Return of the Polar Vortex Wunderground. I hate to sound like the old fart that I am, but in the 1980s, every winter, there would be at least one 2-3 day period when the daily high was below 5 degrees in NYC, sometimes below zero. The problem is with over 20 years of not having spells like that, no one has the right clothes for it when it does show up. Wear more layers!!!

Risks associated with the use of antidepressants & antipsychotics David Healy (furzy mouse)

Boeing Finds a Promising Green Diesel Reviving Gaia

“Password” unseated by “123456” on SplashData’s annual “Worst Passwords” list Splashdata

The coming Calculus MOOC Revolution and the end of math research Cathy O’Neil. More than robots can replace white collar jobs….and the knock-on effects can be large.

Middle class rage threatens democracy AsiaPacific

On the overvaluation of the yuan FT Alphaville

Thai ‘red-shirt’ protest leader shot BBC

Sullen in Singapore: Its workers are the unhappiest in Asia Reuters

China’s princelings storing riches in Caribbean haven Guardian

Malaysia blocks US trade shocker. Will we? MacroBusiness. AFR = Australian Financial Review, their answer to the Wall Street Journal. Malaysia has been vocal about its opposition to parts of the TPP, so the key bit isn’t their unhappiness per se, but that more and more media outlets in other potential signatories are taking note.

Police storm Kiev protest barricades BBC

What Is Going on in Euro Money Markets? WSJ Real Time Economics (Scott)

Euro and Non-Euro Countries and Fiscal Policy Menzie Chinn, Econbrowser

Secret funding for war on al-Qaeda in Syria Telegraph

Syria: The Geneva II Conference Trouble Moon of Alabama

Big Brother is Watching You Watch

SNOWDEN CALLS RUSSIAN-SPY STORY “ABSURD” New Yorker

The World Is Not Enough – How To Reinvent The Internet Evgeny Morozov (Lambert)

U.S. officials privately worry NSA plan is ‘impossible’ to accomplish quickly Washington Post

Trucking company that moves soldiers is accused of bilking government McClatcy

New Study Finds Tea Party Membership Ranks Still Growing, Even as Sympathy Declines Institute for Research & Education on Human Rights

McDonnell, wife charged Washington Post

Port Authority study supported Hoboken project at center of allegation Daily Kos (Carol B)

West Virginians Still Need Water After Coal Chemical Spill Jooleman, Firedoglake

What’s Cuomo spending $30 million on at Onondaga Lake? County Legislature chairman won’t say Syracuse.com (bob)

Cuomo tried gifting private university $200M for football stadium Daily Kos (Carol B)

IBM revenue misses Street hit by weak China demand and Chipmaker AMD forecasts revenue below estimates Reuters

The Golden Age of Journalism? Your Newspaper, Your Choice Tom Engelhardt

Ownership of WaPo by CIA Contractor Puts U.S. Journalism in Dangerous Terrain Real News Network

Why The Washington Post passed on Ezra Klein Politico

El-Erian quits as Pimco chief in reshuffle Financial Times

The Damage From the Housing Bubble: How Much Did the Greenspan-Rubin Gang Cost Us? Dean Baker

Concentrated cash pile puts recovery in hands of the few Financial Times. Furzy mouse: “Here’s the real problem with the “recovery”….why should We the Corps spend one red cent, when sitting fat and happy?”

Analysis: Corporate cash may not all flow back with recovery Reuters

O.E.D.’s New Chief Editor Speaks of Its Future New York Times (furzy mouse)

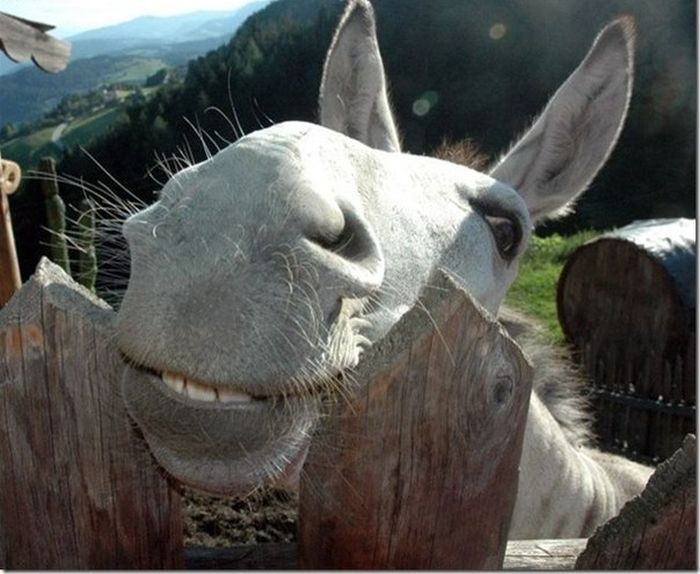

Antidote du jour:

Is Greek para-state playing its last card?

http://failedevolution.blogspot.gr/2014/01/is-greek-para-state-playing-its-last.html

let’s try again;

you have till Feb 24 to comment on the USDA approval of Agent Orange GMOs

http://www.regulations.gov/#!documentDetail;D=APHIS-2013-0042-0050

to me, the main issue is that industrial manufacture of 2,4-D invariably is contaminated with carcinogenic and mutagenic tetra-dioxin, which does not break down even when incinerated

look up agent orange and 2,3,7,8 -T on wikipedia

All this proves the fundamental lie at the core of the whole GMO regime. Herbicide tolerant GMOs as a genre already comprise a proven failure from any reality-based point of view, in the same way that corporate agriculture has long since been proven to be unable and unwilling to “feed the world”. If there was ever any doubt, there no longer is. Both of these now qualify as Big Lies, repeatable only by conscious liars and by those with a willful, reckless disregard and contempt for the truth.

http://climatechangepsychology.blogspot.com/2014/01/usda-expects-to-approve-agent-orange.html

**Man is not what he thinks he is, he is what he hides.**

André Malraux

Wikipedia states the Green Party has as many members as the Tea Party, and they are a true electoral party, rather than some Republican faction. Why does the Tea Party continue to get attention, when they act as nothing more than Republican spoilers – more so than the Greens for the Dems, because at least the Greens represent a separate party organization. I wish the equally strong Greens got the same level of attention as the Tea Party.

because the tea party has rich sugar daddies to promote them and the Green party does not.

I’d say you’re right, dcblogger. And add that our corporate media is happy to promote teapers, while deriding the Greens.

And for the same reason…the teapers serve the interests of people with money (lower taxes! less regulation!), and the Greens do not.

~

I think it’s worth a PR try to go with a more catchy name – Green Tea Party.

‘Green Tea Partiers, we are better than just Tea Partiers, and you can take it with or without sugar daddies.’

I believe you would have more success if they were referred to as “organic stevia daddies.”

That’s strong stuff.

Re: What Is Going on in Euro Money Markets? WSJ Real Time Economics (Scott)

This excess of reserves is an interesting problem. This seems to be the main effect of QE. To the extent that the interest rates are too low and not backed by high quality collateral probably reflects an unhealthy subsidy to banks. This appears to reflect mainly a lack of political will to deal with fraudulently induced insolvency.

I don’t know what the figures are for the ECB but I think they would be hard pressed to match the Fed.

http://www.levyinstitute.org/pubs/rpr_4_13.pdf

“”Before the first policy moves related to the current crisis in August 2007, the Fed’s reserve accounts were equal to about 5.5 percent of the monetary base. Today, the Fed’s reserve accounts—nearly all of which are in excess of the amounts required—are equal to about 60 percent of the monetary base. Required reserves are only three percent of the monetary base.””

“”Essentially, the new reserves provided by the purchases program enabled the banking system to fund the repayment of about $1 trillion of various forms of advances to financial institutions under the emergency lending program. The emergency lending program ended, but quantitative easing replaced it.””

“”Charging below-market subsidy rates violates the classical ideal of impartiality in LLR (lender of last resort) lending, and channels credit not to its highest and best uses as the market tends to do, but rather to politically favored recipients. The same inefficient and suboptimal allocation of credit occurs when the Fed purchases tarnished assets from selected preferred sellers.””

“”Rescuing Unsound Firms Too Big to Fail. Fourth, the Fed ignored the classical admonition never to accommodate unsound borrowers when it bailed out insolvent Citigroup and AIG. Judging each firm too big and too interconnected to fail, the Fed argued that it had no choice but to aid in their rescue since each formed the hub of a vast network of counterparty credit interrelationships vital to the financial markets, such that the failure of either firm would have brought about the collapse of the entire financial system. Fed policymakers neglected to notice that Bagehot already had examined this argument and had shown that interconnectedness of debtor-creditor relationships and the associated danger of systemic failure constituted no good reason to bail out insolvent firms. Modern bailout critics take Bagehot one step further, contending that insolvent firms should be allowed to fail and go through receivership, recapitalization, and reorganization.””

“”In retrospect, it is difficult to see how further expansion of the excess reserves pool by the quantitative easing programs once the initial round of emergency lending generally ceased in March 2009 assisted in the maintenance of sound economic conditions or helped lay the basis for a sustained recovery. Real rates of return have to become positive for borrowers to identify projects for which they wish to borrow and for lenders to prefer to lend.””

“”That is the lesson we can learn from Japan: if government does not ramp up the fiscal stimulus, and keep it ramped up until a full-blown recovery has occurred, the economy will remain trapped in recession””

———

This implies a combination of markets working together with government regulation and without favoritism..

One example of the Feds emergency programs…

TALF: The top three cumulative borrowers, Morgan Stanley, PIMCO, and California Public Employees’ Retirement System would borrow roughly $22 billion or 65 percent of the total borrowing. Together, they borrowed at a weighted average rate of 1.76 percent

“This appears to reflect mainly a lack of political will to deal with fraudulently induced insolvency. ”

Agreed. We have a pretend “profit and loss” system. Well, I guess if your net worth is less than a billion, you can take a loss and be put out on the streets. But no BANKERS – EVER!!!!

You’d have to include Bernanke, Summers, and Geithner with Rubin and Greenspan as the main culprits in the financial crisis. Soon to be joined by Yellen and Lew we might add. But this is almost equivalent to saying no one is culpable. The Marxist idea that capitalism is doomed to collapse has obviously served to excuse our intelligensia for this failure.

Here’s an interesting reference cited in the David Healy article on antidepressants:

“Anatomy of an Epidemic: Magic Bullets, Psychiatric Drugs, and the Astonishing Rise of Mental Illness in America”

Full link (in case the href form above doesn’t work):

http://www.amazon.com/Anatomy-Epidemic-Bullets-Psychiatric-Astonishing/dp/0307452425/ref=sr_1_1

You might like this one too: http://www.amazon.com/Crazy-Like-Us-Globalization-American/dp/1416587098/ref=pd_bxgy_b_text_z/191-7221620-6118317

If alcohol which is a drug and depressant is the #1 drug of choice of Americans, then is it any wonder that we should need anti-depressants to counter alcohol? In addition, many other drugs are prescribed to counter the effects of alcohol.

Death Rattle Cocktail

1 pt. antidepressant

2 pt. alcohol

it ain’t easy bein crazy…(or cheeeep @ 1.00 per mg.)

A Twenty-First Century American Sacrifice Zone

http://www.tomdispatch.com/blog/175585/

The White Ghetto

http://www.nationalreview.com/article/367903/white-ghetto-kevin-d-williamson

Someone wrote the exact response to “For the Love of Money” (by Sam Polk, NYT) that I was hoping for.

http://www.salon.com/2014/01/22/wolf_of_wall_street_syndrome_the_dangerous_individualism_of_the_neoliberal_soul_partner/

Speaking of syndromes, is this Stockholm Syndrome: Chanting ‘GO GDP GO’ when you have been a recent victim of a GDP growth that has gone 120% to the 0.01%?

The more the GDP grows, the more you lose!

And the solution is to identify more with the 0.01%?

The articles now fail to refer to the original source of these protests: that they were in response to the Ukrainian government’s failure to sign an EU integration pact. It upsets me to see that the pro EU message has been lost and that it is now framed as a free speech protest, devoid of the economic and political backstory. One of the sites I was reading yesterday had an interesting quote about how Kiev would blow up once there was a fatality (which then happened later in the day). very sad. Here’s a video from December to contrast the bleak burnt out BBC photos. This is what it looks like when a million people gather to march peacefully (and it’s accompanied by my favorite Ukrainian band! I love DakhaBrakha!!!)

http://www.youtube.com/watch?v=aDj639UStkQ&list=UUiK8ixVCuaNWmC_xVGr8qCQ

I love today’s antidote. it makes me smile just looking at it.

On another note, I got a shocker in the mail yesterday. 3 years after filing two official complaints with the OCC regarding bank malfeasance – in one case Deutsche Bank refusing my court ordered payments for 2 years and then filing a third 21 day notice of trustee sale, and the elective foreclosure by Chase of my current commercial loan (despite expiicit instructions from Treasury and the Fed to extend perfoming, collatoralized loans) the OCC writes to ask basically, How’s it going. Still need our help?

In the case of Deutsche, they actually did do some behind the scenes work and make Deutsche call off the sale (by that time I had given up hope and sued Deutsche and reopened my BK case to get an emergency stay with what turned out to be the most debtor hating hanging judge the US Fed bench has ever seen in L.A. So called “Judge” Sandra Klein. that was a disaster winning that judge in the lottery. Usually in BK cases, given enough time, you wait to see which judge is next in the queue – and wait until you get one that you know tends to be more debtor friendly (or in the case of filing an involuntary BK action against someone, more creditor friendly.)

In the case of Chase, immediately upon getting notification from the OCC Chase called to say they would be sending me a package toward an extension, and the next day filed an NOD, basically shutting out the OCC. Under OCC rules, once there is a legal action filed, they have to bow out. No more “assistance.”

I think it doesn’t hurt that both Chase “Special Situations” and the OCC “assistance” dept. are in Houston. Always keep the revolving door close. I alerted the OCC to Chase’s actions re filing an NOD in response to a request from the OCC, but never heard back until now, I guess because of the Catch-22, “If the bank hires a lawyer, we’re out of here.”

I guess these letters served three functions: CYA, rub salt in your wounds, and say “Did we wait long enough for the banks to achieve their objectives?” 3 years to follow up on cases I filed in 2011.

God, sometimes I hate this country.

Down2; You might want to go about this from the opposite direction. The “names” you mentioned are at war with one another. Chase and Deutsche have sued and counter sued one another for fraud in securitization. I don’t want this to sound like legal advice because it is not. But have you ever thought of going on offensive? When the big name frauds can’t do something it means they are potentially blocked by a law that scares them. You might force them to prove their claims instead of relying on them to do something you expect them to do, or that they are required by law to do. They don’t share this sense of law and order with you.

OCC is good for FOIA answers and consent agreements. Expose the things they can’t patch up and they fade away.

Thanks Brian for taking time to consider my situation. I didn’t mean to imply the Deutsche and Chase cases are connected. They were on two separate properties.

Of the 8 real estate loans I had in 2008, 7 of them were with banks/trusts/servicers that are notorious for breaking the law. The only reasonable lender were the hard money people who had one loan. They knew that if they foreclosed, they would lose a bucket. As it was, I was able to pay them on time at a reduced rate, the property has recovered, I refied, and everyone’s happy. (They also saved my ass by voting for my Chap. 11 confirmation as my biggest creditor. When your biggest impaired creditor votes for your reorg, everyone else just has to fall in line.)

I did finally get a settlement with Deutsche, and save that building, so after four years that is resolved.

Chase did take the building, but had let it go to waste in that criminal neglect charges were filed against them while in possession. I unfortunately did not the notice until after the trustee sale. Had I gotten it before the sale, I could’ve probably gotten the building back. You must always protect the collateral, first and foremost.

I am now involved with Wells/ASC/Lasalle Bank trustee of Morgan Stanley trust on a different property. They have been returning my court ordered payments (returning my checks) for four years, They filed an NOD, we are now at the trustee sale stage, so I am going to have to file for an injunction in State court. After the Glaski decision last summer, this is going to be a mess for all of them. It was a MERS loan, transferred, sliced, diced, etc. Under Glaski you cannot seek relief just for a broken chain of title – but refusing my payments makes it a slam dunk to include broken title in litigation, as well as violation of CA Fair Business Practices, etc.

Am planning to litigate with a jury trial. Been saving my pennies for a new lawyer. I have been lucky enough to find money to pay lawyers between friends and family – but $200K over the last five years has meant that I live a very restricted life. Hey I have my cats, my health, and my fighting Viking spirit. That’s enough sometime.

I worked for 15 years on buying restoring these buildings. It was my retirement. In 2008 it looked like I would end up homeless. So this was always a fight for survival.

RE: U.S. officials privately worry NSA plan is ‘impossible’ to accomplish quickly

Store the data at the Justice Department in a secure environment. Allow unlimited queries. However, if queries without a legal warrant exceed 10% of the total queries in any given period of time the entire encrypted database is purged of information. The database itself should contain content that is no more than two years old.

Requests should contain the following information;

1) Which agency is asking for the information. (CIA, FBI, DEA etc.)

2) The justification for their query. (criminal, terrorism, etc)

3) The individual who is inputting the request w/ appropriate identification credentials.

4) The judge who signed the warrant.

5) Other relevant information including the scope of the metadata they are searching.

This information should be immediately released to the public advocates on the FISC, as well as to the public on an annual basis. I’d be open to allowing warrants to be inputted up to 72 hours after the initial query to provide a decent amount of time for any investigation to file the appropriate paperwork. Combined with an adversarial appeal process to a different judge qualified to sit on the FISC regarding the issuing of the original warrant.

This proposal ensures that legal compliance is being followed with an adequate enforcement mechanism in place. It wouldn’t take very long to put into practice. The realistic alternative is that they won’t do anything differently. That’s what the bastards are hoping for.

How ’bout that Naked Capitalism? Can we live with that for now?

Circle the wagons, boyzz. Keep the fox in charge of the henhouse. Continue to trust known serial liars. Paranoid types, paranoid war waging institutions who treat every human being on earth as suspect. And remember suspect is all one has to be to be vaporized.

I wouldn’t dare presume to speak for NC…. but Hell No!

So you basically want to do nothing. Thus enabling the intelligence community to continue their surveillance efforts uninhibited. Duly noted.

“Fight the pow… err let the powers do what they want. Then we can piss and moan!”

Solutions seem simple.

Since they’re not… my guess is they are lying to us about how the data is being used. Rather than simply searching the DB as a user would say Google, they probably have complex algorithms running in the backend (as say Google) which aggregates the data into graphs. How do you get a warrant for a “I’m feeling lucky” button.

I’m guessing their interface and programs aren’t nearly that advanced…. yet. According to Snowden, their programs are set up so any analyst can input a telephone number or IP address to bring up the relevant data on their screen. As long as this requires a primary target source this process could work.

Their capacity has to be structured in an elementary fashion for non-technical experts to utilize these tools. I imagine the second hop data is brought up in a Microsoft Office spreadsheet format. In any case I am unaccustomed to giving away freebies despite being in the darkness of a street alley.

There’s no way that last statement can be misconstrued.

‘The cumulative loss in output through 2089 as a result of the collapse of the Greenspan-Rubin bubble would be $66.3 trillion.’ — Dean Baker

All well and good, Dean.

If the collapse of the current Bernanke-Yellen bubble costs another $66 trillion, we gonna be in a world of hurt.

The whole equities pricing scam looks like a big bag of Cheese Puffs, half full of hot air at a jacked-up price.

“Return of the Polar Vortex Wunderground. …. The problem is with over 20 years of not having spells like that, no one has the right clothes for it when it does show up. Wear more layers!!!”

No wrong weather, just wrong clothing. Personally I love extreme weather. Everyone should experience taking a walk ( or a bike ride) out in a park or the woods on a F-ing cold day. The air is clean and dense, critters walk up to you for handouts.

http://wx.hamweather.com/maps/climate/outlooks/610day/temperature/us.html

“In your hands winter

is a book with cloud pages

that snow pearls of love.”

Aberjhani

Here Aby..

http://earth.nullschool.net/#2014/01/22/0000Z/wind/surface/level/overlay=temp/orthographic=-89.38,40.91,844

A site I like , a prof. sailor friend of mine passed this along to me

Click on EARTH logo for different imagery parameters

oulala, said the nun to the sailor…Thanks Opti

http://farm8.staticflickr.com/7146/6605705969_658b614d69_z.jpg

Ahem … Ah, um, Yves … “AFR” actually stands for “Australian Financial Review”.

Gift of $200 million for a football stadium.

I think we have to move away from central planning of charity by a committee of one to a free market based charity.

It is a stupid sport that should seek its scale of success while being entirely private sector funded. I heard secondhand that SBowl Skyboxes are $1MM right now? Certainly there is enough corporate money sloshing to cover a stadium.

Ukraine, the Punch populist movement looks like what I expect could emerge in the US presidential cycle around some celebrity or another.

Growing up and becoming wiser…

I have moved beyond these passwords for good:

123456

password

Idontknow

whatwasit

huh (but was rejected for being too easily deciphered)

UDumbRobot

NotUrBizness

123456…that’s the same combination I have on my luggage!

RE: How flu remedies help you…

“However, British experts said that while the Canadians may have a theoretical point, the spread of flu is much more complex than their calculations allowed for.”

I never really thought of close “contact” with a contagious person or something they touched as a particularly “complex” concept, but then what do I know. I’m no “expert.”

Did someone pass a law against agreeing on ANYTHING while I wasn’t paying attention?

This article shows the power of supply side economic thinking (mainly among policy makers) and the power of insurance companies in the FIRE sector. Employment would create the demand that businesses are looking for to invest in plants and equipment. Single payer would provide much relief to both employees and employers..

Analysis: Corporate cash may not all flow back with recovery Reuters

“”Less than a third of firms said moves of up to 200 basis points in key borrowing rates up or down would affect their investment plans at all.

So what would get companies to hoard or invest these days? The two most commonly chosen drivers in the survey cited in the paper were “ability to maintain margins” and the “cost of health care.”

There’s little doubt a sustained recovery and greater earnings visibility could encourage some investment of the cashpiles. But it’s clearly not all about the cycle and temporary corporate caution.””

Peronism struggles with the internet:

Argentina tightened foreign currency restrictions for a second straight day by further limiting the purchases of goods online, escalating an effort to arrest a decline in dollar reserves.

Argentines will be limited to two Internet purchases abroad for delivery at home per year using credit cards, according to a resolution by the tax agency published in the official gazette. The tax agency, known as AFIP, increased paperwork on online shopping yesterday.

“Given the large increase in the use of these channels, which makes it harder for customs to control, we must implement measures to have greater information on the shipments,” the resolution said.

http://www.bloomberg.com/news/2014-01-22/argentina-targets-online-purchases-to-slow-dollar-reserve-drain.html

————

Meanwhile, LatAm’s other strong-peso paradise, Venezuela, has food problems. Bloomberg reports that according to Empresas Polar SA, Venezuela’s largest privately-held company, foreign suppliers of food, packaging, and equipment have closed credit lines because of the government’s delays in giving the company dollars at official rate. Empresas added that dollar delays are now the longest since the introduction of currency controls in Feb. 2003.

Take our bolivars and pesos, comrades … PLEASE!

Illustrates the dangers of running a current account deficit when you don’t own the reserve currency.

The next phase is an inflationary spike that deters consumption, investment and undermines FX competitiveness gains,” Jefferies’ Morden wrote in the report.

Well, that does tend to happen when you devalue your currency in the FX markets. The government hopes to render imports more expensive and exports less so, but it should go without saying that this will lower the Brazilian standard of living.

I just read this story: http://www.rawstory.com/rs/2014/01/22/glenn-beck-bill-nyes-creationism-denial-is-like-the-catholic-church-jailing-galileo/

So now we are “officially” going backwards. Up is down, in is out, black is white, etc.

Just think of all the good that could be done by humans if we stopped propping up the class based social organization that breeds ignorance like this.

Drugs can help bugs spread easily.

Goldmine, that’s a word that comes to mind, for pharmaceutical corporations!

Maybe Ponzi scheme is a better description.

Obama is right: privatizing metadata storage would be a nightmare Yasha Levine

The Liberal Surveillance State Crooked Timber – worth it for the comments

Undercover Googlers Defend Surveillance Valley Yasha Levine

The Guardian makes fun of New Yaawkers slipping on icy streets:

http://www.theguardian.com/world/gallery/2014/jan/22/slipping-sliding-new-york-ice-photos

Cuomo tried gifting private university $200M for football stadium Daily Kos (Carol B)

Love the last line in that story:

“There are few organizations more corrupt than the NCAA.”

http://www.thenation.com/article/173307/ncaa-poster-boy-corruption-and-exploitation

Syracuse, like most universities, is nothing more than a corporation which is a Cash Cow for whoever can get a piece of the action.

And, NC, with two of the most tawdry and rotten “sporting” events coming up, the Olympricks and the Stupor Bowl, how about some special attention to them? Both are part and parcel of the economic problems we face. Certainly, the NFL with its monopoly granted by Congress to billionaire owers who receive massive stadium and tax subsidies deserves some special attention and economic comment. The Olympricks are controlled and operated by the Global 1%. And both these events help to sell all the overconsumption and material excess we see around us.

Syracuse University aka Newhouse private equity group

Would you believe that the local adavance/newhouse owned newspaper is in favor of the 500 million dollar stadium?

Also adding- The land that the 500 million dollar stadium is on is “owned” by SUNY upstate, but the development of the land is “controlled” by COR development, a very private company,

How is the land not taxable? The way it was sold in the press another “private” company would step in to “own” the stadium after it was built. No word on any property taxes, but the R county exec (aka Cuomo’s new bestest buddy), said that private “participation” was a “requirement”.

And then the F-ing sunroof. The last gov funded project of this size in the area, DestiNy, a mall, privately owned by Bob Congel, promised the same.

Syracuse gets less sun that Seattle. But, if you build a sun roof, you get sun!

The Olympics deserve some comment.

Like wealth being not about the 0.01% rich people, but what the average Joe can partake in it, athletics and fitness is about you and me being in shape.

Unfortunately, as the elite athletes jump higher and run faster, more and more out-of-shape people are glued to their couches.

If you are against wealth concentration, you should be against health/fitness concentration.

We need to get back to ‘art is not about the painting on the wall,’ and get people to take their lives back through active thinking, writing, doing, walking, singing, acting, philosophizing, politicking, farming, hunting, etc., instead of watching reality on TV.

“We need to get back to ‘art is not about the painting on the wall,’ and get people to take their lives back through active thinking, writing, doing, walking, singing, acting, philosophizing, politicking, farming, hunting, etc., instead of watching reality on TV.”

The above is one of the most important but little discussed concepts for the individual to understand, way more important than interest rates, for example. Humans are becoming spectators, even spectators of our own social interactions. This leads to illness both physical and mental. Individuals can take back their lives and minds, you don’t need Washington or a change of regime to do it for you.

NH Rebellion in the Footsteps of Granny D

January 22, 2014

As the Nashua Telegraph editorialized, “If you’re cynical about government and think that our politicians are bought off by the super-rich and special interests, this may be the cause for you. If you think our representatives should put the interests of the country before their own re-election, you may want to get in on this.”

http://billmoyers.com/content/nh-rebellion-in-the-footsteps-of-granny-d/

The Golden Age of Journalism? Your Newspaper, Your Choice Tom Engelhardt

“The problem of this moment isn’t too little. It’s not a collapsing world. It’s way too much. These days, in a way that was never previously imaginable, it’s possible to drown in provocative and illuminating writing and reporting, framing and opining. In fact, I challenge you in 2014, whatever the subject and whatever your expertise, simply to keep up.”

It is astounding the breadth and scope of information available. I always have this nagging feeling that I still am not taking full advantage, and seeing the unusual, novel, unique perspectives and sites out there…

Dr. King’s Radical Economics ~Gar Alperovitz on Sojourners.net

CIA connections to media ownership go way beyond the transmission belt! We don’t know what is in that cloud, we don’t know what will happen to any data readers provide via IP address and comments or advertising links. And yes, it is naive to believe people working at WaPo will do hard hitting investigative pieces on the CIA.

As I’ve said before, I think Greenwald has this same problem with his new NSA connected boss. These agencies really are taking down everything and trying to control everything. By owning newspapers directly, they can choke off stories, redirect readers’ attention, shape the coverage and manage your opinion. After a while, people won’t know what is happening anywhere or to us.

Sheryl Sandberg’s fortune surpassed $1 billion yesterday after Facebook Inc. closed at a record.

bloomingberg

“There’s a special place in hell for women who don’t help other women.”

Sheryl Sandberg

“In the future, there will be no female leaders. There will just be leaders.”

Sheryl Sandberg

:-/

aby

About time….

T-Mobile Hopes to Shake Up the Check-Cashing Industry, Too

http://recode.net/2014/01/21/t-mobile-hopes-to-shake-up-the-check-cashing-industry-too/

Thank you for the article on the ownership of the Washington Post. Regarding Bezos and his ownership of the national newspaper of record, it’s just the tip of the tip of the systemic iceberg IMO. Bezos’ Amazon, the source of the wealth that enabled him to buy WaPo, sports a trailing 12-month P/E of 1,467% and a stock price that is 800 percent where it was just five years ago. IMO this is reflective of long standing support from top Wall Street banks for his “business model”, as Amazon has never been a big money maker to put it charitably.

Ties to and between those top Wall Street banks post-Glass Steagall and the organizations mentioned are of at least equal interest IMO. If you have some time on your hands, take a look at cross-ownership of America’s largest corporations and consider the network in the context of both Fed QE-ZIRP policy and “The Cloud”. It’s all about wealth concentration policy ammo IMO. Makes the old trusts Teddy Roosevelt tried to dismantle seem but a quaint anachronism.

Having said all this, I will add that I admire Bezos as an individual. I preferred him to other prospective buyers I saw mentioned at the time. Until it is demonstrated otherwise, I will take him at his word that he will not attempt to influence the newspaper’s investigative journalism, reporting, or editorial policies either directly or indirectly. However, it would be my further observation that he may find it challenging to resist pressure to do so from those who brought him here.

Oops!… should read: … “P/E ratio of 1,467x (times earnings for the period), not %.

Psycotropics,

I agree there is little knowledge about how these drugs work. They have potentially devastating side effects for many and for most, they have some nasty side effects. They are prescribed with wild abandon. All true. What else is true is I have seen them work when nothing else would. I can’t throw them out for everyone.

We don’t know how many things work. We didn’t know about aspirin’s function until rather recently. My personal philosophy about all drugs is this. Start with the least or completely non-dangerous treatment that helps someone and work up from there. That may be an herb, accupuncture, etc. whatever can help but do no or little harm. But sometimes what faces people is so bad, so devastating to their ability to live, that they have to move to things like psychotropics.

I applaud questioning their use. I take a completely empirical approach to health. If nothing is working, and there’s no other choice, then that’s the choice. In the meantime, I hope people are working like hell to help others in ways that don’t cause such harm or any harm at all.

Old School vs. New School

Humans are slightly advanced monkeys. They just have a slightly expanded language center in a feedback loop with the computational center, which allows them to zoom in and zoom out incrementally better, to create more event horizons, channels of communication, to work with. That’s it.

You can train a human monkey to do anything another human monkey can do in about 6 months, if you can train. It’s the quality of the person you care about in the hiring decision, not the compliance paper. The latter are a dime a dozen from an economic perspective, and the only difference in empire “market” cost is political, the group position in the ponzi, the value of extortion.

The corporation – public, private and nonprofit, is always bankrupting itself, because it operates on myopic peer pressure. It requires a pool of small businesses from which it can incorporate ideas, replicate the process, and scale up, and, over time, it always eats the seed and spoils the soil, along the curve of diminishing returns.

Education, the explicit kernel, is no different. The monkeys attack themselves with bipolar control anxiety, just as they were taught in school, by systematically ignorant teachers, exploiting peer pressure as a control mechanism. Back in the day, experiments in love deprivation, Pavlov swaps, and electrocution abstraction were standard curriculum in discussing the rise and fall of Hitler, classic Family Law, before Kissinger and Kids took America on a ride to empire, and raped her with computer precision.

Develop your own frequency and the empire cannot hope to contain you; you become timeless relative to the empire, and its multiplexer vanishes, allowing you to build your own. Whether the kids are lost or the empire is lost depends upon perspective, and your perspective says a lot about where you stand on the scale. Life is not a tourist attraction.

The empire majority wants you to pay for an artificial feedback mechanism that ensures poverty for future generations, when God has freely given you a natural feedback mechanism that ensures prosperity. An equal opportunity to compete for a piece of paper, and pay an ever increasing price for the entitlement to extort from others, in a long line of extortion, is nonsense.

Time is precious, not jobs, money or property. Don’t waste your time chasing morons in a circle, first in one direction, a demographic boom, and then in the other, a demographic bust, and the echo interference. Do something productive, anything. If you are not rewarded, you are in the company of monkeys.

Ping the system in a feedback loop, and, before long, you will know who not to work for before they open their mouths and prove themselves empire, new school fools. Old timers aren’t stupid, they’re just old, and the most efficient way to bypass stupid is to employ a double-sided mirror, with a passageway.

Build your own school for your children, an elevator that will go to any floor on demand, and the empire crawls back under its rock, until the next generation forgets where it came from, because it stole what it thought was the future, material possessions. The path to the future is narrow, only relative to the empire, for your own protection.

That’s what parents do, teach their children to create their own paths, the value of which is beyond empire recognition, which is why the empire can only boom and bust, in ignorant population ponzis. Internet IPOs are never going to replace parents, try as the empire might.

Don’t destroy your self because the empire, or anyone participating in it, is too stupid to breathe. The empire is just a stupid extension of gravity, distilling out talent, the cream of the crop. Life is about learning, in an environment created for the purpose, not knowledge agreed to by monkey consensus.

Education, healthcare and all the other cartels have not hit the wall of diminishing returns by accident.

Nice rant,

Problem is, jobs worth doing don’t pay a living wage— usually nothing at all.

Teachers are foot soldiers in the Social Conformity Guild.

Craftsmanship is dead: long live plastic replicas from sweatshops in China.

Farming is sharecropping Frankenfoods for Monsanto.

Policemen and soldiers are enforcers for the ruling .01% class.

Growing high-grade weed is one of the few honest jobs left that actually pays money.

“Craftsmanship is dead”

No, it still exists in spite of mainstream education not making it a conventional choice for young people

From the interview linked above:

““It’s not the smears that mystify me,” Snowden told me. “It’s that outlets report statements that the speakers themselves admit are sheer speculation.” Snowden went on to poke fun at the range of allegations that have been made against him in the media without intelligence officials providing some kind of factual basis: “ ‘We don’t know if he had help from aliens.’ ‘You know, I have serious questions about whether he really exists.’ ”

At least ES is keeping up his sense of humor in exile!

Prosecutors Balk, Bankers Walk

One of the most disturbing realities of the 2008 financial crisis is that no Wall Street executives have been held accountable. After searching more than five years for the reason some people have gotten away with the financial equivalent of murder, I think I have finally figured it out: It’s the revolving door, stupid.

The chance for senior government officials to make millions of dollars after their public service ends convinces them -– subliminally or not -– to pull their punches. No doubt that’s why Jimmy Cayne, the former chief executive officer of Bear Stearns & Co., continues to enjoy playing bridge and golf, his $400 million-plus fortune, his sprawling mansion in Elberon, New Jersey, and his duplex at the Plaza Hotel.

It also explains why Dick Fuld, the former CEO of Lehman Brothers Holdings Inc., was able to form Matrix Advisors to consult on mergers and acquisitions, even though he had been a trader, not an M&A banker. Even if the firm has no clients, it doesn’t much matter: Fuld testified before Congress that his 2000-2007 Lehman compensation was about $310 million. He later conceded it could have been $350 million. The real number is closer to $520 million, according to people who prepared and studied Lehman’s public filings.

When Stan O’Neal resigned from Merrill Lynch & Co. in 2007, less than a year before it almost went bankrupt, he was given a parting gift of $161.5 million and a board seat — which he still holds — at Alcoa Inc.

The dossier of executives being rewarded for bad behavior goes on and on. The question is: Why have prosecutors allowed Wall Street executives to slither away into the 1 percent, or one-tenth of 1 percent, without paying a financial penalty or serving time? After all, as the Financial Times reported, about 3,500 bank executives went to jail after the 1980s savings-and-loan crisis, which wasn’t nearly as devastating as the 2008 debacle.

http://www.bloomberg.com/news/2014-01-21/prosecutors-balk-bankers-walk.html

Here is what the psychotropics give to patients:

1. an easy fix; 2. possible relief 3. a tangible solution (a pill)

Here is what they give to doctors:

1. status (psychiatrists were never real doctors until they could prescribe lots of meds….)

2. an easy fix 3. protection from litigation (psych meds became a mandatory treatment option after a key lawsuit involving Sheppard Pratt Hospital in the 1980’s in which treating with therapy rather than antidepressants was deemed medical neglect) 4. some $$$

Here is what it gives big pharma and expert witnesses who do court testimony against meds:

LOTS of $$$$$$$$$

I wish these critics of the mental health system would provide effective treatments for people who are severely ill-those of us in the field are happy to learn about safe and effective alternatives. Still they make valid points.

“China’s princelings storing riches in Caribbean haven”

Communism; Capitalism: same same in actual practice. Obscenely wealthy sociopathic kleptocrats loot, hoard and hide the wealth of hundreds of millions of workers–well just because they can. Who’s gonna stop them? Different names for the same mega scam.

re lead photo:

Looks like John Kerry is getting prematurely grey—

Been wondering if Obama will talk about the TPP and what lies he might spew in the forthcoming State of the Union. (i assume if he does speak of it, it will be to suggest it will lead to job growth). Also went looking for any evidence of citizen activism on the TPP front and found this taped panel presentation from last May. Much of what is probably old info to many NC readers, but i found the comments made by the rep. from the Sierra Club (starting around 21.00) on fracking, the exporting of natural gas, the TPP and environmental effects very informative.

http://www.youtube.com/watch?v=Pj_Wiq9J0LM

Examples of neoliberal globalization

http://failedevolution.blogspot.gr/2014/01/davos-2014-world-economic-forum.html

Regarding the link to the blog post about MOOCs and their threat to math departments, I am not buying it. I don’t have much to add to this Slate article a commenter to the post put up:

http://www.slate.com/articles/life/education/2013/11/sebastian_thrun_and_udacity_distance_learning_is_unsuccessful_for_most_students.html

except that I am actually an adult non-trad student who in the last three years has gone from not remembering basic rules for distributing exponents to finishing a pretty challenging math minor with a fairly rigorous Real Analysis course (accompanying an Econ major). I am waiting on responses to PhD apps right now, which is to say I am in it for the long haul i.e. a very motivated student. And I don’t think that even I could have hacked it at all with just open courses and the internet. I gained, far and away, the most value from small learning environments, talented grad students and a few especially gifted (at teaching) professors. I gained the least value from large lectures where back and forth was mostly infeasible. I spent MANY, MANY hours in the math learning center using grad student tutors and did use some online courses to enhance understanding.

I really, really think that math departments have little to worry about from online offerings and that Baumol’s disease is alive and well in the classroom. One person teaching a modest number of people in person still can’t be beat, particularly by the utterly impersonal and especially demotivating tool of online video playback. Correspondence courses and video taped courses have been around for quite some time, just because the content streams fast or “there’s an app for that” does not really change anything especially given how low grad rates for marginal students are already.