the Qvigstad criterion. All medians are based on author’s calculations.

Table 2 Median projections from the Yellen Fed

Notes: These are median projections (from the SEP) for the fourth quarter unemployment rate (UR) two years ahead, the fourth quarter-to-fourth quarter PCE core inflation rate (inflation) two years ahead, and the long-run unemployment rate (long-run UR). (The median projection for the long-run core PCE inflation rate is 2% at every meeting.) They are color-coded as described in the text, so that “red” projections are more dovish than prescribed by the Qvigstad criterion. The medians are based on the author’s calculations for meetings through December 2015 and are included in the post-meetings thereafter.

Table 3 Median projections from the Powell Fed

Notes: These are median projections (from the SEP) for the fourth quarter unemployment rate (UR) two years ahead, the fourth quarter-to-fourth quarter PCE core inflation rate (inflation) two years ahead, and the long-run unemployment rate (long-run UR). (The median projection for the long-run core PCE inflation rate is 2% at every meeting.) They are color-coded as described in the text, so that red projections are more dovish than the Qvigstad criterion and the purple projections are more hawkish than the Qvigstad criterion.

Why does the Fed not adhere to Qvigstad’s criterion? As is standard, the logic behind the criterion (as described above) assumes that the Fed sees unemployment and inflation misses relative to its long-run target as being equally costly whether they are overshoots or undershoots. But the Fed’s choices suggest that it does, in fact, perceive higher costs with respect to inflation overshoots and larger benefits with respect to unemployment undershoots. Under Bernanke’s leadership, the aversion to inflation upward misses led the Fed to aim for low inflation and high unemployment. The Powell Fed repeated that pattern early in the Covid pandemic. Under both Yellen and Powell, the desire for unemployment downward misses led the Fed to aim for (slightly) high inflation and historically low unemployment.

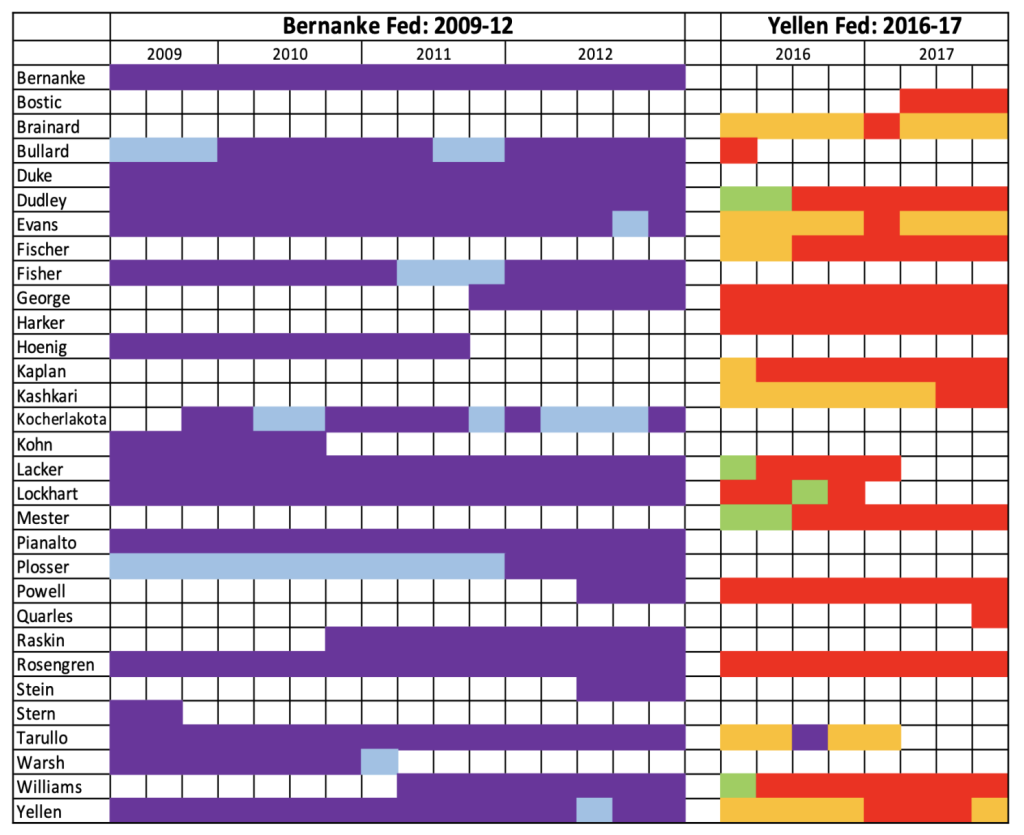

Medians are of course only summary statistics. Figure 1 uses individual-level data from the Survey of Economic Projections. (Unfortunately, the relevant data has not yet been disclosed for the years 2013-15 or the years 2018-22.) The figure documents that almost all of the 11 policymakers who served under both Bernanke and Yellen have at times exhibited aversion to high inflation (purple projections) and at other times a desire for low unemployment (red projections). It seems reasonable to conclude that policymakers are consistently trading off these downward tilts in their objectives in their determinations of appropriate monetary policy.

Figure 1 A panel of projections

Notes: For each meeting at which they submitted projections, a policymaker’s projection is coded as purple, blue, green, orange, and red (as described in the text). Blank spaces mean that the listed policymaker did not submit a full set of projections for the relevant meeting. (James Bullard attended meetings after March 2016 but did not submit long-run projections after that date.) The Fed has not yet disclosed individual-level data for 2013-15. The table omits First Vice Presidents who served temporarily as FOMC participants in the absence of a regional Bank President.

Kocherlakota (2023) discusses the possible sources of these asymmetries and their implications for future research. In terms of inflation, central bankers have expressed concerns that above-target inflation could lead “inflation to become unmoored” (Bernanke 2011) or “inflation to become entrenched” (Powell 2022). That could give rise to the follow-up need to bring down inflation expectations through a severe recession. As Bernanke (2011) says, “the cost of that in terms of employment loss in the future, as we had to respond to that, would be quite significant.” This risk is often discussed informally by both academic and policy economists but is not part of benchmark models of monetary policy. In terms of the labour market, the Federal Reserve sees low unemployment as being a way to generate potentially large gains for demographic groups (such as Black people) who face barriers to employment (Brainard 2020). To the best of my knowledge, there are no macroeconomic models in the academic world that integrate possibilities of this kind.4

Footnotes

- At the risk of emphasising the obvious: the asymmetry in this column is between upward versus downward misses relative to long-run targets. It is not about the treatment of unemployment versus inflation.

- Williams (2013) describes the important role of the Survey of Economic Projections in Federal Open Market Committee communications.

- In principle, this hawkishness could be a reflection of constraints on easing (like the zero lower bound on interest rates). However, Kocherlakota (2023) emphasises that the Bernanke Fed always had room to ease further (in particular, by communicating more accommodative conditions for lift-off from the lower bound). See also Riva et al. (2020) for an analytic discussion along these lines.

- See Chang (2023) for a discussion of related research along these lines.

This is only tangentally related, but while we’re on the subject of federal reserve policy…

It seems the economy has held up better than expected thus far into the rate-hike cycle. We should be asking why that is. Is it because there’s actually few functional channels for monetary policy to impact the real economy? For example, it seems credit card rates, and student loan rates weren’t exceptionally low during ZIRP and haven’t been meaningfully impacted during the tightening cycle, either.

It seems fed rate hikes have definitely cooled down the housing market (a good thing) and have reduced commodities speculation and also reduced the availability of cheap capital for private equity to go on shopping sprees.

Any others who’ve got thoughts on this? I’d love to hear them.

The housing market in the Pacific northwest has definitely not cooled off – there seems to be a ton of money sloshing around these parts, at least for some people.

The Federal Reserve conjured into existence $5 Trillion since January 2020. That money is still sloshing around the real economy, an economy which hasn’t grown in real terms.

That is why things are still turning and churning in the stock and bond market and some other areas.

The Fed does a lot of talking, Government spends money on current consumption while handing the debt onto others.

That is today’s economics.

JohnnyGL, my theory is that “inflation” (I hate that term so will henceforth just talk about price increases) can be divided into two major categories. 1) Consumer goods, and 2) Assets/Investments. What we saw during the ZIRP era was an increase in prices of Assets that are typically purchased on credit (e.g houses)

and investments–such as the stock market–as investors seek returns above the nominal ones they can get through standard savings and bonds. At the same time, consumer goods prices–as measured by things like the CPI–remained low.

Recently, we saw supply driven price increases caused by world-wide disruptions–Covid and Russian oil embargo. The Fed responded by raising rates, which promptly cooled off the housing and stock markets, but did basically nothing for consumer prices. Is it any wonder since consumer goods aren’t typically purchased on credit? I don’t see too many people putting milk, eggs, and bread on their credit cards.

You know who does by milk, eggs, and bread on credit though? Grocery stores. So those increased credit expenses end up getting passed along to consumers, increasing prices even more. As you correctly point out, the prices on credit at the higher end (e.g. credit cards) haven’t changed much, but the prices on the low end (such as short term credit for a grocery store) have increased by several multiples from what they were.

I personally think a rate around 3-5% is decent in that in encourages savings, prevents undue speculation, and isn’t too onerous for borrowers. However, this Fed seems dead set on raising rates until something breaks. Not sure how crashing an economy is the solution to inflation, but I’m not a Chicago school economist.

Bookmarked for this frank admission:

Generally, economists tend to obfuscate a bit more when it comes to the job of central banks to keep people out of employment.

Am I the only one who thinks the name Emperor Powellpatine is funny? He really did look like that on TV.

Don’t you fight inflation by increasing taxes to suck money out of the economy.