Yves here. As we noted in January,

Treasury Secretary Timothy Geithner is trying to duck the assignment given the Financial Stability Oversight Council under the Dodd Frank legislation, namely, that of identifying “systemically important” financial institutions….The Treasury devised a list of banks it subjected to stress tests; conceptually, how is this process any different?

I’m pleased to see four professors from New York University’s Stern School take up this task. And they end their analysis with a rebuke:

This is the easy part for the Financial Security Oversight Council. The tough part is to then design efficient regulation that discourages the build up of excessive risk.

By Viral Acharya, Thomas F. Cooley, Robert Engle, and Matthew Richardson. Cross posted from VoxEU.

As part of the US policy response to the global crisis, the Dodd-Frank Financial Reform Act calls for regulators to identify systemically risky financial firms – the sort that took the US financial crisis global. But how to identify these firms remains unclear. Some claim the task is impossible. This column begs to differ and names the 10 most systemically risky financial firms in the US.

The Financial Stability Oversight Council is beginning to confront its various mandates under the Dodd-Frank Financial Reform Act. These include implementation of the Volcker Rule, the establishment of concentration limits for financial firms, and the procedures for designating systemically risky financial “utilities” (Acharya et al 2010). While all of these steps may enhance financial stability, arguably the most important step is the identification of systemically risky firms. After all, the market failure of the financial crisis was that firms created massive amounts of systemic risk without “paying” for it.

It was somewhat disconcerting that Treasury Secretary Timothy Geithner, who is the Chairman of the Financial Stability Oversight Council, believes “creating effective, purely objective criteria for evaluating systemic risk is not possible” (Nicholson 2011).

This simply isn’t true. And, the Council’s initial proposals miss what is the critical element in such risk assessment, which is the extent of correlation between the risk of a firm and the whole financial sector. Their primary focus on firm size and firm capital (based on current risk assessments) misses this entirely.

Objective criteria can identify the majority of systemically risky firms and their contribution to risk. And if a few are missed, the Council can add to the mix using more subjective information.

Lessons from September 2008

While the financial crisis started in the summer of 2007, it was not until the early autumn of 2008 that systemic risk fully emerged. Around this time, Fannie Mae, Freddie Mac, Lehman Brothers, AIG, Wachovia, Washington Mutual, and effectively Merrill Lynch and Citigroup, all failed. An important insight is that this risk was due not just to these failed financial firms, but also to other large banks, investment banks, and insurance companies that were struggling. In a financial crisis, it is the capital shortfall in the system as a whole that causes financial markets to freeze with devastating follow-on effects for the real economy.

And after the capital shortfall in late 2008, over the next 3-4 months, the economy fell off a cliff. Stock markets worldwide fell between 40%-50%, GDP dropped 3% in developed nations and international trade fell 10%. The link between the financial sector’s undercapitalisation and economic collapse is unmistakable. For that reason alone it is imperative to measure the build-up of systemic risk.

The first step then is to be clear about what constitutes systemic risk. A natural assumption is that systemic risk emerges when the aggregate financial sector falls short of capital, and that the costs of this risk increase with the magnitude of the shortfall. Given this assumption, everything follows. Economic theory provides a precise measure of systemic risk for a financial firm (see for example Acharya 2010a, 2010b). It consists of two parts. First, the costs to society of a systemic crisis measured per dollar of capital shortage in entire financial sector, times a second part which is the firm’s anticipated contribution to the capital shortage in that sector.

The first term – expected systemic costs – is difficult to measure precisely, but it is the same for all firms, so it has no impact on which firms are systemic on a relative basis. The second term, formulated as the anticipated percentage contribution of the institution to costs incurred in a financial sector collapse, is clearly measurable.

With our colleagues at the NYU Stern School of Business, we have done just that using publicly available stock return and balance-sheet data for financial firms in the US. We are currently in the process of expanding our work to European and Australasian firms. The analysis is provided as the measure SRISK% (% contribution to systemic risk) on the NYU Stern Systemic Risk Rankings page here.

This calculation takes three steps.

First, it estimates the daily drop in equity value of this firm that would be expected if the aggregate market falls more than 2%. This is called Marginal Expected Shortfall (MES). The measure incorporates the volatility of the firm and its correlation with the market, as well as its performance in extremes. These are estimated using asymmetric volatility, correlation and copula methods similar to those in other sections of VLAB (for econometric details see Brownlees and Engle 2010).

In a second step this is extrapolated to a financial crisis which involves a much greater fall (eg, 40%) over a much greater time period (six months).

Finally, equity losses expected in a crisis are combined with a measure of the financial firm’s leverage (LVG), measured using current equity market value and outstanding measures of debt, to determine how much capital would be needed in such a crisis. A firm is assumed to require at least 8% capital relative to its asset value.

Then, the Systemic Risk Contribution, SRISK%, is the percentage of financial sector capital shortfall that would be experienced by this firm in the event of a crisis. Firms with a high percentage of capital shortfall in a crisis are not only the biggest losers in a crisis but also are the firms that create or extend the crisis. This SRISK% is the NYU Stern Systemic Risk Ranking of the US Financial sector.

As an illustration, applying these methods in July 2007, of the top 10 systemic firms, Citigroup, Merrill Lynch, Freddie Mac, Lehman Brothers, Fannie Mae and Bear Stearns all show up. By March 08, AIG, Bank of America and Wachovia enter into the top 10 rankings. Currently, the biggest contributor to risk by a wide margin is Bank of America and the top five riskiest firms account for over 70% of the risk.

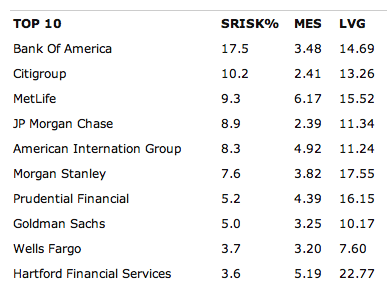

As another illustration, we report below the top 10 systemically important financial institutions, as per SRISK%, using our analysis up to the week of 20 February 2011. Just five institutions are anticipated to contribute to up to 55% of the financial sector’s under-capitalisation in case of a market-wide crash, with Bank of America alone contributing 17.5%, not just because of its size but also due its high correlation with the market and relatively high leverage (contrast, say to JPMorgan Chase). Several nation-wide insurance firms show up as significant contributors as well. And, Citigroup and AIG still rank at number two and five, respectively, even though their immediate problems may have been resolved through government backstops.

Figure 1. Systemic risk top ten (as of 20 February 2011)

Words of caution

There is no doubt that relying only on publicly available data has issues. The financial crisis is the poster child for manipulation of leverage numbers. But these statistics can be supplemented with a more thorough micro analysis of each financial firm by regulators using confidential information and all the tools at their disposal. The Council cannot argue this is beyond their capabilities because, in fact, the US government already did this for 20 financial firms in 2009 when they conducted the highly regarded stress tests of these firms. These stress tests were completely analogous to the above measure of systemic risk, and to our statistical calculations mentioned above. Our statistics align well with the government’s stress tests (see Acharya 2010a).

The advantage of objective criteria based on traded market data is that it is very difficult for financial firms to manipulate these numbers. The statistical methods can provide estimates in real time. As a check, and also as a more careful update, periodic stress tests can be performed which provide alternative estimates of the exact same systemic risk measure. And the newly legislated Office of Financial Research can collect exclusive regulatory data on inter-connections of financial firms to augment such estimates. It is important that firms that want to avoid systemic prudential regulation have clear paths to follow. They can de-lever, de-merge, and decline the bets of the rest of the sector.

This is the easy part for the Financial Security Oversight Council. The tough part is to then design efficient regulation that discourages the build up of excessive risk.

Oh, if we only had the public will.

Of course the easy part will not get done so that the difficult will be avoided.

Nice work though. Proof that the emperor and such truly have no clothes.

Any numbers of what the SRisk% of the big firms that failed were prior to the crash…be nice to compare them

I really like their methodology and the way it rigorously isolates the risk factors.

However, the names on the list are no surprise for the most part.

You have the 4 megabanks – C, BAC, JPM, WFC. You have the two remaining investment banks turned bank holding companies – GS and MS. You have the basket case that is AIG. No surprise at all. Then you have 3 large insurers, which may surprise some, but shouldn’t given the statements during the crisis by a certain Congressman that a couple of unnamed insurers were on the brink of collapse.

The question is when will anyone in power actually DO SOMETHING about it? Companies like Citigroup are a systemic threat by ANY measure, insiders have stated that they are so large as to be literally unmanageable, and they are still to a large degree on government life support. Yet there is not even a whisper from officialdom about breakup plans.

This methodology is akin looking for keys under a lamp post even though they were lost in the dark alley.

They key part of being systemically important is that if the financial institution fails, it will affect many other financial institutions to which it is connected. Hence what is really needed is to estimate the number of such connections and their quality (i.e., how quickly they could be resolved). This is how the Lehman’s bankruptcy caused the global freeze in financial markets.

Instead, the authors suggest to identify firms that will contributed the most the aggregate decline in the equity market value of the financial sector (adjusted for leverage). How is it linked to the systemic risk, precisely?

Besides, it does not take into account non-publicly traded firms, such as hedge firms. So, LTCM was not systemically important, really? And it was much smaller than today’s mega funds.

Finally, if Goldman were go to back to the partnership model, would it cease being systemically important because now it would contribute zero to the market value of equity of the financial sector?

“Instead, the authors suggest to identify firms that will contributed the most the aggregate decline in the equity market value of the financial sector (adjusted for leverage). How is it linked to the systemic risk, precisely?Instead, the authors suggest to identify firms that will contributed the most the aggregate decline in the equity market value of the financial sector (adjusted for leverage). How is it linked to the systemic risk, precisely?”

Umm, that’s not what they’re doing at all.

They’re looking to see which firms would suffer the greatest loss in firm capital in the event of a broad-based decline in equity markets, and then adjusting that number for leverage.

The authors use the drop in the equity market cap as a proxy for the drop in capital taking into account the financial leverage – that’s what I said (or wanted to say).

It is not at all obvious how this measure is linked to the systemic importance of a financial institution, except that it captures large firm, which are indeed likely to be systemically important, but it misses other potentially important firms. Inadequate metric.

The inclusion of two major non-AIG insurers on this list is enlightening. I fear that TurboTax Timmy is so focused on protecting his friends that he is not thinking about the long-term consequences of his positions.

Looking out in the long-term, I am about 10-15 years away from retirement. I am beginning to build up a reasonable asset base with which to fund retirement. That is largely mutual funds and ETFs with major independent mutual fund and brokerage firms where the assets are held in turst with auditing.

At retirement, one of my potential income solutions is to take some percentage of my asset base and buy annuities, probably from insurance companies. However, at present I view this as riskier than holding those same funds in mututal funds because financial reporting of the entire financial industry is obviously seriously damaged and may be virtually irrelevant to understanding actual solvency risks.

If my concerns begin to spread among the general population, that could be the equivalent of a reverse bank run for many of these companies where they may not get the assets they need in the first place to run a growth business.

The Bernank and TurboTax Timmy are still viewing this as a holding rear-guard action just praying that another year or two of “stability” will carry them past the hurricane. I am not convinced that they are thinking a decade or more out.

BTW, under no circumstances would I put more than 5% of my total assets with any one insurance company, but the current financial system has me thinking that number should be closer to 2%. The list above has also told me that if I were to do it today, I would probably put some assets in the Prudential or the Hartford, but not both unless there was a real plan in place that appeared real. I am sure that this is not what their marketing departments want to hear.

Depending on your state to some limit there are state guarantee funds backing annuities. So don’t get just one from one company, but get several from different companys with the value of each less than that limit. The state funds are assesed on other insurance companies from the state. BTW note that in the Conseco case it was just the parent that got in trouble because the state regulated insurance companies had to hold the reserves, as it was in AIG’s case, the parent becuase both of its security lending and Financial products, got in trouble. As noted in All the Devils are here the insurance subsidiaries could not bail the parent out.

Could it be a case of Timmy-boy choosing to ignore his responsibility because he wants the free market to come up with their own measurements of systemic risk? In other words “hey big bank, are u systemically risky? And why aren’t u? Ok great, we like that answer. See we are doing our ‘regulatory job by asking’ but we are also keeping a hands off approach because if govt interferes, these banks might not be able to pay out billion dollar bonuses.”. I am trying to say that it’s this whole ‘let the banks/markets regulate themselves’ while maintaining the govt backstop thru these vague regulations that allow for freedom to do whatever is necessary to rescue the banks when they blow up again.

Timmy can say ‘see, the banks do better when they police themselves’.

I am giving examples of the same theme. Like the author says, it’s the same thing as the stress tests. Make it really easy to pass based upon figures provided by the banks. Then when everybody passes, say how successful everybody was, including the regulators, and continue business as usual.

This is where the DC hallucenogenic drug culture comes into play. They actually believe that the free market still exists. Timothy Leary, Philip Dick, and Eric Blair would be proud of them.

The US has been beating the drum for the past two-and-half years that all of these big institutions are systemically improtant and therefore Treasury, the Fed, and Congress will simply not allow them to fail.

The “free market” has been taking them at their word and is bidding for their shares and business accordingly.

If TurboTax Timmy wants to find out which ones the free market really thinks are systemically important, he and Big Ben need to go on TV and announce that the system is fixed and all support for these institutions is withdrawn and will not be re-instated under any circumstances and Fed funds rates will be increasing at 0.5% per month for the next six months. They will be backed up by a chorus of Tea Partiers in Congress.

That will scare the bejeezus out of the markets and we will get some interesting re-pricing of risk in certain equities that will provide him with the information he apparently desparately craves.

Except of course that they wouldn’t believe his statement that he would maintain this stance should things go bad.

At this point I don’t see the markets doing anything other than pricing in governement support until the Government behaves in a different manner in the next crisis.

Yves,

What a fantastic and timely guest post. As the “recovery” continues and finance ministers continue to preen before the media on their victory laps, it’s important to think about where we go next. If we’re to build any kind of movement, as I think you suggested a week or two ago, we have to have some concrete (and hard-ass) demands.

Why not demand the break-up of the “systemically risky” banks/firms (per this list, or Treasury’s forthcoming one) AND a steep reduction in allowable leverage? Leverage and size — these are simple to conceptualize, involve no “socialistic” policy measures, and will legitimately help to prevent the need for any future bailouts.

I’m not sure where demands for criminal prosecution fit into this picture, but they could be separate demands or joint ones. At the very least, we should be able to demand reductions in leverage and size and hold our ground on those two points.

What does this little shit Geithner do all day, anyway?

During the financial crisis, people were posting his phone logs, and these indicated he was answering his telephone switchboard faster than a high frequency trading computer makes trades.

But now that things have slowed down, he just gives meeting.

LOL! Well put.

If I had to answer, it would be “sucking up.”

Well sympathetic with the aims I think the methodology blows.

The link to the rankings page didn’t work for me, so I will second MrM’s observation that no hedge funds are listed (just because they’re black boxes doesn’t mean that they aren’t systemic) and add that no foreign banks with significant US presences and ties like HSBC and Deutsche Bank are named.

I am not sure what capital shortfall means. It sounds like liquidity but the fundamental problem in the financial sector is one of insolvency. Then there is all that about equity to outstanding debt, but we know that banks have been cooking their books. Where do all the current unrecognized losses fit into this schema? Seems like these would affect the leverage ratios in a big way. And what about derivative exposures? Netting only works if we assume everyone is solvent but we know that essentially no one is. So at most I see this as only beginning the conversation.

Whenever I see someone use stock market cap as an indicator for anything, my eyes start to glaze over.

Monitoring systematic risk sounds good as first blush, but if you exclude private firms, foreign firms that are all linked multinationally, then you quickly get to “what’s the point?”

Then you get back to if these places are made sound on a standalone basis, like fix accounting, reduce leverage, require capital to back derivative exposure, do away with silly fraudulent things like CDS alltogether, then systematic risk goes down as an outcome.

And that may mean breaking them up so they are manageable, both by management and regulators.

“This is the easy part for the Financial Security Oversight Council. The tough part is to then design efficient regulation that discourages the build up of excessive risk.”

I don’t think you need regulation for that. What you need is to allow the free market system to function. When you look at many of the economic problems the US is facing today, it’s market interference that subsidized both risk and malinvestment. You don’t need to regulate risk, you need to allow risky behavior that fails to fail. Interfering in that self-regulating process only encourages the bad behavior. Not only do the responsible make less money and have a difficult time competing with the fiscally irresponsible during the “good times” but they then have to continue competing with the flawed business models once the irresponsible are bailed out.

That is true for both companies and individuals. Look at how the fiscally responsible and economic literate that didn’t buy a home during the bubble are still having to pay premiums due to price fixing and the artificial manipulation of both supply and demand variables for housing, while the irresponsible are receiving bailouts in the form of foreclosure moratoriums and reduced monthly payments.

http://www.wtffinance.com/2011/02/more-socialism-for-california-homeowners-3000-monthly-housing-allowance/

I agree with you that we need “regulation”…we just disagree with the kind of regulation we need. I believe that allowing the market to function without interfering would be self-regulatory.

What is important is to figure what parts of these TBTF systemic risk entities are actually necessary for the economy to function most efficiently along with those parts that if they stopped would collapse or seriously impair the economy. Do these parts need to be connected to the TBTF firms? Can they be separated out?

I have been reading and reading about what is wrong with the present system. It is obvious the ‘powers that be’ don’t want to fix it. They want the general populace to pay for their gambling and looting and miscalculations. It is certainly what they expect of the Irish. It is what the FED and the Treasury did in the US.

Now, tell me again, how did just one firm, Lehman almost crash the whole system and cause it to freeze up? Was it They Made It Happen On Purpose? OR was it They Let It Happen on Purpose? Was it ‘Nobody Cudda Node? Did it just happen and savvy manipulators like Paulson, who just happened to have left being the CEO of GS and moved to the Treasury just in time to engineer TARP which bailed out GS and Deutche Bank and CitiBank and …

I think Timmy speaks the truth. It is impossible to accurately identify risk when so much of the books are hidden.

Also, Any real analysis would have to conclude that the system is the systemic risk itself. It is complete risk in and of itself, so why bother?

No excuse. As regulators they should be able to get access to whatever they need.

The banks do not want any interference by the gov in their profitable endeavors. They have many tools at their disposal to thwart attempts by gov to rein them in, if and when a gov appears willing to dimiss dimwitted Timmy and his friends whose lack of will or ability assures the continuation of the existing snafu. To measure risk, every activity the bank pursues has to be on an enterprise balance sheet. The current system allowing highly leveraged special purpose entities to remain concealed from regulators legalizes fraud upon the regulators and the public. The major institutions control capital flow by controlling,for example, CDS trading by thwarting development of an open market, giving them asymmetric knowledge against their customers, and keeping capital requirements so high to participate as a dealer as to exclude any new competitors. As long as Timmy &Co. Do their bidding under the Rubinite system, the next catastrophe is probably just around the corner. The same gang of Machiavellian con men are in charge of the banks and Obama is their servant.

It would seem that independently derived data, based on the mandate of the newly enacted law can construct objective criteria. Of course, what objective means to Mr Geithner, objective to a metaphysical point of certainty on par with gravity, the 2nd law of thermo dynamics may be unobtainable, but we are talking about human behavior as a self organizing system. It is observable, measurable and a general consensus of easily verifiable premises can be set down, as the Stern Group has, in defining by what they mean by systemic risk. Mr Geithner’s impossible task would then seem to lie in the political will category. By political will, Washington DC would have to rise above the level of a well meaning social club. It seemed headed in that direction by the sweeping Democratic majorities and the willing to tackle health care in a deliberate systematic legislative process. This of course triggered the reactionary counter force of the militant right wing extremist. The republicans took the lower house away from the Democrats, who are now facing a real differentiated political opponent. Franz Neumann, in his ground breaking analysis of the Nazi State, “Behemoth” points this out clearly, and references Max Weber as well:

“sabotage of the power of parliament begins once such a body ceases as a social club. When deputies are elected from a progressive mass party and threaten to transform the legislature into an agency for profound social changes, anti parliamentary trends invariably arise in one form or another.” p. 24.

With financial regulation passed under the Dem majority including the Volker Rule, the Fed Audit, and the FinSOC, headed by Mr Geithner, there are necessary but not sufficient components to guard against predict and act upon systemic risk over capacity. Certainly, reading Yves and her caddre of critical analysts on this point, we have only some the structural changes needed in the government role of regulation, but even with that, a denial that the tools at hand are useless by the very person charged with their implementation.

Now, the Stern School group points out that this is not an impossible task. Once again, it is not political will, that is the moderate Neo-liberal incrementalist dogma. What is being said, is that to get that level of power sharing, no one is ready to trade away anything meaningful to obtain a financially stable banking system. The system is unmanageable, it is too large to measure in meaningful ways that do not stop the outright trading in markets that too much wealth and power are dependent upon. We have seen the gradualism in the civil rights struggle of African and Gay American come to a conclusion. What was traded away to get that support to overcome those who would never accede to accommodate these groups? It would seem that those objecting were pushed out the way. That is political struggle. It is not WILL, it is fighting to diminish the opposing group’s ability to function, to organize, to stop the changes. Don’t candy coat it with the “political will” bromide. Say it out loud, it is a war of annihilation against those who want sweeping meaningful wholesale change and those who will stand by their institutional power base of existing industries, such as they are, no matter the consequences, because it is rule or ruin. If they can not have the existing system exactly as it is, they will destroy anyone trying to replace it with anything, even IF it is IN the best of interests of the financial system. If there is any doubt about the irrationality of the people involved, the impossibility claim in the face of a demonstration of the capacity to act with a chance of success by the example of the Stern Business School group, should leave along with any other unwillingness to push aside the people who would self destruct and take us with them.

Systemic risk? We’re still waiting for Mary Schapiro to explain what happened in the May 6, 2010 “flash crash”.

Don’t hold your breath waiting for bureaucrats to enforce regulations even though it’s their job to do so.

The biggest systemically important financial institution at risk is the US federal government, followed by California.

It’s interesting to analyze B of A’s drivers, some of which can be made the case that they are “systemic” risks. I looked at a site, stockfront.com, to do my analysis. Specifically for Bof A, there are a bunch of drivers that pose large risks to investors: http://www.stockfront.com/trade/BAC-BANKOF-buy-sell-trade.html.

Making money from shares, property and investments can be mentally draining to many people intially because peopleare overcome by alot of jargon and it is unavoidable that he or she need to read up up extensively, especially on the forms of investments they are interested to invest in. Ultimately, individuals have much to lose in terms of money, confidence, and sometimes in drastic situations, their family and careers when their investments fail. Thus it is very important for individuals who are looking to make money from investments to be careful and take steps to make financial decisions in consideration especially in the initial stage. I’ll advise anyone who reads this to be careful in whatever financial decisions you make. Good luck, and may you be prosperous!

I think the focus for the forseeable future should be on keeping what money you have rather than trying to make any more from it. If you can’t keep ahead of even the lying gov’s value for inflation by puting your money in a saving’s account, then you know that The Man wants it all. Good luck on _that_.