Last June, we posted on a blockbuster suit, Stevenson v. Thornberg, against Credit Suisse New York entities, a rogues’ gallery of Credit Suisse top brass, and KPMG partners who worked on or oversaw the Credit Suisse account before the bank failed and was merged by Swiss regulators into its fellow Swiss behemoth, UBS.

The case is so meaty, in terms of the length of the Credit Suisse and KPMG rap sheets, that we found it challenging to limit ourselves to a high level overview. That also applied to describing the legal strategy, as in the arguments the plaintiffs are using to haul a Swiss bank into Federal court (the Southern District of New York) not using US securities law claims, but Swiss law and RICO claims. Here is the recap from our initial post; we’ll then add a few more details:

The recitation of bad acts is overwhelming, even for those jaded by the sorry history of serially misbehaving banks. For instance, Credit Suisse effectively refused to get out of the money laundering business. It chose to carry on even after the US forced its Swiss competitor UBS to pay $780 million in fines, enter into a deferred prosecution agreement, and turn over customer names. In 2014, Credit Suisse paid a $2.6 billion fine and pled guilty to criminal conduct. Even so, it was fined repeatedly after that by US and European authorities. In March 2023, the US Senate released ““Credit Suisse’s Role in United States Tax Evasion Schemes,”summing up a two year investigation. Short version: Credit Suisse violated its 2014 plea deal.

That overview does not include indictments of former Credit Suisse execs for drug-related money laundering.

I’m skipping over Tunagate, or more accurately, Tuna Boats, which also produced Federal criminal convictions, this on the investment banking side of the house. And how about “Princelings Payoff,” which resulted in ~$80 million in fines and a non-prosecution agreement?

And then we have many many other train wrecks: an over $5 billion settlement for misrepresenting mortgage securities. Archegos. Greensill.

The plaintiffs have filed their Plaintiffs’ Omnibus Memorandum of Law in Opposition

to Defendants’ Motions to Dismiss the Amended Class Action Complaint, which we have embedded below, along with the Amended Class Action Complaint.

Even though the aim of this new filing is to respond to the defense challenges to the plaintiffs’ legal arguments, it contains plenty of detail on the factual allegations, as in the description of a decade of misconduct that produced over $35 billion of fines and losses. For those of you who read the financial press and dimly or perhaps even well recall the many instances of Credit Suisse serial misconduct, the Opposition Memorandum (first of the two below) will give you the scope of the bad acts, albeit with thinner detail.

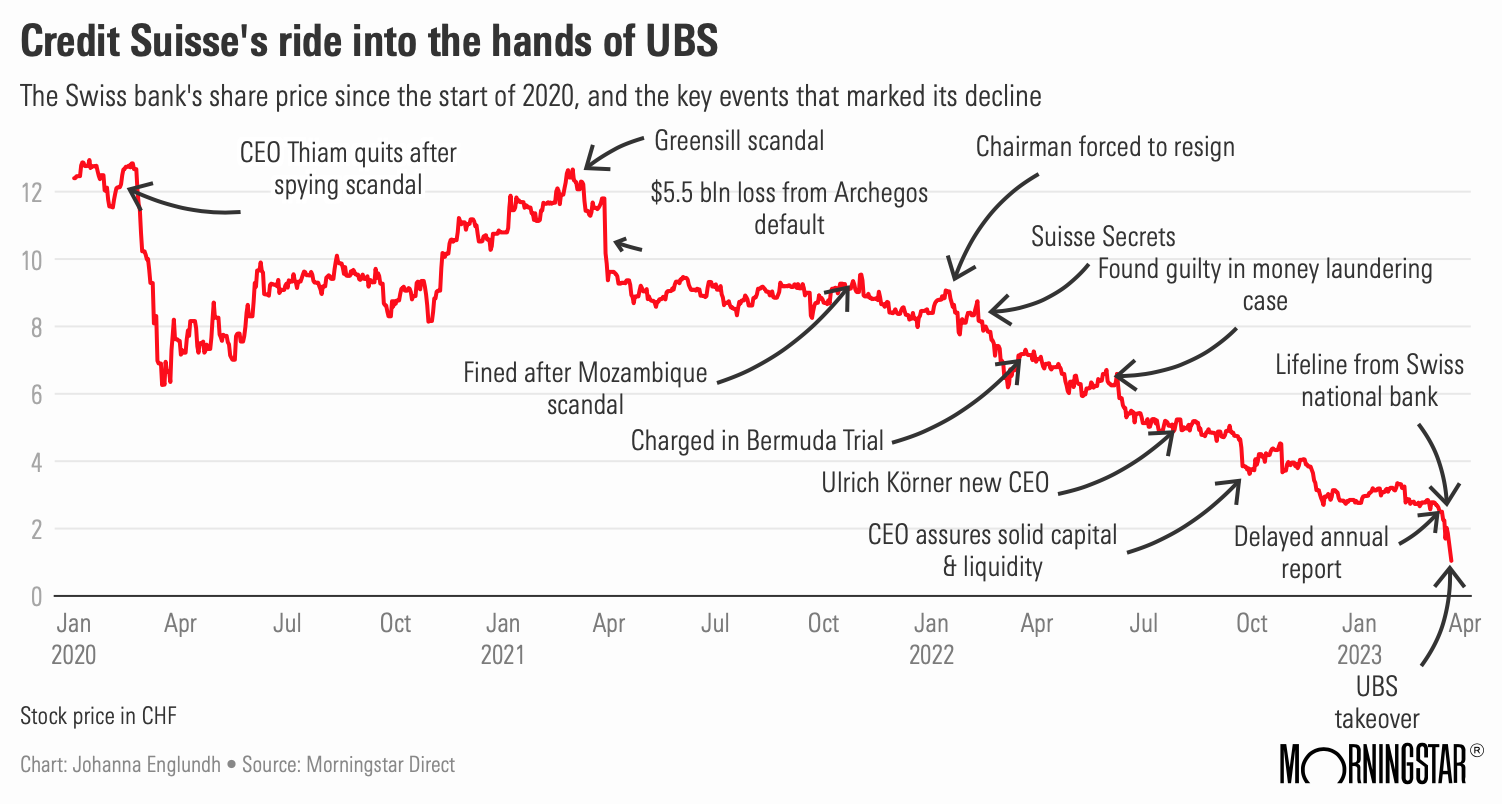

The Opposition Memorandum, on pdf page 21 shows some of the major events from 2013 to 2023, with the stock going from $33.84 a share to $0.75 in the merger. This one from Morningstar shows the more recent trajectory to Credit Suisse’s demise:

As for one of the recent events that put Credit Suisse on its terminal slide, Archegos, recall that it was a so-called family office of Bill Hwang. Hwang was later convicted of fraud, along with 3 staff members, for stock market manipulation using total return swaps. Those derivatives allowed Hwang to greatly leverage his capital. When the stocks collapsed, Credit Suisse, which wrote many of the swaps, took losses estimated at $5.5 billion.

For the second big trigger, Greensill, the Financial Times provided a recap shortly before Credit Suisse collapsed:

The implosion of Greensill in March 2021 caused Credit Suisse to suspend and close $10bn worth of funds that had lent money via the supply-chain finance business, trapping the savings of 1,000 of the Swiss bank’s most prized clients.

Credit Suisse is in the middle of a fraught and expensive operation to reclaim the funds for its clients through insurance claims and lawsuits, which is expected to continue for several years. So far, it has managed to recoup $7.4bn of the $10bn invested in the funds….

In a statement on Tuesday, Finma, the Swiss regulator, said that Credit Suisse had failed to “adequately identify, limit and monitor risks in the context of the business relationship with Lex Greensill over a period of years”. As a result, “Finma thus concludes that there has been a serious breach of Swiss supervisory law,” it added.

Mind you, we are skipping over many many instances bad behavior, like a private banker who embezzled from his clients to the tune of hundreds of millions, yet the bank ignored numerous warnings. But Tuna Boats is pretty priceless. From the filing:

Credit Suisse officials put together a $850 million loan to fund a tuna fishing industry for an African country. Working in cahoots with corrupt officials, they siphoned off hundreds of millions of the loan proceeds. The project failed. Tuna Bonds, sold to investors in NY/US, defaulted.

And an indicator of the corporate culture, again from the filing:

Top Credit Suisse insiders pocketed over $32 billion between 2013–2023 while Credit Suisse lost $3 billion. They also had a secret “skinning” operation that took for themselves “sure thing” economic opportunities in the course of their employment. There was a secret, unreported bonus pool for them…

Remember, that $32 billion would be on top of bonuses to non-executive investment bankers and traders, which would also be substantial.

The examples above merely skim the surface of the Credit Suisse rap sheet. But the press regularly skips over how deeply entwined KPMG was in the bank’s unraveling. KPMG bribed PCAOB officials to find out when Credit Suisse was up for a review, and then destroyed and altered records in anticipation of it. KPMG also certified that Credit Suisse had adequate controls, which was hardly the case. Again from the filing:

KPMG got over $30 million per year from Credit Suisse while its officials participated inthe mismanagement of Credit Suisse and in falsely certifying Credit Suisse’s Internal Controls. Without that certification of Credit Suisse’s financial statements (see ¶¶ 7, 20(f), 122), Credit Suisse could not have continued to operate. In March 2023, when PwC disclosed that Credit Suisse lacked adequate Internal Controls,37 Credit Suisse’s stock collapsed.

The legal theories come into focus in this filing. This section describes the argument set forth in the Amended Complaint, which noted that Credit Suisse stock traded only outside the US:

149. The Swiss Code of Obligations/Corporation Law imposes substantive obligations on Credit Suisse and its Directors and Officers and those who assist them or participate in the management of the company, i.e., KPMG as Credit Suisse’s external auditor, and provide remedies to shareholders of Credit Suisse damaged by their negligence whether they live in Switzerland or elsewhere. Swiss law contains no provision that purports to restrict jurisdiction or venue for Art. 754 and Art. 755 actions to Switzerland. Nor do Credit Suisse’s Charter or Articles.

150. The substantive claims made are based on (a) Swiss law — the Code of Obligations §§ 41, 42, 50, 716(a), 717, 754, 755, 756, 759, 760; and (b) federal statute — RICO, 18 U.S.C. §§ 1962–1964. This action is not based on fraud or false or misleading statements by the Credit Suisse Defendants or KPMG Defendants in connection with the purchase or sale of securities, but rather on their conduct including breaches of their statutory duties and acts of mismanagement. The claims are for holders, not purchasers, of Credit Suisse common shares who suffered damages or losses due to the negligence of the Credit Suisse Defendants and the KPMG Defendants, by continuing to hold or upon disposing of those securities. The claims are direct; the claims are not derivative for Credit Suisse.

151. Most of the acts, transactions and wrongdoing occurred in New York.

Plaintiff, a United States citizen, is presumptively entitled to access the United States

courts. Most of the Defendants are United States citizens; and many reside in New York

City. Most of the witnesses and the bulk of the evidence and live witnesses needed for the

case are here in New York. The headquarters of Credit Suisse’s United States operations — where the bulk of relevant evidence is located and witnesses worked — are here in New

York. So are the headquarters of KPMG. In addition, the files of regulators, prosecutors

and the like that conducted the many past criminal and regulatory proceedings involving

Credit Suisse are in the Southern and Eastern Districts of New York. So are the files

relating to KPMG’s “steal the list” criminal scandal, as well as the files of the New York based lawyers and investment banks that put the UBS-Credit Suisse merger together.

Little if any discovery in Switzerland will be necessary.

The new filing points out:

Consents to NY/US venue/jurisdiction exist in several agreements, all related to the allegations of wrongdoing. ¶¶ 179–183.

2016 Deposit Agreement with BNY Mellon for Credit Suisse’s American Depositary Shares states it “consents and submits to the jurisdiction of any state or federal court in the State of New York”.

2014 Settlement Agreement, where Credit Suisse paid $885 million in Federal Housing Finance Agency v. Ally Financial Inc., No. 652441/2011 (N.Y. Sup. Ct. N.Y. Cnty.), agreeing to “submit to the personal jurisdiction of the [S.D.N.Y.].

2016/2018 Settlement Agreements with the NYAG to pay $5 million for “dark pool” misconduct in which it “irrevocably and unconditionally waiv[ed] any objection based upon personal jurisdiction, inconvenient forum or venue.”50

And statutory shareholder rights under Swiss law are much stronger than those in the US:

Art. 716a The board of directors has the following non-transferable and inalienable duties:

(1) The overall management of the company …

***

(2) The organization of the accounting, financial control and financial planning systems as required for management of the company;

(3) Overall supervision of the persons entrusted with managing the company, in particular with regard to compliance with the law, … operational regulations and directives;

Art. 717 The members of the board of directors and third parties engaged14 in managing the company’s business must perform their duties with all due diligence.

Art. 754 The members of the board of directors and all persons engaged in the management … of the company are liable both to the company and to the individual shareholders for any losses or damage arising from [a] … negligent violation of their duties.

Art. 755 All persons engaged in auditing the annual and consolidated accounts … are liable…. Both to the Company and to the individual shareholders for the losses arising from any negligent breach of their duties.

Art. 756 In addition to the company, the Individual shareholders are also entitled to sue for any losses caused to the company. …

Art. 759 If several persons are liable for a damage, any one of them is jointly and severally liable with the others ….

This is simply deadly. In the US, shareholders are usually limited to securities law claims, like failure to make adequate disclosures. If management is negligent or loots the business, that is considered to be a violation of their duties to the company and only the company has the right to assert claims against them. The only way shareholders can claim damages based on those sort of abuses is by filing a so-called derivative action,1 where the plaintiffs argue they can step in and assert the rights the supposed corporate stewards have neglected. You’ll see in the new filing, one of the points it disputes as some length is the defense trying to say this suit should be presenting derivative, not direct, claims).

If you read the Swiss statutory language carefully, you can see it provide for shareholders to sue for losses resulting from negligent violation of their duties. That can be taken to mean losses to shareholders (as in the result of stock price declines) due to bad actions or failure to act. But these provisions also explicitly provide that individual shareholders can sue for “losses caused to the company” as in all those billions of fines and potentially even management overcompensating itself in light of the lack of adequate controls and recidivist bad conduct.

Note finally that Swiss law makes anyone who was liable jointly and severally liable for the damages. Recall that the defendants include four Credit Suisse US entities, KPMG, 29 individual “Credit Suisse” defendants and 11 from KPMG.

Now one might wonder, Credit Suisse having failed, where the deep pockets are, aside from KPMG and the directors and officers insurance of various executives. Assuming the plaintiffs prevail (and recall RICO charges provide for treble damages), how can they collect from a failed company?

Credit Suisse did not go through a bankruptcy, which would have wiped out or reduced liabilities. It was instead nominally purchased by UBS. UBS has assumed Credit Suisse’s liabilities as its corporate successor. UBS reported a $30 billion profit on the transaction so there would appear to be a lot of dough to spread around.

However, clawing this much back from the one standing big Swiss bank could threaten its solvency and create a huge political controversy between Switzerland and the US. If I were the plaintiff’s attorneys (the formidable BottiniI & Bottini, with Michelle Lerach and her consultant expert Bill Lerach playing major roles), I would avoid flying in small planes.

______

1 A derivative action is when shareholders or other interested parties acton behalf of the corporation to sue individuals who have violated their legally-defined duties to the corporation. To sue derivatively, the plaintiffs must satisfy at least one test of “demand futility,” that a majority of the directors were incapable of making an independent decision to bring suit against the alleged bad actors because 1. they were not impartial (aka they were part of the problem), 2. they didn’t inform themselves when they should have (they played ostrich), or 3. the behavior was so heinous “on its face that it could not have been the product of sound business judgment.”

00 (2023-10-27) Conformed Omnibus Opposition to Defendants' Motion to Dismiss00 (2023-09-14) Conformed Refiled Amended Complaint

At first, it’s shocking to see how a firm like KPMG is still allowed to do business. But then I remember two passages from Lenin’s “State and Revolution”:

And…

Our bourgeois state and its laws exist to allow a rapacious oligarchy to continue to do its thing, while keeping the plebs beyond spitting distance. By and large, such lawsuits and the laws and regulations they are based on, are about protecting oligarchs from other oligarchs. I say, let them fight it out, that the fight be dirty, protracted, and very painful, and that more of their filth gets brought out into the light for all of us to see.

To your point about KPMG, accounting expert Francine McKenna has said for many years that it is the worst of the bad lot of big firms. I suspect one reason they have been allowed to soldier on is that the Big Eight went to the Big Four. Various regulators are leery of more shrinkage. So the big audit players have become Too Big to Fail because (among other things) you need a substantial international footprint, and have a very big staff to meet the audit needs of major multinationals. So there are big barriers to entry.

I do wonder about that.

Some of the “mid tier” audit networks appear to have the substantial international footprint, so it would seem that the staff requirements, and presumably the lack of experience, are the major sticking points.

Also, given the number of less-massive companies which use “Big 4” auditors, even though the mid-tier networks do have the staff and experience to do their audits, there seems to be an element of “we won’t get criticised if we use Big 4”. (Despite numerous scandals that imply the opposite ought to be true.)

It’s also very time-consuming and expensive to tender for a major audit. Mid-tier firms that think they’ve only been invited “to make up the numbers”, will decline to do so.

The conflict of interest in auditors paid by the clients they are auditing has been obvious for many years. Corporations should be audited by randomly selected panels organized by the government and paid for by corporation taxes. The current practice is an invitation to corruption.

Sadly, our Inverted Totalitarian governments in the post-Powell Memorandum world are bought and paid for by corporations such as Credit Suisse and UBS, and their “regulators” are nothing more than revolving-door sycophants hoping for future sinecures serving those they purportedly regulate.

Also an invitation to corruption…

> Tuna bonds

“Son, those tuna ain’t for eatin’….”

This is wild stuff. But how do we know they’re the worst?

How strange to see the name Bill Lerach again. I once upon a time used to litigate against him. After he went to prison, I never ever thought Mr. Lerach would re-involve himself in securities litigation. Good for him. I hope he’s making a boatload of money.

Such clever players; knowing all this from the inside one wonders if some money was made shorting CS?

Such clever players; knowing all this from the inside one wonders if some money was made shorting CS?