Yves here. The Fed keeps trying to rein in inflation with rate hikes, which as we have repeatedly pointed out, will do little to check cost increase which are not the result of a wage-price spiral. This inflation started out with supply shocks. Inflation was extremely high in some sectors, such as energy, lumber, and food, hard to see in others. That is not the pattern you see with demand-pull inflation. On top of that, we have other factors that the Fed is not well-disposed to consider, such as “greedflation” and long Covid constraining the labor supply.

On top of that, we see perilous little mention that the Biden Administration engaged in an insane level of fiscal stimulus in 2023 given that the Fed was trying hard to hit the brakes, with the deficit amounting to 6.2% of GDP. So the central bank is indeed seeing the potential for a big uptick in spending, not primarily from consumers as you would anticipate in historical demand-pull inflation, but businesses if the Fed relents.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

If it’s unleashed at the “first hint” of a rate cut, it “would create upward pressure on prices.” But it may be too late, it has been unleashed by rate-cut mania.

Atlanta Fed President Raphael Bostic came up with a new risk to the inflation scenario, or not really a new risk – because it’s been there and it’s already happening – but a new phrase to describe that risk, a phrase that will resonate here: “pent-up exuberance.”

“Pent-up exuberance” is that businesses, “ready to pounce,” would unleash a torrent of new hiring and investment at the “first hint of an interest rate cut,” which would unleash inflation all over again.

It has already been happening. The rate-cut mania has loosened financial conditions to pre-rate-hike levels, employment has surged over the past few months, hourly earnings have spiked, and inflation in services has begun to re-accelerate. So this rate-cut mania has already unleashed the first wave of this “pent-up exuberance.” And Bostic nodded in that direction:

“It is premature to claim victory in the fight against inflation,” Bostic said in his speech. “January inflation readings came in surprisingly high, the latest reminder that the path to price stability is not a straight line.”

There’s a “New Upside Risk” in Town: “Pent-Up Exuberance.”

“As my staff and I have talked to business decision-makers in recent weeks, the theme we’ve heard rings of expectant optimism. Despite business activity broadly moderating, firms are not distressed. Instead, many executives tell us they are on pause, ready to deploy assets and ramp up hiring when the time is right,” Bostic said.

“I asked one gathering of business leaders if they were ready to pounce at the first hint of an interest rate cut. The response was an overwhelming ‘yes,’” he said.

“If that scenario were to unfold on a large scale, it holds the potential to unleash a burst of new demand that could reverse the progress toward rebalancing supply and demand. That would create upward pressure on prices,” he said.

“This threat of what I’ll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months,” he said.

Fear that this “pent-up exuberance” could reignite – or already has reignited – the inflation fire is valid. We have seen instances over the past few months.

Putting three rate cuts in 2024 into the dot plot at the FOMC’s December meeting and letting markets assume six or seven rate cuts in 2024 and run wild with this rate-cut mania, has turned out to be a strategic blunder of colossal proportions by the Fed.

And ever since, Fed officials have been backpedaling on the rate cut scenario, and markets have dialed back their rate-cut mania by a couple of notches. But it may be too late. That pent-up exuberance may have already gotten out of the bull pen, and it’s doing its darndest to make the inflation fight harder and longer.

Here’s That Un-Pent Exuberance at Work

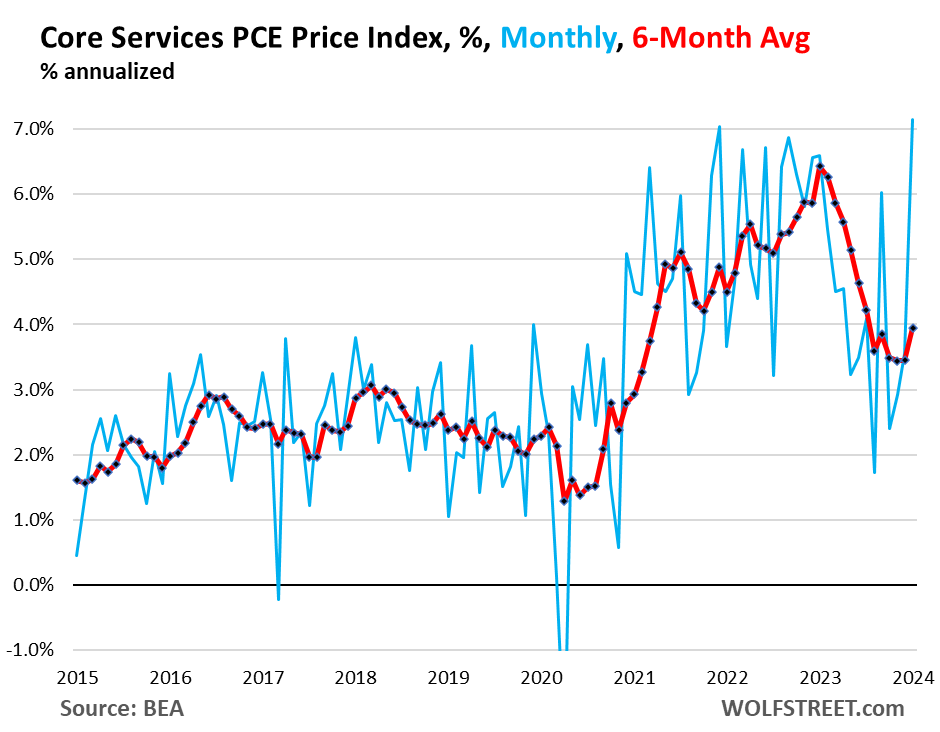

The core services PCE price index spiked to 7.15% annualized in January from December, the worst month-to-month jump in 22 years (blue line). Drivers of the spike were non-housing measures as well as housing inflation. The six-month moving average, which irons out the month-to-month volatility but is slower to react, accelerated to 3.95% annualized, the worst since July, after having gotten stuck at the 3.5% level for three months in a row (red):

I’ll be surprised if or when they begin easing, say any earlier than June of this year. The economy is not the equity market of course, but equities went full on risk on mode late last year with this anticipation. And another issue is the strong payroll numbers ( even if the latest one appeared too good to be true ). Unemployment does not seem to be cooperating with this narrative of rate cuts at the ready in the coming months.

Layer in the national elections and it all makes for an interesting mix.

Listening to CNBC, which is always like going on an anthropological mission into another culture, it seems that the bubble mentality is back with a vengeance.

The current equity rally looks to be getting high on its’ own supply. Every CEO is clamoring for AI which is being extrapolated into every going concern far and wide buying its’ own server farm full of AI chips and hardware to run LLMs. Which, on the face of it, makes no sense … why wouldn’t 3-4 big players end up owning the LLMs, sort of like Microsoft is trying to do with OpenAI?

The main beneficiary of this seems to be Nvidia and Microsoft. Apple and Tesla are already showing signs of fatigue and cannot keep up with the “terrible twosome”. Of course, Facebook is still out there spending beaucoup bucks to try and become one of the big players.

So from my cheap seats, yes, Virginia, it is a bubble … of course how long it takes to play out is anyone guess. The Dread Pirate Powell is on the Hill today so that should make for some great opportunities for the machines to play off his words and “react” in ways that are always biased towards the easing side.

As long as equities keep surging there will be no rate cuts in 2024. Powell is not happy with monetary stimulus all going into speculation and not “real economic growth.” One unspoken goal is to take down trading on margin.