Even though the US has waded into the Greece versus Troika impasse to press Eurozone officials to soften their position on austerity, the battle lines seem only to get harder.

Today, February 11, an emergency meeting of the Eurogroup, a committee of 19 Eurozone finance ministers, officially begins to commence negotiations about a possible bailout for Greece. But keep in mind that “bailout” is a term of art, and is used to refer specifically to the Eurozone bailout that is set to end on February 28. Unless it is extended, Greece will not receive a payment of €7.2 billion of bailout funds plus an additional €1.9bn in income on Greek bonds held by the ECB that most observers think Greece desperately needs. But Syriza continues to reject taking these bailout funds, since the strings attached include austerity measures like labor-crushing “structural reforms”.

On Monday, Greece Finance Minister Yanis Varoufakis briefed the media on his reform proposals. Even though financial markets responded positively to news of US pressure on Germany, and Varoufakis’ efforts to position this draft as making concessions, neither side has budged. As the Financial Times noted, “But several officials at the G20 meeting in Istanbul said that the new compromise appeared to be neither new nor a compromise.”

And despite US entreaties, European officials are even more insistent that Greece must yield. From Bloomberg:

Schaeuble damped any expectations talks were possible on a new accord, saying in Istanbul yesterday after a meeting of finance chiefs from the Group of 20 that if Greece doesn’t want the final tranche of its current aid program, “it’s over.” Creditors “can’t negotiate about something new,” he said. Deutsche Bundesbank President and European Central Bank Governing Council member Jens Weidmann said Greek efforts to get bridge financing through debt instruments was a non-starter.

The EU economics commissioner joined the chorus of nay-sayers and told Greece it has only until February 16 to get a deal done. From Reuters:

Greece will have to ask for an extension of its current bailout to give itself and the euro zone time to hammer out a new agreement, as there is no specific plan for Athens now, the EU’s economics commissioner said on Tuesday…

Greece would have to agree to extend the bailout and apply for it by the next meeting of euro zone finance ministers on Feb. 16, he said, because otherwise there would not be enough time for parliaments in some euro zone countries to approve the extension before the program expires on Feb. 28.

The Financial Times also took note of Eurocrat annoyance with Greece:

EU officials have grown frustrated with what they believe is a misunderstanding of EU procedures by the new Greek government and hope the eurogroup meeting will offer Mr Varoufakis a chance to begin more formal talks over how Athens wants to proceed.

And these media accounts seem to be polite versions of how deep the rifts are. See EU Sources: Eu-Greek Relations Soured by Leaks; Sides Further Apart MNI Euro Insight (hat tip Jim Haygood) for an unvarished version.

It’s critical to note that the friction isn’t merely the result of the two sides being so far apart. Both are taking unheard-of measures to undermine each other outside the negotiations. As economist and former IMF staffer Peter Doyle explained at FT Alphaville:

On the one hand, in an incredible reversal of practice during the global financial crisis—when central banks were at pains to conceal which institutions were receiving their emergency assistance for fear of compounding the adverse signals and therefore the crisis—the ECB has brazenly publicized exactly which Greek banks depend on its help and how much. And it has overtly warned it would withdraw that help. In this way, the central bank is overtly threatening to blow up the Greek banking system, in order to make the euro work. Walter Bagehot, the nineteenth-century father of lenders of last resorts, would be dumbfounded.

On the other hand, Syriza would like nothing better now than to see the yields on Spanish, Portuguese, or Italian sovereign debt relative to Germany jump, signalling broader market disquiet—that Grexit may be imminent and that the rump eurozone would be badly destabilized by it—so forcing ECB retreat. So Syriza, in league with Podemos in Spain and prevailing anti-euro Italian political forces, is openly threatening to blow up its own exchange rate regime, the euro, in order to make it work. The many fathers of exchange regime credibility would be as dumbfounded as Bagehot.

I have heard today from a source with knowledge of the US discussions with Germany that they see signs of movement, and that Greece has supporters in other Eurozone bureaucracies. This is not inconsistent with what we’ve said, that there is a contingent that recognizes that austerity has failed and might use the Greek negotiation to advance their cause, and they could ride in and help rescue Greece. But that was before so many parties staked out hard line positions against Syriza’s proposals. The sympathizers don’t appear to be close enough to the negotiations to push for a climbdown, even if the principals could find a way to finesse what would otherwise look like a big loss of face.

It would be better if I were wrong, but what I am hearing of the US reading sounds like a classic American projection of our worldview. First, the Administration contingent seems to believe if it can get Germany to agree to a deal, the rest of the Eurozone will follow. But that isn’t how its structure works. If Greece continues to reject the bailout framework, Germany would need to lead some sort of funds extension outside the Eurozone structure. That has far more moving parts that just trying to settle differences over, say, how much of a break if any Greece gets on its fiscal surplus requirement. The White House/Treasury assumption seems to be that the two sides will negotiate within the current bailout framework, when Varoufakis keeps insisting that that is not on. If he does not budge tomorrow, the basic premise of the US view that the two sides can be pushed to come to a deal would seem to be far from the mark.

Moreover, with no financial market pressure on Merkel, the US seems to miss how large the downside of giving a concession to Greece would be for her. We discussed repeatedly that the Germany’s political leaders have successfully demonized the Greeks, with the result that German voters see them as slovenly, lazy, and fully deserving of their current misery. What justification could there possibly be for cutting them a break, particularly given that Germans prize honoring commitments far more than Americans do? There isn’t remotely enough time to launch a media campaign to try to shift German opinion. And as Doyle stresses, the domestic risks to Merkel are immediate and large:

That takes us to the other half of the dreadful euro dance—the Polka featuring Merkel and the markets. The last time that push came to shove on this, in 2012, as the markets, Syriza, and the ECB all now know, she blinked and we got “whatever it takes” and OMT. Back then, her Minister of Finance, Mr Schäuble, had overtly led the charge to be done with it and to push Greece out. She wavered, during which time markets across the eurozone- and world-wide boiled. But partly (largely?) as a result of their boiling, she was persuaded that Germany could not be insulated from the bedlam that would follow Grexit. So she overruled him. And Varoufakis smiled at him during their press conference last week in Berlin.

This time around, the non-Greek euro markets are quiescent, and though Greek markets are stressing, that is nowhere near the pandemonium there that would reflect imminent Grexit.

So is this because markets think, along with Syriza, that she will ultimately cave as in 2012 if the Greeks hold their line? Or is it because markets are becalmed by QE and believe what those VSPs are all telling her, that the euro defences to deal with Grexit have all been “improved” since 2012? The answer is unknowable in advance.

But the risks of mutual misreading between Merkel and the markets on this are potentially catastrophic. If she wrongly finds affirmation from markets’ quiescence that defenses are strong enough to withstand Grexit and so lets Greece go, but markets’ quietude actually reflects QE and their belief that she will again crumble, bang goes the euro. But if she buckles for a second time rather than risk misreading, it is hard to see Schäuble tolerating that further humiliation at her hand, not least right after his defeat on QE. And if he goes, that would be a prelude to unprecedented German political turmoil. Merkel always prefers the less risky option. But in this context, it is not clear what that is for her. Thus is her dance with the markets.

Recall Schäuble’s remark that if Greece refuses to accept the current bailout, on pretty much the current terms, there was nothing further to discuss. That statement reflects Schäuble’s Dr. Strangelove-level fervor for austerity. But it may also have been to box Merkel in in the face of US arm-twisting.

There is another possibly ugly piece in this equation. Greece has been given a drop-dead date of February 16 for asking for a bailout extension. The next ECB board meeting is right on its heels, February 18. The ECB board rotates, and the group coming up on the 18th is skewed heavily toward the parties most hostile towards Greece. That board could conceivably uses a Greek rejection of the bailout to justify changing its posture, using the justification that the refusal resulted in a considerable increase in risk, and use that rationale to kick Greece on its way to default and/or a presumed Grexit. The big point of vulnerability is the Greek central bank’s continued access to an ECB banking system backstop through the Emergency Liquidity Assistance program, or ELA. If you read the ELA rules, it is meant for solvent institutions and to operate below a certain threshold and only for a “pre-specified short period of time.” The voting members on the 18th could impose time limits or even take the more brutal step of lowering the ELA limit from €60 billion. While Draghi would presumably try to moderate their actions, he might not get far enough.

Further confirmation of how unlikely it will be to get the Eurozone countries to relent from their hostility towards Greece, or indeed come up with any lasting solutions in the current framework comes from the Telegraph. It suggests that the US and the UK need to provide support to prod a reluctant Europe to pony up:

The Whitehouse’s approach to date appears to have been focused on trying to persuade Berlin to compromise and accept the reality of Greece’s can’t pay, won’t pay position. It also wants Germany to ease back on austerity in the round, in the hope of securing wider economic recovery in Europe.

This is unlikely to work. Europe is not a single country, and is still decades away from acting like one. Too much time and energy has already been expended trying to keep the Eurozone together. Even if a way of forestalling the immediate crisis is found, it will only be until the next time. Greece, and perhaps others too, demand different solutions, immediate exit from the Eurozone being the first step, allowing the debt overhang to be redenominated in devalued drachmas, and creditor haircuts to be imposed appropriately.Greece then needs to be supported with a realistically constituted programme of international support, including American and British bilateral loans, in place of the nonsense imposed on it by the Troika. Without the adjustment mechanism of devaluation, this was always doomed to fail.

And there are much bigger issues in play, as Swedish Lex points out by e-mail:

I hope that Obama is experienced enough by now (i.e. cynical enough) to understand that he needs to apply a lot of pressure on the Europeans for them to avoid self destruction. Such pressure in my guess comes through security policy arguments, not economic arguments. A Greek implosion would derail U.S. recovery, send the USD to the sky (did you see Coke’s numbers which were down a lot on the USD) and make Putin the happiest man on the planet. Putin’s plans and ambitions, long term, would get an incredible boost if/when the EU starts to unravel. Do not forget that Putin skillfully has been nurturing his relationships with e.g. Le Front National in France.

Divide and conquer. In this case, Putin would not even have to divide. The Europeans, “lead” by Germany, would do it to themselves.

This confrontation is stark, so it is no wonder that commentators are taken with the personal drama as well as the high stakes.

But here we are not dealing just with the theater of highly public, high stakes negotiations. This pitched battle is a symptom that the failure to address the fundamental contradictions of the Eurozone cannot be delayed much longer. Even if Syriza capitulates in the next few days, the even bigger threat of Marine Le Pen looms. It is now Merkel, not Varoufakis, who needs to take up the mantle of the convention-defying leader, but her history strongly suggests she is too cautious and blinkered a player to assume the role that Europe desperately needs her to take on.

Yves,

I’d like to take a minute to applaud your very detailed coverage of the Greek crisis. It’s been one of the first things I check out in the morning and one of the best reads of the day. Thanks for staying on top of such an important story.

+ 1

+2 Excellent coverage and analysis! Thank you!

+10, at least. I particularly liked today’s post because you, Yves, began to give us some hints about what needs to happen to prevent a catastrophe.

I’m sorry to say that the egregious attitude of Frau Merkel brought to mind the atrocious remark of Winston Churchill.

+11. I havent seen the readership that excited since the days of Occupy Wall Street. Prof. Varoufakis is our own modern Spartacus.

yes, remarkable job.

thankyou.

Very good reading. I think Merkel will take the chance on Grexit. Even if the markets are calm, Italy is at almost 140% debt to GDP and has about 350B in non-performing loans in its banks.

Italy cannot take even an ounce more austerity before it crumbles. If any Italians get the notion that Greece may not be a one-off, that the euro is not permanent, that almost 140% debt to GDP is unsustainable, then look out. If Italians begin removing euros from their banks, then how are these banks going to stay solvent with so much dead money (NPLs) on the books?

I’m not looking at Spain or Portugal–I think Italy is where the S hits the F.

D’accordo!!

Completamente de acuerdo.

From Berlin: Das stimmt.

In fact, what should be keeping Herr Schaeuble awake at night is not the image of Pablo Iglesias– leading millions of Podemos supporters to victory in Madrid. No, it is that even an establishment figure like Stefano Fassina, in Italy, has his expectations raised to the point where he was saying this yesterday:

http://www.huffingtonpost.it/stefano-fassina/europa-colga-opportunita-greca_b_6659570.html?utm_hp_ref=italy&utm_hp_ref=italy

As always, I must beg indulgence for the very hasty translation:

“The main solutions proposed by the Tsipras government, to bring Greece out of the tunnel of democratic and economic involution, therefore, have a systemic and general value. A European conference to restructure unsustainable public and private debts, in a framework of shared responsibility between creditors and debtors is what’s needed. This would amount to a “New Deal for Europe.” A U-turn, then, along the road of devaluing labor, in the direction of building a strategy structured around sustainable development and revitalization of aggregate demand. This would give to the working men and women of Europe the chance, not just to recover their negotiating power, and power to consume, but also to recover their rights of democratic citizenship.”

+100. It is an astonishing chronicle. Yves has covered it masterfully, with wit and wisdom. Poor Greece. Short of German tanks rolling over their border, it’s hard to imagine how things can get worse. My heart goes out to them.

Wholeheartedly agree. Diagnosis, analysis, prognosis and recently some useful forays into a suggested regimen. The commentariat has made a significant contribution, with the host rolling her sleeves up and engaging, often to dampen our occasionally misguided ardour. Who said blogging was dead?

It is encouraging too that this collective wisdom has a direct if probably only occasional connection to the front line via Yves’ and Ilargi’s contact with the man of the moment, who has for me spearheaded a movement which has electrified politics and economics, both moribund for years. And not just righteously but very cannily indeed – a rare combination.

Of course there is nothing else to talk about: the issue of democratic governance is at stake and it must be made perfectly clear the will of the people has no hook in banking.

THAT is the crux of what is so wrong with the EU. The nations remain, on the surface, sovereign BUT unelected banksters are actually in a position to nullify sovereignty and democracy. The basic setup of the EU is wrong. Banks must serve the peoples, NOT the other way around. The EU is doomed until it reigns in the banksters.

well said, jan and Praedor

This is the New World Order, as designed by the international plutocrats, and led by the United States. One of the reasons the Greek story resonates so deeply with awakened Americans is because we have seen this play out in florid display over the past 7 years. This perverse subservience of the people to the institutions that are ostensibly designed to serve the people is being hammered home even now with Obama’s quest for sovereignty-surrendering “trade deals” that have little to do with historical conceptions of trade between independent nations, but are really about reordering the international and domestic power structures by cementing transnational corporations as omnipotent . These institutional reorganizations are all designed to tighten the grip of neoliberalism on the people of the world. Greece is a microcosm.

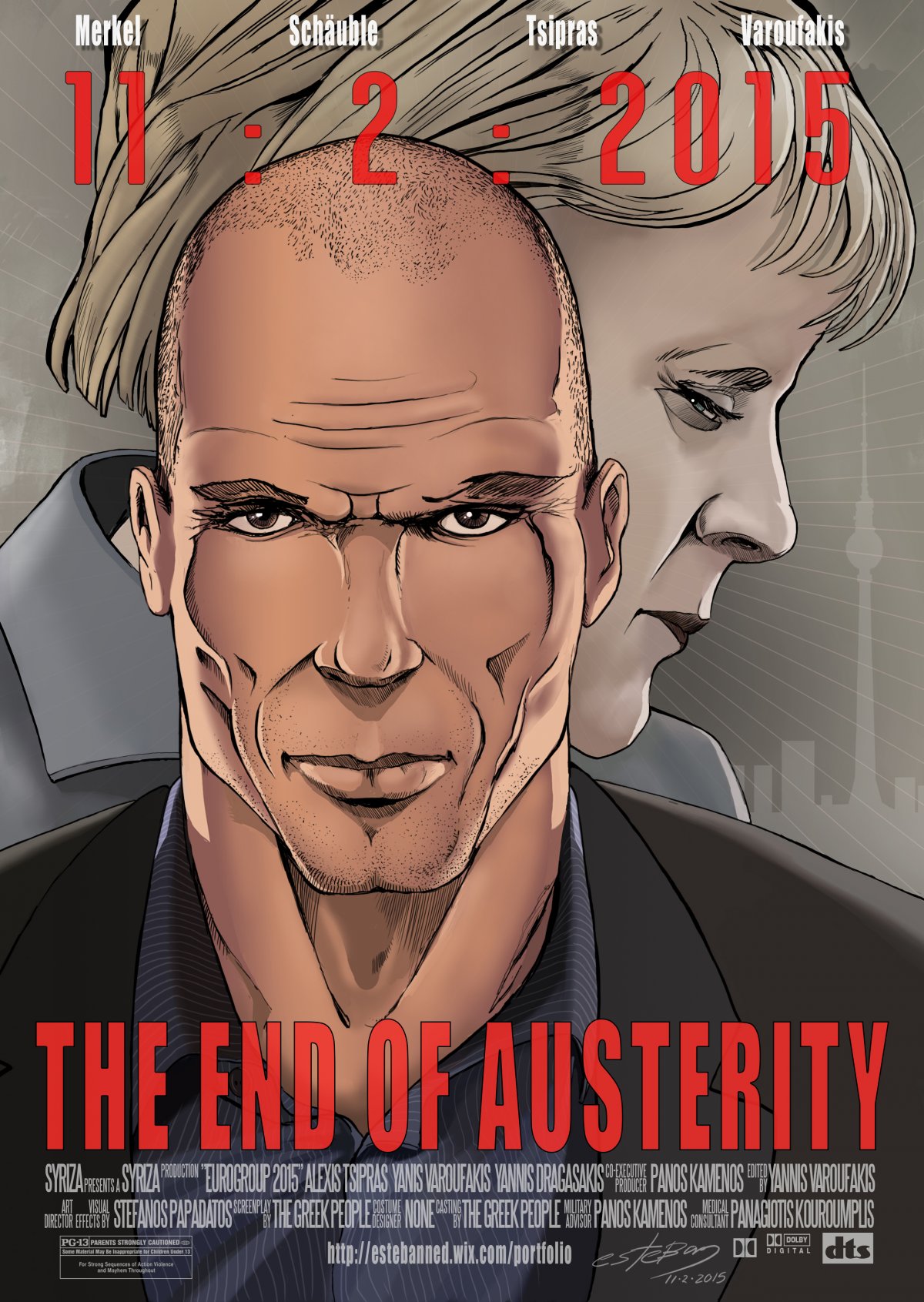

Yves, thanks for the bigger version of the poster graphic.

I’ve been a principal in a couple of business stand-offs played as if the stakes were existentially high (they rarely actually are). My track record is about 50/50 like most everyone else I know who isn’t a squillionaire. I wish the Syriza team well. I’m a big fan of (actual) Democracy.

“I’m a big fan of (actual) Democracy.”

Me, too. We need to try it sometime.

Podemos is pioneering a new way to accomplish that, with their “circles” and bottom-up organizing and policy structure. They’re using Loomio to facilitate their discussions and decision-making, which I love since Loomio was created by a co-op/collective in the wake of Occupy (cue Banger to say Occupy didn’t accomplish anything ;-).

From what I can tell, they idea behind Podemos is similar to the one I’ve been advocating here. A political party where the platform is simply that we provide a transparent platform for democratic decision-making. It’s not about demanding everyone agree with your policy proposals, it’s about giving everyone a voice in shaping those proposals from the bottom-up.

I had a little nerdgasm when I saw how many Podemos groups were on Loomio, a tool we’re using to organize a national Commons Day and/or Week. One of the founders told me over twitter that they’ve got over 1000 Podemos groups using Loomio and are now working on how to network all of them together. So basically they’re building the platform I’ve been hoping somebody would, that will allow for actual direct democratic control of elected representatives.

I have an unfortunate reflex aversion to the name Podemos — “We Can” —as in “Yes we can!” The association is cringe and gag inducing. The only thing worse would be “Esperanza y Cambio”, Hope and Change.

Will mrs. Merkel’s legacy be of the one that punctured the inflated Europe dream?

It’s now six year of mishandling the euro crisis, and on it goes without any serious EU leadership that act in the interest of it as a whole. Shortsighted and narrow-minded they seems to be.

Greece only have bad choices. If Germany is manhandling Greece it will boost Marine Le Pen, EU doesn’t have another decade to kick the can, at most until the French election 2017.

marine le pen is a racist and a xenophobe, but she is no hitler. in fact, if she were to win i would expect her impact on the world to be less adverse than that of gwbush or obama.

I agree re Marine. The apple may not fall far from the tree, but she is nowhere near as execrable in her public statements as her father was. Hell, even as a lefty I’d be tempted to vote FN lacking any non-austerian alternatives on the left. Hollande’s PS appears to be completely captured by the neoliberal austerian juggernaut. On some issues she is in fact the only mainstream French politician talking actual sense.

To be frank I support the FN and hope they sweep the elections in 2017. Whatever problems you have with their nationalism and the racism of many of their rank-and-file members I think it’s quite a stretch to say they’d be introducing pogroms or anything of the like, and they’re strongly anti-austerity, anti-neoliberal establishment and seem to me to be legitimately pro-welfare (at least Marine herself is, I’m sure there are reactionary forces in the rank-and-file). The neoliberal orthodoxy is the biggest enemy of the day and vs. them, the FN is on the right side no matter what else they’re on the wrong side of.

I don’t think Marine LePen is all that bad either. She consistently makes excellent economic points for the French economy, and she was loud and clear against the TTIP. Nobody in the EU, not many, are in favor of the new “Investor State” provisions which disregard sovereign solutions with a supranational tribunal… which process seems to be philosophically related to the methods of the Troika. I’m also sympathetic to Merkel. I’m sure she and Schaeuble are smart enough to realize that Varofakis has just submitted the skeleton of a plan that would establish EU-wide democracy and be a virtual replacement for the sovereignty that has been made so meaningless against a virtually blind financial system. And I also thank Yves; If it weren’t for Yves none of us would have come to appreciate the politix of this situation.

There is something called “Front de Gauche”, one of their guys (François Relle) regularly attends Fort Apache, (see for instance one about European Right and European Left), the program that Pablo Iglesias used to lead in La tuerka.

Excellent analysis. Thanks.

Although I disagree with your premises, I believe Greece has a relative productivity problem that only a devaluation can solve, may I thank you for the clarifying blogs you have been all along this Greek crisis. They certainly help, whichever boat you may on.

Any country in a depression, with no investment, a collapsing economy, is going to lose productivity, not gain it. Greece could continue cratering for a decade or more, until it looks like Somalia. You can always get worse. The last several years in Greece have seen tens of thousands of successful businesses (many with over 200 employees, exporters) shuttering doors, not gaining from the lower costs (i.e. employees working at half pay).

Most investors know that Greece’s 180% debt to GDP is unsustainable, and as long as there’s no writedown, Greece risks leaving the euro. So there is no possibility of investment in such conditions, no possibility of improved productivity.

Of course, for Greeks, there’s a delicate balance, since tourism is 18% of GDP, and it works effectively as a form of export as euros come into the country from outside. Lowering prices in the tourism product is not going to lead to nominal gains, but instead losses. Tourism is better off with the euro. Greece is already full to the gills with tourists who do not mind spending euros for 100 a night hotel rooms. Going back to 50 euro a night is not going to help Greece at all.

Excellent comments.

If hotels are full now at 100 e, and drachma falls in half, visitors will continue paying 100e equivalent. This is simply supply and demand.

‘This pitched battle is a symptom that the failure to address the fundamental contradictions of the Eurozone cannot be delayed much longer.’

Yes: namely, monetary integration without fiscal integration produces uncomfortable consequences.

One can see this in other contexts. Hong Kong’s currency has been pegged to the US dollar since 1983. Given southern China’s explosive growth, Hong Kong’s imported US monetary policy was way too stimulative during much of the subsequent thirty years. Enormous share and property bubbles erupted. Apartment prices and rents became among the most expensive in Asia. And still, the currency peg came close to breaking on a couple of occasions.

Europe doesn’t have a low-cost, fast-growth Pearl River delta across the border to bail it out. Perhaps it could, but under NATO’s corrosive tutelage, it’s busy recruiting and arming eastern European satellites, recreating a ‘western COMECON’ to confront Russia. As the economic collapse of the Ukraine demonstrates, this is no formula for growth and stability.

Europe, with its distinct nationalities, is not prepared for fiscal integration. How could that happen, when ‘Brussels’ is an epithet much like ‘inside the Beltway’ in the US? Although a euro-fudge may yet be found to patch over the current contretemps, the euro’s future is not bright.

Will the movie sequel be titled V for Vendettafakis?

Wow, fantabulous art! Yanis Varoufakis — Greek god superhero, really gorgeous work.

I like it too, though a complementary photo of the ‘Tombs of the Unknown Austerity Victims’ or perhaps a portrait of the valiant, defiant Greek demos will be nice (People Power!).

We should just bail them out. What’s 7 billion? I don’t even think you can get an F-35 wing for that anymore.

Yes. The sums required by Greece to buy negotiating space strike me as trivial by oligarch standards. Real .01%ers could probably find 7BB under their couch cushions.

Remember, we have the global reserve currency (Don’t leave home without it) and can print at will (in theory, though many claim, in practice already).

It helps if we can visualize Athens as the Green Zone in Baghdad, with pallet-loads of cash brought in by helicopters.

Accumulate, accumulate — that is Moses and the Prophets! So what does bailing out Greece have to do with that?

‘Real .01%ers could probably find 7BB under their couch cushions’

There is probably some multiple of that number, all of it spirited away from licit tax regimes, hiding in Swiss bank vaults by virtue of HSBC skulduggery.

Curious. When the US administration asks Europe to impose sanctions on a giant country, Russia, that practically bring Europe to the brink of all out war, the French poodle, the German Shepard, the English Terrier and all the other dogs stand up on their hind legs and prance around in a unison that makes the New York Rockettes seem crusty by comparison. But when it asks for an almost a symbolic gesture of financial support to a tiny country that is actually one of their very own EU members,

.

I join with other commenters to applaud Yves’ coverage of this and particularly to say thanks for her rather unique combination of objectivity underlined by humanity. I think she can understand why some of us have a hard time shaking off our “romanticism”, or perhaps more accurately our identification with and support for Syriza – a group of people who hold their ground under intense pressure – even if it is a relatively moderate group only branded as hard core left. It is a uniquely novel phenomenon in an intensely tragic and horribly unfair situation.

That is interesting that Europes dances to the military objectives of the US while acting independent to the US when it comes to economic objectives. I suspect it demonstrates the relative powers of Europe vs the US.

The sanctions on Russia are largely economic with very negative economic consequences for Germany in particular and Europe in general. With due respect, It is inaccurate to say, Europe dances to the military objectives of the US while acting independent to the US when it comes to economic objectives.

Yes, thanks for the excellent coverage. Taken together, your posts will stand as a good narrative of Syriza’s struggle (and maybe the crucial phase of the Eurozone’s collapse). But one dimension tends to get short shrift, both here and on other sites: Greek internal politics. Are there any signs Syriza’s opposition is preparing a counter, either to a Grexit or to concessions to the Troika? The extent of Greek unity, and Syriza’s reading of it, will significantly determine their bargaining stance.

It depends on who you listen to. Varoufakis is a moderating influence since he believes Greece cannot go it alone. Although he believes Greece should have never joined the eurozone (Greek per capita GDP was actually HIGHER before joining than it is now), he believes things will become worse outside the eurozone: http://yanisvaroufakis.eu/2012/05/16/weisbrot-and-krugman-are-wrong-greece-cannot-pull-off-an-argentina/

But then you have other influences in the finance ministry, like Costas Lapavitsas, economist at the London School of Economics, who has been counseling Grexit from the very beginning. He also thought it was a huge mistake to convert Greek debt under jurisidction in Athens to both London debt and EU public debt.

And finally, as for alternate plans, there’s this:

Rania Antonopoulos, Deputy Minister for Labor, she’s now part of the cabinet.

https://www.youtube.com/watch?v=dKXwn3nOw3c

To further elucidate a plan for a co-existing alternate currency (a California scrip?) here’s her colleague, Parenteau: http://neweconomicperspectives.org/2013/12/exit-austerity-without-exiting-euro.html

How to Exit the Euro Without Exiting the Euro.

All of these options are bad for Greece, IMO, but Varoufakis actually said it best: “If the very bitter and toxic medicine had a chance of healing the patient, I would recommend we swallow it.”

Essentially, even the moderates in this Greek administration believe there is absolutely no choice available to them.

Varoufakis also uttered these words in Parliament on Sunday, “It is up to tiny insignificant Greece to say ‘NO’… once again.” A clear reference to the decision not to surrender to Germany and Italy in WW2, which lead to devastation. Would have been much easier on the Greek people if they had simply capitulated to the fascists from the start.

The Greeks are unified and behind the government:

From Reuters: “Greek public strongly behind government’s hard line in EU fight: poll”

http://www.reuters.com/article/2015/02/10/us-eurozone-greece-support-idUSKBN0LE1YA20150210

It’s quite something to see the man-on-the-street interviews where people say that their dignity is more important to them than money and that Syriza has restored their dignity. One popular comedian in Greece was talking about how the mood had greatly improved once Syriza came to power. He said something like, “We’re going to default under this government. We would have defaulted under the last one too. But under this government we will do so with happiness.” It really does seem that the Greeks will put up with anything now because they are so glad to finally have real leaders in office for a change, ones who are looking out for the people.

Another excellent piece of work. You do spoil us.

In the event of failure to reach some sort of deal, or unless Syriza cave, the logic has to be that the Greeks go unilateral? In that event, for reasons Yves has already explained, immediate Grexit seems unappealing, which seems to leave some sort of default while retaining the euro as the most plausible option. I assume that the Greek banking system goes down in these circumstances as the ECB pulls its lines, so the Greek government seize the banks and impose haircuts – or at least restrictions on withdrawals – on the largest depositors? I guess the appeal for Syriza could be that they can blame the EU for failing to meet them halfway and the ECB for destroying their banking system? I can see that that might sell to the Greek public.

What happened to the concept that the Europeans acted in a way that was ‘communautaire’?

Who did the movie poster?

(I also agree with everybody who praised both the poster and NC’s coverage of ECB vs Syriza.)

stefanos papadatos.

portfolio:

http://estebanned.wix.com/portfolio#!character-design/c1n0f

you can zoom in on the “credits” here:

http://estebanned.deviantart.com/art/THE-END-OF-AUSTERITY-No2-512954973

note there is an actual movie, by theopi skarlatos, with a similar title: “greece: the end of austerity?”

he is seeking funding to continue documenting the present situation and extend his work to a full length feature film. the current “mini-documentary” (about 15m) is watchable free on vimeo right now:

https://vimeo.com/118149514

i have seen skarlatos’s full-length film “love in the time of crisis: the untold story of the greek unrest,” which he first released about a year ago, and it is quite good in my opinion.

he seems to have taken it down from his vimeo page, except for the trailer.i watched it in full length for $4.00 just after the election (to my best recall), but now that option is not being offered, and he is seeking further funding for it as well, presumably in order to work on it some more.

The movie poster art was done by Greek artist Stefanos Papadatos and he uploaded the image in a much larger version (3.27 Mb) to DeviantArt — the link is:

http://estebanned.deviantart.com/art/THE-END-OF-AUSTERITY-No2-512954973

Fantastic stuff…

someone (i think ned lund?) mentioned in a comment to another post what syriza should be doing, and should have started doing from the start. it went something like (this is not verbatim but from memory):

1-draft plans for a parallel currency including distribution in the event of a likely default (not necessarily grexit), while implementing capital controls.

2-begin negotiations with brics countries for emergency funding in exchange for leases, but not sales, of ports and bases

3-draft plans for drug legalisation, not just decriminalisation, to revive local ‘agriculture’ and export to the rest of europe, much to their chagrin

that syriza in general and varoufakis/tsipras in particular have no intention of doing any of this is a dead horse beaten stiff already, but what hasn’t been said is that they should have been doing this anyway to strengthen their negotiating hand so they would likely never need it. if you publicize that you are having important meetings with russia and demonstrate a credible understanding of your situation and a willingness to make difficult choices, the troika becomes much more likely to blink. if they don’t, then at least you’ve created a viable back up plan. as things stand, if the troika doesn’t blink, a double-k.o. still takes place but greece goes back to the pre-doric age.

What puzzles me is why they haven’t imposed capital controls. That would have greatly reduced the bank run and would be a critically important hedge against a forced Grexit.

I think their best negotiating hand is the following: once the EG makes clear than they will not cave, Varoufakis/Tsipras should deliver a number of short videos, interviews, blog entries, conferences,… explaining why they are opposing to austerity, and how they think the events will play in time. They announce in advance the decisions that they will take: that they will default on such and such payments on such and such date if the agreement is not reached and they expose the macro figures of the Eurozone as a whole. In other words, the old “The Emperor is Naked” play.

As obviously there is no solution for the Eurozone that does not imply a serious policy U-Turn (I encourage anyone thinking there is a solution to watch again the half an hour lecture by Heiner Flassbeck), the markets should react to such a slow motion train wreck and take care of Merkel. It s dangerous, but this is how war games are played ;)…

If I was in Varoufakis position I’d play exactly this way. It is mostly the only solution for Greece, Portugal, Spain… people. I’ll do my part when the Unions and Podemos want to get 100.000 people demonstrating in Madrid. If possible before the default, but after the ECB has set date to cut liquidity to Greece. I think lots of us in Europe are ready for a fight.

http://www.zerohedge.com/news/2015-02-05/whispers-greek-capital-controls-begin

Capital controls are in violation of the European Union Treaty, but could happen with permission as in Cyprus, or after the ELA is yanked I think.

That makes sense. I had wondered if they were against the rules. That would seem to be the only reason NOT to impose them given how wide the differences between Greece and the Troika are.

That’s a good question, Yves. I’ve been wondering when that fairly obvious step would at least be mentioned. Probably a little late now to stem bank runs.

Very curious indeed. Capital controls gets discussed here at the 7:40 mark.

The Real News Network: https://www.youtube.com/watch?v=B7G3IgpeMgc

Special Eurobarometer #421

Ha, ha, ha!

Another quote from the summary:

Intransigents do not want decent conditions for Greece.

Tsipras should prepare a report on how health care has been downgraded in Greece and make it public in the face of those hypocrite finance eurocrates just before they say NO to renegotiation. Insist on what gratuitous harm is austerity is causing without solving ANY financial/economical problem.

I have printed out the poster and have it on my wall!

Maybe I missed the memo, but I do remember reading somewhere that there was no constitutional framework for a country leaving the Euro, or for that matter the EU. Did something change while I was sleeping?

“…no constitutional framework for a country leaving the Euro,….”

Sounds very like the Chinese Finger Trap toy.

https://en.wikipedia.org/wiki/Chinese_finger_trap

EU minister: Syriza, drop dead. But you Greek people, you must stay alive. We need you to provide a steady stream of income as you pay off your debt in the next 200 years.

“Dead men don’t make you rich*.”

*That’s the current best technology. One day, dead men can make you rich, unless you know some tricks available today that I am not aware of.

The transnational capitalist class already knows full well that the Greeks can move elsewhere if they want jobs. As they see it, Greece will be the Nicaragua of Europe — it will stay financially afloat through the remittances of migrant workers in other countries to relatives back home.

‘My Greek slaves, sorry, my Greek serfs…ok, one more try, my Greek friends, one day, you too, can take over British fast food and make Souvlaki their national dish. I mean, how long do you think it will be before people get bored with Chicken Tikka? But why limit yourselves to one island country? Germans won’t eat Doner Kebab forever. Imagine, spanakopita available at Rothenberg ob der Tauber?

That’s their attitude.

From the Telegraph (of course):

Greece then needs to be supported with a realistically constituted programme of international support, including American and British bilateral loans, in place of the nonsense imposed on it by the Troika.

If you rub your flying broom stick with toad skin and fly naked, you will believe American and British loans are virtuous gifts.

That’s essentially the message from the imperial mouth piece newspaper (Tin pot dictators restricting freedom of speech and doing nonsensical loans; we are much savvier. We quietly monitor our citizens and we do liberty loans).

Yves, thanks very much for posting about Greece’s efforts – survival efforts – to modify its financial arrangements with the EU and maintain its democracy. This story may turn out to be the starting point of a new chapter in European history. NC seems to have the clearest and most straight forward reporting.

I also want to thank Yves for the covereage on Greece. In thinking ahead, I have been trying to figure out what the likely scenarios would be. Those who keep talking about Greece exiting the EMU (i.e. stop using the euro) should look at a couple of papers written on that topic. No EU country can stop using the euro without voluntarily leaving the EC. Syriza has made it clear that they are not leaving either the euro or the EC.

Secondly, there is no provision in the treaties establishing either the euro or the EC for throwing a country out of the EC, the prerequisite for forcing them to stop using the euro. When you hear people talking about “Grexit” it is people outside of the eurozone establishment and not public officials making public statements on behalf of their governments. To put it in American terms, what if Utah held a constitutional convention and decided to change its form of government to a theocracy, based on the Book of Mormon and issue its own currency? Is the remedy for the central U.S. government the expulsion of Utah from the United States? I don’t think so.

Thirdly, as was pointed out in a paper by the counsel for the ECB in 2009, expelling Greece the country impacts both Greek citizens as individuals and Greek companies, all of whom have rights as citizens in the EU today, such as the right to travel, etc. It is unlikely that they would sit on their hands and just accept expulsion as EU citizens without some kind of challenge. The vote of confidence which Syriza received in the Greek parliament on Monday was opposed by Pasok and the other members of Parliament outside of the Syriza coalition. Is expelling Greece from the EU after the (now) dissenters have spent all this time supporting the troika the reward other politicians in other countries can expect?

Finally, if Greece is no longer using the euro, in what currency will various existing contracts be settled? Can Greece and Greeks begin settling existing contracts in drachmas?

Based on these factors, I don’t think Grexit is in the cards, either voluntarily or (especially) involuntarily. Instead, if I read Yves’ analysis correctly, if there is no funding for the public debt, the Greek government will default on its debt obligations because they won’t have the cash flow to both pay debt and run the government. I.e., it seems to me that without support forthcoming, the Greek government will prioritize its remaiing cash flow in favor of continuing domestic obligations. However, this is where things get very fuzzy for me, because I am unfamiliar with the cash needs of the Greek central bank and the member banks of that country.

So, does anyone have any sense of what choices Greece would have if they: 1) steadfastly refuse to leave the EC; and 2) Are cut off from funding from the troika?

I have no good answers to your last question, but the US did all sorts of things that were supposedly not legally possible during the crisis. If Greece were to default and continue to defy the Troika on structural reforms or breaks Eurozone rules somehow, I would not underestimate the ability of the Eurozone officialdom to find a way to legitimate forcing Greece out. As a Washington insider said, “I’m regularly told things are procedurally impossible until someone wants something badly enough, and then suddenly that impossible thing happens.”

Right. I guess that is one of the unknowns – how willing are Germany and other northern European powers to just roll through what they want. I think, though, that Greece is capable of making things much messier than many analysts think.

financial morality vs. human morality

What will win the battle?

Yves hints at the full complexity of the situation by mentioning Putin’s support for the French political party on the right, quoting Swedish Lex: “Putin’s plans and ambitions, long term, would get an incredible boost if/when the EU starts to unravel. Do not forget that Putin skillfully has been nurturing his relationships with e.g. Le Front National in France.” The nature of Russian support comes in the form of at least a 9 million Euro loan from a Russian bank out of Cyprus by Marie Le Pen’s own admission and maybe as high as 40 million Euro. However, the Putin as Koch Bros cash infusion for political parties he finds useful does not end with right wing French pols, but seems to extend into other European nations. Greece’s Golden Dawn, UK, Bulgaria, Hungary, and German right wing political parties all have reportedly received funding from banks linked to Russian nationals.

This as well as the invasion and annexation of part of Ukraine, Crimea, without military retaliation from NATO serves as the clear intent of Putin and the Russian government to influence by force and internal interference as great as the recent history of national Communist Parties within France, Italy, etc under direct control and funded by the Kremlin. Some things have not changed in regard to Russian imperialism. Already the largest territory in the world, even after the dissolution of the Soviet Union trimmed its size, it still stole Crimea at gunpoint.

http://www.alternet.org/world/europes-fascist-far-right-wants-exploit-charlie-hebdo-attack-and-putin-will-benefit

http://www.france24.com/en/20141123-france-far-right-turns-russian-lender-national-front-marine-le-pen/

Of course, the assembling of a European Union, a Eurozone and NATO, into a unitary nation state of Europeans would be a direct challenge to the Russian goal of a complete end to end transcontinental nation, extending from the North Atlantic to the Pacific Oceans, without any other intervening territory out of its direct control. The North Atlantic grouping rivals Russia in scope of territory under control, a cultural shibboleth of Russia running through Tsarist, Communist and not Capitalist Russian Geopolitics. The Russian fixation on Spatial dominance, territorial massing under direct political control, is a philosophy promoted among Russian intelligentsia and closely aligned with Putin as Atlas Shrugged is with Rand Paul.

For a unitary nation state of Europe to arise, certainly Greece has to be treated with more respect than some sort of ghetto of lazy, undeserving pensioners and 2nd class Europeans. The problem lies with the tug of war between the economic interests, the Eurozone and the Political interests, the European Union and the military interests, in the form of NATO. Finland is not a part of NATO because it will set off the Russians, but is in the Eurozone and the EU. The UK will not let go its British Pound, but is in NATO and the EU. And some like France and Germany are on board with all 3. As much as America would like to see a United States of Europe, it would still be less aligned with the US interests if the unitary nation state of Europe would emerge, straining the North Atlantic ties that bind. But Russia would be faced with a real border that it could not touch without starting WWIII, which is not the case right now with some NATO members on its border and some not. But then again, Russia is so big, it has and will have border problems with most of the world’s largest economies because it is on the border with over a dozen nations from the Atlantic to the Pacific.

The Europeans have more than a Grexit problem, they have a geopolitical mess to sort out with their unresolved tri-partate military, political and economic unification, with some half in, some half out somewhat due to Russian being so touchy and some part due to unresolved financial interests which will take a hit if a unitary state with all first class citizens unite together in a US of Europe, one nation with a unified currency, military and taxation and political government where there is no 2nd class treatment of any member state within the nation. Greece, is showing this problem up for what it is and Russian and US interest are involved as well. This is the best example of the worst of rule by committee imaginable.

There was no “invasion,” the troops were already stationed there. Also, there was a vote in Crimea following a coup in Kiev that was led, in part, by self-declared neo-Nazis…iirc…

Uh huh.

A United Europe, after a brutal financial Civil war, and with the Brits marginalized in the future, will eventually clash with the one and only superpower of the world. There will be re-construction. And, as it happens all too often, in 50 or 100 years, they will be all one big family, with sufficient ‘education’ of the coming generations.

“We are very similar. And if they can do it, so can we.”

Russia and China can be allies, but no union for them – too different culturally and physically – to take advantage of any opportunity that comes their way.

if they can save the whales why can’t they save Greece? Well, I guess somebody could say the whales are innocent of any terpitudes That seems to me like a projection unless somebody spent time with the whales on their own turf. no pun intended, It’s always imagination that makes reality. Very rarely does reality make itself.

here’s what they’ll do. this is a prediction from channeling the Laws of Group Consciousness; They’ll set up another organization, with another acronym, and they’ll fund it and that new organization will bail out Greece. It won’t be the ECB. It won’t be the IMF. It won’t be the EU it won’t be the BUBA. it probably wont even be the EIB.

It has to be brand new in order to receive the full power of new imagination. All of these other acronyms can give it money, voluntarily of course, as a form of investment in Europe and Mankind. And then it can give Greece money and then Greece can give the acronyms the money it owes them. That way the acronyms can paid by Greece and they not give Greece another penny, or euro equivalent thereof. By the time the money gets back to the acronyms, nobody will remember where it came from. It really dosen’t matter anyway, but nobody would believe that.

Has it been demonstrated that “they” can actually save the whales?

If so, are the “they” who can save the whales the same “they” who can’t save Greece, or is it a different “they”?

Your rhetorical question is like asking, “if they can land astronauts on the Moon, why can’t they end world hunger”? There’s an answer to that, and this is it: “Landing an astronaut on the Moon is a simple engineering problem; it’s easy. Solving world hunger [or saving Greece, or whatever] isn’t.”

Really, you’re talking apples and banana slugs here.

Excellent summary, Yves. Thank you!

But haven’t you, Varoufakis, and so many others, been saying all along that the persistent “extend and pretend” strategy for perpetuating the European status quo indefinitely was doomed to failure? And doesn’t it look as though, finally, the whole colossal house of cards is about to collapse?

It’s important to realize that it is not only Greece, but Merkel and her cohorts who are caught in a double bind. They are not simply being stubborn, but acting out of fear, literally implanting their scrawny fingers in a very dicey dike. If they give in to Syriza, then other countries on the financial edge will make similar demands and the whole shaky edifice will collapse. And if they don’t, then Greece will default and be forced to exit the Euro — and the whole shaky pretense will collapse.

Their only hope is for Syriza to give in and accept their terms under some sort of face saving “compromise.” But even if that were to happen it’s too late. The cat is out of the bag. The absurdity of the situation they’ve created has been exposed. Not to mention its destructive power. And the possibility of a default and exit has finally taken concrete shape.

Greece, Portugal, Spain and Italy (among others) can clearly no longer survive under the present regime and sooner than later other Syriza’s will arise, with similar demands. The entire Euro zone will then itself be forced into a spectacular default, which will shake the world.

About time, sez I.

I wish to simply add my voice in saying humble thanks to Yves. Your coverage of this latest Greek tragedy is insightful and riveting.

Great blogging from Yves.

Vis-a-vis some comments above and Jeremy Warner’s column in the Telegraph from the Links:

I’d be curious to hear what more learned commenters think the US could/should do if this game of chicken ends in a nasty collision, and Grexit becomes necessary.

2 dumb questions:

Warner suggests the US give a bridge loan — would that have to go through Congress?

If Grexit had to happen fast, could the Greeks temporarily switch to the US dollars as their currency, since there are lots of these sloshing around and one could fill the ATMs relatively quickly? This would help get Greece out of its abusive marriage with the EU, while giving some breathing room to take care of the practicalities of issuing a new currency. The new currency could then be pegged to the dollar before being allowed to float freely and devalue.

Anything the US could do to keep Grexit from turning into a total catastrophe would be in everyone’s long-term best interests, I think, and the Greek economy is comparatively small.

I have three embarrassingly-ignorant questions.

1) How much money are we talking here?

2) Is there something that average Americans could do (collectively) to help Greece–super fast? (An Athens Kickstarter?) :-)

3) Is there anything (creative) that the U.S. government could do to help–super fast?

My daughter was recently visiting Greece and she said the souvenir shops were selling their items for such little money that she felt badly for purchasing them at the prices that were being charged.

Wikipedia says that tourism and shipping makes up a large portion of the Greek economy.

What if the U.S. government offered to purchase every single souvenir (every tee-shirt, every postcard, etc.) being sold in every single souvenir shop in all of Greece? (Would it be better for them if we paid them in U.S. dollars or in Euros?) And we could hire all of those idle Greek shipping vessels to transport them here for us. And then we could sell them on Craigslist. Or Ebay. And maybe Jeff Bezos could agree to ship everything for free.

Or, maybe we could (via a super brief audit) notice an accounting error in which it is discovered that we have been paying a grossly inadequate amount of money for our military base in Crete–and quickly send them a (large) amount of money to make up for this newly-discovered deficiency in payments?

Ya know–some sort of idea that is so far out of the box that it is even outside of the box that’s outside of the box? That kind of idea.

And this wouldn’t be construed as a slap in the face to the rest of the EU–it would just be perceived as a gesture of compassion from the people of the United States to the people of Greece. (And a sudden and deep appreciation for the likes of hand-painted stones by the nuns who live at Meteora?) :-)

Everyone reading this should google image Meteora, Greece. Now try to imagine a bunch of Nazis there. We can’t let that happen…..

i’d pay $50 for a good statue of Plato,

See? This could totally be a “thing!”

@ Craazyman: Look: here’s a nice statu(esque) of Plato for only 9 Euro……

http://www.souvenirsfromgreece.com/details.php?prid=390&p_id=&is_sales=

My daughter bought me one of these:

http://www.grekomania.com/catalog/alboom-souvenirs (She said it reminded her of the Disney’s classic animated movie, “Hercules.”)

We totally need this stuff. It’s a matter of international importance.

Could I interest anyone in few million shot glasses?

wow. is that a statue of the actual Plato or is it the Platonic ideal of Plato?

either way it’s a baaagun at 9 euros. I can see why your daughter felt pangs of guilt. Somebody could get the entire School of Athens for $50.

Thank you, Yves for your lucid and excellent reports on the Greek crisis. You manage to make complicated issues understandable, and the comments are equally enlightening. I don’t have anything to add except that I hope that Greece can somehow show the world that people who are being oppressed by the chains of neoliberalism break free. As you say, when everything seems desperate and there are no good options, surprising and unexpected events can take place. My heart is with the Greek people.