This is Naked Capitalism fundraising week. 615 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card or PayPal or our new payment processor, Clover. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year,, and our current goal, continuing our expanded news coverage.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

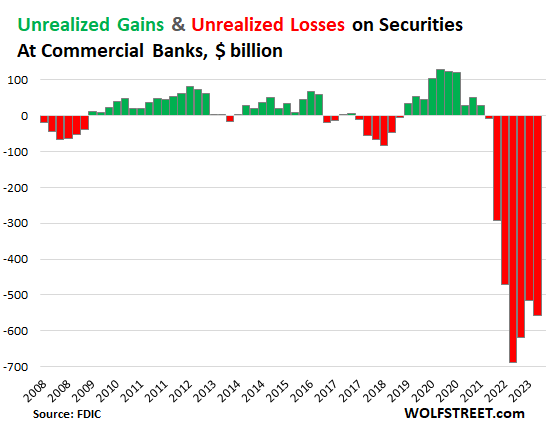

“Unrealized losses” are paper losses on securities that banks hold, but via a quirk in bank regulations, they don’t have to mark them to market value, but can carry them at purchase price.

On one level, it makes sense.

The closer the bonds get to the maturity date, the closer the market value gets to face value, and the unrealized losses vanish, and on the day the bonds mature, the banks get paid face value, and there are no losses, and everyone smiles.

On another level, the bank collapses.

During a bank run, when scared uninsured depositors yank their money out, banks have to sell assets to cover their cash outflows from the run. But now the banks only get market value for those securities – if that, during a fire sale – and not their original purchase price, and they have huge losses on those sales that vaporize their capital. No cash, no capital, no problem? Big problem.

That’s why we now have to pay attention to unrealized losses in the banking system.

Banks can hedge against rising interest rates, but some banks prefer to collapse.

Hedges against the risk of rising interest rates, such as interest-rate swaps, can be costly, and some banks don’t hedge, or don’t hedge enough, because executives prefer to show a little extra income to prop up the banks falling stock price and to fatten up their compensation.

SVB terminated or let expire nearly all its remaining interest-rate hedges in 2022, to where by the end of 2022, they were nearly all gone, and three months later it collapsed.

Where are banks now? Unrealized losses rise by 8% to $558 billion.

The balance of unrealized losses on securities – mostly Treasury securities and government-guaranteed mortgage-backed securities – at FDIC-insured commercial banks rose by $43 billion, or by 8%, to $558 billion in Q2, after two months of declines, according to the FDIC’s bank data on Thursday.

This $558 billion is the cumulative loss balance over time on all securities. The balance rose because longer-term yields rose in Q2: The 10-year Treasury yield rose to 3.84% on June 30, from 3.47% on March 31, and so bond prices fell over the period.

In the free-money periods, when yields fell and bond prices rose, banks had “unrealized gains” (green). And in the periods when yields rose and prices fell, banks had “unrealized losses” (red).

These unrealized losses of $558 billion were spread over two categories of bank accounting treatments:

- Unrealized losses on held-to-maturity (HTM) securities: $309.6 billion

- Unrealized losses on available-for-sale (AFS) securities: $248.9 billion.

The balance of unrealized losses is down by $131 billion from the peak in Q3 2022, in part because three banks with big unrealized losses collapsed, and their balance sheets vanished from the system, with losses getting transferred to the FDIC.

Already gotten worse in Q3 so far.

Thing is, today, the 10-year yield closed at 4.27%, and if it’s still at 4.27% at the end of September, it would be another 43 basis points higher than at the end of Q2, and the balance of unrealized losses will be higher yet again.

Bad-case scenarios: How big can the losses be on specific bonds?

A bank that bought $1 million of 10-year T-notes at the Treasury auction on August 12, 2020, at the very tippy-top of the 40-year bond bull market, ended up with a security that paid a coupon interest rate of 0.625% per year. Today, this security has seven more years to run before maturity, and so trades like a 7-year Treasury security, and the 7-year yield today in the market is 4.35%.

So how much is a security worth today with a coupon of 0.625% per year and with seven years to maturity, when the equivalent market yield is 4.35%?

Roughly, that $1,000,000 in 10-year T-notes might be worth $778,000 in the market today – thank you, bond-price calculator. Results may vary.

The bank that purchased this security at auction and carries it under HTM accounting rules on its books would show no loss on its income statement, and its earnings-per-share would be just fine, and it would pay its executives big-fat bonuses.

But on its balance sheet way down somewhere in the footnotes, it would show an “unrealized loss” of roughly $222,000, or roughly 22.2% of the purchase price.

And that $1,000,000 in 30-year T-bonds that a hapless bank bought at auction in August 2022, with a coupon of 1.375% might sell for about $529,000 today, for a loss of about $471,000, or 47%. That’s about the worst-case scenario, the punishment for buying at the peak of the 40-year bond bull market.

Uninsured depositors figured out where to look.

SVB, in its final quarterly report as a living bank for Q4 2022, in a footnote on page 125, disclosed unrealized losses of $15.2 billion on its HTM securities and unrealized losses of $2.5 billion on its AFS securities, for a total of $17.7 billion in unrealized losses.

The $15.2 billion in unrealized losses on its HTM bonds amounted to 16.7% of the carrying value of $91 billion of its HTM bonds.

Once uninsured depositors, some with billions on deposit at the bank, figured out where to look, they started yanking their money out, and SVB collapsed.

The declining pile of securities held by commercial banks.

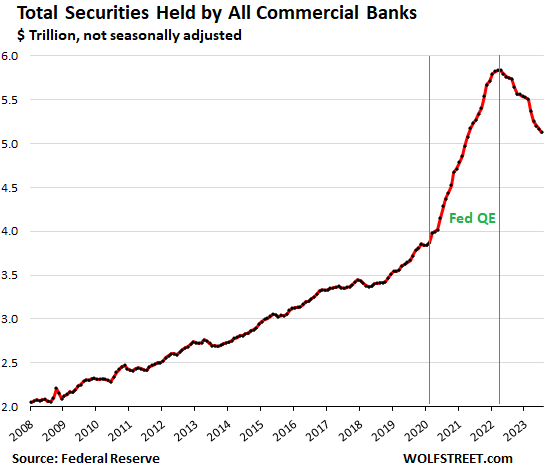

The total balance of securities held by all commercial banks has been declining for 16 months in a row to $5.13 trillion in July, down by 10% or by $705 billion, from the peak in March 2022 ($5.84 trillion) when the Fed’s rate hikes began.

Several factors make up the $705 billion decline:

- Securities of the collapsed banks that the FDIC sold to the market (not to other banks) are no longer part of this.

- Banks have written down AFS securities to market value.

- Banks may have sold some securities.

The $558 billion in unrealized losses amount to about 11% of the total securities held by banks.

The chart also shows how banks gorged on these low-yielding securities at the worst possible time just before, during, and after the peak of the 40-year bond bull market – on the ancient strategy of buying high and selling low – as a result of the reckless money-printing by the Fed starting in March 2020 through early 2022. “Free money is a virus that turns investors’ brains to mush” is a well-documented and generally undisputed scientific fact I have been pointing out for a while now.

The punch bowl being gradually emptied was always going to hurt. Low rates and ZIRP for such a long period of time, and I witnessed some of the pressures circa 2012 to 2015 working at a safekeeping and fixed income accounting role. Banks were beholden to the rules of the road, so trading into or out of 3.5 or 4.0% mortgage backed securities was not a riskless trade. Heads you were winning then, but it can be argued not with exceptional return vs risk (absent leverage or maybe some repo strategies), and now we flipped tails in 2023 and you were and are losing.

we gotten to the point, the Feds might as well raise the FDIC cap to something like 10 or 50 or 100 or 200 million.

It is blatantly unfair and anti-capitalistic that the too big too fail banks and (politically connected) Sil. Valley Bank won’t be allowed to die, while First Appalachia or Bronx Federal are left on their own.

Having so much assets and deposits concentrated in the top 20 entities makes those interests too powerfulwhen it comes to lobbying

Imo, we are in the regulatory doom loop. I’ve had those that would know tell me the estimated asset size of an FI that can afford the to comply with the regulatory regime. It’s a number that many top 20 banks are not yet at. Like any good alphabet soup gourmet knows, the bigger the crisis, the larger the new regulatory compliance program becomes. So next crisis comes along and table stakes go up. These folks only know one thing, bigger is better.

It will be deliciously ironic if we end up like the Chinese with 10-12 behemoth banks that have all carved out their specialized monopoly.

Naturally I’m thinking of some of the dreadful bullpens of my favorite Olde Town Team. Right-handed, left-handed…no difference…the fireman is the arsonist. HTM T-bonds work OK when the banjo-hitters are at the plate and can’t tell a speed-ball from a slider. But when a bondsman with a practiced eye takes the plate against a tottering tranche of CMBS all your boys can do is pray for rain and remember the words of the stellar batsman Charles de Gaulle…apre moi, le deluge.

@Chuck roast:

Actually it was French king Louis XV who apparently said ”après moi le déluge”. Charles de Gaulle probably thought it as well!

No, Charles de Gaulle was a remarkably level headed man. When he was petitioned to help save France (he left power multiple times in the 4th Republic and once in the 5th Republic) he was told by a delegation that he was the indispensable man, to which he replied that the graveyards of the world were full of indispensable men. DeGaulle saved France’s self-respect during WW2 by holding the Free French together and keeping them a (de minimus) presence in the counsels of war despite FDR’s well known animus; he then saved France again in 1945-6 when he walked an incredible tightrope that balanced lustration of Vichy crimes while holding off the French Communists demand for power and the potential civil war that courted; finally, the 5th Republic was almost literally created to fit DeGaulle’s tall, gaunt frame (he was 6’5″ tall) after the Fourth Republic had worn out its welcome by the mid 50s. DeGaulle declined a magnificent memorial as death approached and instead dictated that he be buried in the small Catholic church near where he’d been born and lived much of his life. My late mother was French born and bred and despite losing her father and brother to Nazi arrests in 1941, she worshipped DeGaulle. That’s why I know most of these DeGaulle-related facts.. ;-)

P

Awaiting MMT discussion.

Naive question: How does this affect 401k savings in, say, Fidelity? If dangerous, is there a better (safest) investment choice?

Having those retirement funds in such a large investment manager is perhaps one of the more safe choices an individual can make. Fidelity, Vanguard, T Rowe Price to name but a few are historically sound firms, to my knowledge.

And more specific to the above question, which is relevant to ask. Research perhaps what your brokerage / investor relationship is with that firm, and what they owe you as a fiduciary / instution responsible for the collective retirement savings of millions. Secondarily, check through the link below to see what else you may wish to find. The safest investment choice / risk free is supposed to be the US Treasury. Frankly I’d place more trust in a company like Apple or Microsoft. Learning to read up on such topics has been a beneficial part of my work in finance and consumer finance companies.

https://www.sipc.org/about-sipc/

There is SIPC which (a bit analogous to FDIC) protects your assets (up to 500k) if the broker fails.

then there are some money market products which a broker like Schwab issue via a related bank…which usually gets FDIC protection.

Then there are money market funda which invest in very short-term corporate bonds…these have zero protections and while safe, are not literally risk free

the literal safest asset, with zero counterparty risk, is opening an account with the US Treasury.

https://www.treasurydirect.gov

imo, owning a FDIC-insured money market product via your broker is the next safest (as long as you don’t breach SIPC limits)

There are several ETFs which manage this for you. Check the yield on each; I’m not going to tout anything here but one is better than the rest.

This seems pertinent:

Chartbook 238: Making & remaking the most important market in the world. Or why everyone should read Menand and Younger on Treasuries.

https://adamtooze.substack.com/p/chartbook-238-making-and-remaking

Banking seems like it has been smoke and mirrors basically from the get go.

The second people start emptying accounts, banks fold en mass.