Yves here. The Fed has insulated banks from the Treasury carnage by continuing to allow them to fund seriously underwater Treasury holdings at below-market rates. From a Brookings description:

The Bank Term Funding Program (BTFP) is a lender of last resort facility. It was created in March 2023, after the failures of Silicon Valley Bank and Signature Bank, to lend to other banks that had big unrealized losses on their holdings of government bonds and were, therefore, at risk of large-scale withdrawals of deposits. The facility allows banks to exchange assets such as U.S. Treasuries for cash at their full-face amount, regardless of the current market value. These loans are for up to one year at an interest rate equal to the one-year overnight index swap (OIS) rate, plus 0.10 percentage points. This rate varies daily. As of April 28, the BTFP rate was 4.92%. As of May 8, the BTFP rate was 4.81%. As of May 3, banks borrowed $75.8 billion through the Bank Term Funding Program, down from $81.3 billion the week before.

A Fed spreadsheet shows the current funding rate as 5.54%. Note that banks are still losing money on a cash flow basis. So one can view this approach as allowing banks to ride out the problem at modest pain until rates normalize or a classic “kick the can” approach.

And lets us not forget other investors do not have access to this facility and typically don’t have very forgiving accounting.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

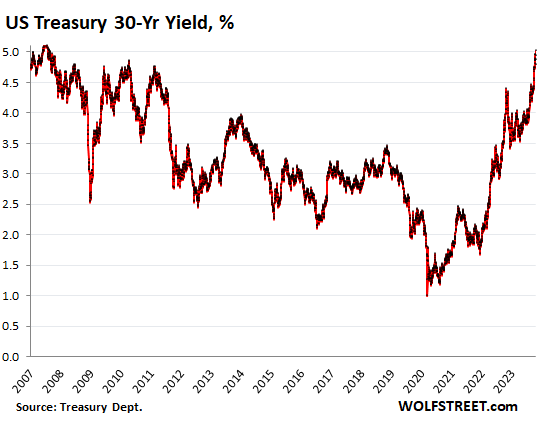

Today it’s the 30-year Treasury yield that pierced the 5% line. It currently trades at 5.02%, the highest since August 2007.

The first of the long-term yields to spike through the 5% line was the unloved 20-year Treasury yield on October 3; it currently trades at 5.25%.

These long-term yields above 5% are an indication that a form of normalcy is gradually being forced upon the bond market by the resurgence of inflation, and by the belated realization that this inflation isn’t just going away on its own somehow. This is a huge regime change, after years of the Fed’s QE and interest rate repression, and all prior assumptions are out the window.

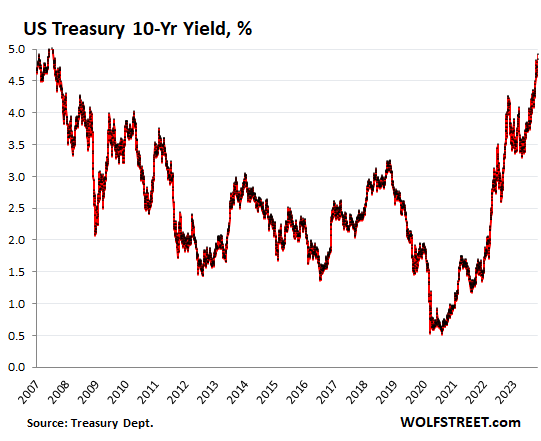

The 10-year yield jumped to 4.92% at the moment, the highest since July 2007, edging within easy reach of the magic 5% line.

Bond Market Delusions Fade

It seems, the long-term Treasury market is gradually coming out of its delusion about inflation and normalizing interest rates after having spent 18 months believing in the hype about a Fed pivot and rate cuts to something like 0% that would be forced on the Fed by a steep recession, with lots of forever-QE to follow, or whatever.

Instead, consumers are earning lots of money and are spending like drunken sailors. Businesses are spending and investing too. And the government is the biggest drunken sailor of all, further boosting the economy, and throwing more fuel on inflation.

And this deficit-spending by the government has to be funded by piling enormous amounts of Treasury securities on the market that need to find buyers. Yield solves all demand problems by rising until demand emerges. And that’s in part what we’re seeing now.

All of this is happening as the Fed is unloading its balance sheet at record pace, having already shed over $1 trillion in securities in a little over a year.

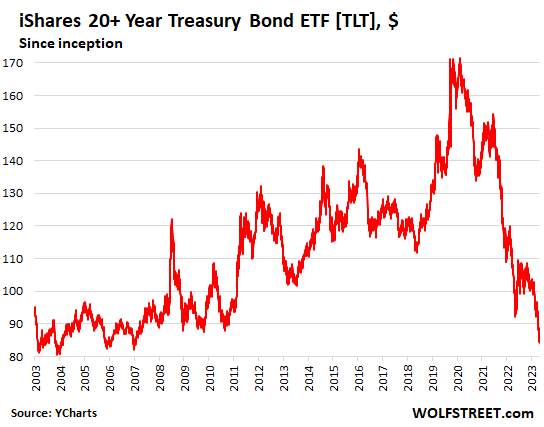

Bond Bloodbath for Investors That Bought During QE and Still Hold This Stuff

Higher yields mean lower prices. So this return to normalcy has been dishing out huge losses to investors who’d bought long-term bond funds or long-term bonds in the era of QE. Investors that own these way-under-water 30-year bonds outright can choose to hold the bonds to maturity at around 2050, when they will get face value back, and collect 1.5% or 1.8% coupon interest along the way.

Future bond buyers are looking at these juicy yields, and they’re licking their chops, hoping that yields will rise further to hit some magic number, at which point they’ll jump in, forming part of the demand for those bonds. There will always be enough buyers if the yield is high enough. And current bond buyers find those yields juicy enough, and a lot of demand emerges at 5%.

But investors that bought during QE are in a world of hurt. The iShares 20+ Year Treasury Bond ETF [TLT], which focuses on Treasury bonds with a remaining maturity of 20 years or more, fell another 1.6% today at the moment and has plunged by 51% from the peak in August 2020, which had marked the peak of the 40-year bond bull market that had turned into the biggest bond bubble ever (data via YCharts).

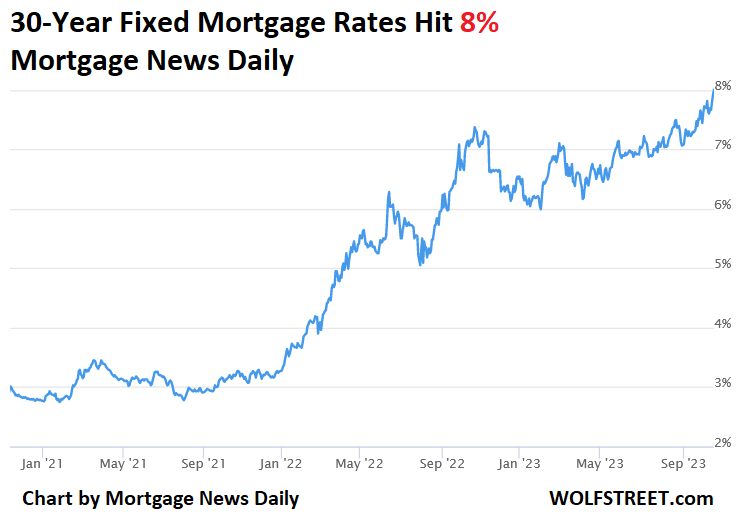

The 8% Mortgage Rates Are Here

The average 30-year fixed mortgage rate kissed 8% today, according to the daily measure by Mortgage News Daily. If mortgage rates stay there to enter the weekly averages at that level, it would be the highest since 2000. Ah, the good old times are coming back?

Housing Market in Deep Freeze.

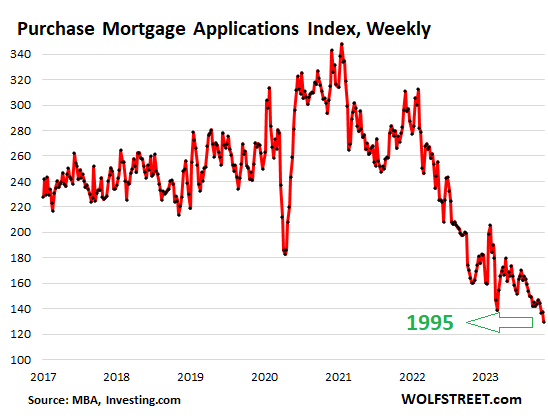

Mortgage applications to purchase a home have been on a steady collapse-track and in the last reporting week slid another 6% from the prior week to hit a new multi-decade low, and are 48% below the same week in 2019, according to data from the Mortgage Bankers Association today.

Mortgage applications to purchase a home are an indication of where home sales volume will be over the next few weeks. And home sales volume has already collapsed, and mortgage applications indicate that it will continue on this trend.

These 8% mortgage rates worked just fine back when prices were a lot lower. But prices have spiked in recent years, as the Fed repressed mortgage rates with QE and 0% short-term rates. And the resulting sky-high prices are impossible to make work with these mortgage rates.

In other words, the Fed-repressed mortgage rates have triggered a huge bout of home price inflation, and the surge in mortgage rates has now started to unwind it.

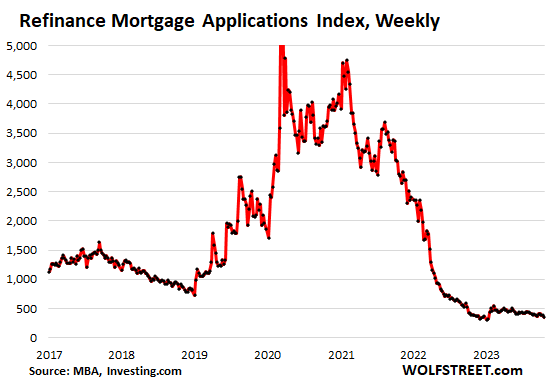

Mortgage applications to refinance a home plunged 10% for the week and were down by 87% from the same week in 2019, according to the MBA.

Most of the refis are cash-out refis, with non-cash-out refis having essentially vanished – they’re down about 97% from the same week in 2019, according to AEI Housing Center.

File under when housing became a neoliberal asset class RE/MBS and investor demand for it enabled the mother of all frauds in issuing loans to satisfy both demand and pay days for lenders …. FREE MARKETS – ! !!!!!

Fknfamialyblog … ideological economics …

With apologies to Keynes, when housing development in a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.

There is a positive aspect to the current backup in bond rates.

Cap, or capitalization, rates for many real estate asset classes are trending below 10-year Treasuries.

That put the brakes on those investors hoovering up houses to rent out, so there is that. Current and prospective tenants won’t have to face that type of landlord quite as much.

Of course, CRE asset prices are also impacted so there will be more pressure on borrowers and lenders as price discovery increases. Easy money for years comes at a cost, often deferred.

Yet every time this happens the stock gets consolidated by big owners[tm] and then the pricing dynamics come into play. Then the so called markets determining price goes right out the window thingy … better yet it then aggregates all services to provide maintenance for stock with kick backs too boot … party time … for the right peoples … ugh …

Veblen/Keynes … ugh …

Rumblings in the bond market for a while. Now this. Wait til the spread hits the derivatives trades. What’s the phrase? Look out below?!

Good thing the Fed is once again giving the tbtf banks ‘special consideration.’ / …

FT from 3 months ago. June 28th.

Bank of America nurses $100bn paper loss after big bet in bond market

https://www.ft.com/content/df4f343c-5666-43a2-ba01-ef315bfb119a

Will this put the brakes on PE ?

No because of structural path dependency and pay day incentives.

You’re probably right. My second question: will this be a repeat of 2008-9, where the tbtf banks were rescued while the smaller banks were left to fail and be bought out by larger banks? The fed has had as a goal for the last 30 years the reduction of the number of banks in the US. It’s almost like they want only 4 or 5 banks in the US and not the hundreds of small community and regional banks. (I see how well that works in Canada for Canadian citizens.)

Stupid question maybe but read that poverty is at all time high and around forty percent of USA workers are living paycheck to paycheck, one root canal away from disaster, so who are these consumers making all this money and spending like drunken sailors?

Probably the same people who love punching each other out during Black Fridays.

The few that aren’t, like some of my kids. They’re a job loss away instead of a root canal, but the overconfidence rides high still.

Egads, an emergency root canal, started on Tuesday…to walk in the door…$315.00. Treatment: unfortunately, possibly in my youth, age 20’s? I had a root canal done, perhaps on the military base by my home, we had dental at the base, Pops was an Air Force pilot. Well, it has failed, slight pain, nothing more, best get it looked into. Egads, the root canal…price, Senior, with small discount for cash…$1,602.00. Oops, then, taking off the gold crown which was in excellent condition…and replacement with a new…God Only Knows, right….gold crown …another $1,300. Headed up to the food bank later today. On my bike…one check away from loosing the house, this is after the 150k emergency spinal surgery in 2021, ongoing treatments. My town burned down in the Almeda Fire, the strain of evacuating thousands of my neighbors, and close to 3 decades of floor nursing…shelf life, I dare say. Day by day, breath by breath…stay the course.❤️🐈⬛

Brush twice a day, and floss once a day. I know, it’s too little too late for you JG, my condolences. This is advice for every one else, like my younger self.

Always, once I reached adulthood, winks, 20, as it came early into my life, homeless waif I have been a class one dental patient. So much can happen, so rapidly. The house, the pension, the 401k…the SS. Poof. All is well, just saying. Thank you for your kindness, be well my friend❤️🐈⬛old lady with a virtual cat.

It seems to have been memory holed but I recall, a little while after the first stimulus checks went out, the Trump administration whined anonymously to the press that people had stuck the money in savings rather than spend it all at once.

Mark Cuban then floated the idea of issuing the next stimulus check as a debit card with an expiration date thus forcing people to use it or lose it.

Our consumer economy demands that people SPEND, SPEND, SPEND, even if that goes against all personal financial device.

It’s not that people bear no responsibility for bad decisions with money, it’s that our current political and economic climate increasingly leaves people with only bad decisions to choose from

if you have a fixed mortgage, life is good(er).

essentially inter-generation financial repression

I have a small house with a small mortgage @3.125, so while I agree with your sentiment in general, there are exceptions, and my daughter will inherit it hopefully!

Though “paid off” is even good(er)(er). ;-)

At … 3.25% I think is where we were at.

People who have inherited money from their parents who died of covid (or “not covid” but actually covid). I think there is likely a lot of that; that it is propping up the economy.

“Instead, consumers are earning lots of money and are spending like drunken sailors. Businesses are spending and investing too. And the government is the biggest drunken sailor of all, further boosting the economy, and throwing more fuel on inflation.”

One must see the BS here, Unless framed from the Financial Capitalist view where “Businesses” referred to are Financially parasitized, “Consumers” are just financial services consumers put on the rack of debt peonage, and ‘government spending’ is throwing money at the MIC and supporting financial institutions in their drunken Wall Street market supports and boosting. I say that because the rest of us Smurfs are getting tired tredding water and watching folks drown

Yeah, Richter has been talking about consumers spending like “drunken sailors” for a while now. which is odd given his uber-capitalist bent. During the pandemic he was complaining about a country of “free-loaders” soaking up all that emergency unemployment money and ruining his day, telling them they needed to go out and get a job, any job, and get back to work. I stopped reading him at the time. He always has great data to share but his capitalist-at-any-cost attitude needs serious adjustment.

Richter also has a strong paleo-Puritan, anti-spendthrift bent.

get off my lawn! lol

But didn’t Krugman just tweet that inflation was slated and it was painless?

Having switched jobs in the last couple of weeks meant giving up my fancy, company supplied truck. The used car market is an absolute mess. Interest rates make late model used cars and their inflated price tag (gone are the days of a car losing almost 50% of its value when you drive it off the lot) ridiculous. Even with excellent credit, a $30k vehicle is going to be $7k+ down and ~$500/month for five freaking years.

I saw 20 year old trucks with rust so bad you could see through the bed and the asking price was $6k+. The working class is being ground to a fine paste.

Two years ago I purchased a used 9 year old Subaru Outback for about $6K. This year I purchased another 9 year old Subaru Outback for $15K. The more recent car did have less mileage on it, so not a total apples to apples comparison, but not so much less that it justifies an extra $9K.

I’ve been looking for a small single cab, two seater pickup which they don’t really make new anymore. The ones I see online are about 20 years old and priced as you said. Something definitely ain’t right.

My wife paid $50 for a can of paint. Thanks Joe! $100B for stupid loser wars though.

…earning a lot and spending like drunken sailors. Hmmm. Using cash/ debit cards, or Magik Plastique?

methinks the earning a lot is over-hyped and mis-stated…

Also, is the 2023 intra-bank trade kicking a can, or really more of swapping wet paper bags full of warm redolent fresh dog crap being passed at the speed of light, a nasty game of Musical Chairs?

Reminds me of the old jocular spoof… an object thrown, with delayed warning:

Catch!!!

What could possibly go right?

Instead, corporations are engaging in massive price gouging and consumers are racking up stratospheric levels of debt to stay afloat.

There, ftfy.

Gouge-flation is what my friend called it.

What if banks, dealers, foreign central banks, etc., are selling their bonds because they need dollars?

The dollar is especially strong right now relative to other currencies, especially the yuan.

Mortgage rates at unaffordable levels? As it should be. Homes should be purchased with cash only. Good way to weed out the undesirable. Mission accomplished.

This article is plain wrong and has been disputed by other reputed blogs. There is no inflation and even if there is, it is not a big problem compared to other terrible economic challenges that might occur.

https://www.nakedcapitalism.com/2013/03/what-is-modern-monetary-theory-or-mmt.html

“And, of course, it is perfectly true that a poorly managed monetary system, or one which is experiencing something like an oil-price shock, can also experience inflation. But people today simply don’t realize how much bigger a problem the opposite condition can be. Under the gold standard, and largely because of the gold standard, the capitalist world endured eight different deflationary slumps severe enough to be called “depressions.” Since the gold standard was abolished, there have been none – and, as we shall see, this is anything but coincidental.

The great virtue of modern, fiat money is that it can be managed flexibly enough to prevent *both* deflation and also any truly damaging level of inflation – that is, a situation where prices are rising faster than wages, or where both are rising so fast they distort a country’s internal or external markets. Without going into the details prematurely, there are technical reasons why a little bit of inflation is useful and normal. It discourages people from hoarding money and encourages healthy levels of consumption and investment. It promotes growth – provided that a country’s fiscal and monetary authorities manage it properly.

The trick is for the government to spend enough to ensure full employment, but not so much, or in such a way, as to cause shortages or bottlenecks in the real economy.”

——————————–

MMT’s predictions proved to be correct as Bill Black argued here. Government can print (borrow) money with no consequence.

https://www.nakedcapitalism.com/2019/02/bill-black-modern-monetary-theory-march.html

“One, MMT shows that governments with fully sovereign currencies do not “need” to “finance” their debt. Two, what does the phrase “such high levels of debt” mean? Three, how much “less money” is “available.” Four, what “other investments” supposedly will lack “money?” MMT makes clear that a nation with a fully sovereign currency cannot lack “money” to undertake “investments.” MMT makes clear that real resource constraints can actually serve as constraints. Scholars, and finance professionals, overwhelming agree with MMT on the issue of real constraints. Five, the journalists did not inform their readers that MMT scholars correctly predicted that the fiscal stimulus program responding to the Great Recession would not “crowd out” access to finance. The reality is that corporations are sitting on unprecedented amounts of cash and engaging in record stock “buybacks” – so the “crowding out” prediction of archaic monetary theorists was, again, falsified.”

The Dark Side of MMT

https://adamtooze.substack.com/p/chartbook-246-how-america-can-pay?utm_campaign=email-half-post&r=1cc3o&utm_source=substack&utm_medium=email

Presented for comment and not necessarily for truth

Better article than I expected. I don’t really disagree with much of it.

I agree that arguing against multiple wars because we can’t afford them (in monetary terms) is a trap. You’re placing yourself on the same footing as politicians who argue for cutting essential social programs. Either austerity is a valid card to play or it isn’t.

Multiple wars might be a bad idea because of other pragmatic concerns or real resource or production constraints (as noted in the article) or because the wars themselves are unjust or misguided, but it’s not because of lack of funds.

Ugh … MMT has no agency … its just a description of a accounting system available to a few nations and nothing more, acknowledgement of it only provides the space for national policy frameworks and nothing else. The idea that it enables humans to do antisocial things is just so ignorant, same stuff happened under so many other systems.

The better question is what ideological agency has been operative since neoliberalism became the dominate economic agenda and why, regardless of monetary system is in place.

That the Fed is stilling paying face value to banks for impaired bonds is criminal.

Why is no one talking about this?

We are, but those who could make a difference are paid to do otherwise, don’t you know.

Local bank in area just offered 40-year mortgage for first time home buyers. The average price-point in the community (North Shore MA) is $1.2 million.