The IEA dropped a little bombshell yesterday by ‘fessing up that the economic prospects for Europe and China are so crappy that the outlook for oil prices is less than robust, even with the US bristling to go after its new favorite Middle Eastern nemesis, ISIS. The Financial Times was blunt: International Energy Agency notes ‘remarkable’ oil demand growth fall. From its article:

The world’s appetite for crude oil slowed at a “remarkable” pace during the second quarter because of weak economic growth in Europe and China, prompting the International Energy Agency to revise lower its demand forecasts for 2014 and 2015.

In its widely followed monthly report, the west’s energy watchdog said on Thursday that global oil demand growth had slowed to below 500,000 barrels a day in the three months to June – the first time it has reached this level in two-and-a-half years.

Slowing demand and plentiful supplies – in spite of conflicts raging in countries such as Iraq and Libya – have together pushed down the price of Brent crude, the international oil marker…

“Oil is a leading indicator, so maybe the global economic recovery is weaker than we think,” said Antoine Halff, author of the report. “At the same time you can see more structural changes in consumer behaviour and a shift towards more efficient technologies trickling through the numbers.”

OilPrice provides more detail:

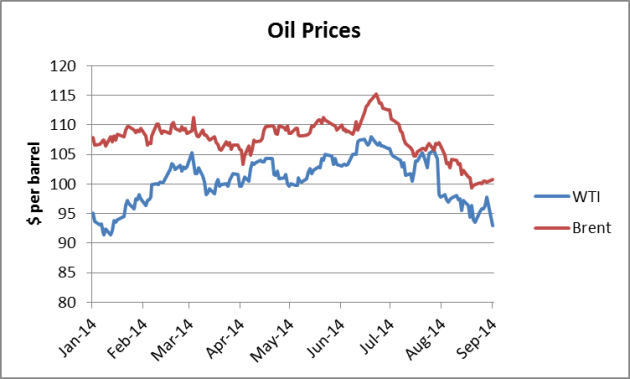

Brent crude has now dipped below $100 per barrel, for the first time in over a year. WTI is trading around $92 per barrel, a 16-month low.

Prices have dropped for a few reasons.

ISIS’s advance has come to a halt and fears that Iraq’s oil production would be affected have abated.

Libya has brought some of its oil back online, with August production averaging around 538,000 barrels per day (bpd) — more than double its average daily production from June. Libya’s National Oil Corporation says that production is now topping 800,000 bpd and could exceed 1 million bpd in October.

U.S. oil production also continues to rise. In June, the U.S. produced 8.5 million bpd, an increase of 500,000 bpd since the beginning of the year. Higher production continues to cut into imports, leaving greater supplies on the global market.

Perhaps most importantly, global demand has been surprisingly lackluster. The latest data from the U.S. Energy Information Agency (EIA) shows that refined product (gasoline, for example) inventories are increasing – an indication that production is overwhelming consumption.

A slowing Chinese economy is also putting a damper on crude oil prices. Weak economic data published by the Chinese government showed that China’s import growth slowed for a second straight month, suggesting the economy continues to cool.

The glut of supplies and weak demand is causing problems for OPEC, according to the cartel’s monthly report. OPEC lowered its demand projection for 2015 by 200,000 and in August, Saudi Arabia cut production by 400,000 bpd in an effort to stem oversupply.

As noted by Steve LeVine in Quartz, cheaper oil could present problems for oil producing countries, which generally rely on high prices to keep their national budgets in the black.

Iran, for example, needs a price of $136 per barrel to pay for its current levels of public spending. Other countries – Nigeria, Ecuador, Venezuela, Iraq – are all facing looming budgetary problems as their required “breakeven” prices are higher than what oil is currently selling for on the market.

Russia needs between $110 and $117 per barrel to finance its spending, which means the Kremlin can’t be happy as it watches Brent prices continue to drop. Combined with an already weak economy, Russia could see its $19 billion surplus become a deficit by the end of the year.

It isn’t just some of the West’s favorite baddies, as well as the Saudis, that have a problem with weaker oil prices. It exposes the conflict that $100 a barrel for oil may be the minimum ongoing price that works for the majors, but even that price is too high for economies that are struggling to generate what they deem to be adequate levels of growth. Joe Costello, author of Of, By, For, explains via e-mail:

As growth has slowed most everywhere, it has taken the demand pressures off. This is particularly true of China, which for the past decade and half has been far and away the greatest demand growth. But as good as numbers are for this, China’s oil growth has been stagnant this year. The real proof of this is that in the last few weeks there’s been a growing number of stories of whole lot of surplus in the spot market.

The real question is how low could it go. If you remember in 2009 during money crisis, oil prices dropped to high $30s before the producers were able to catch it and bring it up to the mid $60s. It held for a year and half or so and then started to drift up. In 2011 the House of Saud said $100 is a good number and thats where it has been. Now two things about that, one is part of the reason, and an extremely important one: the global economy remains stagnant is it was built on cheap oil and can’t run how it was running on $100 a barrel.

Second and now even more important, the last year the oil companies have come out saying they can’t find and produce new oil profitably at $100 and the shale people, and the hour gets later every day on that boom, haven’t shown they can make a profit at $100, so certainly not on $90 or less.

Which gets to the point, what price of oil? Right now the spot guys are playing with price and for short periods, they have the ability to jack it around like in 2008 when they bought it up to $147 and then down to high $30s next year, but they can only do that for a limited time. The one thing for sure the longer it stays below $100 the more pain the industry is going to feel, and if it gets much below $90 for any length of time, it’s going to pop the shale bubble. My guess is that wont be allowed, but you know the best laid plans of mice and industrialists….

Now in theory, cheaper oil should be a boon to stressed consumers, but the oil development/shale gas boomlet has given a lift to the Rust belt. So if this readjustment proves to be meaningful, it will produce some real cross currents in the US.

Less oil should equate to reduced carbon emissions, which is a good thing for the planet.

Less oil equates to more extreme economic hardship, hunger, and death…but only for the 99%.

“Less oil equates to more extreme economic hardship, hunger, and death…but only for the 99%.”

And MORE oil means an acceleration of AGW which “equates to more extreme economic hardship, hunger, and death…but only for the 99%.” One of these negative results is reversible and can be transitional, while the other is effectively permanent.

Is there some sort of “reverse Jeavons Paradox” exploitable here . . . if I am understand terms and concepts right? If the price of oil spiked high enough long enough, would it destroy enough demand for long enough so as to pull the longer-term price of oil down enough for long enough to exterminate the shale frack-oil industry beyond restoration even if the price ever goes back up again? And if so, would that create a longer-enough oil shortage to strangle economies further enough that more demand is destroyed, thereby exterminating more high-cost fringes of the oil industry? And onward and downward to a less-carbon-skydumping low oil/ no oil future?

If there is, is there a way to set it into motion on purpose? When prices are high and tight, could a hundred million activist consumers all over the rich world buy and burn just enough oil products to drive the price so high that broader economies are strangled into pulling the oil price down into exterminate-fracking territory?

And would that “save” more oil over ten years than would have to be burned in the year of petro-arsonist activism required to set off the long strangle/ demand reduction trend? And if it would, could enough people be organized to burn enough oil in the short term to kick the strangulation cycle into motion?

That cycle is the prediction in the Deutsche Bank report.

The accelerator in this is ever-cheaper, ever-higher-volume solar power and batteries; they effectively set a price cap on oil, whenever it goes above that, people switch to solar and batteries, crashing the price again.

This cap appears to be $4/gallon gasoline in the US right now. The cap is, of course, dropping.

This is precisely in line with predictions of Chris Martenson et al. in the peak oil community: a ratcheting effect in reverse, where fossil fuels fluctuate wildly from too expensive to too cheap, as industrial civilization gradually winds down.

If “renewable” energies were not dependent on exotic materials and fossil fuels to function, and were actually not pipe dreams, the economics of $100+ barrels of oil would have caused them to be all over the place by now. Although in point of fact, renewable energies can work, and will work if anyone manages to survive; all we have to do is cut our energy budget about around 90-95% or so. Then (dramatically simplified with not-so-exotic material) solar panels and wind turbines will perform quite splendidly for our energy needs.

Since it describes/predicts the problem illustrated in the post above, once again Chris Martenson’s presentation in Madrid on the subject of peak oil back in 2011: http://www.youtube.com/watch?v=8WBiTnBwSWc

Links? So far, the information I have seen purportedly limiting renewable’s potential by dependence on fossil fuels are weak at best coming from some of our best propaganda outlets. The standard assumption one can challenge right off is that energy to produce solar panels or wind turbines MUST come from fossil fuel and can not be produced by renewables. The other limp assumption is that the materials used to build these devices (which often have a service life of 30+ years) produce and put significant amounts of carbon dioxide into the atmosphere. As to pipe dreams and competition with $100 pb oil, I suspect that has been largely “engineered” by the oil industry, in the same way they “engineered” our bat-sh*t crazy gas guzzling system of internal combustion transportation to practically eliminate rail and public transportation. The only degree those engineers need is in how to put payola in the pockets of politicians. I note, for instance, that arguments about the cost related to innovation almost never take into account subsidies given to the oil industry that are not given to renwables. Finally, the meme that it is impossible to store the energy or move it around is too shrill to be credible and usually has its roots buried deep in the false assumption that all energy production MUST be centralized AND profitable to oligarchs.

JGordon–

Yes. Those predictions are now old news, and obviously nobody wants to remember them–especially as they are proving correct!

–Gaianne

Renewable energy — solar and batteries — is made entirely from cheap, abundant materials; can be produced entirely using renewable energy; and no fossil fuels. We don’t even need to cut our energy budget by very much. Even LEDs use primarily common materials.

(FWIW, we’ve cut the lighting budget by 90% just by swicthing to LEDs. Heating budgets can be cut by upwards of 50% just using insulation. As long as population stabilizes — which is necessary — we’re good.)

Shale fracking will never be profitable due to the rapid production declines on the order of 50-80% in the first year requiring more and more wells just to keep production level. Even more accurate and better drilling techniques aren’t going to help much:

http://www.bloomberg.com/news/2014-02-24/wells-that-fizzle-are-a-potential-show-stopper-for-the-shale-boom.html

“Ultimately, Dave Dunlap, chief executive officer at Superior Energy Services Inc., said he doesn’t ever see the decline curve challenge going away entirely.

“We’ve drilled all the good stuff,” he said. “These are very poor quality formations that I don’t believe God intended for us to produce from the source rock.””

To Curb Global Poverty Every https://en.mwikipedia.org/wiki/Third_World Currency Should Be Pegged To OPEC Oil For 4 Years Till https://en.m.wikipedia.org/wiki/Triffin_dilemma Is Resolved.

“The one thing for sure the longer it stays below $100 the more pain the industry is going to feel, and if it gets much below $90 for any length of time, it’s going to pop the shale bubble.”

What kind of joke is this? Oil has tripled in the last ten years.

Sorry about this rave: There are a lot of catch-22s in a world based on profit. Everybody’s profit depends on everybody else’s profit. So if we get real about GW and really put the stops on the use of oil and natgas, very large economies based on those revenues will go under. Competition for revenue will heat up. And cheap energy will then be used excessively to promote other industrial uses to achieve the necessary surpluses, etc. In fact, oil supplies are depleting and becoming less available, and today’s reserves will be used up pretty fast even when world business is in a long depression. So there is only a perceived glut, a temporary glut, due to less use. The best way to adjust is to limit the amount of oil being extracted and raise the price. Price fixing. For now. But we/they can’t fix the price of energy unless we/they control all the energy supplies. Not sure how to understand what will happen to economies (all based on profits based ultimately on cheap oil) in a totally price-fixed, rationed world. The way our government is manipulating perception these days, I think we’re almost there. What better explains all this weirdness? If we worked backwards from a stated goal for stopping GW it would be interesting. I’m sure the government has got this very study locked up in a safe somewhere. The trick will be to get rid of most of the bad and keep most of the good. The most disconcerting thing is to watch what looks like a total lack of action. The only thing that has been done to stop global warming (and it was huge) is the GFC, which was rigged, but nobody’s confessing – imo.

STO,

Your comment, and particularly your final sentence, provided food for thought both from a historical perspective and about future policy possibilities. I recall that in 2008 some of the big Wall Street banks were buying and storing physical crude oil in leased tankers while the price of oil spiked ever higher. Based on their past patterns of behavior, it would be surprising to me that da Boyz included the ancillary benefits to humanity and other life forms of slowing global warming in their equation at that time, but it is heart warming to consider that as possibility.

And who can argue with the “bottom line” result?

Oil at $30/bbl will do more damage to ISIS than any number of bombs we might drop on them. And yet why is hatred for ISIS inversely correlated with love for non-fossil fuel energy sources in our politicians?

US OIL should be NATIONALIZED by WE THE PEOPLE and used by government for the benefit of ALL citizens.

If you make $8.00 per hour a gallon of gas would cost that poor person $1.20. 15% of the hourly wages for All. If you make $100 per hour a gallon of gas would cost that fortunate person $15.

Simple to change, hard to sell!

From the piece:

“Second and now even more important, the last year the oil companies have come out saying they can’t find and produce new oil profitably at $100 and the shale people, and the hour gets later every day on that boom, haven’t shown they can make a profit at $100, so certainly not on $90 or less.”

We cannot let that statement pass unexamined:

a) A substantial share of the world’s known conventional reserves have been kept off of the market altogether, or available only at a much higher price as a direct consequence of US policy – policy that can and ought to be abandoned forthwith.

b) Why should we just accept what some of the largest, most powerful corporations on earth say ‘they’ require to make a profit? I am dead-set against dependence on fossil fuels at all, but I’d wager if the US majors had free access to the Orinoco tar sands in Venezuela, they’d be producing oil for $50/barrel and making money hand over fist. It is of course much less costly to produce conventional oil in Iran, Iraq (coming along), Libya, and others. Angola, Nigeria, Sudan, Ukraine and now Russia are all now problematic, but also need not be. If the goal is to get the oil, the right policies are available this very minute. If the goal is to keep the oil in the ground to control the price, or just keep it under military protection, then again, it’s a policy choice.

c) We know an awful lot of oil has been financialized. Who wins when the price goes down?

We can’t allow ‘current political realities’ as defined by the world’s worst policymakers in Washington unduly limit our thinking. The incredibly wrong-headed policies of the past do not preclude reasonable actions now: for instance, as the West owes the Arab/Gulf region literally trillions in damages, it ought to commit to a global plan to use the high quality crudes from those areas to provide the energy to build the global infrastructure needed to get off fossil fuels entirely, rather than rip up dozens of countries in order to ruin their water supplies or force half the world to plow headlong into all-coal solutions.

We have everything required except real leadership.

Um, you just discredited yourself.

Tar sands aren’t economic at anything less than $100 a barrel, and probably well more. $100 a barrel was the minimum price that was viable 7 or so years ago. Oil is not the same. Heavy sour crude (which is what Iran and Venezuela have a lot of) produces less gas and more of the heavier distillates like tar when refined, when contrasted with light, sweet crude, which is what the Saudis have.

The biggest underexploited source of cheap crude, BTW is Iraq. Second biggest proven reserves after Saudi Arabia. The fact that you didn’t mention that either is yet more proof that you are way out of your league on this topic. I’m no expert, but I have far more appreciation of what I don’t know than you do.