Yves here. With Argentina one of the emerging markets economies whose currency has taken a huge tumble, its aggressive pro-labor, redistribution-oriented policies have come under attack (as an aside, one has to note that Turkey, which was touted as a model emerging economy a few years back, is also fighting a currency downspiral). And a predictable by-product is that some of Argentina’s policies have been misrepresented. For instance, it’s widely accused of “living beyond its means”. Yet as this post shows, the government ran surpluses in eight of the past ten years.

It is also important to recognize that some important elements of its current distress are not of its own making. For instance, two of its biggest sources of foreign exchange were soya and corn exports. The fall in price of those commodities worsened its balance of payments. (Critics conveniently forget that since Argentina ended its hard peg to the dollar in 2001, intervention has been largely selling pesos to curb appreciation and accumulate foreign exchange reserves. That is, the currency has tended to appreciate until recently). Warren Mosler forwarded this note from an insider:

Exporters are not bringing back the dollars since they expect further adjustment of the peso, but also due to the fact that the big grain companies know they harm the government. It is a political problem, not economic. Right wing don’t want populist governments. The global crisis affected the government after six years, and they will do what takes to bring it down.

Not surprisingly, the picture is more complex than what you read in the funny papers.

By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil. Originally published at Fixing the Economists

Paul Krugman is waving his true colours while his followers try to look the other way and pretend that he’s not making stuff up. Basically Krugman is saying, following that pundit Yglesias, that Argentina’s inflation problems have to do with their fiscal balance. Here is the quote from Krugman,

Matthew Yglesias says what needs to be said about Argentina: there’s no contradiction at all between saying that Argentina was right to follow heterodox policies in 2002, but it is wrong to be rejecting advice to curb deficits and control inflation now. I know some people find this hard to grasp, but the effects of economic policies, and the appropriate policies to follow, depend on circumstances. (My Emphasis)

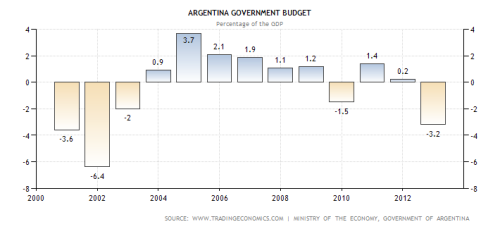

Of course, Krugman — instead of engaging in tough guy rhetoric (“doing what needs to be done” etc.) — could have done two quick Google searches to see if Argentina had been running major deficits in the years when it was suffering from inflation. If he had he would have found that for many of the years after the 2001 default Argentina ran substantial fiscal surpluses. The stats are pretty hard to track down in the original (the website is in Spanish) but Trading Economics has pulled them and their statistics are typically accurate.

As we can see, the government ran substantial deficits in 2001-2003. This was at a time when GDP was shrinking at upwards of 6%. But once the economy left that major recession the government budget balance swung back into surplus and remained there until a brief deficit in 2010.

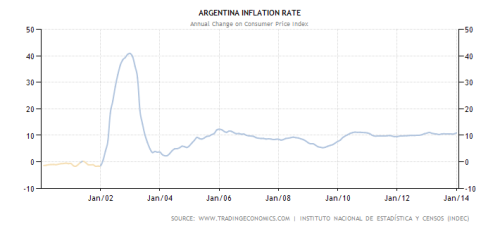

Now, if Krugman’s story were accurate we would expect to see inflation come down between 2004 and 2010, right? Do we? Nope. Not at all.

The following graph is the official inflation rate. Note that even though these statistics are well-known to under-exaggerate inflation they nevertheless track the unofficial measures insofar as their trends go — i.e. while they are not useful to give us a real picture of the rate of inflation they do give us a good picture of when the inflation accelerates and decelerates.

As we can see inflation soared in 2002. This would seem to overlap with the enormous budget deficit of that year. But the correlation is spurious. The inflation soared that year because the Argentinian peso was devalued to such an extent that it was worth about 25% of what it was worth the previous year. The spike in inflation was due to a sharp, fourfold increase in import prices that were then passed through to the rest of the economy. Something very similar happened in Iceland after the banking crisis there in 2008.

Between 2004 and 2010, however, we see consistent levels of high inflation (the real figures would probably be close to 20-25% a year rather than the government’s 10%) — and this was in a period when the country was running substantial government surpluses. What does this suggest? Simply that the inflation is likely due to the value of the Argentinian peso together with a host of other factors. These other factors are basically a classic wage-price spiral with the unions demanding that their standards of living keep up with rising prices, while firms raise their prices to pass on the cost of higher wages.

Since 2011 the peso has continued to devalue and is today worth about half what it was worth back then. Again, this is probably the root cause driving the inflation in Argentina. But it has very little to do with the government deficit. Rather it has to do with the fact that Argentina has been faced with these inflationary problems since at least as far back as the late-1980s when the country experienced a bout of hyperinflation proper.

During the 1990s the government tried to wring the inflation out of the system with a misguided currency board arrangement that fell apart in 2001. And I don’t think anyone would openly advocate that they try that again.

So, what are the solutions? Unfortunately, there are no easy solutions. In an ideal world the government would allow the burst of inflation that is going to accompany the recent devaluation of the peso to run through the system and then they would step in with well-enforced wage and price controls. Such controls, if history is to be any guide, are often less popular than inflation — with both trade unions and companies feeling their rights being encroached upon.

So, the likely path that Argentina will have to take is to try to keep economic growth buoyant while navigating the inflation. By not allowing incomes to fall too much the government can ensure that people do not experience their loss of purchasing power as an all-out impoverishment. Meanwhile, the government should bring the trade unions and the management of the firms to the table and try to make them gradually see reason. But again, that’s a tough game indeed.

The last thing that Argentina need, however, is the likes of Paul Krugman with his Neo-Monetarist models of inflation telling them to cut government spending. Argentina is already extremely unpopular in the financial press because of the bitterness that still surrounds the 2001 default. When so-called ‘friends of the left’ like Krugman jump on the bandwagon as an easy way to outline their primitive theories of inflation it just adds fuel to the fire.

With their discredited money supply-growth ideas (as I argued here inflation typically causes money growth and not vice versa), they will only encourage the Argentinean public to vote in another bunch of lunatics who will try some idiotic arrangement like they did in the 1990s. Such a regime may temporarily put a lid on inflation but only at the cost of wrecking the economy and causing much suffering.

Yes, the Argentinian financial elite will be pleased that their money is temporarily sound, but it will only be a matter of time before the riots kick into high gear and the whole thing falls to pieces in an ugly and perhaps bloody mise-en-scène orchestrated by economists who think that their doctrines and their little geometric toys fly in some heavenly space above political and social realities.

Finally, an article that provides a fair and balanced view of what is going on in Argentina!

Thanks, Yves. This is why objective-minded people turn to naked capitalism for their financial news.

Krugman and Yglesias: birds of the same asinine feather…

On my first visit to Mexico, in Veracruz I saw an elderly man go by driving an oxcart. ‘Looks like fun,’ I remarked to my companion. A young Mexican guy overheard my remark and translated for his friend. They both started laughing.

Instantly I realized my naiveté: the old man was poor. He drove an oxcart because he couldn’t afford a car. From his perspective, there was nothing fun or picturesque in his predicament.

Calling Argentina’s policies ‘pro labor’ is much the same. Facing 30% inflation, unions strike every year to win wage increases. Within four months, 10 percent of their newly-won purchasing power is already dissipated by price increases. With respect, Americans and Europeans living in low-inflation economies just don’t get it. Inflation is a nightmare for workers.

I guess your naiveté doesn’t end with your love for oxcards. Given the state of economies in EU and the level of unemployment there, people who didn’t see any work for years would laugh at your bitching how bad it is when one gets a rise that is eroded over year and has to fight another one next year to stay even.

Really!! Or is it a nightmare for those sitting on cash.

Interesting development in Buenos Aires → Suspicious fire destroys bank records.

I guess your naiveté doesn’t end with your love for oxcards. Given the state of economies in EU and the level of unemployment there, people who didn’t see any work for years would laugh at your complaining how bad it is when one gets a rise that is eroded over year and has to fight another one next year to stay even.

Oh, my. So Europe’s unemployed would be better off if they were facing double-digit inflation too? Or are you pulling the old Phillips curve on me? Ouch, ouch, stop it!

When all else fails, try research. On the Argentine central bank’s website, monthly monetary reports are posted, going back more than a decade. The most recent one is at http://www.bcra.gov.ar/pdfs/estadistica/boldat201401.pdf

On page PAN-SER-1-3, the third column is Argentina’s M1 money supply. Rates of increase in recent years: 2007: +23.6%; 2008: +17.9%; 2009: +19.6%; 2010: +33.1%; 2011: +20.0%; 2012: +40.5%; 2013: +28.2%.

Inflate the money supply and prices … go up! This ain’t rocket science, except to peronists and their rich-country admirers who — like admirers of Stalin in the 1930s — see only what they want to see.

Bingo!

Inflate the money supply and prices … go up! Jim Haygood

Maybe but credit repayment deflates the money supply so a balance can be contrived to maintain a constant or slowly growing money supply IF new bank credit is muzzled.

That’s a huge IF of course. Also, new reserves DO NOT increase M1 so your ire should be directed at the banks only, no?

Oops! I misspoke. New reserves do increase M1 but only 1-1 ($1 in new reserves = $1 in new deposits).

It’s the banks you should hate.

And 1-1 is worse case since the central bank can create new reserves without adding new deposits to the banking system – instead the new reserves back existing deposits.

So what, you’re arguing money violates the laws of physics? For the money supply to cause a change in the general price level would require each unit of currency to have instantaneous communication with every other unit, valuing and devaluing themselves each time a change occurs.

In accepting your proposition we must accept self-aware currencies equipped with subspace radios.

Them three dots (…) could indicate a time interval so you’re being hysterically(?) disingenuous? Because it is common knowledge that price inflation takes time to diffuse throughout an economy?

Beard, you have a talent for missing the point. Neither you nor Haygood can describe the mechanism by which price changes are transmitted via changes in money supply. Like good neo-austrians you simply assume it exists; and for it to exist even with sticky prices it would require virtually instantaneous devaluation of the currency which then ripples out into the real economy over time.

For a – good time – ask them about flex pricing, funny thing, how it all works out in their head, tho they are the boom – bust posse.

skippy… how many cycles do you observe till the word – fail – starts flashing red… oh… but… tis the nature of man thingy[!!!]… action man[!!!]… sigh~~~

Boom-bust?? Common stock as private money is spent, not lent, into existence so there is no boom-bust cycle built in to it.

I’m getting tired of this especially in view of the fact that eventually those who oppose justice will be mere ashes to be trodden down (See Malachi 4).

Neither you nor Haygood can describe the mechanism by which price changes are transmitted via changes in money supply.

By bids in excess of the growth of what is being bid on.

But I’m not opposed to increases in the money supply; normally they are GOOD – IF done ethically. If not done ethically then they are a means of theft.

What part of “purchasing power MUST be ethically created” don’t you get?

Neo-Austrian? I abandoned the gold-loving, hypocritical Austrians a long time ago.

So what’s their latest scam? Or have they repented?

BenJ,

Leibnitz believed that every monad in the universe possessed a sort of consciousness, and within itself reflected the “point of views” of every other monad in the universe, an old theory some physicists are re-visiting to explain….

Inflate the money supply and prices … go up! Yes, quite right, at least in the short term, the major on prices should be to increase or maintain them. Obviously, asymptotically true. True more or less in the rare case of full employment. But in real life only with qualifications ( in addition to Ben Johannson’s):

1) Won’t really happen in deep depressions, almost no matter how the money is spent. Will just increase demand, employment, wealth-creation – a free lunch.

2) Won’t happen if the money is spent on something valuable, something productive (e.g. not gold :-) ). Above all, on productive fixed-wage labor for the unemployed. Why should government money have such a magical inflationary effect – when bank money – say for new investment employing the unemployed – doesn’t?

MMT, Keynes, Institutional, Creditary economics is a General theory. It absorbs and generalizes the insights of neoclassical, commodity theory economies, and makes them much more correct. Much more logical arguments for them, much better agreement of theory with observation.

Reading the primer on MMT by L. Randall Wray, I feel his emphasis on taxes as THE driving force behind the acceptance of a fiat currency is way over done. I think the Argentine situation is a case to ponder in thinking about this very topic. Pilkington proposes a non-economic solution to the Argentine problem – getting the manufacturers and the unions to cooperate to solve the problem. Pilkington does not propose raising taxes to drain the excess reserves from the system.

I’d love the hear the MMT experts address my concerns about this.

It’s private debt in a government-enforced monopoly money supply for private debt that really backs fiat – and Wray and Co have no problem with that.

Two quotes as examples:

MMP BLOG #8: TAXES DRIVE MONEY

MMP BLOG #12: COMMODITY MONEY COINS? METALISM VS. NOMINALISM, PART ONE

True and yet while one might think that bank credit is repaid with bank credit with no need for fiat there is the still the missing interest problem since the banks do not recycle all the interest they collect as consumption. So SOME fiat is needed to service private debt so continuous budget deficits should be the norm for that reason alone, not to mention population and real economic growth.

The MMT perspective is that taxes are sufficient to drive a currency, but are not necessarily required (although I am unaware of any monetized country which became so without taxation). Keep in mind that Argentina’s problem is coming from the external sector, as the country is unable to obtain sufficient dollars to satisfy its desire for imports without buying them. Raising taxes would only work in the Argentine case if they prevented consumers from purchasing those imports., but the effect of lowering living standards would be identical.

I think the MMT guys address this when they talk about devaluations. And I know that they all recognise the risks of wage-price spirals. They just don’t focus on this area. None of them, as Warren Mosler showed in his email to me and Yves, would ever make the mistake of attributing Argentina or Turkey or the UK in the 70s problems to government deficits as Krugman did though.

If a government just prints money to pay for its spending, budget deficits/surpluses become meaningless, even if you actually believe the numbers the Argentinian government puts out.

You miss the real problem with Krugman here- Argentina has become a thorn in his side, and he is looking for a way to extricate himself since he has been singing her praises for a decade. Brazil is also becoming a major problem for a few pundits in the econosphere, too.

Michael Pettis, whose posts have been featured here at NC, described in his book The Volatility Machine how capital from the ‘rich core’ flows into emerging markets, then later gets pulled back to the core, in a regular tidal cycle.

Today’s generalized emerging markets distress showed up, in Argentina’s particular case, in late 2011. Mercedes Marco delPont, memorably headlined as the ‘world’s worst central banker’ in a 5 Oct 2012 post by Randy Wray, was on her way to cranking the M1 money supply by an eye-popping 40.5% in 2012. By no coincidence, the parallel exchange rate took off with a bang. Meanwhile, forex reserves began to shrink, as the central turned from fighting capital inflows to fighting capital outflows. Chart:

http://www.focus-economics.com/charts_texts/Argentina-Exchange_Rate-June2013.gif

Previous posts at NC have claimed that agricultural exports had little to do with Argentina’s then-prosperity. Now we are told that ‘the fall in price of those commodities [soybeans and maize] worsened its balance of payments.’ Help, my head is spinning!

While soybeans are off their record highs, it’s still a sodbuster’s dream of ‘beans in the teens.’ But in a scene right out of Ayn Rand, Argentina’s farmers have gone on strike in response to the double whammy of export taxes and an overvalued peso which gives them a lousy exchange rate when their dollars are converted back to pesos. Who is Juan Galt?

Straw man. “Prosperity” does not equal FX reserves. The fall in ag prices led to the loss of one of Argentina’s major means of acquiring FX.

Marc Weisbrot disagrees:

‘Agricultural exports are clearly not driving growth; and in fact they are too small a share of GDP to have anywhere near the kind of impact that is often attributed to them.’

http://www.cepr.net/documents/publications/argentina-success-2011-10.pdf

You are still straw manning. I said “Prosperity does not equal foreign exchange reserves.” The argument we’ve made recently is that the fall in soya and corn prices contributed to the scarcity of FX reserves, NOT incomes/wealth generally.

You are racking up big time troll points on this post. This is bad faith argumentation, pure and simple, and I’ve called you out on it more than once.

And the long-term soybean chart — does this look like agricultural depression?

http://www.mrci.com/pdf/s.pdf

Straw man again. We never used the expression “agricultural depression’ or anything even palely resembling that. And the chart supports the contention. Argentina’s currency woes are recent, as is the fall in soyabean prices. The long term trend is not germane to this discussion.

‘For many of the years after the 2001 default Argentina ran substantial fiscal surpluses.’

The commodity chart shows that soybean prices have risen from around $5.00 a bushel in 2001 to about $13.00 a bushel now. This is not a ‘fall in price’ (quoting 2nd para.) over the stated time period.

Quoting your remarks of Oct. 23, 2011 at 2:18 pm:

‘Exports were less than 1/4 of GDP growth only 1.8%! And net exports were a NEGATIVE contributor. And of that total, over 60% are manufactured goods, not commodities.’

http://www.nakedcapitalism.com/2011/10/the-verboten-story-of-argentinas-economic-success.html

If net exports (and particularly commodities) are of such minor importance, why invoke them now as ‘an important element of [Argentina’s] current distress’?

Are you going to keep DELIBERATELY misrepresenting what I have said here and in Links recently?

Argentina still needs FX. Corn and soya contributed materially to FX reserves (GROSS EXPORTS). The decline in prices hit FX. That is separate and apart from how much they contributed to GDP overall.

You can drown in six inches of water as well as 12 feet and be just as dead either way.

To make the point clear, Zimbabwe wasn’t running deficits either the day their currency finally bit the dust- the government had long lost the ability to borrow from anyone.

Meanwhile, tragic fire of suspicious origins yesterday in Argentina’s central bank document storage facility: http://www.trivalleycentral.com/casa_grande_dispatch/world_news/responders-die-in-fire-in-argentina/article_7e018622-8f5e-11e3-b58e-0019bb2963f4.html

Wonder about motivations?

Vox Eu has an interesting related post up by Kristin Forbes on the topic of the multiple factors behind emerging markets’ current trials, including the role of domestic players: http://www.voxeu.org/article/understanding-emerging-market-turmoil

In Argentina’s particular case, I also wonder about the role, if any, of large transnational grain companies, large venture capital vulture firms, and those who were affected by the nationalization of YPF?

It is monumentally tragic that such a wealthy and beautiful country in terms of its people and natural resources is seemingly unable to find social balance.

Clarín’s comment on the tragic warehouse fire in Barracas, which killed seven Buenos Aires firefighters:

To quarrel with the media, to criticize those who bought dollars, to play with English words, the President always finds the time and place on Twitter. But to show solidarity with the families of the firefighters, no.

Twenty-four hours after the tragedy, Cristina Kirchner so far not only hasn’t raised the issue, but hasn’t even dedicated a single 140-character sentence to the nine dead from her Twitter account @cfkargentina.

She decreed two days of mourning, true, but that’s just an administrative process. As far as being close, accompanying the grieving, showing solidarity, nada. On the social networks she had time, though, to call out a girl who had complained on Facebook about rising prices. Those are her priorities these days.

http://www.clarin.com/politica/Cristina-ausente-tragedia_0_1079892488.html

————

Union solidarity from the Black Widow for the fallen firefighters? Dream on, comrades.

Tragic loss of innocent lives isn’t really an ideological issue, is it?

… “If the cause is found to be arson, it wouldn’t be the first time for Boston-based Iron Mountain Inc., which manages, stores and protects information for more than 156,000 companies and organizations in 36 countries. Fire investigators blamed arson for blazes that destroyed its warehouses in New Jersey in 1997 and London in 2006″… (From: http://www.washingtonpost.com/business/7-die-in-fire-destroying-argentine-bank-archives/2014/02/05/7c489abc-8e70-11e3-878e-d76656564a01_story.html )

See also: http://www.buenosairesherald.com/article/151435/at-least-4-iron-mountain-facilities-previously-hit-by-fires

I believe a fire also destroyed the company’s headquarters in Italy in 2011:.

http://rammell-consulting.co.uk/2011/11/08/fire-at-iron-mountain-facility-in-aprilia-italy/

Seems books and records might be considered problematic by someone.

I was in Argentina in 2008 when the gov’t made public its intention to put an export levy of up to 40% (related to market price) on Soy beans. Immediately roads to export ports (Rosario) were blocked by farmers and truckers. A few days later the Argentinian gov’t announced it had received a US $4 billion loan from China in return for future Soy bean deliveries.

Argentina is the country that has everything, having to eat chicken is considered to be a sign of poverty. The Steak and wine are the best and cheapest in the world. A paradise on earth with a population of 60% Italian origin and a government that matches the gov’t in Italy.

Before going to Argentina I carefully check their newspapers for ongoing or expected disruptions. Right now i would have a plan B that includes Uruguay.

First of all, in my opinion, Trading Economics’ data suffers from extraordinary inaccuracies. Second, Trading Economics states that it gets its Argentinian fiscal deficit data from the government of Argentina. And if Argentina’s official consumer price inflation rates are admitted by Pilkington to be an enormous fiction, what makes him so sure that their fiscal deficit data is any less suspect?

According the IMF, at least as far back as 1995, Argentina has never run a general government fiscal surplus:

http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/weorept.aspx?sy=1995&ey=2014&scsm=1&ssd=1&sort=country&ds=.&br=1&c=213&s=GGXCNL_NGDP&grp=0&a=&pr.x=27&pr.y=14

True, the IMF estimates that Argentina’s general government deficit was less than 0.9% of GDP in calendar year 2008, but it is forecast to reach nearly 4.1% of GDP this year.

Philip Pilkington:

“The last thing that Argentina need, however, is the likes of Paul Krugman with his Neo-Monetarist models of inflation telling them to cut government spending.”

To be clear, there is no monetarist model which claims that government spending is the primary cause of inflation. On the contrary, monetarism claims that inflation is always and everywhere a monetary phenomenon. So where is this bizarre statement coming from?

Pilkington is evidently drawing from a peculiar rewriting of the history of the Thatcher years, when the UK’s public sector borrowing requirement (PSBR) was targeted for reduction as a means holding down interest rates. No form of monetarism, not even an imaginary special Thatcherian variation, believes that inflation is a fiscal phenomenon.

However, why in Argentina’s case might fiscal policy be connected to inflation? Well for one thing Argentina has been virtually shut out of the global credit markets since its 2001 default.

How does a country succeed in running fiscal deficits without borrowing money you might ask? Well one way is to simply print it.

In March 2012 the Argentine Senate approved a “reform” of the central bank charter, effectively allowing the Argentine Treasury unlimited direct financing by Central Bank of the Argentine Republic.

So it sounds to me like Krugman is just following the pesos.

So, you’re NOT going to provide evidence then? Just some vagure, insubstantial questioning of the source and some wink-wink, nudge-nudge stuff regarding the central bank. Very convincing… not really. Try harder next time, Mark. I’ve come to expect better from you.

There are numerous sources, but here’s a working paper by Alex Fuste, the Chief Economist of Andbank. Page 4:

“1. Government spending has been financed by printing pesos.

2. Since changes in BCRA charter (March 2012), the scope for

the central bank to print money and lend it to the Treasury

has been dramatically expanded (see the chart)

3. In reality the IOUs (non-negotiable debt instrument)

issued by the Argentine Treasury in exchange of newlyprinted

pesos tend to be rolled over indefinitely.

4. This policy probably put further pressure on inflation and

Fx in the past, but if policy is relaxed even more (in a

desperate attempt to pump the economy) then, inflation

could run wild above the 30% and we could witness a

disastrous impact on the currency.

5. Incredibly, low quality, illiquid government securities

(including non-transferable bills and temporary IOUs) now

account for 60% of BCRA assets. And the pensions agency

ANSeS have already been drained of a significant amount

of its liquid assets. Any other movement in the same

direction, could be critical.”

http://www.andbank.com/comercial/files/workingpaper57.argentina-yes,windsofchangeareblowingonthehorizonbut…donotputlongyet_181013_1382107731_71_.pdf

The graph shows the amount of “temporal advances” dating back to 2002.

Where is Andbank getting its data? From the BCRA. See pages BAL-BCE-1-2 and BAL-BCR-2-2:

http://www.bcra.gov.ar/pdfs/estadistica/boldat201401.pdf

On the first page you’ll find the transitory advances under the column labeled “adelantos transit.”. The monetary base is on the following page under the column labeled “base monetaria”.

Transitory advances totaled 20.9 billion peso in 2011, 60.6 billion peso in 2012 and 54.9 billion peso in 2013. According to the IMF Argentina’s nominal GDP was 1,839.9 billion peso in 2011, 2,163.0 billion peso in 2012 and 2,666.0 billion peso in 2013:

http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/weorept.aspx?sy=2000&ey=2013&scsm=1&ssd=1&sort=country&ds=.&br=1&c=213&s=NGDP%2CGGXCNL%2CGGXCNL_NGDP&grp=0&a=&pr.x=86&pr.y=8

Thus transitory advances totaled 1.1% of GDP in 2011, 2.8% of GDP in 2012 and 2.1% of GDP in 2013. Compare that with the deficit figures from Trading Economics: a surplus of 0.2% of GDP in 2011, a deficit of 1.7% of GDP in 2012 and a deficit of 2.5% of GDP in 2013:

http://www.tradingeconomics.com/argentina/government-budget

Thus transitory advances are more than the fiscal deficit figures reported by Trading Economics in 2011 and 2012. According to the IMF the fiscal deficits were 3.5%, 4.5% and 3.6% of GDP in 2011-13 respectively. Assuming the IMF figures are correct transitory advances accounted for about 31%, 62% and 59% of the deficits in 2011-13 respectively.

Argentina’s monetary base more than tripled from 124.5 billion peso at the end of 2010 to 377.2 billion peso at the end of 2013. Transitory advances accounted for 54.0% of the change in the monetary base during that period.

You’re mistaking cause for effect. Central banks that target interest rates will always accommodate a monetary expansion. The more advanced New Consensus Macroeconomists recognise this when they insert a Taylor Rule into their models. David Romer wrote a good paper here:

http://elsa.berkeley.edu/~dromer/papers/JEP_Spring00.pdf

Unfortunately most of the profession are WAY out of date in this regard, as you demonstrate here. What they’re picking up here is the advances the Argentinian central bank is making as private sector debt expands. The money supply is expanding due to wage-price increases together with import price shocks. I suggest you do some reading on how modern central bank policy works.

“You’re mistaking cause for effect.”

I’m describing how the Argentinian Treasury is financing its deficit.

“Central banks that target interest rates will always accommodate a monetary expansion.”

True, but the BCRA does not have an explicit interest rate target. More importantly, central banks don’t typically purchase non-transferable and non-negotiable debt instruments. And in the final analysis, how could the purchase of non-transferable and non-negotiable debt instruments directly enable the BCRA to hit an explicit interest rate target even if it had one?

“The more advanced New Consensus Macroeconomists recognise this when they insert a Taylor Rule into their models.”

“New Consensus Macroeconomics” is a term invented by Philip Arestis. A much more common term for the approach you are attempting to describe is “neo-Wicksellian”. Also, I don’t think the Argentinian monetary policy framework can be described by a Taylor Rule given they don’t have an explicit interest rate target, don’t have an explicit inflation rate target and don’t explicitly target an output gap.

“David Romer wrote a good paper here:”

The IS-MP Model is a nice teaching tool mostly because it corresponds to how most central banks operate today. However it is not useful for describing the conduct of monetary policy in Argentina precisely because the BCRA does not have an explicit interest rate target.

“What they’re picking up here is the advances the Argentinian central bank is making as private sector debt expands.”

On the contrary, transitory advances represent the direct expansion of Treasury debt.

“The money supply is expanding due to wage-price increases together with import price shocks.”

Broad money supply *is* expanding, but I the monetary base is not the same thing as broad money supply. The BCRA’s monetary policy framework is an exchange rate anchor, and the conduct of that policy is being adversely affected by the need to directly finance the Treasury.

Hyperinflation happens when an economy is suffering from exogenous shocks – when a government loses control of its own destiny. The Weimar Republic and Zimbabwe are two great examples. The WR was saddled with punitive war reparations, for which other countries would not accept Deutschmarks.

That crippled the currency, leaving it useless for international trade. German production went to foreign countries in repayment, leaving nothing on German store shelves for people to buy. The French then invaded and sieved the Ruhr, literally taking German production out of German hands. German currency couldn’t buy anything. It had no use. It wasn’t printing of currency that did that, but reparations and loss of production.

In Zimbabwe, a new government shot themselves in the foot by redistributing land. That probably needed to be done, but it needed to be done in a more rational, incremental way. The result was a total collapse of Zimbabwean agriculture, which crippled their exports. That left them having to pay for imports with something else other than exports, and again, left nothing to buy on Zimbabwean store shelves. Not a matter of printing money – a matter of a destroyed economy in which the government’s currency was useless. In this case Zimbabwe did it to itself.

BTW on the link you provided earlier, I disagree with a lot of the methodology. He uses Cullens metric which is PM influenced to describe hyperinflation [Mo on Mo 50% – over year if memory serves], that and he starts straight off burnishing Milton, and the bit about negative political index [reductionist twaddle] being a contra indicator.

Skippy… the bias was astounding, precursor to the observation – methinks.

In addition It seems your links author bastardized Cullen

Hyperinflation – It’s More than Just a Monetary Phenomenon

Cullen O. Roche – Orcam Financial Group, LLC

March 30, 2011

Abstract:

In this paper I will argue why the common misconception that “inflation is always and everywhere a monetary phenomenon” cannot be used to explain most historical hyperinflations. I will argue that “money printing” is often the response to exogenous and unusual events and not the direct cause of the hyperinflation.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1799102

skippy… got anything else.

oops @ Mark A. Sadowski – above

I’m sorry but I don’t follow you at all. If you’re refering to the University of Pretoria working paper by Albert Makochekanwa (the comment which links to that paper has been removed for some inexplicable reason), it was published in July 2007, nearly four years before Cullen Roche published his paper. More importantly, I don’t see any similarity in content. In particlar Roche does no econometric analysis, probably because he is not an economist.

Albert Makochekanwa explicitly states in the beginning of his paper that he is using Cullen metric [one of many imo out there, its not empiric]. That and the issue with his Political Index metric showing contra causality. In reading it, I came away with conclusion proceeding the investigation.

Skippy… did he have eyes on the ground or was it completely a remote exercise.

Note that Mark’s own stats suggest a negative correlation between inflation and the fiscal deficit.

The data doesn’t correlate with inflation at all. From 1995 to 1999 there was barely any inflation in Argentina and the average fiscal deficit recorded by the IMF was 2.7% of GDP.

Between 2003 and 2010 there was substantial inflation and the average fiscal deficit recorded by the IMF was 2.2% of GDP. So, even by the IMF stats the deficit in the high inflation years was lower than in the low inflation years — thus indicating, if anything, a negative correlation.

So, why is Mark including these stats even though they continue to buttress my argument? I get the feeling that he’s playing agnotologist. By questioning the validity of the stats he sows doubts about the overarching argument without actually dealing with it.

This is similar to his groundless, evidence-free claims about the central bank printing money and spending it directly into the economy. He has ZERO evidence of this but he says it anyway. Interesting that.

Overall though, the IMF supports the argument put forward in the piece — albeit in a different way.

Zimbabwe? You mean the country that gave the commonwealth the finger and then went crazy with land redistribution, are you to say that had nothing to do with its currency. That it was only how much they printed [dilution of value] on its own.

Skippy… in all of the historical cases, what was the political precursor… eh.

Again- Argentina doesn’t fund the deficit by borrowing. No one will lend to Argentina’s government. Using deficit/surplus numbers in such a case is beyond stupid.

Regarding my last piece on Krugman there was some dust kicked up because I referred to his position as ‘monetarist’. Actually, it is quite clear that in the monetarist-Keynesian debates in the 1970s and 1980s Krugman would fall on the monetarist side. I have showed why this is clearly here:

http://fixingtheeconomists.wordpress.com/2014/02/07/what-is-the-monetarist-position-on-fiscal-deficits-and-is-it-similar-to-krugmans/

Exactly the point I was making. The claimed surplus in the past is bullshit of the highest order. Pains me greatly to have to defend Krugman, but there it is. Just wish Krugman made it easier on the soul by being consistent rather than flipping around like a suffocating fish.

Sorry to say that but that Krugman might be wrong doesn’t make the introduction to this post right. Regarding

I’ve just come back from a 10-weeks stay in Argentina and if the police and teachers have to strike to see increases of their below-1000 euro salaries (at Belgian supermarket prices), “pro-labor” seems to take a newspeak meaning. If these strikes are commented on by the cabinet chief Capitanich with statements along the lines that the national government will not give in to those demands and that doing so would throw the salary structure for public servants out of whack (because supposedly medical diplomas need to be rewarded, police work not so much), one can’t even blame this on the regional governments (as I tried in the beginning).

Furthermore

This might work as a repudiation of the “living beyond means” claim but the MMT-reader in me can’t help but notice that this also means that private sector wealth has shrunk or at least not increased as fast as it could have. So I am not sure about the “redistribution” either. But yeah, Capitanich is very proud of the fact that Argentina has a lower public debt ratio than the US.

Finally, regarding Pilkington’s

When we left, the national government had just announced price controls on a number of supermarket items. Add to this the capital controls (best represented in the existence of the “blue market” exchange rate) and they’re at least trying to use well-known measures.

Basically inflation is caused by the fact that the supply of money is not met by demand. In Argentina the lack of demand for the peso is due to the fact that nobody wishes to hold pesos, be it for saving or investments purposes. This peso phobia – and its mirror, dollar obsession – is a phenomenon that feeds on itself, converting any non peso thing (dollars, consumer goods, real estate, etc.) in a potential valuable asset, against the worthless peso. Hence inflation.

Now you may ask what led in the first place to this kind of psychological block? Very challenging question. The fact is that, in the last 40 yerars or so, Argentine authorities have allowed or were forced to implement macro devaluations of the peso for at least three times. Many Argentines lost their savings in the process. The government debased the currency and now Argentines reciprocate by getting rid of it as fast as they can.

I know this does not go the root of the problem but at least I believe it helps to explain the behaviour behind inflation.