Fitch shot a rocket at Treasuries that turned out to be a dud, in the form of its downgrade of US debt from AAA to AA+. This leaves Moodys alone among major rating agencies scoring Treasuries as AAA.

One might think, given all the hand-wringing about US debt, that the press and investors would be in a funk over this action. After all, when S&P threatened to downgrade Federal obligations from AAA to AA+ in 2011, business commentators, nearly all analysts, and the press spoke with one voice that this would be a meteor-wiping-out-the-dinosaurs-level event, an end of the financial universe as we knew it. Your humble blogger was virtually alone in disputing this view.1

Unlike S&P in 2011, Fitch did not broadcast its plans in advance. Even though investors and commentators seemed surprised, and the White House predictably got huffy, Mr. Market shrugged. Not only did the usual Democratic party economists like Larry Summers, Paul Krugman, and Jason Furman come out swinging on Twitter, but so to did highly respected, perceived-as-nonpartisan analysts like Mohamed El-Erian.2

Treasury yields fell, meaning investors were buying more, not fewer Treasuries at the margin, and the softening of the dollar is expected to be fleeting:

The dollar’s weakness following Fitch’s downgrade of the US is unlikely to persist, according to analysts https://t.co/plSmHNFFNE

— Bloomberg Markets (@markets) August 2, 2023

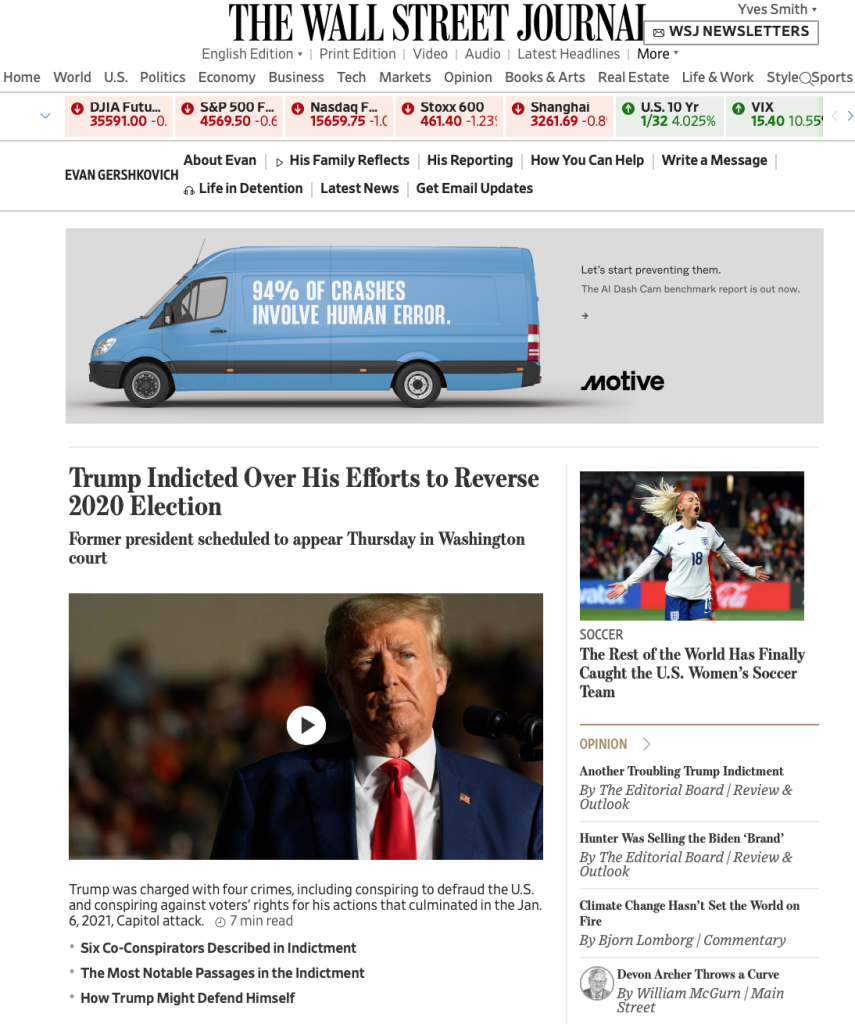

The financial press didn’t even give the story prominent billing this morning. The latest Trump indictment was the hot news:

At the Wall Street Journal, the Trump story is given so much real estate that the Fitch downgrade is below the fold (admittedly, it is the top story on the left once you scroll down):

So what exactly happened here?? As we’ll explain, one element of Fitch’s critique is correct, that the ugly and too frequent debt ceiling and budget cliffhangers are a sign of political dysfunction and raise the specter of a disastrous miscalculation.3

But the big reason for the collective yawn is Fitch’s economic case was weak and contradicted by recent data. We’ll turn the mike over to Twitterati as representing common views among the economist and investor cohorts:

Strange timing from Fitch. US debt to GDP is heading down, the term premium is negative (suggesting strong demand for long-term bonds), and the only likely point of bipartisan consensus in this Congress is to avoid a an avoidable default …

— Brad Setser (@Brad_Setser) August 1, 2023

The fiscal deficit perhaps should be a bit lower in an ideal world (Congress passed on easy opportunities to increase the tax paid by US MNEs and lower US pharma costs … ) but it clearly has come down a lot.

— Brad Setser (@Brad_Setser) August 1, 2023

The US government is the highest income generating entity in human history and issues the dominant reserve currency. If the US govt isn't AAA rated then nothing is. https://t.co/AlfdBjd5nm

— Cullen Roche (@cullenroche) August 2, 2023

Note that Zandi is super orthodox and we have criticized him regularly on this site, so for him to blow the downgrade off is telling:

Fitch’s downgrade of U.S. Treasury debt to AA+ is off-base, IMHO. They rate the sovereign debt of a rather lengthy list of countries AAA. Really? Ask global investors whose bonds they would rather own if push comes to shove in the global economy – it’s those of the U.S. Treasury.

— Mark Zandi (@Markzandi) August 1, 2023

And just because Jason Furman is an administration defender does not make this argument wrong:

A year ago Fitch upgraded the US AAA credit rating outlook from "negative" to "stable". It also set out the criteria for a downgrade:

1. "Significant and sustained rise in… debt/GDP ratio." DIDN'T HAPPEN

2. "Deterioration in governance quality" HARD TO SEE MUCH CHANGE, IF… pic.twitter.com/NXoLeyLOLx

— Jason Furman (@jasonfurman) August 1, 2023

Mind you, none of these arguments rely on the MMT point, that the US can always meets its Federal obligations. As a currency issuer, it cannot run out of money. It can engage in net fiscal spending (aka deficits) in excess of economic capacity and generate too much inflation.

The one way Fitch was correct is the US could make a voluntary default due to failed debt ceiling negotiations. But with the US economy showing pretty good groaf and inflation weakening (according to the Fed’s preferred measures), the idea that the US situation is worsening and therefore debt wobbles are becoming more likely is not an imminent worry.

Another way the debt critics could be correct, but it is an argument that is virtually never made, is that deficits should not be as big a worry as where the spending goes. If net fiscal spending is directed significantly to investments and programs that increase the productive capacity of the economy, like infrastructure, basic R&D in high potential sectors, education, cheaper broadband, the deficit spending will pay for itself via higher GDP growth.

Now if you want to make a case for poor US prospects, there is plenty of grist for that argument: falling US lifespans; rentierism by the health care, higher eduction, real estate, and arms sectors, which hurts productivity and competitiveness; rising partisanship; and as we and others (see Andrei Martyanov, for instance) a serious and accelerating fall in strategic and operational capability on a widespread basis.

But even with the US in decline, it is still faring better than Europe and some other areas of the world. And the elites are very good at preserving their interests even as the prospect of decline looms. Recall that even in the Dark Ages, the nobility did not fare too badly. Archeologists have found evidence they still were able to procure luxuries from around the world, like spices and fine china.

So the US sell-by date is coming but it is not imminent. That does not mean the US will not take yet more self destructive action, but the charges Fitch made largely did not stand up to scrutiny.

____

Remember Y2K? The world was gonna end because there was tons of legacy code that couldn’t accommodate the rollover to the new century. I know people in who went into survivalist mode, stocking up months of supplies, and others who took less extreme precautions, like having lots of cash on hand in case ATMs were disrupted.

As we now know, January 1, 2000 came in without major incident, since the widespread publication of this software threat to End the World as We Know It led to lots of preventive action. Perversely, the big effect of the Y2K scare was that it accelerated tech spending, since many firms bought new systems and upgraded hardware as part of their overhaul. That increased the severity of the post-bubble economic downturn….

It isn’t yet clear what the impact of the S&P downgrade of the US to AA+ will have. There are good reasons to believe, despite the media hyperventilating, that it won’t add up to much, and may perversely hit wobbly stock markets more than Treasury yields.

But there is a much bigger issue, namely S&P’s highly questionable conduct, the lack of any analytical process behind this ratings action, and the political implications.

2 For instance: Mohamed El Erian says Fitch downgrade of the US is a strange move, likely to be dismissed ForexLive.

3 Cynical and seasoned observers know that this debt/budget game of chicken is in large measure a play act and the principals won’t precipitate a default. Congresscritters if nothing else have too much in the ways of investments to be in the net worth self-harm business. However, given the way the US acting against its self-interest by escalating with China while things are not going at all well in Ukraine, it is not impossible that some ideologues down the road will get their hands on the wheel and not steer out of a crash.

After the ratings agencies helped pump up the subprime market which imploded in the 2008-2009 Financial crisis, they afterward claimed their ratings were not advice but mere opinion (a free speech issue, so they could not be sued). Many people decided – fairly or not – that the rating agencies were not impartial and might be engaged in pay-to-play.

Who would benefit from this downgrade? Would it be a lever the Fed can use to justify raising rates? Inquiring minds… / ;)

Yeah, these sovereign debt ratings don’t seem terribly credible in a world of fiat currencies, and it’s even more bizarre to me when applied to the risk free asset against which all other assets denominated in $USD are priced.

And I’m with Yves that it’s not the right metric by which to measure US relative decline — look there to the real metrics as she outlines.

Re: Trump above the fold, it makes you wonder what is going to happen if Trump ever goes away? Do they have more headlines that they want to obscure? I can see them all now…

“Trump indicted for 50th time!” California runs out of potable water in Southern part of state, emergency declared…

“Trump brand valued at 50% less than previously, loans called in” average US worker needs 55 hours a week to earn a living wage…

“Trump smells like a fart when he talks, advisers suspicious he’s drunk all the time…” Glorious Leader Biden gets standing ovation from Congress while signing bill enshrining Freedom from Privacy act, “all those terrorists have nowhere to hide now”…

This is getting into inner arcana of the finance world that I know really nothing about, but I did see this in the news. And I wondered if there’s another explanation for why Fitch did this so suddenly and everyone else is blowing it off.

Is it possible someone at Fitch was tipped off about something most of us don’t know (and that other well-connected people have to extricate themselves from more slowly)? Sort of like signaling in a game of bridge?

Otherwise, while I consistently underestimate America’s ability to memory-hole bad news and “extend & pretend”, I always get a bad feeling a hammer’s about to fall when people talk like in the one tweet by Cullen Roche.

Yeah it reminds me of people who say how amazing the us military is by pointing out the massive amounts of money spent on it.

The Congressional Budget Office recently published a study of what would happen to the national debt and the economy if social security benefits were reduced by 25% in 2034. Who ever requested that study might be under pressure to slash benefits to avoid raising taxes on corporations and the well-to-do for budget balancing, even though it will likely lead to a recession in the short-term at least. As to forces at work behind the smokescreen, any or more than one large corporate/finance entity that makes regular use of Fitch might have been influential.

It is hard to say enough bad things about the CBO but we have tried to do our part. Some examples:

And I agree completely with your suspicion that someone pressured Fitch. That could even account for the peculiar timing, that they were being arm-wrestled to get this out while the deficit fights were in progress, but some processes (vetting? editing? internal debates against being manipulated?) meant it come out late.

Concur the CBO just foams the runway for the next click in the ratchet to screw down all the mopes with bad maths and models so the ruling investor class never takes a hit for its bad socioeconomic choices ….

The timing is so weird, it’s August.. the Congress is going into recess, and nothing is getting done. It would have more power if there were actually negotiating going on.

Furman identifies in his tweet: “Factors that could, or collectively, lead to negative rating action/ downgrade”.

The second bullet point- “Structural”, and the third “Macroeconomic policy…” read as though Fitch should have considered downgrading the U.S. to BBB-.

I’m a long-time reader of this blog but I don’t believe in “economics” other than as a social mechanism for setting and manipulating asset prices. In the real world there is psychology and there is politics. Like with the recent indictments of our former president, the timing is suspect but the substance is there.

The latest indictment was clearly a trigger. This morning Reuters quotes Fitch senior director Richard Francis as saying that the January 6 sedition was a major factor in the downgrade. “It was something that we highlighted because it just is a reflection of the deterioration in governance, it’s one of many. You have the debt ceiling, you have Jan. 6. Clearly, if you look at polarization with both parties … the Democrats have gone further left [HUH?] and Republicans further right, so the middle is kind of falling apart basically.”

This entire blog, since the publication of ECONned, has been a litany of the decline of governance in the U.S. since Clinton, Summers, and Gingrich presided over the dismantling of the New Deal regulation of banking and public markets. Now the two-party duopoly has ridden into a box canyon in which their two leading presidential candidates are either under multiple indictments for corruption and fraud — or ought to be. The gerontocracy controlling the federal legislature are literally stroking-out before us. Meanwhile both parties put forth rank amateurs to conduct mindless foreign policy that places the country in jeopardy of losing access to manufactured goods and the world in jeopardy of nuclear annihilation.

Finally the rest of the world has woken-up and are seeking an alternative to U.S. Treasuries. For a variety of practical reasons they won’t succeed any time soon — but it’s bad enough that they’re working on it.

“Democrats have gone further left [HUH?]”

It’s especially silly (and part of the same partisanship they are railing against) coming from an agency that should be focused on economic issues.

In that area, the Dems give the rentiers everything they want somehow.

US could make a voluntary default due….

Hnmm, I believe that should be

US could make a

due

The widespread usage in finance and economics is voluntary default, as in you don’t pay when you could have, versus involuntary default, as in you don’t have the funds.

I think Fitch was correct but it really won’t matter to US borrowing or investor outlook. In any other country with America’s level of borrowing, deficits and mismanagement – their rating would be much lower even junk. So the fact that the US is the largest economy and the world’s reserve currency cushions it from the reality. In effect – the twitterati’s arguments conflate the fiscal situation which is terrible with the structure of the world economy which is dominated by and favorable to the US. All demand for US bonds rests on the laurels of decades of prudent management, growth and the collapse of the British empire.

Thank you for this piece. You mentioned ” rentierism by the health care, higher eduction, real estate, and arms sectors, which hurts productivity and competitiveness.” Would it be a consideration that the legal tort system leading to, for example, overtreatment and defensive medicine, out of sight workers comp costs, and personal injury costs that are not based on much but lead many manufacturers out of the US might be an additional factor?

Downgrade America’s credit rating and indict a former President (again) during the same week as a major scandal for Biden escalates.

From Brad Setser’s tweet: “US debt to GDP is heading down.”

From Wolf Richter’s piece on the downgrade:

Fitch said that it expects the general government (GG) deficit to reach 6.3% of GDP this year, from 3.7% in 2022, “reflecting cyclically weaker federal revenues, new spending initiatives and a higher interest burden.” Fitch forecasts the deficit to reach 6.6% of GDP in 2024 and 6.9% of GDP in 2025.

Rising Government Debt: Fitch said that the debt-to-GDP ratio at 112.9% in 2023 is “well above the pre-pandemic 2019 level of 100.1%.” It expects the ratio to reach 118.4% by 2025.

Not seeing a “heading down” in the above numbers – what am I missing?

Yves writes: “Another way the debt critics could be correct, but it is an argument that is virtually never made, is that deficits should not be as big a worry as where the spending goes. If net fiscal spending is directed significantly to investments and programs that increase the productive capacity of the economy, like infrastructure, basic R&D in high potential sectors, education, cheaper broadband, the deficit spending will pay for itself via higher GDP growth.”

True, but what do you think the odds are of the DC grifter class having such a come-to-Jesus epiphany?

Irrespective of financial considerations, that Fitch was willing to go there just shows how far US ‘influence’ has ebbed.

If all of the MICIMATT spending is shown to have been a colossal failure and waste of the people’s treasure (I know it’s mostly debt and not tax revenue, but still) and a multi polar world emerges at the expense of the “rules based” USA! unipolar/ petrodollar/ reserve currency based model then what?? I love my country but think I’m going long on metals and rubles….