Yves here. I’m taking the unusual step of publishing two not-too-long cross posts because the commonalities and differences in analysis and conclusions might be illuminating to readers. These two pieces, interestingly, suggest in the neoliberal and (press-wise) fiscally orthodox UK, quite a few informed commentators accept the proposition that this inflation was not created by too much spending but by two supply side shocks, first Covid disruptions, and second, Russia sanctions blowback. Europe and the UK have been more affected by the latter due to their greater dependence on cheap Russian energy.

Now you can argue that the US persisted in big time spending and excessive demand is a bigger perp here. There is a lot of commentary not founded on actual analysis touting that idea. The better analyses suggest that at most is still a secondary contributor; in the US, what is informally called greedflation, as in companies jacking up prices in excess of cost increases under the cover of inflation in other sectors, is an important but hard to quantify source too.

The first we are reproducing, that by Richard Murphy, correctly berates the idea that increasing interest rates is sound medicine for a primarily supply side inflation.

The second piece, by City A.M, which is a mouthpiece for conventional wisdom in finance circles in London, is almost schizophrenic. It goes on at some length to describe the drivers of the current inflation and government deficits do not feature prominent and even concedes in its opening bullet points that interest rate increase have not been very effective. But later on, it defaults to the incorrect view that central banks are the only line of defense. That may be true in practice, but that is due to legislators being unwilling to use tools they have, like strongly favoring countercyclical spending programs, and preferring to have unelected central bankers handle the inflation hot potato.

Note that Russia, after the war started, did a great deal of direct intervention in the economy to alleviate the shock of the loss European goods and services. The fast rebound suggest these targeted measures helped a lot. By contrast, the US sees focused initiatives like that as industrial policy, which is ever and always bad. And our approach to budgeting means the Administration has limited room to move. Nevertheless, the handwaving exercises when, for instance, the LA ports were bottlenecked were an embarrassing show of impotence. Even if this problem really was intractable on a short-term basis, former McKinzoid Pete Buttigieg needed to make a better show of fact-gathering as to why.

Murphy’s title is The present is unsustainable. Oil and banking have made it so. Something is going to have to change. The City A.M. title is What Really Caused The Inflation Crisis?. To Murphy first.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

The Bank of England meets this week to consider raising interest rates, yet again. The consensus of opinion is that they will do so by at least another quarter of a per cent. No doubt this will be accompanied by yet more calls for pay restraint because that is the only mantra that Andrew Bailey, the governor of the Bank of England, really knows.

There is no need for this increase in rates. This Guardian headline makes that clear:

Prices are falling, as was always expected to happen now, irrespective of interest rate rises.

What is more, pay continues to fall behind inflation, as this headline makes clear:

And what is the real cause of inflation? That is hiding in plain sight as these headlines from the FT and Guardian this morning make apparent:

It is profiteering that is driving inflation – with the government going all out to help by raising interest rates and maximising its support for big oil.

As I have already discussed this morning, climate policy is already creating one tipping point for politics in this country. A continuation of the current interest rate policy will create another. Things cannot continue as they are with politicians and big businesses laying waste to people’s lives without any apparent concern for the consequences. Something is going to have to change I feel: the present is unsustainable.

By Jack Barrett in CityAM.com, the online presence of City A.M., London’s first free daily business newspaper. Cross posted from OilPrice

- After pandemic disruptions and unusual goods spending, demand surged for essentials like energy, clashing with limited supply and leading to inflation.

- Significant events such as Russia’s invasion of Ukraine and the impact on energy and food markets greatly affected inflation, leading central banks to respond with novel measures such as interest rate hikes.

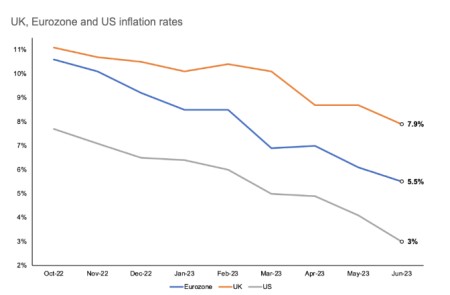

- Inflation rates remain above target in the US, Eurozone, and the UK, raising questions about their effectiveness and necessitating bold actions from politicians and business leaders to prevent future inflation spikes.

International supply chains were stretched by a combination of ports suddenly closing at short notice due to virus outbreaks, workers being forced to stay at home and unusually high goods spending overwhelming suppliers.

Once lockdowns ended and citizens gradually returned to normal spending habits, demand for essential items like energy came roaring back, colliding with strained supply.

Judging these trends to be “transitory”, as the Federal Reserve, ECB and Bank of England did at the time, can be seen as justifiable. Staff would eventually return from the pandemic. There was little reason to think spending wouldn’t rebalance. Oil, gas and electricity production would rise in response to higher prices.

The bigger concern for central banks was that they didn’t know what shape their respective economies would be in after two years of being ravaged by the pandemic, delaying the start to their tightening cycles.

That’s not to say interest rate rises weren’t required. Signalling an inflation intolerance to financial markets, households and businesses helps retain credibility. Quantitative easing probably lasted too long and was too generous.

Source: ONS, Eurostat, US Bureau of Labor Statistics

Everything changed in February 2022. Russia’s full-scale invasion of Ukraine could not have been foreseen. Its ramifications in energy and food markets were huge.

CPI in the UK jumped two percentage points in April to nine per cent. That was the biggest month on month annual increase since June 1979, according to modelled data from the Office for National Statistics.

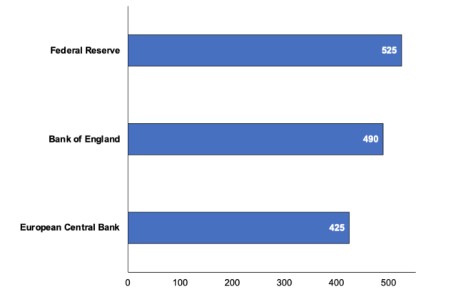

In the US and eurozone, prices raced ahead. The dynamics required novel responses from central banks and they delivered. The Fed launched four 75 basis point rises. The ECB’s first increase was a smaller 50 basis points.

Those on Threadneedle Street were spurred into such action not by inflation but by the haphazard tax and spending decisions of Liz Truss during her premiership.

Kudos must be given to the Bank for its handling of that episode. It launched an emergency short-lived bond buying programme to hose down a fire in UK debt markets. Its 75 basis point increase went a way to tame higher inflation expectations.

Jerome Powell and co at the Fed have arguably been more aware of stimulative fiscal policy nudging up inflation. They went faster and steeper than their peers, partially to offset Americans pumping the up to $2,800 of parachute payments they received during the pandemic into the economy.

FOMC officials were also grappling with an inflation problem that was more demand driven, a factor that monetary policy is better at influencing.

Energy support packages were rolled out across Europe. France erected a more than €100bn support scheme, including capping prices. Germany doubled that gift. UK policymakers froze bills at £2,500.

Cumulative tightening by ECB, Fed and BoE

Source: ECB, Fed and BoE (basis points)

All these measures were designed to blunt the initial shock from soaring gas prices. They were necessary to avert a living standards catastrophe.

By partly shielding incomes, governments supported spending and inflation. The tension between monetary and fiscal policy was there for all to see.

So how have central banks done? Inflation is three per cent in the US (lower than Japan), 5.3 per cent in the Eurozone and 7.9 per cent in the UK – all above target.

Doubtless the Fed, ECB and Bank of England have had some of their credibility knocked. Those on Threadneedle Street should be regretful of their terrible forecasting record over the last 18 months.

Central banks, though, as economist Mohamed El-Erian puts it, aren’t the “only game in town”. They are simply inflation stabilising vehicles navigating the economic conditions handed to them. To prevent future inflation flare ups, politicians and business leaders must be bolder.

Investment needs jolting, Infrastructure renewed, better jobs created. Mere tweaks to interest rates will not cut it.

I’m no expert on UK economic policy, but I think a very understated driver behind the BoE policy is their terror of a sterling crisis. They know there is no way back for the UK economy if there is panic selling of sterling. So they see themselves as having little choice but to be visibly more hard line on interest rates than other major central banks.

Another key issue – not unique to the UK, but particularly acute there – is that the residential property market is under enormous strain, with a half year drop in prices not far off that in 2008. I suspect that the only thing stopping a complete rout in the property market is that rents are still quite strong (mostly due to a rapidly rising population) and a relatively robust jobs market (again, not great, but not a huge rise in unemployment either). But at some stage there must be a tripping point where a genuine collapse could take place, and I’m surprised that this hasn’t been a bigger issue for the BoE. This is one reason I think to suggest that their focus is almost entirely on protecting sterling, everything else is secondary.

So basically we are back to the 70s-80s methods and thinking all over again…

Thank you, PK.

I second that and add that banks are being allowed / subsidised to boost profits, build up reserves and avoid a banking crisis when the music stops.

Thanks CS. I’ve suspected that a lot of the public discourse about interest rates in the UK is a deliberate smokescreen so they don’t have to talk about the fragility of sterling, or for that matter, the domestic banks.

It is said that interest rates is a blunt tool to deal with inflation partly because it doesn’t distinguish amongst economic sectors with different needs but also geographically. At least in the case of ECB there are significant differences between states. Even if ECB increases were lowest between the CB analyzed here these might result ultra-hawkish in countries which are not experiencing inflation rates as high as Germany.

For instance, I have noticed that self-consumption PV installations in Spain have, to say the least, stalled (possibly plunged) and interest rates have had a role on this (with energy prices as well).

In particular as it primarily target the demand side of the seesaw.

But the ongoing inflation started with a supply side “shock”, and continues thanks to corporate greed.

Regarding the energy price shock at the onset of the Russo-Ukraine war: Here in Italy, IMHO they were already pricing in the effects of a war well before November 2021 (when Germany said it would not open Nordstream 2 – even I knew war was coming when I heard this). Energy price rises were occurring already in Summer 2021. I cannot help but believe that energy companies knew well that war was on the way (via their Blob connections, perhaps?), so we can hardly say that the war with Russia was “unexpected”.

As NCers know, we were hearing repeated warnings of war since the 2014 Maidan coup.

But I was also reading here as late as December 2021 that the Russians wouldn’t invade, so it wasn’t at all obvious to me, especially given the prevailing Russia Russia Russia Dem drumbeat since 2016.

>as late as December 2021 that the Russians wouldn’t invade,

I have the impression that the thing that triggered the R intervention was evidence that the U armed forces were preparing a coup de main to recover the two Donbas republics, for example the dramatic increase in the number of artillery strikes launched from U territory in the days immediately prior to the R intervention.

Perhaps that is what was not foreseeable, that U would (putting an R-sympathetic interpretation on the matter, which is my posture — though one doesn’t have to adopt this posture to try to understand the motives of the various actors) essentially “force the hand” of the Rs.

It’s hard to predict “own goals”, especially when one assumes that the respective teams are trying to behave rationally.

Richard Murphy quote: “Things cannot continue as they are with politicians and big businesses laying waste to people’s lives without any apparent concern for the consequences. Something is going to have to change I feel: the present is unsustainable.”

vs

Jack Barrett quote: “Russia’s full-scale invasion of Ukraine could not have been foreseen.”

Could not be foreseen you say. Hogwash.

As I’ve noted before, there is another big reason why the rich want interest rate increases. They hate labor.

The pandemic created a shortage of workers in some fields, most notable, the “Great Resignation” indicating that the working class had options to leave for better careers. This is worsened by those who are not going to go back to the labor force due to the impacts of long Covid-19.

Now though with the Federal Reserve fiercely to try to induce a recession, under the pretext of weakening demand, it has stopped this.

https://cnn.com/2023/06/13/economy/great-resignation-job-quitting-over/index.html

In my opinion, dealing with inflation as the conventional finance publication claim by City AM, is the most important situation and justified the interest increases, is actually a lower priority for the ruling class than inflation. If the real goal is to make inflation lower, as the other commentator in the article noted, start with Greedflation like Murphy says.

Kalecki has a good article about the real goal.

https://www.nakedcapitalism.com/2012/08/kalecki-on-the-political-obstacles-to-achieving-full-employment.html

Full employment is totally undesirable to the ruling class.

Thanks for this, Yves, and thanks Altandmain. I am not an economist but I have my ittle bitty opinions about “inflation”. What I’m running into at every turn is not inflation, imho. It’s plain old price gouging, because, well, they can.

The spike in Energy, Agricultural produce price, post Russian SMO, had far more to do with the Western sanctions, SWIFT cutoff etc than the SMO itself.

Russia insisted that it would continue to supply gas/energy that it had contracted to do. There would not be any cutoff. Post Turbine Fiasco, Russia again said, if you want, license Nordstorm 2 and we will provide all the energy you want.

Post Nordstorm bombing, Russia again said – there is one functioning pipeline not bombed, we are willing to provide gas to Europe through that if you want.

The Energy & Agricultural Price Spike in EU, UK, Germany are fully the fault of the EU and the political leadership of those states. It has absolutely nothing to do with the SMO.

$900,000 a year BS job openings at Netflix.

Surely every other business and industry can keep pace.

RM always makes sense. But that second article made my eyes glaze over. Excuses excuses. The thought occurred, kinda like mental first-aid, that we are failing to plan and correct our policies because some phenomenon like an endemic financial carry trade frenzy is the only profitable thing left to do. We could shut that off at the spigot if we controlled “inflation” by decree. By fiat, because our currencies are fiat, right? So why not establish a stable value by fiat by policies that prevent chain reactions of profiteering to take off? We are definitely going to need some mechanism like that to stabilize the environment/climate.