In some of the latest news on the student loan debt crisis, the pause in federal student loan payments that has been in effect since March 2020 may soon come to an end, and Senator Elizabeth Warren is out with another one of her famous plans that would attempt to make the peonage a bit more tolerable. Meanwhile, US student loan debt totals roughly $1.76 trillion.

The numbers and half-measures are familiar enough by now, but today I wanted to look at the circular role that nonprofits play in pushing high school students towards loans.

The gist is that lenders and loan guarantors made massive profits. Some lenders and guarantors actually became nonprofits themselves due to new federal rules under the Obama administration. Either way, the money made off the backs of students, goes to a wide variety of nonprofits focused on “college access,” usually with an emphasis on racial justice and equity. The national non-profit rains money down onto a web of smaller, local non-profits all pushing higher education and making sure potential students know about their financial options.

Many of these organizations offer scholarships, but they are often nowhere close to enough to cover the annual cost, leaving students reliant on lenders. Not to mention, universities are increasingly shifting costs that used to be covered by tuition to the “fees” category, where they can no longer be covered by scholarship money. There’s also the scholarship reduction trick.

To be clear, I’m not arguing that anyone should not have “access” to higher education (everyone would have access if it was free), but the likes of Navient using it to launder its reputation with stuff like this?

With Navient’s support, Boys & Girls Clubs of America launched a new digital program to help young people and their families learn about financial aid and how to pay for college. The data-driven curriculum includes activities for teens to learn about college costs, understand financial aid, complete the FAFSA, learn how to find scholarships and understand student loans. The program also helps Club members identify trusted adults who can guide them through their journey, including discussion guides and parent handouts. The digital curriculum, Diplomas to Degrees, can be accessed through Boys & Girls Clubs of America’s online platform, MyFuture.

One of many major hurdles to doing anything about a nation of student debtors is the entrenched PMC at the nonprofits. According to the Urban Institute, there were 2,161 higher education public charities as of 2016, the most recent year it had data available.

Let’s take the National College Attainment Network (NCAN) as a starting point.

What is it?

From its about page:

[NCAN] is a nonprofit, nonpartisan professional association with nearly 600 member organizations across the U.S. that help students prepare for, apply to, and succeed in college. NCAN member organizations touch the lives of more than 2 million students and families each year. They span the education, nonprofit, government, and civic sectors.

NCAN believes everyone – regardless of race, ethnicity, or socioeconomic status – should have the opportunity to complete affordable, high-quality education after high school.

Where does it get its money?

On its “supporters” page NCAN says the foundations and companies have provided significant assistance to NCAN since its founding in 1995 include:

- ALL Student Loan, “a nonprofit student lender dedicated to increasing access to education by offering innovative, affordable and seamless student loan products to students and their parents.” [1]

- American Student Assistance, which is the business name for the Massachusetts Higher Education Assistance Corporation, a nonprofit student loan collection agency.

- Ascendium Education Group, one of the nation’s largest student loan servicers, as well as the designated student loan guarantor for Minnesota, Ohio, Wisconsin, South Dakota, Iowa, Puerto Rico, and the US Virgin Islands.

- Consumer Bankers Association. Nearly 70% of private student loans are made by six lenders, five of which are CBA Members

- ECMC Foundation, which is part of the ECMC Group that also performs loan collection for federal student loans that are in default or bankruptcy.

- Helios Education Foundation. The corporate conversion of Southwest Student Services Corporation created Helios in 2004 with an endowment in excess of $500 million dollars.

- Nelnet, the conglomerate that deals in the administration and repayment of student loans and education financial services.

- Strada Education Network, formerly USA Funds, which was at one point the largest guarantor of federal student loans.

- XAP Corp., which “provides state-level sponsors, school districts and individual schools with online solutions for students and adults to explore careers and discover, plan for, and apply to colleges and universities.”

This brief list is just a fraction of NCAN’s partners. If their mission was truly “access” and “innovation,” you’d think with so many well-heeled friends they might consider opening a few free universities.

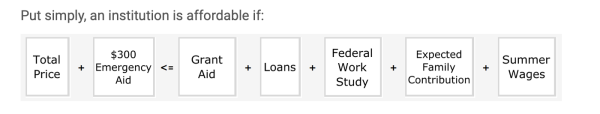

But instead all that money and influence goes to coming up with stuff like this:

Meanwhile, over the past decade the $130 billion private student loan market has grown more than 70 percent.

According to NCAN’s form 990 return of organization exempt from income tax income, most of its disbursements go to local and state non profits lower on the food chain that reflect NCAN’s top priorities, which are:

- Simplifying the FAFSA

- Increasing the PELL Grant so it covers 50 percent of college

- Making sure work study grants go to more schools with a higher proportion of low-income students

- Allowing DACA recipients to be eligible for federal financial aid

- Ensuring that student loan counseling is consumer-tested with students and balances an informative process with one that does not create barriers to aid.

- Standardizing financial aid award letters

- Allowing students who would otherwise be eligible for SNAP to receive these benefits by fulfilling the 20-hour work requirement with a combination of work and credit hours.

One could argue these priorities are simply to ensure that student debt keeps piling up, which could aid NCAN’s benefactors, which keeps the money flowing into the higher ed nonprofit complex.

Again private loans are on the rise since half measures like those proposed by NCAN only go so far when faced with the following:

The cost of attending college has been rising steeply, with the annual price tag of a public college, including room and board, at more than $18,000 and more than $47,000 for a private one.

There are limits to how much students can take out in federal loans — the most an undergraduate can borrow in a year is $12,500 — and so many turn to private financing to finish covering their bill.

How about the staff of the National College Attainment Network?

One of the senior managers of policy and advocacy, previously served as policy associate for AccessLex Institute. What is the AccessLex Institute? It “provides resources to law schools and scholars by recognizing student barriers and offering services that help improve legal education access.” More from Insight to Diversity:

AccessLex formerly operated as a student loan lender exclusively for law students and was previously named AccessGroup. In 2013, the federal government cut out middleman loan providers and made student loans accessible directly from the U.S. Treasury. This move caused AccessGroup to be pushed out of the student lending market. The CEO and board of directors then decided to rename and refocus the organization on reforming legal education.

“Our funding comes from lawyers paying their loans back to us,” says Aaron Taylor, executive director of CLEE. “We use that money to make it better for the next generation of law schools and lawyers.”

Before that, AlQaisi was at the Lumina Foundation, another nonprofit created as a conversion foundation using proceeds from the sale of assets of the USA Group, a student loan administrator.

Another senior director of policy and advocacy, previously worked as senior director at the Institute for College Access & Success, which “advocate[s] for more accessible and effective Pell Grants and Cal Grants, more affordable student loans, greater and more equitable state funding, and better information to help students make good financial decisions.”

Board members have missions to help the “LatinX” community, there’s the chair for the California Student Aid Commission, the executive director for the Louisiana Office of Student Financial Assistance, a former senior VP of Team Member Philanthropy at Wells Fargo, the head of UBS Community Affairs & Corporate Responsibility, Americas, etc.

You get the drift. Nearly all the staff and board hail from the chummy, buzzword world of innovation, equity, and access, which is almost always backed by big money made off the backs of the people they are supposedly trying to help.

We’ve long been told a college education is the path to a better life, but that message has crumbled. Among bachelor’s degree holders with debt, 72 percent said the costs of their education were greater than the benefits.

And now universities are increasingly shifting institutional aid to wealthier families they know can pay at least a part of the tuition. Overall, a historic decline is taking place – one that began in the fall of 2020. Since then, more than 1 million fewer students enrolled in college than normal over such a time period.

Was it more the pandemic? Despite repeated declarations that the pandemic is “officially” over, enrollment is not rebounding. Is it the labor shortage and offer of better-paying jobs that don’t require a degree? Or is it a decline that will continue as the American elites have finally made higher education so unattractive, save for the wealthy?

NOTES

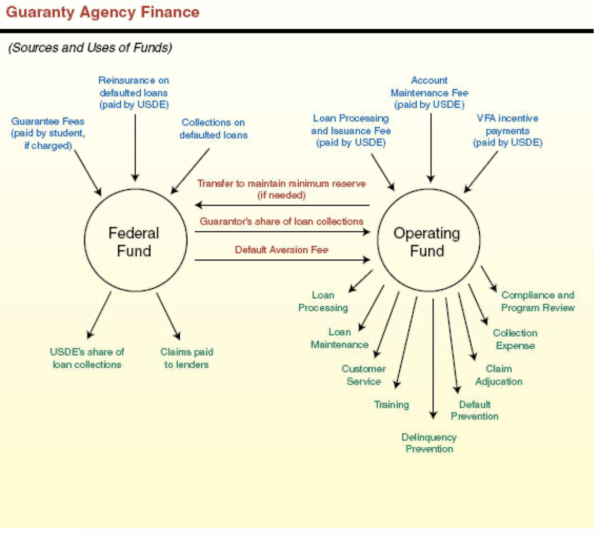

[1] Of course many of the nonprofit student loan guarantors donating to the nonprofit NCAN are just rebrands of formerly private student loan companies or guarantors of government backed private lenders. That’s because when the Obama administration eliminated government-backed private lending (FFEL) the business of insuring bank loans was destined to dry up, and guarantors are required to be either nonprofits or state-run.

Although the federal government ended the FFEL program, companies still had plenty of time to make a fortune beforehand, and the well won’t run dry for a while. There are still about 9.2 million borrowers with outstanding FFELP loans totaling $208 billion, as of Dec. 31, 2022, according to the Education Department. That could take another few decades for people to pay off.

Here’s the system our elite great minds were able to come up with for nonprofit guarantors rather than free college:

Meanwhile Education Department encouraged guarantors to propose new services that build on their experience backing loans. And so now their mission mostly reflects that of NCAN. The now-nonprofits continue to earn revenue off the FFELP loans with fees for collection and account maintenance.

After making fortunes servicing government-backed private lending, these companies suddenly began to care for students and higher education once converting to nonprofits that help students explore their financial options. Who knows, maybe they’ll convert back to for-profit entities if/once there are enough private loans outstanding again.

Way back in 2014 Inside Higher Ed wrote about guarantors reinventing themselves:

…regulators should keep an eye on guarantors as they branch out, to make sure their new programs are sensible. He said it’s clear many among them plan to stick around for a while, albeit in different forms.

“They’ve got the money to have the ambition,” said [Ben Miller, a senior policy analyst at the New America Foundation].

You’d think some neocon like Nuland might look at all these alphabets of higher education organizations scamming students and say “Ok we’re doing 95% federal funded education through State University systems and direct student aid and set up The Department of Transitional Job Training For The Production of 150mm Shells Factory Skill” for those losing their PMC jobs as a result of new regime of free education. She could add “F**k The Dept of Education”

“We’ve long been told a college education is the path to a better life, but that message has crumbled. Among bachelor’s degree holders with debt, 72 percent said the costs of their education were greater than the benefits.”

I remember some time ago reading “Does Education Matter?” by Alison Wolf, a British academic who happens to be the wife of Martin Wolf of FT renown…. She made precisely this point that a large part of higher education (obviously not all) is about “signalling” rather than about augmenting human capital in the way that it is usually presented. The argument is that it is not clear that western populations are so much better at cognition or possess higher vocational skills now when as much as half of the population leaves university in their early to mid twenties. This is as compared to the early twentieth century when typically most people left school at sixteen or even fourteen. My own experience has also been that executive assistants today aged under circa forty have university degrees but their elders typically do not. I have not noticed a systematic difference in ability. Alison Wolf made a very coherent case and recommended far more focus on secondary and primary education.

Linked to this, there does seem to be a giant “rent” seeking dimension at work in the whole university sector and they have effectively pushed up their fees to absorb as much of the available “surplus” as possible. All the issues around loans are correct but seem to be the icing on the cake as it were. Economic theory would suggest that for the marginal student all of the surplus will have been absorbed in this way.

Obviously, none of this is to say that university is completely pointless. I want my doctor to be medically qualified (for example) but questioning rather whether the extent of it is appropriate from a societal perspective. As with healthcare, legal services and padded military spending , this is a sector that contributes to headline GDP numbers but whose overall productivity is less clear.

I wonder if previous generations were not taught better how to reason and learned more of some essential professional-type skills in grade school than more recent generations are being taught even at the college level.

Yes. I think that was part of Alison Wolf’s point. Some historians point to the literate and highly complex letters that Civil War and World War One soldiers wrote as evidence for this. The challenge with proving these hypotheses, of course, is that we only have letters from some soldiers. There is a bias in the sample! Standardised test scores also do not help so much because the tests and the evaluation curves change over time. But I will say that even in the 80s when I was at secondary school, the older teachers used to say that 50s U.K. school examinations were tougher than then. But again there may be an element of bias in those assertions.

I have some textbooks from my great-grandfather who only got an eighth grade education and left school in about 1913 as well as some continuing education books of his from the 1920’s. They are much more advanced than the high school textbooks today with the possible exception of calculus. My son just graduated from high school so I’ve seen the most recent stuff.

My great grandfather worked in a power plant doing machine maintenance and his continuing education books cover all sorts of electrical and mechanical stuff that obviously wasn’t covered in his primary education.

Go to YouTube and look at television interviews from the ‘50’s through the ‘70’s – Buckley (as annoying as he was), Cavett, Mike Wallace, even Carson – and you observe a far higher level of verbal skill and what used to be called general knowledge.

Thanks for shedding light on the warm fuzzy npo sector.

In terms of public discourse, I wonder how many American know the meaning of “capitalized interest?” Asking for a friend.

When I went to college in the 60’s there was no such thing as a student loan. I wen’t to a state school. My tuition was $75 a semester and books ran another $20.That means my 4 year education cost me around $800. A private school at that time was two to three times this cost.I lived at home so commuting costs was the only other expense. Since gas was 15 cents a gallon that wasn’t much. I believe the student loans, intended to help students attend college, actually are responsible for the inflated cost of an education today. When I wen’t, colleges couldn’t drastically raise their tuition because students couldn’t come up with more or borrow to cover it. Today it is totally different. Schools can raise the cost because the student simply can sign their name and borrow the money. They don’t have to pay because repayment is deferred until they drop out or graduate. The shock comes when it is time to pay up.Another problem with todays students is they want to have their extravagant life style. Money for expensive clothing, cars, and entertainment are expected to not change. The only solution is to provide a low cost or free education to all that qualify and want it.In the long run taxpayers would get more back than they invested. This won’t happen because our elites want to keep people poor and dependent so they can control them for their gain.

Same experience for me. Why can’t we get that decent low cost State University system back? Liz Warren & Co must be aware of what you & I experienced, they’re old enough to remember. They have the knowledge to fix things in education. So why aren’t they? Have no patience for Warren’s incrementalism.

Follow the money.

Social polarization. Back then you could go into the trades, you could be a receptionist, you could do any number of jobs that pay extremely poorly today and have a modest middle class lifestyle and own your own place – obviously a bunch of other factors apply and could affect your life (inflation, race, geography, etc) but bottom line is you didn’t *have* to go to university to get prosperity.

Now – unless you’re a small business tyrant,someone who lucked into a dwindling slot in the right trades union, or in a temporary boom (oil rig pigs in alberta/the dakotas) – you don’t have a shot. The devaluing of ordinary, daily jobs means that there is (correctly) a huge surge in demand for university education, which gatekeeps your access to joining the PMC. The increase in demand and desperation for this commodity (which it is, like housing) means they can jack up the price to the extremes we see now.

Actually my dad made more working in a factory than I made my first few years as a teacher.The downside was it was hard, dirty, unhealthy work.

The ruling class learned their lesson, they don’t want an education youth that can think for themselves if they are not indentured. They don’t want to see the 60’s again

Conor writes: “We’ve long been told a college education is the path to a better life, but that message has crumbled. Among bachelor’s degree holders with debt, 72 percent said the costs of their education were greater than the benefits…Alison Wolf made a very coherent case and recommended far more focus on secondary and primary education.”

Agree and support these two points.

Contrast this to how some families seem to heed the call from PMC branding. Socially and class divided, there are those families who can tap into their wealth and those who can’t. Either way the get-your-kid-into-the-right-school mentality is a boon for those who sell potential access to those vaunted halls such as those found along Nassau Street in New Jersey or upper Broadway in NYC.

Original at Bloomberg (but linking another site due to Mikey’s paywall)

https://www.msn.com/en-us/money/careersandeducation/parents-are-paying-consultants-750-000-to-get-kids-into-ivy-league-schools/ar-AA19jPdS

“Eric Sherman, a counselor at college counseling firm IvyWise, compares the veneration of name-brand colleges to a Hermes bag. You hit a certain point where quality is legitimately increased, and then everything above that is just brand,”…[a family quoted in the article] have been working with Command Education since he was in ninth grade, considering it a worthwhile investment in his future. The consulting firm charges as much as $750,000 to work with students starting in seventh grade and as much as $500,000 starting in ninth grade. Altogether, Rim estimates many of his clients spend “over $1 million” to prepare their kids for college.”

This was very illuminating, thank you! My go-to analytical question is, “Is anybody making any money off it?” and I think of myself as a fairly hardened skeptic with respect to the non-profit sector, but I was edified/horrified by the sleaze of this set-up all round. As Lily Tomlin said, “No matter how cynical I get, I can’t keep up!”

Thank you Conor, very appreciative of this kind of work.

I think there needs to be a revolutionary movement to either shift people away from debt, toward self-sufficiency, and/or to eradicate all forms of debt altogether. In this world it seems almost all forms of debt and usury are predatory and exploitative, used to ensure a form of slavery.

Free College! Has anyone seen those adverts for free online college? Just fill out a FAFSA, no matter your age or income, sign up for free college. Get a BA in business!

I’ve always wondered how that works. Where does the funding come from? Is it a racket?

The U.S. currently has $1.7 trillion in outstanding student debt, which is $150 billion more than all our outstanding auto loans ($1.55 trillion), and over $700 billion more than all our outstanding credit card debt ($986 billion). The only category of consumer loan that is larger is home mortgages. This category of consumer debt is in such a dire situation that the U.S. federal government has had to pause all federal student loan payments for almost three years (initiated by the COVID relief CARES Act on March 27, 2020). Think about that for a moment – the U.S. government needed to freeze all payments on one of the largest categories of consumer loans. Not even during the depths of the 2007-2008 financial crisis, when mortgages were blowing up every banks balance sheet, was a step this extreme deemed necessary. No one said let’s pause everyones mortgage payments for three years.

I say this to draw attention to how severe our government believes the student debt situation to be. The Department of Education in 2020 reported that they were expecting to lose at least $400 billon on student debt, which is likely an estimate that was arrived at before the pandemic, and before three years of suspended payments, and before these outstanding loans surpassed $1.7 trillion. What losses will be in the near future is anyones guess.

The reason this situation is so dire is the price that U.S. universities charge for a college education. Students borrow money to pay universities, which are the main beneficiary of the $1.7 trillion in outstanding student debt. How much students borrow has ballooned exponentially over the last 15 years. This was during a period of record low borrowing costs (see Fed ZIRP – Zero Interest Rate Policy), and a drop in college enrollment.

The trillions in federal student loans that universities get is in addition to their exemption from all federal and state income taxes, their exemption from paying property taxes on university land, and their right to issue tax exempt bonds to fund construction, renovation, and operational costs. This does not include the $50 billion per year the U.S. government pays to universities in federal contracts and research grants. These institutions are eligible for almost every government subsidy and tax loophole imaginable.

All of these privileges do not mean that universities pay most of their front line staff generously. According to a Berkeley study “25 percent of “part-time college faculty” and their families now receive some sort public assistance, such as Medicaid, the Children’s Health Insurance Program, food stamps, cash welfare, or the Earned Income Tax Credit”. The real picture is that only a few illustrious professors, administrators, and university contractors ( famous architects come to mind ) gorge on outsized compensation, while the rest of its staff receives only leftover crumbs.

But the biggest of these subsidies is our federal governments willingness to loan trillions of dollars to a universities customers (students), without any evaluation of their ability to repay, so these students can pay whatever tuition the university decides is reasonable. It is in this environment of supreme privilege and protection, that tax exempt and supposedly not for profit universities have chosen to shockingly overcharge their students. And because none of these institutions considered the long term consequences of these actions, we are just now starting to realize we are in a student loan crisis. The debt burdens they foisted on all these students will likely hinder our national economic health for several generations. While temporary fixes like student debt relief will just encourage universities to continue these unethical practices.

To give you an idea of what comparable schools cost in different countries, undergrad tuition at Switzerland’s Swiss Federal Institute of Technology ( ETH Zurich ) is $1,300 USD per year, undergrad tuition at Japan’s University of Tokyo is $4,000 USD per year, undergrad tuition at the UK’s University of Oxford is $11,000 USD per year, and undergrad tuition at the USA’s Harvard University is $54,000 per year. Can you spot the outlier?

Despite all this media is extremely hesitant to point out that universities are the most responsible for creating and perpetuating a student debt crisis.

Forgiving some portion of past student debt is a good start to helping currently indebted students. But if nothing is done to manage the cost of a university education, then future student debt will just end up with the same problems.

I recommend we have someone investigate the precise nature of how universities and banks created this student loan crisis, and make suggestions for how we can prevent it from ever happening again.

“Investigate the student loan crisis”…’regulators oversee their guarantors’

>Sure, why wouldn’t we. And while on the subject of college degrees…and gov’t programs to promote them….over 90% of the 118th Congress members have a bachelor’s/advanced degrees, (8% in economics, 14% in business/accounting)…and of course the lawyers and policy types.

Currently there are over 20,000 active lobbying representatives…56% of these the ‘revolving door’ types.

How many of them are affiliated with the ‘rent-seeking’ university sector…who knows?

I can confirm that private colleges are shifting costs to fees that are not covered by grants or loans or scholarships. Drake University charges $49,466 in tuition, offered $30,000 in scholarships, and grants take it up $45,245. Look at that! My daughter can take out $2221 in loans per year after the $2000 Federal Work Study. That’s do-able.

Plus $11,858 in housing and food and another $4407 in books, etc, adding up to $16,265 annual out-of-pocket. Go family blog yourselves, Drake University.

As usual, what was a low cost program for the lesser middle class, has morphed into a frankenstein of debt for education. And like the mortgage crash before, bonds are traded and sold to great profit for the financial class. Who told Joe to jack around the gravy train?

This is what happens when the government subsidizes industries (given that the student loans are backed by the federal govt — it IS subsidized; if you took away the backing of the government, there would be far less lending to students). You see the same thing in the military/defense industry and the healthcare industry — tons of various grifter groups all siphoning off some of that sweet US Treasury money.

The other part of the value equation for students is that what they get for their payment is so poor. I agree with the commenters above who point out the seemingly higher intelligence of those who wrote letters in the civil war, revolutionary war. (reading those is a great real education about what was really going on during that time)

I’m all for STEM (I’m a physician) – but it is really bad that universities don’t actually teach critical thinking and language — we need to bring back the traditional humanities of linguistics, logic, philosophy.

Of course, the government/corporations/ivory tower/bankers dont want critical thinkers out there. It would get in their way of control and pushing crazy marxist behavior.