Although Dave Dayen and Abigail Field have already given a well-deserved shellacking to a remarkable piece of bank PR masquerading as “insight” at Reuters, “Evidence suggests anti-foreclosure laws may backfire,” it merits longer-form treatment as a crude macedoine of anti-homeowner messaging.

The way Big Lies get sold is by dint of relentless repetition. In the wake of the heinous mortgage settlement, foreclosure fatigue has set in. A lot of policy people want to move on because the topic has no upside for them. Nothing got fixed, the negotiation process took a lot of political capital (meaning, as we pointed out, it forestalls any large national initiatives in the near-to-medium term), and Good Dems don’t want to dwell on a crass Obama sellout (not that that should be a surprise by now). But the fact that this issue, which ought to be front burner given its importance both to individuals and the economy, is being relegated to background status creates the perfect setting for hammering away at bank-friendly memes. When people are less engaged, they read stories in a cursory fashion, or just glance at the headline, and don’t bother to think whether the storyline makes sense or the claims are substantiated.

Just look at the headline: “Evidence suggests anti-foreclosure laws may backfire.” First, it says there are such things as “anti-foreclosure laws.” In fact, the laws under discussion are more accurately called “Foreclose legally, damnit” laws. Servicers and their foreclosure mill arms and legs have so flagrantly violated long-standing real estate laws in how they execute foreclosures that some states have decided to up the ante in terms of penalties to get the miscreants to cut it out. As Dayen points out:

No state law in this country disallows legal foreclosures. If the banks cannot substantiate ownership of the property, why is the finger pointed at the state laws that force that substantiation, and not the banks themselves? Nobody told them to lose ownership of mortgages, prompting them to falsify documents in an attempt to foreclose.

And how does a requirement to obey the law “backfire”? The claim is that it prevents foreclosures, and that in turn is keeping the market from “clearing.” Never mind that we found out how well Andrew Mellon’s “liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate” prescription turned out. Notice the failure to consider alternatives besides foreclosure. The story gives one example of a borrower who got a mod in Nevada, which it suggests was due the passage of a law criminalizing improper foreclosures. But this example just hangs there, while immediately preceding it is a broker complaining how they don’t have enough properties to keep bottom fishers happy, and a defense lawyer saying he sees prospective clients trying to game the law. Each of these anecdotes has colorful quotes and align with the overall narrative.

Funny how there is nary a mention of the reasons banks have for wanting to draw out foreclosures: more servicing and late fees, deferral of recognition of losses on second liens. Nor is there any mention of how, in Las Vegas, I have been told by informed insiders that there are entire blocks in affluent areas where pretty much no one has paid their mortgage in over two years as of late 2010 with nary a foreclosure notice sent. Read that date: a lot of big ticket properties were being kept in limbo before the new law was passed. Similarly, Keith Jurow wrote in February:

In November 2011, Minyanville.com posted my 30-page New York City Housing Market Report. The report included never-seen-before charts, graphs and data that revealed what has been going on there. The banks have not been foreclosing for the past three years. This started well before the robo-signing mess. On February 7, 2012 there were a total of only 242 repossessed properties on the active MLS in Queens according to foreclosure.com. This is a borough with a population of 2.2 million.

Because of this, the number of seriously delinquent properties throughout NYC has been soaring. Based on individual charts for each borough from the NY Federal Reserve Bank which I included in my report, there were roughly 80,000 properties where the mortgage had not been paid in more than 90 days as of June 2011.

He found similar patterns in Suffolk County and Connecticut.

But what does the Reuters author Tim Reid want you to believe?

At the request of Reuters, RealtyTrac compared three states where borrower protection laws had prolonged foreclosures – Florida, New Jersey and New York – with three with fewer protections and where foreclosure completion times were shorter – Arizona, California and Virginia.

In the three states with the shorter delays, the average sale price for foreclosed properties has been trending higher, suggesting a recovery that has underlying strength.

Funny, Jurow debunked that in a May piece:

We hear that California markets are showing signs of revival and that prices are rising in certain markets. Let’s see. Here are the latest figures from trulia.com.

In Los Angeles, trulia reports that the average price-per square foot for homes sold in February through April was down 9.3 percent year-over-year for 3-bedroom homes and down 8.7 percent for 2-bedroom homes.

In San Francisco, allegedly one of the hottest areas in the nation, the 3-bedroom average price-per-square-foot was down 4.7 percent year-over-year and 1-bedroom price-per-square foot was down 8.1 percent.

Price-per-square-foot statistics are the best way to compare prices because it does not matter how large the house is. Median prices are skewed by square footage as well as by the percentage of distressed properties sold.

And that recovery in Arizona? Banks are holding properties off the market:

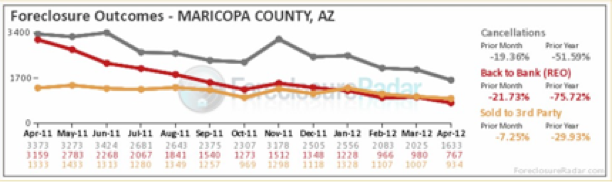

Take a good look at this revealing chart for Phoenix from foreclosureradar.com.

Bank repossessions in Maricopa County plunged from 3,159 in April 2011 to a mere 767 a year later. Clearly, the banks are gambling that this will help to stem the decline of home prices….

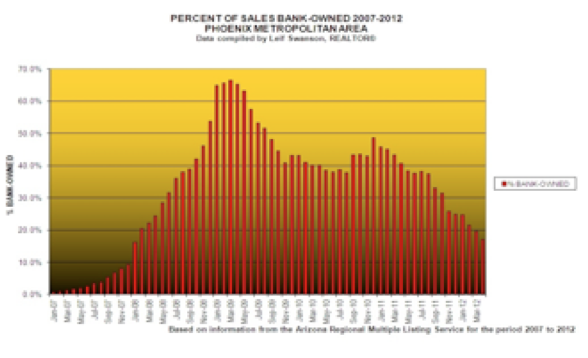

During the height of the credit crisis in early 2009, 2/3 of all homes sold in Maricopa County were repossessed properties. That percentage was down to 40 percent a year ago. Take a look at this chart from Phoenix broker Leif Swanson.

In April, only 17 percent of all homes sold in the Phoenix metro were REOs on the active MLS. Banks are hoping that this cutback of foreclosed properties for sale will steady home prices.

What about that Fed study?

A study by three Federal Reserve economists compared the foreclosure processes and outcomes for borrowers in the 20 “judicial” foreclosure states – where banks must seek court approval before they can foreclose – and the 30 “nonjudicial” ones, where such court oversight is not required…

Their conclusion? States with judicial protection over the foreclosure process or the arrears system “indiscriminately” slowed down the foreclosure process, but with no measurable benefits.

In fact, delinquent borrowers were more likely to make good on their arrears in nonjudicial states than in states where they had more time to do so. These borrowers were also just as likely to be repossessed in a judicial state than in a nonjudicial one – it just took longer.

Notice how the message is pounded in again and again: longer foreclosures are bad because they interfere with market operation. There are no offsetting considerations allowed, such as the damage to the integrity of land records in this country. (And how was this study conducted, anyhow? Did the authors adjust at all for state unemployment levels, or wage trends?)

By contrast, look at how Wall Street Examiner’s Lee Adler characterizes the situation:

Meanwhile, the mortgage servicing bankster mafiosi have figured out that by holding rather than dumping massive numbers of foreclosed properties, and even by slowing down the foreclosure process while allowing a few cramdowns in the form of short sales, the market has begun to rebound on its own. The bankster mafia know that placing massive numbers of properties on the market at once would crash the market and destroy the value of their portfolios, and essentially crash the financial system. So they have made a wise strategic decision not to self immolate.

Indeed, the Fed authors provide information that undermines their thesis:

Lauren Lambie-Hanson, one of the Federal Reserve economists, said delays in foreclosures had scared off potential buyers because prolonging the process raised doubts about how clean the title to a property was.

The “scared off” is meant to suggest that the buyers who were deterred were irrational. Hogwash. Title insurance companies have backed away from guaranteeing properties sold out of foreclosure. The truth, which the Fed economists refuse to admit, is the buyers who are concerned about title problems are clear-eyed about risk, while the economists think it’s swell to stick buyers with bum properties.

And get a load of this:

Foreclosure protection laws also probably led to an increased incidence of blight, the economists found.

Read that twice. You can’t make that sort of crap up. This claim alone makes it a candidate for the Frederic Mishkin Iceland Prize for Intellectual Integrity. (If you want to see on a textual level what a shameless piece of propaganda this article is, read Abigail Field’s shredding. She goes line by line, or at least until it becomes too painful to read it that closely.) No, it isn’t the failure of the party responsible for managing a foreclosed property, the servicer, to secure and maintain the homes, that leads to blight. No, it’s the government, erm, the law.

And that is perhaps the most remarkable bit, the failure to consider that gutting the protections to the parties to a contract undermines commerce. Borrowers in judicial foreclosure states paid higher interest rates due to the greater difficulty of foreclosure. So now they are to be denied what they paid for because the banks recklessly disregarded the procedures they set up and committed to perform? What kind of incentive system is it when we reward massive institutional failure with a bank-favoring settlement and supportive messaging from central bank economists? As Dayen stated:

So when these officials argue against laws like those in Nevada, which merely criminalize a criminal practice, or California, which provides due process for people having their homes taken from them, they’re arguing in favor of what amounts to a dissolution of justice.

Thanks Yves, one hopes the fight you’re putting up is gaining traction!

Thank you, Yves, for the record you are creating. In detailing the crimes of a corrupt regime and the breakdown of the rule of law, you are writing the history of our time.

Just so. Yves may be the “I, Claudius” of our time.

I’m A Real Estate Broker who has been reading yves for years. I won’t put a buyer in an REO and neither will a number of other agents I know.

Is it because you think a title policy won’t cover the loss if the title is challenged?

Ping, just so you know….the title officers are being indemnified by the banks. Title policies are useless for any foreclosure issue. The policies that title agencies are writing for these properties come with a long list of exemptions….and those excemptions are all the title issues left by the bank’s malfeasance.

Guy,

Both CAR & WAR (California Assoc of Realtors and Washington Association of Realtors) are attempting to side with the bankers in legislative efforts this year.

If you really believe so, please make a phone call to:

CAR 213-739-8200 They are opposing the CA Homeowner Bill of Rights legislation

WAR 1-800-562-6024 Last legislative session, the WAR legislative steering committee voted unanimously to support legislation that would have mandated the recording of all RE assignments and transfers. And while they voted for unanimous support, the lobbyist for the Realtors sat at the back of the room during the Committee hearing on the bill. So, we know whose pockets are being lined by the bankers. And this legislative session, the bankers actually asked to have the Realtors join into the backroom conversations regarding our Foreclosure legislative efforts for this session.

Please do call each of these organizations and let them know that you know what’s going on.

I would like to thank realtor Tom Stone on his honesty and integrity. We need alot more patriots like you. You sir, are a true gentleman.

Corruption fatigue, like the corruption, is everywhere and explains a great deal of what seems irrational behavior. Why so many folks are caught up in “lesser of evil” loops, for instance, when it’s plain as day there is no lesser of evil.

A lot of people I know simply block it out now. Don’t want to even think of politics except to repeat and retreat into any nonsensical mantra or sound bite that suggests safety. Telling torn and crumpled bodies of children killed by drones that Republicans would be soooo much worse if they sent the drones doesn’t make much sense on the face of it until you are absolutely exhausted by getting bombarded from all sides by the corruption and greed and war lust.

“Of course the individual mandate is great, otherwise the SCOTUS wouldn’t be trying to kill it”, (babies will die if they don’t uphold fascism), followed the next day by, “I’m amazed that Roberts finally saw the light”. Yea, absolutely amazing that a corporatist put millions of fish in a barrel for the benefit of corporate profligacy. Next stop on the privatization express; social security and Medicare. Obama should be able to work it so that “progressives” are begging to have the social safety programs handed over to the nice corporations rather than let Republicans do it.

I imagine they would have never cut down the last tree on Easter Island unless they had a system of at least two tribes.

“Obama should be able to work it so that “progressives” are begging to have the social safety programs handed over to the nice corporations rather than let Republicans do it.”

Just like they want “progressives” begging for Newt Ginrich’s minimum wage workfare jobs. It is really very hard for me to discern any “outside” to neoliberalism these days.

+10

Corruption fatigue — the shock and awe doctrine used by the TPTB to grind people into submission and servitude. You describe very well how otherwise decent people, even Christians, will come to tolerate an openly fascist, homocidal war criminal as legitimate president and conspicuously corrupt robber barons as paragons of free enterprise. There seem to be no lines Americans will not cross.

“The Banks”

I whole-heartedly agree with you! What we have to worry about is that they will not stop here and now!

The greed has not stopped; they continue to fleece the world’s institutions, citizens, and governments.

It is time to “burn the banks (not literally)”

They are plotting as we speak, to take the rest of our money.

Great piece Yves.

Many don’t remember that filing volumes were mysteriously declining before Robogate. That’s what torpedoed David J. Stern. Right before Q2 earnings — two years ago, before Robogate — Stern was telling investors in his public company, DJSP, filings were peachy. In fact, they were sharply declining, for him and everybody else.

When the real figures came out and the stock predictably tanked banks — many who owned his stock — were shocked, shocked!, to find he was operating a fraud factory, despite that he pled guilty to doing the same thing years before.

Inventory management is legal, though collusion is illegal. But whining that a regulatory regime is the cause of the behavior, rather than admitting the behavior stems from one’s own business strategy, is outright obnoxious.

Tim, the proprietor of The Fraud Factory, wants you to know he ‘does not whine!’.

lol

Nor do his bodyguards appreciate the publicity.

lol

http://escapetyranny.com/wp-content/uploads/2011/07/Tim-Geither-Beavis.jpg

The photo of Geithner in that link shows what looks like the “Rockefeller nose” — a covert DNA tell?

The shape of the nose (barring plastic surgery), and other DNA tells, are such as eye color and shape, hairline configuration at the temples, eyebrow shape and slope, etc.

We mustn’t forget how often the “maternal DNA” name is mostly “lost,” because children tend to use the name of their fathers alone.

In politically savvy Louisiana (home of “la politique de Richelieu”), one of the first questions in meeting is “What is your mother’s maiden name?” A whole discussion of genealogy going back at least three generations ensues, before any “mutually beneficial” plans can be made.

In Louisiana, you are “positioned” politically by genealogical history. It is recognized by old-timers that “History is Genealogy.” The 1% adhere to this.

You should take a look at how the EU nations handle foreclosure. Despite the crisis the default rate (other than Latvia) is a fraction of the U.S. rate. Regulatory hurdles and encouraging banks to do workouts has so far worked. As rancid as the problems are they did not do sub-prime etc. Check out the EU website and you can see the several approaches. Banks are insolvent but folks are not being kicked out in any number approaching U.S. Check it out.

It’s worth noting that the big happy-talk piece in the NYT yesterday about “housing finally turning” was met by extreme and almost universal skepticism among the 225 people who commented. They basically spat on the newspaper’s claims. If I were the writer or editor of that piece, I’d be thinking hard about what the public so nearly universally sees that I do not. The answer, I think, is that the public doesn’t meet with PR flacks from the National Association of Realtors, who serve up pre-packaged stories that make it so that nobody at the NYT needs to do any work in order to put print on the page.

This reporting, and the skepticism of readers, reminds me of the NYT coverage of the Duke lacrosse team rape allegations 5+ years ago. For more than a year, the paper ran pieces that strongly suggested that the defendants were guilty, while the comments were increasingly skeptical, based on developing facts being reported elsewhere, that a crime had not occurred. Right up until the dismissal of charges, the NYT clung to its version of events, even though it was clear from the comments that almost nobody believed them. Then when the case was finally dismissed, the paper’s story about the dismissal had the audacity to lead with the phrase “as was widely expected”, trying to imply that the reporter knew all along that there was no case.

Housing story link from yesterday:

(http://www.nytimes.com/2012/06/28/business/economy/new-indications-housing-recovery-is-under-way.html

Yes happy days are on the horizon per Post and NYT!

Not only have they been taught to feel ‘thanks’ that ‘al-Qaida’ didn’t take out their HQ on 9/11 for publishing the Pentagon Papers, now they do penance for prosecuting Ivy Leaguers by publishing Realtors-as-ALEC ?

Blinkers pulled down tight.

One can’t constantly point out that the FED condones, allows, or ignores corruption without eventually coming to the conclusion that the FED is corrupt.

The FED so believes that “credit is the lifeblood of the economy” (I would say the lifeblood is full employment at good wages and a productive society)that it believes that its mission is to POTECT banks. The FED truly believes that America exists for the purpose of finance, instead of finance existing for the purpose of America…

“The FED so believes that “credit is the lifeblood of the economy”

The FED so believes that “debt is the lifeblood of the parasitical .01%.

fixed it for ya!

In otherwords, the heavy millstone of debt hung around the necks of the 99% to funnel enormous wealth extraction for the financial gains of the lazy parasitical class.

good fix! I agree

Why can’t original buyers of real improved property sue the entire chain of mortgage malefactors right up to the deepest pockets, for “title tampering” or “clear title destruction,” or for whatever the legal term is for ruining the original result of the Act of Sale which conveyed just ownership of one clear title to another? The original buyer should sue the entire chain of Destroyers of Titles from the first step in this process unto the last that can be determined, including the “BigBanks” that shoveled suck to “clients” on the long side of chaos while going short on the other side for monumental insider profits.

It’s past time for these Destroyers of Worlds to be shuffled in shackles off the stage of “free trade” in the Great Grifter Theatre of Finance. What would Shakespeare do with this material?

LeonovaBalletRusse said; “Why can’t original buyers of real improved property sue the entire chain of mortgage malefactors right up to the deepest pockets, for “title tampering” or “clear title destruction,” or for whatever the legal term is for ruining the original result of the Act of Sale which conveyed just ownership of one clear title to another?”

Errrrr… because the ‘rule of law’ is a selectively enforced Xtrevilist scam that provides freedom and opportunity to those at the top who own and control the scam and feedom and disunity to those at the bottom.

Are we ready for the election boycotts yet?

Deception is the strongest political force on the planet.

http://www.ritholtz.com/blog/2012/02/holder-obama%e2%80%99s-propaganda-is-%e2%80%9cbelied-by-a-troublesome-little-thing-called-facts%e2%80%9d/

“The failure of the article to generate a scandal reflects badly on both parties. The candidates for the Republican Party’s nomination have been searching for every conceivable issue as a potential basis for attacking Obama. The administration’s conduct as described by the NYT article provides the perfect club to the Republican candidates, yet none of them will use it. Why? The Republican candidates could not oppose a settlement that, substantively, was so exceptionally favorable to the largest banks. Finance is the largest contributor to both parties.”

http://www.rollingstone.com/politics/blogs/taibblog/iowa-the-meaningless-sideshow-begins-20120103

“In fact, this 2012 race may be the most meaningless national election campaign we’ve ever had.”

Uh, TV HAS to sell ads – let me edit: BREAKING NEWS – In fact, this 2012 race may be the most HISTORICALLY meaningless national election campaign we’ve ever had.

Leonova is right. There are all sorts of statutes across the nation in each state which are virtually the same wording and intent as in all the other states; there are currently class action and RICO lawsuits in progress because titles were so screwed up. It is disheartening because in the meantime government has taken no moratorium action to wait until this can be settled. It just rolls on with its nonsense. I wish they would impeach Holder for treason. That’s what I wish.

Key is that the U.S. legal system is rules guided rather than principles guided like the EU. Say what you will about the EU they ain’t tossing people out of their homes–ever read anything about foreclosure crisis in EU? Nope think not. Yes, their banks are as venal as ours but the little guy is taking it in the shorts a lot less. Rules based system explains why there are a multiple of lawyers in the U.S. per capital compared to say France, Spain or Italy, etc……..

Point–don;t pin to much hope on statutes–they can be bent by a good lawyer and compliant judge. In fact most of top law firms are all about bending statutes ad finding nice compliant forums…

CR, maybe so, but Don’t Mess with Louisiana Clerks of Court.

As Warren replied, it is a scam, and it has been taken to the top,

http://market-ticker.org/akcs-www?post=207908

‘Compelled Abortions’ of the Constitution

Up, link: “of course, Congress can levy taxes.” But can it tax “non-compliance? — or, or in the terms of others, Can it tax “failure to choose an option?”

Up to now, taxes on goods and services are allowed. But is this a precedent, as a “tax on specific performance?”

or, further, a “tax on failure/refusal to perform specifically?”

Well on small upside–investors will now be another screwed group. Ultimately all scams and corruption go too far. Perhaps enough people of means will get P’O ed. The biggest tragedy of all of this is trust. You can institutionalize corruption but you can;t institutionalize trust. With trust totally wiped out life becomes more and more unpleasant. Go to low trust countries at core hard places to live. Trust easy to destroy but hard to develop. There is no going back……

“The biggest tragedy of all of this is [respect, a quaint concept]. ”

fixed it for ‘ya

“damage to the integrity of land records in this country” — In light of Global Shock Doctrine for 1% Lebensraum come Homeland to roost, is this not a FEATURE rather than a bug?

Would point out that in much of the Third World the attack has taken the form of instituting private property in order to then steal it – African land is being carved up as we speak led by global predators from the US, China, Saudi Arabia and India as we speak.

Yep – Absolutely and utterly disgusting – Long Live Imperialism!

Love

I have to sympathize with the banks on this one. Based on past experience, they had no reason to believe that anyone would actually enforce the law.

And, they are being proven right on a near daily basis.

“near” ??

alex, they failed to square it with the Louisiana Clerks of Court. Big Fail.

“First, it says there are such things as ‘anti-foreclosure laws.’ In fact, the laws under discussion are more accurately called ‘Foreclose legally, damnit’ laws.”

This is the reason I read your blog. It is for gems like this one.

“Capitalism” is a game….and it’s operating exactly how it is (not) expected to……

Evidence suggests anti-foreclosure laws may backfire?

No, One Percent Whisperers suggest anti-foreclosure laws may backfire. (credit to Lynn Parramore of AlterNet for coining the phrase)

Yves,

As always, an excellent post.

Gillian Tett discovered the same phenomena you are talking about when she looked into possible problems with Libor.

The banking industry went into attack mode.

The result being to point the finger at her conclusion as if it were to blame for the problem and not the banks themselves.

I heard Ann Pettifor on the BBC last night. I was surprised she was on. She was introduced as a long standing critic of finance, etc. She was very clear in saying that the banks’ awful behavior needed to be investigated judicially, not via the regulatory “authorities.” Clearly implying to my ears that this is obviously a criminal problem. She went on to say that we should never have trusted the banks with so much leeway cuz we knew they were scorpions. And then she said it had been a huge mistake to let the banks treat money as a commodity that finds its own market because the banks make money “out of thin air.” She was in good form. Not a wasted word. Her point about Libor was that damned-near everything is pegged to Libor, most importantly mortgages. So I partially conclude that one reason the banks are fudging Libor to keep as many mortgages in the black as possible.

“damned-near everything is pegged to Libor” yet those who authorized the acts shall go nameless and be covered by the Justice Depts.’ new-found Executive Privilege.

And don’t forget, Mukasey did it [didn’t do it].

Up, the head of the Bank of England is not so glib. He has a keen sense of danger, however “cool” he may appear on video.

“a keen sense of danger” exhibited by the Brit bankers may very well be the defining sense of ‘crisis measures’. see that ‘Anglophile’ stuff.

and Iceland.

http://www.nakedcapitalism.com/2012/06/obamacare-the-market-state-and-the-nudge-theory.html#comment-748465

and this, lol,

http://www.nakedcapitalism.com/2012/06/obamacare-the-market-state-and-the-nudge-theory.html#comment-747856

Richard, the head of the Bank of England, Mervyn King, seems to be running scared. NOT YET have the Highland Scots, the “Ladies from Hell,” and others oppressed by the “British Crown” marched en masse into the City with torches and ropes.

And will the French re-kindle the Aulde Alliance with Highland Scots for the sake of justice for “Citizens?”

The Shadow Inventory of Executive Privilege

“Title insurance companies have backed away from guaranteeing properties sold out of foreclosure. The truth, which the Fed economists refuse to admit, is the buyers who are concerned about title problems are clear-eyed about risk, while the economists think it’s swell to stick buyers with bum properties. ”

“The banks have not been foreclosing for the past three years. This started well before the robo-signing mess. ”

Keith Jurow

Looks like it’s time to back away from several seekers of “title insurance”,

“Ironically, the only document produced yesterday by the department appears to show that senior officials in the attorney general’s own department were strategizing about how to keep gunwalking in both Wide Receiver and Fast and Furious under wraps,” he said.”

And their response is to trail in Mukasey’s slime.

http://www.washingtontimes.com/news/2012/jun/20/obama-asserts-executive-privilege-over-ff-docs/

We’ll call them ‘SarbOx retractions’.

This is the END of “Title Insurance” for homeowners.

“And that is perhaps the most remarkable bit, the failure to consider that gutting the protections to the parties to a contract undermines commerce.”

Waddayamean, remarkable? Contracts were made to be broken. That’s black letter economics, isn’t it?

Rule of law is overrated

https://www.taz.de/uploads/hp_taz_img/xl/herrhausen_b.jpg

Rule of Law is based upon property rights. However, in a (monarchy)Bankarchy, the king claims ownership of the entire fiefdom.

The portfolio of Freddie Mac and Fannie Mae is worth roughly $1.5 trillion. They and the Federal Housing Administration (FHA) together now guarantee about 90 percent of all new mortgages probably not including what was put on their books in Bernanke’s mad rush to save the banks. Both are 80 percent owned by the government after their 2008 bailouts.

The taxpayers own 90% of the mortgages. The banks don’t own squat, rather they take a cut of the home-owers mortgage payment as the ‘servicers,’ and pass change to FNMA, FHA, and Freddie Mac. Someone tell me how that works out for us with the bank’s fists in the pie and foreclosures?

It works out for us like the banks are running everything, and they are.

The only way I think we’ll get any traction on the foreclosure issue is to somehow force the Obama administration to change sides, and start prosecuting Banksters.

And the OCC has again extended the “Independent Foreclosure Review” nonsense, with stipulated amounts up to $125,000 plus equity (what’s that?) for various missteps; very narrowly defined.

https://independentforeclosurereview.com/Viewfinancialremediationframework.pdf

Good luck getting Obama off the corporate teat!

Wish Yves would wrap a sentence here around Zillow’s negative-equity map of the US. New York looks pretty lightly underwater compared with other parts of the country, like Florida and the Southwest for instance.

http://www.sacbee.com/2012/05/24/4514569/interactive-57-percent-of-sacramento.html

From Living Lies blog, June 1:

I just discovered this blog. Yves, I love you.

FYI, a friend’s property, in a middle class area of Long Island, is being foreclosed on. She was a few months late and was sent a notice of intent. She found out from the escrow dept. at BofA how much it would cost to reinstate, which she promptly paid. The servicer then informed her that the loan was reinstated and all was well. Then she became a couple months late again, and when we called to find out how much to pay to catch up, we were informed that the foreclosure is still moving forward and a lawyer has been assigned. I learned that the mortgage was securitized and the trustee (or “investor”, as far as MERS tells us) for the mortgage is BofNY Mellon. The originator was Countrywide. Therefore I am pretty sure the mortgage and note are long lost. I told my friend “good luck, we are going to get your mortgage tossed and you will own the house free and clear”. She is having a hard time believing it but from all I’ve read over the past several years hear on NC and elsewhere, these douchebags are not going to be able to prove standing. We have a knowledgeable attorney who knows what’s been going on, and I think its gonna be open and shut. Goodbye mortgage, and thank you Countrywide, BofA and BofNY for being so damned incompetent that it’s free house time! Gotta love America! Land of the scammer getting scammed.

My friend was perfectly happy and wanted to pay her mortgage but these bastards won’t take yes for an answer. Of course we know why: they make more money pretending she “said no”. Disgusting, and I have no idea who is actually getting scammed in the end — could be some rich assholes, or could be a pension fund. I really have no way of knowing, and its sad that its come to this, but what can an honest person do? You try to do right, and they force you to their level. So if we’re gonna play in the muck, I’m gonna make damn sure we’re not the ones that wind up drowning in the gutter.

At least you’re in New York. Please post again and tell us how it goes.

will do.

Since an “Informed Citizen is an Armed Citizen”, and since the Highest Prosecutorial powers in this Land (and most courts) are corrupt beyond recognition, ..Each fight will need to be won on a per-Battle basis — No, i don’t know who *eventually* be left without a chair in the end of this maniacal game of musical titanics, since in essence; All the TBTF banks are Insolvent, and all FRNs are counterfeit to begin with.

Love

Anyone but me notice that comments on the Reuters piece are closed, after only two days, and there ARE NO COMMENTS? Does this seem reasonable?

Contract Law and Constitutional Law are the two pillars on which Law School Education rests, for a good reason. The ISSUE here addressed is an issue of Contract Law, not of expediency to Agents of Monopoly Finance.

The Louisiana Clerks of Court seek Justice for breaches of contract.

heh, since we’re on “Law”

Ever see the definition in an early Ballentines Law Dictionary of HUMAN BEING?

Which really ties in rather nicely to a comment i made to Fiver’s point here, recently upthread,

http://www.nakedcapitalism.com/2012/06/quelle-surprise-fed-economists-side-firmly-with-bank-criminality-over-the-rule-of-law.html#comment-749247

oops, forgot to mention [emphasis mine] where bolded/italicized.

Love