By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Cross posted from MacroBusiness

The oil price jumped to an eighteen month high last night:

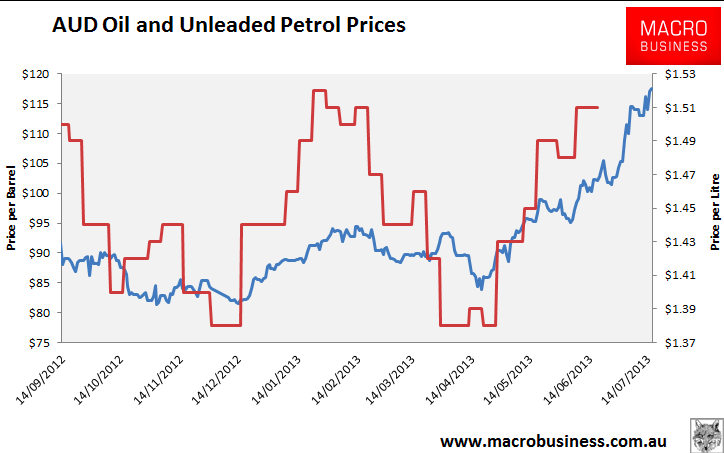

With the Aussie stuck in the low 90 cent range for now, that has pushed AUD oil to a new high as well around $117.60:

As you can see, local petrol prices are yet to punch above February prices but going they’re to, probably next week. The upside to come is somewhere between 5-10%.

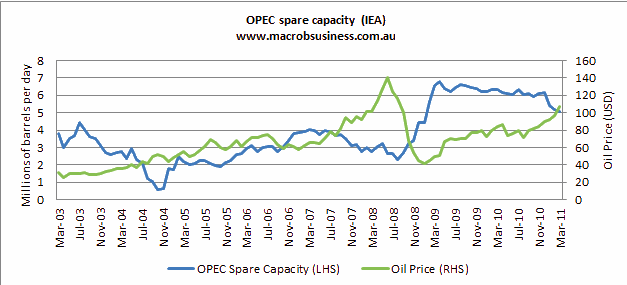

I’ve argued that this is unlikely to continue. Global growth does not justify prices at this level. As I’ve argued before, as an inelastic supply market, global oil prices are set largely on perceptions of spare capacity:

As the graph shows, that invasion marked two vital turning points in the oil market. The first was that OPEC’s spare capacity became severely constrained on geo-political concerns and, second, it was the last time that the world saw oil priced in the $20 range, in my view, for good. From 2003 to mid 2006, OPEC’s spare capacity oscillated in a band between one and three million barrels per day and the oil price more than doubled from $30 to $80. For the following year, spare capcaity rose to four million barrels and the oil price corrected to $60.Then, as the last growth cycle wound itself toward its blow off phase, and spare capacity dropped toward 2 million barrels again, the price skyrocketed.

According to the IEA, spare capacity currently sits at 4.38 m/bl per day so there is no fundamental reason for rising prices.

But geopolitical risk is another factor in play. And adding to concerns of over Egypt there are increasingly unstable signs around Syria. Israel is already engaged in surgical bombing strikes on Hezbollah supply lines and the US is considering similar intervention. From AP:

The situation in Syria, where a civil war has killed almost 93,000 people, figured prominently at Thursday’s hearing amid an increasing clamor among Assad’s opposition for active U.S. involvement.

Senators including Levin and McCain have pressed Obama to take a more forceful approach to defeat Assad’s forces. While the administration has authorized lethal aid to rebel forces, it isn’t trying to enforce a no-fly zone in which Syria’s combat aircraft would be barred from flying, or otherwise intervene militarily.

“Senator, I am in favor of building a moderate opposition and supporting it,” Dempsey told McCain. “The question whether to support it with direct kinetic strikes … is a decision for our elected officials, not for the senior military leader of the nation.”

The use of kinetic strikes, a military term that typically refers to missiles and bombs, “is under deliberation inside of our agencies of government,” Dempsey said.

Asked about Dempsey’s comments, White House spokesman Jay Carney said Obama always asks his military commanders for options “and that is true in an arena like Syria.” He said the president is constantly reviewing U.S. options in Syria.

“There are a whole range of options that are out there,” Navy Adm. James Winnefeld, vice chairman of the Joint Chiefs, said of the planning for military action in Syria. “We are ready to act if we’re called on to act.”

Dempsey acknowledged in response to a question from Sen. Lindsey Graham, R-S.C., that Assad’s forces have the upper hand.

“Currently the tide seems to have shifted in his favor,” the general said.

It think it unlikely that the US will intervene. A Syrian democracy more tolerant of Israel would certainly contain Hezbollah and dent Iran’s influence but the risks are high. With its explosive borders, Syria is a far complex problem than isolated Libya. Air strikes or a no-fly zone aimed at regime change would pose risks to the Syrian people, serious people movement risks into neighbouring states as well as complicate US relationships in the region. There’s little humanitarian rational therefore and so long as the Syrian authorities don’t use WMD, there’s no proliferation argument either.

Syria has no oil but the instability is enough to give oil speculators the upper hand for now. I maintain that oil is more likely to fall than stay high once this pulse exhausts itself.

It will be ironic if the shock that starts the next collapse comes from the alpha seekers flooding the crude futures market.

It seems like we keep waiting for the ExpensiveMistake that collapses the liquidity chain. Then we see how much worse the repeat of 2007/8 could be.

If TBTF really is not, and the fed take out any credibility for the dollar, what top is there for oil? Can the feds pull double or worse on the balance sheet over the next few years as they did in the last 10? How many trillion was that again?

Not that much demand will survive 8 to 12 a gallon.

I wonder how much of this is peak oil and how much is hot money leaving other markets that are readily facing declines. I imagine that there is quite of bit that has left the Chinese economy that is now facing a conclusion of their bubble, with roll off effects on the Australian economy, it has probably been exiting Europe for quite a while, and then recently we have the fed decision to slowly remove themselves from QE deflating the U.S market. I don’t know the mechanics of this, but I imagine that they may pop back into commodities with these other areas facing problematic prospects.

A truly muddled piece …

According to both the US and German militaries we are headed for oil shortages in 2015 as demand outstrips supply by 10 million barrels … The shortages are only being tempered by the economic crash in the EU and MENA and the slowing of the rest of the world economy …

Complete English translation of German military analysis of peak oil now available

http://www.resilience.org/stories/2011-08-30/complete-english-translation-german-military-analysis-peak-oil-now-available

US military warns oil output may dip causing massive shortages by 2015

http://www.guardian.co.uk/business/2010/apr/11/peak-oil-production-supply

I agree – the use of Australian figures is silly as the value of the Australian dollar has dropped by > 10% in a couple of months explaining the sharp hike.

And the big look of the hikes reflect also in part the use of very short Y axes – an old trick from “How to Lie with Statistics”.

The first plot by contrast shows a more gradual peak consistent with your points.

It may be that high prices in part reflect Middle East instability too. But since ‘peak oil’ was recognised as an issue the real question in this one about massive shortages. What it doesn’t say yet is the impact of gas which can both replace petrol/diesel and can now be converted into the latter – temporarily and albeit at a premium and with a delay for tooling up.

Oilprice ran a piece about Kazakhstan and Turkmenistan and also Azerbaijan. All three countries extracting Caspian oil and due to be a big new supplier for Europe. Iranian oil is already going to China. The spat between Syria and Israel seems like it might be over the natural gas reserves in the eastern Mediterranean more than anything else. Except of course that they hate each other. Who wouldn’t?

Anyway, this is just another reason to stop driving cars. Scarcity causes war.

Tight OPEC spare capacity levels, namely Saudi spare capacity levels, serve as a supportive backdrop for these supply risks. The latest IEA data showed Saudi spare capacity holding under 2 mln bbl/day, with OPEC spare capacity as a whole at 3.4 mln bbl/day.

“A Syrian democracy more tolerant of Israel”

Why would a Syrian democracy be more tolerant of Israel?

Or is the Orwellian definition of “democracy”, so common in the US, also common coinage in Australia?

Syrvocracy?

I think a democracy made of islamic fundamentalists, would be the worst. Thing. EVER. For Israel.

No clue why anyone would think having Assad go would be in Israels interest, but apparently Israel thinks its a good idea.

I think his statement makes sense if democracy means a government that will give it’s own population the finger (or worse) and do whatever the US tells it do.

That’s ordinarily what we mean when we restore “democracy and the rule of law” overseas, and it’s the likely outcome of a US-backed military action.

The fact is that Assad is doomed. Israel liked having Assad in power… for a while… but when a leader is doomed, it just makes sense to back his opposition.

Is the current oil shock a result of that? No, as you said, it seems to be speculators driving oil prices higher in the face of geopolitical instability. In this case oil prices are more likely to fall in the long term then stay high unless a scenario like the below happens:

High oil prices due to geopolitical risk may drive investors into the market to minimize economic risk (Market top… shift of risky assets into so called safe assets). If oil prices were around $85-90 a barrel there might no incentive to do so but at current prices it may look like prices could continue to rise.

I am not sure its a supply shortage that is affecting the WTI price. More likely its a combination of factors :

1) Potential reversal of the pipelines into Mexico and to the coasts (Seaway).

2) Genuine seasonal demand.

3) The wrong quality of oil being stored at Cushing, causing a shortage in light sweet crude.

4) The WTI carry trade unwinding due to slight rises in interest rates on tapering talk.

5) Other taper talk effects on the cost of storage and financialisation of US crude stocks.

http://ftalphaville.ft.com/2013/07/10/1563962/the-wti-carry-unwind/

http://ftalphaville.ft.com/2013/07/03/1555962/wti-and-the-taper-effect/

The short term picture is one thing. In the long term, oil is going to get more expensive.

If you are buying a vehicle in the next few years and can afford a vehicle that can run on electricity, it makes sense to buy one. If you can afford an electric car or plug in hybrid, buy one. If you can’t afford an electric car, buy an electric bicycle. If you can’t afford an electric bicycle, buy a regular bicycle.

This is sage advice.

My primary reluctance in using a bike is the traffic and the disrespect and lack of observation some drivers show toward cyclists on the road resulting in hospital visits and permanent cemetery stays for the cyclists. When oil prices increase radically enough that my city starts looking like Beijing on the roads, I’ll be perfectly ok with biking.

And if you can easily move somewhere with urban rail (a subway, etc.) where you don’t need a car at all, do so.

You might still want a bike in case of strikes, though.

FT AV had a post few days back arguing that the high oil prices were due to an unwind of synthetic oil structures (the unwind triggered by rising real rates courtesy of Fed)

Over at EconMatters, they have a few ideas—Oil in Tankers to Manipulate Prices?

“…the real reason they (gas prices) are rising is that a bunch of oil is being taken off the market and stored in ports around the world to artificially raise prices.”

http://www.econmatters.com/2013/07/oil-in-tankers-to-manipulate-prices.html

And, “Oil is the Next Major Commodity to Crash”—http://www.econmatters.com/2013/06/oil-is-next-major-commodity-to-be-taken.html

With the futures curve in backwardation, the oil-in-tankers play makes no sense for actors driven solely by economic motives.

But it makes perfect sense if you think something violent will be happening on the Iranian nuclear front.

Best (not very likely) case: Somebody’s looking to influence hearts and minds among the Iranian leadership.

We’ve all heard of “cog-dissonance.” Here comes “chart-dissonance.”

seems as long as Assad is in charge, Israel can keep control, like they do now. wouldn’t any change from Assad be bad for Israel? Israel calls the shots in that whole region now. seems Israel would want to keep the status quo. a splintered Syria is good for Israel, isn’t it?

I agree that it would not be in their interest.

But we are talking about Likudniks here. They have never proven to be reliably sane.

Yeah, they have some strange ideas about what’s in Israel’s national interest alright. Their thinking seems very short term.

Syria with a defeated Assad would be an al qaeda driven wild west, mad max with burkas and car bombs.

Oil is important but fresh water and food will go hand in hand with oil/energy needs! If we don’t get fusion power on line to supply our ever growing electric energy needs we WILL forced to fight wars over oil, water and food!!!! Many of our problems of dwindeling oil, food and water with an increasing population can be overcome with the extra electrical generation capacity that ONLY fusion power can offer. Nuclear fusion power can be made to work safely. It takes time and effort! Little effort has occured and WE ARE RUNNING OUT OF TIME!!! Has anyone had any power outages due to over demand, lately? It’s a warning sign of things to come…. and it’s coming really fast!!!

Where I live solar returns unused electricity to the grid. Also we have good bike lanes.

Ah, fusion power.

Amateurs can build mini-fusion reactors for a few hundred bucks in their garage Of course the energy required is less than the energy produced but still it’s encouraging.

correction: “less” should be “more”

Understand the difference between a fusor and a fusion reactor…

The kid is very sharp but what he built has been a lab curiosity for a long time…

A few points.

1. according to Greg Palast (occasional contributor to NC), Cheney made the Iraq war about restricting Iraq oil output, thus jacking up the price. High oil price = tar sands become profitable to collect = Halliburton gets paid.

2. Over time, the biggest oil price jumps have coiincided with the 1979 Iran revolution and the 2003 Iraq war.

3. Quantitative easing causes the price of imports to spike (e.g. oil)

4. There was a recent (NC cross-posted?) article which said that Saudi Arabia has the opportunity to flood the market with oil, in order to make the tar sands oil unprofitable to collect.

I’ve wondered why the Canadians run their pipeline to Hudson Bay and ship it out there?

my guess is – I don’t think the Canadians want the resulting mess from refining

And all the while Halliburton does business with Iran.

Greg Palast is shilling for someone…

At the time Iragi production was in serious decline in no small part due to the sanctions in place. In fact, since the invasion Iraqi production is up 2 mmbpd while oil prices have roughly tripled…

The reason Iraq was invaded was in the most part due to the desire to keep oil priced in dollars and not some other currency. The US insured the hegemony of the petro-dollar…

Rig counts in SA are at historic highs while production stagnates and internal consumption rises at 7% p.a.

http://mazamascience.com/OilExport/

Select SA or Iraq

As for SA rig counts, here let me google that for you

http://lmgtfy.com/?q=Saudi+Arabia+rig+count

Please, lets have fact based discussions…

Oops! insert don’t

As if the carnage of the Iraq disaster wasn’t enough, or is forgotten, or didn’t nearly destroy the country. or may still before it’s all over. Daily suicides, foreclosures and job losses don’t matter to the vulcans, who clearly inhabit a different air conditioned reality.

Israel, that shining beacon of tolerance? Yet it’s Hezbollah that needs to be contained? Let’s contain Goldman Sachs and the Pentagon first. Ground the F35, auction off the USS John McCain!

It is unfortunate that such a dated and impoverished analysis has been published yet again on this site. Some time ago, may be a year ago, there was a person, I believe from England who wrote for this site that the price of oil was going to go down to around $35-50! So, the price is pushing US$110! There needs to be more competent analysis on this site. Syria is a very low level producer and the conflict there has absolutely nothing to do with the price of crude or gasoline.

1/ Supply and Demand for oil has no bearing on the price of gas or oil. It is the big banks like Goldman-Sachs, JP MOrgan Chase, Citi, etc. which manipulate futures markets and which lack regulation of futures positions is the main culprit here. Canada, which has excess crude, albeit of poor quality, and which is going for around $50 less than the U.S. bench-mark crude stored in Oklahoma has higher gas/petrol prices than those in U.S. Unless, the big banks are both broken up by region and forced to divest their risky/investment portfolios from the basic function of banking, the price of oil/gasoline will remain very high, absent very tough regulation by the SEC and CFTC, which is well nigh impossible under the current political regime. The Dept. of Energy tells us that the consumption has gone down substantially, and concomitantly so has inventory. Yet, the lower inventory is trotted out as the reason for higher and higher oil prices as is Syria. What a joke! Refiners like Tesoro and Valero continue to make triple digit profits by buying cheap crude from Canada and selling it for very high prices in the U.S.

2/ The banks and oil companies don’t want the Australian Labor Party to win in the coming Australian election.

Look at the Brent Price as the WTI price until recently has been held down by infrastructure factors. (there was a glut in Cushing OK and it was hard to get it to the gulf coast, as the pipelines ran the wrong way) This was due to the North Dakota oil boom. The pipelines have been turned around to ship oil to the gulf coast removing the glut. It should be noted that folks on the US coasts are more influenced by Brent than WTI. Anyway Brent is about $10 below prices at the begining of the year. The Austrailian prices show confirm this. I wish folks would cease to refer to WTI and instead look at Brent, which is a true world market not limited to central Oklahoma.

The cheap oil is gone and we are on to the expensive stuff. Westerners are being outbid by Asians for a declining supply of available exports, as suppliers get increasingly high on their own supply. The oil we consume now comes at far greater cost in energy as well, meaning we have to produce more and more barrels to achieve the same amount of net energy.

Oil price ‘shock’? It shouldn’t be a shock to anybody at this point.

In the medium term, the coming Chinese recession will bring some drops in oil prices, but we should get another peak first, because it’ll take a while for China to actaully hit its recession.

It looks very strange to me. The Syrian civil war has been ongoing for months (years already?) and nothing happened, Hizbollah seems hardly a justification and by the moment trouble in Egypt seems contained. None of them seem a clear justification.

So I would think that either it is a purely speculative movement of some sort or there is insider information floating in some circles announcing something much more serious to come, such as an attack against Iran or something of the like.

You tell me.

“You tell me.”

How about this: If the price were lower then the world would want to consume more oil than can currently be produced?

If anybody has adequately disproved the simple explanation, I haven’t seen it.

But that’s a long term explanation, not a short term one, Robert. And the phenomenon as described above is pretty much a sudden thing, with barrel price rising from $90 to $118 (and probably higher soon) in few weeks.

So why now? All the “explanations” about Syria, Hizbollah rumors, Egypt’s nothing happening… sound like not making any sense. Guess we can always imagine it’s a fluke but I was hoping someone could muster a better explanation.

PS- If we look at the previous (2011) peaks, they seem to be motivated by actual hardcore turmoil: Egyptian revolution, Bahrain uprising, Lybian civil war, as well as the Fukushima catastrophe in the first peak; the second peak is less clearly motivated but can be considered in part a speculative aftershock of the first one with some independent motivation by OWS turmoil in the USA and the power vacuum incognite of Lybia.

But right now there’s nothing particularly notorious I can see justifying this climb of 30%.

I guess you are asking why WTI is catching up with Brent. I would argue that whatever circumstances were causing the spread between WTI and Brent in the first place are anticipated to be removed. As for why Brent is as seemingly high as it is, see previous answer.

What? No analysis of imperialist pigs choking on a gargantuan mountain of unpayable debt saddling a collapsing physical economy, whose top layer having been added by lenders of last resort over recent years desperately awaits discovery by the Mars Curiosity Rover of a benevolent, alien life form willing to provide a deep backstop, which failure thus far only but further exposes the average imperialist’s revulsion toward paying taxes and love of collecting them (which function the energy market serves)? Don’t know what you’re talking about per Syria, but the strategy of sending as many bearded crazies as humanly possible to a place where their anxiously anticipated dirt nap is being facilitated, although welcome news, hardly seems reason justifying the bid under crude. This just in from the year 2006… Hezbollah beat back the Zionist lunatics who had invaded Lebanon, which outcome begs the question, whose dumb idea was it to concentrate Jews in Palestine? ANSWER: The same imperialist pigs of the Venetian variety who brought the world that other Austrian nightmare (before von Mises) named Hitler…