Since it conflicts with Americans’ widely-held image of self-reliance, the fact that new business creation has fallen to the point that even Hungary has a higher rate of starting new ventures than the US hasn’t gotten the attention it warrants in the mainstream media.

Unfortunately, many of the explanations for why that happened are more than a bit off.

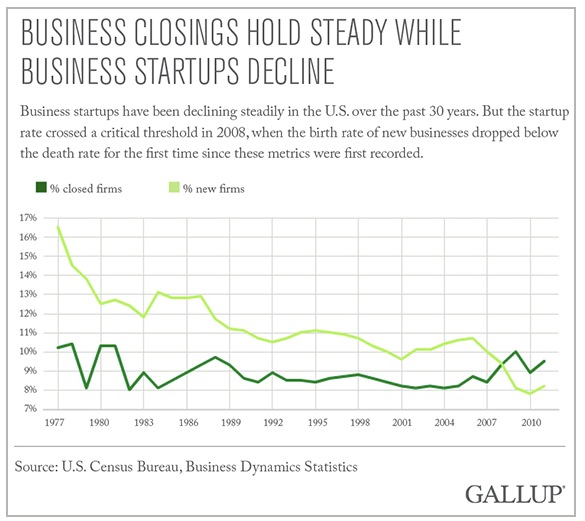

The original report came in Gallup last week. Key section:

The U.S. now ranks not first, not second, not third, but 12th among developed nations in terms of business startup activity. Countries such as Hungary, Denmark, Finland, New Zealand, Sweden, Israel and Italy all have higher startup rates than America does.

We are behind in starting new firms per capita, and this is our single most serious economic problem. Yet it seems like a secret. You never see it mentioned in the media, nor hear from a politician that, for the first time in 35 years, American business deaths now outnumber business births.

[snip]

Business startups outpaced business failures by about 100,000 per year until 2008. But in the past six years, that number suddenly reversed, and the net number of U.S. startups versus closures is minus 70,000.

This change is critically important because small and medium sized businesses are the creators of new jobs. Large corporations have in aggregate been in liquidation mode for well over a decade, net saving and net shedding employees. You can see this behavior in the regularity with which the business press reports on headcount-cutting exercises, as if they are mere cost cutting exercises, as opposed to a sign of how deeply unwilling large corporations are to invest in their workers and their futures.

Notice how the change dates to the crisis? This is no accident. While correlation is no proof of causation in and of itself, it’s not hard to fill in causal drivers.

The Gallup article lays on thick the mythology of American entrepreneurship, as if its some sort of value or character attribute we are losing, like the old Roman virtue, and that it rests on “innovation”. The problem is that the cultural hype is based on high-flying, often venture-capital funded startups. Worse, not just journalists but also even academics have fixated on venture-capital backed young companies, even though they account for only 1% of total new ventures in most years and only 25% of the Inc. Magazine 500 roster of most successful high-growth companies.

So what about the understudied overwhelming majority of startups that are the real job engine of America? What are they like?

In his landmark study, The Origin and Evolution of New Ventures, Amar Bhide found that the most common path for successful entrepreneurs was that they had worked for large, established industry players and noticed a market niche that wasn’t served well. The most common way these new businesses were funded were savings, borrowing from friends and family, and credit cards.

Now if you think for a bit about what has been happening in our economy, and in the business world overall, you can see how the impact of the crisis and its aftermath would lead anyone with an operating brain cell to be cautious about hanging out their own shingle.

First, a classic balance sheet recession means a slow and weak recovery, as we have seen all to well. Coddling Wall Street has exacted a high toll on Main Street, and the players at risk like small business most of all. Only recently have small businessmen expressed a decent level of optimism about the economy and hiring. But even with that, there are a lot of headwinds, such as a questionable outlook for retail, which is one of the most popular targets for new ventures.

Second is that a lot of people had their savings depleted or wiped out during the crisis due to job losses or hours cutbacks. And older people who have some capital are still facing a low interest rate environment, and questionable prospects for capital gains. While that may make some more willing to take a flier, many people respond instead by working to save even more (if they are still working), trying to find not horribly risky income producing assets, and being careful about risk taking. In general, when times are robust, most investors have higher risk tolerances than when times are bad or uncertain. So the savings and friends and family route for getting funding also is not what it used to be.

Third is that credit card companies slashed credit lines during the crisis, felling a lot of ventures that relied on seasonal credit. And two important small business credit card lenders have exited the business or cut back on their offerings. Advanta failed, and American Express, which used to offer a suite of small business funding products, such as a capital lines, has eliminated some of its products and has become more stringent on how much credit it provides on its business card products.

There is an additional development which is longer term and was exacerbated by the crisis, which is short job tenures. It’s hard to get enough insight about customer behavior and what it might take to compete with or sidestep industry incumbents if you don’t spend enough time at a company to understand its operations and processes. Related to that is that many companies now make workers sign highly restrictive non-compete agreements as a condition of employment, making it hard for them not just to join other companies but go out on their own.

So while Wall Street isn’t the sole perp in the decline of American entrepreneurship, it is still a leading perp. And that’s why it is important not to give up on the effort to cut our hypertrophied finance sector down to size.

Correlation is not causation and wall street might still have contributed, but immigration policies and boomers moving to retirement might explain the trend too. I think either conclusion is premature.

Tell me how immigration policy would explain a change in 2008? There’s no relationship there. And why would boomers retiring have ANY bearing on the change in 2008? People in their 60s just about never start new ventures. It takes too much energy and risk.

Harland Sanders started Kentucky Fried Chicken when he was 65.

Uh, I resemble that remark. Except for the “energy and risk” thing. My group of “Super-Senior Entrepreneurs” here in North Florida (age 60+) – we are a group of over 250 viable business owners who have started businesses and, get this – have helped others do the same – don’t think “studies,” “memes,” or false narratives of any kind should be floated about us, even with the best of intentions. With all due respect, because I love the NC site.

Y’all wanna see old farts working 80+ hour weeks and experiencing a 97% success rate (3+ years)? With most of us (64%) having multiple business successes? C’mon down, sweet young thangs!

With all due respect, the plural of anecdote is not data. The overwhelming majority of businesses are started by people who are younger. Hence the “boomers starting to retire” is not a strong explanatory factor in why startups fell in 2008 and have continued on a downward trajectory. A large survey found that the average and median age of company founders when they started their current companies was 40.

I am curious if the decline actually may be related to the distortionary effects of both a housing market that is more seen as an investment these days and the pull of high salaries in the finance industry. I think I actually see some of these factors in everyday interactions with young professionals. There are a number of push and pulls here that could be extrapolated, obviously this is going to be multi-causal.

1) The increase in housing costs could take individuals trying to bootstrap with or without families and make it more difficult for them to start businesses.

2) Local funding that would otherwise have gone to small businesses via friends in family could be trapped in housing or housing related investment.

3) The time and resources of individuals with surplus incomes could be invested into buying renovating and flipping housing.

Add stagnant wages and job insecurity to these factors and people may be holding on to a job that doesn’t give them the opportunity to save enough to start a business. Additionally, the pull of high incomes in finance probably also has a distortionary effect on segments of the population that may otherwise have used their talents to start businesses or gained experience productive sectors of the economy.

I think it is important to remember about business starts there is only a segment of business starts that have high growth trajectories. It is not necessarily going to be the people that start restaurants, landscaping firms, etc.

boomers? uh, no. Looking at the chart one sees the current reversal start about 2007, at the housing crash, brought on in large part by the tbtf banks’ mortgage “programs”, so well documented here at NC. In 2008 the tbtfs crashed and were bailed out by the govt. The bailout idea was – or so they said – to revive Main Street and the economy by providing money to the tbtfs to lend. Except, the tbtfs held on to the money. I know of 2 established, profitable small businesses that had their credit lines pulled by a tbtf bank for no reason except the bank had decided to stop lending the to small business community. The bank apparently decided to keep the bailout money, not lend it, park it for a guaranteed interest return, and “pay back” the govt bailout loans. Said small businesses were left scrambling to find a new line of credit source.

Billions in local retirement accounts (for example) going to Wall Street instead of local investment. Many BARRIERS to local investment, while the economy skews endlessly toward corporate domination. Neoliberal multinational corporate domination is pretty obviously an enemy of local development. Think–if you are still a little challenged about this–about streets full of chain restaurants in any town in the US, where that money goes. Twice as much money stays in the local economy if you shop at a farmers’ market, but farmers markets capture less than 1% of local food sales. Pretty obviously intuitive notion.

Obviously, the emphasis at this site is international capital. But readers might be interested in Chelsea Green’s Community Resilience series, especially in Local Dollars, Local Sense: How to Shift Your Money from Wall Street to Main Street and Achieve Real Prosperity by Michael Shuman.

. . . might have added that Shuman is very strong on all of the constraint on local development that the Wall Street investor model has, increasingly, reinforced. (Maybe some readers here have a notion of entrepreneurship as a matter of geeks with good ideas mating with venture capital, but the “entrepreneur” tends to be another person, no matter what the early development theorists–Inkeles et al–in their dubious wisdom thought.) Again, not hard to intuit some of this once you latch on to the idea: Wall Street is no friend of Main Street.

Consolidation! We are in the end phase of capitalism. Capitalism is a global game to the finish and capital can and always will trump all. We have a hand full of mega businesses that allowed and even rewarded for monopolizing multiple sectors of business. These entities have the advantage of scale and can destroy any and all newcomers.

Funny how when talk of growing the economy there is no mention of the fact that Climate Change demands we curb and even de-grow, and when we talk about Climate Change there is no mention of the fact that all the solutions work out to essentially doing less and impoverishing billions. What we seem to “HOPE” for is 5% growth while reducing emissions by 80%. Magical thinking.

Everyone talks about localization, farming, green business, but the economics of starting something means all inputs and other costs are expensive and therefore the product is more expensive. New business can function for a bit at the boutique level selling high priced goods and services to wealthy patrons but as soon as their is a whisper of economic hard times patrons flee to the big box for cheap. This all happened exactly like that in 2008 and I say dozens of well meaning start-up biz fold and loose it all. People are just now forgetting that enough to try again and again it will go down like 2008.

This morning Robert Schiller was schmoozing on CNBC that mom and pop no longer trust the US economy or the fate of the world. He avoided talking about global warming – and instead he inserted the “fear of technology.” Whatever. Everybody is now willing to buy bonds at negative rates. I am old enough to have seen my father-in-law bootstrap a new business (as Yves says – a spinoff of a corporate vacuum in some service) which is doing very well today. They are doing well because all their small Bz competitors went out of business. My grandfather, like yours, bootstrapped his way out of the depression in a time when starvation was not a major concern. We live in different world today. Nobody knows how to skin and spit a rabbit. Bootstrapping is almost not possible. Unless you are in NYC or New Delhi where you can feast on all those “tasty” rats. Really. Look at Greece. If they could’a, they would’a. Just how primitive should we become?

First poster to a comment thread impacts the tone of the following discussion.

]{umar has troll stink.

Noted.

Isn’t there another issue at work here, namely the failure of the massively bloated banking sector to do old-fashioned banking, i.e., loans to businesses? Perhaps you imply that in the reference to Wall Street as a “perp”–why bother with tedious chores like studying business plans and calculating returns when you can make vastly more on casino financial instruments using government-backed deposits? Same with the sudden drawback from mortgage lending: when the macro conditions tanked–suddenly people who were perfectly capable of carrying debt couldn’t find a loan because figuring out their creditworthiness actually required bankers to do some work. Just wondering.

Loans from banks were never a source of startup capital. A bank might let you borrow against other property, like your house or if you had an investment building that was under mortgaged. But never never never to finance a new business.

Banks even back in the day when banks actually did small business lending would provide loans only to established businesses that were already customers and had a track record of profitable operation.

In Washington State, this is very true. The majority of commercial banking is very risk adverse, especially after 2008 when lending requirements tightened. Even community banks have scales back their access to credit. You can find the odd credit union or microfinance website (such as lending club) that will give you a loan, but usually for under 50k. As the article noted from Amar Bhide, most new small biz are created by borrowing from friends and family. When those relationships and resources are constrained, new biz ventures are snuffed out in the conceptual phase. It doesn’t surprise me. An interesting blog cocers some of the challenges to a particular small biz owner in Arizona, called “coyote blog”, has an interesting narrative about the challenges posed small biz owners.

“Loans from banks were never a source of startup capital. A bank might let you borrow against other property, like your house or if you had an investment building that was under mortgaged. But never never never to finance a new business.”

^Hit the nail on the head with that one.

Banks prefer to lend against collateral. (And a small entrepreneur is unlikely to have an abundance of collateral)

I haven’t read anything by Amar Bhide but I have read Michael Hudson’s book “The Bubble and Beyond” and it does a good job at explaining the type of loans Banks prefer to make and why they prefer to make them.

Read Gottfried Feder’s Manifesto for the Breaking of the Financial Slavery to Interest.

Those countries all have universal health care as well, if I’m not mistaken.

But you are missing the point! The US had a high rate of new business formation even with its messed up health care system. And Australia, with a universal system (admittedly public/private) has long had a low rate of people going into business for themselves. You need to focus on factors that can explain the sharp decline.

1. I think people underestimate the role of health care in the debate. Any American with benefits would be insane to leave these benefits behind and be forced to deal with private health insurance on their own. Single payer health care might actually be a great thing for business startups.

2. Not sure how they define a startup. Are we including opening another franchise outlet of Subway? If so then this problem has been growing for a long time. The only small business I seem to see starting up are franchises, and those are really not the best measure of entrepreneurship levels.

Please look at the chart as to when the decline took place. Entrepreneurs have always had to deal with the health care/insurance issue. That is a general big disincentive to starting your own business, but it does not explain the change in the 2000s. The exercise here is to explain the marked shift.

The numbers used in the Gallup study are establishments with employees, as few as one. There are lots of paper companies with no employees, or businesses with more corporations than workers (believe it or not, I’m in that category). Someone who bough a franchise would almost certainly set up a new corporate entity (in fact, the franchise agreement probably requires it), so that would be included.

And I do not see why opening a franchise should not count. The operator is taking a risk and employing people. You seem caught up in the PR around American entrepreneurship and not the reality.

The decline goes back a lot further (per the chart). The out of character blip was 2001 to 2006 where construction was booming (with attendant small businesses).

Franchises are symptomatic of the way that large businesses have a large advantage and so discourage new start ups in the US. Go to Europe and Asia and you will see a lot more small retail (not chain stores) including small restaurants (not chains). When I go to the US I find it a veritable wasteland of sameness – same hotels, stores, restaurants, etc. (Yes if you scrape deep enough there is regional flavour but you have to scrape).

On another note I do work for an entrepreneur (7 employee firm that exports 90% of product) and our biggest “concern” is being bought up by one of our customers (money is cheap, growth is hard to find, so we look attractive).

Oh i would say the independent health insurance situation got much worse in the late 2000s. I think risk aversion and abysmal credit are the key factors, not to mention low demand, but health insurance was by no means a stable variable.

OK, fair point that falling access to health insurance may represent a slow long term negative.

“Please look at the chart as to when the decline took place. Entrepreneurs have always had to deal with the health care/insurance issue”.

As well, I think municipal/state/federal governmental agencies go to the same seminars on how to tax and create barriers which have further raised the business start up barriers across the board. I think these barriers in many cases by coincidence or design favor large companies vs small companies.

I dealt with the healthcare/insurance long before the crash when it was probably less of a financial burden to buy a small group policy.

One factor (that wasn’t relevant for me) is whether or not a spouse is fulltime employed w/ health benefits adequate to cover the healthcare aspect of entrepreneurial risk. There may be fewer people w/ that 2nd source of income/insurance post crash? Personally we just took a flyer and jumped ship w/ the expectation that we could always find re-employment in our fields, bought a small group policy and ate pbj for a year.

In the end it’s always perception and evaluation of risk/reward. People post crash may be more risk adverse?

My perspective was that I recognized a major difference between temporary employees and permanent employees is that the later class doesn’t necessarily understand they are also temporary employees, albeit better remunerated in most cases. As well I took note of what happened to some unfortunate professionals in my fathers generation when they started getting past their freshness date (into their 50’s). IMO, “job security” in the corporate environment has always been an illusion, more so now human functions are replaced w/ new tools..

If I may, I’d like to stress … startups don’t need debt, they need capital.

New and improved just isn’t what it used to be.

CapEX has never materialized … so new capital product sales never went from vapor to real.

As the article mentions … new retail? Bucking a trend if ever there was one

The middle class doesn’t have the bucks to start a venture and it doesn’t have the bucks to buy from a new venture.

Why start up a new venture and work your fool head off when you can get paid to watch day time TV

Pet rocks anybody?

“The middle class doesn’t have the bucks to start a venture and it doesn’t have the bucks to buy from a new venture.”

You’re limiting new entrepreneurial ventures to those that produce a product to sell to retail. It’s a bigger world than that.

Unfortunately w/ the financialization of our economy, substantial elements of the manufacturing/industrial sector infrastructure & talent rolled up the carpet. Corporate memory/expertise was lost as it retired/moved on.

Much of what is now “Manufacturing” in this country is more akin to Lego set assembly. But herein lays opportunities for the wise. Bit and pieces of value added intermediate stuff come from smallerish “supply chain vendors”. BUT to be in the game, it requires qualifications, adequate capitalization and ability to preserve through government bureaucracy.

What used to be the simple Eastern European immigrant in Chicago starting out in his garage w/ a Bridgeport Mill banging out parts because he was “too dumb” to know he cant do that is now the couple w/ the used CNC MAZAK Vertical Mill in the leased 2,500sqft slice in a multi-tenancy that know their way around the MS Office suite, QuickBooks and AutoCAD and are embedded as approved vendor in the SAP system of some bigger companies that keep renewing orders because it easier than trying to change vendors.

Unfortunately, this type of skill set and inclination is not typical of most of the fodder getting pumped out of college these days. My conversations w/ college grads, over recent years is that they don’t even conceptually percieve this as a path to aim for. Most still perceive “success” as being plugged into an office cubical in a pleasantly HVAC controlled environment rolling an orange on the keyboard to generate software code or accounting spreadsheets w/ a break at noon to eat a sandwich out of a plastic clam shell.

“startups don’t need debt, they need capital”

That’s right. But many people, including most economists, don’t see the real difference.

The difference, of course, is that capital investment can and must be patient.

But bankers are not patient. And government is not. Both want immediate and regular payment. Both of these 24-carat parasites siphon off as much surplus as possible, as soon as possible, from the real economy to do “God’s work” or serve “the greater good”, respectively.

Blaming the bankers — as they are surely deserving — only distracts from noticing the limitless self-indulgence of government. How else could 11 of the 20 richest counties in the US be found daisy-chained around Washington DC? http://en.wikipedia.org/wiki/List_of_highest-income_counties_in_the_United_States

It isn’t an accident. Consider, for a moment, that Congress recently declined to deny its members’ elite privilege to utilize insider information about pending legislation to benefit their own Wall Street investments by front-running the market.

Any idea that “more regulation” promulgated by this noble body will clean up Wall Street is pure, feckless folly. Regulation of financial “players” regularly fails in just the right places at just the right time. The perps are slapped on the wrist with a fine and no admission of wrong-doing — basically no more than a business licensing fee paid into the public treasury. The government benefits by this windfall money to spread around lavishly while Wall Street carries on with business as usual.

The fact is there are TWO blood-sucking squids, not just one. They cooperatively soak up gobs of capital for their own useless benefit, leaving behind only more and more massive and unpayable debt laid on the public.

Under this elitist tag-team regime, formation of capital in the middle class is understandably diminishing as the blood-suckers drink ever more deeply. It naturally follows that small business startups will steadily decline.

Further to systematic graft and self-enrichment among government leaders, The Intercept today offers a livid example about how things actually roll in precincts nearby the nation’s capitol:

Read the rest to get a stomach full about this particular hero of the people: House of Cards: A DC Real Estate Column

It is no wonder that government “regulators” are permitted to be captured by industries they pretend to regulate. Lying and thievery are central to the culture of government. No matter how much these wonks may be paid during their “public service”, big business can always bid way more to bring them into contrary service to cut the public purse to their private enrichment.

The fish rots from the head down.

It used to be that Wall Street’s raisin d’être was to fund Main Street. Now it’s just a rigged casino that’s leveraged to the hilt.

While Wall St. kills of small businesses, sometimes Main Street can save them! This article, about Buffalo Street Books, in Ithaca, NY, was written a few years ago. I’m happy to report that my elderly parents, who are among the 600+ new community owners of the bookstore, tell me that it is thriving today– and a hotbed for the local literary scene.

http://www.freshdirtithaca.com/savior-of-buffalo-street-books/

Obviously this kind of thing isn’t always possible, but I do think a community’s determination to support small businesses can sometimes succeed in bucking the tide. If you’ll forgive me another Ithaca example, my hometown friends tell me that a successful local vegetarian restaurant, Moosewood, has contributed food and labor, on several occasions, to host fundraisers for another local movie house, Cinemapolis, to help keep it healthy.

Down here in the big city, independent coffee shops are using an app to promote their businesses among loyal customers who don’t want to settle for Starbucks:

http://www.theverge.com/2014/4/13/5610606/cups-app-unlimited-coffee-subscription-service-launches-new-york-city

Anyways, all I’m saying is that we can and should push back against the forces that hurt small business!

Here’s another innovation. Community Siurced Capital puts together small contributors now in the state of Washington, one day nationally. https://www.communitysourcedcapital.com/aboutus

“While Wall St. kills off small businesses, sometimes Main Street can save them! ”

And the Main Street banks. There’s a reason the the Independent Community Bankers of America came out against the Weiss nomination. Wall St. is hurting Main Street businesses. Community bankers see this clearly.

My sister owns her own business and is looking at taking an equity stake in a related business that someone she knows well professionally is looking at starting. This person is very talented but is struggling, two young kids, husband makes ok money at his job, and is underwater on their mortgage. With no equity, very hard to get financing from a bank to start a business hence the partnership. I see the problem being that the most talented people don’t have the capital to open their own venture. My sister said that rents, licensed contractor costs (electricians), permits and fees are all very high which is a barrier to one opening a business. In my mind, the problem really comes down to peoples income unable to keep up with costs (taxes in all forms, healthcare, schooling, food, utilities) over an extended period of years preventing working class people from saving even after working for many years. The credit crisis only exacerbated the situation. Ultimately, this person decided to not open her store even though my sister believed there was a strong need and had developed a solid business plan.

I’d be curious about what you might know about AngelList ( https://angel.co/ ). AngelList has received a lot of local publicity through the Downtown Project of Las Vegas.

The Downtown Project has funded 300+ start-ups through VegasTech and has announced that it is selecting “cannonballs” for further financing and promotion. What happens to the “non-cannonballs” has not been specified. The start-up scene here is worth paying attention to, but it’s hard to get any solid information about who the players are.

Isn’t that Tony Hsieh’s project? I don’t think its going as smooth as he had hoped.

I suspect that this is where the desire for ‘Always Lower Prices’ has landed us. Anti-trust law had been quite rigorous in the post war era because of the still present fear that a few dominant producers would concentrate all the resources in their own hands and ultimately roll up political institutions to do their bidding. In the 1980s, the Reagan Administration started the benign neglect of the anti-trust laws that has gone on for decades. They used the excuse that anti-trust law did not serve the ‘consumer’. The implication was that selective or weak enforcement would serve the consumer better by allowing very powerful companies to use their power to lower prices.

And now, we are living in the veritable Eden of low prices. Unfortunately, a side-effect of this is that enormous, monopolistic trading companies dominate most industries by themselves or along with at most one competitor. Because they control supply chains right the way down, they are easily able to strangle any start-up competitor that might arise, usually by enfolding them into their own supply chain. Since the 1980s, the U.S. government has ceased to prevent entire areas of industrial activity from being captured by giant trading companies. Small business is killed before it knows what has hit it.

I tend to agree. The consumer market for most goods today is a race to the bottom. The only market for quality is in the luxury items and even that is dodgy today. Using LED bulbs as an example, a high quality 60w replacement will still cost you upwards of $12. What is the hottest mover on the market? 60w replacements in the $8 range. Does it matter to the customer that the warranty on those new bulbs has dropped from 10 years to 3 years and the rate of failure is significantly higher? Nope.

People have become inured to the crapification of everything. They don’t expect anything to last as long as it should, even when they pay top dollar for it. Entertainment and tech are following the same path, people expect everything to be free and they’re willing to put up with ever increasing amounts of advertising in order to keep it free. Anyone with any sense is adapting to the Always Lower Prices / Freemium mentality.

The high cost of low prices, we like to call it. Walmart has 25-30% of the U.S. market for groceries now. When they hold a 55 or 60% share, do you think they’ll still sing the “Always Low Prices” tune? Well, maybe they’ll sing it, but you won’t recognize the melody. If you haven’t read Tim Wu’s “The Master Switch,” try it.

I read this site almost every day and I rarely post, because when I do, I either get caught up in the spam filter, blocked or shouted down, but I feel like I have something useful to say, so please let this post go through.

I started my own small business in 2012 after being laid off. I’ve been doing OK for two years now and I make slightly more money working for myself than I did working for somebody else. but I’m still a small business and I don’t gross enough to hire employees.

I personally find taxes to be the biggest issue. I’m not sure how the tax code is in other countries, but the in the US, the government STRONGLY favors big business and is strongly suspicious of small business. I believe that the tax code actually discourages small business.

First of all, I have to file a schedule C and it’s a complicated mess. I am 8x more likely to be audited than any other tax filing entity. Multinationals pay little tax and often receive credits or refunds, but guys like me risk being audited for taking a home office deduction.

Secondly, I pay 1/3rd of my after expense income in taxes. My self-employment taxes and my marginal tax rate (because my wife works) mean that every quarter I need to send in a large check to the IRS. It doesn’t matter if I have a slow quarter, which I often have, I need to pay roughly 25% of last year’s taxes in quarterly payments. Taxes are my biggest expense and almost exceed all of my other expenses combined.

Third, the tax code favors employees of big business who can afford to give pre-tax perks to their employees – none of which I’m eligible to give myself as a self-employed schedule C business owner. My wife works for a large corporation with thousands of employees, and she gets her commuting expenses pre-tax, our daycare expenses pre-tax, a retirement match pretax, health, dental and disability pre-tax, a health saving account pre-tax, and so on and so on. I’d get audited in a heart beat if I put any of those on my schedule C as an expense.

Finally, corporations pay far less tax than small businesses. Apple/Google/GE etc have all sorts of tricks like the double irish to keep money offshore and pay low corporate tax rates, whereas guys like me, I’m taxed on my business income at ordinary tax rates – which are often marginal rates because of the second wage earner.

I’ll be honest, it’s extremely discouraging to start a business with these kind of tax issues. like I said, 1/3rd of my after tax income goes to taxes – plus sales taxes, gas taxes, real estate taxes….

And if I even wanted to grow and hire employees……I’d have to start paying payroll taxes, unemployment compensation (taxes), worker’s compensation payroll taxes, health insurance for my employees

It just isn’t worth it to me. I have a strong drive, and I’ve done well in life, but it’s just too much, too much to start to deal with all these things – and if I fail – I lose everything and I’m stuck with tens of thousands of dollars in student loans.

It’s just not worth the risk in this environment. It’s perfectly understandable why we have such small start up rates. When guys like me who come from lower middle class backgrounds work their way up to earn professional degrees, and then become discouraged at the handicaps that are placed upon small businesses, I say it’s just not worth it.

Sorry you got tangled up in the tripwires.

I can’t believe that many truckers are independent operators making a modest wage and need to hire an accountant to do their taxes and have to file articles of incorporation with the secretary of state. Naturally, people starting a business on the cheap are a target rich environment for an IRS auditor. On the flip side there is General Electric, a notorious loophole exploiter. I recall reading that their tax department was 1,100 strong. The tax code belongs to General Electric.

http://www.nytimes.com/2011/03/25/business/economy/25tax.html?pagewanted=all&_r=0

What are you talking about? The F-ing Congress and the White House belong to GE.

You might want to look into being an S-Corp or LLC. The IRS is not as down on these entities as much as a C corp and the tax breaks are much better. C corporations are only for the big guys these days.

dogwoods, I really wanted to like your post. I agree with about half of what you say, and must disagree with the other. First, I think you’re absolutely right about the tax code being biased towards big business. I don’t think there is any doubt that corporate America has its thumb on the scale in a big way. BUT, I don’t think there is any argument that small business also has a whole raft of perks that mere employees could only dream about.

New Lexus? Sure, we’ll charge it to the business. Lunch at Morton’s? No problem, save the receipt and the company is buying. Travel to Vegas to ‘meet clients’? Ka-ching, hey, the company’s buying. Have to pay for your employee’s health insurance? Boo hoo. Commuting expenses are NOT tax deductible so I’m puzzled how your wife gets to claim them. Also, tax deferred does not mean tax exempt. Do you really think taxes will be less when she tries to collect on all those tax deferred benefits? I’ve seen too many examples of small business owners taking every benefit available, but then cry when they have to pass along some pittance to their employees.

But the biggest bitch I’ve got, is to listen to ilk like Mitt Romney talk about the ‘job creators’ without one word about the job doers. Well screw that. Until I hear some empathy for the millions of everyday working folks who work hard, pay THEIR taxes and don’t have any corporate or small business perks, I’ll just have to wish you luck.

The law forbids the rich and poor equally from sleeping under bridges. What your rant has to do with businesses of a size that don’t have that sort of disposable income escapes me, since a 20% discount isn’t actually free (despite my tax preparer’s boosterism).

If only the small business perks were anything like you think. Lexus my a$$. I had my own law practice for 30 plus years and I never had one. And the really irritating thing was I found myself buying stuff I didn’t need or want just so I could have deductions. It was either buy $hit or pay taxes.

What also galled the hell out of me was not just the income taxes, but also the property taxes. I had my own small office building (size of an average house) for awhile. Taxes were pretty darn high (Double the taxes on my house). Meanwhile, FedEx got tax moratoriums by the city and county, because it “brought jobs.” I managed to hire a person full time for many years, but I got no break. And it is well known that the real job creators are small business.

And I would get pounded with income tax. My wife always worked. All my income came from contingency fee cases. Some years I made a really good income and some years income didn’t pay expenses. But the years I did make good income, I got pounded. They used to have income tax averaging for businesses who had up and down cycles. But that went out about the time I went into business.

And it is worse now. I retired at 62 because I was sick of trying to run a small business.

It is the common experience of small business owners that discussing the risks, difficulties, and burdens of running a business with persons who have only ever been employees is an utter waste of breath. Your comments offer a concrete example of why that is.

It also helps explain why many small business owners will move heaven and earth to avoid hiring employees whenever possible and may prefer to invest in capital equipment to avoid that necessity if possible and they can afford it.

A good employee can be worth his or her weight in gold and should be justly rewarded for the contribution they make to the business. Every (real) business fortunate enough to survive the cradle (as most do not) requires a level of personal commitment of time and energy which the typical employee will simply never make. Especially if bringing home a regular paycheck is the highest priority for them. If so, they are likely to remain employees for life.

That doesn’t make it wrong to be an employee. But it damn sure makes it different for any would-be business owner, starting with the usual necessity to set aside personal capital (probably earned as an employee) to offset expenses during the startup period. Scrimping and saving are a usual habit necessary to carry the long haul before that Lexus appears in the driveway. If it ever does. And it probably won’t for a long time if there are kids going to school, etc.

If you wonder why some business owners accept venture capital from others, it’s because running out of capital is the most common proximate cause for new business failures. Starting a new business with no other adequate household income to keep things afloat (perhaps for a very long time) is likely financial suicidal. Taking out a loan against your house (if you own one) is a possibility but also a risky one. Because…

What the bankers give, the bankers can take away. I’ve seen two rather substantial family businesses put under by their banks even though both businesses were in the black — because their local friendly banks needed to reduce their balance sheet risk. You have no control over that eventuality. It is vital to bear in mind the banker is never your friend. Just a useful enemy.

Family businesses can be successful, of course, not least because wages are minimized. Asians and others who migrate to this country often do well by making the business a burden shared by the entire family. They also arrive with a built-in work ethic, which is their real secret weapon. Everybody works to fill the rice bowl. It isn’t a democracy.

If you own a business, you are always rolling the dice even after it’s well established. When you’re ready to take on that challenge, go for it. But that’s unlikely because a high tolerance for personal risk is what fundamentally separates (the few) business owners from (the many) hired employees.

Dogwoods,

You file a schedule C (which means that you’re not a corporation of some variety — and not to be confused with a C-corp).

My first serious question: do you use an accountant?

My second serious question: why are you afraid of being audited?

You use the example of the home office deduction – the IRS has very specific and VERY clear guidelines on the home office deduction (e.g. home office must be regularly and exclusively used for the business among others – http://www.irs.gov/publications/p587/ar02.html#en_US_2013_publink1000226292).

If you meet the rules, take the deduction. If you don’t — then don’t.

You note that “. I’d get audited in a heart beat if I put any of those (a retirement match pretax, health, dental and disability pre-tax, a health saving account pre-tax, and so on and so on) on my schedule C as an expense.. Why? These are perfectly legitimate expenses. Now administration of some of these may be cost prohibitive in your position, but, for example, you can march yourself down to Fidelity (or any brokerage) and set up a “Solo” 401(k) among other plans and contributions are deductible (well, income taxes are actually deferred).

I understand the fear that small business people have of the IRS (my wife is a solo entrepreneur) but generally the IRS puts out pretty clear guidance as to what you can and can’t do. It may be painful to read the IRC — but the IRS typically tells you exactly what you can do. I suspect that most small business people get into trouble from either:

a) pushing or ignoring the explicit rules

b) don’t document their expenses.

And good luck with your business.

weinerdog43: in response to your post Ed S. makes some good points. The IRS lays out exactly what you can or can’t do. And as a small business sole proprietor, there are LOTS of things I cannot do. As far as expensing a Lexus or expensing Morton’s, that’s a minority of small business owners who want to drive lexuses and eat at mortons and has little to do with tax write offs. Morton’s is only deductible at 50% as long as it’s business related; and vehicles purchased or leased have small ‘write offs’. Ask any small business accountant, they will tell you that the public perception of the value of vehicle write off is very high, but the actual value of the vehicle write off is very low. My write off is worth $600 less in taxes for an entire year *for me*.

Now a corporation can write it off as a car perk to an employee, and give the employee a nominal income allowance for ‘non business’ use of the vehicle and no one will ever be audited for that….but if a small business owner takes too much of a car deduction, red flags start going off…

I have no fear of being audited, but if you research audit rates of the IRS (which I’ve done extensively) you’ll realize that audits are heavily skewed towards small businesses and schedule C’s, and some S corps. Big businesses and w-2 employees are rarely if ever audited. This is a fact.

As far as becoming an S Corp, the net effect of a Schedule C and the S are pretty similar — business profit is taxed to the individual as ordinary income. The problem with small businesses – especially those in the service sector – declaring S corp status is really frowned upon and at one point, there was a congressional bill pending to make it illegal for sole proprietorships to declare S corp state. You see, with an S corp you can pay yourself a salary, and then pay yourself from business profits. Income is subject to FICA tax (or self employment taxes of about 14%!!!!) but profit derived from the business is not. so that’s a 14% savings on any money that can be attributed to profit rather than salary. So if I’m an S corp with 15 architect owners and 30 architect associates, I can pay myself $100k a year salary and say that another $100k is a result of the business paying me a profit and save about $14,000 in FICA tax. However, with small businesses it’s difficult to say that the business generated the profit, when it was actually the individual earning income, not profit. My business doesn’t generate teh income – I am the business, I generate the income. That’s another ‘red flag’ for small businesses when they do their taxes…..

Regarding my wife’s commuting: there are special pre-tax accounts for employees of large corporations to buy their public transportation or parking garage passes. it’s generally not available to small businesses. Neither are my health insurance deductibles, nor can I take the Illinois 529 employer’s tax credit, nor can I set up my own pension. I do have a Keogh SEP which is basically an IRA – but it’s tax free to me at ordinary income rates – not tax free at corporation rates.

if you wanted to take it even further, there’s the whole carried interest tax break for financial busineses, stock options, tax free life insurance scams, and all sorts of other goodies buried in the tax code that chumps like me can’t dream of taking.

It may sound like I’m whining about paying taxes, but that’s not my intention. I’m just saying that taxes are extremely complicated and the tax code does not favor small business. it basically looks at small businesses as tax cheats and that’s why they get audited 8x more frequently than w-2 employees or large corporations. But the tax code is also written so unfavorably to small businesses that many of them cannot make any money without taking extremely aggressive tax positions.

I have a decent accountant and basically it is what it is. I’ve taken every deduction and expense to the letter of the law, for example if I made 60,000 in 2014, I will have paid $20,000 in state and federal taxes; ;and I will have to pay $5,000 a quarter for next year.

Obviously, as a small business owner, you get the picture. As I mentioned above, I was in business 30 years. I was audited extensively twice. The biggest red flag is to have a really good year one year and a bust the next. That happened a number of times for me, but on the two times of huge discrepancies, I was audited both times, And both times the IRS ended up cutting me a check. Same thing happened to my partner of many years. He was audited a couple of times and the IRS always ended up cutting him a check after the audit. Both of us always had accountants.

It is really tough to run a small business. Those that haven’t done it have no clue. I just wish people like weinerdog43 would try it before they start ranting about how good small business owners have it. They equate us with the CEO’s of major corporations when we are worlds apart.

I question the caliber of your accountant’s advice. Telling you to be a C corp is self-serving. It is generally harder to be tax-efficient as a C corp if you are small since you have to make your company broke at the year end to avoid paying taxes on income at the corp level. I’ve had tax attorneys, and now a regular accountant (but one recommended by a one of the world’s leading tax attorneys) as my accountants, and what they say is radically different than what your guy is saying.

There is NO risk in taking some of your home or rental expenses as office rent if you are incorporated. It is people who are employed or are otherwise taking a home office deduction on their PERSONAL tax returns who are raising a big audit red flag. Ditto with being an S corp. The idea that that is risky is barmy.

The IRS is well aware of the S corp issue and has norms it expects S corp filers to take in salary relative to their revenues. Your guy is clearly over his head if he doesn’t know how to have you file as a S and what is a reasonable level to take as payroll v. profits. All of my past accountants (I’ve had 4 over my over 30 years of being self-employed) were quite certain re what level of payroll I needed to take.

I think we’re talking past each other. i’m not a C corp; I’m an LLC that is considered a ‘disregarded entity’ for income tax purposes, and I file a Schedule C -Profit or Loss from business. It’s the tax for filed by many small businesses.

As far as S-Corp goes (corporate dividends aren’t taxed self-employment rates), there are plenty of articles out there that say the IRS views most small service businesses – and especially sole proprietors – with S corp status as disguising their salary i.e. 100% of income is salary and 0% should be dividends, and the penalties of getting whacked for paying late payroll taxes outweigh the benefits of saving a few thousand in self-employment taxes. That’s not everyone’s situation, but it’s my situation as a sole proprietor in a service business area.

I’m just saying that it’s discouraging to try and start a business. I get whacked on taxes, the tax rules are very complex, and I would have never started my own business unless I had to. I’m plenty sure it discourages other people too.

At my point in life I’m basically unemployable – employers don’t want to pay me what I need to feed a family; and my skill set lends itself to working for myself.

Combine taxes with the fact that I DON’T want hire employees because of the hassle, and it’s another piece of the puzzle why small business isn’t really a driver of employment as it used to be.

What you are saying is simply not true. I have top tax accountants and all have no issue with my running as an S (and I have run as a C in the past), and many years I’ve shown profit as well as taken a salary. The issue is that the salary has to be reasonable in light of what business you are in (the IRS classification of your business) and your revenue levels. There is no requirement that you take 100% as salary. And there is similarly no issue with taking office rent if you do that on your business returns. The audit red flag is taking a HOME OFFICE deduction on your PERSONAL tax returns. Whoever is telling you otherwise is wrong.

These are very good points

So true, and the same issues exist in Canada. I am an accountant who set up shop after years off raising children, and was faced with entry level positions. There is no way I can hire more than a secretary thanks to taxes; payroll taxes most of all. And the paperwork every month…it may keep me in business, but it is depressing to see the limited funds of my clients (other small businesses) spent on my time to ensure their compliance with government regulations with nothing left over for cost analysis, cash flow planning or other work that will ultimately help a business grow. Every red tape cutting measure seems to come with additional paperwork.

Some big reasons not cited are lack of competitive pricing power from deflation ( the largest driver of that being the internet), over retailed America ( the internet makes store fronts business death traps); venture backed businesses that are designed from the start to lose money until a profit model is found (which can take years and millions of dollars) thus driving away bootstrapped competitors; very high failure rate, even more so today, making investment more risky than ever; lack of good jobs to serve as a back up plan in case things go bad; and the prevalents of the independent contractor model making millions self-employed (not by choice) and already in business for themselves. Several other ambient conditions could also be in play like the general oppressive mood of conformity that permeates every facet of America culture and denial of any failure despite evidence to the contrary. A business startup is a big reality test and that is in short supply here.

On the startup business reality television shows, the entrepreneurs are more often than not a subject of ridicule, despite the stated intention of the program to foster new businesses. However, if the business owner mentions they were in the military everyone jumps up and salutes and thanks them for their service. The message is if you want praise, respect and glory here become an American Sniper.

It’s highly instructive to, with a critical, objective eye, compare the US version of Gordon Ramsay’s Kitchen Nightmares with the UK version (both are available from time to time on Netflix). The US version is a ceremony of all the components of the US delusion of grandeur: magical thinking, arrogance, a conversion narrative and lots of implied swearing. The UK version has real swearing and real knowledge to take with you.

I was in Sears yesterday for the first time in years, and wow, deflation, lack of consumer spending and the internet (along with bad business decisions lke Kmart) have really destroyed that business.. They shold be on death watch…

Gallup CEO Jim Clifton did a nice job of nailing the problem but neglected to identify crony capitalism and financialization as the root causes. And the situation may be even more dire than it appears. Lance Roberts over at STREETTALK makes a good case that BLS has failed to incorporate the reality of more businesses closing than opening into its birth/death model, causing the agency to grossly overestimate job creation in the faux recovery. http://bit.ly/1BxBYyA

Yves, thanks for both the original article and your defense/amplification. You would think that the crapification of yield on invested assets (ZIRP) would make start-ups more attractive. But the uncertainty about the volatility of the business cycle translates to enhanced fear of losses through Black Swans. Hell, the big boys are running toward another Black Swan as hard as they can by my reckoning. Why would they invest in uninsured sure-things when they can keep it financialized and “protected.”

It took us years, and a healthy revenue track record, to get Wells Fargo to bless us with a piss-ant line of credit (that we don’t actually need). I’m afraid the globalization junkies (that would be Wall Street and their Minions) have won. Investment money is very hard to find and everyone we talk to who wants to be an entrepreneur is too strapped for cash and credit to bootstrap from scratch.

The vacancies on Main Street and the failures to generate more start-ups than shut-downs in our cohort can only be addressed with more wealth among the 99% so that the real engine that creates jobs and fuels broader social mobility can be re-started. The 0.01% have tied up the real wealth in the global financial casino. Neoliberalism has dried up the fuel for “the little engine that could.”

If I open a small coffee shop tomorrow I know I will have to sell over 200 cups per employee per month just to cover the most basic health insurance required by law (meaning none of us ever need actual care or a sick day). And that’s if most of my customers don’t use cream or sugar. And that doesn’t count the time nor nightmare of “shopping” for insurance.

If I ask the vast majority of my boomer friends or family for help financing the start up nearly all would want to but they are older, understandably less willing or able to take risk. This is the generation who were once willing and able to take more risk than any other in my experience.

If I read in detail and intend to fully honor the terms in most leases today I would not start a business. The terms/cost of insurance alone in most leases is prohibitive. There are scores of traps and pitfalls in leases alone… I’m now afraid to make a cup of coffee and too tired and I owe the lawyer a few hundred cups of coffee for telling me how scared I really should be of the fine print. He/she has really told me I’m crazy if I sign this lease, but we both know I will.

Also as mentioned above the number of permits and fees and taxes etc. a small business person has to negotiate is quite frankly mind boggling and exhausting. Then there is actually paying them, constantly proving you paid them for all eternity. Plus the crapification of service from everyone – telephone companies on up – which I blame both wall street and government for, eats up more time.

Whether I have to do much of these things myself or keep up with a number of professionals whom I pay to do these things I am too damn tired to enjoy the business… much less run to the bank, clean up around the shop, smile for the customer, design an occasional new print ad, deal with all the vendors, have quirky conversations with the employees and dawg forbid savor the Sumatran Friendly Orangutan roast of the week myself. Unless I turn it all into half a dozen cafe’s or more, quickly, I will never make more than the employees who have no skin in the game. Oh yes, I now must – get a life.

Unless you are starving to death there is no such thing as a delicious scone.

Great article. Wall Street and Banks are not interested in loaning to small business. Venture Capitalists go in herds towards trivial tech start-ups geared only to skim money from other businesses and individuals for dubious products and services, but some succeed to IPOs on pure bullshit marketing and hidden scams. Most small businesses need capital (no strings attached initial investments) but very little capital is now available for most Americans who might be willing to help their friends, acquaintances and family members. Also national, state and local regulations are onerous for smaller enterprises who do not have the small armies of lawyers and accountants to handle the paperwork and massaging of regulatory entities. And any prior mistakes or failures are viewed by many as unforgivable and thus most entrepreneurs (outside a small group of already successful people or those with wealthy benefactors willing to forget the past) cannot obtain capital, and that seriously limits new start-ups in the US. Sadly, the status quo’s puppet politicians are not going to change anything for the 99% when they only represent the 1%. For more information on a outside-the-matrix approach to creating income and helping new small businesses grow and obtain debt-free capital, please visit this new website: “www.i-globals.org” that shows how using the legal-accounting fictions of money, currency and income can be available to all people, not just the corrupt crony capitalists, banksters and the wealthy oligarchy in most countries. Thanks and best wishes for 2015.

Forget Wall Street and the Banks. The Small Business Administration is not interested in lending to small businesses. I became aware of this quite a few years ago when a client (an executive of a multi-national manufacturer headquartered here in the “rust belt”) bragged to me about bagging SBA loans. Looks like the blogosphere has finally caught on. About frigging time.

http://www.zerohedge.com/news/2014-12-03/governments-small-business-administration-exposed-corporate-welfare-big-business

When will the small business community face reality? You’re in the same boat as the 99% too many of you like to malign. Our government ain’t workin’ for us, and it ain’t workin’ for you.

Excellent article about a subject that I have heard much about from anecdotal accounts, but about which I have seen little in the way of supporting data. It is particularly interesting to me that the long-term decline in interest rates which has been ongoing since the 1980s up to the present clearly has not played a significant role in new business formation, although it has played a very significant role in elevating stock and bond prices over this same period.

It appears from the Gallup chart that there were three periods of sharp decline in new business formation:

The first from 1977 to 1983 coincided with hyperinflation, a boom/bust in Oil, a flood of imported durable and consumer goods from Asia, and and the initial rounds of offshoring American manufacturing. The latter factors derived in large part from both a perception by policy makers that the U.S. needed to run large trade deficits to preserve the role of the petro-dollar and $USD as the global reserve currency, as well as a desire by large U.S. manufacturers to expand their profit margins.

The most recent period of accelerated decline in new business formation clearly coincides with the collapse of the housing bubble and related systemic financial problems.

The extensive MSM coverage of the poster children in social media, internet services, computing, and consumer electronics sector had caused me to think that the entrepreneurial opportunities in this country remain as rich as ever. Based on this chart and the enlightening comments of other readers, that is not the case.

Excellent article and comments. Starting a small business nowadays is like sticking your head up when there are snipers out there — in the form of venture vultures with mountains of money ready to buy out or build a duplicate business to steal your niche.

The best defenses any small business has in the USA today is to be niche, be regional, and above all be cooperatively owned and funded as much as possible. You can’t be bought out when dozens to hundreds of voting members of the cooperative want their equity investment to stay local, and you can’t be copied by some over-funded ventue capitalist. The value of sweat equity to a small, local business cannot be stolen or copied by Wall Street, nor even effectively taxed by the IRS. Yet it provides lasting value to the locals who volunteered their time and materials and expertise to build something that serves their community.

The Belleville Sisters Energy Project for the 21st Century. A new small business with the potential to take over the planet and share the returns. With franchises all over North America. The basic idea is this: Every unemployed person who is facing poverty can be hired for his/her human energy potential alone. Each employee is considered to be Capital. Yes capital. Because labor is the ultimate capital. That is if it is fed and cared for. And don’t let the banksters tell you otherwise. They are middlemen, aka Nothing. No, “technology” is not the ultimate capital because it is as dumb as a blob of unspun steel. Humans, however, have everything the universe requires. Humans are self=perpetuating capital. Self-perpetuating capital. Because each employee is also a shareholder. That was a good model once – but not well executed. The thing that destroyed it was changing the definition of labor from capital to commodity. How clever.

Unless we’re all to be waving our hands around howling at the moon and calling that labor power, you seem to be making that great liberal error that everything and anything including matter itself is and ought to be a slave to liberal values, but just needs to be convinced of it… talking to plants again…

Perhaps, instead, it was with the not-quite simultaneous renunciation and enclosure of land as a form of capital (an Austrian perversion, wasn’t it?) that economics went off the rails, where we lost the ability to measure or even see the breadth of influence that is invisibly and powerfully exercised simply by denying humans the direct productive capacity of the earth itself.

Monocausal explanations for anything are a bit wanting even for Marxists!

Banks alone cannot stifle innovation as they don’t operate in a vacuum.

I suspect that the amount of innovation in any given sector levels off over time. For example, how much innovation is there left for radial tires or in steel making? Increases in efficiency can be had here and there regarding production/delivery but once a technology matures how much innovation in the actual product occurs thereafter? Maybe materials science is on the verge of a replicator but…

At the outset of the IT revolution way back when there was tremendous room for innovation. After the initial explosion of the PC, Internet, Smartphone, online retailing [Amazon, etc] doesn’t the scope of innovation begin to shrink as market saturation begins to take hold? The real trick is to convince the masses that they need it or to make it indispensable. Back in the early 1900s, for example, an automobile was a luxury. But 70-80 years later it became difficult to find employment without reliable transportation. From luxury to necessity…almost a kind of forced innovation. Look at Windows XP and/or Internet Explorer 6.0-7.0. It’s not that either won’t work, but that neither is no longer supported. Upgrade or else… forced innovation. How many other examples exist?

Likewise with financialization. It was great while the boom lasted but eventually we, the mortals, fell back to earth. Online banking was unheard of in 1990 but now in 2015 going paperless is routine. And if enough of you go paperless it will become extremely more difficult/expensive for those like me who don’t want to. Forced innovation again…

Is it just possible that we have begun to exhaust the avenues for innovation and await the next deus ex machina from John Galt? I know it’s hard for many of you rugged individualists to shed the “entrepreneurial” spirit embedded in your Calvinist work ethic, but as we “progress” into postscarcity the actual production of something we really need would begin to decrease as basic needs were met, right? Even product differentiation and crappification have their limits. Since the US, in many ways, spearheaded this race to mass consumption, business startups in other advanced countries might be due in part to their playing catch up. What if this proved to be the case?

Then too, after 40 years or so of declining wages/living standards and the rightward drift toward conservativism, could it be that the average American has become more risk averse? I know the average schmuck isn’t the innovative hero we’re really concerned with here. God knows putting food on the table and making ends meet take little entrepreneurial talent, right? Just about anybody can do it. We’re really talking about the innovators who provide/create jobs for the rest of us…

Add to this risk aversion the fact that innovation in large bureaucracies is almost an oxymoron. Yet ironically in some ways the “fat” in such large organizations makes experiments that result in product/process innovations possible that medium or small scale companies would go bust trying. So it’s more of a mixed bag.

If necessity is mother of invention as some would have us believe, what happens when necessity has been overcome or rendered less pressing? Having enough to eat in a warm house with Internet access to NC and flat screen TVs makes you fat, dumb, and lazy. No need to innovate! Be HAPPY! That’s why austerity is so appealing. A return to hard times will necessitate more invention and subsequent innovation. Austerity will make some of us average schmucks entrepreneurs who startup new businesses so that we can provide jobs for the rest of us who fail at innovation. Some of us will be the new “heroes” deserving of our spoils for ushering in the next wave of innovation. Capitalism will go on forever… That’s the real message and concern with INNOVATION.

You’re conflating “innovation” and “invention”. Look at the very word “innovation” analytically, and you’ll see that it’s nothing more than injecting novelty into something. In other words, fashionable self-aggrandizing nonsense.

If anyone is still in want of proof that Americans are, at a very deep level, sadomasochistic, I think the last paragraph ought to satisfy them.

Funny you mention the discontinuing of support for WindowsXP…

http://aeon.co/magazine/science/why-has-human-progress-ground-to-a-halt/

“The golden quarter. Some of our greatest cultural and technological achievements took place between 1945 and 1971. Why has progress stalled? […]

The recent history of psychiatric medicine is, according to one eminent British psychiatrist I spoke to, ‘the history of ever-better placebos’. […]

What we do with our money (NB: I think the author means capital) might be the reason that innovation has stalled.[…]

As success comes to be defined by the amount of money one can generate in the very short term, progress is in turn defined not by making things better, but by rendering them obsolete as rapidly as possible so that the next iteration of phones, cars or operating systems can be sold to a willing market.In particular, when share prices are almost entirely dependent on growth (as opposed to market share or profit), built-in obsolescence becomes an important driver of ‘innovation’. Half a century ago, makers of telephones, TVs and cars prospered by building products that their buyers knew (or at least believed) would last for many years. No one sells a smartphone on that basis today; the new ideal is to render your own products obsolete as fast as possible. Thus the purpose of the iPhone 6 is not to be better than the iPhone 5, but to make aspirational people buy a new iPhone (and feel better for doing so). In a very unequal society, aspiration becomes a powerful force. This is new, and the paradoxical result is that true innovation, as opposed to its marketing proxy, is stymied. In the 1960s, venture capital was willing to take risks, particularly in the emerging electronic technologies. Now it is more conservative, funding start-ups that offer incremental improvements on what has gone before.

But there is more to it than inequality and the failure of capital. […]

In short, the great advances in medicine, materials, aviation and spaceflight were nearly all pump-primed by public investment. But since the 1970s, an assumption has been made that the private sector is the best place to innovate.[…]

There must be another reason why this increased investment is not paying more dividends.

Could it be that the missing part of the jigsaw is our attitude towards risk? Nothing ventured, nothing gained, as the saying goes. Many of the achievements of the Golden Quarter just wouldn’t be attempted now.[…]

today’s hyper-conformist youth is more interested in the policing of language and stifling debate when it counters the prevailing wisdom. Forty years ago a burgeoning media allowed dissent to flower. Today’s very different social media seems, despite democratic appearances, to be enforcing a climate of timidity and encouraging groupthink.[…]

If the pace of change had continued, we could be living in a world where Alzheimer’s was treatable, where clean nuclear power had ended the threat of climate change, where the brilliance of genetics was used to bring the benefits of cheap and healthy food to the bottom billion, and where cancer really was on the back foot. Forget colonies on the Moon; if the Golden Quarter had become the Golden Century, the battery in your magic smartphone might even last more than a day.”

It appears you did not get past the headline. This was not a monocausal explanation.

Well two good places to “innovate” are energy production and distribution, and (admittedly very general) re-innovating all the “innovations” that have effectively painted our species into a corner. Have you read Karl Marx?

Ahh, but there’s another way to look at this. What I think of as the Producer’s View. Communication, to use the word in the French sense, IT, the information age, globalization; forced a change in corporate structure. Gone is the vertically integrated company – think GM in the 60’s with their start-to-finish ownership (including ore mines) – where each business component was contained in one organization. Manufacturing had to support all the other components, accounting, legal, etc., etc.

Today it’s horizontally integrated – think APPL where each business component stands on it’s own. Even manufacturing. Cost centers become profit centers. And if not for you at least for somebody else. And you can hire that component more economically than do it yourself. The flexibility is fantastic. I’ve tried to explain to you before that it’s this flexibility that is the primary driver for having driven us off shore. Rather that the simple labor savings alone.

What gets left out is R&D. When margins on manufacturing no longer support the entire enterprise something has to be able to finance that development. Those projects which were once the bailiwick of the giants (as in Bell Labs) must be done in the garage. At one time in my past I hoped that would fall to VC. It hasn’t and it won’t.

The capital formation process is broken at the bottom of the development cycle where all the innovation, good ideas, and jobs come from. From my Producer’s View, that’s a better reason to break up the mega banks than systemic risk. This financialization is at best zero sum. And at worst Ponzi.

I would add that the horizontal business/corporate structure places far more emphasis on contracts, accounting, and litigation (you can’t get a good deal if you don’t force a good deal). In turn, this has made business much less a matter of technical prowess (in the scientific sense) and more a matter of legal prowess. This ties in with other complaints posted above. Our system is far too complex because of this structure. I recognize its benefits within our cultural paradigm, though I feel the benefits are bestowed more on organizations that are flush with capital, lawyers, and actuaries rather than technicians, engineers, scientists, artists, writers, etc. (or any business with narrow-margins as in restaurants).

The ultimate HAZMAT patient

http://www.msn.com/en-us/news/world/litvinenko-inquiry-radioactive-body-posed-autopsy-hazard/ar-AA8G0BT

“Ben Emmerson, lawyer for the dead man’s widow Marina Litvinenko, suggested that polonium’s rarity made it an ideal assassination weapon.”

And the corporate press, whose social purpose is to reproduce an obedient underclass, carefully scissors out the most flattering (or not) figures to paste onto its découpage rendition of The Garden of Earthly Delights, all while the NSA and others build their retroreflectors out of COTS components specifically to avoid attribution by way of component access.

“that polonium’s rarity made it an ideal assassination weapon”

My first thought was that it struck me as an incredibly poor choice of assassination weapons as it narrows down incredibly the possible suspects, unless of course that was the intention in the first place as a message? He could just as easily (more easily?) been eliminated w/ some neurotoxin or such thing administered in his dessert flon that metabolizes and is untraceable.

I think this was likely a case for wanting him to die in slowmotion as an object lesson.

The choice of an obscure and rare poison available only from a powerful government may have been precisely to warn any other possible “offenders” about which state actor was really behind the act — but with no risk anyone could actually prove it. Arguably a perfect crime.

‘Horizontal integration’ is another way of saying ‘monopoly’. What the horizontally integrated monopolists have worked out is that, if they control the supply line to market, they can control, discipline, and squeeze their supply chain as much as their hearts desire and there is absolutely nothing their suppliers can do about it. Companies like walmart do not want to own their suppliers, because if they owned them, they would have to take responsibility for them. And they would rather have the freedom to squeeze them until they turn blue.

Anyone who hasn’t been living under a rock for the past few years has seen this graph or a similar version thereof :

https://anticap.files.wordpress.com/2011/09/us-top.jpg

We’ve also seen numerous accounts of how income and wealth have been shuttled to the tippy-top of the distribution of individuals. Where are the corresponding descriptions for for what has happened among businesses ? The dynamics of capital flows , and the impacts on the 99% , are probably directly analogous , as are factors like the capture of regulatory agencies / politicians by the business 1% , resulting in further tilting of the playing field to their benefit.

Why doesn’t the inequality lobby pick up on this ? It seems to me it would double the force behind their arguments , and would serve to unite workers and small businessmen in common cause.

What if the inequality lobby itself were captured? Then among their objectives would be to capture mindshare, control the Overton window and ensure that the movement well serves its captors. To what sorts of interests might small business identifying and allying with labor (instead of management, as now) be deemed a catastrophic mission failure?

Hat tip to Voltaire: To learn who rules over a movement, simply find out who they are not allowed to criticize.

Why doesn’t the small business lobby pick up on this?

Look into what the NFIB does and who controls it. It’s a vehicle for oligarchs to put in harness the anger of aspirational small businesspeople who are predisposed to identifying with the rich. At their own expense. It’s purest genius to have marginal mom and pops support a big business lobbying outfit with their donations.

Marko,