Perry Mehrling is a professor of economics at Barnard College

The Financial Times devoted an entire article this week to the fact that foreign banks borrowed more than half the funds deployed under the Federal Reserve’s first emergency program, the Term Auction Facility.

Why is this a surprise?

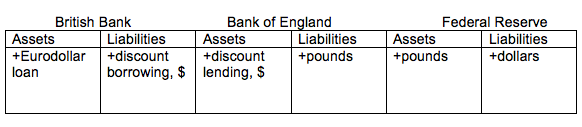

We know that, after the collapse of Lehman and AIG in September 2008, the Fed’s liquidity swap facility with other central banks swelled quickly to about $600 billion. The whole point of that facility was to provide dollar funding to non-US banks. The foreign central banks simply served to channel the funds.

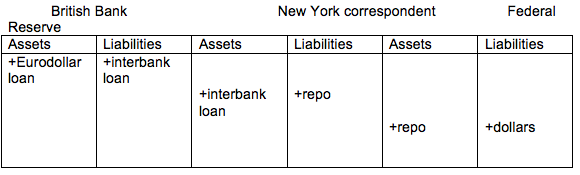

We also know that, as early as Fall 2007, non-US banks were bidding strongly for dollar funding in the Eurodollar market, driving the spread between LIBOR and the Fed Funds rate to unprecedented levels. The non-US banks, just like the US banks, had made lending dollar funding commitments that were being called in, and they were scrambling to find the funds. At this stage, however, the source of the funds was their US correspondents, not the Fed.

In Fall 2007, the Fed was not lending much, but it was encouraging the lending by backstopping the Fed Funds market, driving the target Fed Funds rate down from 5% to 2%, using daily intervention in the Treasury repo market to keep the Fed Funds rate from being bid up along with the Eurodollar rate.

Now comes the news that the Term Auction Facility, created in December 2007 as a kind of anonymous discount window, lent on a fully collateralized basis directly to non-US banks. Personally, I did not know this until the disclosure, but I am not surprised. I had thought that TAF was lending only to the New York correspondents, who were marking it up and on-lending the money to the non-US banks. So it was new information for me, but not surprising information.

In other words, anyone who was paying attention knew quite well that the Fed was lending indirectly to non-US banks, using domestic banks and then foreign central banks as conduits. It could hardly be otherwise. The Fed is lender of last resort for the domestic dollar funding markets; inevitably it serves also as lender of last resort to the international dollar funding market.

Critics will probably contend that the Fed has taken an unduly expansive view of its role. They might do well to ascertain how far the central bank sees its responsibility for dollar markets extending and how it reconciles that with acting as the primarily regulator only of domestic banks.

misses the operational point

TAF was for domestic domicles of foreign banks

Swaps were for foreign domiciles via foreign central banks

Anon, you are correct, but also consider the counterparty risk facing the Fed. By moving from TAF to swaps they transform foreign bank risk into sovereign central bank exposure.

….I believe foreign banks with domestic shops don’t all operate under one roof, so to speak…their operations/finances are categorized separately and thus risk of foreign bank failure would not have directly affected the Federal reserve, though I’m no law expert.

Though I’m not certain why you bring up counterparty risk at all when, as anon pointed out, we’re talking about operationally different things.

Economic Nationalism is like any other outlaw viewpoint. Any hint you hold it will bring the harpies to the fore. However…

The Fed has always been presented as the US central bank. Partly optics, but mostly to keep government support without too much bribery, the story is usually maintained. This isn’t helped by learning it’s become the world central bank. Shades of the 1890’s Populist international banking cabal. Or has that resurfaced?

If the dollar goes tits up, the foreigners will lose a bit of skin, but not nearly so much as those of us who have our paychecks, bank accounts, savings bonds, and loose change in the dollar. And it’s a heck of surprise they took these loans at zero risk. Doesn’t anyone here know how to play this game?

Borders matter, since it is unreasonable to expect people beyond the borders to care much about the locals. The real world isn’t Star Trek. Whether from self interest or genuine concern, a government will pay most attention to those they govern. And that includes, most definitely and most widely, economics.

However, this is the philosophy that dare not speak its name. Whatever Lou Dobbs did or did not say about Mexicans in this country, his main crime was writing the books Exporting America: Why Corporate Greed is Shipping American Jobs Overseas and War on the Middle Class: How the Government, Big Business, and Special Interest Groups Are Waging War on the American Dream and How to Fight Back. Crazy talk like that will get you jumped in the alleys of the traditional media. The racist slur is to the left what the porn slur is to the right. But pointing out, publicly, that others were battening on an economy they didn’t build, only visited, was dressing in a big bulls eye.

The foreign elites care nothing for the American Citizen. If anyone is going to care, it will have to be us.

In the end, whether it’s border-determined industrial or financial policy, it seems to work for everyone else except us.

Yves: Since I’ve been paying attention to realpolitik for so damn many years and I dig the raw simplicity of the word, may I humbly suggest a new word for our lexicon; namely, the word “REALECONOMIK”. What’s your take? Your above article regarding the same old machinations of the Fed and European financial bank systems(the Fed’s genesis was deeply affected by Europe) begs the word.

ok porn is utterly disgusting y did i open my eyes!

Great post, again, Yves. I notice now it’s Perry Mehrling, who’s written the post. Thanks Perry for the the thought-provoking points.

No I don’t think anyone should be surprised by this. I am surprised it wasn’t obvious, but then again context colors perspective/perception. What has surprised me in this context refers to your final statement:

“Critics will probably contend that the Fed has taken an unduly expansive view of its role. They might do well to ascertain how far the central bank sees its responsibility for dollar markets extending and how it reconciles that with acting as the primarily regulator only of domestic banks.” — Perry Mehrling

It surprised me when the Bernank basically said on 60 Minutes that his fiduciary responsibility was to the short term interest of America. He said it not in so many words – but it shocked me nonetheless. I would say also it brings into question the idea behind QE2 et al : that the Bernank is only responsible for the stability and soundness of the US banking system. If that were the case, then what was this stuff before? and since we now know what was the case – perhaps it’s time to rethink the excuses, I mean justifications for the behavior now.

QE+ seems to be the last roundup for those who didn’t catch the after-party the first time…ie. those not sophisticated enough to recognize the whole thing was coming down.

…Very thought-provoking indeed.