The Wall Street Journal, in its lead story, features various economists debating how how long the central bank should keep interest rates high in order to bring inflation from just over 3% to the Fed target of 2%. Most US consumers are likely to challenge the notion that inflation really is at that level, and as we’ll soon discuss, wage demands support the idea that the supposedly paramount factor of inflation expectations are higher than experts, or at least the ones the Journal consulted, believe.

Let us first point out that the Journal tacitly accepts the bad conventional wisdom that the Fed deserves credit for inflation falling from 9.1% to 3.2%. As we and others pointed out, the inflation resulted from supply constraints, particularly in key sectors like automobiles, and other Covid-related demand whipsaws, such as consumers spending what would have been vacation dollars on home improvement projects. The big accelerant of inflation was sanctions blowback, particularly increased in energy prices. Again, the Fed can’t take credit for them falling back in the US to something approaching old normal levels. From Finder:

Indeed, the central bank got a lucky break with the recent performance of the Chinese economy. Most experts assumed a fast rebound once Zero Covid restrictions ended. That would have put pressure on energy prices. But that isn’t what happened. From the New York Times last month:

China’s economy slowed markedly in the spring from earlier in the year, official numbers released on Monday showed, as exports tumbled, a real estate slump deepened and some debt-ridden local governments had to cut spending after running low on money.

The new gross domestic product data for the second quarter — from April through June — underlined what has been apparent for weeks: China’s recovery after abandoning its extensive “zero Covid” measures will be harder to achieve than Beijing and many analysts had hoped.

The sagging renminbi points to even more weakness in China. That means the Fed’s spell of good fortune on energy and potentially other commodity prices continues.

Let us not forget another wild card: the in-progress increase in Covid cases and sighting of new variants that look pretty likely to escape prior vaccinations and infection-induced immunity. If things get worse, it could dent activity in many ways, from workplace absences lowering output to the more-Covid cautious refraining from traveling and cutting back on restaurant spending. And that’s not even considering possibly more extreme action, like halts in international flight to countries deemed to have dangerous infection levels.

Another challenge to the Fed’s contribution to the moderation of price increases comes via a new article in Barron’s, which points out that the Fed’s models said the central bank would have to keep the high interest rate choke chain on much longer to wring inflation out of the economy. Since inflation moderated so much faster, if you believe those models, you’d have to concede something in addition to Fed action produced the results. From Barron’s:

When the Federal Reserve began to raise interest rates from zero in March 2022, the unemployment rate was at a near-historical low of 3.6%. The labor market had recovered almost all of its losses from the pandemic…Getting back to low and stable inflation, the story went, would require a severe recession and rising unemployment.

Fast-forward to today. Inflation is still higher than the Fed’s 2% target, but prices are rising far slower than they were a year ago….And yet the latest unemployment rate is still 3.6%, exactly the same as when the Fed’s rate hikes started…We’re seeing disinflation, but no recession; if anything, real growth is accelerating.

The recent sunny path of the economy stands in stark contrast to last year’s stormy forecasts from some of the biggest names in macroeconomics. Former Treasury Secretary Lawrence Summers predicted it would take “five years of unemployment above 5%” to contain inflation….

In a paper by economists Laurence Ball, Daniel Leigh, and Prachi Mishra presented at the high-profile Brookings Papers on Economic Activity conference last September, the authors estimated a model in which inflation was determined by labor market slack, inflation shocks, and inflation expectations. The implications of their paper for the inflation trajectory were dire. Even under highly optimistic assumptions, inflation was likely to remain high unless unemployment rose significantly or job vacancies fell.

During the conference discussion of this paper, Frederic Mishkin, a former member of the Fed’s Board of Governors, implored central bankers to not blink in the face of a recession if that’s what it would take to fight inflation. “The bottom line is that the recession is probably going to be a serious recession,” he said. Robert Gordon, an economist at Northwestern University, worried that inflation expectations would spiral out of control and the traditional relationship between job vacancies and unemployment might not return back to its prepandemic state. “Sell your stocks, folks, I think we’re in for a difficult ride,” he said.

Based on the paper, former White House Council of Economics Advisers Chair Jason Furman said it could take two years of 6.5% unemployment to return inflation to 2%.

If you had any doubts about the degree to which economists remain wedded to a 1970s picture of inflation, with rising wages producing too much demand and therefore leading to even higher wages, is sorely outdated. The nearly 50 year campaign to weaken labor bargaining power has been remarkably successful (the Barron’s article also points out flaws in the standard models). The chart below from Axios shows that workers weren’t able to demand pay increases in line with inflation, despite famed worker shortages, until very recently, and that’s due mainly to the recent sharp plunge in inflation.

Nevertheless, the debate in the Wall Street Journal centers on how hawkish the central bank should be, with some pushing for more hair-shirt wearing, others advocating for kinder treatment, and yet another cohort calling for the inflation target to be 3%. The latter is not a new idea; during the secular stagnation era, several papers argued a 4% inflation target would produce better results over time than 2%.

The Journal piece mentions the elephant in the room, how Fed action would impact Biden/Democratic party prospects in 2024. Recall that Bush the Senior attributed his 1992 election loss to Greenspan waiting 6 months longer than he should have to drop interest rates in short but pretty nasty 1991-1992 recession. My recollection is Greenspan did not deny the charge. From the Journal:

Some had concluded years ago that, because of more frequent spells in which the Fed couldn’t cut interest rates once they were lowered to zero, the 2% inflation target was too low. With a higher target of 3%, interest rates would be higher in good times, giving the Fed more scope to counteract downturns by cutting them…

“The inflation target…is not meant to be an absolute rule,” said Adam Posen, a former Bank of England policy maker who now runs the Peterson Institute for International Economics. “We should be understandably reluctant about crushing the economy to get from 3.5% to 2.25% inflation.”

A higher target is also popular among Democrats concerned that rising unemployment or a recession would threaten President Biden’s re-election prospects.

The goal of 2% inflation “is not a science. It’s a political judgment they have to make,” said Rep. Ro Khanna (D., Calif.) “I don’t see why having a particular number as the Holy Grail…is the right way to get that judgment.”

It is striking to see the Peterson Institute voting against Fed hawkishness.

But the central bank is wedded to the idea that sticking to its sacrosanct 2% target is critical to managing inflation expectations. Again from the Journal:

Central banks have used explicit inflation targets to help convince the public that inflation would remain low and stable because the banks were signaling, in advance, how they would react in periods of higher inflation.

Powell made clear he won’t consider raising the target with inflation running above it, because it risks undercutting the entire strategy. “We’re not going to be considering that under any circumstances,” he said last fall. He repeated that view to a skeptical lawmaker in March. “This is not a time at which we can start talking about changing it,” Powell said.

Richmond Fed President Tom Barkin argued that Mr. Market expects the Fed to stick to and attain its 2% goal, and setting a higher target would lead to a bond selloff. Powell and some other Fed governors reportedly believe that the current level of interest rates is already restrictive and the Fed does not need to do more unless it sees signs of accelerating activity or price increases.

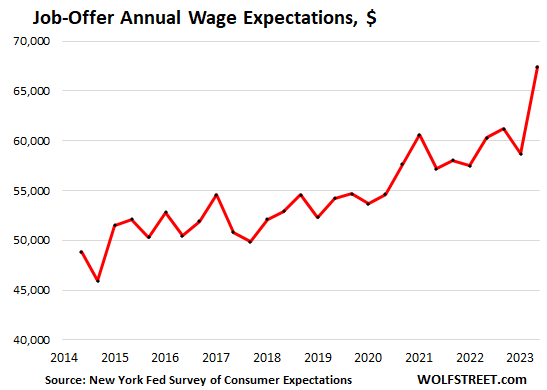

Barkin and other Fed officials believe they have reset expectations lower. Wolf Richter’s latest post argues the reverse, that workers want meaningful wage increases, markedly above the Fed’s pet level. From Wolf Richter in Powell’s Inflation Nightmare: Job Seekers, incl. the Employed, Suddenly Expect Massively Higher Wages in Job Offers:

Wages of job offers received by job seekers, and expectations for wages by job seekers surged in July…

The wages that job seekers – not just the unemployed, but also the employed looking for another job – expect to get in their job offers spiked by $7,105, or by 11.8%, from a year ago to $67,400 on average, according to the New York Fed’s Survey of Consumer Expectations (SCE) this morning. This portion of the SCE is conducted three times a year, in July, November, and March.

It was the biggest spike in job-offer wage expectations in the data of the SCE, which goes back to 2014…:

Even more important, workers on average are getting pay increases that exceed curren levels of inflation:

The average full-time wage of job offers that job seekers actually received spiked by $8,711 year over year, or by 14%, to a record $69,500 in July, according to the SCE.

The lowest wages that job seekers would be willing to accept to take a new job – the average reservation wage – jumped by 7.9% year-over-year, to $78,600.

These are massive increases in what job seekers expect, and what they were offered. And it comes amid the still unfolding scenario of unions pushing for much higher wages, and not shying away from labor action to underscore their demands. Minimum wages in states, counties, and cities that have them have also been raised, in some cases substantially.

Now this may be employers having to throw in the towel to pay more in the face of widespread workers shortages. Perhaps some establishments have hit the limit of workarounds.

But if our view is correct, that Covid, and particularly Long Covid, is a big unacknowledged driver of the employee shortage, that’s not getting any better unless and until effective Long Covid treatments are developed, tested, and launched. But there seems to be no urgency to respond, perhaps because admitting the severity of the Long Covid problem problem means also admitting how badly the officialdom has mismanaged the pandemic. Yet more and more research suggests that repeat Covid infections make Long Covid more likely.

The data on Long Covid incidence is terrible due among other things the absence of decent data on who has gotten Covid in the first place. But let’s assume the odds of getting Long Covid after a Covid infection is 10%, which is lower than the 14% odds that Science reported for Omicron. We will also charitably assume that reinfection does not increase the odds of getting Long Covid.

With those assumptions, cumulative probability says the odds of getting Long Covid after 4 infections is 35%.1 So I would bet on continued labor market tightness and more employers having to pay up for hired help. If that’s how this plays out, it’s pretty pathetic that it will have taken a lasting pandemic to shore up labor bargaining power. But the historically-minded will point out that was one of the few upsides of the Black Plague.

_____

1 Sticklers will point out that this result does not allow for what happens to people who get an active Covid case while also having Long Covid. The state of search engines plus the apparent lack of inquiry into this topic means I could not find an answer. However, I think it’s not crazy to exclude reinfection among active Long Covid cases because most sound as if they are so sick as to be largely isolated and thus at less risk of reinfection while suffering from Long Covid.

Yup, the timing strikes me as about right with regard to an increased political impact on the Dems. Who knows, possibly enough to lose the White House following the 2024 election.

Moreover, absent a resolution with regard to COVID, we’re still not back to spending $1000/mo eating out. This, for 3+ years and counting. Why? Simple, it’s because we take precautions seriously and can do math. Simply put, 14% odds of Long Covid each time you catch it means more bullets in the chamber each time you spin the cylinder of the COVID revolver.

But eating out isn’t COVID’s only impact on our spending. Commercial travel spending to the tune of $6000/year as well, has been totally curtailed. It’s even led to using our small aircraft to go to zero (other than maintenance flights to keep the machine exercised as sitting is especially bad for them). Why has travel gone to zero? Well principally because there’s nobody we want to be physically close to due to COVID concerns. Not business associates. Not family, either.

Added to which, miles on vehicles has plummeted to <2000/year combined. Meaning we're not going to be replacing vehicles any time soon (both of which were within a year or two of being due). This is a significant sum not flowing into the economy as well. In truth, easily more than we're withholding for eating out and travel.

Worse, we're prepared to withhold this spending activity for the rest of our lives. So more math means the conclusion of this article is spot on, this will persist until COVID is defeated.

Same here. Just cancelled trip to see our first grandchild. Covid in the home, and both parents work from home. Schools back open and cases popping up everywhere here. Brother just recovered from a “summer cold”. We mask everywhere. Forget dining out. Have noticed more online ordering carts moving. through local Walmart.

Is this having an effect upon your business in terms of labor availability? Do you use mitigations to reduce people’s exposure to COVID at work?

I did the same, not because of covid but rather the deterioration of quality and service while the doubling in price of most things. my favorite place where i used to go for ossobuco took the price from $28 to $64 and the service is significantly worse. same with taking the plane, the experience is terrible, so stay home unless you have too

Isn’t it interesting that the “golden age” of the fraudster banksters, coincides with the erosion of democracy, political institutions and the total destruction of the manufacturing base?

Now, amid a tsunami of memos with misleading graphs, passing as academic papers, the Jasons, Larrys, Adam/s, et al, to continue the great heist, must blame high wages & high employment as the cause of greedflation.

No wonder Biden’s poll numbers remain safe in amber at 41%.

Btw, can we agree that the so-called new jobs are contract jobs that offer no security, health care benefits or vacation?

On the other hand, let’s not forget how members of the Fed like Dallas Fed president Robert Kaplan, and Boston Fed president, Eric Rosengreen were forced to step down because they had been trading on insider information? Yet, these are the people who’re setting “ economic policy”?

Food costs at LEAST 25% more than it did a year ago. Oh, I forgot. Food isn’t factored into inflation numbers because it’s “volatile.” OK. The average price of a USED automobile hit $29,000 last November.

https://www.cnet.com/roadshow/news/average-used-car-cost-november/

Has anyone heard that used car prices have come down? Me, neither.

Maybe used cars don’t count according to economists, either. But food and used cars count more to actual people than whatever the economists are measuring.

Housing costs are also not part of official inflation calculations…

Here in western WA I see help wanted signs all over the place.

Help wanted….at the wages they paid back in 2020. If you want more, keep walking

Housing costs are included in the CPI-U inflation calcs.

See:”https://www.bls.gov/news.release/

(You’ll have to enter the website URL yourself. NC is not allowing me to provide an active link.)

unless inflation is defined as cpi+asset prices any discussion about it is pure sophistry to make any point you want. the more you compartimentalize it the more obfuscation is possible.

Two years ago I got a used 9 year old Subaru for $5K plus about $1K trade-in value on the clunker that wouldn’t pass inspection it replaced, so $6K total. A few weeks ago I got another 9 year old Subaru – same model from the same dealer – and paid almost $14.5K for it. The newer one had about 60K fewer miles on it than the other at the time of purchase, but I don’t think the lesser mileage can account for that much of a price increase.

I must be missing something. The US is supposed to be powered by the consumerist economy. That is why after 9/11 George Bush told Americans that they best thing that they could do to take action was to go shopping. Yes, he actually said that. But if the Feds keep on inflicting more and more pain on the economy, that translates into people buying less, not driving so much, cutting back on services, etc. So where does that leave the consumerist part of the economy? Or has it been supplanted by the FIRE part of the economy now?

I keep tellin’ em. It’s the rentier fueled economy more so than the consumerist economy attributed to the more industrialized era of USA history.

And I finally figured out what tingles my spidey sense in much of the analysis about the consumers and their spending. I’m reminded of those NY Times types of stories about Millennials. But all that analysis of Millennials was often a laser focus on the first world problems of the children of the upper classes.

About 1/2 of consumer spending is driven by the top 10% of American households. This group also disproportionately receives interest income from holding US treasuries. In 2020 the government spent about $525B in interest. This year it will likely spend over $850B or about 60% more. That’s over $325B in stimulus that is negating some of the interest pain felt by other Americans.

The overall trend in the economy seems to be more about capturing customers and milking them daily or monthly rather than providing them a wide variety of choices.

Just came across this, which the NYT is calling a radical right-wing scourge

https://www.youtube.com/watch?v=sqSA-SY5Hro

hitting the top of the charts, as well it should.

Shhhhh! Don’t tell anyone! I really like this song!

Oh, they are at wit’s end:

https://variety.com/2023/music/news/oliver-anthony-responds-industry-offers-rich-men-north-richmond-1235699012/#!/

Oliver Anthony Says He’s in No Hurry to Sign a Deal: ‘People in the Industry Give Me Blank Stares When I Brush Off $8 Million Offers’

“People in the music industry give me blank stares when I brush off 8 million dollar offers,” he wrote in a 730-word message posted to his Facebook account Thursday morning. “I don’t want 6 tour buses, 15 tractor trailers and a jet. I don’t want to play stadium shows, I don’t want to be in the spotlight.”

He continued, “I wrote the music I wrote because I was suffering with mental health and depression. These songs have connected with millions of people on such a deep level because they’re being sung by someone feeling the words in the very moment they were being sung. No editing, no agent, no bullshit. Just some idiot and his guitar. The style of music that we should have never gotten away from in the first place.”

“…Writing about the response that has come in over the last week, Anthony wrote, “It’s been difficult as I browse through the 50,000+ messages and emails I’ve received in the last week. The stories that have been shared paint a brutally honest picture. Suicide, addiction, unemployment, anxiety and depression, hopelessness and the list goes on… I’m sitting in such a weird place in my life right now. I never wanted to be a full time musician, much less sit at the top of the iTunes charts. Draven from RadioWv and I filmed these tunes on my land with the hope that it may hit 300k views. I still don’t quite believe what has went on since we uploaded that. It’s just strange to me.”

Amazing how many people in his neighborhood hate the ‘welfare.’ I was thinking that it may be akin to ‘Protestant Soup’…the lifeline so despised by the starving Irish Catholics during the era of the blight.

What a video!! He may not be the best at playing his Dobro guitar, but he sue as hell can sing his music.

Like pretty much everything else in economics, a 2% inflation is based on a whim, nothing even approaching an empirical basis:

“The 2 percent target widely adopted by central banks today originated from New Zealand, and surprisingly it came not from any academic study, but rather from an offhand comment during a television interview. During the late 1980s, New Zealand was going through a period of high inflation. In 1988, inflation had just come down from a high of 15 percent to around 10 percent. New Zealand’s finance minister, Roger Douglas, was pressed during a television interview about whether the government was satisfied with the now lower—albeit still high—level of inflation. Douglas replied that he was not, saying that he’d ideally want an inflation rate of between zero to 1 percent. At the time there was no set target and the remark was completely off the cuff. But now that it had been made by the nation’s finance minister, the Reserve Bank of New Zealand felt it had to work out a specific target. It determined that there tended to be an “upward bias” in inflation calculations and estimated that this bias in New Zealand was around 0.75 percent, which it rounded to 1 percent, providing a target boundary of 2 percent.”

The History and Future of the Federal Reserve’s 2 Percent Target Rate of Inflation

I’m reading economists talk about things like spending on vacations, but when workers go asking for a raise it’s the things like rents, food, healthcare, and child care that is in the forefront of their minds.

“The bottom line is that the recession is probably going to be a serious recession,” he said. Robert Gordon, an economist at Northwestern University,

Sounds like wishful thinking, as is larry summers Five years of high unemployment. My question is what was the goal that was to be forwarded on this disruption? Obviously summers has the ear of the democrats, what policies were to be imposed upon the population during this major recession? Remember the old saw, never let a crisis go to waste. First the ukraine debacle, now this…how many more losses can these useless eaters take? It would be ironic if the rational actions of individual actors like quiet quitting tip the scale, or if just assuming people will pay higher prices runs into the reality that theres no money in the lower orders to fleece. Cars, for instance, have become prohibitively expensive…where do the uber drivers come from as their cars wear out? A year ago last spring I saw progresso soup is 5$ a can, so I just made soup (that would be substitution for the chicagoans). Substituting healthy for not healthy, fewer trips to the store is fewer impulse buys, subbing the bus for a car…Even bars are going out of business. I’m sure there’s a lot of low hanging fruit along those lines. And homeless people are not participating either. I’m still waiting for the stories those $20/hr fast food workers realizing that they are the obamacare cash cow, earning enough money to no longer be subsidized but not enough to afford the deductible. Why continue participating in such a scheme? In the macro, the wall streeters have enacted their greedy policies on americans who truly have no choice, like I can’t just decide to go to mexico, they don’t want me. There’s really no out for US citizens…but the rest of the world is not confined in the same way and as amlo and others (synophone of those canadian gravy fries) are proving, are not keen to enter the abattoir.

Serfs up!

Ding! Ding!

We have a winner!!

I appreciate that NC is the only place that acknowledges that COVID impacts the real economy. If I look anywhere else, there’s no indication that the Pandemic even exists. I guess I shouldn’t be surprised, given the lack of executive function in this country. Why would you want a complete picture of the world from which to base decisions about things like planning economic activity? lol.

Thanks for the kind words.

Actually there was an article in the New York Times in January, which cited a Brookings study. But to your point, there’s been so little that it seemed to be the exception that proved the rule. See

https://www.nytimes.com/2023/01/24/health/long-covid-work.html

And

https://www.brookings.edu/articles/is-long-covid-worsening-the-labor-shortage/

Even by the admittedly understated CPI calculated by BLS (https://data.bls.gov/cgi-bin/cpicalc.pl) $100 in January 2021 now buys $85.57 in goods in July 2023. The rate of change may have slowed, but at a current trajectory of 3 – 4% per year, that $100 in January 2021 will be around $80 by November 2024.

Eyeballing Wolf’s Job Offer Annual Wage Expectation chart, the change from 2021 to the latest data point is roughly 57,500 to 67,500 – about 17.5%. The “outrageous” increases are simply keeping even with the cost of living.

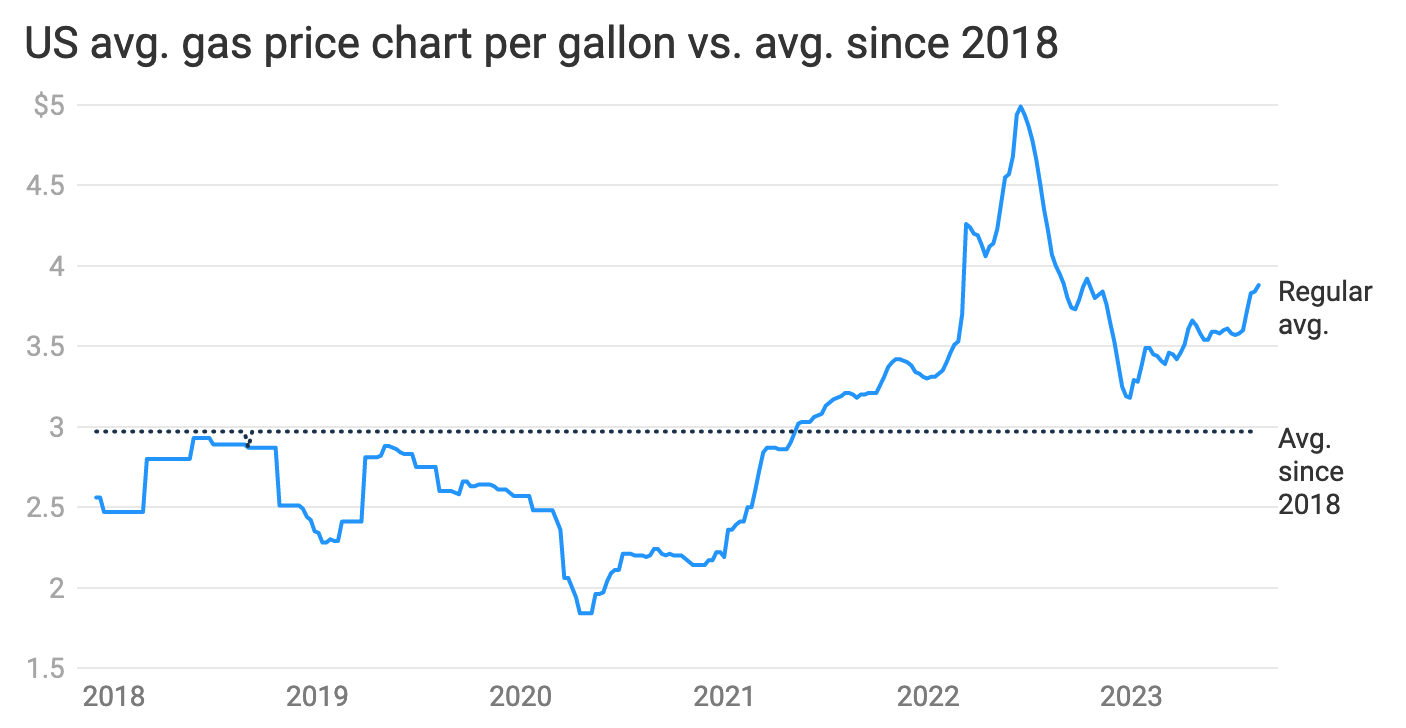

And like most commentators here, I’m hard pressed to think of any regularly purchased good or service that isn’t up 20% or more. Even gas is back over $5/gallon in California (and closer to $5.50 most places).

One final note: I noticed a billboard announcing Sheriff Deputy positions in Contra Costa County (Bay Area) on a highway yesterday: starting salary $100k + bonuses. Sounds great until you look at the cost of living.

So 2 or 3% is what has proven to be the minimum push for the economy, keeping capitalism afloat. The economy is an old combustion vehicle so gotta flood the engine a little to keep it from stalling out. Deflation is worse than inflation. What if the economy ran like an EV? Always agile and able to accelerate. Would capital and labor find themselves in balance for once? We aren’t even an old sputtering car, we’re more like a horse and wagon with the wagon ahead of the horse. In order to keep the economy steady we need a replacement for inflation altogether. That kinda means a replacement for interest on money as well. That innocent-sounding 2% actually spirals off the chart as the economy tries to absorb it with some unnecessary growth and prices go up and wages go up and nobody can afford a house. It’s a merry-go-round that is devastating the planet for profits for the already money-rich. So how can we replace it? It’s a forbidden question.

This is the best description of the daily choices we are all forced to make. Get sick? Sucks to be you. Stay well? Lucky duck, keep on truckin’

I can’t believe policymakers chose this reality, after 1.17 million citizens died…..

Jackpot design engineering. Make it look like a slow-rolling accident. Maintain plausible deniability.

Where’d you get that number? People just making up their own data isn’t helping.

When I try to understand inflation narratives and statistics, I’m usually actually thinking about what is happening to disposable (discretionary) spending.. Here in Southern VT wages are going up, but it’s not clear they are keeping pace with insane housing food and fuel increases. The recent flooding has people worried about next year’s homeowner’s insurance etc.

At the risk of saying too much I will acknowledge that the question is more than academic for me. I recently started post retirement here when I opened a little pinball gallery downtown as an extension of my and my husband’s hobby of fixing and restoring them. Capturing a little of that disposable income keeps the rent and utilities covered on the storefront.

The entertainment budget is always subject to limitations and rationalization. It’s easy enough to put off an evening of pinball for another day and save that roll of quarters for later. There are lots of expenses and external factors that can influence those decisions; back to school, winter weather preparations, and covid infections etc. But wondering about that “pool” of locally available disposable income has made me wonder if there are reasonable proxies that could be identified.

Do pinball nights correlate to movie tickets and bowling lanes rented? Is there a reasonable correlation to sales figures for recreational marijuana? Beer/liquor sales? I tend to guess there is possibly some gross connection that raises prospects for all these things in tandem. And more to the point of the post, is there a way to connect inflation to the general impact on discretionary spending? It’s not difficult to imagine that expectations of sustained or even increased inflation might temper and moderate “mad money” type spending.