Over the years, this site and some important writers like Michael Hudson have written regularly about rentier activity and how it distorts economic performance and creates a parasitical elite. A new paper by finance maven Richard Ennis, who has been systematically analyzing the performance of high-fee so-called alternative investments, shows that they systematically fail to deliver on their promise of superior returns. And the huge amounts of money involved produce an economy-wide drag, even before getting to the destructive effects of shifting more wealth to the top 0.1%, starting with cementing oligarchical control over politics.

Ennis’ new article is embedded at the end of the post.

Readers react to examples like medical industry grifting such as balance billing and upcoding, and ever-rising housing and higher education costs. But they seem to be less interested in the far greater extraction that occurs via the asset management industry. As we wrote in 2021:

Many of you may think that money management is a tiresome subject, on the same plane as accounting except the practitioners generally wear better suits.

If you think that, you’ve just admitted to not understanding one of the big reasons why the rich keep getting richer. Specifically: asset managers are twice as likely to become billionaires as technologists. And during the period when economists were looking at what was causing the post-financial-crisis “secular stagnation,” many papers, even one by the IMF, concluded that overdeveloped financial sectors were a major part of the problem. And the asset management industry was the biggest drain of resources.

The biggest vehicles1 for extraction are high fee “products” like private equity, hedge funds, and real estate funds. Together, those three are often called “alternative investments” or “alts” in contrast to liquid securities like stocks and bonds. The partners in large funds make so much money that they wield outsized influence. When you look at who heavyweight political donors are, you’ll see these big money men overrepresented. Similarly, as we have pointed out, private equity firms are far and away the biggest source of fees not just to Wall Street but also the “white shoe” law firms and the biggest consulting firms. A knowledgeable source told me that private equity firms were the source of over half the fees to McKinsey, Bain, and BCG starting in the early 2000s. That is a lot of scratch.

Recall that many financial services are essential to commerce, even if banks are able to find sneaky ways to make them unduly expensive. These include bank accounts, fund transfer mechanisms such as bank wires, checks, debit and credit cards; custody services aka safekeeping your assets; primary sales of stocks and bonds, which raise money for companies).

The justification for active money managers and the managers of complex investment strategies is that they outperform, as in deliver what in the industry parlance is called alpha, as opposed to beta, which is market exposure to that investment type (which are often misleadlingly labeled “asset classes”; that claim could be made for real estate but is dubious for private equity and hedge funds). As most investors know, active stock managers do not beat the performance of indexes; that’s why so-called passive investing has become so popular. Index funds seek to match index performance as closely as possible while minimizing fees.

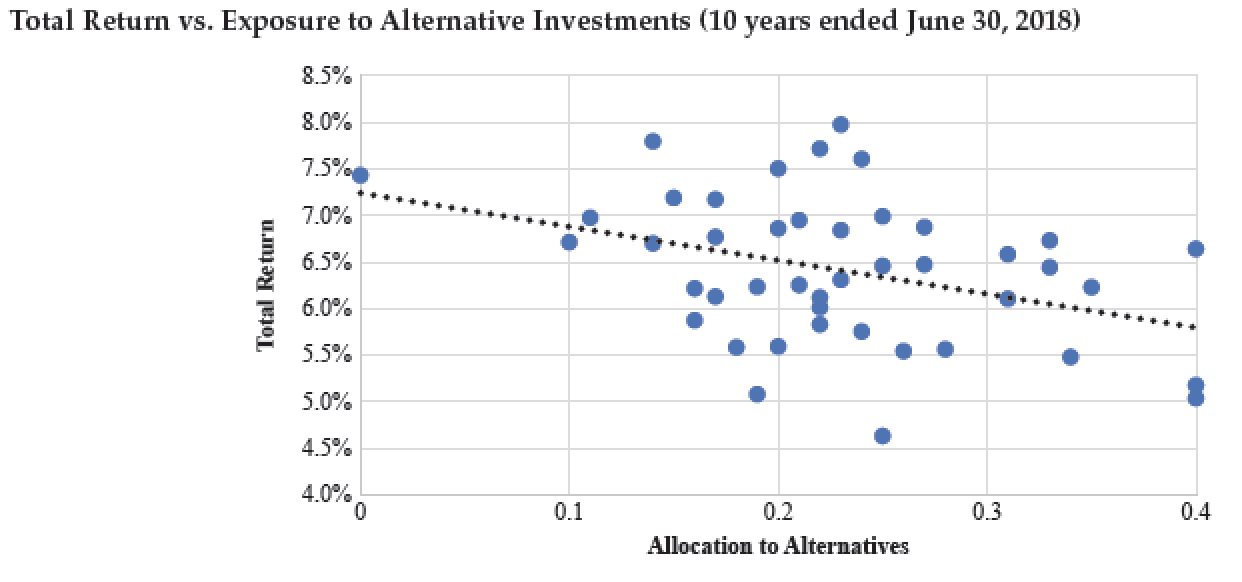

The picture is just as bad when you look at alternative investments. Richard Ennis, one of the leaders in quantitative investing (among other things, he founded EnnisKrupp and also was the editor-in-chief of the Financial Analysts Journal for many years), has been looking systematically of the performance of these alternative investments and has not liked what he sees.

In earlier papers, Ennis documented that public pension funds have underperformed and that underperformance is due to these high-falutin’, big fee schemes. For instance, from a 2020 post New Study Slams Public Pension Funds’ Alternative Investments as Drag on Performance, Identifies CalPERS as One of the Worst “Negative Alphas”; Shows Folly of CalPERS’ Desperate Plan to Increase Private Equity and Debt and Go Bigger Using Leverage:

We are embedding an important new study by Richard Ennis, in the authoritative Journal of Portfolio Management,1 on the performance of 46 public pension funds, including CalPERS, as well as of educational endowments.

Ennis’ conclusions are damning. Both the pension funds and the endowments generated negative alpha, meaning their investment programs destroyed value compared to purely passive investing.

Educational endowments did even worse than public pension funds due to their higher commitment level to “alternative” investments like private equity and real estate. Ennis explains that these types of investments merely resulted in “overdiversification.” Since 2009, they have become so highly correlated with stock and bond markets that they have not added value to investment portfolios. From the article:

Alternative investments ceased to be diversifiers in the 2000s and have become a significant drag on institutional fund performance. Public pension funds underperformed passive investment by 1.0% a year over a recent decade…

For a decade [starting in 2009], stock and bond indexes have captured the return-variability characteristics of alternative investments in composites of institutional funds, for all intents and purposes. Alternative investments did not have a meaningful effect. The finding that the correlation between funds with significant alts exposure and marketable securities benchmarks is near perfect runs counter to the popular notion that the return properties of alts differ materially from those of stocks and bonds. That, after all, is an oft-cited reason for incorporating alternative investments in institutional portfolios. As we see here, however, alt returns simply blend into broad market returns in the context of standard portfolio analysis in the latter decade.

Needless to say, this finding also shows the folly of CalPERS’ plan to pile on risk by investing even more in private equity and plunge into private debt.

As the extract above indicates, Ennis found the median cost of the mismanagement by the 46 public pension funds as roughly 1% per year. CalPERS is a standout in the “negative value added” category, ranking 43 out of 46, with a “negative alpha” of 2.36%. This is a particularly appalling scoring, since CalPERS has far and away the largest and best paid investment office of any US public pension fund.

Back to the current post. Notice that CalPERS’ particularly poor results, as contrasted with all the staff it has to pick winners among the high fee managers, shows yet another fallacy. Pensions funds overwhelmingly accept the proposition that you can’t outcompete other investors in choosing stacks.2 They also can’t outcompete each other in picking alts winners either.

In fact, a later Ennis paper found that the supposedly oh-so-much-more-sophisticated-than-public-pension funds endowments did worse that public pension funds:

Ennis’s analysis paints an extremely unflattering picture. One way to summarize it is that endowments’ staff and their outside managers have added negative value, or in finance-speak, negative alpha. Note that Ennis’ estimate is charitable since he does not add in the cost of the endowments’ investment offices, which run to 0.50% to 0.75% of assets. And on top of that, all of their machinations, um, exercises in diversification, have achieved absolutely nothing. Their results are functionally the same as being fully invested in US equities. From his overview:

Endowments have underperformed by 2.5% per year over the 13 years ended June 30, 2021. I estimate that endowments’ annual cost of investing is approximately 2.6% of asset value. Given the extreme diversification of the composite, which comprises more than 100 large endowment funds with an average of more than 100 investment managers each, there is every reason to believe that cost is the principal cause of endowments’ poor performance. During the most recent 5–7 years, which I refer to as the Modern Era, endowments have exhibited an effective US equity exposure of 97% of asset value, with frictional cash accounting for 3%. The overwhelming exposure to the US equity market raises important strategic questions related to risk tolerance and diversification for trustees and fund managers.

Ennis’ latest offering picks apart returns of the major types of alternative investments: private equity, hedge funds, and real estate. Ennis previously determined that none of these supposed “asset classes” do what asset classes are supposed to do, which is create diversification by offering a different profile of returns than stocks. That may seem counter-intuitive particularly as for as real estate is concerned. But Ennis pointed that many major corporations are actually substantial real estate owners and that blunts the diversification impact of owning real estate versus stocks.

Ennis finds that real estate and hedge funds directly contribute to public pension fund doing less well than they would have if they simply bought stocks, while his analysis finds that private equity performs on a par with public stocks. That is actually a damning finding and confirms years of commentary here. The entire raison d’etre for private equity is its claim to beat all other types of investments. If it does not, and then by the rule of thumb of 300 basis points over public stocks, then investors are not being paid enough to assume private equity’s additional risks of illiquidity and leverage. From his abstract:

Despite all the attention paid to alternative investments in recent years, there has been little study of their impact on the performance of institutional investment portfolios, e.g., those of pension plans and endowed institutions. This paper attempts to help fill the void. It shows that, since the Global Financial Crisis of 2008, US public-sector pension funds realized a negative alpha of approximately 1.2% per year, virtually all of which is associated with their exposure to alternative investments. While exposure to private equity neither helped nor hurt, both real estate and hedge fund exposures detracted significantly from performance. Institutional investors should consider whether continuing to invest in alternatives warrants the time, expense and reduced liquidity associated with them.

And another big nail in the coffin:

In addition to revealing the underperformance of the composite, Exhibit 1 demonstrates the absence of a diversification benefit from alts. Stock and bond indexes alone capture the return-variability characteristics of alternative investments in the public fund composite for all intents and purposes in the post-GFC era. This runs counter to the view held in some quarters that alts are good diversifiers by virtue of being uncorrelated with stocks and bonds. In fact, alts are highly correlated with US stocks, in particular.

Ennis omits a key factor which would lower private equity performance. Private equity funds are bizarrely widely acknowledged to lie exaggerate their valuations, which are unaudited. Specifically, one important study found they goose their valuations in the years immediately before they raise a new fund (typically 4-5 years after their last big fundraising) and then back out the inflation in later years. That may all sound harmless unless you’ve done net present value analysis. Higher performance earlier on boosts returns. So the industry is systematically reporting better returns than it is generating, and that is incorporated in the public pension data Ennis used as the basis for his study.

A second way private equity lies is by failing to mark down valuations adequately in bad markets, like the financial crisis. the 2014 taper tantrum, and the Covid swan dive. Private equity is levered equity and should suffer a bigger hit in bad equity markets. This is confirmed by the fact that private equity fund managers don’t sell business they own at these times. The fact that they are avoiding monetizing the loss does not mean it has not happened on a current valuation basis. But bizarrely private equity gets to run this con.

Even with this quibble, Ennis is performing an extremely valuable service in chipping away at these investment mythologies. Unfortunately he is up against a huge industry of hired guns and pension fund/endowment employees who would be turfed out were his findings accepted and acted upon. So sadly, don’t expect change any time soon.

____

1 As Lambert likes to say, they are called vehicles because they drive off with all your money.

2 Yet CalPERS appears to be engaging in the sin of trying to pick some stock winners, with its investment in Silicon Valley Bank, which generated a loss of $67 million, and now, as reported in Barron’s Largest U.S. Pension Bought Up Roblox Stock Before It Tanked.

00 Ennis Public Funds Alts 18.0

It’s only possible to generate alpha by taking it away from another market player. It’s zero sum before fees. Fees are great, so we all want to pretend that we will be one of the few special managers who will win.

Some of us do produce alpha.

I’m retired from managing but still consult on manager selection for some very large allocators. It’s rare for me to recommend anyone, maybe one in fifty, and mostly for diversification reasons not pure alpha.

Ennis is basically on target, certainly on average alts are a losing bet.

But picking a winner earns a lot of bragging rights at the country club.

“Yet CalPERS appears to be engaging in the sin of trying to pick some stock winners…”

They just can’t help themselves.

Roblox and Lucid Motors for Pete’s sake? What are these people smoking???

But Ennis buries the lede: “High cost must be a partial, at least, explanation, for alts’ weak showing.”

For nearly two decades the CalPERS Board has never seen a fee that’s too high when it comes to outside Private Equity and Real Estate managers or third-party Health Care administrators. Billions of dollars in outrageous, unjustified, and unearned fees have been flying out the door every year at CalPERS since Willie Brown and Bill Lockyer began skimming kick-backs for the Democrats while Fred Buenrostro was CEO during the early aughties. As always: Follow the Money.

This would all be of mere academic interest but for my complete dependence as a beneficiary on CalPERS remaining solvent for my (hopefully) 25-30 years of remaining lifespan. While I’m nothing but a milquetoast retired bureaucrat, you’d think that they’d be more worried about all those retired cops who’ll come knocking when CalPERS goes belly-up…