Yves here. This post from MacroBusiness describes three risks facing the American housing recovery, and I thought I’d add a fourth, which is the open question of how much longer private equity funds and other speculators will continue to bid up housing prices. No one knows for sure how much they’ve contributed to demand, since in the hotter markets, there are flippers who are buying properties and then reselling them within months to PE investors. The assumption is that a big proportion of the “all cash” buyers are investors as opposed to homeowners. At the end of May, we posted on how single family home rents had already started to fall in some major markets, including Chicago, Orange County, and Washington. Some recognized-as-astute property players such as Carrington have said they’ve stopped buying homes for rent because too much “stupid money” is chasing this trade.

Reader Scott send us further confirmation by e-mail from his buddy George N, which he took from the website of Silver Bay Management Company:

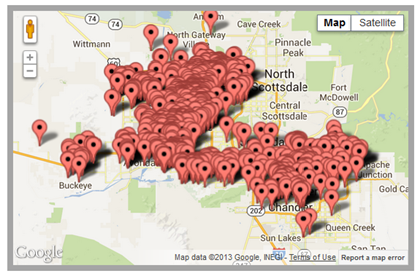

Take a look at the number of houses for rent in Phoenix…The snap shot above was taken today [July 22] off their website.

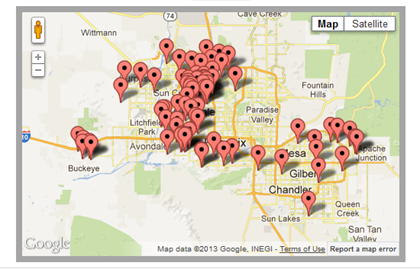

The following is the snap shot I took on March 18, almost exactly 4 months ago.

How the hell can they be making money when there are so many empty houses cooking in the desert sun? How can they possibly generate those double digit cap rates?

Sooner or later, these Wall Street OPM is going to lose interest. I like to see how Bernanke is going to carry the pump all by himself to inflate this real estate recovery story.

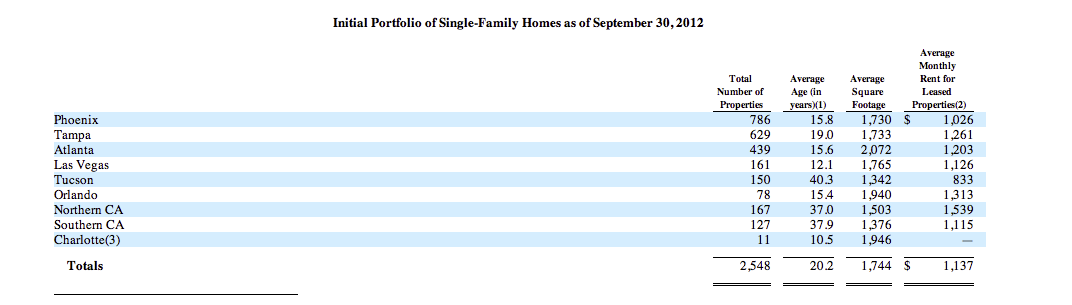

Now if anything, the picture is in some ways even uglier. Silver Bay, at least according to its website, is operating in only two cities, Phoenix and Atlanta. In fact, its form 424B does show it to be operating in more cities, but as of the time this tally was made, Phoenix was more than a quarter of its holdings (click to enlarge):

In addition, conventional wisdom among the rental investors I’ve heard discuss various markets was that Phoenix had better fundamentals than a lot of other distressed markets, such as Vegas. Of course, that may just have meant it attracted more hot money.

One issue addressed in the piece below is that the low level of household formation is a concern. I’ve seen some analysts take a sanguine posture, that all these young folks will eventually live independently and buy houses. I’m not sure that’s such a given. Historically, Americans have had more people living in extended family groupings than we do now. In Japan, in the long bust, “parasite singles” or young women living with their parents, have become common. Unless the employment market for young people improves considerably, there’s no reason to assume we’re going back to the old normal any time soon.

By Leith van Onselen, Chief Economist of Macro Investor, Australia’s independent investment newsletter covering trades, stocks, property and yield. You can follow him on Twitter at @leithvo. Cross posted from MacroBusiness

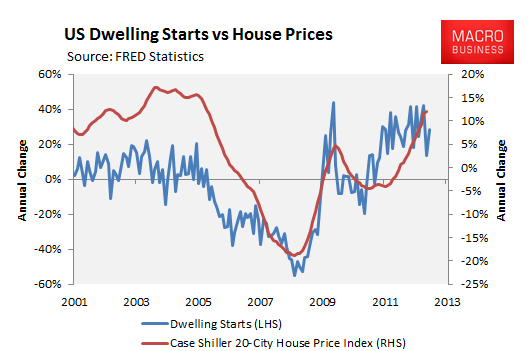

The US housing recovery is seemingly on track. The latest results show home prices increasing by 12% annually across the 20 biggest markets, with the rate of housing starts up almost 30% (see next chart).

While the recovery looks good on the surface, there are a number of factors conspiring to thwart the housing market, which in the process could also threaten a broader US economic recovery.

First, the rate of US household formation remains weak, held back by a high proportion of Americans opting for shared housing over going it alone. According to the Wall Street Journal, the number of “missing households” — defined as adults who would be owning or renting their own home if household formation rates had remained at normal rates since the recession — increased by 4% over the past year, representing a total of around 2.4 million individuals, up 100,000 from a year earlier:

The analysis on missing households, performed using census data by Jed Kolko, chief economist of real-estate website Trulia Inc., suggests that four years into the U.S. recovery, slow household formation remains an obstacle to a more robust economy. It is damping demand in the housing market, where home sales have been rising but remain below historical levels.

Young adults “have not regained confidence in the economy enough to start moving out of their parents’ homes,” Mr. Kolko said. “Even people with jobs are choosing the security…of living under their parents’ roof rather than forming their own households”.

Multiple factors lie behind slow household formation. Unemployment remains high, and wages stagnant, particularly for young adults. Many of them lack the down-payments and credit histories needed to qualify for mortgages. High rents, due to rising demand and tight inventory, also are likely limiting household formation. Also, Americans are waiting longer than previous generations to start families, a trend that began well before the recession…

Economists say household formation is closely linked to home construction: If the 2.4 million “missing households” took the leap and entered the housing market—either as renters or buyers—overall housing demand would increase, leading to a pickup in construction…

“This key measure of the housing recovery is still near the worst point of the recession,” Mr. Kolko said.

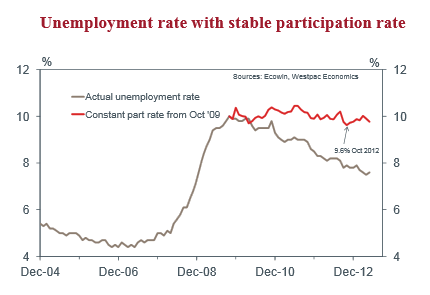

The sluggish rebound in household formation rates is perhaps not surprising given the weak recovery in both the jobs market and incomes. According to analysis published last month by Westpac, the US labour market has barely recovered, with the unemployment rate remaining stubbornly high (when adjusted for the participation rate):

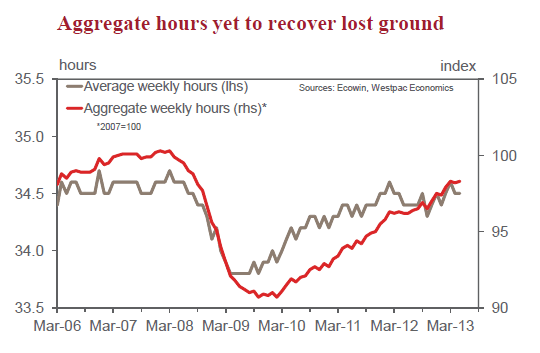

In fact, the overall number of jobs is still 2.5 million below its peak, the employment-to-population ratio has also barely moved off its lows, and aggregate hours worked is yet to recover lost ground (see next chart).

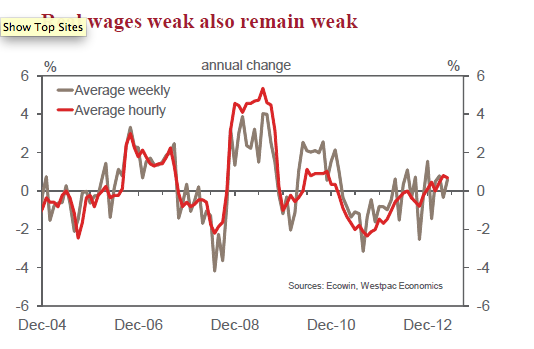

To make matters worse, real average hourly wages are still 0.5% lower than their June 2009 level, with real weekly wages (inflation-adjusted take-home pay) having grown by only 1.3% over the past four years (see next chart).

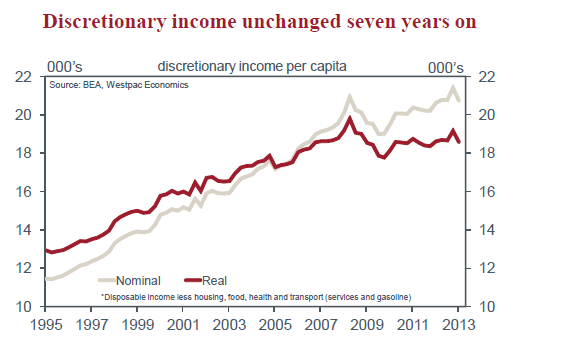

And while households have benefited from lower interest rates, this boost to discretionary incomes has been offset by rising health care and gasoline costs, meaning that real discretionary incomes have not grown since 2006 (see next chart).

The second factor that could thwart the nascent US housing recovery is the steady decline of first home buyers (FHBs), which have fallen significantly, according to the Wall Street Journal:

First-time home buyers, long a key underpinning of the housing market, are increasingly getting left behind in the real-estate recovery.

Such buyers, typically couples in their late 20s or early 30s, have accounted for about 30% of home sales over the past year. They represented 40% of sales, on average, over the past 30 years, and accounted for more than 50% in 2009, when recession-era tax credits fueled the first-time market, according to data from the National Association of Realtors.

The depressed level of first-time buyers could prove to be a drag on the housing rebound and the broader economic recovery over the longer haul…

“First-time buyers are important to get the housing market to move to a new plateau,” said Steven Ricchiuto, chief economist with Mizuho Securities USA Inc. “Without them, you just get stuck at a marginal recovery environment”…

In June, first-time buyers accounted for 29% of purchases of existing homes, compared with 32% in June a year ago, according to the NAR’s June existing home-sales report released Monday.

FHBs, along with investors, are key sources of new housing demand and chief enablers of the upgrader market, since upgraders typically sell to FHBs or investors. If demand from FHBs is restrained, then logically it could have flow-on effects up the chain, potentially stifling the housing recovery.

The final obstacle that could thwart the US housing recovery is the recent lift in 30-year mortgage rates, which have risen by around 1% over the past month (see next chart).

Needless to say, a circa 1% increase in the cost of financing has a material impact on mortgage affordability, materially reducing the size of the loan that can be taken on by a potential buyer for a given monthly outlay. Moreover, it reduces the windfall discretionary income gain on offer to US households from refinancing, also reducing their incentive to do so.

Only time will tell if the housing market is strong enough to weather these headwinds.

Yves,

The Reader Scott piece above was lifted directly from Barry Ritholz’s Big Picture Blog here: http://www.ritholtz.com/blog/2013/07/so-you-want-to-be-a-landlord/

Credit him.

No, Scott sent that message to me PRIOR to Barry receiving it. I would be happy to cite Barry if he was my source. He most assuredly was not, nor was he first to get this or first to ask to publish it.

1. I asked Scott for permission to run it a full 2 days ago within minutes of seeing it. Barry was not on the original distribution list (I am not sure how he got it, it might have been forwarded from one of the few other recipients)

2. Scott first said yes, then said no, let me check with the source.

3. I saw Scott online in the middle of the night on the 23rd (more than 24 hours ago) and pestered him again. Scott replied at 3 AM and said he had not heard back from the guy, he’d try again.

3. At 8:36 AM, Scott e-mailed again and said he had not heard back. I had been up all night and turned in.

4. At 10 AM (I am asleep now), Scott e-mails and tells me he got permission and sent it to Barry too.

5. I wake up in the late PM and chew Scott out when I see what has happened. Scott confirms he sent it to me first and I corresponded with him before Barry saw it and apologized.

This is a sore point with me. I did not get this from Barry, I got it independently BEFORE Barry and asked for permission to publish it before Barry had seen it. And I can put you in contact with Scott to confirm that.

as a fellow insomniac (although yours seems due to working on this website-??), don’t forget that nighttime work shifts increase your risk for cancer.

hopefully you are getting a full 8-10 hours of near perfect darkeness.

You have my apology!

I realize my reply was more heated than it needed to be (another symptom of too much to do and too little time), but I hate being lectured when if people knew what happened, I was not behaving badly.

And thanks for concern re my hours. There’s a more general theory that a lot of cancer can be tied to Vitamin D deficiencies (as in people now work almost entirely indoors and don’t get as much sun as we need). It would be better if I were on more normal hours, but I do take large doses of Vitamin D.

I also started taking a lot of vitamin D3 a few years ago. About 8,000 IU/day.. I recently had a vit D blood level performed and it was 35.1 with normal range of 30-100..

In our study only about 15% of people were within normal range. Apparently about 25% on average are within the normal range in northern climates..

We are a fully registered loan agency, we give out loans to all in need of help

across the globe. Our loan takes a maximum of 1 working days to get to approved

to customers across the globe. We offer lowest interest rate 2% and its fixed

with best match loan including loans for applicants with impaired or bad

credit, Pay off existing debts, reduce your monthly outgoings by consolidating

any existing personal loans and credit card debts. Our offer loan amount ranging

from $5,000.00 to a maximum of $2,Million.

Please fill in the short form below

Full Name:

Amount Needed:

Loan Duration:

Purpose of Loan:

Country of Residence:

Mobile No:

In acknowledgment to these details,We will send you a well calculated

Terms and Conditions which will include the agreement.

Regards,

Mr. mark moel

Email:markmoelloanhouse@live.com

‘Young adults “have not regained confidence in the economy enough to start moving out of their parents’ homes,” Mr. Kolko said. ‘

I suspect it’s not so much a lack of faith, er, confidence, but of money. Labor stats and analyses show not only high unemployment, but high under-employment, part-time wworkers who would prefer full-time and, temps, contractors and ‘self-employed’ who whould love permanent jobs. YOung people without a reliable source of sufficient income won’t even venture renting on their own, let alone buying.

Faith alone is not sufficient for salvation, but good work(s) also.

The problems identified here are absolutely correct, but it might be a bit early to declare this as a negative for the housing market.

The assumption being made is that first time buyers are important to get the housing market to move. The game is to capture enough of the rental market so that you can push up rents (typically to about 1.5 times the cost of buying). You can then afford to have empty housing (typically 50%). House building changes from building for ownership to building for rental and is carefully released into the market. Building for ownership is deliberately depressed with scacity sending values sky high so that nobody can afford a house unless parents can put down a deposit.The housing market is changing so that only the rich can afford housing and the financial system can tax the poor with rents.Financialisation of the housing market means it will operate in a very different way.Not all housing markets have the same drivers and we need to be carefull about assuming the housing market of tomorrow will look anything like the one of the past.

In Berlin, the rental property share is an incredible 90% of the total residential market and prices are only kept in check by housing associations and municipal authorities holding about 12% of stock.Sydney and Brisbane are the two main cities in Australia where it has become cheaper to buy a home in the suburbs than rent.

I think the biggest risk to housing it the mortgage rate increase and you are correct that if Bernanke blinks, housing could continue to perk along. However, Berlin and Australia aren’t good bases for looking at the US. Germany has long has incredibly strong protections for tenants and has never (culturally or politically) been big on home ownership. Its’s long been an outlier in the OECD.

I lived in Oz. Rentals were always cheaper than owning, always. Much bigger tax breaks for investors than owners. So lots of people bought property to rent as for investment. To a person, they said they made a negative yield (lost money on the rent v. the interest payments). And Oz has very cheap rental brokerage costs and very well developed support services for single unit landlords. But Australians LOVE owning real estate, they are more attached to the idea than Americans.

This article still says it’s cheaper to rent than buy in most places, and I separately saw quite a few comments at MacroBusiness, which posted on this, that pooh poohed the analysis, in that it understated the cost of ownership, so a better comparison would show many fewer places where owning is cheaper than renting:

http://www.smh.com.au/business/property/where-its-cheaper-to-buy-than-to-rent-20121220-2bopa.html

The game is to capture enough of the rental market so that you can push up rents (typically to about 1.5 times the cost of buying). You can then afford to have empty housing (typically 50%). House building changes from building for ownership to building for rental and is carefully released into the market. Building for ownership is deliberately depressed with scacity sending values sky high so that nobody can afford a house unless parents can put down a deposit.The housing market is changing so that only the rich can afford housing and the financial system can tax the poor with rents.Financialisation of the housing market means it will operate in a very different way.

this is exactly how The Game works in desirable R.E. markets (like the Bay Area). the “creative class” types who want to actually own the home they live in help contribute to the rising prices since they are paid better than the rest of us servant-class workers. the result is many have no choice BUT to rent, and under conditions which allow rentier=owners to raise the rent 10 % year over year. very quickly, one IS actually paying more than they would if they bought in some less desireable neighborhood, which prevents ever being able to save for a down-payment.

I see this as the end-strategy for the rentier/owning class in property=forcing those of us who have few choices to pay 50-60-70% of our income simply for a roof. it is the flip-side of wage slavery for us peons.

that first paragraph should have been quoting you! yikes…

interesting post Yves. But I find it odd that we are talking down the real estate recovery which only really began last year. RE is usually characterized by long cycles and I dont see why it would change this time. All the points you and Leith make point towards slower appreciation, not depreciation IMO.

As for PE and Silver Bay. 1) I dont mind following in the steps of Schwartzman, the guy mints money, even his bad investments in ’07 still made money. 2) SBY is a spinoff from Two Harbours, some really bright guys in the mREIT space. I am not sure who the other publicly traded residential REITs are, so I would be hard pressed to call the space crowded with Wall Street money. For sure ther is PE money, but let the pension funds do what they want.

RE is all about location and in the USA even more so. I dont think good areas are going down again (until the next cycle) and class B/C areas are also holding in well. Harder underwriting standards = more renters. Of course the recent spike in prices will reduce 1st time buyers, as they have to re-set their expectations. But I think they come back

Unemployment is higher for those under 30 (and without a degree) but those under 30 and with a degree are the ones in the knowledge economy making money. They are the marginal buyers, and the marginal buyer sets the price.

Lastly, where else in the developed and even not so developed world can you find RE cheaper than in the US?

The reason I am not convinced is:

1. If you are talking about normal, housing booms are followed by busts in which prices become “too cheap” relative to incomes and rents, that is, you have a meaningful overshoot to the downside. We never had that.

2. We still have a LOT of inventory. What we don’t have is a lot of official inventory. Foreclosure timetable are only getting longer, banks are not putting homes they own on the market (buyers report with considerable frustration that they see homes vacant and work hard to figure out who the owner is with no success), are still not doing many short sales, and are not even starting FCs in a lot of markets on delinquent homeowners.

Supply and demand 101 is if you have excess inventories, the “market” price in inflated. There is tons of evidence we still have inflated inventories and servicers are withhholding houses to try to keep prices up. Now they may succeed in their game of goosing the market and bleeding supply into it, but they have a LONG way to go.

3. This is a balance sheet recession, not a normal economy. Home prices increases are a function of wage growth (over the very long term, as Shiller has shown, the bubble just past was a huge historical anomaly). We not only don’t have any wage growth and terrible unemployment, but shortening job tenures make taking a mortgage a terrible bet for most people. How can you be sure you’ll have high enough income for long enough to pay it off? And remember, transaction costs are 7% or so, meaning 1/3 of your equity, so if you have to sell because you lose your job or have a wage reduction, you need decent appreciation to come out whole.

Our bubble wasn’t as bad as Japan’s, but housing prices there kept falling for 20 years. With no real recovery, and housing now fairly priced by some estimates relative to wages as of earlier this year (that at historically low interest rates that are becoming a thing of the past), I don’t see a strong case for housing, particularly with the amount of overhang there is (unless the servicers just plan to let it decay and force new building eventually).

As for cheaper in developed countries, New York is on the list of 10 most expensive real estate location in the world, so I’m not sure where your “real estate is cheap” unless you are talking places like Atlanta. I mean if you want to live in a poor state, that’s another matter. Right now Barcelona is a screaming bargain. If I had enough play money, I’d take a flier. And those international comparisons matter only if you are a member of the international elite (you can afford to have second or third homes or twentieth homes around the world) or you are in position to move (you can relocate and get a job in New Country). I’ve done an international move. Let me tell you it is very hard to get a permanent residence in advanced economies unless you have a corporate sponsor or are married to someone who is a citizen and when you move you should expect to get lower income (unless you have a big rich company moving you).

And remember, in most advanced countries, you need to factor in the much cheaper health care.

Finally (and this is not going to influence enough people to have an impact, but I feel compelled to say it), anyone who buys a house with a mortgage does not have property rights. You have a property lottery ticket. The odds are good that if you do everything correctly you will be fine, but you still have odds that even if you do everything right you will be fucked and unable to get recourse on top of that. IMHO, housing is too expensive to take that sort of gamble.

What we learned in the aftermath is if you have a problem with your servicer, even if it is not your fault (it is totally servicer error) and he deems you to be delinquent, you are pretty much certain to lose your house. I have a friend who is a career-long securitization professional and an attorney (he has visited over 100 servicers over his career). He sold his apartment and never intends to buy again based on what he knows about servicer behavior. He had a problem 10 years ago because he sent 2 payment in, one on time, one in advance because he was going to be on vacation on the due date). The servicer double credited him in one month and treated the next month payment as late. He was eventually able to get it straightened out, but it took a long time and he took credit report damage for a couple of year. He says if that had happened now, he is certain (even being an attorney and knowing how to hire and manage attorneys) he would not be able to get that kind of error fixed and he would lose his home.

Been having problems replying, hopefully I havent spammed.

All good points Yves,

1) I would disagree. I think you had the overshoot. When homes were priced cheaper than replacement cost that is value to me. Especially since the US population is still growing. Broad measures of income and rents are interesting but for a large country like the US and for location specific housing, I would rather go with a Book Value/Replacement Cost based valuation vs a P/E

2)Agree there is still lots of inventory. But I would guess that most of it is still in crappy neighborhoods. In nice areas across most of the country supply is very tight.

3) What has been driving Australia/Canada/UK/Middle East/ China/Indonesia/Brazil RE. Sure strong wage growth but the multiple has also risen (look at economist house price index) We are in balance sheet recession, yes, but with money printing galore. Wage growth underpins the housing market, agreed, but Cap Rates play a big role as well.

4) int’l move is hard, agreed, but int’l money moves quickly, whom are financing the PE guys, I presume.

A house in a good nieghbourhood in Alanta for $400k is >1mm in most other countries. Not sure what is so bad about living there. Know lots of ppl who like it there.

And you can only compare NYC with a few cities, Hong Kong, London, Sao Paulo, Moscow etc. To me, NYC isnt the most expensive of the lot.

PS. Barcelona does look interesting!

We are leaving one of your comments in the spam folder for forensic purposes. We know it shouldn’t be there, but we want to know how it got there. And yes, money and time are being spent on the issue….

Yves, even paying cash for a property, you still do not have true property rights. You are at the tax man’s whim. Rates tend to go up much faster than income does. As the fed distributes less to states and states less to counties, it’ll only get worse. Home ownership is really just a damn good tether to the bloodsuckers.

Yves,

Awesome summary.

I think the next 6 months will be telling — deals that are closing today are for properties that went on to the market in the spring. In the last six months, we have had substantial selling price increase (MSM reporting anywhere from 15 to 40%) and a substantial increase in mortgage rates (from 3 & 3/8 to 4 1/2+).

A 20% increase in price plus the increase in rates bumps the monthly payment by nearly 40%. What was affordable is no longer affordable.

The knowledge based economy is a myth. There is widespread unemployment for people with degrees under 30 as well, not to mention widespread unemployment. Staying marginally in school to avoid paying student loans is not counted as unemployed in the government’s metrics.

People with college degrees working mcjob aren’t buying houses.

The idea of the knowledge based economy is only a means to blame poor people for their lot in life and deflect criticism from wealth inequality.

Agreed. U.S. real estate is definitely not cheap in those stronger markets which have experienced the bulk of the recent gains, basically all of the nicer places you would actually want to live.

Regarding the title issues you bring up, I think this problem is severely understated by most of the media, and of course that’s just the way Wall Street wants it. The securitization syndicate are still looking for a legal means to institutionalize the fraudulent scheme behind MERS and bypass real property rights. Sadly, NAR seems to be perfectly complicit in this movement to bolster sales.

lastly, check out this silverbay listing in Atlanta.

http://silverbaypm.appfolio.com/listings/listings/e4af1fc1-89aa-45a6-8243-b24a3c203494

tell me you still think US real estate is expensive

LOL! Great property….if you don’t mind driving 40 miles into downtown Atlanta! I can find you similar deals out in the sticks in surrounding Houston suburbs. That doesn’t mean you’d want to live there.

The point being that “affordability” is relative to location and incomes. As they say, all real estate is local.

Meaning what? Rents by and large have little to do with property cost or value. They’re closer tied to what the market will bear. I’m sure you can always find cheaper rents where mean incomes are less. It’s obvious the house wasn’t built to be rented out. Rather I’d wager it was built, then sold as someones dream, then foreclosed upon. Wherein Silver Bay bought it with OPM and can make a good return at the $1600….

Median household income for 30248 is $53k.

$1,600/month rent. Keep the math easy and figure an additional $400 for utilities, etc. Call it $2k/month or $24k per year. So rent on this monster is roughly 45% of median PRETAX income.

Let’s have some more fun with numbers. Let’s say you’re at 2x median — it’s still 22% of PRETAX income. Figure tax eat 25% of your gross — you’re at 30% of net.

Paying 1/3 of your take-home pay for shelter isn’t cheap. It wasn’t that many years ago that the MAX PITI to buy was 28% of gross.

Aren’t housing prices still insanely high, and have been since say 2000? We aren’t supposed to look back at war crimes, fraud, and those sorts of things, or say or write anything that might threaten our collective perches, but housing is still too expensive unless you are part of the 1% in San Fran, DC or a handful of other places. Most people are even less secure in their employment prospects these days and the 30rd year mortgage can still be something served up in the mafia’s casino, not one Governmental steward has done much of anything to restrain the sociopaths other than hire them.

Pointed out by others, Phoenix rental market is seasonal. Analyst 101 – please compare year over year and some depth of analysis rather than posting two micro views four months apart.

Please read the post and Silver Bay’s offering documents.

This is Silver Bay’s inventory, not inventory across the market.

If you read any of these PE guys offering materials or see their investor presentations, they are NOT targeting seasonal renters. Their leases are one year, some will give a two year lease if the tenant asks. They don’t want seasonal renters. They don’t want the turnover (the big damage to a rental property is on the move in and out) and they don’t want the vacancies.

They are targeting locals, as in young people who can’t afford to buy a house yet and people who lost their homes and need to rent.

Understand the basics before you shoot from the hip.

Incidentally, what is the mind game about people driving around hunting and flipping? This was promoted heavily to induce a bunch of suckers during the so-called benevolence of the bubble. Most good ol’boys I happen to know buy something, and stay for decades, something that undoubtedly Wall Street frowns upon. There are still Bankers, originators co-consipators who need to be punished for the last go-round in housing. If yer a youngin’, I would stay the hell away from realtors as a form of boycott and buy cash if possible.

Call these guys, and ask them for a foreclosure moratorium, be civil, since most of these guys are just doin’ they jobs:

Doug Braunstein, Chase vice chair, cell: 917-837-6775

James Crown, Chase board member, home: 312-642-5512

Kevin Watters, CEO of Chase Mortgage Banking, home: 914-771-6677

June new home sales hit their highest level since 2008

The housing market has no bottom. No household formation, no first time buyers, no appreciation for many years, high taxes, expensive maintenance, unpredictable interest rates, falling birth rates, aging populations, no credit, and nobody trusts bankers, appraisers, realtors or mortgage brokers. The boomers want to sell but nobody wants to buy so the boomers can’t get their retirement money out. Location is relative except for a handful of places the very rich already own. A junk yard is as sublime as a polluted bay. But then the stock market also has no bottom. The bond market has no bottom. All our “assets” are simply worthless. We’re one freak-out away from a deep depression.

Exaggeration is a poor way to make a point. Just demonstrates your lack of analytical skills. I believe you are the same clueless commenter who suggested a few days ago that gold had “no discernible value”. Please try again once you’ve done some actual research.

Well the Native Americans often left gold on the ground since it had no value to them. And even to the silly Europeans, gold had little real value except as jewelery and decoration until it was later used to make excellent electrical contacts.

I’d say Susan is closer to the truth wrt gold than many gold-bugs who have near religious veneration for it despite the Bible which elevates wisdom and righteousness far above gold and silver.

Yes,

I neglected to mention the bearded fool. Equally clueless, but eager to provide completely irrelevant information.

Well, there is no need to get upset Profound. You can still run out and buy up all the gold you want. Put your money where your mouth is. In fact, you can eat gold.

I’ve always thought the Midas myth was more literal than just being about greed. Gold makes many cultures go nuts because its a sign of power that (until recently as F. Beard notes) gold has no use except status.

The pursuit of gold ignores the pursuit of more practical wealth. Cattle, land, bridges, and geese produce more than gold historically. Being able to wield power over a useless commodity makes people crazy. The gold bugs just want to be rewarded for pursuing gold.

Geithner, you gave me a WONDERFUL idea!

I am going to become a CowBug, and demand the dollar is backed by cows!

Now I just need to buy up as large a herd as I can before the dollar becomes cow backed!!

Dear Massinissa;

If I remember correctly, the basic measure of worth for a shilling was a cow or sheep, depending on what part of England you were in. The shilling descended from the earlier Roman solidus I believe, so even earlier associations between cattle and coinage exist. You have indeed channeled the ‘Wisdom of the Ancients!’

“Ave Bos!”

The most ancient money we know of, from ancient Sumeria, are tokens which indicate that the holder is owed one cow.

So you are on to something. Get back to the roots of money — COW-based money!

Well, a fool is someone who refuses to learn. The cure is Scripture reading and heeding*.

I’ve had my dose for the day. You?

*Proverbs 8:32-36

Don’t worry, just keep dosing. At some point hopefully the cure will become apparent.

If the cure is “gold as money” or “gold is money”, I’ve been there and done that and now reject both except for private debts only (but only because I think ANYTHING decent should be allowed for private debts only.)

imagine paying 350 months in a row and then having difficulty paying the last 10 payments…..something wrong when that would be A banks dream scenario

Yeah, it’s obvious something is very wrong with the housing market, no doubt another bubble being blown.

In my Pittsburgh neighborhood, very modest and working class, the house down the street from me just sold for $241,000. The same house had been purchased the previous year for ca. $60,000. The flippers made only superficial improvements, though they did a great job repainting, cleaning up and making it look nice. To make this story even stranger the house was purchased with an FHA loan, which means, theoretically, the new owners actually have to live in it. Why would someone with that kind of money want to live in this very modest (though safe) neighborhood?

So can someone explain WHAT is going on?

I’d say it’s an “outlier”. Don’t expect it to recurr often.

Another possibility is that the person(s) who took out the FHA mortgage lied on their application and have no intention of living in the house. Who is going to know that the buyers are renting? And if a neighbor finds out what is he/she going to do — call FHA and lodge a fraud complaint with the agency that has a mandate connected to “foaming the runway” (i.e., re-inflating real estate prices to make the housing sector look good?)

Yeah, that’s my suspicion. Looks like someone’s buying a few houses here and there at outrageous prices to pump up the market.

When I saw that video segment the WSJ did yesterday about the lack of first time home buyers and they didn’t even mention student debt and wage stagnation I wanted to throw things at my monitor. Thanks for posts like this, they help cut through the noise.

Sincerely,

An angry and skeptical potential first time home buyer

You are wise to be skeptical. If the Administration gets behind one of the two flawed bills currently being tossed around as a solution to Fannie and Fredddie, your skepticism would most certainly be justified.

http://blogs.marketwatch.com/capitolreport/2013/07/24/obama-says-its-time-to-turn-the-page-on-fannie-and-freddie/

No ‘vee-shaped’ recovery for us, it is indeed different this time.

Contrary to very popular myth, most pros in the real estate business were very aware that the 2000-2005 ‘bubble’ was coming to an end … before the fact. They decided to cash out … which they did. They might have invested in the stock market, maybe not. Most folks who have succeeded with one form of investment tend to stick with that form.

Five years after the crash of 2008 and these folks are back in the market believing in that vee-shaped recovery. After all, somebody had to sell all those overpriced houses to the sub-prime people. In 2006-07 that amounted to a lot of cash.

The problem is these second-tier speculators will lose all their money … the same way Jesse Livermore, William Durant and Richard Whitney lost all of theirs in the 1930s, being caught out by market head-fakes and their own optimistic belief systems.

The US’s and the world’s post-WWII economic miracle has been nothing more than the buildout of suburbia, made possible by -$20 per barrel crude oil and a vast finance-driven debt subsidy. What is different is that the cheap crude is all gone … forever. Suburbia is underwater and on its way to oblivion; we are left with the (stupendous) credit costs which cannot possibly be met.

How exactly will this work out? Hard to say but that it will be brutal is certain … headwinds, indeed.

New housing starts is the economic driver missing and the most significant difference between the market that existed prior to the bubble and today. The reality is that the low over hanging fruit has been picked as America is left with few alternative locations close to employment centers to build out large endless housing tracts at a cost which makes sense for today’s workers. It’s also becoming clear that the boomer housing build outs of the the past 40 years has generated poorly constructed houses needing endless upkeep and repair which is a bitch when the new owner has no equity and little cash.

I live in Memphis TN and I am a GIS mapper. Memphis was ground zero for targeting minority homeowners/purchasers for subprime loans. Memphis is unique in the United States in that it is the only black majority MSA with a population over 1 million people. The worst of the foreclosure crisis has passed, only in the fact that there are not many more owner occupied left in minority neighborhoods. From Jan 1 2007 to to Dec 31 2011, there were 25,000 foreclosures. 75% of the foreclosures happened in census tracts that were 50+% minority. Another 15% were in census tracts that were 1/3 to 1/2 minority. This has meant a loss of a generation of wealth creation in the black community, which has resulted in a decline in political power. Memphis is highly polarized economically and racially. So much so that the terms race and class are interchangeable. Here are maps that show the geographic, racial, and political distribution of those 25,000 foreclosure as well as who owns those foreclosures now. http://polardonkey.blogspot.com/2013/07/in-memphis-foreclosurewealth.html

On average, homes in 2/3’s of the city (the mostly black areas) lost 30+% of their value between 2005 and 2013, non-adjusted for inflation. (The local tax assessor does reassessments every 4 years. The 2013 assessment was just released a few months ago) In white areas things have remained stable housing value-wise, and in some areas the housing market has done well. The 4 headwinds discussed in this post are brutal in the black communities across the nation and in particular here in Memphis.

Thanks for this comment. That is one of the frustrating thing about trying to talk about housing. One, the data is hard to get and often bad and 2. it really is local, so generalizing is hard. Some markets have done ferociously well due to having fallen severely and being targeted by speculators, others by being in the pockets of the US (Silicon Valley, some areas of Seattle and LA, Washington, New York) where the economy is doing well and/or (more true of NY) a lot of foreign money is coming in (more than usual because the international wealthy are nervous about buying property in Europe right now).