Martin Wolf, in today’s Financial Times, argues that the eurozone has done wonders for Germany by allowing it to keep the value of its currency down. With Germany’s persistent, large trade surpluses, the value of the deutschemark would eventually have risen, dampening Germany’s trade surpluses and forcing it either to accept a higher level of domestic consumption or greater unemployment.

This picture runs at odds against the stereotype of German industry, that its success is due to high levels of investment, attention to quality, a good workforce, etc. While all these things are no less true, consider: how would German businessmen have reacted if a German currency appreciated and stayed at a high level? They’d presumably shift operations to lower cost centers and reduce their level of domestic investment. They might also might be less keen to support high levels of infrastructure spending, since their operations would now make less use of it. And they might push for lower taxes to compensate for margin pressures at home.

In other words, they might adopt some of the bad behaviors of American executives.

From Wolf:

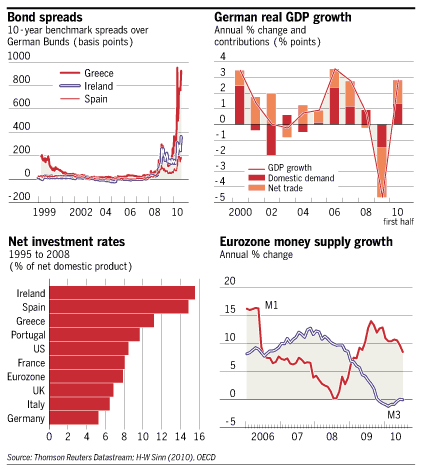

So why….should Germans accept that they have an overwhelming interest in the success of the eurozone? The immediate answer is that the economy is hugely dependent on exports for demand (see chart). From 2000 to 2008 external demand generated as much as two-thirds of the growth in overall demand for German output. Germany needs both captive markets and a competitive exchange rate. The eurozone has delivered both, to an inordinate degree: the crisis in the periphery has dragged down the value of the euro; and many of Germany’s eurozone partners (who absorb two-fifths of its exports – nine times as much as China) are uncompetitive, after a decade of rising relative costs.

{click to enlarge]

More important, imagine what would have happened, in the absence of the euro. The exchange rate of the D-Mark would have exploded upwards, as currency crises savaged the European economy, as happened in the 1990s. In peripheral Europe, currency depreciations would have been at least as big as, if not bigger than, sterling’s. The absence of such shocks has greatly enhanced the prospects for the German recovery. The creation of the eurozone was, for this reason alone, much more than a favour Germany did for its partners. It was also a big economic (not to mention political) gain for Germany. German industrialists are clear on this, as is the government.

Note how a cheap currency supports activities that look virtuous – high savings, investment in capital – but require other parties to run trade deficits (which implies they import capital, which usually means borrow) and consume. Mercantilism is a great model until your trade partners wake up and realize the real costs. As Niall Ferguson points out, “China gets 10pc growth: the US gets 10pc unemployment. That doesn’t seem the basis for a happy marriage.” And partners that can’t divorce often wind up making life miserable for each other.

ignoring the eurozone for s second the dialectic between china and the U.S is false. china’s mercantilism would be great for the united states if we took our ability to work less for more goods and services as a benefit (lower taxes/higher government spending) rather then as a terrible problem (high unemployment/capacity underutilization). a government that understood our monetary system would benefit greatly from china’s willingness to hand over goods and services and could lead the united states into one of the most prosperous periods in it’s history. unfortunately this is not the case.

Interesting thought! Along these lines, if Americans had more vacation time and spend more on leisure and vacations rather than manufactured goods (which we do not need, our garages are full!) and housing (mercy! we have more rooms that we can use or maintain in good repair) and if the governments reduced military spending and taxes, the US economy would be rejuvenated. Well, we would be a bit more like Germany, perhaps…

Being a citizen of California, I find that the overall taxation rate for the middle class is really high. About half my salary goes to taxes and contributions (health and retirement). In a country like Germany, taxes and “social security” contributions are also high, but not nearly as high as Americans think. This would be a good topic for someone to research.

Tom Walker, Sandwichman, has made the same argumnet numerous times on fewer hours worked for same wages. If you study Chapman, I believe you will find a sound argument in favor of such.

More likely they would heavily intervene in the FX markets, like Japan. The US is pretty much the only country that can consistently run up huge account imbalances and is geared for high consumption share/GDP.

Not so black, not so white: there are a whole range of greys describing reality.

Germany’s profiting from a fixed exchange rate *now*. But they have had an overvalued real exchange rate for nearly a decade. This was the cause for Germany’s sluggish growth, low investment, etc. They needed a painful internal devaluation to get at their current advantage.

On the other hand, there are many advantages to having a hard currency for Europe’s periphery: low interest rates, low inflation, etc. You could argue some countries on Europe’s periphery should have waited before jumping into the euro (e.g. Portugal and Greece didn’t trade so much with the rest of Europe as optimally), but don’t ignore the long-term effects of having a soft currency vs. a hard currency.

Diego,

How do you figure that the Deutsche Mark was overvalued for a decade? If German exports continually outpace consumption of foreign imports then the currency will rise, but this does not make it overvalued. This simply reflects that Germans do not want foreign currencies because they don’t consume as much foreign goods but foreigners do want German currency to consume more German produced goods. Over time the movement of freely floating exchange rates acts as an important stabilizer that prevents the buildup of unsustainable long term trade imbalances.

The countries on the periphery need easy money. A “hard currency” was not in their best interest when it let them borrow and spend more than they would have been capable of had they had their own currencies and it is not in their best interest now that they cannot use monetary policy and devaluation to get out of their current bind.

Paul,

I meant Germany’s *real* exchange rate was overvalued, i.e. German prices and salaries were too high (in euros) when they entered the euro. It took them nearly a decade of wage restraint and zero inflation to get at their current, competitive price level (which is still higher than on Europe’s periphery, but the German economy is based on higher-value-added industries).

Why do I figure out this? Well, it was the explanation given in every article (whether in German or in English) on the German economy released from 1998 ’til 2005.

As long as the wages remain constrained ( process under

huge discussuin right now in Germany ) by the Schröder

reforms and his follower, one cannot really expect a huge

consensus about the E.U about M.Wolf’s credo:’Germans must lean to love the eurozone’.

G.Davies had a few remarks before the trade unions started

recently the round of negotiations on wages

http://blogs.ft.com/gavyndavies/2010/08/31/the-part-time-german-jobs-miracle/

This paper also was an eye-opener: ‘Germany’s super competitiveness: A helping hand from Eastern Europe’

http://voxeu.org/index.php?q=node/5212

This is no joke: When Clinton let the dollar plummet in the mid-1990s through the policy of “benign neglect,” Japanese industry began (or at least sharply accelerated) its pace of hollowing out — specifically, by moving production of lower value-added goods to China. That is a big part of the explanation for the China boom. Germany, with “captive” export markets in the eurozone and in Eastern Europe has not had the same problem to contend with.

The EU, has indeed fallen to internal colonialism of sorts. And Germany is the main metropolitan agent in this process (not the only one anyhow).

In South Europe the euro has basically caused hidden hyper-inflation (I get flippant each time I translate the price of things to pesetas) because prices converged to NW European standards. It is such inflated cost of life what causes low competitivity because salaries cannot be reduced effectively without reducing living costs. With very limited welfare state policies, housing and other basic costs of life for workers are insultingly high, what makes simply impossible to reduce salaries without destroying the social fabric totally.

In practice the NW European states are subsidizing the costs of labor by paying for at least an important part of housing and other basic expenses. In order to have fair play, the public housing system and other welfare (labor subsidies) should be extended to all EU methodically, and specially in the Eurozone. Additionally, of course, Germany and other NW countries have a technological/educative/cultural advantage (for instance a more civic-responsible attitude by citizens or a more effective research policies by the governments) but this is only part of the whole issue.

The core issue is that, as “neocolonies” become more and more independent and also as Capital becomes more purely international, the “first world” countries/blocs are largely forced to “internal colonialism”, specially in the context of the current major crisis, if they want capitalists to keep their profit level, which is a priority for their ruling elites. In the case of EU this adopts the form of draconian budgetary and normative measures, that can only serve to dump the working class (and even the middle class) into increased misery, so they have to sell themselves cheaper. But fails to address the central problem of the cost of life, which is a red line under which salaries cannot descend much.

In this sense, a greater deprecation of the euro would be desirable within the limitations of the system, so companies can export more and even sell more inside EU without worrying so much about foreign competence. But this would also cause a dump of living standards. A better alternative would surely be to invest public money in lowering housing costs and in general basic costs of life, making. But this would mean to more intensively tax profits and wealth, what seems relatively difficult under the elusive international statute of Big Money.

So the only realistic alternative is a socialist Europe.

Whilst I completely support Germany´s membership of the Euro for historic and political reasons, I do believe I believe Mr. Wolf´s analysis to be seriously flawed on several fronts:

The time frame that Mr Wolf chose for his analysis falls squarely into the period where costs due to German reunification(€1.3-1.6 trn[if you want a frame of reference: this is just shy of Germany´s current gvnt. debt of approx. €1.8 trn]) had their major impact, it is therefore highly questionable, in how far the currency union is the main explanatory factor for Germany´s evonomic performance in that period of time.

Comparing unemployment and exchange rates of the DM, for prior periods, not influenced by these special circumstances, does not necessarily lead to the conclusion, that (at the time West-) Germany´s economy was incapable of dealing with revaluations of 30-40% as implied by the current gains in cost per unit of output in relation to other Euro countries.

In dollar terms the secular trend was 4.22DM/USD to a low of 1.443DM/USD compared to other European countries the secular trend is even more pronounced: 11.74DM/GBP to a low of 2.26DM/GBP.

Considering a shorter time frame: there were a couple of periods(equivalent to the age of the Euro), where revaluations greater than what is implied by current cost advantages happend, without Germany´s economy collapsing or even showing higher unemployment rates today´s(1969-1979: 3.92USD vs 1.83USD/DM; 1985-1995: 2.94USD vs 1.43USD/DM[the comparison is even more stark with relation to GBP]).

The second issue I have with M. Wolf´s article and especially your comments is the assertion, that “Germany” has benefited and that matters would be a lot worse without the Euro. Who has actually benefited from this arrangement? It definetely was not the median German.

The implicit bargain in Germany before reunification and before the Euro was, that employees would not upset the system by restraining their demands what wage increases were concerned, hereby enableing gains in competitiveness and gaining additional purchasing power through revaluation. After the introducion of the Euro, the second half of the equation no longer worked, without the first part changing.

I´ve been living in Germany for a long time and I can see the difference to my patrie. In France we have always demanded the share that is due to us a equal citizens. Right now my compatriots are bringing public life to a standstill for an increase in the working age from 60 to 62 and I absolutely love the democratic spirit that this is based on! In Germany however, the past 10-15 years have been spent worrying about how to compete with China(without a major shift in the exchange rates) and from what I can see it seems to have had some results what more sophisticated products are concerned. I am not saying, that one way is better(french/german) or worse, what I am saying is that my average compatriots are currently better off than the Germans despite the fact that “Germany” is apparently profiting all that much.

Given that Mr. Wolf probably hasn´t really spent any time major time in Germany, I do understand, that he, given the macro numbers, assumes, that all is well in Germany.

I am however astonished, that you, Yves, whilst worrying so much about the American economy(which seems in at least fair health, what headline numbers are concerned) only because of unemployment statistics, mindlessly repeat the most neoconservative articles purely due to the fact, that you don´t know(don´t care?) about the circumstances of the average person in countries other than the US.

Pierre, Cologne.

AFAIC Wolf is an idiot… no idea why you repeatedly front page his opinions. His track record on everything EU is worse then Greenspan on the mortgage bond meltdown: Wolf has been wrong about everything.

Wolf falls into the disreputable category you describe today in your: Summer Rerun: Why the Happy Talk About the Credit Crisis? He’s the Glenn Beck equivalent of economic punditry.

Wolf pointed out that equities around the globe were substantially overvalued in March 2007. Tell me who else then got that one right. Answer: not many, particularly among economists (as opposed to fund managers). He’s also been acute on the subject of bank regulation.

And tell me how he is wrong on Europe? He’s been warning that they need to do something about internal rebalancing. That’s actually not terribly controversial (except politically) yet it seems to annoy you quite a good deal.

And periphery country bond yields also seem to be agreeing with Wolf.

I know of few economists whose integrity and insights differentiate their behavior from snow particles attaching themselves to a snowball rolling downhill. This citation, AFAIC, is unremarkable: it was common sense.

So I sit corrected: Wolf was/is not *always* wrong.

He’s also been acute on the subject of bank regulation.

Geez… for a sector (banking) which has not only been unprofessional (criminal IMO), while taking huge fees from $$ pools for which they were *custodians* but acted like owners, while simeoultaneously bankrupting their customers/investors while ignoring their primary role…

Personally, I’m not terrible impressed by someone of Wolf’s visibility being “acute” in advocating some bank regulation. Really… this guys is best known columnist in Britain’s most read financial publication. Bank regulations, which really haven’t manifested in any meaningful way, don’t even begin to examine foibles of banking this decade.

Rebalancing… ahhh.

This article is a subset of that. And it’s really quite absurd, if one thinks about it. For one thing, Germany thrived long before Euro’s recent tumble… how does his theory explain that?

But to answer your question: how has he been wrong on Europe? A: he’s been among vociferous voices predicting manifest failure of EU, for some years now. Personally, that whole crowd lost me long ago.

And about his “rebalancing” thingie annoying me, well… yes, he does annoy me. For about a minute whenever I read his screeds, then move on.

But in general, well distributed pundits… experts of economy, who pontificate authoritatively on the crisis, problems, etc. while offering near nothing of common sense… they do, indeed, annoy me.

And FWIW, I’d recomend you give up the amateur psychoanalysis Yves. On this particular accessment, evidence strongly indicates it’s not your strength.

And regarding your intro to article:

So, let’s see… Germany had

a)

b) hi investment levels,

c) best trained workforce,

d) highest quality manufacturing on planet

… and you say ok, let’s forget all that and do a thought experiment: what if German currency appreciated like it did during EURO growth years, then what?

And this is useful how? I mean, what problem is identified or proferred solutions by this little rubic’s cube experiment?

You’d do well to focus a little harder on the a) – d) issues you blow off, and perhaps get a handle on just what are the cause & affects of those economic virtues on Germany’s success.

You & Wolf have oft played this experiment, and it does (for a minute) annoy me.

Have a good day.

I find it fascinating that you take pot shots at Wolf when it appears you have read at most headlines of his columns.

On regulation, he’s made numerous SPECIFIC proposals and also spoken re implementation issues. Oh, but you just treat him as pro regulation, a caricature.

On Germany, Wolf and this blog have discussed more than once that Germany runs a big surplus WITHIN THE EUROZONE and that Germany needs to readjust if it wants the PIIGS not to accumulate debts. Germany (and China) want to have their cake and eat it too. They want to run sustained large trade surpluses and not wind up lending to their trade partners. That’s simply not possible.

So your thought experiment re the euro is simply not germane to a major portion of Germany’s surplus.

Boring America no1 we do no wrong jingoism.

Dont ask yourself what other countries can do for you, ask yourself what your country can do for others. Hehe, Kennedys rethoric was great.

Really stop to work from this America is always right framework. Ask yourself, what can you do to clean up the crap you vomited all over the world, including Germany. For the help of others, ask nice, dont be so arrogant to claim the morale highground while demanding sacrifices from others, others that are often far worse off to deal with American problems while they have to deal with huge problems at home, many of them US made. Funny how the washington consensus is suddenly all wrong and hyperkeynsianism is all right when America wants an easy painfree answer to her own problems.

Did you even read the post? Where is the US jingoism from a British economist in an article that makes no mention of the US?

And how exactly is this article calling for sacrifice? It’s telling Germany to consume more, which means be more hedonistic, at least in some people’s eyes.