Yves here. This article documents how the dollar operates as a refuge only at times of funding stress, and only temporarily when investors are seeking a safe haven, as in protection from other types of risk. This may explain the phenomenon identified in a new story in the Wall Street Journal today, that retail, and not institutional investors are driving the precious metals rally:

Prices for gold, silver and platinum have surged to record levels, and individual investors are celebrating. The pros? Not so much.

Some trading professionals and hedge-fund managers, including billionaire Paul Tudor Jones, were bullish on gold, silver and other commodities last year. But many trimmed their positions, according to investors and trading data, following an industry tactic of locking in gains as prices rise.

Some of them may be old enough to remember that the bottom of the Global Financial Crisis was also a low point for gold. During the acute phases of the crisis, gold prices would regularly drop bigly for seemingly no reason. This was apparently due to investors being hit by margin calls and needing to sell something fast. Dumping gold made sense as an investment that was not implicated by the subprime/CDO crisis and in which they presumably had a profit. BTW the Internet is not accurate on the price history. It depicts gold as bottoming at around $700 then. I bought it then almost exactly at the low point, at a smidge over $670 an ounce. Yours truly is not keen about speculative investments, and if you make them, it is important to remain detached. The very best traders review their positions daily and are willing to add to them or cut them based on fresh developments.

In keeping, storied investor Jim Rogers left Glenn Diesen uncharacteristically tongue-tied when Rogers refused to trash talk the dollar when Diesen brought up the topic. Recall that Rogers lives in Singapore and made his reputation as a global macro investor. Rogers said he owned dollars, that people wanted dollars in a crisis and he could lighten up on his position then but saw no reason to now.

Are many retail precious metals investors leveraged now?

By Jakob Feveile Adolfsen, Head of Monetary and Macrofinancial Analysis Danmarks Nationalbank; Asger Munch Grønlund, Principal Economist, Monetary and Macrofinancial Analysis Danmarks Nationalbank; and Thomas Harr, Chief Economist Danmarks Nationalbank. Originally published at VoxEU

Safe-haven currencies are generally understood to appreciate when risk sentiment deteriorates, providing investors with insurance. This column demonstrates that the US dollar differs from that of traditional safe-haven currencies such as the yen and Swiss franc. The dollar strengthens persistently and broadly only during episodes of severe global funding stress; in contrast to the yen and the Swiss franc, safe-haven shocks strengthen the dollar only temporarily. The analysis suggests that the weakness of the dollar following “Liberation Day”, which constituted a safe-haven shock but did not trigger a funding stress shock, was less surprising than it might initially have seemed.

The US dollar is typically regarded as a safe-haven currency, but its status has been increasingly questioned following its depreciation after “Liberation Day” (Kamin 2025). In this column, we demonstrate that the US dollar has not historically behaved like a traditional safe-haven currency. Unlike classic safe-haven currencies such as the Japanese yen and the Swiss franc, the dollar appreciates only temporarily during ordinary ‘risk-off’ events. Moreover, during such events, the dollar weakens persistently against the yen and Swiss franc. The exception occurs during episodes of global funding stress, which generate dollar shortages and, in turn, lead to a broad-based and persistent appreciation of the dollar. There are tentative signs that the dollar has increasingly diverged from the behaviour of traditional safe-haven currencies in recent years. This is striking given its role as the global reserve currency and its position at the centre of the world’s deepest and most liquid financial markets.

Different Characteristics May Generate Safe-Haven Status

Safe-haven currencies are generally understood to appreciate when risk sentiment deteriorates, providing investors with insurance. Safe-haven dynamics may be self‑reinforcing if investors hoard safe-haven currencies during risk-off events to limit losses (Goldberg and Krogstrup 2023).

Various fundamental characteristics can confer a currency’s safe‑haven status. The typical safe-haven behaviour of the yen and the Swiss franc is often attributed to their role as funding currencies in carry trades (e.g. Ranaldo and Söderlind 2010, Hossfeld and MacDonald 2014). Investors tend to unwind carry trades in times of heightened uncertainty, thereby strengthening these funding currencies. Habib and Stracca (2012) argue that a country’s net foreign asset position is a key determinant of safe‑haven status. While this characteristic aligns well with the safe‑haven status of the yen and Swiss franc, it squares poorly with the case of the dollar, as the US has accumulated a substantially negative net foreign asset position since the Global Financial Crisis.

However, US dollar dynamics have also been linked to its central role in global funding markets and the international monetary system. Episodes of funding stress have triggered global dollar shortages, contributing to dollar appreciation (Jiang et al. 2021, Bacchetta et al. 2023). This feature implies that the dollar may appreciate in times of funding stress despite not being a classical safe‑haven currency. Yet it remains unclear whether these exchange‑rate dynamics resemble those of more traditional safe-haven currencies such as the yen and Swiss franc.

We study US dollar dynamics using a newly constructed funding stress factor alongside a more traditional safe‑haven factor. To analyse these differences, we construct a global ‘funding stress factor’. Following Chari et al. (2024), who identify risk‑on and risk‑off flows via covariation in financial variables, we narrow the focus to variables directly associated with funding conditions. Specifically, since 2007, we extract the first principal component from daily changes in IBOR–OIS spreads in the US, Japan, the euro area, and the UK, and from deviations from the covered interest parity (CIP) of the US dollar, the euro, the yen, the Swiss franc, and the pound.

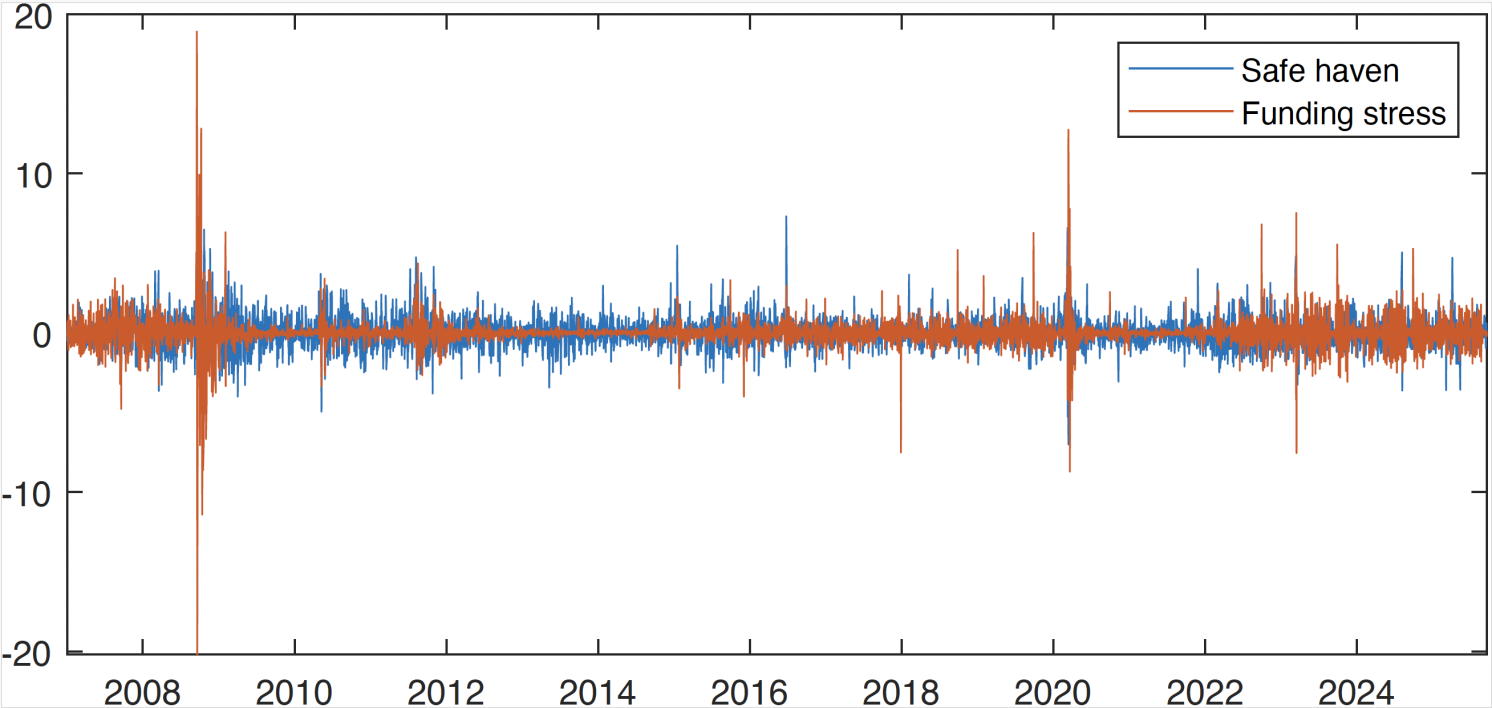

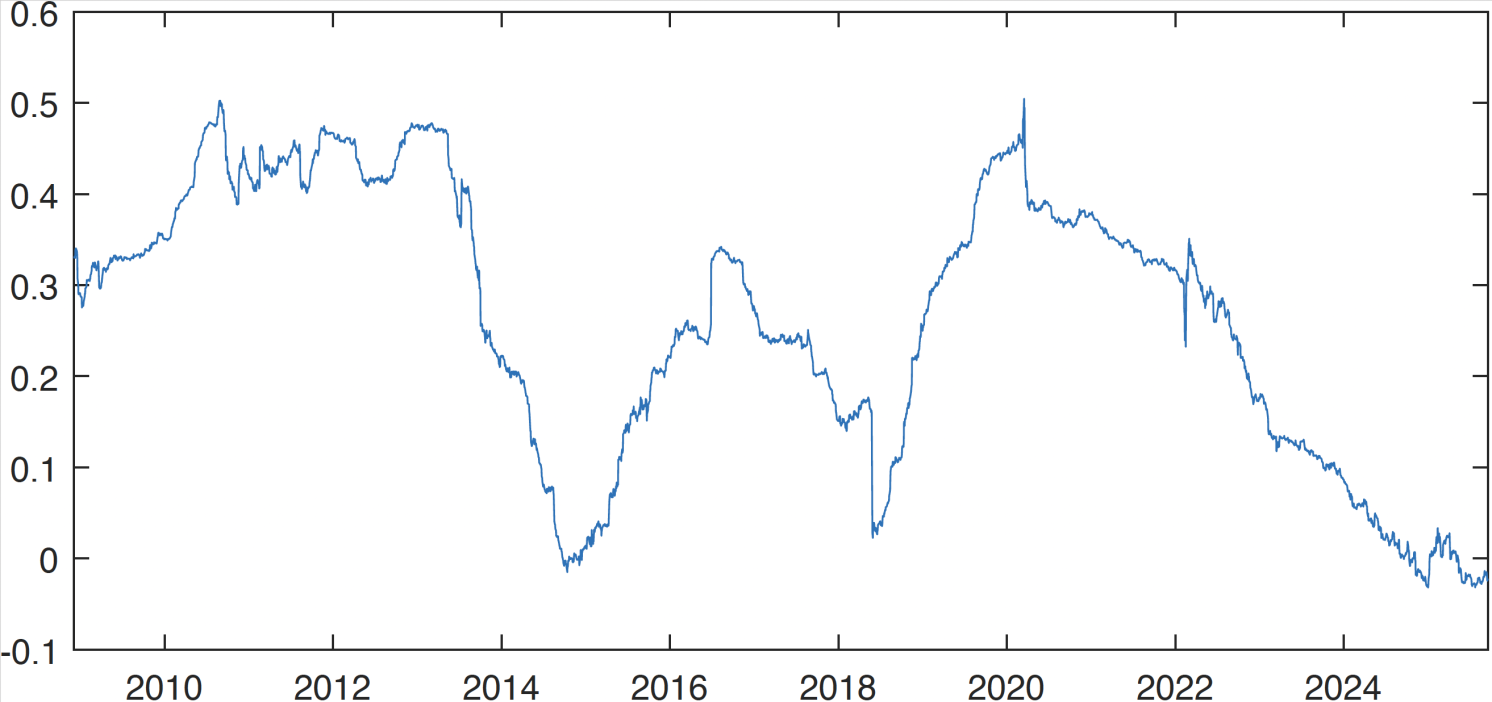

We estimate the impact of changes in the funding‑stress factor on the dollar using local projections (Jordà 2005) and repeat the exercise for the safe‑haven factor from Grothe et al. (2025). Grothe et al. construct their safe‑haven factor using the first principal component of nominal effective exchange rates of typical safe‑haven currencies (US dollar, euro, yen, Swiss franc); 10‑year government bond yields for the US, Germany, and Japan; as well as the gold price and the VIX. Their factor therefore serves as a useful benchmark for comparing the effects of classical safe‑haven characteristics with those captured by our funding stress factor. Both series are shown in Figure 1 and display a fairly low correlation of around 0.2. 1

Figure 1 The safe-haven and funding stress factors

Note: Positive values indicate funding stress and safe-haven flows (risk-off). Both factors are standardised to have unit variance. Daily data from 1 January 2007 to 17 September 2025.

Source: Bloomberg and own calculations.

Nevertheless, in our local projections estimation, we isolate the effect of funding stress by controlling for the safe-haven factor, and vice-versa. For comparison, we also repeat the analysis for the yen and Swiss franc. 2

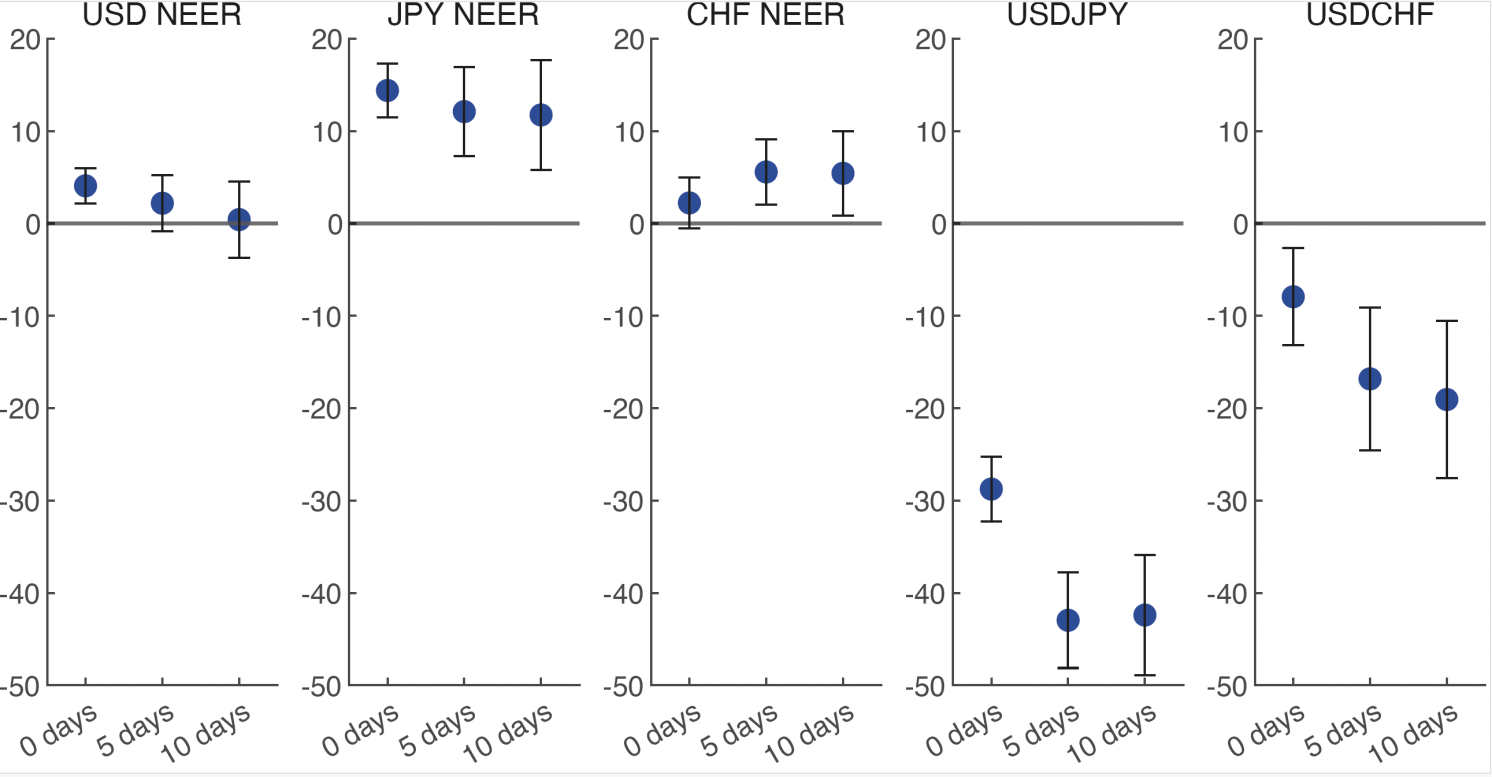

A safe-haven shock strengthens the dollar temporarily, while the dollar weakens against classical safe-haven currencies. A one standard deviation shock to the safe-haven factor leads to an immediate appreciation of the dollar of around 4 basis points, with the effect dissipating within five days (Figure 2). Strikingly, the dollar weakens against more classical safe-haven currencies — by 0.4% against the yen after ten days and by 0.2% against the Swiss franc. The appreciation of the yen and franc is generally stronger and more persistent than the temporary strengthening of the dollar.

Figure 2 Effect of a safe-haven shock on spot exchange rates (basis points)

Note: The effect of a 1 standard deviation shock. Whiskers are 95% confidence bands based on HAC standard errors. Based on daily data from 1 January 2007 to 17 September 2025.

Source: Bloomberg and own calculations.

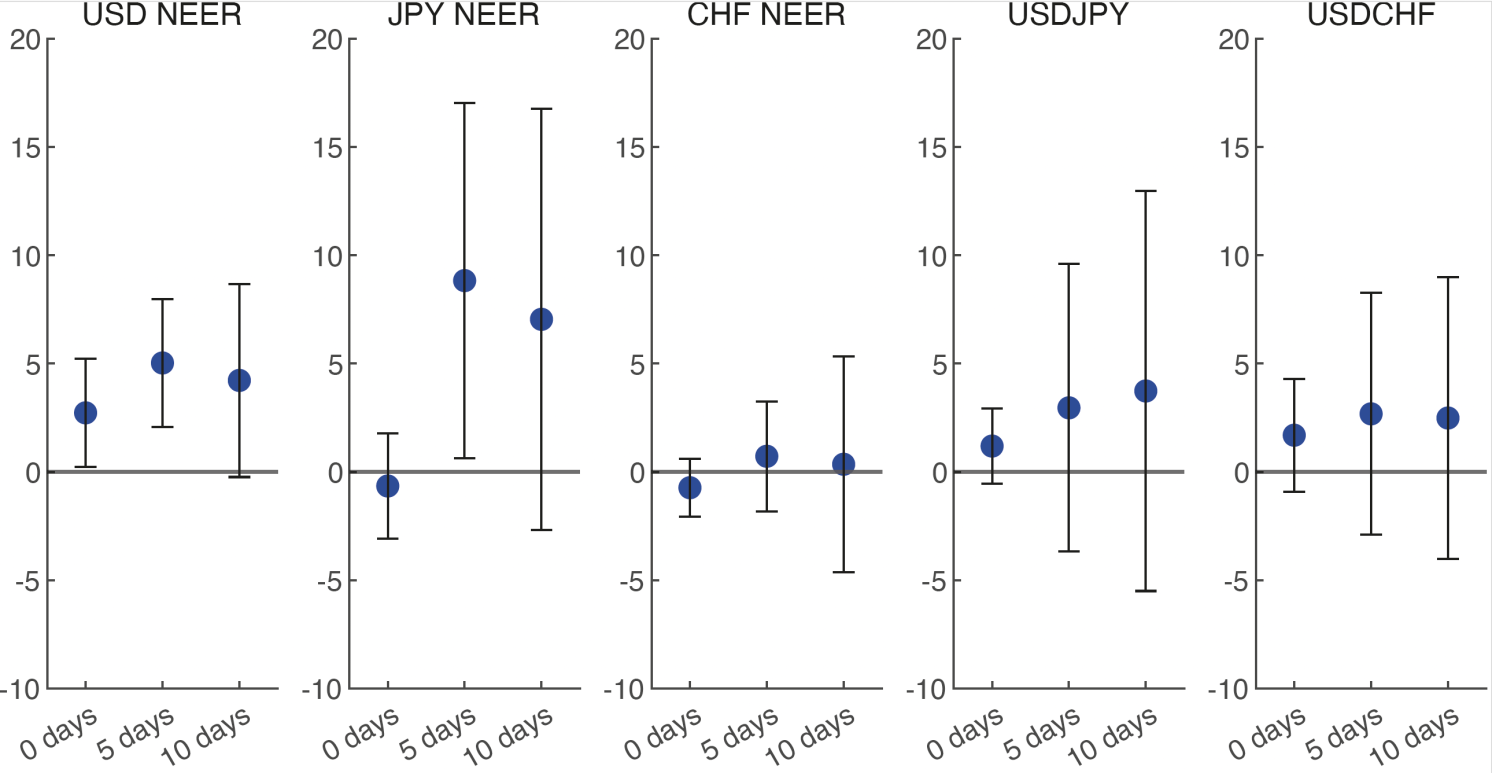

During periods of funding stress, global markets experience a pronounced shortage of dollars, resulting in a broad‑based strengthening of the dollar. Following a one standard deviation funding‑stress shock, the dollar also appreciates by 4-5 basis points (Figure 3) and, unlike in response to safe haven shocks, the effect is persistent. The dollar also strengthens against the yen and Swiss franc, although these effects are not statistically significant.

Figure 3 Effect of a fundings stress shock on spot exchange rates (basis points)

Note: The effect of a 1 standard deviation shock. Whiskers are 95% confidence bands based on HAC standard errors. Based on daily data from 1 January 2007 to 17 September 2025.

Source: Bloomberg and own calculations.

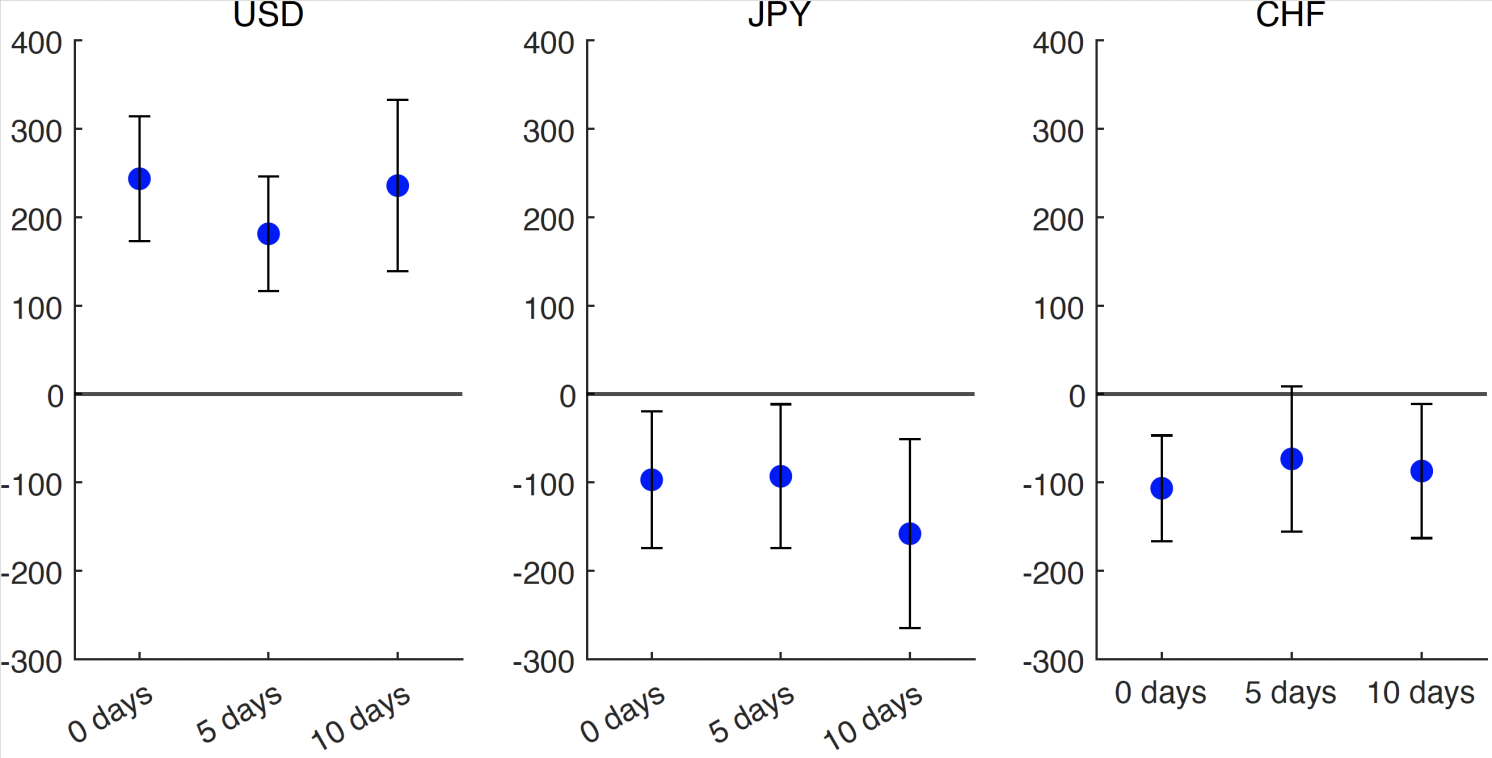

It is evident that the US dollar responds much more strongly to funding stress shocks than to classical safe‑haven shocks, as dollar appreciation is both persistent and broad‑based during episodes of funding stress. These dynamics reflect an acute tightening in global funding conditions during funding stress, which is unique to the US dollar. This is illustrated by a persistent 200 basis points increase in the deviation from CIP for the dollar — an increase that corresponds to a higher cost of borrowing dollars via FX swaps — and stands in contrast to the lower borrowing costs for the yen and Swiss franc (Figure 4). 3

Figure 4 Effect of a funding stress shock on CIP deviations (basis points)

Note: The effect of a 1 standard deviation shock. Whiskers are 95% confidence bands based on HAC standard errors. Based on daily data from 1 January 2007 to 17 September 2025.

Source: Bloomberg and own calculations.

Conclusion and Further Reflections

Our analysis shows that the behaviour of the US dollar differs from that of traditional safe-haven currencies such as the yen and Swiss franc. The dollar strengthens persistently and broadly only during episodes of severe global funding stress. Although the weakness of the dollar following “Liberation Day” was notable, our analysis suggests that it was less surprising than it might initially have seemed. While “Liberation Day” constituted a safe-haven shock, it did not trigger a funding stress shock. 4 From “Liberation Day” until President Trump postponed the tariffs one week later, the dollar weakened marginally against most G10 currencies – such as the euro and the pound – and more markedly against the yen and Swiss franc. While the broad-based weakness of the dollar was remarkable, the declines against the yen and Swiss franc were consistent with historical patterns.

Taking a longer perspective, a simple rolling correlation between the safe-haven factor and the US dollar suggests that the currency’s traditional safe-haven status may have been fading in recent years (Figure 5). We believe there are several potential factors which may explain this development, and going forward, it could imply lower demand for US assets during classic safe-haven episodes.

Figure 5 The correlation between the US dollar and the safe-haven factor has declined in recent years

Note: 500 trading days rolling correlation between the nominal effective exchange rate of the USD and the safe-haven factor from Grothe et al (2025). Based on daily data from 1 January 2007 to 17 September 2025.

Source: Bloomberg and own calculations.

First, the increasingly negative net foreign asset position of the US undermines the dollar’s status as a traditional safe-haven currency. Foreign investors also hold a different composition of US assets today, having increased their share of US equities while lowering their share of US Treasuries (Chari et al 2025). As a result, their dollar-denominated assets provide a less effective hedge during periods of adverse market conditions than in the past.

Second, in recent years, the dollar has become a relatively high-yielding currency compared with its G10 peers. As a result, it is unlikely to serve as a funding currency in carry trades, in contrast to the yen and Swiss franc.

Despite these developments, the US dollar remains by a wide margin the dominant payment currency worldwide (BIS 2025), and it continues to play a central role in global funding markets, partly due to regulatory changes in the realm of the global financial crisis (see also Avdjiev et al. 2019). Consequently, the dollar is likely to continue to strengthen during periods of global funding stress.

_______

- The funding‑stress factor spikes during the height of the Global Financial Crisis and at the onset of the COVID‑19 pandemic. Both episodes were characterised by pronounced dollar shortages, as evidenced by the Federal Reserve’s introduction of USD swap lines. Although the safe‑haven factor also increases during these periods, the two factors seem to capture different underlying dynamics, with the safe‑haven factor appearing to reflect shifts in asset allocations rather than funding stress.

- We purge both the funding‑stress and safe‑haven factors of US‑specific variables by setting the weights on all US variables to zero and control for daily changes in the S&P 500 and US 2‑year OIS rates. The nominal effective exchange rates (NEERs) of the remaining currencies in the safe‑haven factor are also adjusted to remove USD‑driven movements. For example, we purge the Japanese yen NEER using the following procedure: First, we regress the USD NEER on all bilateral exchange rates among JPY, EUR, CHF, and GBP. Second, we extract the residuals from this regression, which are orthogonal to movements in the US dollar. When repeating the analysis for another currency – such as the yen – we apply the same purging procedure to both the safe‑haven factor and the funding‑stress factor.

- Unreported results show that the cost of dollar funding in the FX market does not increase to the same extent during safe-haven shocks.

- On the 3rd and 4th of April 2025 (where the market reaction was strongest), our safe-haven factor increased by 9 standard deviations in total, while our funding stress factor increased by 1 standard deviation.

See original post for references