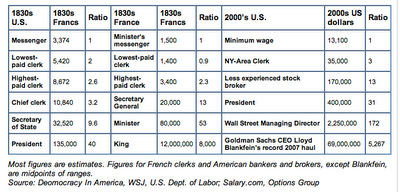

The Wall Street Journal Economics Blog today featured an update of a chart prepared by Alexis de Tocqueville, author of Democracy in America, comparing the compensation of French and American civil servants, with an update (click to enlarge):

The problem is that this comparison is misleading. The intent is to illustrate pay disparities over time.

However, while the President and the King were indeed the highest paid “civil servants”, the President than as now was almost certainly not the highest paid individual, while the King most certainly was. And that’s before we get into the royal perks: the castles, staff, stables, artwork, the list goes on). Plus the idea of a king as civil servant is a bit strained too. However, this was the Bourbon Restoration, so kings were a bit more mindful of the citizens than in pre-Revolutionary times.

But the King was almost certainly the richest and best paid individual in France. He made 8,000 times the most menial civil worker. Our disparity (minimum wage versus Lloyd Blankfein) at a mere 5,000+ isn’t quite as bad, right?

But Blankfein was far from the best paid American. Forbes told us that the 400 highest earning taxpayers reported $105 billion in adjusted gross income. That averages $262.5 million. $262 million versus the minimum wage level of $13,100 gives a ratio of over 20,000 to one.

Now some will protest that the $105 billion probably includes one time windfalls, like the sale of major businesses. Doesn’t wash. We are looking for the disparity top to bottom. I haven’t seen any estimates for 2008 yet, and hedge funds had a rougher year, but the Institutional Investor ranking of top hedge fund managers for 2007 showed John Paulson at $3.7 billion, George Soros at $2.9 billion, and James Simons at $2.8 billion.

So the popular perception is right. The super wealthy today are better off than royalty of old. And it’s not due to indoor plumbing, either.

Sounds like it is time to put the great equalizer back into operation:

http://files.blog-city.com/files/A05/141484/p/f/louis__head.jpg

With a pyramid that steep only a few heads need to go onto the block.

So the popular perception is right. The super wealthy today are better off than royalty of old. And it’s not due to indoor plumbing, either.

I haven’t personally wiped anybody else’s behind as of yet, but your posts make me increasingly concerned I’m doing so by proxy.

I actually think this chart is more valuable than its initial comedic worth would indicate. House-owners are truly indentured servants, tithing a truly exorbitant portion of their weekly nut — considering comparable rents — towards the lenders controlling the disposition of their home. An exceedingly large portion of society’s product has been allocated to owners of capital due to structural oversupply and, dare I say it, low value of labor.

Maybe I’m just another neo-Luddite, but I honestly believe the fruits of a fellow human’s labor are less valuable than at any time in the past given our ingenious technology and capital base.

I don’t expect this disparity between human creativity and exploitation of human labor to narrow any time soon, which to me indicates social unrest.

wasn’t there a whole book written about the fact that the world is becoming more extremistan? I don’t think the root cause of greater disparity derives from social disfunction, but rather from the relative efficiencies of large organizations. Through improved communications and infrastructure, there has been greater commercial centralization.

@ndk & bg…or the the dreaded E word EFFICACY and whom welds it for their benefit. I feel the game never changes just the titles and costumes. Its only when they become to overconfident in their capture of the common man that they risk unrest. The human play to be re-released, same stereotypes in fresh garb, ad infinitum.

These personality types did serve a purpose in the formative years of the human race but seemingly now are a liability, their must be a beneficial role that they could play with out bringing US (the human race) to ruin, every generational turn. Suggestions anyone.

The sad part if that if it wasn’t for the egregious government bailouts of Wall Street the market would be taking care of some of the worst of the excesses.

For example, if you check the Goldman Sachs fiscal 2007 proxy, you see that 60% of Blankfein’s $69 million was paid in restricted stock units and options. If the government hadn’t stepped in with the TARP money (and bailed out AIG and all of Goldman’s CDS counterparty risk with AIG), where would Goldman shares be trading today?

And of course, that was your money, and ndk’s money and my money that Paulson used to bail out Blankfein with . . . . . .

I mentioned a text on how scale divergences are maximized in modern economies last Spring. For reference of those elsewhere then: The Power of Scale: A Global History Approach. By John H. Bodley (Armonk, M. E. Sharpe, 2003). Check it out, sez I. Iddn’t pretty.

@Richard kline,

Yes, imperia/scale x10 and the assumption growth is an elite-directed process that concentrates power in the form of ever expanding imperia, with America being commercial imperia.

My favorite is the “summum bonum for the whole globe requires more than one rightful party (in our case the ruling wealth class) or the remarkable fact that the carrying capacity of the planet in-creased twice, and each time by several orders of magnitude in the neolithic and industrial revolutions. I feel my head hitting a celling, how about you, and who can the other classes ever escape capture.

skippy

Tragic; having worked at Credit Suisse and Lehman I can unequivocally tell you that none of Wheat, Mack, Fuld or even Brady Dougan regularly walked the floors, talked to the traders or asked ‘regular employees’ what was going on in the markets. Wheat was the closest thing to a man of the people. So much for Mack’s humble Lebanese origins, he seems to have left them on the golf course at Apawamis his Rye club, and site of his McMansion with a built-in racquet-ball court (hopefully, this means squash). These guys were out for their own personal gain, and f— the employees. Fuld had his stooge, Joe Gregory, do all of his dirty work and who knew what the heck he did except soliloquize before his court jester, Tom Russo (ex-Davos correspondant and as I recall “Executive Counsel” or something similar). Sound bitter? That’s about right.

With 300 million people in the US today versus 13 million in the 1830s, wouldn’t you expect a larger disparity between low-level clerks and the highest paid individuals if incomes were normally distributed? Just having that many more people virtually assures that a few of them will be on the far extremes of the bell curve.

Not that I disagree that executive salaries are disconnected from reality (I find it hard to believe that the $200 million guy is that much better than the $5 million guy) and that we could use some re-balancing.

From your post; “Now some will protest that the $105 billion probably includes one time windfalls, like the sale of major businesses. Doesn’t wash. We are looking for the disparity top to bottom.”

if you want to find the real disparity from top to bottom in scamerica you need to use total net worth as a measure. Then you can compare the average top tier scum bag billionaire, with a net worth of ball park 30 billion, with the now two million homeless who have a net worth of zero.

That makes it about 30 billion to one.

The Wall Street Urinal is a butt sucking infomercial on roids for the greedy, corrupt, high exploitation footprint, elite.

Deception is the strongest political force on the planet.

i on the ball patriot

One word: clawbacks.

Anarchus is exactly correct.

Mr. Bush’s government stepped in to preserve the compensation/loot at Goldman after the market had found a way to claw back at least a part of it by knocking the stock price towards zero.

Sadly Mr. Obama evidently felt compelled to hire from the same pool, ironically providing some measure of cover for Bush et al — their apologists can now argue that what the Bush admin did, and did not do, with respect to the failings of modern Finance was just in keeping with the spirit of the times.

This is your last chance. If you don’t get in now you are gonna miss out. Not everyone has this opportunity but if you act now, much money is gonna be made. I am not going to tell you my secret formula but it works, I promise. Is this Madoff or Obama talking? Is this Paulson talking about TARP 1 or Obama talking about Stimulus? Does anyone actually understand what Obama is selling? Has anyone done any math? How can people support something they don’t understand based on the words of Politicos or their Shills? Does anyone understand the multiplier effect, how it is actually computed, where the numbers come from, which derivative of some estimated number is being used to bolster the hypothesis? What about the Lucas Critique, has it been factored into the analysis and if so how? All the people purveying the stimulus have been dead wrong so far yet they are the ones being relied upon to fix everything? Now Rush is in the act with some ill defined unquantifiable analysis which is becoming the mantra of the conservatives, is everyone just an idiot? Why anyone listens to Rush the junkie is beyond me especially since like most conservatives that which he rails against most, he is a purveyor of. If most Americans were honest they would admit their stupidity, admit they are sheep, admit they are relying on people who have not only been wrong the whole time about his mess but now are hoping for the best. Of course, Freud or Einstein would describe this behavior as fantasy or lunacy. My point, how can Americans be so passionate about something they don’t understand and which is being purveyed by those who have been wrong every step of the way (not to mention the purveyors been have lying to them their entire lives)? Madoff truly had the psyche of man figured out which is incredible as the scams have been going on for centuries. Most Americans are truly rats in a maze.

It would be interesting to compare the late 1920s in that chart too, I wonder if it was be very similar to 2007

Here’s the thing — even most middle class people in developed countries are better off than the kings of france were – at least in terms of material comforts. Sure, the sheer disparate ratios of wealth can be compared, but in fact these are apples and oranges. The wealth of the the kings of france, like that of any dictator is mostly irrelevant. Their coercive power over the populace is the thing that any ambitious billionare of today would give up most of his wealth for. For all the wealth that these people have, it is nothing compared to the coercive power of a state actor that may at any point deprive them of life, liberty and property.

-Peruser

Wow, listen to you guys. You sound like my kids when they clench their fists, pout their lips and mutter “It’s not fair!” through clenched teeth.

Life’s not fair, sugar. Get over it. Waaa, I wasn’t born into royalty. Boo hoo, I am not a corporate prince. Woe is me, I don’t have this / that / the other that he/she has.

Seriously. What a bunch of losers.

It’s impossible to have an intelligent conversation about this without seeing the whole Pareto curve.

The elite business oligarchy and their paid whores who make the laws in this corporate state run this country and have for years. This should come as no surprise.

Some years ago I worked in a call center. One day the company CEO (fortune 500 company) and a crew of top exucutives came to visit. Seemed cool at first and the last thing on my mind was that he was making around 300 times my salary.

Here’s what got me. At lunch time in the cafeteria they set up screens around about a third of the cafeteria for them to eat. WTF? Not only must they be hidden from the commoners’ view, but a small group of 5 or 6 commands a third of the cafeteria leaving hundreds of rank and file employees to squeeze into the rest. I think a lot of us rethought how the company values its human resources.

Long live the King

A different thing strikes me: France had only one King to support at that level – you guys are supporting herds of these creatures.

It seems there is a disconnect here between the right and the left coasts. The CEO of the company I work in (Silly Valley) co-founded it. While he does play in the income league described here and buys himself the occasional Ferrari, he dresses in Jeans, eats with everyone else in the cafeteria and drinks the same machine coffee. He donates a lot. (Many millions.) In a way he did not forget that 20 years ago he was just like everyone else. I find it very hard to argue against his behavior.

Is it the dynasties that mess everything up and that you are bemoaning in the east? But some of the people described in the comments came from humble origins. How did they forget? Is it finance that corrupts more than other fields? It seems many traders (Kerviel etc.) describe their work as playing a video game. Does finance disconnect from life and the world?

Maybe if we go back to early-nineteenth century France levels of wealth, we can get closer to their level of income/wealth equality, thereby striking a blow for social values!

One wonders where these figures would now sit if Wall Street had not been feasting on 20 years of easy Fed credit and the Greenspan Put.

The American peasantry do NOT look at it this way tho. THEY look at it as: if “these liberals” help ME, they’ll also help “those people”. And, there’s NO WAY the that’s gonna happen in America.

Income “equity” can only happen if the majority of America peasants hate those above them MORE than they hate themselves (and “those people”, of course). Ain’t gonna happen with Bill O’Reily (sp) making sure the big picture is kept in focus (I’m thinking the “war on christmas” here).

Good thing about the poor, you can always pay one half to kill the other half.

This post was meant only somewhat in jest. We wrote a lot in 2007 about growing income disparity. I haven’t seen updates since the crisis, but there was quite a lot of evidence pointing to greater concentration of both income and assets in the top 1%.

America also showed higher growth in the period when income disparity was lower. It’s hard to prove that there was a causal relationship (a lot of things contribute to growth; difficult to parse out the role of perceived fairness and access to opportunities). However, one might contend the reverse: greater income disparity does not appear to help economic growth.

There is a good bit of evidence that says that economic mobility has fallen in the US.

As for “the middle class lives better now than kings of old”, that isn’t the point. The US has long believed in and promoted the idea of the American Dream, that if you work hard, you can attain and hold on to a middle class standard of life, and if you are talented and work really hard, you can do even better. Obama invoked it in his Inauguration speech.

Huge concentrations of wealth, falling income mobility, and stagnant average worker incomes belie that. There has been an order of magnitude increase in “sharpen the guillotine” type comments here as it is also revealed that some of the gains at the top were not won fairly (as in, how real were those boom year Wall Street earnings? William Black, a FDIC official who was on to Charles Keating early, contends that the accounting fraud in financial services is at Enron levels).

That’s why people are angry. It isn’t just that the rich are rich. People still admire folks like Warren Buffett and Bill Gates who built large, successful enterprises. It’s folks like CEOs who inherited successful businesses and extract rents that appear unjustified that are the source of resentment.

ndk:

“An exceedingly large portion of society’s product has been allocated to owners of capital due to structural oversupply and, dare I say it, low value of labor.”

Maybe you should think that over a bit more deeply. It’s anything but a natural fact, though it occurs through a process that occurs “naturally”.

Yves:

Distribution of wealth/income is not just a “fairness” issue and normative matter; it’s a crucial functional issue, insofar as the distribution of income effects and conditions the reproduction of both the composition and level of real effective aggregate demand.

John,

I hadn’t wanted to go there, but yes, that is the reason why more even income distribution may in fact be pro growth. The rich can only consume so much; we’ve finessed this problem for the last 25 years as the concentration at the top has increased by increased borrowing among the lower income groups. We’ve hit a wall as far as that is concerned.

The other way to deal with insufficient domestic demand is to export, but with a lot of countries onto that game, and more openly mercantilist than we are, our ability to go that route is limited.

One bit of Keynesian wisdom that isn’t invoked enough is that he though a system with large trade imbalances was not sustainable and crisis prone. Countries can run small chronic surpluses and deficits, but not large ones without a cost to stability. And the Reinhart/Rogoff work shows empirically that high levels of international capital flows are correlated with banking crises.

Of course the answer is higher taxes …

But the media and the Republican noise machine still prevails. Two wars unpaid for, yet the “stimulus package” is chock full of yet even more tax cuts even while tax receipts fall dramatically.

We need a new 60% top bracket income tax while treating all income as ordinary income. This is the only way to reduce income disparity while gaining the revenue to support existing programs such as SSI and Medicare while expanding heath care to all through HR 676.

Still, the Democrats shrink from even decrying even more tax cuts! There is NO leadership in Washington DC. Obama’s mandate has been betrayed … it only took two weeks.

@mmckinl:

While I won’t agree or disagree about the need for a new higher rate tax bracket, this potential change needs to keep something very important in mind. When we talk about the ultra-rich we’re not talking about the “people making over $250,000/year” that President Obama repeatedly mentioned during election time. An increased tax bracket starting at sub-million/year income levels will only help to keep the middle class in the middle class, and the upper class in the upper class.

We should want people to aspire for $200k+/year income levels without being discouraged by high taxes. Doctors, top-notch scientists, and even the best financial professionals should be very well incented to continue working hard. If a new tax bracket were to be initiated, it should be no lower than $750k or $1mil/year, taxing only those “top 1%” or similar income earners, and not penalizing the highly skilled specialists in our country.

Er, taxes are far higher now as well: no European peasant faced 70% or 80% tax rates. European history is replete with peasant tax revolts, many of which usually occurred once the local nobility attempted to excise taxes greater than 40% of the peasants’ income.

Forgawdsakes, the American revolution was undertaken on account of tax rates far less than they are today.

Meaning for all of the effort undertaken by the class-warfare advocates to equalize wealth through higher taxation than European peasants faced, what has occurred is wealth inequality.

Regardless, there is a vast difference between the wealthy classes of today and those of the aristocratic era, namely, aristocrats siezed their wealth by the use of law and force of arms. Today’s wealthy create wealth.

If you can’t see the difference between Bill Gates and an 18th-century French baron, then you’re hopeless.

Here’s a quick estimate of what the highest paid person in the US made in the 1830s:

I think that person was Jacob Astor (if it wasn’t Astor in 1830 he was certainly in the running), and he left a $20 million dollar estate when he died in 1848, at the age of 84. I can’t find his actual income in the amount of time I’m willing to spend on this, but let’s guess that $750,000 annually would give him that kind of wealth., which should be within a factor of 2 or so.

According to wikipedia, the president made $25,000/year at that time, so multiply dollars by 5.4 to get francs to be consistent with your table.

So Jacob Astor made somewhere in the vicinity of 4 million Francs annually. That’s 1185 times the pay of the lowest-paid American clerk.

This figure is obviously not totally accurate, but there’s no way it’s off by the factor of 20 or so that it would have required to put Astor in the same ballpark as today’s 400 highest earners.

So apparently inequality has increased over time in the US. No surprise. I don’t think it would have been possible to live on 1/20000 of Jacob Astor’s income.

whitetower,

Had you bothered clicking the Forbes link, or doing any research, the tax rates paid by the rich are vastly lower than the levels you suggest.

And who faces 70% to 80% tax rates? I live in New York City, which has one of the highest tax regimes in the US (we have city income taxes and a sales tax). I have income which is not amenable to being sheltered,. Your figures are delusional.

The top 400 earners, for instance? Their effective tax rate was 17%, considerably lower than in 1995 and 2002.

So you are 100% incorrect. Even on an after-tax basis, the disparity from top to bottom is greater than in France in 1830.

Did those european peasants get a welfare state and other social benefits?

mmckinl:

Yes, we need to raise taxes on the top to manage this current crisis, through debt destruction and the re-balancing of income distributions, but not necessarily through raising top marginal rates on the top 5% to .5% of the income distribution, (aside from the fact that replacing a progressive income tax with a progressive consumption tax would be a good idea). For one thing, incomes vary from year to year, so it wouldn’t necessarily be capturing the same “miscreants”, and, for another, we wouldn’t want to discourage the shifting of professional labor though muting income effects, as with, e.g., lawyers and MBAs shifting from writing CDOs to dealing with bankruptcy issues.

One of the proposals that I’ve been trying to flog, as essential to a functionally efficient address to the crisis, is a surtax, for as long as needed, on the wealth/net worth of millionaire households, (starting at, say, .5% at $1 million and rising to say 3% at $100 million, with carve-outs up to a point for retirees and the invested or re-invested capital of small businessmen). That would have claw-back effects from those who profited from the financial bubble and the exorbitant prior tax cuts for the high income and wealthy, which is the right incidence and would go some way toward satisfying popular concerns for equity and revenge among the torches-and-pitchforks crowd. But my main concern is with managing the decline of the U.S.$ in orderly fashion, in the light of the huge public debt that will be incurred through fiscal stimulus efforts, cleaning up the financial mess, and debt reductions for the household sector, all of which would be required for any prospect of economic recovery. The tax would at once partly compensate for the increasing level of debt, but more importantly, signal foreigners, from whom we’ll be de facto borrowing, of our “seriousness” in addressing our fiscal woes, thereby forestalling a dollar rout. At peek U.S. asset wealth was about $58 trillion. If that falls by $8 trillion for housing and $10 trillion for stocks, then that leaves $40 trillion. If 40% of that is held by millionaire households, and the tax averages a 1% yield, that would be $160 billion per year, (without any dynamic scoring), which would yield, say, $1.6 trillion over 10 years.

It would be argued to the contrary, that the effect of such a tax would be to marginally lower the price of financial assets. But that is precisely a desirable effect of the tax, in my book, since we want to discourage short-run financial speculation in favor of long-run, high cost, uncertain real productive capital investment, and lowering the attractiveness of speculation on increased prices of financial assets would increase the relative attractiveness of real productive investment, (in which profits, er, might actually be earned). Further, we want to decrease the size of the financial sector, which means that new sectors for real investment must be found to effect such a structural shift. But also lower prices on financial assets also mean higher yields on them, (at least, once real business profits recover), which should encourage and reward the rebuilding of savings amongst the broader society, at the expense of excess “incentives” for the wealthy.

Now, rather than engaging the the fallacies of ideologues and of neo-classical “growth” theory, what we need to do, breaking a further ideological taboo, is to begin to debate and discuss industrial policy, since we’ll need such public guidance and support both to re-industrialize to address the trade deficit through increased export/decreased imports, and to assist in the discovery of new avenues and innovative sectors for real productive capital investment, since “fiscal policy” and government spending will do preciously little good, if it doesn’t assist in the structural adjustment of the real productive economy. On the contrary, given the fallacies of “New Keynesian” GE theory and its easy assumptions about restoring the “output gap”, (when the dynamic conditions of both production and demand have been altered from the previous “equilibrium”), if “fiscal stimulus” is just “designed” to restore prior conditions of consumption-and-debt based demand, then it will fail in its attempt to restore the status quo ante, and just increase the muddle and the mess.

I don’t know about France, but England had a system of Poor Laws dating back to the Tudors that was formalized under Queen Elizabeth. They were funded via local property taxes.

In France, I would guess charity was dispensed via the Catholic Church rather than through the state or local nobility. That would have been swept aside in Revolutionary France. I can poke around a bit, but anyone who knows what system would have been in place in 1830 (one of Napolean’s biggest accomplishments was the establishment of an effective bureaucracy, which was kept in place during the Bourbon Restoration) is encouraged to comment.

Did those european peasants get a welfare state and other social benefits?

Yeah, the option of living on the dole, and having public indoctrination centers to send their kids to, means today’s workers are *totally* compensated for 30%+ tax rates.

Yves said; “Huge concentrations of wealth, falling income mobility, and stagnant average worker incomes belie that. There has been an order of magnitude increase in “sharpen the guillotine” type comments here as it is also revealed that some of the gains at the top were not won fairly (as in, how real were those boom year Wall Street earnings? William Black, a FDIC official who was on to Charles Keating early, contends that the accounting fraud in financial services is at Enron levels).”

The “sharpen the guillotine” type comments go well beyond decrying the unfairness in just the financial services sector. The rapidly growing disenchantment is with the entire scam ‘rule of law’ and all of the aggregate generational corruption that is embodied in it. The playing field is at a ninety degree angle, free markets and freedom are a fantasy. Bought and paid for corruption and its resultant protectionism are the order of the day.

Yves said further; “That’s why people are angry. It isn’t just that the rich are rich. People still admire folks like Warren Buffett and Bill Gates who built large, successful enterprises. It’s folks like CEOs who inherited successful businesses and extract rents that appear unjustified that are the source of resentment.”

I think you might want to ask around about admiration for Gates and Buffet. There is a sea change taking place based on the above mentioned aggregate corruption and the fact that people are getting on to it. I personally think that Buffet and Gates are scum bags. They of all people are fully aware of the tremendous advantages that they operate under. Especially Buffet, who made his early fortune as a drug dealer invested in cigarettes. He even bragged about the investment value of cigarettes — they cost “a penny” to make and were “addictive”. If you want a perfect example of aggregate generational corruption in the scam rule of law look at how alcohol and tobacco, which kill over 500,000 scamericans a year, became the state drugs (makes 9/11 look like Mr Rogers). And look at the graft and corruption that perpetuate the status of alcohol and tobacco today and by extension fuel the prison industry by jailing all of those hundreds of thousands who use competitive products.

Deception is the strongest political force on the planet.

i on the ball patriot

i on the ball,

I don’t disagree as Buffett has chosen to cash in on his good guy image. I would not invest in a cigarette business, personally, but a lot of capitalism is based on creating addictions or phony needs, Some types of business are more dubious than others, but it is hard to find lines of work that are truly honorable in our system. So the question becomes not one of black or white but where in the grey you choose to draw the line,

One can contend that his conduct of the last few years has been more openly self serving than before. But that does not detract from his earlier accomplishments. It may speak to the fact Lord Acton’s observation that power corrupts, and money is power.

Personally, I think Microsoft is a bad monopolist and produces crappy products, and the company has long been a bare-knuckle competitor. I would never buy its stock on general principles, but a lot of people still see Gates as admirable. I’m speaking to the zeitgeist.

You are correct, however, that perceptions are changing now that people are starting to look harder as to how successes were achieved.

The point is that when the people who are living in European now are taxed, they get welfare benefits, but those peasants do not.