One of the most striking things about the testimony in the AIG bailout trial is the degree to which Fed officials play fast and loose with the truth. And I don’t mean the normal CEO version of having no memory of events that are inconvenient and very detailed recollections of things that boost their case. I mean statements that are flat out false.

Two key examples come at the very top of the trial, namely, Scott Alvarez, the general counsel of the Board of Governors, and Tom Baxter, the general counsel of the New York Fed. They are also the most important government witnesses, given the plaintiffs’ strategy, that of Hank Greenberg, via Starr International and the class of AIG shareholders that Starr represents. Their case hinges on the legality of the central bank’s conduct in the bailout, as in whether it exceeded its authority under its “unusual and exigent” powers, more formally known a Section 13 (3) loans. These two attorneys are critically important both in having told their principals, meaning for Alvarez the Board of Governors and for Baxter, Tim Geithner, what they thought was permissible conduct, and as players in their own right.

Much of the time Alvarez and Baxter try, with mixed success, to navigate a credible, government-defending path through the facts on record, but there are times they simply punt, as in this exchange between David Boies, Greenberg’s attorney, and Alvarez:

Q: Would you agree as a general proposition that the market generally considers investment-grade debt securities safer than non-investment-grade debt securities?

A: I don’t know.

And Alvarez simply would not drop trying to maintain that black was white. This is from Day 2 testimony. Q is again Boies and A is Alvarez, and Boies is referring to the Financial Crisis Inquiry Commission report:

Q. Let me ask you to turn to page 382 of the exhibit. And let me ask you to look at the second full paragraph. And it begins, “As it had on the weekend of Bear’s demise, the Federal Reserve announced new measures on Sunday, September 14, to make more cash available to investment banks and other firms. Yet again, it lowered its standards regarding the quality of the collateral that investment banks and other primary dealers could use while borrowing under the two programs to support repo lending, the Primary Dealer Credit Facility (PDCF) and the Term Securities Lending Facility (TSLF).”

Do you see that?

A. I see that

Q. And do you remember colloquies that we had yesterday about whether the Fed was accepting collateral that was not as good, in layman’s language, as it had before?

3 A. I do recall that.

Q. Using the language here, would you agree that the Federal Reserve had lowered its standards regarding the quality of the collateral that investment banks and other primary dealers could use while borrowing under the PDCF and the TSLF?

A. No.

Q. You would not agree with that.

A. Right.

It’s one thing to see people representing banks, which is what Alvarez and Baxter are in this case, try to pull a fast one over judges in foreclosure court. It’s another thing to see attorneys of this stature pulling the same tricks with a smidge more finesse. And this isn’t my view; I’ve conferred on many of the examples below with well recognized legal experts on lending, bankruptcy, and bank regulation who don’t have a dog in this fight. Via e-mail, here’s the reaction of one to some of the AIG bailout trial testimony:

Alvarez either a fool or a liar, and I know he’s not a fool. Of course, there’s no chance that the DOJ will prosecute him for perjury given that they’re defending the Fed.

Let’s just look at some examples of what I am talking about. I tried to find relatively short ones, and that was not as easy as I’d like, give how uncooperative Baxter and Alvarez were when caught out. But trust me, there are quite a few more.

Quacks Like Perjury

Alvarez, on the second day of testimony (see the transcript here, at the bottom of the post). Q is Boies:

Q. Now, the interest rate that was set for the AIG 13(3) loan was an interest rate that you believed at the time of your deposition was the interest rate that had been discussed between AIG and certain private-sector banks; correct?

A. That’s correct….

Q. And insofar as you are aware, that interest rate was simply accepted by the Federal Reserve without any analysis or consideration as to whether that interest rate was a reasonable interest rate; correct, sir?

A. No.

Q. Let me ask you to look at your 2012 deposition at page 33, lines 16 through 20: “QUESTION: Was any analysis or consideration done or given by the United States to the question of whether the interest rate that the banks were asking for in the discussions was a reasonable interest rate?

ANSWER: No, not that I’m aware of”

Here is another eye-popping statement from Day 2, again from Alvarez:

It is common for banks in the business of banking to obtain equity interests in connection with distressed debt and speculative — in distressed debt situations, and the comptroller of the currency has authorized this in a variety of circumstances, so it is within the business of banking and incidental to the business of banking.

This was such a rank falsehood that reader grayslady jumped on it. A recognized bankruptcy expert was if anything more indignant. Via e-mail:

Total bullshit. DIP [debtor in possession] loans only get paid in cash: fees and interest. They cannot require warrants, much less equity, because at the time the DIP loan is made, nobody knows who will be getting the equity in the reorganized company or if there will even be a reorganized company. The DIP loan is the super-senior piece of the capital structure. It’s secured up the wazoo and often has serious governance rights (like appointment of a chief restructuring officer). But it’s not equity. That said, there’s plenty of loan-to-own in bankruptcy, but that’s based on pre-bankruptcy investment getting converted into equity. It’s very rare that the DIP loan itself gets converted into equity under the plan. (Sometimes the DIP loan will rollup the pre bankruptcy senior facility, but its rare to see that plus an ultimate equity conversion).

It’s also not normal for competent lenders, and one assumes Baxter means to refer only to the practice of competent lenders, to take equity other than in the form of warrants or another contingent exposure. The reason is that taking equity taints one’s status as a lender, and the implication in the event of bankruptcy that a court would subordinate your loan. So the same notion applies to distressed lenders as well as lenders in bankruptcy.

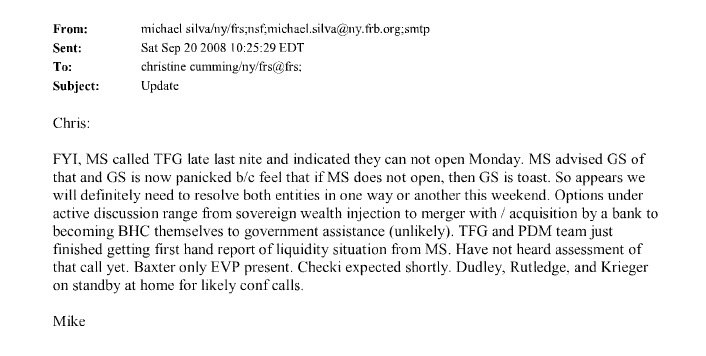

Here’s another remarkable exchange, this one from Day 1 of the trial, with Q. as David Boies and A. as Alvarez. Bear in mind that after this testimony was entered into the record, Boies introduced into the record an e-mail dated Saturday September 20 that Morgan Stanley had informed Tim Geithner on September 19, a Friday, that Morgan Stanley would be unable to open the following Monday.

Q. Do you think that Morgan Stanley, on September 14th, 2008, could have continued to operate if you had taken away the primary dealer credit facility and not substituted something equal in its place?…

THE WITNESS: — and I don’t know if Morgan Stanley was even borrowing on that day….

Q. Mr. Alvarez, did I hear you say that you didn’t know whether Morgan Stanley was borrowing from the primary dealer credit facility?

A. On September 14th I think was your question.

Q. Was it borrowing from the primary dealer credit facility at any time in September 2008?

A. I don’t know the answer to that…

Q. Would it surprise you that that number was as high as $100 billion?

A. I just don’t know.

Q. While we’re on the subject of Morgan Stanley, there came a time when the Federal Reserve System was apprised that unless Morgan Stanley got federal assistance or additional federal assistance to what they were already getting over a weekend, that Morgan Stanley would not be able to open the following Monday, correct?

A. No, I’m not aware of that ever happening…I’m not aware that Morgan Stanley — I’m not aware of that. I don’t know what you’re referring to. Could you be more specific?..

Q. You were the general counsel of the Federal Reserve Board at that time?

A. Yes, I was.

Now let’s stop right here. As we indicated, Boies later entered into evidence shows that the New York Fed immediately cranked up a team to analyze what to do about Morgan Stanley saying it was toast unless it got a rescue. This is Plaintiff’s Exhibit 175:

TFG is Geithner.

The e-mail clearly states that “options under discussion” included becoming a bank holding company and that the New York Fed was getting further briefings on Morgan Stanley’s liquidity. It is inconceivable that the idea of becoming a bank holding company or a merger with another bank (JP Morgan) would not have been discussed with the Board of Governors, or at least Bernanke, immediately, and that Alvarez would not know about it. The principals, Paulson, Bernanke, Geithner, and John Mack of Morgan Stanley, were willing to tell Andrew Ross Sorkin about a heated conversation over the weekend in which the three officials pressed Mack to sell Morgan Stanley to JP Morgan.

Mind you, I don’t want to give readers the impression that Alvarez was worse than Baxter; they made quite the Tweedledee and Tweedledum in the veracity category.

This section is from the second day of Baxter’s testimony (Day Four of the trial, see transcript at the bottom of the page). David Boies, as usual, is Q:

Q. What’s correlation risk?

A. Correlation risk doesn’t go so much to the legal issues associated with the collateral. It goes to the valuation. And the problem with taking shares of a subsidiary as collateral for a loan made to the parent is that if the parent files in bankruptcy, that customarily will have a deleterious effect on the value of the subs, particularly in a regulated space like insurance and banking.

Q. Can you expand upon what? What do you mean? What is the correlation risk concerned with insured subsidiaries?

A. Well, you can value an insured subsidiary today, for example, where the parent company is fully operating and not in bankruptcy. Once the company, the parent, goes into bankruptcy, you lose all source of parental support, so with respect to the ability to downstream equity, for example, that goes away. So a bankruptcy of a parent always has an adverse effect on the valuation of subsidiary shares. It can’t be good for the subsidiaries. And that is a shorthand summary of correlation risk.

As a recognized bank regulatory expert said (name withheld because he deals with the Fed) wrote about this section:

WTF? The bankruptcy of a parent only matters if the parent has guaranteed the sub’s liabilities or there’s some sort of integrated operation that can be disrupted. The FDIC’s whole single-point-of-entry proposal is premised on the idea of the parent going bankrupt while the subs are ring-fenced and seamlessly moved to a bridge bank. Heck, that’s the FDIC receivership model already more-or-less. In any case, insurance solvency regulation is based around the sub — I don’t think it involves the parent at all.

We now turn to a discussion of the AIG CDOs. I must confess that I take personal offense at this part of Baxter’s testimony (from the Day 5 transcript, again at the bottom of the post). Those of you who followed the crisis and its aftermath closely may recall that the New York Fed refused to give out information about the AIG CDOs that were transferred to Maiden Lane III, arguing that it would help traders and therefore put Blackrock, which was managing Maiden Lane III on behalf of the Fed, in a worse position when it came time to sell or unwind the CDOs. Structured credit expert Tom Adams and your humble blogger demonstrated in a series of analyses that there was already a great deal of information already in the public domain on over 80% of the AIG CDOs. Traders would have considerably more by virtue of having access to specialized information services like Intex. The idea that keeping information secret had anything to do with having any advantage over traders was ludicrous. Darryl Issa apparently agreed, since he released all the information about the AIG CDOs shortly after our posts ran. As we stated at the time, the justification offered for secrecy was bogus:

We also want to challenge the Fed’s oft-touted notion that it is necessary to keep transaction-level detail in the Fed’s various special bailout vehicles (Maiden Lane I, the Bear Stearns vehicle, Maiden Lane II, which holds RMBS related to AIG’s secured lending portfolio, and Maiden Lane III) secret. As we demonstrate here, this information was not secret in the case of Maiden Lane III, but the repeated assertion that it was helped discourage further investigation.

The Fed claims that exposing the original and estimated current value of the Maiden Lane III CDOs would reduce the ability to realize maximum value from the entity. But that is spurious. In real estate, for instance, the ability to determine the owner’s purchase price and its appraised value is distinct from what a buyer might offer and a seller might accept. No one in New York City, for instance, believes that the owner of a condo (where buyer can find what the owner paid) has more negotiating leverage than the owner of an apartment in a co-op (where that information is not available). Any possible buyer of a CDO would do his own due diligence and valuation.

Knowing someone’s position size and cost basis can a give a buyer an advantage in liquid market (where dealers front run, or as they would more politely put it, get out of the way if they see inventory being sold and they think more is coming). But these are bespoke transactions in an illiquid market. The seller will have an idea of what its wares might fetch, and shops for bids. And even if a seller has a large position, if he can afford to wait and signals patience, he becomes much harder to exploit. And who can greater staying power than a central bank?

But more mundane factors make the “traders can take advantage of us” argument even more dubious. There is simply very little in the way of bids for CDOs. They are very difficult and costly to value if one does it correctly, and with so many moving parts, it is easy to be very wrong. And wrong often means you recover nothing. So the implicit idea, that the Fed’s exit is a sale of the CDOs as CDOs, as opposed to via liquidation, is also questionable.

So what did Baxter have to say about this episode?

A. My best recollection, again, is of a conversation I had with Ed Liddy, and Ed Liddy, then the CEO of AIG, was concerned about releasing the names of the people with whom AIG was doing business, and the sense was that there could be a kind of stigma associated with doing business with AIG and a feeling that it was inappropriate to disclose the names of your customers.

Q. Was there information that the New York Fed was concerned with having been publicly disclosed in AIG’s SEC filings?

A. The concern on the part of the Fed related to the CUSIP numbers — and that’s a specific identification of a security — the CUSIP numbers of the securities that we had brought into our vehicles.

Q. And that’s C-U-S-I-P?

A. Yeah. And, again, I want to be clear, this is a concern on the part of our investment staff. This is not something that I had a personal concern about, but the investment staff said if you disclose to the market the securities you’re — the specific securities you’re holding in portfolio, when you try to sell off some of those positions, you’ll be disadvantaged. So, the investment staff felt that if you could not disclose specific securities and CUSIP numbers, that that would be in the interests of good portfolio management.

Q. Did AIG ultimately disclose the names of the counterparties publicly?

A. They ultimately did.

Q. Why, to your knowledge?

A. There was — there was a great controversy at the time that AIG and the Fed were being nontransparent or were hiding information, were trying to cover over what was characterized, to use the terms of your question, as a backdoor bailout. And as a result of that controversy, public controversy and in Congress and the media, a decision was made to disclose.

This account is patently false. It was Darryl Issa who made the information public by providing it to Huffington Post, which then published it. And We had provided considerable transaction level detail, including CUSIPS, on 85% of the Maiden Lane III CDOs before Issa made his release. And Baxter repeats the same unfounded “traders will pick us of” rationale that the Fed tried passing off in 2009 and 2010.

Finally, for trial junkies, there is an astonishing section in the first day transcript (see the end of this post, starting on p. 207, line 13, where Boies takes Alvarez through some notes he had made on a September 17, 2008 meeting. Boies catches Alvarez saying he remembers what he said about a critical section of the notes. In an earlier deposition, Alvarez had made clear he was interpreting those notes, as opposed to having a specific recollection. Alvarez does not back down when confronted with the deposition. The judge is clearly skeptical of the miraculous improvement in Alvarez’s recall and allows Boies to ask as to whether conversations with counsel had anything to do with the improvement in Alvarez’s memory.

The Fed’s Contempt for the Court

The example that best illustrates the contempt the Fed has for the trial is actually documents not produced in discovery.

The plaintiffs, meaning Starr International and the class of shareholders the company represents, sought the term sheet presented the New York Fed to Bob Willumstad, the AIG CEO, on September 16, 2008. This was the first infusion of funds. Willumstad said the term sheet was amateurish and looked like it had been put together by his pre-teen grandchildren. The board met that evening and received only a verbal presentation of terms, so Willumstad was the only board member to see the term sheet. The full board made its decision that evening based solely on a verbal presentation from the New York Fed.

The New York Fed mysteriously can’t locate this critically important term sheet.

This matters because the Fed maintains that the board was told that the Fed wanted to take an equity stake in connection with its loan, when press reports at the time (which included leaks from government employees) and AIG’s initial 8-K filing referred only to warrants. Not only do warrants not confer voting rights, but in AIG’s case, because AIG’s stock has a $2.50 per share par value. That means that exercising warrants for the agreed-upon 79.9% interest would have required the Fed or whoever exercised the warrants to stump up $30 billion.*

Now you might say, didn’t the board’s own resolution show what they thought they’d agreed to? Astonishingly, the Fed got Willumstad to fax a signed page stating “”American International

Group, Inc. hereby agrees to and accepts the summary of terms for the Senior Bridge Facility presented to AIG…” to which the Fed would attach the term sheet. I am not making this up. See the first document at the end of this post. And Baxter asserts that he actually got a term sheet faxed back, even thought the Fed has been unable to produce one. Willumstad testified later in the trial (Day 28) that he did not bring the term sheet he received to the board meeting and the board received only an oral presentation of the terms.

Q here is Boies, A is Baxter and Gardner, who speaks later, is the government’s attorney:

Q. Now let me go to Plaintiffs’ Trial Exhibit 94. This is a fax cover page and a signature page that was faxed to you at 8:44 p.m. on September 16; correct?

A. What I recall, Mr. Boies, is receiving this page, which is PTX 0094, but what I recall was appended to it was the term sheet. So I don’t recall receiving it in my office in this form. The first page and the second page were there, but what I got also had the term sheet attached.

Q. So it’s your testimony that when this came to you, there was a term sheet attached to it?

A. That’s the way I remember it. Now, I don’t — this is my fax number, and I don’t man the fax machine, so it’s possible whoever pulled this from the fax machine put the two together. I don’t know. But what I remember, Mr. Boies, is getting this fax with the term sheet attached….

MR. BOIES: Your Honor, I want to be very clear about this, and I don’t want counsel who was not involved in discovery to misspeak to the Court. That document I do not believe anyone has testified was a document faxed to Mr. Baxter. Now, what I believe that document to be is something that has been put together, but — by somebody, but I don’t believe anybody has testified that document was faxed to Mr. Baxter at 8:44 p.m. on September 16.

MR. GARDNER: And I don’t actually think that’s Mr. Baxter’s testimony. What I understood Mr. Baxter to just say is he does not know whether or not the term sheet was faxed along with the cover page or someone from his office put them together. That’s what I understood his testimony to be. If I’m mistaken, Mr. Baxter certainly will correct me. But all I can tell you right now is that JX 83 is a copy of those three things put together, and Mr. Baxter’s testimony is what it is.

This is all a little too cute. Baxter says he recollects getting a term sheet, and the implication is that that came along with the fax from AIG. Boies makes sure not to let that stand. Technically, what Baxter said was not perjury since no one can verify his recollection, and his save, that maybe it came that way or maybe an assistant put the pieces together. But this still comes off as a desperate, credulity-straining effort to pretend that Willumstad faxed back a term sheet after the government made a verbal-only presentation to the AIG board.

Pretty much everyone who has commented on the trial has noted that the judge tends to rule in favor of the Hank Greenberg side. That’s generally a sign that the opposition has racked up lots of bad faith points with the judge. With examples like the ones we have in this post and the longer and more painful ones we spared you, you can see why.

___

* In reality, the Fed didn’t need to exercise the warrants. It could just sell them if the objective was simply to recover the bailout funds.

2014.10.02-DAY-4-Full

2014.10.02 – DAY 4 – Full

2014.10.03-Day-5-full

2014.10.03 – Day 5 – full

I guess I can sum up my confusion in one 3-part question:

What is the best possible outcome for 1) Greenberg 2) AIG 3) American people in the aggregate?

Because I am assuming that there will be an outcome of some sort….

Best possible outcomes for Greenberg and AIG are probably obvious.

The best outcome for the American people is more open to question, but I think in the best case this would be a step towards regaining some control of public institutions and restoring their accountability. The Fed should not be able to do as it likes and ignore the law, even if it claims to be doing so on behalf of taxpayers. If the trial result gives the public some confidence that laws aren’t just for preying on the little people and actually need to be followed by the wealthy and those in power as well, that would be a salutary outcome, even if it meant that taxpayers needed to write Greenberg a large check.

People like Alvarez making statements to the court of the type documented here (and there are plenty of other examples) are symptomatic of a rotten culture that needs to be fixed.

Every competent securities lawyer knows the legal distinction between investment and non-investment grade debt. But Alvarez is an economist as well, having earned his B.A. Econ from Princeton in 1977.

http://www.acus.gov/contacts/scott-g-alvarez

As Henry Wotton might have said, “A Federal Reserve general counsel is an honest gentleman sent to lie for the good of his country.”

I followed this very closely at the time, AIG got their bailouts… last 4+ years I’ve hardly followed any of this.

Something I’ve been curious about for a long time, never investigated. AIG paid back these loans, right? How the hell could a business so upside down, selling competitive insurance, possibly stay solvent and repay that kind of money in a few short years? My gut sense was always the payback was another convoluted manifestation of Enron accounting, but the specifics of this one I don’t know.

Anyone investigated this?

According to an article at the Daily Beast, the loans were paid back from three sources: 1) sale of profitable AIG subsidiaries, 2) strong insurance sales in China, where AIG had a well-developed presence, 3) continuing strong U.S. stock market, enabling the government to sell its AIG shares at a profit.

Thanks Grayslady.

I found that DailyBeast article to be somewhat superficial.

At this stage just curiosity on my part. I found an article on Barry Ritholtz’s site written by James Tilson and Robert E. Prasch (Jan. 2013) here that goes into more depth. I think there’s some error there, but more truth than not. Strongly suggests this was a net loss for taxpayers, not a profit.

Another more detailed article on the Atlantic: The Profitable Bailout? Inside the Real Costs of the Saving AIG and Wall St., which touches on many of same issues as Ritholtz’s article above.

Still, not having looked at this prior… seems all in all AIG repaid the majority of that with real assets, although still a net loss for taxpayers. More legitimate repayment than what I would have guessed.

Interesting information from Ritholtz regarding Treasury waving its magic wand and providing AIG with a $25 billion tax break never approved by Congress. If true, that means taxpayers are in the hole $2 billion, not up $23 billion.

This link from the Daily Beast gives a fairly good explanation of the recovery.

‘TFG’ (at right) flees the crime scene with his accomplices:

https://farm4.staticflickr.com/3876/14756972148_b9a6420d48_b.jpg

Absolutely marvelous that Geithner’s initials are TFG.

From the Declaration of Independence:

….And for the support of this Declaration, with a firm reliance on the protection of Divine Providence, we mutually pledge to each other our Lives, our Fortunes, and our sacred Honor.

It is symptomatic of modern sensibility, of the philosophy of “economic” man, that defense of the indefensible is so ubiquitous that it is unremarked upon.

If the DoJ had more experience in defense they would have settled this case by now. As it is, they are bringing the Fed deeper into disrepute.

It’s more complicated than that. Greenberg is probably the most litigious man in the country, which also means he is very seasoned and likes to fight. The fact set and the legal theory used by Boies is also one that really has the government cornered. Greenberg would not settle for less than a pretty serious number and politically no way would the government do that. Plus since he filed as a class on behalf of other AIG shareholders, the government also could not keep any settlement secret.

The government is punting its defense. It seems to be assuming that the judge won’t rule for Greenberg and award meaningful damages, or if it does, it will easily get the verdict overturned on appeal. By contrast, I think the odds are high that the judge rules for Greenberg and also awards big damages. Anything over $500 million would have the government up in arms, while I expect any damages to be at least $1 billion.

But appeal is another kettle of fish. I’d hazard it depends almost entirely on what judge they get. As terrible as the facts are relative to what powers the Fed actually has by statute, the bar is now packed with judges who seem perfectly comfortable in engaging in tortured readings of the law to render decisions in favor of the “bigger” party, which is usually big business but here it the government.

LOL “depends which judge they get” LOL

We’re not talking about some street hood, we’re talking about the US Government itself and there could not be a more central crime to the entire fabric of the country and its entire economy. Will NO ONE stand up and scream that we have sold the very basic founding principles of this country down the tubes? That we are now a nation of men and not of laws?

“What would you do? Cut a great road through the law to get after the Devil? … And when the last law was down, and the Devil turned round on you – where would you hide, Roper, the laws all being flat? This country is planted thick with laws from coast to coast, Man’s laws, not God’s, and if you cut them down – and you’re just the man to do it – do you really think you could stand upright in the winds that would blow then?” A Man for All Seasons

The judge in this case has been given plenty of opportunities to dismiss this case in favor of the defendant and has not!

It would seem to me unpossible for any appeal from the defendant, to an adverse verdict for the plantiff, to prevail.

Huh?

If the plaintiff loses, it’s the plaintiff (Starr) that would appeal.